Debunking Doubts: How XRP Could Achieve A 3-Digit Surge — Analyst

25 Julio 2024 - 1:30PM

NEWSBTC

With strong forecasts and major endorsements, XRP is drawing fresh

interest. Renowned crypto educator Common Sense Crypto has lately

underlined the token’s ability to reach triple digits despite some

doubts from some quarters. Related Reading: Will PEPE Climb 30%

This Week? This Analyst Thinks So This positive view is based

mostly on the ambitious projection of Ripple CEO Brad Garlinghouse

for the larger crypto industry. Garlinghouse projected a $5

trillion market valuation for the crypto industry earlier this

year—a number much beyond the $2.4 trillion market cap right now.

Garlinghouse claims that in a strong bull market this estimate is

not only realistic but also a cautious one. Making use of

Garlinghouse’s conviction, Common Sense Crypto sees XRP as a main

contender for significant price rise. For all the naysayers out

there that don’t think $xrp can pull a 3 digit run let’s look at

some ways it can happen: 1. Brad Garlinghouse expects $5 trillion

to flow into this space by end of year 2024 & said that’s

conservative. 2. Archax plans to bring $30 – $50 trillion in…

pic.twitter.com/Lwi9cHYirY — Common Sense Crypto (@TheCSCrypto)

July 23, 2024 Institutional Interest Archax, a well-known UK-based

bitcoin exchange with big ideas for the XRP Ledger, fuels the

positive story. Recently, CEO Graham Rodford presented a bold plan

using XRP’s blockchain to oversee $50 trillion in tokenized

assets. Made during Ripple’s Swell conference, this narrative

emphasizes XRP’s transformative power in the financial industry.

Common Sense Crypto said that Archax is only one of numerous

partners helping XRP’s upward trajectory to be seen. Attracting

institutional investors eager to profit on the token’s potential

depends critically on the outcome of Ripple’s protracted legal

struggle. Ripple’s lawsuit is crucial for XRP’s institutional

investor appeal. Legal procedures have defined the cryptocurrency

regulatory landscape, specifically XRP’s security status. A major

verdict said that XRP sales to institutional investors are

securities, while sales on public exchanges are not, allowing

individual investors to trade more freely without extensive

regulatory compliance. XRP Price Projections And Supply Dynamics

XRP, which is currently trading at $0.62, has exhibited little

change over the previous day—0.53%. Short-term projections show

significant volatility; the token is predicted to trade 20.12%

below its anticipated price during the next month. Related Reading:

Ethereum Name Service (ENS) 153% Rally ‘Underway’, Analyst Says The

medium-term picture is bright, though; a predicted 16.34% rise over

the following three months and an astounding 170% expansion

expected within six months, data from CoinCheckup shows. Looking

ahead, a one-year estimate shows a possible 98% increase,

signifying strong long-term development prospects. XRP would need a

market cap between $5 and $10 trillion if it were to reach the

illusive $100 mark—an ambitious target that recognizes the token’s

ongoing challenges. The analyst is cautiously hopeful in spite of

these obstacles, pushing investors to weigh the token’s potential

while keeping abreast of the related risks. Featured image from The

Motley Fool, chart from TradingView

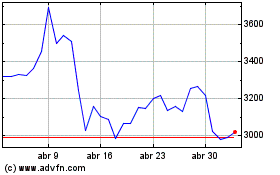

Ethereum (COIN:ETHUSD)

Gráfica de Acción Histórica

De Jun 2024 a Jul 2024

Ethereum (COIN:ETHUSD)

Gráfica de Acción Histórica

De Jul 2023 a Jul 2024