Bluefield Solar Income Fund Limited Unaudited NAV 31/03/20 & Second Interim Dividend (4032L)

30 Abril 2020 - 1:00AM

UK Regulatory

TIDMBSIF

RNS Number : 4032L

Bluefield Solar Income Fund Limited

30 April 2020

30 April 2020

Bluefield Solar Income Fund Limited

('Bluefield Solar' or the 'Company')

Unaudited NAV 31 March 2020 and Second Interim Dividend

Bluefield Solar (LON: BSIF), a sterling income fund that invests

in UK-based solar assets, announces its net asset value ('NAV') as

at 31 March 2020, and the Company's second interim dividend for the

current financial year, which ends on 30 June 2020 (the 'Second

Interim Dividend'). Unless otherwise noted herein, the information

provided in this announcement is unaudited.

The Company's unaudited NAV as at 31 March 2020 was GBP418.7

million, or 113.02 pence per Ordinary Share, compared to the

audited NAV as at 31 December 2019 of GBP447.4 million, or 120.75

pence per Ordinary Share.

The Company's NAV as at 31 March 2020 reflects the adoption of

the most recent central power curves published by the Company's two

independent power forecasters (which the Company blends on a 50/50

basis). Compared to December 2019, the blended curves used by the

Company have reduced on average by 15% over the next five years

(including a 25% reduction over 2020 and 2021) and by 1% from 2025

until 2050. This corresponds to an average capture price of c.GBP41

per MWh for the period 2020-2024 and GBP48 per MWh for the period

2025-2050 (in 2019 prices).

The impact on the Company's NAV from adoption of the latest

power curves is a reduction of 6.7 pence per Ordinary Share,

reflecting the reduced independent revenue estimates, particularly

in the period 2021-2024.

The Company has 100% of its revenues contracted until 30 June

2020, 88% until 31 December 2020 and 77% until 30 June 2021.

The NAV update also includes the addition of the 13.9MWp

portfolio which the Company purchased in January 2020, generation

in the period to March 2020, a roll forward of portfolio working

capital and an increase in the corporation tax rate from 17% to

19%.

For the avoidance of doubt, the 31 March 2020 NAV does not

include a liability for the second Interim dividend of 1.95 pence

per Ordinary Share as this has been declared post 31 March

2020.

All other core valuation assumptions have remained consistent

with the NAV issued in the Company's Interim financial statements

for the period ending 31 December 2019.

The Second Interim Dividend of 1.95 pence per Ordinary Share

(April 2019: 1.90 pence per Ordinary Share) will be payable to

shareholders on the register as at 11 May 2020 with an associated

ex-dividend date of 7 May 2020 and a payment date of 29 May

2020.

Furthermore, the Board is pleased to reconfirm its guidance of a

full year dividend of 7.90 pence per Ordinary Share for the

financial year ending 30 June 2020. This will be covered by

earnings and is post debt amortisation.

The portfolio continues to perform extremely well. As at 31

March 2020, generation was 4.8% above target. In respect of the

Covid-19 pandemic and business continuity, the Company reconfirms

that its investment adviser, Bluefield Partners, and its technical

asset management provider, Bluefield Services, and its operation

and maintenance provider, Bluefield Operations, are all

successfully remote working and there are no foreseen issues around

business continuity.

As indicated in previous announcements, the Company is reviewing

the policy of increasing the dividend in line with RPI.

For further information:

Bluefield Partners LLP (Company Investment Tel: +44 (0) 20 7078

Adviser) 0020

James Armstrong /Neil Wood/Giovanni www.bluefieldllp.com

Terranova

Numis Securities Limited (Company Broker) Tel: +44 (0) 20 7260

Tod Davis / David Benda 1000

www.numis.com

Ocorian Administration (Guernsey) Limited Tel: +44 (0) 1481

(Company Secretary & Administrator) 742 742

Kevin Smith www.ocorian.com

Media enquiries:

Buchanan (PR Adviser) Tel: +44 (0) 20

Henry Harrison-Topham / Victoria Hayns 7466 5000

/ Henry Wilson www.buchanan.uk.com

BSIF@buchanan.uk.com

Notes to Editors

About Bluefield Solar

Bluefield Solar is a sterling income fund focused on acquiring

and managing UK-based solar projects to generate renewable energy

for periods of typically 25 years or longer. The Company's primary

objective is to deliver to its shareholders stable, long term

sterling income via quarterly dividends, which are linked to RPI.

The majority of the Group's revenue streams are regulated and

non-correlated to traditional markets. Bluefield Solar owns and

operates one of the UK's largest, diversified portfolios of solar

assets with a combined installed power capacity in excess of 478

Megawatt peak (MWp).

Further information can be viewed at www.bluefieldsif.com

About Bluefield Partners LLP ('Bluefield')

Bluefield was established in 2009 and is an investment adviser

to companies and funds investing in solar energy infrastructure. It

has a proven record in the selection, acquisition and supervision

of large-scale energy and infrastructure assets in the UK and

Europe. The team has been involved in over GBP1.5 billion of solar

PV funds and/or transactions in both the UK and Europe since 2008,

including over GBP800 million in the UK since December 2011.

Bluefield has led the acquisitions of, and currently advises on,

over 85 UK based solar PV assets that are agriculturally,

commercially or industrially situated. Based in its London office,

Bluefield's partners are supported by a dedicated and highly

experienced team of investment, legal and portfolio executives.

Bluefield was appointed Investment Adviser to the Company in June

2013.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

NAVPPUWPCUPUPGB

(END) Dow Jones Newswires

April 30, 2020 02:00 ET (06:00 GMT)

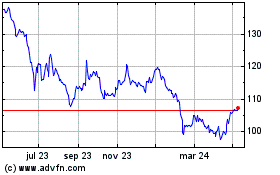

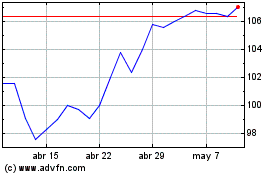

Bluefield Solar Income (LSE:BSIF)

Gráfica de Acción Histórica

De Sep 2024 a Oct 2024

Bluefield Solar Income (LSE:BSIF)

Gráfica de Acción Histórica

De Oct 2023 a Oct 2024