Stacks (STX) Shines With 50% Weekly Gains While Market Drops

27 Febrero 2023 - 10:15AM

NEWSBTC

Stacks is a Bitcoin-adjacent blockchain, and STX is the native

token powering it. The network was launched on Bitcoin in 2017 to

enable developers to build and launch smart contracts secured by

the host blockchain. As the NFTs on the network keeps

growing, the native token STX has seen increased usage and price

growth. Stacks STX, is recording a whopping 24.76% in its 24-hour

price gain and 58.82% in weekly gain. The most impressive is STX

trading volume which has spiked by 94.56% pushing its market cap up

by 21.07%. Related Reading: Analysts Argue Why Bitcoin Is On The

Verge Of A New Bull Run Let’s consider some events taking place on

the network now and how STX might move in the next few days.

STX Price Trend In 2023 STX entered the New Year at $0.20 on

January 1. It maintained that level until January 24, when it

recorded an intraday high of $0.30 before continuing its former

trend. Then on February 3, STX closed the market at $0.30 and

started an uptrend but couldn’t sustain it. By February 9, STX went

back to the $0.20 price level and continued until regaining its

$0.30 on February 14. But by February 19, the token spiked to $0.64

and has continued growing until currently at $0.95 today, February

27. STX Price Chart Today STX is in an uptrend today, trading

at $0.9203, a significant jump from yesterday’s closing price of

$0.7822. The uptrend started on February 17, with the asset posting

higher highs to date. The 50-day Simple Moving Average (SMA) has

moved above the 200-day SMA, a bullish signal. Also, STX is trading

above its 50-day and 200-day SMAs, which indicates short and

long-term bullish sentiments for the asset. Stacks has experienced

three consecutive green days on the chart and is finally set to

attain the $1 price level in 2023. STX Relative Strength Index

(RSI) indicator is at 83.55, firmly in the overbought region above

70. It indicates strong pressure from the bulls. STX’s Moving

Average Convergence/Divergence (MACD) is also bullish and above its

signal line. It shows divergence, and the histogram bar for today

shows that the bullish energy is strong. Stacks’ support levels are

$0.6784, $0.7047, and $0.7428; and resistance levels are $0.8072,

$0.8336, and $0.8717. The token will likely increase to $1 in the

next few days if the current momentum were to continue, although a

price pullback may occur. Notable Events on Stacks Network Capable

Of Sustaining Rally Notably, one of the recent events fuelling the

token price is the hype around Bitcoin-based NFTs. Ordinals

protocol is the protocol on Bitcoin supporting NFT developers to

store them on the host blockchain. According to Dune analytics

data, since the launch of Ordinals, the network has recorded almost

178,000 Bitcoin Ordinals inscriptions, increasing network

activities and spiking STX prices. Related Reading: Ripple

Scores New ODL Partner As XRP Bulls Target These Price Levels The

second notable event pushing STX price is the upcoming upgrade

slated for March 2023. According to the Stacks Foundation

announcement, this upgrade to Stacks 2.1 will strengthen the

network’s connection to Bitcoin. Featured image from Pixabay

and chart from TradingView.com

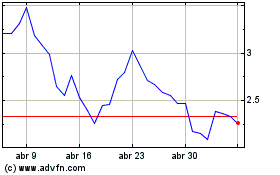

Stacks (COIN:STXUSD)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Stacks (COIN:STXUSD)

Gráfica de Acción Histórica

De May 2023 a May 2024