Yen Extends Slide; U.S. Fed Decision In Focus

19 Marzo 2024 - 9:19PM

RTTF2

The Japanese yen continued to weaken against other major

currencies in the Asian session on Wednesday, as Asian stocks

traded higher after the monetary policy announcements from the Bank

of Japan, People's Bank of China and the Reserve Bank of Australia.

They are also cautiously looking ahead to the U.S. Fed's monetary

policy decision later in the day.

The Bank of Japan ended 8 years of negative interest rates,

making a historic shift with the first-rate hike in 17 years.

The Fed is widely expected to leave interest rates unchanged,

but the central bank's accompanying statement could have a

significant impact on the outlook for rates. Fed Chair Jerome

Powell and his colleagues will update their economic and rate

projections later in the day for the first time since December.

The Reserve Bank of Australia yesterday left interest rates at a

12-year high and signaled it may be done tightening monetary

policy.

The safe-haven currency or the yen traded lower against its

major rivals on Tuesday, after the BoJ decided to end negative

rates amid signs that inflation is strengthening.

In the Asian trading now, the yen depreciated to nearly a

16-year low of 164.68 against the euro and nearly a 9-year low of

192.76 against the pound, from yesterday's closing quotes of 163.90

and 191.88, respectively. If the yen extends its downtrend, it is

likely to find support around 165.00 against the euro and 194.00

against the pound.

The yen slipped to more than a 4-month low of 151.54 against the

U.S. dollar and more than a 2-week low of 170.45 against the Swiss

franc, from yesterday's closing quotes of 150.85 and 169.82,

respectively. On the downside, 152.00 against the greenback and

173.00 against the franc are seen as the next support levels for

the yen.

Against Australia, the New Zealand and the Canadian dollars, the

yen dropped to nearly a 1-month low of 98.95, nearly a 2-week low

of 91.61 and more than a 3-week low of 111.62 from Tuesday's

closing quotes of 98.49, 91.61 and 111.19, respectively. The next

possible support level for the yen is seen around 99.00 against the

aussie, 94.00 against the kiwi and 113.00 against the loonie.

Looking ahead, German producer price data for February and

Eurozone construction output for January are due to be released in

the European session.

In the New York session, U.S. mortgage approvals data, U.S. EIA

crude oil data and Eurozone flash consumer confidence for March are

slated for release.

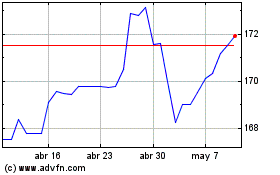

CHF vs Yen (FX:CHFJPY)

Gráfica de Divisa

De Mar 2024 a Abr 2024

CHF vs Yen (FX:CHFJPY)

Gráfica de Divisa

De Abr 2023 a Abr 2024