Pound Climbs Against Majors

06 Febrero 2024 - 5:10AM

RTTF2

The pound firmed against its major counterparts in the European

session on Tuesday, as European stocks edged higher amid strong

earnings from BP and China's stimulus measures for battered

financial markets.

Investors looked ahead to comments from Fed officials for clues

on the timing of the first interest-rate cut.

Strong U.S. economic data and hawkish comments from Fed Chair

Jerome Powell intensified hopes that the central bank is unlikely

to reduce rates before May.

Traders are pricing in an 83% chance the Fed will keep rates

unchanged in March, and have lowered expectations for a similar

move in May.

Survey results from S&P Global showed that UK construction

activity contracted at a slower pace in January as business

optimism reached a two-year high.

The construction Purchasing Managers' Index posted 48.8 in

January, up from 46.8 in the previous month.

The pound edged up to 1.2583 against the greenback, 186.78

against the yen and 0.8536 against the euro, off its early lows of

1.2527, 186.19 and 0.8570, respectively. The currency is poised to

challenge resistance around 1.28 against the greenback, 188.00

against the yen and 0.84 against the euro.

The pound touched 1.0985 against the franc, setting an 8-day

high. On the upside, 1.12 is possibly seen as the next resistance

level.

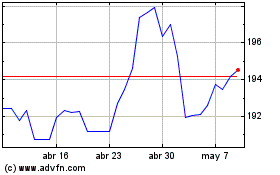

Sterling vs Yen (FX:GBPJPY)

Gráfica de Divisa

De Jun 2024 a Jul 2024

Sterling vs Yen (FX:GBPJPY)

Gráfica de Divisa

De Jul 2023 a Jul 2024