Litecoin At 12: How Has Its 84 Million Supply Been Distributed Over Time?

16 Octubre 2023 - 8:00AM

NEWSBTC

Much has changed since Litecoin launched in 2011 with a maximum

supply of 84 million LTC as a silver to Bitcoin’s gold. The crypto

recently completed its third halving in August, finally reducing

the number of LTC miners receive as a reward for mining a block

from 12.5 LTC to 6.25 LTC. Over the past 12 years, much of

this supply has been distributed to miners as block rewards for

verifying Litecoin transactions. At the time of writing, there are

73.76 million LTC in circulation, with data showing this supply

concentrated among large holders. Estimates from the crypto

analysis platform IntoTheBlock show that over 49% of LTC is held by

accounts with more than 0.1% of the circulating supply.

BitInfoCharts also puts addresses with more than 100,000 LTC having

38.01% of the total supply. Related Reading: By The Numbers:

Bitcoin Hashrate Poised To Complete 100% Growth In 2023 Source:

IntoTheBlock Who Are the Biggest Litecoin Wallet Holders Today?

Litecoin’s 84 million total supply has been distributed over the

past 12 years through mining rewards and market trading. The

biggest wallet addresses include large miners that have accumulated

Litecoin from years of mining and crypto exchanges. Charlie Lee,

its creator, claims to have sold or donated all LTC tokens in his

collection. The honor of the biggest Litecoin wallet address

belongs to “M8T1B”, accounting for 3.34% of the entire supply in

circulation. This wallet holds 2,504,667 LTC worth $158,105,141 at

the current market price. Next is “ltc1qr” holding 2,225,000

LTC worth $140,451,374. Wallet addresses “MQd1f” and “ltc1qn” comes

third and fourth in rankings, holding 1,344,464 LTC and 1,097,050

LTC worth $84,868,217 and $69,250,423 respectively. According to

data from BitInfoCharts, these top four addresses hold 8.18% of the

total coins in circulation. Source: BitInfoCharts Other top-ranking

whales include addresses “ltc1q2” and “MQSs1,” with 927,542 LTC

($58,550,373) and 745,000 LTC ($47,027,540), respectively. Looking

through the data shows these six addresses are the Litecoin

blockchain whales holding more than 1% of the circulating supply.

Metrics from IntoTheBlock put the total concentration of these

whales at 11.88% (8.84 million LTC). Wallets “MB8nnF”, “MFULdM,”

“MESruS,” and “LZEjck” complete the top 10 rankings with 513,259

LTC, 472,674 LTC, 416,688 LTC, and 394,044 LTC, respectively.

What Does Litecoin’s Supply Distribution Mean for the Future? There

seems to be a dull market movement with the whales as sellers

continue to maintain control over the market. As a result, the

inflow to wallets holding at least 0.1% of the circulating supply

has decreased by 91.07% in the past three months. Source:

IntoTheBlock With 87% of LTC already mined, the rate of new supply

will slow down over time. This could support price stability and

sustainability. Litecoin is currently trading at $63.07, and like

all cryptocurrencies, and pseudonymous crypto analyst P_S_trade

predicts Litecoin can push up to $84 very soon. Related

Reading: On-Chain Tracker Notices Major Difference Between Bitcoin

And Ethereum Whales According to historical data compiled by crypto

analyst Tony “The Bull”, Litecoin has always retraced 70% in the

weeks following its past halvings. However, the recently concluded

halving event may present a different narrative. Litecoin is

currently trading in a range since last week and is seeking to

extend its gains of 2.35% over the past 24 hours. LTC price

holding above $62 | Source: LTCUSDT on Tradingview.com

Featured image from Investopedia, chart from Tradingview.com

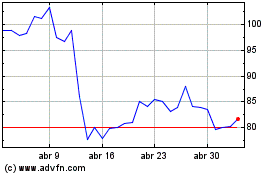

Litecoin (COIN:LTCUSD)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Litecoin (COIN:LTCUSD)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024