Steady progress on Ontex’s transformation, realizing key strategic

milestones, while continuing to deliver solid results

- Social negotiations regarding transformation of Belgian

operating footprint concluded successfully;

- Agreement reached to sell Brazilian

business;

- Cost transformation program delivery and revenue growth

of 2% LFL drove adj. EBITDA up by 29% year on year, and margin to

12%;

- Leverage ratio further improved to 2.4x;

- Full year outlook for adj. EBITDA margin, free cash

flow and leverage confirmed, while revenue growth expected between

2% and 3% LFL.

CEO quote

Gustavo Calvo Paz, Ontex’s CEO, said: “With

the agreement to sell our Brazilian operations, Ontex's

transformation is marking a major milestone, shifting our focus

even more to retail brands and healthcare in the rapidly growing

North American market and in the streamlined European market.

Finalizing social negotiations to optimize our European

manufacturing footprint has been another milestone to realize that.

Meanwhile we delivered solid results, allowing us to confirm our

adjusted EBITDA margin and free cash flow expectations, which is an

excellent achievement for the entire Ontex team.”

Q3 2024 results

- Revenue [1] was €468 million, up 1.7%

like for like. Volumes, including mix effects, were up 4.4%, driven

by contract gains and supportive demand in adult care, and by

growth in baby care with new retail customers in North America.

Sales prices were 2.6% lower, as expected, reflecting raw material

index decreases and investments in increased competitiveness. Forex

fluctuations were supportive, adding 0.7%, bringing total growth at

2.4%.

- Adjusted EBITDA [1] was €56 million, up

29% year on year, thanks to volume and mix growth and the cost

transformation program delivery, contributing €8 million and €14

million respectively. The operational efficiency improved further

by 3.7%, driving stronger profitability and competitiveness.

Index-driven lower raw material costs more than compensated for

lower sales prices, leading to a €4 million positive net impact.

The increase of other operating and SG&A costs had a €(12)

million effect, mostly due to continued inflation. Forex

fluctuations had an adverse effect of €(2) million. The adjusted

EBITDA margin thereby rose to 12.0%, up 2.4pp year on year.

- Operating profit [1] was €8

million, compared to €29 million in 2023. The decrease relates to

the transformation of the Belgian operating footprint and reflects

the additional one-time provisions taken following the recent

successful conclusion of the social plan negotiations.

- Discontinued operations generated a €14

million operating profit, compared to €12 million in 2023. While

revenue was 3.0% lower like for like and the adjusted EBITDA margin

dropped to 7.6%, reflecting more challenging market conditions,

this was compensated by a net gain on disposal, that was triggered

by the agreement to divest the Brazilian business.

- Net financial debt for the Total Group dropped €9

million to €579 million over the quarter. Combined with the

adjusted EBITDA improvement, the leverage ratio thereby fell from

2.5x at the end of June to 2.4x at the end of September.

Strategic

developments

- In September, Ontex reached a binding agreement to sell its

Brazilian business activities to Softys SA for an enterprise value

of approximately €110 million, enabling improved focus on retail

brands and healthcare in Europe and North America. Net proceeds of

approximately €82 million are due at closing, which is expected

during the first half of 2025, subject to customary

conditions.

- In October, the social negotiations regarding the

transformation of the operating footprint in Belgium were

successfully concluded. This transformation fits in Ontex’s

footprint optimization, allowing to further strengthen Ontex’s

competitive position. The total one-time cost is estimated at €(66)

million, of which €(37) million was already recorded in the second

quarter.

2024 outlook

Ontex’s management confirms its guidance for

adjusted EBITDA margin, free cash flow and leverage for the full

year. While new customers are on-boarded in North America, the

ramp-up is phased more gradually over the third quarter and the

coming months, leading management to review its revenue growth

guidance, now expecting:

- Revenue [1] to grow between 2% and 3% like

for like;

- Adjusted EBITDA margin [1] of

12%;

- Free cash flow higher than €20 million;

- Leverage ratio below 2.5x at year end.

[1] Reported P&L figures,

represent continuing operations, i.e. Core Markets, only. As from

2022, Emerging Markets are reported as assets held for sale and

discontinued operations, following the strategic decision to divest

these businesses.

