U.S. Dollar Gives Back Ground Following Recent Strength

27 Febrero 2023 - 10:25AM

RTTF2

After trending higher over the past several sessions, the value

of the U.S. dollar has given back some ground during trading on

Monday.

The U.S. dollar index is falling 0.56 points or 0.5 percent to

104.66 after reaching its highest levels in over two months last

Friday.

Currently, the greenback is trading at 136.21 yen versus the

136.48 yen it fetched at the close of New York trading on Friday.

Against the euro, the dollar is trading at $1.0608 compared to last

Friday's $1.0548.

The dollar's retreat versus the euro partly reflects concerns

about the outlook for European interest rates, with some traders

pricing in a terminal rate of 3.9 percent next February.

"The king dollar trade might make a comeback, but many investors

are expecting the ECB to deliver more rate hikes than all of its

major trading partners," said Edward Moya, senior market analyst at

OANDA.

The pullback by the dollar also came following the release of

some mixed U.S. economic data, including a Commerce Department

report showing a sharp pullback in new orders for durable goods in

the month of January.

The report said durable goods orders plunged by 4.5 percent in

January after surging by a downwardly revised 5.1 percent in

December.

Economists had expected durable goods orders to tumble by 4.0

percent compared to the 5.6 percent spike that had been reported

for the previous month.

The steep drop by durable goods orders came as orders for

transportation equipment plummeted by 13.3 percent in January after

soaring by 15.8 percent in December.

Excluding orders for transportation equipment, durable goods

orders climbed by 0.7 percent in January after falling by 0.4

percent in December. Economists had expected a 0.1 percent

uptick.

Meanwhile, the National Association of Realtors released a

separate report showing pending home sales in the U.S. spiked by

much more than expected in the month of January.

NAR said its pending home sales index soared by 8.1 percent to

82.5 in January after jumping by 1.1 percent to a downwardly

revised 76.3 in December.

Economists had expected pending home sales to advance by 1.0

percent compared to the 2.5 percent surge originally reported for

the previous month.

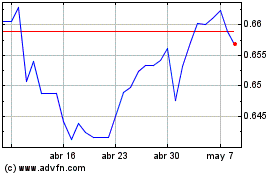

AUD vs US Dollar (FX:AUDUSD)

Gráfica de Divisa

De Mar 2024 a Abr 2024

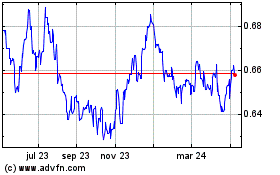

AUD vs US Dollar (FX:AUDUSD)

Gráfica de Divisa

De Abr 2023 a Abr 2024