TIDMCGS

RNS Number : 5936C

Castings PLC

14 June 2023

The information contained within this announcement is deemed by

the Company to constitute inside information stipulated under the

Market Abuse Regulation (EU) No. 596/2014 as it forms part of UK

domestic law by virtue of the European Union (Withdrawal) Act 2018.

Upon the publication of this announcement via the Regulatory

Information Service, this inside information is now considered to

be in the public domain.

Castings P.L.C.

Annual Financial Report

DTR 6.3.5 Disclosure

Year ended 31 March 2023

Chairman's Statement

The turnover of the group increased to GBP201 million (GBP149

million last year) with a rise in profit before tax to GBP16.7

million compared to GBP12.1 million last year.

Overview

Turnover increased by 35% compared with the previous year and

operating profit increased by 36%. The despatch weight was at the

highest level since 2014.

Demand from our customers has been very strong, with the heavy

truck OEMs (approximately 75% of revenue) increasing build rates

throughout the year and this has continued into the current

financial year. In order to satisfy the increasing schedules, which

has been skewed towards certain production lines, it has been

necessary to rebalance production in the foundries which resulted

in some inefficiencies particularly in the second half of the year,

but these are now behind us.

We have experienced very significant price increases in raw

materials and energy, which have been largely recovered from our

customers through established escalators. The most significant

increase related to electricity following the end of our fixed

price contract on 30 September 2022. This additional cost of power

was surcharged to our customers and although it did not adversely

affect group profit, it did impact reported margins.

Further price increases have been negotiated in respect of other

cost rises which have taken effect from the start of the current

financial year.

Foundry businesses

Despite the impact of the production rebalancing, foundry

production increased compared to the prior year. The recruitment

issues that have been experienced in the last few years now seem to

be largely behind us. With increased demand, the foundry

profitability has improved compared to the previous year, although

the margin percentage is impacted by the direct pass-through of the

cost increases.

We continue to invest both at Castings Brownhills and William

Lee to improve productivity, reduce labour costs and improve

working conditions.

CNC Speedwell

It is pleasing to report on the return to profitability in the

machining business, with a particularly strong final quarter of the

financial year. With higher output levels and improved prices, the

current performance of CNC Speedwell is beginning to reflect the

level of investment that has been made in the business.

Outlook

Our customers continue to increase schedules with the demand for

heavy trucks in particular remaining very strong. In addition,

demand in other growth sectors such as USA, wind energy, trailer

braking and coupling systems and innovative agricultural products

continues to grow.

Dividend

The directors are recommending the payment of a final dividend

of 13.51 pence per share to be paid on 18 August 2023 to

shareholders on the register on 21 July 2023. This, together with

the interim dividend, gives a total dividend for the year of 17.35

pence per share.

Supplementary dividend

In addition to the final dividend set out above, the board has

reviewed the cash position of the group and considered the balance

between increasing returns to shareholders whilst retaining

flexibility for capital and other investment opportunities. As a

result, the directors are declaring a supplementary dividend of 15

pence per share to be paid on 26 July 2023 to shareholders on the

register on 23 June 2023. This dividend, being discretionary and

non-recurring, does not compromise our commitment to invest in

market leading technologies to maintain our competitive

advantage.

Brian Cooke

As previously announced, after nearly sixty three years with the

company, of which forty have been as Chairman, Brian Cooke is

standing down as a director and will not be seeking re-election at

the AGM in August. Brian joined the company from foundry college in

1960 and was appointed a director six years later. Prior to

becoming Chairman in 1983, he served as managing director at

Brownhills and then as group chief executive.

Brian has led Castings from the front and everything the group

does reflects his energy and wise business acumen. We would all

like to thank him for his outstanding contribution over the last

seven decades. I am very pleased that he has agreed to remain

available to consult with the group after the AGM.

I also wish to thank the directors, senior management and all of

our employees for their help and commitment during the year.

A. N. Jones

Chairman

14 June 2023

Business and Financial Review

General overview

The year has seen increasing demand during the period with our

commercial vehicle customers, which make up approximately 75% of

group revenue, experiencing extremely strong order books for heavy

trucks.

