Bitcoin Price Braces For Volatility Ahead Of Chinese Stimulus Speculations, Options Expiry

12 Octubre 2024 - 1:00AM

NEWSBTC

Bitcoin (BTC) may experience increased volatility in the coming

days, driven by speculation surrounding another Chinese fiscal

stimulus announcement and the expiration of BTC options worth $1.1

billion. Chinese Stimulus Measures To Help Bitcoin? According to

the State Council Information Office, China’s Finance Minister, Lan

Fo’an, is expected to provide details on upcoming fiscal stimulus

measures during a press conference on Saturday. These measures aim

to stimulate economic activity in the country. On September 24, the

People’s Bank of China (PBoC) cut interest rates on existing

mortgages by 0.5% and lowered reserve requirement ratios for banks

to boost market liquidity. The global crypto market is

increasingly paying attention to China’s stimulus plans, as

enhanced liquidity could positively impact the prices of digital

assets like BTC. Related Reading: Is The Bitcoin Bull Run Over? Top

Analyst Predicts What’s Next For Crypto While the announcement is

anticipated, confirmation of another round of fiscal measures,

especially if they exceed market expectations, could significantly

boost risk-on assets like Bitcoin. In addition, if the US

Federal Reserve (Fed) decides to cut key interest rates further, it

could increase investor appetite for riskier assets, including

digital currencies known for their volatility. Currently,

prediction markets are speculating at least another 50 basis points

(bps) cut in interest rates by the end of the year. Such a move

would increase global liquidity and help BTC avoid a capitulation

that could cause its price to crash into the high $40k range. BTC

Options Expiry Could Trigger Price Volatility Another factor

that could impact Bitcoin’s price volatility is the $1.1 billion

worth of 18,000 BTC options set to expire on October 11. At press

time, the put-call ratio is 0.91, indicating a slight tilt toward

put options. With Bitcoin hovering around $60,000, the chances of

reaching the “max pain” price of $62,000 are growing. For those who

are uninitiated, “max pain” refers to the price level where the

most options traders are likely to incur losses. While Bitcoin has

recently benefited from global interest rate cuts, geopolitical

tensions in the Middle East and uncertainty surrounding the U.S.

presidential election in November have made it difficult to predict

BTC’s future price movement. Related Reading: Bitcoin Price Fails

At MA-200, Is A Crash To $52,000 Coming? Despite the challenges

above, some trading firms and crypto analysts are confident about

the resiliency of digital assets and the potential for a Q4 2024

crypto rally. For instance, crypto trading firm QCP Capital noted

that Bitcoin’s swift recovery following the Iranian offensive

against Israel indicated its strong demand among investors.

Similarly, Bitwise CIO Matt Hougan outlined three major factors

that could help the BTC price “melt-up” to a new all-time-high

(ATH) of close to $80,000 in Q4 2024. BTC trades at $62,086 at

press time, up 2.7% in the last 24 hours. Featured image from

Unsplash, chart from Tradingview.com

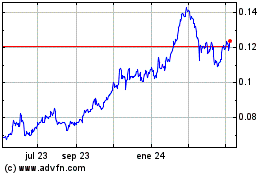

TRON (COIN:TRXUSD)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

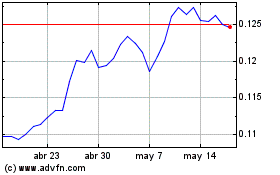

TRON (COIN:TRXUSD)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024