2024 targets confirmed

- Revenue of €1,428 million, up 11% compared with the first

half of 2023 and up 5% on a like-for-like basis1

- Revenue of gaming activities in France2 up 7% to €1,299 million

- Lottery revenue up 5% to €1,005 million, thanks to a good

performance from instant games and draw games

- Sharp rise in sports betting and online gaming open to

competition, up 15% to €294 million, boosted by sports results

exceptionally favourable for FDJ

- Very sharp rise in digital revenue to €201 million, up 40% when

including the acquisitions of PLI and ZEturf, and up 25% on a

like-for-like basis. This performance is still largely attributable

to the increase in the number of players and takes the digital

share of revenue to 15%. Point-of-sale revenue up 8% and up 3% in

France

- Recurring EBITDA of €370 million, up 23%, giving a margin of

25.9% which benefits from the exceptional effect of high sports

betting margin

- Adjusted net profit3 up 28% to €235 million:

Continued high level of net financial income

- 2024 targets confirmed: Revenue growth of around 8% for

the Group and around 5% for gaming activities in France. Recurring

EBITDA margin of around 24.5%.

Regulatory News:

La Française des Jeux (FDJ) (Paris:FDJ), France’s leading gaming

operator, announces its revenue and results for the first half of

2024.

Stéphane Pallez, Chairwoman and CEO of the FDJ Group,

said: “The second quarter confirmed the positive trend seen since

the beginning of the year thanks to our network of points of sale

and to a very strong momentum from digital games, which now account

for 15% of Group revenue. This solid performance confirms our

annual targets. In addition, we hope to finalise the acquisition

project of Kindred in the near future, thereby marking a major new

step in the Group's development, both internationally and in our

online sports betting and gaming activity, to the benefit of all

our stakeholders.”

Key figures (in €

millions)

H1 2024

H1 2023

Change

Revenue*

1,428

1,289

+10.8%

Recurring operating

profit

285

240

+19.0%

Net profit

213

181

+17.5%

Adjusted net profit**

235

183

+28.3%

Recurring EBITDA***

370

300

+23.5%

Recurring EBITDA margin /

revenue

25.9%

23.3%

* Revenue: net gaming revenue and revenue from other activities

** Adjusted net profit: With effect from the publication of the

2024 half-yearly financial statements, FDJ is introducing a new

indicator to reflect the Group’s actual economic performance and

enable it to be monitored and compared with its competitors. The

Group has decided to adjust consolidated net profit to eliminate

the following items:

- depreciation and amortisation of intangible and tangible

assets, recognised or revalued when allocating the purchase price

of business combinations

- the non-cash impact of the currency hedge relating to

acquisitions, which is recognised under other non-recurring

operating expenses

- and changes in deferred tax resulting from these items

*** Recurring EBITDA: recurring operating profit(/loss) adjusted

for depreciation and amortisation expense

Highlights of the first

half

- Renewal of Stéphane Pallez’s term of office as Chairwoman

and CEO

The Board of Directors of the FDJ Group has approved the

reappointment of Stéphane Pallez as Chairwoman and CEO for a

four-year term. This reappointment is part of the renewal of

Stéphane Pallez’s term of office as director, which was put to the

vote of FDJ shareholders at the Annual General Meeting on 25 April

and approved by 94.2% of the votes cast.

- Public tender offer for Kindred

On 20 February 2024, the tender offer for Kindred was opened for

a maximum period of 39 weeks. The completion of the takeover is

subject in particular to obtaining regulatory authorisations and

the acquisition by FDJ of at least 90% of Kindred’s share

capital.

At this stage, the authorisation decision of the French

Competition Authority (ADLC) is the last regulatory condition

necessary to finalise this offer.

On 14 May, FDJ notified the ADLC of its acquisition project of

the Kindred group by means of a tender offer. Following comments

from third parties and questions from the market, FDJ proposed

adjustments to the commitments it made in 2023 in connection with

the acquisition of ZEturf, relating to the separation of activities

under exclusive rights from those open to competition.