With demand being skewed towards particular foundry lines,

significant production rebalancing has been necessary to try to

satisfy the dramatic schedule increases. This has caused some

production inefficiencies, particularly in the second half of the

year, but these are now largely behind us.

Input price increases have been another key element in the

financial year. We have seen significant changes in respect of raw

materials and energy which have been recovered from our customers

through established escalators. The most significant increase

related to electricity following the end of a fixed price contract

on 30 September 2022; the additional cost for power (approximately

GBP15 million) was surcharged to our customers and resulted in

increased revenue in the second half of the year. This did not

adversely affect group profit as it is a pass-through of a direct

cost increase.

Overview of business segment performance

The segmental revenue and results for the current and previous

years are set out in note 2. An overview of the performance,

position and future prospects of each segment, and the relevant

KPIs, are set out below.

Key Performance Indicators

The key performance indicators considered by the group are:

-- Segmental revenue

-- Segmental profit

-- EPS

-- Net cash

-- Dividends per share

Foundry operations

As set out previously, customer demand was strong with schedules

increasing during the financial year.

The foundry businesses experienced an increase in output of 6.6%

to 53,100 tonnes and a rise in external sales revenue of

GBP53.4 million (36.7%) to GBP199.0 million. After taking into

account the reduction in weight from machining, this equates to

approximately 59,000 tonnes of production.

Of the total output weight for the year, 59.2% related to

machined castings compared to 54.0% in the previous year. The

change reflects a return to the increasing proportion of more

complex, machined parts after the reduction last year as a result

of disrupted demand patterns.

The segmental profit has increased to

GBP16.3 million, from GBP13.1 million in the previous year,

which represents a profit margin of 7.3% on total segmental sales

(2022 - 8.0%).

The most significant impact on the margin percentage is due to

the pass-through impact of cost rises, along with the disruption

due to production rebalancing. Further price increases have been

negotiated with customers to address the margin erosion experienced

during the year.

Investment of GBP4.8 million has been made in the foundry

businesses during the year. This included GBP0.8 million completing

the project to partially automate the pouring on one of the William

Lee production lines and a further GBP1.1 million on other

automation projects.

Machining

The machining business generated total sales of GBP27.7 million

in the year compared to GBP22.5 million in the previous year. Of

the total revenue, 7.3% was generated from external customers

compared to 13.3% in 2022.

The segmental result for the year was a profit of GBP0.2 million

(2022 - loss of GBP0.9 million).

With the higher volumes in the year, the benefits of the

engineering and productivity improvements that have been made are

now being realised. With the pricing corrections that have been

made, the result in the final quarter was particularly strong.

We have invested GBP1.4 million during the year, which included

GBP0.4 million in the roll-out of automation which will continue

during the current year. A further GBP0.5 million investment was

made in a more power efficient cooling plant in one area of the

business, which will help to reduce energy consumption.

Business review and performance

Revenue

Group revenues increased by 35.3% to GBP201.0 million compared

to GBP148.6 million reported in 2022, of which 83% was exported

(2022 - 79%).

The revenue from the foundry operations to external customers

increased by 36.7% to GBP199.0 million (2022 - GBP145.6 million)

with the dispatch weight of castings to third-party customers

increasing by 6.6% to 53,100 tonnes (2022 - 49,800 tonnes).

Revenue from the machining operation to external customers

decreased by 32.3% during the year to GBP2.0 million (2022 -

GBP3.0 million).

Operating profit and segmental result

The group operating profit for the year was GBP16.4 million

compared to GBP12.0 million reported in 2022, which represents a

return on sales of 8.1% (2022 - 8.1%).

Finance income

The level of finance income increased to GBP0.34 million

compared to GBP0.05 million in 2022, reflecting the rising interest

rates available on deposits during the financial year.

Profit before tax

Profit before tax has increased to GBP16.7 million from GBP12.1

million in the prior year.

Taxation

The current year tax charge of GBP2.92 million (2022 - GBP3.52

million) is made up of a current tax charge of GBP2.41 million

(2022 - GBP1.89 million) and a deferred tax charge of GBP0.51

million (2022 - charge of GBP1.63 million).

