Dollar Recovers From Early Weakness

11 Diciembre 2018 - 8:26AM

RTTF2

The dollar got off to a weak start Tuesday, but has since stage

a recovery and is now up slightly against its major rivals. The

buck weakened in early trade as traders turned optimistic on the

trade negotiations between the U.S. and China.

China's Commerce Ministry said Chinese Vice Premier Liu He spoke

with U.S. Treasury Secretary Steven Mnuchin and U.S. Trade

Representative Robert Lighthizer.

"Both sides exchanged views on putting into effect the consensus

reached by the two countries' leaders at their meeting, and pushing

forward the timetable and roadmap for the next stage of economic

and trade consultations work," the ministry said in a

statement.

Producer prices in the U.S. unexpectedly showed a modest uptick

in the month of November, according to a report released by the

Labor Department on Tuesday. The Labor Department said its producer

price index for final demand inched up by 0.1 percent in November

after climbing by 0.6 percent in October. Economists had expected

prices to be unchanged.

The dollar dropped to an early low of $1.14 against the Euro

Tuesday, but has since rebounded to around $1.1315.

German investor confidence rose strongly in December, defying

expectations for a modest weakening, but caution prevailed as

financial analysts' assessment of the current economic situation

again deteriorated sharply due to sluggish economic growth and

uncertainties linked to global trade and Brexit.

The ZEW Indicator of Economic Sentiment for Germany rose 6.6

points to reach minus 17.5 points in December, results of a survey

by the Centre for European Economic Research, or ZEW, showed on

Tuesday.

Economists had forecast the index, which reflects analysts'

economic expectations for the next 6 months, to worsen further to

minus 25.

The buck fell to an early low of $1.2638 against the pound

sterling Tuesday, but has since bounced back to around $1.2525.

UK wages rose at the fastest pace in a decade in the three

months to October, suggesting that real pay growth is turning

sustainable and contribute to economic growth if a "no-deal" Brexit

is avoided.

Average wages including bonuses rose 3.3 percent year-on-year,

which was the biggest increase since the May to July period of

2008, the Office for National Statistics said on Tuesday.

Economists had forecast a 3 percent increase.

The greenback has risen to around Y113.350 against the Japanese

Yen Tuesday afternoon, from a low of Y113.008 this morning.

The M2 money stock in Japan was up 2.3 percent on year in

November, the Bank of Japan said on Tuesday, standing at 1,010.5

trillion yen. That was shy of expectations for an increase of 2.6

percent and down from 2.7 percent in October.

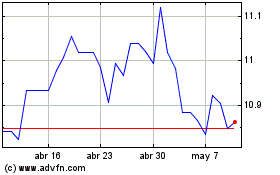

US Dollar vs NOK (FX:USDNOK)

Gráfica de Divisa

De Dic 2024 a Ene 2025

US Dollar vs NOK (FX:USDNOK)

Gráfica de Divisa

De Ene 2024 a Ene 2025