Unless otherwise indicated, all comments in

this document are on a year-on-year basis and for revenue

specifically on a like-for-like (LFL) basis (at constant currencies

and scope and excluding hyperinflation effects). Definitions of

Alternative Performance Measures (APMs) in this document can be

found on page 6.

Key business and financial indicators

|

Business results |

Q3 |

9 months |

|

in € million |

2024 |

2023 |

% |

% LFL |

2024 |

2023 |

% |

% LFL |

| Core

Markets (continuing operations) |

|

Revenue |

468.0 |

456.9 |

+2.4% |

+1.7% |

1,384.0 |

1,348.7 |

+2.6% |

+2.4% |

|

Baby Care |

201.3 |

202.3 |

-0.5% |

-1.2% |

592.0 |

598.9 |

-1.1% |

-1.7% |

|

Adult Care |

200.2 |

185.0 |

+8.2% |

+7.6% |

594.8 |

544.9 |

+9.2% |

+10% |

|

Feminine Care |

56.6 |

61.0 |

-7.1% |

-7.8% |

177.2 |

184.0 |

-3.7% |

-4.3% |

| Adj.

EBITDA |

56.1 |

43.6 |

+29% |

|

165.8 |

127.4 |

+30% |

|

|

Adj. EBITDA margin |

12.0% |

9.5% |

+2.4pp |

|

12.0% |

9.4% |

+2.5pp |

|

| Operating

profit |

8.3 |

29.3 |

-71% |

|

39.4 |

64.9 |

-39% |

|

| Emerging

Markets (discontinued operations) [2] |

|

Revenue |

68.3 |

111.0 |

|

-3.0% |

234.2 |

448.1 |

|

-4.6% |

| Adj.

EBITDA |

5.2 |

14.8 |

|

|

25.2 |

37.6 |

|

|

|

Adj. EBITDA margin |

7.6% |

13.3% |

-5.8pp |

|

10.8% |

8.4% |

+2.4pp |

|

| Operating

profit |

13.5 |

12.3 |

|

|

6.7 |

9.5 |

|

|

| Total Group

[2] |

|

Revenue |

536.2 |

567.9 |

|

+1.0% |

1,618.2 |

1,796.8 |

|

+1.3% |

| Adj.

EBITDA |

61.2 |

58.4 |

|

|

191.0 |

165.0 |

|

|

|

Adj. EBITDA margin |

11.4% |

10.3% |

+1.1pp |

|

11.8% |

9.2% |

+2.6pp |

|

| Operating

profit |

21.9 |

41.6 |

|

|

46.2 |

74.4 |

|

|

| Net financial debt

[3] |

579.5 |

665.3 |

-13% |

|

|

Leverage ratio [3] |

2.4x |

3.3x |

(0.9x) |

|

|

Core Markets revenue |

2023 |

Vol/mix |

Sales |

2024 |

Forex |

2024 |

|

in € million |

|

|

price |

LFL |

|

|

| Q3 |

456.9 |

+20.0 |

-12.0 |

464.8 |

+3.1 |

468.0 |

| 9 months |

1,348.7 |

+61.5 |

-28.6 |

1,381.7 |

+2.3 |

1,384.0 |

| |

|

|

|

|

|

|

|

|

|

|

Core Markets adj. EBITDA [4] |

2023 |

Vol/mix |

Raw |

Operat. |

Operat. |

SG&A/ |

Forex |

2024 |

|

in € million |

|

/price |

mat'ls |

costs |

savings |

Other |

|

|

| Q3 |

43.6 |

-4.4 |

+16.0 |

-10.1 |

+14.2 |

-1.6 |

-1.6 |

56.1 |

| 9 months |

127.4 |

-14.7 |

+38.9 |

-21.1 |

+51.3 |

-13.7 |

-2.3 |

165.8 |

[2] The Emerging Markets and Total

Group year-on-year comparison is affected by divestments, i.e. the

Mexican business activities in 2023 and the Algerian and Pakistani

ones in 2024. The LFL comparison is corrected for this scope

reduction.