The effective rate of tax of 17.5% (2022 - 29.2%) is lower than

the main rate of corporation tax of 19%. The primary reason for

this is a credit to the deferred tax estimate relating to the prior

year of GBP0.43 million, offset by the deferred tax liability

arising from the super-deduction claimed on plant investment during

the year.

Earnings per share

Basic earnings per share increased 61.5% to 31.66 pence (2022 -

19.60 pence), reflecting the 38.0% increase in profit before tax

and a significantly lower effective tax rate compared to the

previous year.

Options over 42,468 shares were granted during the year (2022 -

options over 32,149 shares). The company purchased 47,900 shares

during the year (2022 - 26,100). As a result, the weighted average

number of shares has decreased to 43,671,502 resulting in a diluted

earnings per share of 31.58 pence per share (2022 - 19.57 pence per

share).

Dividends

The directors are recommending a final dividend of 13.51 pence

per share (2022 - 12.57 pence per share) to be paid on 18 August

2023 to shareholders on the register on 21 July 2023. This would

give a total ordinary distribution for the year of 17.35 pence per

share (2022 - 16.23 pence per share).

In addition, a supplementary dividend of 15.00 pence per share

has been declared which will be payable on 26 July 2023 to

shareholders on the register on 23 June 2023.

Cash flow

The group generated cash from operating activities of GBP22.4

million compared to GBP12.9 million in 2022. When compared to 2022,

the variance is mainly due to a significant increase in operating

profit of GBP4.6 million and a working capital outflow swing of

GBP5.1 million.

In the year to 31 March 2023, the main working capital movements

centre around the higher input prices from suppliers which are then

passed onto customers in the form of higher selling prices. This

has resulted in a GBP10.0 million increase in trade receivables in

the year and a GBP6.5 million increase in trade payables. The input

price increase impact on inventory has been offset by the lower

level held in stock at the year end compared to the prior year.

Corporation tax payments during the year totalled GBP2.9 million

compared to GBP2.6 million in 2022.

Capital expenditure during the year amounted to GBP6.2 million

(2022 - GBP4.4 million). This included investment of GBP0.8 million

as part of a foundry moulding line automation project as well as

other automation and productivity enhancements. The charge for

depreciation was GBP8.6 million (2022 - GBP8.6 million).

The company pays pensions on behalf of the two final salary

pension schemes and then reclaims these advances from the schemes.

During the year repayments of GBP2.1 million (2022 - GBP2.5

million) were received from the schemes and advances were paid on

behalf of the schemes of GBP2.1 million (2022 - GBP2.1 million).

These advances will be repaid to the company during the current

financial year.

Dividends paid to shareholders were GBP13.7 million in the year

(2022 - GBP6.7 million) which includes GBP6.5 million in relation

to a supplementary dividend in respect of the year ended 31 March

2022.

The company purchased 47,900 (2022 - 26,100) shares to be held

in treasury at a total cost of GBP0.15 million (2022 - GBP0.08

million).

The net cash and cash equivalents movement for the year was a

slight decrease of GBP0.18 million (2022 - decrease of GBP0.35

million).

At 31 March 2023, the total cash and deposits position was

GBP35.6 million (2022 - GBP35.8 million).

Pensions

The pension valuation showed an increase in the surplus, on an

IAS 19 (Revised) basis, to GBP10.4 million compared to GBP9.9

million in the previous year.

The majority of the liabilities of the schemes are covered by an

insurance asset that fully matches, subject to final adjustment of

the bulk annuity pricing, the remaining pension liabilities of the

schemes. However, there remains the uninsured element relating to

the GMP equalisation liability. This liability has decreased during

the year as a result of the change in valuation assumptions.

The pension surplus continues not to be shown on the balance

sheet due to the IAS 19 (Revised) restriction of recognition of

assets where the company does not have an unconditional right to

receive returns of contributions or refunds.

Balance sheet

Net assets at 31 March 2023 were GBP131.7 million (2022 -

GBP131.5million). Other than the total comprehensive income for the

year of GBP13.9 million (2022 - GBP8.7 million), the only movements

relate to the dividend payment of GBP13.7 million (2022 - GBP6.7

million), shares purchased in the year for GBP0.15 million (2022 -

GBP0.08 million) and share-based payment charge of GBP0.1

million

(2022 - GBP0.08 million).