The Group estimates4 that it would have recorded combined

revenue of around €3.5 billion and combined recurring EBITDA of

around €840 million for the full 2023 financial year if Kindred had

been acquired on 1 January 2023, and combined revenue of €1.9

billion and combined recurring EBITDA of around €490 million for

the first half of 2024 if Kindred had been acquired on 1 January

2024.

- Cancellation of 3% of FDJ’s share capital following the

French Court of Cassation’s ruling in favour of the FDJ Group in

its dispute with Soficoma

This decision by the Court of Cassation results in the

cancellation of 5,730,000 FDJ shares and the corresponding

reduction in FDJ’s share capital, which now stands at 185,270,000

shares.

- Payment & Services: launch of Nirio Premio and a

free-flow motorway toll payment service

- At the end of April, Nirio, FDJ Services’ payment solution,

launched Nirio Premio, an offer combining an account domiciled in

France and a payment card, as well as budget management tools.

- Since the end of June, Nirio can also be used for free-flow

motorway toll payments, in cash or by card, in the network of

approved bars, tobacconists and newsagents. This payment is now

available to customers on the A14 and A79 motorways.

- Sustained social commitment in favour of responsible gaming,

inclusion and the environment

- Initiatives to prevent underage and excessive gambling have

been stepped up, with convincing results

- The proportion of gross gaming revenue from online lottery

generated by high-risk players is 1.6%5, compared with 1.8% at the

end of December 2023, which is below the 2025 target of less than

2%.

- The Group, which devotes 10% of its annual advertising spend to

preventing underage and excessive gambling, runs campaigns

reminding people that gambling is prohibited for minors and that it

is important to set limits to ensure that this practice remains

recreational.

- As with every major sporting event, FDJ stepped up its

prevention activities for the UEFA European Football Championship,

notably by increasing dedicated TV campaigns. In addition, almost

1,500 awareness-raising calls were made to sports betting players

before and during the Euro.

- “Héritage 2024”: the FDJ Foundation supports two inclusion and

education projects for a total of €3 million

- The FDJ Corporate Foundation is supporting two new projects as

part of its “Héritage 2024” call for major projects, for a total of

€3 million. The first, “ETRE et devenir”, trains young people who

have dropped out of school for careers in the ecological

transition. The second, “La récré sportive 100% inclusion”,

develops sporting activities for vulnerable children.

- A recognised commitment to reducing its carbon footprint

- For the third consecutive year, FDJ obtained an “A” carbon

score for the Vérité40 index established by the investment

consultancy Axylia, comprised of the 40 best carbon scores of SBF

120 companies.

- Continuation of the Group’s sponsorship of Office français de

la biodiversité (OFB)

- The FDJ Group has renewed its commitment to the French Office

for Biodiversity with the signing of a new sponsorship agreement

providing for support of €700,000 over two years. FDJ is keen to

continue its commitment as a “Major Sponsor” of the OFB by

supporting three new biodiversity conservation projects in France

and the French Overseas Territories.

First-half activity and

results

Gross gaming revenue (GGR) for the first half of 2024 was €3,660

million, an increase of 11.1%. After €2,304 million in public

levies, net gaming revenue (NGR) rose by 11.3% to €1,356

million.

After taking account of €72 million in revenue from other

activities, the Group’s first half revenue came to €1,428 million,

an increase of 10.8%, or +4.7% on a like-for-like basis.

Revenue (€m)

H1 2024

H1 2023

Change

€m

Change

%

of which on a like-for-like

basis

Lottery

1,005

958

+48

+5.0%

+5.0%

Sports betting and online gaming

open to competition

294

257

+37

+14.5%

+6.7%

International and Payment &

Services

129

75

+54

+72.9%

-5.8%

Group total

1,428

1,289

+139

+10.8%

+4.7%

Revenue of €1,428 million, up 10.8% and

up 4.7% on a like-for-like basis

- Gaming revenue in France rose by 7.0% to €1,299 million.