[3] Balance sheet data reflect the

end of the period and compare to the start of the period, i.e.

December 2023.

[4] The adjusted EBITDA bridge

methodology was changed in order to only present currency

translation effects separately, whereas before all foreign exchange

and hedge effects were presented separately.

Q3 2024 business review of Core Markets (continuing

operations)

Revenue

Revenue was €468 million, up 1.7% like

for like. Lower sales prices were more than offset by the volume

and mix growth, driven by adult care and by retail baby care in

North America. Forex fluctuations were supportive, leading to a

total 2.4% year-on-year increase versus the third quarter of 2023

and a 2.6% sequential increase versus the second quarter of

2024.

Volumes were up 4.4% including

mix effects. In adult care these were up double digit thanks to

market share gains in the institutional channel and an overall

supportive retail market in Europe, in line with societal trends.

Baby care volumes were up as well, thanks to double digit growth in

North America, boosted by the recent contract gains with retailers.

The growth acceleration in the region was tempered, however, by

phasing of the order ramp-up and by lower deliveries in the

contract manufacturing channel. In Europe baby care volumes were

solidly stable, outperforming the subdued market demand, in which

retail brands did not gain further market share due to intensified

promotional activity by branded players. Refocusing and

optimization of the portfolio, led to lower feminine care sales in

North America.

Sales prices were lower across

categories and 2.6% down on average compared to last year,

stabilizing versus the second quarter of this year. This was

expected, reflecting planned investments in competitiveness, and

adjustments for the decrease of raw material price indices since

2023.

Forex fluctuations were

supportive, adding 0.7%, mainly thanks to the appreciation of some

non-euro denominated currencies in Europe.

Adjusted EBITDA

Adjusted EBITDA was €56 million, up 29%

year on year, thanks to volume and mix growth of €8 million and the

cost transformation program delivery. Net pricing had a positive

impact, with lower raw material prices offsetting lower sales

prices. The increase of other operating and SG&A costs weighed

on the result and forex fluctuations also had a slight adverse

impact.

The cost transformation program delivered

€14 million net operating savings, leading to a reduction of the

operating cost base by 3.7% year on year, with purchasing, supply

chain, product innovation and manufacturing initiatives. To further

support these initiatives in the coming years, Ontex is

transforming its operating footprint in Belgium, with the closure

of its Eeklo plant by year end, and the transformation of its

Buggenhout plant over the next two years into a center of

excellence for research, development and production of medium and

heavy incontinence care products.

Net pricing had a €4 million

positive impact. The year-on-year decrease of raw material indices

impacted purchase prices positively for €16 million, in particular

for fluff, super-absorbent polymers and non-woven materials. This

more than offset the €(12) million effect of lower sales prices.

Raw material indices started to rise sequentially again in the

second half of 2023 but have largely stabilized since mid-2024.

Other operating costs were up

by €10 million year on year, largely due to inflation of salaries,

energy and distribution costs. These were exacerbated by temporary

inefficiencies resulting from the North American production ramp-up

and the footprint adjustments in Europe.

SG&A expenditure was up as

well, by €2 million, mainly due to salary inflation.

Forex fluctuations had a €(2) million net

negative impact, mainly linked to the depreciation of the Mexican

peso affecting the contribution from the Tijuana plant.

The Adjusted EBITDA margin was 12.0%, up

2.4pp year on year compared to the third quarter of 2023, and down

0.5pp sequentially versus the second quarter of 2024.

Q3 2024 financial review of Total Group

P&L

Operating profit from

continuing operations was €8 million, compared to €29 million in

2023. While adjusted EBITDA came out €12 million higher,

depreciation was €(19) million, which is €(2) million more than the

year before due to the increased level of investment in the recent

period. Moreover, EBITDA adjustments were taken for €(29) million

costs related to the transformation of its operating footprint in

Belgium. It represents the additional provision taken for the

recently successfully concluded social plan, and comes on top of

the €(37) million provision taken in the second quarter already,

which covered the redundancy cost according to the Belgian legal

requirements. About half of the total amount of €(66) million is

anticipated to be spent in 2024, and the remainder in 2025 and

2026.