Non-current assets have decreased to GBP60.7 million (20221 -

GBP63.2 million) primarily as a result of investment in property,

plant and equipment during the year being at a level below the

depreciation charge.

Current assets have increased to GBP113.7 million (2022 -

GBP102.0million) as a result of the increase in trade receivables

as previously mentioned.

Total liabilities have increased to GBP42.8 million (2022 -

GBP33.7 million), largely as a result of an increase in trade

payables.

Consolidated Statement of Comprehensive Income

for the year ended 31 March 2023

2023 2022

GBP000 GBP000

----------------------------------------------------- --------- ---------

Revenue 200,990 148,583

Cost of sales (162,077) (118,105)

------------------------------------------------------ --------- ---------

Gross profit 38,913 30,478

Distribution costs (5,440) (3,411)

Administrative expenses (17,104) (15,040)

------------------------------------------------------ --------- ---------

Profit from operations 16,369 12,027

Finance income 344 47

------------------------------------------------------ --------- ---------

Profit before income tax 16,713 12,074

Income tax expense (2,923) (3,522)

------------------------------------------------------ --------- ---------

Profit for the year attributable to equity holders

of the parent company 13,790 8,552

------------------------------------------------------ --------- ---------

Profit for the year attributable to equity holders

of the parent company 13,790 8,552

Other comprehensive income/(losses) for the

year:

Items that will not be reclassified to profit

and loss:

Movement in unrecognised surplus on defined benefit

pension schemes net of

actuarial gains and losses 117 119

------------------------------------------------------ --------- ---------

117 119

----------------------------------------------------- --------- ---------

Items that may be reclassified subsequently to

profit and loss:

Change in fair value of financial assets (40) 88

Tax effect of items that may be reclassified 10 (22)

------------------------------------------------------ --------- ---------

(30) 66

----------------------------------------------------- --------- ---------

Other comprehensive income for the year (net

of tax) 87 185

------------------------------------------------------ --------- ---------

Total comprehensive income for the year attributable

to the equity holders

of the parent company 13,877 8,737

------------------------------------------------------ --------- ---------

Earnings per share attributable to the equity

holders of the parent company

Basic 31.66p 19.60p

Diluted 31.58p 19.57p

------------------------------------------------------ --------- ---------

Consolidated Balance Sheet

as at 31 March 2023

2023 2022

GBP000 GBP000

--------------------------------------------- ------- -------

ASSETS

Non-current assets

Property, plant and equipment 60,353 62,801

Financial assets 356 396

---------------------------------------------- ------- -------

60,709 63,197

--------------------------------------------- ------- -------

Current assets

Inventories 26,095 25,889

Trade and other receivables 51,080 39,874

Current tax asset 980 489

Cash and cash equivalents 35,566 35,745

---------------------------------------------- ------- -------

113,721 101,997

--------------------------------------------- ------- -------

Total assets 174,430 165,194

---------------------------------------------- ------- -------

LIABILITIES

Current liabilities

Trade and other payables 37,051 28,477

---------------------------------------------- ------- -------

37,051 28,477

--------------------------------------------- ------- -------

Non-current liabilities

Deferred tax liabilities 5,719 5,219

---------------------------------------------- ------- -------

Total liabilities 42,770 33,696

---------------------------------------------- ------- -------

Net assets 131,660 131,498

---------------------------------------------- ------- -------

Equity attributable to equity holders of the

parent company

Share capital 4,363 4,363

Share premium account 874 874

Treasury shares (231) (79)

Other reserve 13 13

Retained earnings 126,641 126,327

---------------------------------------------- ------- -------

Total equity 131,660 131,498

---------------------------------------------- ------- -------

Consolidated Cash Flow Statement

for the year ended 31 March 2023

2023 2022

GBP000 GBP000

-------------------------------------------------- -------- -------

Cash flows from operating activities

Profit before income tax 16,713 12,074

Adjustments for:

Depreciation 8,646 8,601

Loss on disposal of property, plant and equipment - 62

Finance income (344) (47)

Equity-settled share-based payment expense 119 74

Pension administrative costs 117 119

Increase in inventories (206) (7,170)

Increase in receivables (11,200) (4,898)

