TIDMCDL

RNS Number : 1717R

Cloudbreak Discovery PLC

25 October 2023

25 October 2023

Cloudbreak Discovery Plc

("Cloudbreak" or the "Company")

Final Results for the Year Ended 30 June 2023

Notice of Annual General Meeting

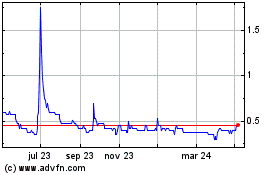

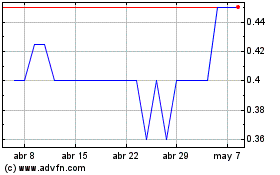

Cloudbreak Discovery PLC (LSE: CDL), a leading natural resources

project generator with a particular focus on commodities key to the

energy transition, is pleased to announce its final results for the

year ended 30 June 2023 ("FY23" or the "Period").

Period Highlights

Company Updates

-- Kyler Hardy stepped down as CEO and Chairman in June 2023

with Andrew Male assuming the role of Interim CEO to realign

Cloudbreak to be more 'London centric'.

-- Consulting contracts with Cronin Capital Ltd and Cronin

Services Ltd. were also terminated at the same time.

-- Towards the end of 2022 a new broker, Oberon Capital, was

appointed for the advancement of financing opportunities and

project generation.

-- Like many of the companies in the resource sector, Cloudbreak

has been quiet during a challenging financial climate.

Projects

-- The Board have reviewed the existing assets of the Company

and are continuing to explore further advancement of all

projects.

-- The Company will continue to look at both mining and oil and

gas projects with a view to maintaining the same thesis for project

generations and asset aggregation.

-- The Company will provide a more robust analysis of its projects in the coming weeks.

-- We look forward to realising continued value across the asset package.

Post Period Highlights

-- Raised GBP340,000 in convertible loan notes from existing shareholders and directors.

-- Continued analysis of new projects and review of additional acquisition proposals

Financials

-- The loss of the Group for the year ended 30 June 2023 amounts

to GBP3,997,899 (30 June 2022: GBP5,557,029.

-- GBP244,074 in cash and cash equivalents held at the period end (30 June 2022: GBP310,578)

-- Exploration and evaluation cash expenditures amount to

GBP590,845 (30 June 2022: GBP370,848)

-- GBP891,255 carrying value of investments held at the period

end (30 June 2021: GBP2,069,302)

-- Consolidated loss per share or the period ended 30 June 2022 was GBP0.01

Notice of Annual General Meeting

The Company announces that its Annual General Meeting ("AGM")

will be held on 24 November 2023 at 1 Heddon Street, London, W1B

4BD at 3:00 pm GMT.

The following documents (as applicable) have been posted to

shareholders or otherwise made available today:

-- Annual Report and Financial Statements for the period ended 30 June 2023;

-- Notice of AGM 2023; and

-- Form of Proxy.

Copies of these documents will shortly be available on the

Company's website:

https://cloudbreakdiscovery.com/investors/

--S--

For additional information please contact:

Cloudbreak Discovery Tel: +44 792 6 397

PLC 675

Andrew Male, Interim andrew@westridgemi.com

CEO

Novum Securities Tel: +44 7399 9400

(Financial Adviser)

David Coffman / George

Duxberry

Oberon Capital Tel: +44 20 3179 5355

(Broker) /

+44 20 3179 5315

Nick Lovering / Adam

Pollock

INTERIM CEO'S REPORT

Company Updates

I am happy to provide shareholders of Cloudbreak with an update

on the activity of the Company over the past year. This will be the

Company's second full year on the Main Segment of the London Stock

Exchange.

As with most junior resource companies, it has been a

challenging year, and ours has been no different. During the past

year we have however continued to maintain and advance our

projects, complete project advancement with our partners and begun

to realise the value of some of the exploration and corporate

assets we have.

During the course of the year the Company raised a small amount

of capital from the market and continued to use its drawdown

facility with Crescita Capital LLC. These funds were used for

general working capital purposed and to advance the suite of

Cloudbreak projects.

In addition, the Company completed corporate restructuring in

order to lessen the overheads and expenditures.

In December 2022 we appointed a new Broker and continue to work

with them for the advancement of financing opportunities and

project generation. In the spring and summer of 2023, Cloudbreak,

like most resource companies, has been quiet waiting for market

corrections and a renewed buoyancy while continuing to advance the

projects the Company has.

In June 2023, the Board accepted the resignation of the CEO and

Chairman along with some of the Executive management team. The

Board wanted to refocus and re-align Cloudbreak to be more "London

centric" and this move allowed for this as well as cost savings.

The Board re-aligned and with Andrew Male assuming the interim CEO

role, Paul Gurney continues as a Non-Executive Director and Emma

Priestley as an Independent Non-Executive Director.

Projects

Cloudbreak has demonstrated the business model's viability and

will continue to progress in this manner. The Company currently has

two energy investments, Legado Oil & Gas Limited and G2 Energy

Corp. While both of these projects have had their own delays and

issues, Cloudbreak is happy with their progress and will continue

to look for projects of this nature going forward.

Cloudbreak has also realised proceeds from the sale of shares

that it holds in other companies as a result of the partnerships it

has fostered over the past two years, as well as realising cash

proceeds from the sale or optioning of various projects in the

mining space.

Outlook

The year ended 30 June 2023 was active for the Group, having hit

a number of operational milestones. We further diversified our

portfolio with projects in the energy sector and in new

jurisdictions.

Despite the global macroeconomic climate, the outlook for the

natural resources sector looks robust. Our focus on commodities key

to the energy transition movement offers an attractive opportunity

for significant shareholder returns as demand, and therefore

prices, are set to remain high. Our project generator model allows

us to diversify our portfolio across the resource sector, building

value while minimizing risk and cost.

We are starting to see some projects reach a point where we

could potentially begin receiving more royalty payments further

underpinning the benefit of our business model. It is down to the

depth of experience within our team that we are able to execute

this model successfully.

We look forward to keeping investors updated over the next year

and beyond as we generate and pursue new ideas, including lithium

assets and bauxite projects, while continuing to diversify into

energy royalties and attracting new partnerships.

Financial Review

During the year ended 30 June 2023, the Group earned GBP364,968

(2022: GBP559,523) in revenue from property option sale agreements.

It realised GBP677,400 from sales of shares and raised a total of

GBP582,625 through the capital market and GBP1,473,581 in draws

from its drawdown facility. Total capital generated was

GBP2,056,206 and at the end of the fiscal year, there was

GBP244,074 in cash on hand.

Subsequent to the year end the Company raised a further

GBP340,000 in Convertible Loan Notes from existing shareholders and

directors.

Whilst the financial statements have been prepared on a going

concern basis the Company will be required to raise additional

funds within the next 12 months. The Directors are confident that

they will be secure the necessary funding, but the current

conditions do indicate the existence of a material uncertainty.

The result for the 2023 FY of GBP3,997,899 (2022: GBP5,557,029)

for the year ended 30 June 2023 consisted mainly of income from

property option payments, expenses from professional and consulting

fees and realised loss on sale of investments. For a further

breakdown on expenses, please refer to note 24 and for further

breakdown on value of investments, please refer to note 6.

Financial Position

The Group's Statement of Financial Position as at 30 June 2023

and comparatives at 30 June 2022 are summarised below:

2023 2022

GBP GBP

---------------------- ----------- -----------

Current assets 487,251 1,611,212

---------------------- ----------- -----------

Non-current assets 3,216,644 3,805,897

---------------------- ----------- -----------

Total assets 3,703,895 5,417,109

---------------------- ----------- -----------

Current liabilities 1,704,437 1,395,910

---------------------- ----------- -----------

Total liabilities 1,704,437 1,395,910

---------------------- ----------- -----------

Net assets 1,999,458 4,021,199

---------------------- ----------- -----------

On behalf of the Board, I would like to record our thanks to

those who have helped the Company throughout the year.