- Lottery revenue was €1,005 million, a rise of 5.0% and 7.8%

excluding Amigo. Digital momentum remains very strong, up 24.4% in

the first half, taking the lottery’s digital penetration to 13.8%

compared with 11.6% in H1 2023. Revenue from instant games rose by

6.7%, buoyed by the success of events in the games portfolio such

as the launch of Ticket d’Or (€5) in early January and the phygital

game Maxi Black Jack (€5) in May. Revenue from draw games was up by

2.1%, and by 9.8% excluding Amigo. This performance was driven in

particular by EuroDreams and more attractive Euromillions jackpots

than in H1 2023, while Amigo returned to growth at the beginning of

June.

- Revenue from sports betting and online gaming open to

competition was €294 million, up 14.5% from H1 2023, and up 6.7% on

a like-for-like basis . The first quarter performance had been

affected by the high comparison basis of the first quarter of 2023,

which had benefited in particular from the very positive impact of

the football World Cup at the end of 2022. In the second quarter,

betting on the Euro football championship fell short of

expectations, but revenue was boosted by results that defied the

odds and therefore played in the operator’s favour. Online business

continued to enjoy sustained growth, up 28.3% on a like-for-like

basis. This performance reflects the intrinsic dynamism of

ParionsSport en ligne, which is also benefiting from the

attractiveness of poker, with a high level of cross-selling.

Horse-race betting was stable, in line with the performance of the

market and on a par with the end of 2023.

- Revenue from other activities (International and Payment &

Services) came to €129 million, compared with €75 million in the

first half of 2023, an increase attributable to the integration of

PLI, which performed well, driven in particular by EuroDreams and

instant games.

- By distribution channel:

- Digital revenue has risen sharply, by 39.8% when including the

acquisitions of PLI and ZEturf, and by 25.1% on a like-for-like

basis. This growth was driven both by sports betting and online

gaming open to competition and by online lottery, which benefited

from EuroDreams’ very high level of digitalisation, as well as the

attractiveness of instant games and the exclusive online offer.

Digital revenue now accounts for 14.8% of total revenue compared

with 11.8% in H1 2023. This performance is still largely

attributable to the increase in the number of players.

- Point-of-sale (PoS) revenue rose by 7.5%, mainly due to the

integration of PLI. In France, point-of-sale revenue has risen by

2.6%.

- Contribution margin by

activity

The Group’s organisation is based on three operating segments:

two Business Units (BUs), Lottery and Sports betting and online

gaming open to competition, and the other activities, which bring

together developing businesses (International, and Payment &

Services), with cross-cutting support functions (notably customer,

distribution and information systems), and the holding company,

which mainly groups together central costs.

The contribution margin is one of the key performance indicators

for these segments. It is the difference between the revenue of the

operating segments and their cost of sales (including PoS

commissions) and marketing and communication expenses (excluding

depreciation/amortisation).

Lottery revenue was €1,005 million, a rise of 5.0%.

Cost of sales came to €536 million, up 1.8% (€9 million)

compared with H1 2023. It mainly comprises PoS commissions of €397

million, an increase of 1.0% in line with the network’s activity

over the period. Marketing and communication expenses rose by 5.7%

to €86 million.

The Lottery BU’s contribution margin came to €383 million,

representing a margin on revenue of 38.1%, compared with 36.4% in

H1 2023.

- Sports betting and online gaming open

to competition

Revenue from sports betting and online gaming open to

competition was €294 million, up 14.5% from H1 2023 and up 6.7% on

a like-for-like basis.

Cost of sales came to €125 million, up 1.5% (€2 million)

compared with H1 2023. This mainly corresponds to PoS commissions,

which are in line with the network’s stakes. Other sales costs rose

slightly due to the integration of ZEturf. Marketing and

communication expenses were €78 million. More than half of this

32.0% increase (€19 million) on the first half of 2023 is due to

changes in consolidation scope.

The contribution margin of the Sports betting and online gaming

open to competition BU was €91 million, representing a margin on

revenue of 30.8% compared with 28.9% in H1 2023.

Other activities (International and Payment & Services)

recorded revenue of €129 million, an increase attributable to PLI,

for a contribution margin of €25 million.