Increase in payables 8,574 4,106

--------------------------------------------------- -------- -------

Cash generated from operating activities 22,419 12,921

Tax paid (2,904) (2,568)

Interest received 327 28

--------------------------------------------------- -------- -------

Net cash generated from operating activities 19,842 10,381

Cash flows from investing activities

Dividends received from listed investments 17 19

Purchase of property, plant and equipment (6,198) (4,379)

Proceeds from disposal of property, plant and

equipment - 27

Repayments from pension schemes 2,114 2,496

Advances on behalf of the pension schemes (2,120) (2,114)

--------------------------------------------------- -------- -------

Net cash used in investing activities (6,187) (3,951)

Cash flow from financing activities

Dividends paid to shareholders (13,682) (6,698)

Purchase of own shares (152) (79)

--------------------------------------------------- -------- -------

Net cash used in financing activities (13,384) (6,777)

Decrease in cash and cash equivalents (179) (347)

Cash and cash equivalents at beginning of year 35,745 36,092

--------------------------------------------------- -------- -------

Cash and cash equivalents at end of year 35,566 35,745

--------------------------------------------------- -------- -------

Cash and cash equivalents:

Short-term deposits 19,993 17,065

Cash available on demand 15,573 18,680

--------------------------------------------------- -------- -------

35,566 35,745

-------------------------------------------------- -------- -------

Consolidated Statement of Changes in Equity

for the year ended 31 March 2023

Equity attributable to equity holders of

the parent

Share Share Treasury Other Retained

capital premium shares reserve earnings Total

(a) (b) (c) (d) (e) equity

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

------------------------------------- -------- -------- -------- -------- --------- --------

At 1 April 2022 4,363 874 (79) 13 126,327 131,498

------------------------------------- -------- -------- -------- -------- --------- --------

Profit for the year - - - - 13,790 13,790

Other comprehensive income/(losses):

Movement in unrecognised surplus

on defined benefit pension

schemes net of actuarial gains

and losses - - - - 117 117

Change in fair value of financial

assets - - - - (40) (40)

Tax effect of items taken directly

to reserves - - - - 10 10

------------------------------------- -------- -------- -------- -------- --------- --------

Total comprehensive income

for the year - - - - 13,877 13,877

Shares acquired in the year - - (152) - - (152)

Equity-settled share-based

payments - - - - 119 119

Dividends (see note 4) - - - - (13,682) (13,682)

------------------------------------- -------- -------- -------- -------- --------- --------

At 31 March 2023 4,363 874 (231) 13 126,641 131,660

------------------------------------- -------- -------- -------- -------- --------- --------

Equity attributable to equity holders of

the parent

Share Share Treasury Other Retained Total

capital(a) premium(b) shares(c) reserve(d) earnings(e) equity

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

------------------------------------- ----------- ----------- ---------- ----------- ------------ -------

At 1 April 2021 4,363 874 - 13 124,214 129,464

------------------------------------- ----------- ----------- ---------- ----------- ------------ -------

Profit for the year - - - - 8,552 8,552

Other comprehensive income/(losses):

Movement in unrecognised surplus

on defined benefit pension

schemes net of actuarial gains

and losses - - - - 119 119

Change in fair value of financial

assets - - - - 88 88

Tax effect of items taken directly

to reserves - - - - (22) (22)

------------------------------------- ----------- ----------- ---------- ----------- ------------ -------

Total comprehensive income

for the year - - - - 8,737 8,737

Shares acquired in the year - - (79) - - (79)

Equity-settled share-based

payments - - - - 74 74

Dividends (see note 4) - - - - (6,698) (6,698)

------------------------------------- ----------- ----------- ---------- ----------- ------------ -------

At 31 March 2022 4,363 874 (79) 13 126,327 131,498

------------------------------------- ----------- ----------- ---------- ----------- ------------ -------

a) Share capital - The nominal value of allotted and fully paid

up ordinary share capital in issue.

b) Share premium - Amount subscribed for share capital in excess

of nominal value.

c) Treasury shares - Value of shares acquired by the

company.

d) Other reserve - Amounts transferred from share capital on

redemption of issued shares.

e) Retained earnings - Cumulative net gains and losses

recognised in the statement of comprehensive income.

