This Expanding Triangle Pattern Could Be The Last Hope For Bitcoin Bulls

16 Mayo 2022 - 3:30PM

NEWSBTC

Bitcoin broke through support and plunged to the lowest prices seen

since 2020. However, despite all the fear the drop has caused, it

could be the last low before the top cryptocurrency continues its

bull run. Here is why an extremely rare Elliott Wave expanding

triangle pattern could be the last hope Bitcoin bulls have for new

highs before a bear market. Ralph Nelson Elliott And His Theory On

How Markets Move Ask most crypto investors and they would probably

agree: we are in a bear market. However, based on the guidelines of

Elliott Wave Theory, the last year and a half of mostly sideways

could be part of one powerful, confusing, and rare corrective

pattern. Related Reading | One Coin, Two Trades: Why Bitcoin

Futures And Spot Signals Don’t Match Up Elliott Wave Principle was

first discovered by Ralph Nelson Elliott in the 1930s. The theory

believes all markets move in the direction of the primary trend in

the same five-wave pattern. Odd-numbered waves move up with the

primary trend as well, while even-numbered waves are corrective in

nature that move against the trend. Is Bitcoin trading in an

expanding triangle? | Source: BTCUSD on TradingView.com In the

chart above, BTCUSD could potentially be trading in an expanding

triangle. In Elliott Wave Theory, triangles of any kind only appear

immediately preceding the final move of a sequence. During the bear

market, a triangle appeared in place of the B wave before breaking

down to the bear market bottom. Identifying A Bullish Expanding

Triangle Pattern Triangles can contract, expand, descend, ascend,

and even take on some “irregular” shapes. The expanding triangle

pictured above and below should in theory only occur before the

final wave five impulse up. If that’s the case, the bull run could

continue once the bottom of the E wave is put in. Each subwave is a

Zig-zag similar to wave two | Source: BTCUSD on

TradingView.com An expanding triangle is characterized as having

five waves that sub-divide into ABCDE corrections. Waves A, C, and

E are against the primary trend, while B and D waves are with the

primary trend. Each sub-wave further sub-divides into three-wave

patterns called a Zig-zag. Zig-zag patterns are sharper, and more

commonly appear in wave two corrections. The fact that an expanding

triangle has five of these brutal corrections in two different

directions makes it especially confusing and frustrating. Expanding

triangles only form under the most unusual market conditions.

Related Reading | Bitcoin Bear Market Comparison Says It Is Almost

Time For Bull Season Extreme uncertainty drives expansive

volatility in both directions. Both sides of the trade are

repeatedly stopped out of trades, adding to frustration. By the end

of the pattern, order books are thin and easily overpowered.

Decidedly bearish sentiment squeezes prices up quickly causing an

upward breakout of the pattern and continuation of the bull run.

The chase and FOMO creates the conditions necessary for wave five.

Why Bitcoin Could Still Have Wave Five Ahead The only problem is

that there is no telling if this is the correct pattern, or if

Bitcoin is in (or possibly just completed) a wave four according to

Elliott Wave Theory. Knowing that triangles only appear before the

final move of a sequence helps improve the changes of this

expanding triangle being valid. However, it is more important to

understand the characteristics of each wave. Corrective waves

result in ABC or ABCDE corrections (along with some more complex

corrections) that move against the primary trend. Between

corrections is an impulse wave up, in a five-wave stair-stepping

pattern. After the bear market bottom, a new trend emerges starting

with wave one. Wave two is often a sharp, Zig-zag style correction

that retraces most of wave one. A bear market will move below the

zero line on the MACD | Source: BTCUSD on TradingView.com The

lack of a new low creates the confidence for more market

participants to join, making wave three the most powerful and

extended of all. Wave four typically moves sideways and lacks the

same severity of the wave two correction. Elliott said that wave

four represents hesitancy in the market before finishing the trend.

Both wave two and wave four tend to bring the MACD back down to the

zero line before reversing higher – a setup clearly depicted above.

Related Reading | Bitcoin Indicator Hits Historical Low Not Seen

Since 2015 When the hesitancy ends, wave five typically matches the

length and magnitude of wave one. But after such a long and nasty

wave four correction, any wave five has the potential to extend

similar to wave three. If this were the case, the expanding

triangle pattern created the perfect shakeout of both sides of the

market. Here is a 🧵 on my full Elliott Wave analysis on #Bitcoin

and why I don’t believe there is a bear market – and why I expect

the last leg up any day now. — Tony "The Bull" Spilotro

(@tonyspilotroBTC) May 15, 2022 Follow @TonySpilotroBTC on Twitter

or join the TonyTradesBTC Telegram for exclusive daily market

insights and technical analysis education. Please note: Content

is educational and should not be considered investment

advice. Featured image from iStockPhoto, Charts from

TradingView.com

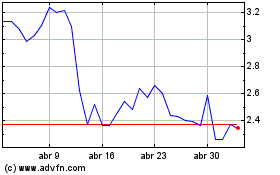

Waves (COIN:WAVESUSD)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Waves (COIN:WAVESUSD)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024

Real-Time news about Waves (Criptodivisas): 0 recent articles

Más de Waves Artículos de Noticias