Central costs came to €128 million, virtually unchanged from H1

2023.

Recurring operating profit of €285

million and recurring EBITDA of €370 million, giving a recurring

EBITDA margin of 25.9%

Cost of sales came to €736 million, including €517 million in

PoS commissions (+4.9%), based on an increase in offline stakes,

driven in particular by the integration of PLI. The 5.4% rise in

other sales costs to €219 million was due solely to changes in

consolidation scope, mainly PLI.

Marketing and communication expenses include costs related to

the development of the gaming and services offer, particularly

digital offers and services, as well as advertising and

communication costs. They totalled €270 million, up 21.3% and 5.3%

on a like-for-like basis.

General and administrative expenses mainly include personnel

expenses and operating costs for central corporate functions, as

well as building and IT infrastructure costs. They totalled €115

million, down 2.8% compared with H1 2023.

Other operating income and expenses amounted to a €22 million

net expense, mainly comprising the amortisation charge for

exclusive operating rights to games in France and Ireland.

The Group’s recurring operating profit accordingly amounted to

€285 million, up 19.0% compared with H1 2023.

Recurring EBITDA corresponds to recurring operating profit

adjusted for depreciation and amortisation. It came to €370

million, up 23.5% compared with H1 2023. Net depreciation and

amortisation of tangible and intangible assets increased by €25

million to €85 million in H1 2024, mainly as a result of the €24

million depreciation of intangible assets recognised in connection

with the acquisitions of PLI and ZEbet / ZEturf in 2023.

As such, the recurring EBITDA margin was 25.9% in H1 2024,

compared with 23.3% in H1 2023.

Other non-recurring operating income and expenses amounted to a

€21 million net expense, compared with a €14 million expense in H1

2023. They mainly include costs related to acquisitions and the

impact of the revaluation of Sporting Group’s B2B assets, which are

in the process of being sold.

Operating profit for H1 2024 was €265 million, up 17.4% compared

with H1 2023.

The high level of net financial income (€23 million in H1 2024

compared with €19 million in H1 2023) reflects the continuing high

level of interest rates.

The Group’s tax expense was €78 million, representing an

effective tax rate of 26.9% for H1 2024 stable compared with H1

2023.

As such, consolidated net profit for H1 2024 amounted to €213

million, up 17.5% compared with H1 2023.

Adjusted net profit of €235 million, up

28.3% compared with €183 million for the first half of

2023

With effect from the publication of the 2024 half-yearly

financial statements, FDJ is introducing a new indicator to reflect

the Group’s actual economic performance and enable it to be

monitored and compared with its competitors.

The Group has decided to adjust consolidated net profit to

eliminate the following items:

- Depreciation and amortisation of intangible and tangible

assets, recognised or revalued when allocating the purchase price

of business combinations;

- The non-cash impact of the currency hedge relating to the

acquisition of Kindred Group, which is recognised under other

non-recurring operating expenses;

- And changes in deferred tax resulting from these items.

As such, adjusted net profit for H1 2024 was €235 million, up

28.3% compared with €183 million for H1 2023.

Net cash surplus of €616 million at end

June 2024

The net cash surplus is one of the indicators that represent the

Group’s net cash position6.

At 30 June 2024, the Group’s net cash position amounted to €616

million. The change from €671 million at 31 December 2023 is mainly

due to:

- Free cash flow of €346 million, after taking into account a

working capital surplus of €60 million and investments in property,

plant and equipment, intangibles and financial assets of €76

million;

- Partly offset by €329 million in dividends in respect of 2023

and €59 million in tax.

For information, the level of the net cash surplus at the end of

June cannot be extrapolated to the end of December, as there are

significant calendar effects on the payment of public levies, with,

in particular, an advance payment on public levies in December.

2024 Outlook

In light of the performance of the first half and taking into

account the integration of the ZEturf group and PLI at the end of

2023, respectively from 29 September and 3 November, FDJ is

reiterating its 2024 objectives of around 8% growth in total Group

revenue, and around 5% growth in revenue from gaming activities in

France, with a recurring EBITDA margin of around 24.5%.