Andrew Male

Interim CEO

STATEMENT OF FINANCIAL POSITION

As at 30 June 2023 Company number: 06275976

Group Company

----------------------------- -----------------------------

30 June 30 June 30 June 30 June

2023 2022 2023 2022

Note GBP GBP GBP GBP

------------------------------------ ------ -------------- ------------- -------------- -------------

Non-Current Assets

Royalty asset 7 1 1 - -

Intangible assets 5 236,518 78,694 - -

Investments 6 891,255 2,069,302 43,046 68,056

Investment in subsidiaries 6 - - 1,997,048 7,252,886

Leased Asset 29,810 - - -

Convertible debenture receivables 8 475,168 1,657,900 475,168 1,657,900

1,632,752 3,805,897 2,515,262 8,978,842

------------------------------------ ------ -------------- ------------- -------------- -------------

Current Assets

Trade and other receivables 10 243,177 1, 300,634 77,254 1,676,619

Cash and cash equivalents 11 244,074 310,578 18,684 124,118

Convertible debenture receivables 1,583,892 - 1,583,892 -

------------------------------------ ------ -------------- ------------- -------------- -------------

2,071,143 1,611,212 1,679,830 1,800,737

------------------------------------ ------ -------------- ------------- -------------- -------------

Total Assets 3,703,895 5,417,109 4,195,092 10,779,579

------------------------------------ ------ -------------- ------------- -------------- -------------

Current Liabilities

Trade and other payables 13 1,704,437 1,395,910 1,454,431 1,357,254

1,704,437 1,395,910 1,454,431 1,357,254

------------------------------------ ------ -------------- ------------- -------------- -------------

Total Liabilities 1,704,437 1,395,910 1,454,431 1,357,254

------------------------------------ ------ -------------- ------------- -------------- -------------

Net Assets 1,999,458 4,021,199 2,740,661 9,422,325

------------------------------------ ------ -------------- ------------- -------------- -------------

Equity attributable to owners

of the Parent

Share capital 14 778,635 654,129 778,635 654,129

Share premium 14 16,753,221 14,821,521 16,753,221 14,821,521

Other reserves 16 519,045 599,093 340,716 297,397

Reverse asset acquisition

reserve (4,134,019) (4,134,019) - -

Retained losses (11,917,424) (7,919,525) (15,131,911) (6,350,722)

------------------------------------ ------ -------------- ------------- -------------- -------------

Total Equity 1,999,458 4,021,199 2,740,661 9,422,325

------------------------------------ ------ -------------- ------------- -------------- -------------

The Company has elected to take the exemption under Section 408

of the Companies Act 2006 from presenting the Parent Company Income

Statement and Statement of Comprehensive Income. The loss for the

Company for the year ended 30 June 2023 was GBP8,781,189 (loss for

year ended 30 June 2022: GBP2,523,971).

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

For the year ended 30 June 2023

Year ended Year ended

30 June 30 June

2023 2022

Continued operations Note GBP GBP

---------------------------------------------------- ------ --------------- -------------

Profit on disposal of exploration & evaluation

asset sales 364,968 559,523

Administrative expenses 24 (4,006,518) (3,308,214)

Foreign exchange (losses)/gains (81,024) 39,380

Operating loss (3,722,574) (2,709,311)

---------------------------------------------------- ------ --------------- -------------

Finance income 19 369,587 154,518

Other income 47,121 11,233

Impairment of loans 9 (128,607) (184,365)

Impairment of property (12,636) -

Other gains 20 17,913 8,332

Realised Loss on investments 21 (866,421) -

Unrealised fair value gain/(loss) on investments 6 309,896 (2,837,437)

Loss before income tax (3,985,721) (5,557,029)

Income tax 22 (12,178) -

---------------------------------------------------- ------ --------------- -------------

Loss for the year attributable to owners

of the Parent (3,997,899) (5,557,029)

---------------------------------------------------- ------ --------------- -------------

Basic and Diluted Earnings Per Share attributable

to owners of the Parent during the period

(expressed in pence per share) 23 (0.01)p (0.01)p

---------------------------------------------------- ------ --------------- -------------

Year ended Year ended

30 June 30 June

2023 2022

GBP GBP

---------------------------------------------- ------------- -------------

Loss for the period (3,997,899) (5,557,029)

Other Comprehensive Income:

Items that may be subsequently reclassified

to profit or loss

Currency translation differences (123,367) 233,866

----------------------------------------------- ------------- -------------

Other comprehensive income for the period,

net of tax (4,121,266) (5,323,163)

----------------------------------------------- ------------- -------------

Total Comprehensive Income attributable to

owners of the parent (4,121,266) (5,323,163)

----------------------------------------------- ------------- -------------

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

For the year ended 30 June 2023

Reverse

asset

Share Share acquisition Other Retained

capital premium reserve reserves losses Total

Note GBP GBP GBP GBP GBP GBP

----------

Balance as at

1 July 2021 560,520 10,905,507 (4,134,019) 511,501 (2,554,928) 5,288,581

-------------------- ---- ---------- --------------- ------------------ ------------- --------------- -------------

Loss for the year - - - - (5,557,029) (5,557,029)

-------------------- ---- ---------- --------------- ------------------ ------------- --------------- -------------

Other

comprehensive

income for the

year - - - - - -

Items that may

be subsequently

reclassified to

profit or loss - - - - - -

-------------------- ---- ---------- --------------- ------------------ ------------- --------------- -------------

Currency

translation

differences - - - 233,866 - 233,866

-------------------- ---- ---------- --------------- ------------------ ------------- --------------- -------------

Total

comprehensive

income for the

year - - - 233,866 (5,557,029) (5,323,163)

-------------------- ---- ---------- --------------- ------------------ ------------- --------------- -------------

Issue of shares 14 93,609 3,994,527 - - - 4,088,136

Issue costs 14 - (78,513) - - - (78,513)

Options Granted 16 - - - 11,238 - 11,238

Warrants Granted 16 - - - 30,075 - 30,075

Options Exercised 16 - - - (24,962) 24,962 -

Share Options

Expired 16 - - - (112,406) 112,406 -

Share Options

Cancelled 16 - - - (1,180) 1,180 -

Warrants Exercised 16 - - - (13,024) 13,024 -

Other equity

movement 16 - - - 4,845 - 4,845

Elimination of

other reserves 16 - - - (40,860) 40,860 -

Total transactions

with owners,

recognised

directly in

equity 93,609 3,916,014 - (146,274) 192,432 4,055,781

Balance as at

30 June 2022 654,129 14,821,521 (4,134,019) 599,093 (7,919,525) 4,021,199

-------------------- ---- ---------- --------------- ------------------ ------------- --------------- -------------

Balance as at

1 July 2022 654,129 14,821,521 (4,134,019) 599,093 (7,919,525) 4,021,199

-------------------- ---- ---------- --------------- ------------------ ------------- --------------- -------------

Loss for the year - - - - (3,997,899) (3,997,899)

-------------------- ---- ---------- --------------- ------------------ ------------- --------------- -------------

Other

comprehensive

income for the

year - - - - (3,997,899) (3,997,899)

Items that may - - - - - -

be subsequently

reclassified to

profit or loss

Currency

translation

differences - - - (123,367) - (123,367)

