China Manufacturing Sector Continues To Expand

30 Junio 2024 - 9:34PM

RTTF2

China's manufacturing sector continued to expand in June as

production growth accelerated the most in two years underpinned by

rising new orders, survey data from S&P Global showed on

Monday.

The Caixin manufacturing Purchasing Managers' Index rose to 51.8

in June from 51.7 in the previous month. A score above 50.0

indicates expansion.

This was the eighth consecutive monthly improvement and also

marked the fastest since May 2021.

However, the official survey showed that China's manufacturing

sector contracted for the second straight time in June. The factory

PMI held steady at 49.5.

Manufacturing output grew at the fastest rate in two years,

S&P Global said. Firms in the consumer segment again registered

sharp output expansion in June. New product launches and market

development efforts helped to lift new work inflows. Export orders

also continued to increase in June.

The increase in new work intakes led to a fourth consecutive

month of backlog accumulation. Employment in the manufacturing

sector was close to stabilization in June.

Manufacturers raised purchasing levels at one of the highest

rates in more than three years in order to meet the rise in

production. Stocks of finished goods increased slightly.

Suppliers' delivery times lengthened for the first time since

February. Shortages of input materials and delivery constraints

were cited as reasons for the delays.

Input costs increased at the fastest pace in two years in June.

This has spurred firms to lift selling prices for the first time in

six months. Average selling prices increased at the fastest pace in

eight months.

Sentiment among manufacturers also remained positive midway into

2024. Confidence weakened to the lowest in over four-and-a-half

years, dampened by concerns over rising competition and uncertain

market conditions.

"Recent macroeconomic data show that the economy continues to

recover, with stable production, demand, employment and prices, as

well as strong exports," Caixin Insight Group senior economist Wang

Zhe said.

The economist noted that the improvement in the manufacturing

sector, insufficient market confidence and effective demand remain

key challenges.

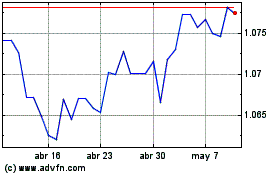

Euro vs US Dollar (FX:EURUSD)

Gráfica de Divisa

De Jun 2024 a Jul 2024

Euro vs US Dollar (FX:EURUSD)

Gráfica de Divisa

De Jul 2023 a Jul 2024