The Board of Directors of FDJ met on 25 July 2024 and examined

the consolidated financial statements for the six months ended 30

June 2024, which were prepared under its responsibility.

The limited review procedures for the interim financial

statements have been performed. The statutory auditors’ limited

review report is currently being issued.

The condensed interim consolidated financial statements and a

financial presentation are available on the FDJ Group website:

https://www.groupefdj.com/en/publications-and-results/

Next financial

communication

FDJ will publish its revenue for the nine months to the end of

September on Thursday 17 October 2024 after close of trading.

About FDJ Group

France's leading gaming operator and one of the industry leaders

worldwide, FDJ offers responsible gaming to the general public in

the form of lottery games (draws and instant games), sports betting

(through its ParionsSport point de vente et ParionsSport en ligne

brands), horse-race betting and poker. FDJ's performance is driven

by a large portfolio of iconic brands, the leading local sales

network in France, a growing market, and recurring investments. The

Group implements an innovative strategy to increase the

attractiveness of its gaming and service offering across all

distribution channels, by offering a responsible customer

experience.

FDJ Group is listed on the regulated market of Euronext Paris

(Compartment A – FDJ.PA) and is part of the SBF 120, Euronext 100,

Euronext Vigeo 20, EN EZ ESG L 80, STOXX Europe 600, MSCI Europe

and FTSE Euro indices.

For more information, visit www.groupefdj.com

________________________________ 1 Excluding the contribution of

PLI and ZEturf over 2024, and Sporting's B2C over 2023. 2 Lottery

and sports betting under exclusive rights and online betting and

gaming open to competition. 3 See note** on next page. 4 FDJ has

estimated the combined revenue and EBITDA for the 2023 financial

year and for the first half of 2024 in order to illustrate the

significant effects that the Kindred acquisition would have had on

the FDJ Group if it had occurred on 1 January 2023 and 1 January

2024, respectively, and on the basis of the scope that would

effectively be retained by FDJ. This scope was announced on 22

January 2024, with the planned exit of Norway and other .com sites,

unless there is a clear opportunity for a local licence (for

example, in Finland, where a draft bill aims to introduce a

licensing system for online betting, online slot machines and

casino games by early 2027). Kindred has also announced its gradual

exit from the US market, to be completed by the end of the first

half of 2024. As Kindred has not published any financial

information on those markets in the scope of consolidation that the

Group has announced it will not retain, FDJ has estimated Kindred’s

revenue and EBITDA in this consolidation scope for the 2023

financial year and for the first half of 2024 without taking into

account potential synergies and exit costs and using a consistent

presentation of revenue. The average EUR/GBP rate used is 0,865675

for 2023 and 0,854647 for the 1 half of 2024. 5 At the end of June

2024, over a rolling 12-month period. 6 This corresponds to

non-current financial assets, current financial assets and cash and

cash equivalents, net of non-current financial liabilities and

current financial liabilities, less: current and non-current

deposits and guarantees given; cash subject to restrictions;

amounts allocated exclusively to Euromillions winners;

non-consolidated securities, mainly comprised of units in venture

capital funds (FDJ Ventures).

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240725400502/en/

Media Contact 01 41 10 33 82 |

servicedepresse@lfdj.com

Investor Relations Contact 01 41 04 19 74 |

invest@lfdj.com

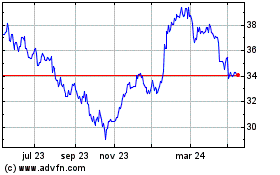

Francaise Des Jeux (EU:FDJ)

Gráfica de Acción Histórica

De Jun 2024 a Jul 2024

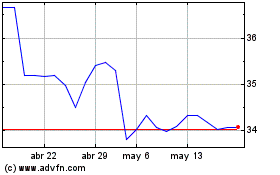

Francaise Des Jeux (EU:FDJ)

Gráfica de Acción Histórica

De Jul 2023 a Jul 2024