-------------------- ---- ---------- --------------- ------------------ ------------- --------------- -------------

Total

comprehensive

income for the

year - - - (123,367) (3,997,899) (4,121,266)

-------------------- ---- ---------- --------------- ------------------ ------------- --------------- -------------

Issue of shares 14 124,506 1,934,700 - - - 2,059,206

Issue costs 14 - (3,000) - - - (3,000)

Options Granted 16 - - - 36,723 - 36,723

Warrants Granted 16 - - - 6,596 - 6,596

Total transactions

with owners,

recognised

directly in

equity 124,506 1,931,700 - 43,319 - 2,099,525

-------------------- ---- ---------- --------------- ------------------ ------------- --------------- -------------

Balance as at

30 June 2023 778,635 16,753,221 (4,134,019) 519,045 (11,917,424) 1,999,458

-------------------- ---- ---------- --------------- ------------------ ------------- --------------- -------------

COMPANY STATEMENT OF CHANGES IN EQUITY

For the year ended 30 June 2023

Share Share Retained

capital premium Other reserves losses Total equity

Note GBP GBP GBP GBP GBP

Balance as at

1 July 2021 560,520 10,905,507 407,656 (3,983,168) 7,890,515

--------------------------- ------ ---------- ------------ ---------------- -------------- --------------

Loss for the year - - - (2,523,971) (2,523,971)

--------------------------- ------ ---------- ------------ ---------------- -------------- --------------

Total comprehensive

income for the

year - - - (2,523,971) (2,523,971)

--------------------------- ------ ---------- ------------ ---------------- -------------- --------------

Issue of shares 14 93,609 3,994,527 - - 4,088,136

Issue Costs 14 - (78,513) - - (78,513)

Options granted 16 - - 11,238 - 11,238

Warrants Granted 16 - - 30,075 - 30,075

Options Exercised 16 - - (24,962) 24,962 -

Share Options Expired 16 - - (112,406) 112,406 -

Share Options Cancelled 16 - - (1,180) 1,180 -

Warrants Exercised 16 (13,024) 13,024 -

Other equity movement 16 - - 4,845 - 4,845

Elimination of

other reserves 16 - - (4,845) 4,845 -

Total transactions

with owners, recognised

directly in equity 93,609 3,916,014 (110,259) 156,417 4,055,781

Balance as at

30 June 2022 654,129 14,821,521 297,397 (6,350,722) 9,422,325

--------------------------- ------ ---------- ------------ ---------------- -------------- --------------

Balance as at

1 July 2022 654,129 14,821,521 297,397 (6,350,722) 9,422,325

--------------------------- ------ ---------- ------------ ---------------- -------------- --------------

Loss for the year - - - (8,781,189) (8,781,189)

--------------------------- ------ ---------- ------------ ---------------- -------------- --------------

Total comprehensive

income for the

year - - - (8,781,189) (8,781,189)

--------------------------- ------ ---------- ------------ ---------------- -------------- --------------

Issue of shares 14 124,506 1,934,700 - - 2,059,206

Issue Costs 14 - (3,000) - - (3,000)

Options granted 16 - - 36,723 - 36,723

Warrants Granted 16 - - 6,596 - 6,596

Total transactions

with owners, recognised

directly in equity 124,506 1,931,700 43,319 - 2,099,525

--------------------------- ------ ---------- ------------ ---------------- -------------- --------------

Balance as at

30 June 2023 778,635 16,753,221 340,716 (15,131,911) 2,740,661

--------------------------- ------ ---------- ------------ ---------------- -------------- --------------

STATEMENTS OF CASH FLOWS

For the year ended 30 June 2023

Group Company

---------------------------- --------------------------------

Year ended Year ended Year ended Year ended

30 June 30 June 30 June 30 June

2023 2022 2023 2022

Note GBP GBP GBP GBP

-------------------------------------- ------ ------------- ------------- --------------- ---------------

Cash flows from operating

activities

Loss before income tax (3,997,899) (5,557,029) (8,781,189) (2,523,981)

Adjustments for:

Exploration and evaluation - -

asset sales (559,523) -

Provision for bad debt 287,052 - 140,000 -

Other income - (11,233) - -

Other gains - (8,332) - -

Realised loss on investments 866,421 - - -

Change in fair value of investments (309,896) 2,837,437 14,961 39,623

Change in fair value of convertible

debentures 91,106 - 91,106 -

Impairment of loans 128,607 184,365 52,444 123,486

Impairment of property 12,636 - - -

Impairment of intercompany

investments - - 6,056,544

Interest income (369,587) (154,518) (309,274) (101,367)

Intercompany sales - - (155,129) (406,186)

Unrealised foreign exchange/(loss) (100,977) 44,615 30,448 (73,125)

Share option expenses 24 43,306 41,325 43,306 41,325

Stock based compensation - 1,770,000 - 1,770,000

Decrease/(Increase) in trade

and other receivables 10 773,143 (776,342) 1,614,494 (766,999)

Increase/(Decrease) in trade

and other payables 13 282,930 491,807 108,424 907,376

Net cash used in operating

activities (2,293,158) (1,697,428) (1,093,865) (989,848)

-------------------------------------- ------ ------------- ------------- --------------- ---------------

Cash flows from investing

activities

Funds received on sale of

investment 6 677,400 210,178 - -

Funds spent on investment 6 (58,649) (181,937) (58,007) -

Funds spent on leased assets (29,810) - - -

Funds received on sale of

exploration assets 5 47,206 97,508 - -

Loans to subsidiaries 6 - - (732,651) (762,391)

Interest received 226,382 - 226,382 -

Exploration and evaluation

expenses (222,667) (41,786) - -

Convertible debenture receivable 8 (503,499) (1,595,635) (503,499) (1,595,635)

Net cash generated from

(used in) investing activities 136,363 (1,511,672) (1,067,775) (2,358,026)

-------------------------------------- ------ ------------- ------------- --------------- ---------------

Cash flows from financing

activities

Proceeds from issue of share

capital 14 2,059,206 2,318,120 2,059,206 2,318,120

Shares cancelled - - - -

Cost of shares issued 1 4 (3,000) (78,513) (3,000) (78,513)

Repayment of leasing liabilities 34,085 -

and borrowings - -

Net cash generated from

financing activities 2,090,291 2,239,607 2,056,206 2,239,607

-------------------------------------- ------ ------------- ------------- --------------- ---------------

Net decrease/(increase)

in cash and cash equivalents (66,504) (969,493) (105,434) (1,108,267)

Cash and cash equivalents

at beginning of year 11 310,578 1,277,617 124,118 1,232,385

Exchange gain on cash and - -

cash equivalents 2,454 -

Cash and cash equivalents

at end of year 244,074 310,578 18,684 124,118

-------------------------------------- ------ ------------- ------------- --------------- ---------------

Major Non-Cash Transactions

During the year ended 30 June 2023, GBP177,549 worth of

investments were received as part of property option income (refer

to note 5 and note 6).

NOTES TO THE FINANCIAL STATEMENTS

For the year ended 30 June 2023

1. General information

The Company is a public limited company incorporated and

domiciled in England (registered number: 06275976), which is listed

on the London Stock Exchange. The registered office of the Company

is 6 Heddon Street, London, W1B 4BT.

2. Summary of significant Accounting Policies

The principal Accounting Policies applied in the preparation of

these Financial Statements are set out below. These Policies have

been consistently applied to all the periods presented, unless

otherwise stated.

2.1. Basis of preparation of Financial Statements

The Financial Statements have been prepared in accordance with

UK-adopted international accounting standards (UK IAS) in

accordance with the requirements of the Companies Act 2006. The

Financial Statements have also been prepared under the historical

cost convention.

