Commodity Currencies Slide As Most Asian Markets Traded Lower

21 Marzo 2024 - 9:42PM

RTTF2

The commodity currencies weakened against other major currencies

in the Asian session on Friday, as most Asian stock markets traded

lower, despite the broadly positive cues from global markets

overnight, as some markets retreated from recent highs with traders

eager to book some profits. Some traders also remain worried recent

hotter-than-expected U.S. inflation data could lead Fed officials

to reconsider lowering rates.

Crude oil futures settled lower, weighed down by a stronger

dollar and weak gasoline demand in the U.S. West Texas Intermediate

Crude oil futures for May dipped $0.20 at $81.07 a barrel.

In economic news, data from Statistics New Zealand showed that

the New Zealand posted a merchandise trade deficit of NZ$218

million in February. That beat forecasts for a shortfall of NZ$825

million following the downwardly revised NZ$1.089 billion in

January.

Exports were worth NZ$5.89 billion, up from the downwardly

revised NZ$4.82 billion in the previous month. Imports came in at

NZ$6.11 billion, up from the downwardly revised NZ$5.90 billion a

month earlier.

In the Asian trading now, the Australian dollar fell to 2-day

lows of 0.6522 against the U.S. dollar, 98.81 against the yen and

1.6611 against the euro, from yesterday's closing quotes of 0.6569,

99.59 and 1.6527, respectively. If the aussie extends its

downtrend, it is likely to support around 0.64 against the

greenback, 97.00 against the yen and 1.68 against the euro.

Against the Canadian dollar, the aussie dropped to a 3-day low

of 0.8845 from Thursday's closing value of 0.8887. The aussie may

test support near the 0.87 region.

The aussie edged down to 1.0848 against the NZ dollar, from

yesterday's closing value of 1.0867. On the downside, 1.07 is seen

as the next support level for the aussie.

The NZ dollar fell to a 4-month low of 0.6011 against the U.S.

dollar and a 3-day low of 91.09 against the yen, from yesterday's

closing quotes of 0.6041 and 91.59, respectively. If the kiwi

extends its downtrend, it is likely to find support around 0.59

against the greenback and 90.00 against the yen.

Against the euro, the kiwi edged down to 1.8026 from Thursday's

closing value of 1.7965. The kiwi may test support near the 1.81

region.

The Canadian dollar fell to a 2-day low of 1.3564 against the

U.S. dollar, from yesterday's closing value of 1.3529. If the

loonie extends its downtrend, it is likely to find support around

the 1.36 region.

Against the euro and the yen, loonie edged down to 1.4705 and

111.69 from Thursday's closing quotes of 1.4692 and 112.03,

respectively. The loonie may test support near 1.48 against the

euro and 109.00 against the yen.

Looking ahead, German ifo business confidence survey results for

March and the Confederation of British Industry's Industrial Trends

survey results for March are due to be released in the European

session.

In the New York session, Canada retail sales for January and

budget balance report for March, U.S. Baker Hughes oil rig count

data are slated for release.

At 12:00 pm ET, Federal Reserve Vice Chair for Supervision

Michael Barr will participate in virtually in discussion,

"International Economic and Monetary Design" before the

Transnational Law Conference on the International Law of Money:

"International Economic and Monetary Design, in Washington D.C.,

U.S.

At 1:00 pm ET, ECB chief economist Philip Lane will give a

policy lecture on inflation and monetary policy at Aix-Marseille

School of Economics (AMSE) in Marseille, France.

At 4:00 pm ET, Federal Reserve Bank of Atlanta President Raphael

Bostic will participate in moderated conversation on "Household

Finance" before the 2024 Household Finance Conference organized by

the Financial Services Innovation Lab at the Georgia Institute of

Technology and the Federal Reserve Bank of Atlanta, in Atlanta, in

United States.

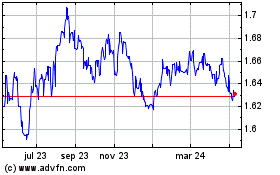

Euro vs AUD (FX:EURAUD)

Gráfica de Divisa

De Mar 2024 a Abr 2024

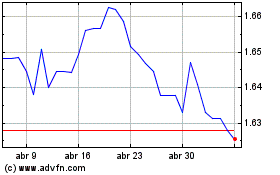

Euro vs AUD (FX:EURAUD)

Gráfica de Divisa

De Abr 2023 a Abr 2024