Notes to the Consolidated Financial Statements

1 Basis of preparation

The group financial statements have been prepared in accordance

with UK-adopted international accounting standard in conformity

with the requirements of the Companies Act 2006.

The IFRSs applied in the group financial statements are subject

to ongoing amendment by the IASB and therefore subject to possible

change in the future. Further standards and interpretations may be

issued that will be applicable for financial years beginning on or

after 1 April 2023 or later accounting periods but may be adopted

early.

The preparation of financial statements in accordance with IFRS

requires the use of certain accounting estimates. It also requires

management to exercise its judgement in the process of applying the

group's accounting policies.

The primary statements within the financial information

contained in this document have been presented in accordance with

IAS 1 Presentation of Financial Statements.

The financial statements are prepared on a going concern basis

and under the historical cost convention, except where adjusted for

revaluations of certain assets, and in accordance with applicable

Accounting Standards and those parts of the Companies Act 2006

applicable to companies reporting under IFRS. A summary of the

principal group IFRS accounting policies is set out below. The

presentation currency used is sterling and the amounts have been

presented in round thousands ("GBP000").

2 Operating segments

For internal decision-making purposes, the group is organised

into three operating companies which are considered to be the

operating segments of the group: Castings P.L.C. and William Lee

Limited are aggregated into Foundry operations, due to the similar

nature of the businesses, and CNC Speedwell Limited is the

Machining operation.

Inter-segment transactions are entered into under the normal

commercial terms and conditions that would be available to third

parties.

The following shows the revenues, results and total assets by

reportable segment in the year to 31 March 2023:

Foundry Machining

operations operations Elimination Total

GBP000 GBP000 GBP000 GBP000

-------------------------------- ----------- ----------- ----------- --------

Revenue from external customers 198,972 2,018 - 200,990

Inter-segmental revenue 24,739 25,640 - 50,379

-------------------------------- ----------- ----------- ----------- --------

Segmental result 16,332 169 (15) 16,486

-------------------------------- ----------- ----------- ----------- --------

Unallocated costs:

Defined benefit pension cost (117)

Finance income 344

-------------------------------- ----------- ----------- ----------- --------

Profit before income tax 16,713

Total assets 162,671 26,687 (14,928) 174,430

-------------------------------- ----------- ----------- ----------- --------

Non-current asset additions 4,826 1,372 - 6,198

-------------------------------- ----------- ----------- ----------- --------

Depreciation 5,235 3,411 - 8,646

-------------------------------- ----------- ----------- ----------- --------

Total liabilities (45,668) (6,759) 9,657 (42,770)

-------------------------------- ----------- ----------- ----------- --------

All non-current assets are based in the United Kingdom.

The following shows the revenues, results and total assets by

reportable segment in the year to 31 March 2022:

Foundry Machining

operations operations Elimination Total

GBP000 GBP000 GBP000 GBP000

----------------------------------- ----------- ----------- ----------- --------

Revenue from external customers 145,601 2,982 - 148,583

Inter-segmental revenue 17,037 19,488 - 36,525

----------------------------------- ----------- ----------- ----------- --------

Segmental result 13,084 (894) (50) 12,140

----------------------------------- ----------- ----------- ----------- --------

Unallocated costs:

Exceptional credit for recovery of

Icelandic bank deposits

previously written off 6

Defined benefit pension cost (119)

Finance income 47

----------------------------------- ----------- ----------- ----------- --------

Profit before income tax 12,074

Total assets 148,554 26,741 (10,101) 165,194

----------------------------------- ----------- ----------- ----------- --------

Non-current asset additions 3,388 991 - 4,379

----------------------------------- ----------- ----------- ----------- --------

Depreciation 4,790 3,811 - 8,601

----------------------------------- ----------- ----------- ----------- --------

Total liabilities (31,561) (6,977) 4,842 (33,696)

----------------------------------- ----------- ----------- ----------- --------

All non-current assets are based in the United Kingdom.