The Financial Statements are presented in Pound Sterling rounded

to the nearest pound.

The preparation of financial statements in conformity with UK

IAS requires the use of certain critical accounting estimates. It

also requires management to exercise its judgement in the process

of applying the Accounting Policies. The areas involving a higher

degree of judgement or complexity, or areas where assumptions and

estimates are significant to the Consolidated Financial Statements

are disclosed in Note 4.

2.2. New and amended standards

(a) New and amended standards mandatory for the first time for

the financial periods beginning on or after 1 July 2022

The International Accounting Standards Board (IASB) issued

various amendments and revisions to International Financial

Reporting Standards and IFRIC interpretations. The amendments and

revisions were applicable for the period ended 30 June 2023 but did

not result in any material changes to the financial statements of

the Group or Company.

ii) New standards, amendments and interpretations in issue but

not yet effective or not yet endorsed and not early adopted

Standards, amendments and interpretations that are not yet

effective and have not been early adopted are as follows:

Standard Impact on initial application Effective date

--------------------- -------------------------------------- ----------------

IAS 12 Income taxes 1 January 2023

-------------------------------------- ----------------

IFRS 17 Insurance contracts 1 January 2023

-------------------------------------- ----------------

IAS 8 Accounting estimates 1 January 2023

-------------------------------------- ----------------

IAS 1 Classification of Liabilities 1 January 2023

as Current or Non-Current.

-------------------------------------- ----------------

IAS 1 Presentation of Financial Statements 1 January 2023

regarding the amendments of

disclosure of accounting policies

-------------------------------------- ----------------

IAS 1 (Amendments) Classification of liabilities 1 January 2024

as current or non-current

-------------------------------------- ----------------

IAS 16 (Amendments) Lease Liability in a Sale and 1 January 2024

Leaseback

-------------------------------------- ----------------

The Group is evaluating the impact of the new and amended

standards above which are not expected to have a material impact on

the Group's results or shareholders' funds.

2.3. Basis of Consolidation

The Consolidated Financial Statements consolidate the financial

statements of the Company and its subsidiaries made up to 30 June.

Subsidiaries are entities over which the Group has control. Control

is achieved when the Group is exposed, or has rights, to variable

returns from its involvement with the investee and has the ability

to affect those returns through its power over the investee.

Generally, there is a presumption that a majority of voting

rights result in control. To support this presumption and when the

Group has less than a majority of the voting or similar rights of

an investee, the Group considers all relevant facts and

circumstances in assessing whether it has power over an investee,

including:

-- The contractual arrangement with the other vote holders of the investee;

-- Rights arising from other contractual arrangements; and

-- The Group's voting rights and potential voting rights

The Group re-assesses whether or not it controls an investee if

facts and circumstances indicate that there are changes to one or

more of the three elements of control. Subsidiaries are fully

consolidated from the date on which control is transferred to the

Group. They are deconsolidated from the date that control ceases.

Assets, liabilities, income and expenses of a subsidiary acquired

or disposed of during the period are included in the consolidated

financial statements from the date the Group gains control until

the date the Group ceases to control the subsidiary.

Investments in subsidiaries are accounted for at cost less

impairment within the Parent Company financial statements. Where

necessary, adjustments are made to the financial statements of

subsidiaries to bring the accounting policies used in line with

those used by other members of the Group. All significant

intercompany transactions and balances between Group enterprises

are eliminated on consolidation.

2.4. Going concern

The Group Financial Statements have been prepared on a going

concern basis. The Directors are of the view that, the Group has

funds to meet its planned expenses over the next 12 months from the

date of these financial statements.

As at 30 June 2023, the Group had cash and cash equivalents of

GBP244,074. The Directors have prepared cash flow forecasts to 31

December 2024, which take into account the cost and operational

structure of the Group and Parent Company, property option income,

debenture interest and any existing licence and working capital

requirements. These forecasts indicate that the Group and Parent

Company's cash resources are not sufficient to cover the projected

expenditure for a period of 12 months from the date of approval of

these financial statements. These forecasts indicate that the Group

and Parent Company, in order to meet their operational objectives,

and meets their expected liabilities as they fall due, will be

required to raise additional funds within the next 12 months.

In common with many entities in the resource sector, the Company

will need to raise further funds within the next 12 months in order

to meet its expected liabilities as they fall due. Whilst the

Directors are confident that they will be secure the necessary

funding, the current conditions do indicate the existence of a

material uncertainty Which may cast significant doubt about the

ability of the Group and parent company to continue as a going

concern. The auditors have made reference to this material

uncertainty in their independent auditor's report.

2.5. Foreign currencies

a) Functional and presentation currency

Items included in the Financial Information are measured using

the currency of the primary economic environment in which the

entity operates (the 'functional currency'). The functional

currency of the parent company is Pounds Sterling as is the

functional currency of the UK subsidiaries which are Imperial

Minerals (UK) Limited and Kudu Resources Limited. The functional

currency of the Canadian subsidiary, Cloudbreak Exploration Inc. is

Canadian Dollars . The functional currency of the US subsidiaries,

Cloudbreak Discovery (US) Ltd. and Cloudbreak Energy (US) Ltd. is

US Dollars. The functional currency of the Guinea subsidiary, Kudu

Resources Guinea is the Guinean Franc. The Financial Information in

The Group's overseas subsidiaries are translated in accordance with

IAS 21 - The Effect of Changes in Foreign Exchange Rates.

b) Transactions and balances

Foreign currency transactions are translated into the functional

currency using the exchange rates prevailing at the dates of the

transactions or valuation where such items are re-measured. Foreign

exchange gains and losses resulting from the settlement of such

transactions and from the translation at year-end exchange rates of

monetary assets and liabilities denominated in foreign currencies

are recognised in the Income Statement in other comprehensive

income. The financial statements are presented in Pounds Sterling

(GBP), the functional currency of Cloudbreak Discovery Plc is

Pounds Sterling, as is the functional currency of the UK

subsidiaries which are Imperial Minerals (UK) Limited and Kudu

Resources Limited.

2.6. Fair value measurement

IFRS 13 establishes a single source of guidance for all fair

value measurements. IFRS 13 provides guidance on how to measure

fair value under IFRS when fair value is required or permitted. The

resulting calculations under IFRS 13 affected the principles that

the Company uses to assess the fair value, but the assessment of

fair value under IFRS 13 has not materially changed the fair values

recognised or disclosed. IFRS 13 mainly impacts the disclosures of

the Company. It requires specific disclosures about fair value

measurements and disclosures of fair values, some of which replace

existing disclosure requirements in other standards.

2.7. Finance Income

Interest income is recognised using the effective interest

method.

2.8. Other income

The other income of the Group comprises royalty income. It is

measured at the fair value of the consideration received or

receivable after deducting discounts and other withholding tax. The

royalty income becomes receivable on extraction and sale of the

relevant underlying commodity, and by determination of the relevant

royalty agreement.

2.9. Cash and cash equivalents

Cash and cash equivalents comprise cash at hand and current and

deposit balances with banks and similar institutions, which are

readily convertible to known amounts of cash and which are subject

to insignificant risk of changes in value. This definition is also

used for the Statement of Cash Flows.

2.10. Trade and other receivables and prepaids

Trade receivables are amounts due from third parties in the

ordinary course of business. If collection is expected in one year

or less, they are classified as current assets. If not, they are

presented as non-current assets.

