Regulatory News:

NOT FOR DISTRIBUTION IN THE UNITED STATES OF

AMERICA, CANADA, AUSTRALIA, SOUTH AFRICA AND JAPAN.

BALYO (FR0013258399, Ticker: BALYO), technology leader in

the design and development of innovative robotic solutions for

industrial trucks (the "Company" or the "Issuer"),

today announces the success of its capital increase, with

preferential subscription rights ("PSR"), for a total amount

of €36.6 million. The operation resulted in the issue of

126,051,546 new ordinary shares (the "New Shares"), at a

unit price of €0.29, representing a discount of 39.7% to the

closing price on October 24, 2024, with a parity of 46 New Shares

for 15 existing shares (the "Capital Increase").

Results of the Capital Increase

At the end of the subscription period, the total demand amounted

to 139,347,221 New Shares, representing a subscription rate of

110.55%, distributed as follows:

- 111,230,714 New Shares were subscribed on an irreducible basis,

representing approximately 88.24% of the total number of New Shares

to be issued;

- The demand on a reducible basis covered 28,116,507 new shares,

representing approximately 22.31% of the total number of New Shares

to be issued, and will be consequently only partially allocated,

amounting to 14,820,832 New Shares, distributed based on a

coefficient of 0.4628 calculated on the number of rights presented

in support of subscriptions on an irreducible basis without

resulting allocation of fractional new shares and without the

allocation exceeding the quantity of new shares requested on a

reducible basis.

As a reminder, prior to the launch of the Capital Increase,

BALYO received a subscription commitment from the SoftBank Group

(“SoftBank”), the Company’s principal shareholder, through

its subsidiary SVF II Strategic Investments AIV LLC (“SSI

AIV”):

(i) on an irreducible basis in proportion to

its interest in the Company's capital (corresponding to 31,978,785

shares in the Company at the date of the Prospectus, i.e. 77.8% of

the capital, following the conversion of the Convertible Bonds1 on

October 24, 2024) by exercising all its preferential subscription

rights, and

(ii) on a reducible basis for the remaining

shares, to ensure that the Capital Increase is fully

subscribed.

SSI AIV has also committed, as part of this subscription

agreement, not to exercise the warrants it holds until the

admission of the New Shares to trading on Euronext Paris, scheduled

for November 22, 2024, and to keep the Company’s stock market

listing for at least a 12-month period following the completion of

the Capital Increase.

The subscription amount of SSI AIV is contemplated to be settled

as follows:

(i) on an irreducible basis, in the amount of

€16.6 million, through off-set outstanding amounts owed to SSI AIV

(the “Receivables”) on the subscription date under (x) the

shareholder loan granted on March 21, 2024 (the “Loan”)2

(approximately €13.4 million) and (y) receivables, certain of which

are liquid and due, related to Convertible Bonds3 that could not be

redeemed in shares on October 24, 2024 (approximately €3.1 million

after the aforementioned conversion);

(ii) on an irreducible and reducible basis,

for approximately €18.4 million in cash.

SSI AIV additionally acquired on the market, during the PSR

trading period, 2,523,675 PSR, granting the right to subscribe for

7,739,270 New Shares.

Shareholders other than SSI AIV participated in the Capital

Increase by subscribing to 5,443,041 New Shares.

Proceeds from the Capital Increase

The total gross proceeds from the Capital Increase, including

the issue premium, amount to €36,554,948.34 (of which

€10,084,123.68 par value and €26,470,824.66 issue premium),

corresponding to the number of New Shares, i.e. 126,051,546 New

Shares, multiplied by the subscription price of one New Share, i.e.

€0.29 (consisting of €0.08 par value and €0.21 issue premium).

The net proceeds from the Capital Increase are estimated at

approximately €19.5 million, corresponding to the gross proceeds

after deduction of the fees relating to the Capital Increase. The

remaining balance of the Capital Increase corresponds to the part

of the subscription of SoftBank which shall be settled through

off-set of the Receivables.

