Bango PLC Trading Statement (0767A)

18 Enero 2024 - 1:00AM

UK Regulatory

TIDMBGO

RNS Number : 0767A

Bango PLC

17 January 2024

Bango PLC

("Bango")

FY 2023 Trading Update

Bango (AIM: BGO), provides an update on trading for the twelve

months ended 31 December 2023.

Highlights (unaudited data)

-- FY23 Revenue of $46.1m representing a 62% increase on

FY22

- Payments continued to trade well during 2H23, in-line

with management expectations

- 9 new long-term recurring Digital Vending Machine(R)

(DVM) contracts signed in the period, driving growth

in telco ARR to $8.8M in December 2023, an increase

of 76% on December 2022 ($5.0M). Launch of the third

Tier 1 US Telco (announced in 1H22) is expected to

contribute an additional $2M ARR following its 1H24

launch

-- Overall Adjusted EBITDA(2) grew from -$0.2M in 1H23 to

between $5.2M and $6.2M in 2H23

-- Profitability expected to further improve in FY24, following

the full decommissioning of the legacy DOCOMO Digital

platform

-- Full year total Adjusted EBITDA(2) is expected to be in

the range of $5M to $6M (FY22: $5.0M) which is below analyst

expectations due to:

- Revenue recognition lower than expected in the period

due to customer launch timing

- Approximately $2M of unplanned cost of sales on a

legacy, non-core Direct Carrier Billing business migrated

across from the Docomo Digital ("DDL") acquisition

impacted Gross Margin. Approximately $1M is expected

to continue into 2024

- Approximately $1M FX impact (non-cash impacting) from

intercompany loans inherited through the DDL acquisition.

This FX impact will cease when the loans are closed

-- Cash of $3.75M at 31 December 2023 ahead of analyst expectations

due to working capital timing.

- The Group has drawn US$8M on its loan facility from

NHN

- With its strong cash generation, the Group is well

placed to return to a positive net cash position in

FY25

-- 33 new content providers added to the DVM in 2023, bringing

the catalog to 93 subscriptions providers

-- New Bango consumer UI (user interface) delivered, which

will speed-up future telco launches

Paul Larbey, Chief Executive Officer of Bango, commented:

"In FY23, Bango delivered double digit revenue growth and

increased profitability. We successfully completed the

transformational DOCOMO Digital Acquisition, investing the synergy

savings into the Digital Vending Machine(R) (DVM) business, leading

to strong ARR growth. Looking ahead, we expect to continue

delivering strong revenue growth in 2024. Operating margins are

expected to trend upwards in FY24 driven by the full

decommissioning of the DOCOMO Digital platform.

There is a significant opportunity for the Bango DVM to become

adopted as the universal standard by merchants to distribute their

subscription products through indirect channels, such as telcos.

Paying for products and services as subscriptions now crosses-over

into every aspect of our lives, representing a growing share of

personal budgets. With 77% of US consumers saying they want to pay

for all their subscriptions on one, consolidated bill, there is a

clear call for much greater control over this spending and for

easier management of multiple subscriptions. These needs are met by

the Bango Digital Vending Machine.

The market opportunity is vast and we enter 2024 with a strong

ARR base and 7 times more DVM prospects in the pipeline compared to

a year ago. I am confident Bango is well positioned to take

advantage of the market opportunity in 2024 and beyond."

N otes

(1) ARR is calculated by annualizing the December revenue

derived from ongoing, contracted, repeating revenues

(2) Adjusted EBITDA is earnings before interest, tax, depreciation,

amortization, share based payment charge, negative goodwill

and exceptional items.

The information contained within this announcement is deemed by

Bango to constitute inside information as stipulated under the

Market Abuse Regulation (EU) No. 596/2014 as amended by The Market

Abuse (Amendment) (EU Exit) Regulations 2019. Upon the publication

of this announcement, this inside information is now considered to

be in the public domain. The person responsible for making this

announcement on behalf of Bango is Paul Larbey, Chief Executive

Officer.

Contact Details:

Bango PLC Singer Capital Markets Stifel Nicolaus Europe

(Nominated Adviser Limited (Joint Broker)

and Joint Broker)

+44 1223 617 387 +44 20 7496 3000 +44 20 7710 7600

investors@bango.com

Paul Larbey, CEO Harry Gooden Nick Adams

Matt Garner, CFO Jen Boorer Richard Short

Anil Malhotra, CMO Asha Chotai Ben Burnett

Sukey Miller, IR

About Bango

Bango enables content providers to reach more paying customers

through global partnerships. Bango revolutionized the monetization

of digital content and services , by opening-up online payments to

mobile phone users worldwide. Today, the Digital Vending Machine(R)

is driving the rapid growth of the subscriptions economy, powering

choice and control for subscribers.

The world's largest content providers, including Amazon (NASDAQ:

AMZN), Google (NASDAQ: GOOG) and Microsoft (NASDAQ: MSFT) trust

Bango technology to reach subscribers everywhere.

Bango, where people subscribe. For more information, visit

www.bangoinvestor.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTDBGDBCXBDGSR

(END) Dow Jones Newswires

January 18, 2024 02:00 ET (07:00 GMT)

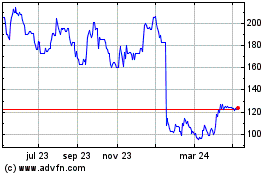

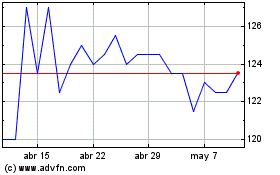

Bango (LSE:BGO)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Bango (LSE:BGO)

Gráfica de Acción Histórica

De May 2023 a May 2024