2.11. Royalty assets at fair value through profit and loss

Royalty financial assets are recognised or derecognised on

completion date where a purchase or sale of the royalty is under a

contract, and are initially measured at fair value, including

transaction costs. All of the Group's royalty financial assets have

been designated as at fair value through profit and loss ("FVTPL").

The royalty financial assets at FVTPL are measured at fair value at

the end of each reporting period, with any fair value gains or

losses recognised in the 'revaluation of royalty financial assets'

line item of the income statement.

2.12. Investments in subsidiaries

Investments in Group undertakings are stated at cost, which is

the fair value of the consideration paid, less any impairment

provision.

2.13. Intangible assets

Exploration and evaluation assets

The Group recognises expenditure as exploration and evaluation

assets when it determines that those assets hold potential to be

successful in finding specific resources. Expenditure included in

the initial exploration and evaluation assets relate to the

acquisition of rights to explore, topographical, geological,

geochemical and geophysical studies, exploratory drilling,

trenching, sampling and activities to evaluate the technical

feasibility and commercial viability of extracting a resource.

Capitalisation of pre-production expenditure ceases when the

prospective property is capable of commercial production.

Exploration and evaluation assets are recorded and held at

cost

Exploration and evaluation assets are not subject to

amortisation, as such at the year-end all intangibles held have an

indefinite life but are assessed annually for impairment. The

assessment is carried out by allocating exploration and evaluation

assets to cash generating units ('CGU's'), which are based on

specific projects or geographical areas. The CGU's are then

assessed of impairment using those specified in IFRS 6.

Whenever the exploration for and evaluation of resources in cash

generating units does not lead to the discovery of commercially

viable quantities of resources and the Group has decided to

discontinue such activities of that unit, the associated

expenditures are written off to the Income Statement.

Exploration and evaluation assets recorded at fair-value on

business combination

Exploration assets which are acquired as part of a business

combination are recognised at fair value in accordance with IFRS 3.

When a business combination results in the acquisition of an entity

whose only significant assets are its exploration asset and/or

rights to explore, the Directors consider that the fair value of

the exploration assets is equal to the consideration. Any excess of

the consideration over the capitalised exploration asset is

attributed to the fair value of the exploration asset.

2.14. Impairment of non-financial assets

Assets that have an indefinite useful life, for example,

intangible assets not ready to use, are not subject to amortisation

and are tested annually for impairment. An impairment loss is

recognised for the amount by which the asset's carrying amount

exceeds its recoverable amount. The recoverable amount is the

higher of an asset's fair value less costs to sell and value in

use. For the purposes of assessing impairment, assets are grouped

at the lowest levels for which there are separately identifiable

cash flows (cash generating units). Non-financial assets that

suffered impairment are reviewed for possible reversal of the

impairment at each reporting date.

2.15. Financial assets

The Group classifies its financial assets into one of the

categories discussed below, depending on the purpose for which the

asset was acquired. The Group's accounting policy for each category

is as follows:

Fair Value through Profit or Loss (FVTPL)

Non-derivative financial assets comprising the Group's strategic

financial investments in entities not qualifying as subsidiaries or

jointly controlled entities. These assets are classified as

financial assets at fair value through profit or loss. They are

carried at fair value with changes in fair value recognised through

the income statement. Where there is a significant or prolonged

decline in the fair value of a financial investment (which

constitutes objective evidence of impairment), the full amount of

the impairment is recognised in the income statement.

Due to the nature of these assets being unlisted investments or

held for the longer term, the investment period is likely to be

greater than 12 months and therefore these financial assets are

shown as non-current assets in the Statement of financial

position.

Amortised Cost

These assets comprise the types of financial assets where the

objective is to hold these assets in order to collect contractual

cash flows and the contractual cash flows are solely payments of

principal and interest.

The Group's financial assets measured at amortised cost comprise

trade and other receivables, convertible debenture receivables and

cash and cash equivalents in the consolidated statement of

financial position. Cash and cash equivalents include cash in hand,

deposits held at call with banks, other short term highly liquid

investments with original maturities of three months or less, and -

for the purpose of the statement of cash flows - bank

overdrafts.

(a) Recognition and measurement

Amortised cost

Regular purchases and sales of financial assets are recognised

on the trade date at cost - the date on which the Group commits to

purchasing or selling the asset. Financial assets are derecognized

when the rights to receive cash flows from the assets have expired

or have been transferred, and the Group has transferred

substantially all of the risks and rewards of ownership .

Fair value through the profit or loss

Financial assets that do not meet the criteria for being

measured at amortised cost or FVTOCI are measured at FVTPL. The

Group holds equity instruments that are classified as FVTPL as

these were acquired principally for the purpose of selling.

Financial assets at FTVPL are measured at fair value at the end

of each reporting period, with any fair value gains or losses

recognised in profit or loss. Fair value is determined by using

market observable inputs and data as far as possible. Inputs used

in determining fair value measurements are categorised into

different levels based on how observable the inputs used in the

valuation technique utilised are (the 'fair value hierarchy'):

- Level 1: Quoted prices in active markets for identical items

(unadjusted)

- Level 2: Observable direct or indirect inputs other than Level

1 inputs

- Level 3: Unobservable inputs (i.e. not derived from market

data).

The classification of an item into the above levels is based on

the lowest level of the inputs used that has a significant effect

on the fair value measurement of the item. Transfers of items

between levels are recognised in the period they occur.

The Group measures its investments in quoted shares using the

quoted market price.

(b) Impairment of financial assets

The Group recognises an allowance for expected credit losses

(ECLs) for all debt instruments not held at fair value through

profit or loss. ECLs are based on the difference between the

contractual cash flows due in accordance with the contract and all

the cash flows that the Group expects to receive, discounted at an

approximation of the original EIR. The expected cash flows will

include cash flows from the sale of collateral held or other credit

enhancements that are integral to the contractual terms.

ECLs are recognised in two stages. For credit exposures for

which there has not been a significant increase in credit risk

since initial recognition, ECLs are provided for credit losses that

result from default events that are possible within the next

12-months (a 12-month ECL). For those credit exposures for which

there has been a significant increase in credit risk since initial

recognition, a loss allowance is required for credit losses

expected over the remaining life of the exposure, irrespective of

the timing of the default (a lifetime ECL).

For trade receivables (not subject to provisional pricing) and

other receivables due in less than 12 months, the Group applies the

simplified approach in calculating ECLs, as permitted by IFRS 9.

Therefore, the Group does not track changes in credit risk, but

instead, recognises a loss allowance based on the financial asset's

lifetime ECL at each reporting date.

Impairment provisions for receivables from related parties and

loans to related parties are recognised based on a forward-looking

expected credit loss model. The methodology used to determine the

amount of the provision is based on whether there has been a

significant increase in credit risk since initial recognition of

the financial asset, based on analysis of internal or external

information. For those where the credit risk has not increased

significantly since initial recognition of the financial asset,

twelve month expected credit losses along with gross interest

income are recognised. For those for which credit risk has

increased significantly, lifetime expected credit losses along with

the gross interest income are recognised. For those that are

determined to be credit impaired, lifetime expected credit losses

along with interest income on a net basis are recognised.

The Group considers a financial asset in default when

contractual payments are 180 days past due. However, in certain

cases, the Group may also consider a financial asset to be in

default when internal or external information indicates that the

Group is unlikely to receive the outstanding contractual amounts in

full before taking into account any credit enhancements held by the

Group. A financial asset is written off when there is no reasonable

expectation of recovering the contractual cash flows and usually

occurs when past due for more than one year and not subject to

enforcement activity.

At each reporting date, the Group assesses whether financial

assets carried at amortised cost are credit impaired. A financial

asset is credit-impaired when one or more events that have a

detrimental impact on the estimated future cash flows of the

financial asset have occurred.