Use of the Net Proceeds from the Capital Increase

In addition to strengthening its balance sheet by repaying the

entirety of the Receivables through the Capital Increase, the net

proceeds from the issue of New Shares aim to enable the Company to

extend and meet its cash flow requirements over the next 12

months.

The net proceeds from the Capital Increase will be allocated as

follows:

- €12.5 million (i.e. 64% of the net proceeds) to support revenue

growth, particularly through the direct sales model BL2, which has

experienced significant acceleration since the start of 2024. This

direct sales strategy is particularly focused on the U.S. and EMEA

(Europe, Middle East, and Africa) markets, thereby reinforcing

BALYO's commercial presence in these key regions, and

- €7 million (i.e. 36% of the net proceeds) to R&D, in order

to maintain a high level of innovation, address the technological

needs of customers, and cover the Company's general expenses.

Settlement-Delivery

The New Shares will carry current dividend rights and will be

admitted to trading on Euronext Paris under the same ISIN code

FR0013258399 – BALYO. They will be subject to all statutory

provisions and will be fungible with existing BALYO shares upon the

definitive completion of the Capital Increase. Settlement-delivery

and admission to trading on Euronext Paris are scheduled for

November 22, 2024.

Breakdown of capital and voting rights

Prior to the Capital Increase, the

Company's share capital was distributed as follows:

Shareholders

Non-diluted basis

Diluted basis(1)

Number of shares

% of capital and voting

rights(2)

Number of shares

% of capital and voting

rights(2)

SVF II Strategic Investments AIV LLC

31,978,785

77.8%

51,766,422

84.6%

Mr Pascal Rialland

182,700

0.4%

450,000

0.7%

Treasury shares

61,717

0.2%

61,717

0.1%

Public

8,880,572

21.6%

8,880,572

14.5%

TOTAL

41,103,774

100%

61,158,711

100%

(1) Taking into account (i) the 11,753,581 warrants issued and

allotted by the Company at the date of the Prospectus, whether

exercisable or not, giving entitlement to subscribe for 11,753,581

new shares of the Company, (ii) preferred shares convertible into

ordinary shares according to a conversion ratio established on the

basis of performance ratios as described in the Company's bylaws;

in principle and subject to the achievement of the performance

ratios described, the conversion ratio could be 100 ordinary shares

for 1 preferred share (the maximum number of ordinary shares to be

issued on conversion of the preferred shares would then be 270,000)

and (iii) the new shares issued on conversion of the 279

convertible bonds, for a total principal amount of approximately

€3.1 million.

(2) Theoretical voting rights. All shares have the same voting

rights, with the exception of 2,700 preferred shares which are

deprived of voting right.

Following the Capital Increase, the

Company's share capital shall be as follows:

Shareholders

Non-diluted basis

Diluted basis(1)

Number of shares

% of capital and voting

rights(2)

Number of shares

% of capital and voting

rights(2)

SVF II Strategic Investments AIV LLC

152,587,290

91.28%

164,340,871

91.7%

Mr Pascal Rialland

182,700

0.1%

450,000

0.3%

Treasury shares

61,717

0.0%

61,717

0.0%

Public

14,323,613

8.57%

14,323,613

8.0%

TOTAL

167,155,320

100%

179,176,201

100%

(1) Taking into account (i) the 11,753,581 warrants issued and

allotted by the Company at the date of the Prospectus, whether

exercisable or not, giving entitlement to subscribe for 11,753,581

new shares of the Company, and (ii) preferred shares convertible

into ordinary shares according to a conversion ratio established on

the basis of performance ratios as described in the Company's

bylaws; in principle and subject to the achievement of the

performance ratios described, the conversion ratio could be 100

ordinary shares for 1 preferred share (the maximum number of

ordinary shares to be issued on conversion of preferred shares

would then be 270,000).

