Bitcoin Weekly Momentum Flips Bullish For First Time In 2022: What This Means

29 Marzo 2022 - 9:00AM

NEWSBTC

Bitcoin price is back at $48,000 and with the most recent weekly

close, momentum has flipped bullish for the very first time this

year. With the momentum now behind bulls, what might this mean for

the cryptocurrency market in the weeks and months ahead? The MACD

And Bullish Weekly Bitcoin Momentum Markets are always seeking

equilibrium. When a large move materializes, the same momentum that

carried an asset upward, pulls it downward when the trend begins to

topple. This makes momentum among the most important factors in

determining if and when a trend might change. Related Reading |

Baby Got Back: 50-Year Veteran Trader Compares Bitcoin Bottoms Few

tools measure momentum better than the Moving Average Convergence

Divergence. On weekly timeframes, the logarithmic MACD has opened

with green on the histogram and formed a bull cross of the MACD

line and signal line. It marks the first time the signal has

appeared in all of 2022. Weekly momentum only now opened

bullish | Source: BTCUSD on TradingView.com The above chart

demonstrates that momentum shifts tend to yield significant trend

changes, but tend to lag behind precise tops or bottoms. It is for

this reason that the MACD is considered a “lagging indicator.”

Lagging indicator or not, the results are what matter. Below

represents an analysis of past bull crossovers. Red rallies failed

to product significant new ATHs, but on average still yielded a 40%

gain. Green rallies produced a return of roughly 327% across three

major impulses. The most recent bull cross comes with a potential

bullish divergence. Notably, a divergence appeared prior to the

culmination of the 2017 bull cycle. Measuring the results of past

momentum shifts | Source: BTCUSD on TradingView.com What Wavelength

Suggests About The Current Crypto Cycle The combined analysis

predicts a potential 40% rally from current prices on the low end,

which would take Bitcoin price toward ATHs, but fall slightly short

of a new record. The higher end of the scale projects a possible

327% rally that would push the top cryptocurrency a touch beyond

$200,000 per BTC. Related Reading | This Bitcoin “Heatmap” Suggests

A Blazing Cycle Peak Is Still Ahead Momentum moves in waves. In the

below chart, sine waves are layered over the LMACD in an effort to

highlight intra-cycle wavelengths. Combined with Elliott Wave

Theory, the same sine waves appear to predict odd-numbered impulses

and the bottom of C-waves with a high degree of accuracy. A

recreation of Brandt's comparison with another look for good

measure | Source: BTCUSD on TradingView.com The smaller wave

harmonic waves are simply pieces of the larger cycle wave in blue.

The blue wave structure added helps to explain the sudden strength

of Black Thursday in 2020, and why Bitcoin price couldn’t reach

$100,000 in late 2021 as the market had expected. When the strength

of a larger wave and smaller harmonics combine, major cycle events

occur. If momentum continues to follow the same wave structure, the

final wave up in Bitcoin might have already begun. Follow

@TonySpilotroBTC on Twitter or join the TonyTradesBTC Telegram

for exclusive daily market insights and technical analysis

education. Please note: Content is educational and should not

be considered investment advice. Featured image from

iStockPhoto, Charts from TradingView.com

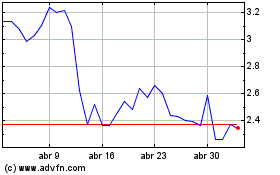

Waves (COIN:WAVESUSD)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Waves (COIN:WAVESUSD)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024

Real-Time news about Waves (Criptodivisas): 0 recent articles

Más de Waves Artículos de Noticias