(d) Derecognition

The Group derecognises a financial asset only when the

contractual rights to the cash flows from the asset expire, or when

it transfers the financial asset and substantially all the risks

and rewards of ownership of the asset to another entity.

On derecognition of a financial asset measured at amortised

cost, the difference between the asset's carrying amount and the

sum of the consideration received and receivable is recognised in

profit or loss. This is the same treatment for a financial asset

measured at FVTPL.

2.16. Financial Investments

Non-derivative financial assets comprising the Group's strategic

financial investments in entities not qualifying as subsidiaries,

associates or jointly controlled entities. These assets are

classified as financial assets at fair value through profit or

loss. They are carried at fair value with changes in fair value

recognised through the income statement. Where there is a

significant or prolonged decline in the fair value of a financial

investment (which constitutes objective evidence of impairment),

the full amount of the impairment is recognised in the income

statement.

Listed investments are valued at closing bid price on 30 June

2023. Unlisted investments that are not publicly traded and whose

fair value cannot be measured reliably, are measured at cost loss

less impairment.

2.17. Equity

Equity comprises the following:

-- "Share capital" represents the nominal value of the Ordinary shares;

-- "Share Premium" represents consideration less nominal value

of issued shares and costs directly attributable to the issue of

new shares;

-- "Reverse asset acquisition reserve" represents the retained

losses of the Company before acquisition and the Company equity at

reverse acquisition.

-- "Other reserves" represents the foreign currency translation

reserve, warrant reserve and share option reserve where;

o "Foreign currency translation reserve" represents the

translation differences arising from translating the financial

statement items from functional currency to presentational

currency;

o "Warrant reserve" represents share warrants awarded by the

Group;

o "Share option reserve" represents share options awarded by the

Group;

-- "Retained earnings" represents retained losses.

2.18. Share based payments

The Group operates an equity-settled, share-based scheme under

which the Group receives services from employees or contractors as

consideration for equity instruments (options and warrants) of the

Group. The fair value of the third-party suppliers' services

received in exchange for the grant of the options is recognised as

an expense in the Income Statement or charged to equity depending

on the nature of the service provided. The value of the employee

services received is expensed in the Income Statement and its value

is determined by reference to the fair value of the options

granted:

-- including any market performance conditions;

-- excluding the impact of any service and non-market

performance vesting conditions (for example, profitability or sales

growth targets, or remaining an employee of the entity over a

specified time period); and

-- including the impact of any non-vesting conditions.

The fair value of the share options and warrants are determined

using the Black Scholes valuation model.

Non-market vesting conditions are included in assumptions about

the number of options that are expected to vest. The total expense

or charge is recognised over the vesting period, which is the

period over which all of the specified vesting conditions are to be

satisfied. At the end of each reporting period, the entity revises

its estimates of the number of options that are expected to vest

based on the non-market vesting conditions. It recognises the

impact of the revision to original estimates, if any, in the Income

Statement or equity as appropriate, with a corresponding adjustment

to a separate reserve in equity.

When the options are exercised, the Group issues new shares. The

proceeds received, net of any directly attributable transaction

costs, are credited to share capital (nominal value) and share

premium when the options are exercised.

2.19. Taxation

No current tax is yet payable in view of the losses to date for

all entities in the Group apart from Cloudbreak Exploration Inc.,

who had a tax payable amount of $19,641 CAD (GBP12,178) for the

year.

Deferred tax is recognised for using the liability method in

respect of temporary differences arising from differences between

the carrying amount of assets and liabilities in the consolidated

financial statements and the corresponding tax bases used in the

computation of taxable profit. However, deferred tax liabilities

are not recognised if they arise from the initial recognition of

goodwill; deferred tax is not accounted for if it arises from

initial recognition of an asset or liability in a transaction other

than a business combination that at the time of the transaction

affects neither accounting nor taxable profit or loss.

In principle, deferred tax liabilities are recognised for all

taxable temporary differences and deferred tax assets (including

those arising from investments in subsidiaries), are recognised to

the extent that it is probable that taxable profits will be

available against which deductible temporary differences can be

utilised.

Deferred income tax assets are recognised on deductible

temporary differences arising from investments in subsidiaries only

to the extent that it is probable the temporary difference will

reverse in the future and there is sufficient taxable profit

available against which the temporary difference can be used.

Deferred tax liabilities will be recognised for taxable

temporary differences arising on investments in subsidiaries except

where the Group is able to control the reversal of the temporary

difference and it is probable that the temporary difference will

not reverse in the foreseeable future.

Deferred tax assets and liabilities are offset when there is a

legally enforceable right to offset current tax assets against

current tax liabilities and when the deferred tax assets and

liabilities relate to income taxes levied by the same taxation

authority on either the same taxable entity or different taxable

entities where there is an intention to settle the balances on a

net basis.

Deferred tax is calculated at the tax rates (and laws) that have

been enacted or substantively enacted by the statement of financial

position date and are expected to apply to the period when the

deferred tax asset is realised or the deferred tax liability is

settled.

Deferred tax assets and liabilities are not discounted.

3. Financial risk management

The Group's activities expose it to a variety of financial

risks: market risk (foreign currency risk, price risk and interest

rate risk), credit risk and liquidity risk. The Group's overall

risk management programme focuses on the unpredictability of

financial markets and seeks to minimise potential adverse effects

on the Group's financial performance. None of these risks are

hedged.

Risk management is carried out by the Canadian based management

team under policies approved by the Board of Directors.

3.1. Treasury policy and financial instruments

During the years under review, the financial instruments were

cash and cash equivalents, shares in listed and unlisted companies

and other receivables which were or will be required for the normal

operations of the Group.

The Group operates informal treasury policies which include

ongoing assessments of interest rate management and borrowing

policy. The Board approves all decisions on treasury policy.

The Group has raised funds to finance future activities through

the placing of shares, placing of shares via the Crescita Capital

LLC draw down facility, together with share options and warrants.

There are no differences between the book value and fair value of

the above financial assets. The risks arising from the Group's

financial instruments are liquidity and interest rate risk. The

Directors review and agree policies for managing these risks and

they are summarised below:

Unlisted investments

The Company is required to make judgments over the carrying

value of investments in unquoted companies where fair values cannot

be readily established and evaluate the size of any impairment

required. It is important to recognise that the carrying value of

such investments cannot always be substantiated by comparison with

independent markets and, in many cases, may not be capable of being

realised immediately. Management's significant judgement in this

regard is that the value of their investment represents their cost

less previous impairment.

Market risk & foreign currency risk

The Group is exposed to market risk, primarily relating to

interest rate and foreign exchange movements. The Group does not

hedge against market or foreign exchange risks as the exposure is

not deemed sufficient to enter into forwards or similar

contracts.

Credit risk

Credit risk arises from cash and cash equivalents as well as

outstanding receivables. The amount of exposure to any individual

counter party is subject to a limit, which is assessed by the

Board.

The Group considers the credit ratings of banks in which it

holds funds in order to reduce exposure to credit risk.

Liquidity risk and interest rate risk

The Group seeks to manage financial risk, to ensure sufficient

liquidity is available to meet foreseeable needs and to invest cash

assets safely and profitably. This is achieved by the close control

by the Directors of the Group in the day-to-day management of

liquid resources. Cash is invested in deposit accounts which

provide a modest return on the Group's resources whilst ensuring

there is limited risk of loss to the Group.

3.2. Capital risk management

The Group's objectives when managing capital are to safeguard

the Group's ability to continue as a going concern in order to

provide returns for shareholders and benefits for other

stakeholders and to maintain an optimal capital structure to reduce

the cost of capital.