(2) Based on a share capital composed of 167,155,320 shares and

167,152,620 theoretical voting rights. All shares have the same

voting rights, with the exception of 2,700 preferred shares, which

are deprived of voting right.

Availability of the Prospectus

The Prospectus consisting of (i) BALYO's 2023 Universal

Registration Document filed with the AMF on April 26, 2024 under

number D.24-0334 and (ii) the Amendment to such 2023 Universal

Registration Document filed with the AMF on 25 October 2024 under

number D.24‑0334-A01 and (iii) a Securities Note (including a

summary of the Prospectus) which received AMF approval number

24‑447 on October 25, 2024 is available on the AMF website

(www.amf-france.org) and on the Company's website

(https://www.balyo.com/en-us/investors). Copies of the Prospectus

are available free of charge from BALYO's headquarters (74, Avenue

Vladimir Ilitch Lénine - 94110 Arcueil).

Risk factors

Risks relating to the Company

The public's attention is drawn to the risk factors relating to

the Company and its business, which are described in Chapter 3 of

the 2023 Universal Registration Document, Chapter 4 of the

Amendment to the 2023 Universal Registration Document and Chapter 2

of the Securities Note.

The occurrence of any or all of these risks could have an

adverse effect on the Company’s business, financial position,

results, development, or outlook. The risk factors outlined in the

aforementioned documents remain unchanged as of the date of this

press release.

Financial and Legal Advisors

TP ICAP

Global Coordinator, Lead Manager

and Bookrunner

McDermott Will &

Emery Legal Advisor

NewCap

Financial Communication

About BALYO Humans around the World deserve enriching and

creative jobs. At BALYO, we believe that pallet movements in DC and

manufacturing sites should be left to fully autonomous robots. To

execute this ambition, BALYO transforms standard forklifts into

intelligent robots thanks to its breakthrough Driven by Balyo™

technology. Our leading geo guidance navigation system enables

robots to locate their position and navigate autonomously inside

buildings - without the need for any additional infrastructure. To

accelerate the material handling market conversion to autonomy,

BALYO has entered into two global partnerships with KION

(Fenwick-Linde's parent company) and Hyster-Yale Group. A full

range of globally available robots has been developed for virtually

all traditional warehousing applications; Tractor, Pallet,

Stackers, Reach and VNA-robots. BALYO and its subsidiaries in

Boston and Singapore serve clients in the Americas, Europe and

Asia-Pacific. The company has been listed on EURONEXT since 2017

and its sales revenue reached €26.7 million in 2023. For more

information, visit www.balyo.com.

Disclaimer

With respect to Member States of the European Economic Area

other than France, no action has been taken or will be taken to

permit a public offering of the securities referred to in this

press release requiring the publication of a prospectus in any such

Member State. Therefore, such securities will only be offered in

any such Member State (i) to qualified investors as defined in

Regulation (EU) 2017/1129 of the European Parliament and European

Council of 14 June 2017, as amended (the “Prospectus

Regulation”) or (ii) in accordance with the other exemptions of

Article 1(4) of Prospectus Regulation.

In France, the offer of BALYO shares described in this document

will be made in the context of a share capital increase with

preferential subscription rights through a public offering in

France, on an irreducible and reducible basis, to the benefit of

shareholders, and a global placement for institutional investors in

France and outside of France, but excluding, in particular, the

United States of America, Canada, Japan and South Africa.

This press release and the information it contains are being

distributed to and are only intended for persons who are (x)

outside the United Kingdom or (y) in the United Kingdom who are

qualified investors (as defined in the Prospectus Regulation as it

forms part of domestic law by virtue of the European Union

(Withdrawal) Act 2018) and are (i) investment professionals falling

within Article 19(5) of the Financial Services and Markets Act 2000

(Financial Promotion) Order 2005, as amended (the “Order”),

(ii) high net worth entities and other such persons falling within

Article 49(2)(a) to (d) of the Order (“high net worth companies”,

“unincorporated associations”, etc.) or (iii) other persons to whom

an invitation or inducement to participate in investment activity

(within the meaning of Section 21 of the Financial Services and

Market Act 2000) may otherwise lawfully be communicated or caused

to be communicated (all such persons in (y)(i), (y)(ii) and

(y)(iii) together being referred to as “Relevant Persons”).

