Antipodean Currencies Rise As Asian Markets Trade Mostly Higher

18 Noviembre 2024 - 8:28PM

RTTF2

Antipodean currencies such as the Australian and the New Zealand

dollars strengthened against their major currencies in the Asian

session on Tuesday, as traders picked up some stocks at a bargain

after the recent weakness in the markets amid concerns about the

outlook for interest rates. Strong gains in mining and energy

stocks also boosted the markets amid climbing commodity prices.

Crude oil prices climbed higher on concerns about likely

shortage in supplies due to an escalation in Russia - Ukraine war,

while a weaker dollar also contributed to the rise in oil prices.

West Texas Intermediate Crude oil futures for December closed

higher by $2.14 or 3.2 percent at 69.16 a barrel.

In economic news, the Reserve Bank of Australia will on Tuesday

release the minutes from its November 5 monetary policy meeting. At

the meeting, the RBA maintained its benchmark interest rate at a

13-year high of 4.35 percent for the eighth straight session,

saying that underlying inflation remains too high. The bank had

previously changed its rate in November 2023, when it was lifted by

25 basis points to the highest level since late 2011.

In the Asian trading today, the Australian dollar rose to 6-day

highs of 0.6525 against the U.S. dollar and 1.6248 against the

euro, from yesterday's closing quotes of 0.6507 and 1.6283,

respectively. The aussie may test resistance near 0.66 against the

greenback and 1.61 against the euro.

The aussie advanced to a 1-week high of 0.9140 against the

Canadian dollar, from Monday's closing value of 0.9119. If the

aussie extends its uptrend, it is likely to find resistance around

the 0.92 region.

Against the yen, the aussie edged up to 100.63 from a recent low

of 100.16. On the upside, 103.00 is seen as the next resistance

level for the aussie.

The aussie advanced to 1.1060 against the NZ dollar, from

yesterday's closing value of 1.1038. The next possible upside

target for the aussie is seen around the 1.11 region.

The NZ dollar rose to a 6-day high of 0.5901 against the U.S.

dollar, from a recent low of 0.5878. The kiwi is likely to find

resistance around the 0.60 area.

Against the yen and the euro, the edged up to 91.00 and 1.7963

from recent lows of 90.62 and 1.8016, respectively. If the kiwi

extends its uptrend, it is likely to find resistance around 92.00

against the yen and 1.78 against the euro.

Meanwhile, the safe-haven currency or the U.S. dollar weakened

against other major currencies in the Asian session today, as Asian

stock markets traded higher.

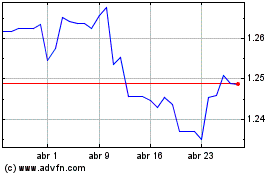

The U.S. dollar fell to a 4-day low of 1.2689 against the pound,

from a recent high of 1.2666. On the downside, 1.29 is seen as the

next support level for the greenback.

Against the euro and the Swiss franc, the greenback edged down

to 1.061 and 0.8827 from recent highs of 1.0583 and 0.8840,

respectively. If the greenback extends its downtrend, it is likely

to find support around 1.08 against the euro and 0.86 against the

franc.

Against the yen and the Canadian dollar, the greenback dropped

to 153.95 and 1.4009 from recent highs of 154.62 and 1.4030,

respectively. The next possible downside target for the greenback

is seen around 151.00 against the yen and 1.38 against the

loonie.

Looking ahead, Eurozone current account data for September, CPI

data for September and flash labor cost index for the third quarter

are due to be released in the European session.

In the New York session, Canada CPI data for October, U.S.

building permits and housing starts for October and U.S. Redbook

reports are slated for release.

Sterling vs US Dollar (FX:GBPUSD)

Gráfica de Divisa

De Oct 2024 a Nov 2024

Sterling vs US Dollar (FX:GBPUSD)

Gráfica de Divisa

De Nov 2023 a Nov 2024