4. Critical accounting estimates and judgements

The preparation of the Financial Information in conformity with

IFRSs requires management to make estimates and assumptions that

affect the reported amounts of assets and liabilities and

disclosure of contingent assets and liabilities at the date of the

Financial Information and the reported amount of expenses during

the year. Actual results may vary from the estimates used to

produce this Financial Information.

Estimates and judgements are continually evaluated and are based

on historical experience and other factors, including expectations

of future events that are believed to be reasonable under the

circumstances.

Significant items subject to such estimates and assumptions

include, but are not limited to:

Share based payment transactions

The Group has made awards of options and warrants over its

unissued share capital to certain Directors and employees as part

of their remuneration package. Certain warrants have also been

issued to shareholders as part of their subscription for shares and

to suppliers for various services received.

The valuation of these options and warrants involves making a

number of critical estimates relating to price volatility, future

dividend yields, expected life of the options and forfeiture

rates.

Classification of royalty arrangements: initial recognition and

subsequent measurement

The Directors must decide whether the Group's royalty

arrangements should be classified as:

-- Intangible assets in accordance with IAS 38 Intangible Assets; or

-- Financial assets in accordance with IFRS 9 Financial Instruments

The Directors use the following selection criteria to identify

the characteristics which determine which accounting standard to

apply to each royalty arrangement:

Type 1 - Intangible assets: Royalties, are classified as

intangible assets by the Group. The Group considers the substance

of a simple royalty to be economically similar to holding a direct

interest in the underlying mineral asset. Existence risk (the

commodity physically existing in the quantity demonstrated),

production risk (that the operator can achieve production and

operate a commercially viable project), timing risk (commencement

and quantity produced, determined by the operator) and price risk

(returns vary depending on the future commodity price, driven by

future supply and demand) are all risks which the Group

participates in on a similar basis to an owner of the underlying

mineral licence. Furthermore, in a royalty intangible, there is

only a right to receive cash to the extent there is production and

there are no interest payments, minimum payment obligations or

means to enforce production or guarantee repayment. These are

accounted for as intangible assets under IAS-38.

Type 2 - Financial royalty assets (royalties with additional

financial protection): In certain circumstances where the risk is

considered too high, the Group will look to introduce additional

protective measures. This has taken the form of minimum payment

terms. Once an operation is in production, these mechanisms

generally fall away such that the royalty will display identical

characteristics and risk profile to the intangible royalties;

however, it is the contractual right to enforce the receipt of cash

which results in these royalties being accounted for as financial

assets under IFRS 9. There are currently no royalties classified as

financial royalty assets.

Estimated impairment of convertible loan notes receivable &

Convertible debenture receivables

Anglo African Minerals Plc ('AAM')

The Group has assessed whether the AAM convertible loan notes

receivable which has been previously fully impaired in the prior

year, should remain impaired in the current year or be reversed.

They have reassessed this asset and determined that there are no

conditions to reverse the impairment.

G2 Energy Corp. ("G2")

The Group also assessed whether the G2 convertible debenture

receivable should be impaired and based on the current production

levels and the programme at the Masten Unit Energy Project, they

have determined it should not be impaired as G2, through the

funding from the Company, now have the funds required to undertake

the exploration activity and advance the project. The terms of the

debenture is still being met by both parties and G2 are paying the

necessary interest payments. The directors assessed this debenture

in accordance with IFRS and concluded it is a financial asset

accounted for as amortised cost as the financial asset is held

within a business model with the objective to hold and collect the

contractual cash flows which is in the form of interest and

principal payments. As part of the debenture agreement, the Group

received a 3.25% Overriding Royalty Interest in the project which

has limited production and revenues. In accordance with IFRS the

directors has assessed the royalty interest and accounted for it as

intangible assets in accordance with IAS 38 because there is only a

right to receive cash to the extent there is production and there

are no interest payments, minimum payment obligations or means to

enforce production or guarantee repayment. These are accounted for

as intangible assets under IAS 38. The directors considered the

fair value of the royalty assets which they receive in exchange as

part of the debenture agreement for which they did not pay any

consideration. Fair value is determined based on discounted cash

flow models (and other valuation techniques) using assumptions

considered to be reasonable and consistent with those that would be

applied by a market participant. The determination of assumptions

used in assessing fair values is subjective and the use of

different valuation assumptions could have a significant impact on

financial results. The current royalty covers a very small

production site. During the year ended 30 June 2023, GBP35k was

received, with a total of GBP61k being received to date from this

royalty. Following their assessment, the directors concluded that

the fair value of the royalty agreement was not material and has

not been recognised as intangible asset. As part of the debenture

agreement, the Group received 6,500,000 warrants for G2, however

management have deemed that these warrants have no material value

at this stage as the assets held by G2 are predominantly made up of

early-stage exploration and production assets which currently

producing limited amounts of revenue. The group is in regular

communication with G2 and is monitoring the results of its

exploration activities that will be undertaken as the result of the

funding by the Group to G2.

Texas Legacy Exploration LLC ("Texas Legacy")

The Group assessed whether the Texas Legacy convertible

debenture receivable should be impaired and based on the programme

at the Butte Strawn Energy Project, they have determined it should

not be impaired as Texas Legacy have the funds required to

undertake the exploration activity and proceed with their projects.

During the year, after review from the Group, it was agreed that

the principal value of the debenture should be reduced from

$1,500,000 USD to $600,000 USD with no further obligations for the

Group. As part of the revised debenture agreement, the Group have

the option to receive a 2% overriding royalty in lieu of cash of

all the outstanding principal amount of the debenture.

Unlisted investments

The Group is required to make judgments over the carrying value

of investments in unquoted companies where fair values cannot be

readily established and evaluate the size of any fair value

movement required. It is important to recognise that the carrying

value of such investments cannot always be substantiated by

comparison with independent markets and, in many cases, may not be

capable of being realised immediately. Management's significant

judgement in this regard is that the value of their investment

represents their cost value. This valuation method was considered

the most appropriate by management due to the limited information

available related to the unlisted investments as at 30 June 2023.

Management have assessed whether any fair value movement on the

unlisted investments is required at 30 June 2023 and have

determined that none is required.

Recovery of other receivables

Includ ed in other receivables is an amount of GBP140,000 as at

30 June 2023 in respect of unpaid ordinary share capital issued on

3 June 2021. The Directors plan to take action to recover the

amount owed and believe that the amount will be recovered in full

in due time, but because this outcome is not certain and the

balance has been owed for an extended period of time, a provision

for bad debt for the full amount has been implemented.

Valuation of exploration and evaluation assets

Exploration and evaluation costs have a carrying value of 30

June 2023 of GBP236,518 (2022: GBP78,694). Such assets have an

indefinite useful life as the Group has the right to renew

exploration licenses or options and the asset is only amortised

once extraction of the resource commences. The value of the Group's

exploration and evaluation expenditure will be dependent upon the

success of the Group in discovering economic and recoverable

resources, especially in the countries of operation where

political, economic, legal, regulatory and social uncertainties are

potential risk factors. The future revenue flows relating to these

assets is uncertain and will also be affected by competition,

relative exchange rates and potential new legislation and related

environmental requirements. The Group's ability to continue its

exploration programs and develop its projects is dependent on

future fundraisings and utilising the Crescita Capital LLC drawdown

facility. The ability of the Group to continue operating within

some of the jurisdictions contemplated by management is dependent

on a stable political environment which is uncertain based on the

history of the country. This may also impact the Group's legal

title to assets held which would affect the valuation of such

assets. There have been no changes made to any past

assumptions.