Any invitation, offer or agreement to subscribe, purchase or

otherwise acquire securities to which this press release relates

will only be engaged with Relevant Persons. Any person who is not a

Relevant Person should not act or rely on this press release or any

of its contents.

This press release may not be distributed, directly or

indirectly, in or into the United States. This press release and

the information contained therein does not, and will not,

constitute an offer of securities for sale, nor the solicitation of

an offer to purchase, securities of BALYO in the United States or

any other jurisdiction where restrictions may apply. Securities may

not be offered or sold in the United States absent registration or

an exemption from registration under the U.S. Securities Act of

1933, as amended (the “Securities Act”). The securities of

BALYO have not been and will not be registered under the Securities

Act, and BALYO does not intend to conduct a public offering in the

United States.

The distribution of this press release may be subject to legal

or regulatory restrictions in certain jurisdictions. Any person who

comes into possession of this press release must inform him or

herself of and comply with any such restrictions.

Any decision to subscribe for or purchase the shares or other

securities of BALYO must be made solely based on information

publicly available about BALYO. Such information is not the

responsibility of TP ICAP and has not been independently verified

by TP ICAP.

1 Subscribed on June 14, 2023: "Proposed tender offer from

SoftBank Group to acquire Balyo’s shares".

2 As a reminder, on March 21, 2024, the Company entered into a

shareholder loan with the SoftBank Group, for a total principal

amount of up to €12 million. Under the terms of a perfect payment

delegation agreement entered into between the Company, SoftBank

Group, SSI AIV, and SoftBank Overseas GK on November 13, 2024, the

Loan was fully transferred from SoftBank Group to SSI AIV. As of

the date of this press release, all of the €12 million has been

made available to the Company; consequently, no further amounts are

available under the Loan. The terms and conditions of the Loan are

described in Section 3.2 of the Amendment to the 2023 Universal

Registration Document. It may be repaid by offsetting receivables

against a capital increase and is subject to sales and operating

cash flow covenants calculated quarterly by the Company, which is

required to issue a compliance certificate every quarter. These

covenants remain unchanged at the date of this press release.

3 As a reminder, on June 14, 2023, the Company entered into a

bond loan agreement with SSI AIV for a total principal amount of

€5,000,000 through the issue of 500 Convertible Bonds. The Company

has drawn down of all the Convertible Bonds in four tranches. At

its meeting on October 24, 2024, the Board of Directors decided to

issue 6,738,037 new ordinary shares in respect of the conversion

request sent by SSI AIV on October 24, 2024 for the conversion of

221 Convertible Bonds, representing an amount in principal and

interest of €2,627,834.43, based on a conversion price of €0.39 per

new share (calculated as the volume-weighted average price of the

last thirty trading sessions (€0.4858) less a discount of 20%, as

defined in the Convertible Bond issuance agreement). Following this

conversion, 279 Convertible Bonds remain outstanding, for a total

amount of €3,133,282.18 (principal and interest to date).

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241120872890/en/

BALYO investors@balyo.com

NewCap Financial Communication and Investor Relations

Thomas Grojean / Aurélie Manavarere Phone: +33 1 44 71 94 94

balyo@newcap.eu

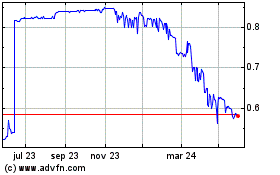

Balyo (EU:BALYO)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

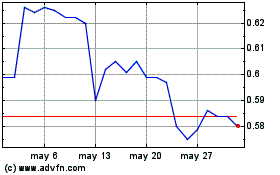

Balyo (EU:BALYO)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024