Discontinued operations

generated a revenue of €68 million, 3% lower like for like. The

adjusted EBITDA was €5 million, resulting in a 7.6% margin. The

revenue decrease and the 5.8pp lower margin reflect the more

challenging market conditions in Brazil and in the remaining

business in the Middle East. EBITDA adjustments were made for the

one-time net gain on disposal of €8 million triggered by the

divestment of the Brazilian business, consisting of a partial

reversal of the impairment taken in 2021, netted with divestment

costs. The operating profit from discontinued operations thereby

amounted to € 14 million.

Balance sheet

Net financial debt for the

Total Group dropped a further €9 million to €579 million at the end

of September, thanks to the solid adjusted EBITDA delivery. This

represents a €86 million improvement since the start of the year

and allows to minimize the need to use the revolving credit

facility.

The leverage ratio decreased further to

2.4x, from 2.5x at the end of June and 3.3x at the start of the

year, as a combination of the net financial debt reduction and the

further increase of the adjusted EBITDA of the Total Group

generated in the last twelve months.

Practical information

Disclaimer

This report may include forward-looking

statements. Forward-looking statements are statements regarding or

based upon our management’s current intentions, beliefs or

expectations relating to, among other things, Ontex’s future

results of operations, financial condition, liquidity, prospects,

growth, strategies or developments in the industry in which we

operate. By their nature, forward-looking statements are subject to

risks, uncertainties and assumptions that could cause actual

results or future events to differ materially from those expressed

or implied thereby. These risks, uncertainties and assumptions

could adversely affect the outcome and financial effects of the

plans and events described herein. Forward-looking statements

contained in this report regarding trends or current activities

should not be taken as a report that such trends or activities will

continue in the future. We undertake no obligation to update or

revise any forward-looking statements, whether as a result of new

information, future events or otherwise. You should not place undue

reliance on any such forward-looking statements, which speak only

as of the date of this report.

The information contained in this report is

subject to change without notice. No re-report or warranty, express

or implied, is made as to the fairness, accuracy, reasonableness or

completeness of the information contained herein and no reliance

should be placed on it. In most of the tables of this report,

amounts are shown in € million for reasons of transparency. This

may give rise to rounding differences in the tables presented in

the report.

Corporate information

The financial information in this document of

Ontex Group NV for the nine months ended September 30, 2024 was

authorized for issue in accordance with a resolution of the Board

on October 23, 2024.

Audio webcast

Management will host an audio webcast for

investors and analysts on October 24, 2024 at 12:00 CEST / 11:00

BST. To attend, click on

https://channel.royalcast.com/landingpage/ontexgroup/20241024_1. A

replay will be available on the same link shortly after the live

presentation. A copy of the presentation slides will be available

on ontex.com.

Financial calendar

- February 19, 2025 Q4 & full year 2024

results

- April 30, 2025 Q1 2025 results

- May 5, 2025 2025 Annual general meeting of

shareholders

- July 31, 2025 Q2 & H1 2025 results

- October 30, 2025 Q3 2025 results

Enquiries

- Investors Geoffroy Raskin +32 53

33 37 30 investor.relations@ontexglobal.com

- Media Maarten Verbanck +32 53 33

36 20 corporate.communications@ontexglobal.com

About Ontex

Ontex is a leading international developer and

producer of baby care, feminine care and adult care products, both

for retailers and healthcare. Ontex’s innovative products are

distributed in around 100 countries through retailers and

healthcare providers. Employing some 7,200 people, Ontex has a

presence in 14 countries, with its headquarters in Aalst, Belgium.

Ontex is listed on Euronext Brussel and is a constituent of the Bel

Mid® index. To keep up with the latest news, visit

ontex.com or follow Ontex on LinkedIn, Facebook, Instagram and

YouTube.

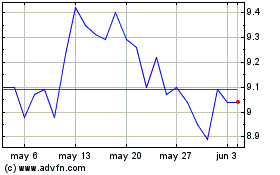

Ontex Group NV (EU:ONTEX)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Ontex Group NV (EU:ONTEX)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024