The Directors have undertaken a review to assess whether

circumstances exist which could indicate the existence of

impairment as follows:

-- The Group no longer has title to mineral leases or the title

will expire in the near future and is not expected to be

renewed.

-- A decision has been taken by the Board to discontinue

exploration due to the absence of a commercial level of

reserves.

-- Sufficient data exists to indicate that the costs incurred

will not be fully recovered from future development and

participation.

Following their assessment, the Directors concluded that an

impairment charge of GBP12,636 (2022: Nil) was necessary. This

impairment arose as a result of the termination of the Stateline

property option agreement by Volt lithium.

5. Intangible assets

As at June 30, 2023, the Group's exploration and evaluation

assets are as follows:

Group

------------------------------

30 June 2023 30 June 2022

Exploration & Evaluation Assets GBP GBP

------------------------------------------ -------------- --------------

South Timmins, British Columbia 1 1

Klondike Property - 1

Atlin West Property 1 1

Yak Property 1 1

Stateline Property - 13,013

Rizz Property 1 6,053

Icefall Property 1 9,018

Northern Treasure Property 111,023 34,638

Silver Vista Property, British Columbia - 1

Silver Switchback Property, British

Columbia - 1

Rupert Property, British Columbia 1 15,966

Apple Bay Property, British Columbia 1 -

Foggy Mountain, British Columbia 43,220 -

Bobcat Property, Idaho 48,183 -

Elk Creek, Pennsylvania 34,085 -

As at June 30 236,518 78,694

------------------------------------------ -------------- --------------

As at June 30, 2023, the Group's reconciliation of exploration

and evaluation assets are as follows:

Group

------------------------------

30 June 2023 30 June 2022

Exploration & Evaluation Assets GBP GBP

---------------------------------- -------------- --------------

Cost

As at 1 July 78,694 30,679

Additions 222,667 139,294

Disposals (47,206) (97,508)

Impairments (12,636) -

Net proceeds from sale - 1

Forex movement (5,001) 6,228

As at June 30 236,518 78,694

---------------------------------- -------------- --------------

South Timmins Property, Canada

During the year ended June 30, 2021, the Group paid $27,540 CAD

(GBP16,080) in asset staking costs to acquire twelve mineral titles

in Ontario, Canada known as the South Timmins property.

On 23 September 2021, the Group entered into an option agreement

with 1315956 BC Ltd , under which 1315956 BC Ltd may acquire up to

a 100% interest in the Group's South Timmins property subject to a

1% net smelter return ("NSR") to the Group. In order for 1315956 BC

Ltd to fully exercise the option on the South Timmins Property,

they must pay the Group an aggregate of $495,000 CAD, issue

2,250,000 common shares of 1315956 BC Ltd and incur exploration

expenses of $1,515,000 with a minimum of $265,000 CAD in the first

year.

To date, the Group has received cash payments of $270,000

(GBP157,579) and 500,000 shares in relation to the option payments

due under the agreement.

No payments due during the 2023 FY.

Silver Switchback Property, Canada

On May 8, 2020, the Group entered into an option agreement to

purchase 100% of the rights to the Silver Switchback Property

located in British Columbia, Canada. To earn a 100% interest, the

Group must make aggregate cash payments of $75,000 CAD ($15,000 CAD

paid - GBP8,850), issue 1,850,000 shares (250,000 shares issued at

a value of $40,000 CAD - GBP23,356) in the Group and incur work

commitments on the property of $475,000 CAD over three years. The

property is subject to a 2% NSR which the Group may re-purchase

1.5% for $1,250,000 CAD.

On August 27, 2020, the Group entered into an option agreement

with Norseman, under which Norseman may acquire up to a 100%

interest in the Group's Silver Switchback Property subject to a 1%

NSR to the Group. In order for Norseman to fully exercise the

option on the Silver Switchback Property, they must pay the Group

$30,000 CAD (received), issue 750,000 common shares and assume

certain obligations due to the original vendor over three years.

Norseman will have the right to repurchase one-half (0.5%) of the

NSR from the Group for $500,000 CAD. The Group has received cash

payments of $30,000 CAD and 750,000 Norseman shares in relation to

the option payments due under the agreement.

During the year ended 30 June 2023 , the option was cancelled,

and the property was terminated.

Silver Vista, Canada

On May 8, 2020, the Group entered into an option agreement to

purchase 100% of the rights to the Silver Vista Property located in

British Columbia, Canada. To earn a 100% interest, the Group will

need to make aggregate cash payments of $65,000 CAD ($20,000 CAD

paid - GBP11,678), issue 1,375,000 shares (370,000 shares issued at

a value of $75,000 CAD - GBP43,793) in the Group and incur work

commitments on the property of $275,000 CAD, over three years. The

property is subject to a 2% NSR which the Group may acquire

one-half (1%) for $1,000,000 CAD.

During the year ended June 30, 2021, the Group made a payment of

$80,000 CAD (GBP46,713) to a prior optionor to fulfil prior option

agreement obligation.

On September 21, 2020, the Group entered into an option

agreement with Norseman, under which Norseman may acquire up to a

100% interest in the Group's Silver Vista Property subject to a 1%

NSR payable to the Group. In order for Norseman to fully exercise

the option on the Silver Switchback Property, they must pay the

Group $50,000 CAD (received - GBP29,500), and issue 2,000,000

common shares (received and valued at $40,000 CAD - GBP23,600).

Norseman will have the right to repurchase one-half (0.5%) of the

NSR for $500,000 CAD.

During the year ended 30 June 2023 , the option was cancelled,

and the property was terminated.

Rupert, Canada

On September 11, 2018, the Group entered into an asset purchase

agreement with a company controlled by a director of the Group and

two unrelated persons to purchase the Rupert Property, located in

British Columbia, Canada. As consideration for the property, the

Group issued 2,000,000 common shares valued at $100,000 CAD

(GBP59,000) and granted a 2% NSR. At any time, 1% of the NSR can be

purchased by the Group for $1,500,000 CAD. Of the common shares

issued to acquire the property, 1,000,000 were issued to a company

that was controlled by a director of the Group. The Group also

agreed to incur aggregate expenditures on the property of $800,000

($100,000 CAD - GBP59,000 incurred).

On December 11, 2020, the Group sold the Rupert Property to

Buscando Resources Corp. ("Buscando"), a company with a director in

common. Payments to be received by the Group are as follows:

-- $150,000 CAD in total cash payments with $25,000 CAD

(GBP14,750) on closing (received), $50,000 CAD on or before 12

months after Buscando is listed on a public exchange (still owing

at 30 June 2023), $75,000 CAD on or before 24 months after Buscando

is listed on a public exchange;

-- 3,750,000 shares in total issued to the Group with 1,000,000

shares issued on closing (received and valued at $50,000 CAD -

GBP29,500), 1,250,000 on or before 12 months after Buscando is

listed on a public exchange (received and valued at $125,000 CAD -

GBP74,653), 1,500,000 on or before 24 months after Buscando is

listed on a public exchange; and

-- $200,000 expenditures incurred on the property with $100,000

CAD on or before 12 months after Buscando is listed on a public

exchange, $100,000 CAD on or before 24 months after Buscando is

listed on a public exchange.

As a result of the sale to Buscando, the original vendors waived

the exploration commitments required by the Group under the

September 11, 2018, agreement.

During the 2023FY, $50,000 CAD (GBP29,862) was due as a cash

payment and is still owed to the Group in relation to the option

payments due under the agreement.

Atlin West, Canada

On August 9 2021, the Group entered into an option agreement