2023 2022

GBP000 GBP000

----------------------------------------------------- ------- -------

The geographical analysis of revenues by destination

for the year is as follows:

United Kingdom 34,519 31,319

Sweden 55,107 38,809

Germany 32,292 20,506

Netherlands 31,763 19,907

Rest of Europe 31,810 26,050

North and South America 14,322 11,294

Other 1,177 698

----------------------------------------------------- ------- -------

200,990 148,583

----------------------------------------------------- ------- -------

All revenue arises in the United Kingdom from the group's

continuing activities.

3 Income tax expense

2023 2022

GBP000 GBP000

------------------------------------------------------- ------- -------

Corporation tax based on a rate of 19% (2022 - 19%)

UK corporation tax

Current tax on profits for the year 2,500 2,050

Adjustments to tax charge in respect of prior years (87) (155)

------------------------------------------------------- ------- -------

2,413 1,895

Deferred tax

Current year origination and reversal of temporary

differences 935 624

Adjustment to deferred tax charge in respect of prior

years (425) (107)

Adjustment to deferred tax charge in respect of change

in tax rate - 1,100

------------------------------------------------------- ------- -------

510 1,627

------------------------------------------------------- ------- -------

Taxation on profit 2,923 3,522

------------------------------------------------------- ------- -------

Profit before income tax 16,713 12,074

------------------------------------------------------- ------- -------

Tax on profit at the standard rate of corporation

tax

in the UK of 19% (2022 - 19%) 3,175 2,294

Effect of:

Expenses not deductible for tax purposes 238 357

Adjustment to tax charge in respect of prior years (87) (155)

Adjustment to deferred tax charge in respect of prior

years (425) (107)

Adjustment to deferred tax charge in respect of change

in tax rate - 1,110

Pension adjustments 22 23

------------------------------------------------------- ------- -------

Total tax charge for the year 2,923 3,522

------------------------------------------------------- ------- -------

Effective rate of tax (%) 17.5 29.2

------------------------------------------------------- ------- -------

Changes to the UK corporation tax rates were substantively

enacted as part of Finance Bill 2021 on 24 May 2021, the applicable

main rate increasing from the current level of 19% to 25% from 1

April 2023. Deferred taxes at the balance sheet date have been

measured using these enacted tax rates and reflected in these

financial statements.

4 Dividends

2023 2022

GBP000 GBP000

--------------------------------------------------- ------- -------

Final paid of 12.57p per share for the year ended

31 March 2022 (2021 - 11.69p) 5,475 5,101

Interim paid of 3.84p per share (2022 - 3.66p) 1,673 1,597

Supplementary dividend of 15.00p per share for the

year ended 31 March 2022 (2021 - nil) 6,534 -

--------------------------------------------------- ------- -------

13,682 6,698

--------------------------------------------------- ------- -------

The directors are proposing a final dividend of 13.51 pence

(2022 - 12.57 pence) per share totalling GBP5,884,695 (2022 -

GBP5,475,249). In addition, the directors have declared a

supplementary dividend of 15.00 pence per share, totalling

GBP6,533,710. These dividends have not been accrued at the balance

sheet date.

5 Earnings per share and diluted earnings per share

The calculation of the basic and diluted earnings per share is

based on the following data:

2023 2022

-------------------------------------------------------- ---------- ----------

Profit after taxation (GBP000) 13,790 8,552

-------------------------------------------------------- ---------- ----------

Weighted average number of shares - basic calculation 43,561,593 43,631,545

Earnings per share - basic calculation (pence per

share) 31.66p 19.60p

-------------------------------------------------------- ---------- ----------

Number of dilutive share options in issue 109,909 67,441

Weighted average number of shares - diluted calculation 43,671,502 43,698,986

Earnings per share - diluted calculation (pence per

share) 31.58p 19.57p

-------------------------------------------------------- ---------- ----------

6 Property, plant and equipment

Freehold

land and Plant

buildings and equipment Total

GBP000 GBP000 GBP000

-------------------------- ---------- -------------- -------

Cost

At 1 April 2022 40,110 155,596 195,706

Additions during the year 437 5,761 6,198

Disposals - (961) (961)

Other 410 - 410

-------------------------- ---------- -------------- -------

At 31 March 2023 40,957 160,396 201,353

-------------------------- ---------- -------------- -------

Accumulated depreciation

At 1 April 2022 12,295 120,610 132,905

Charge for year 1,015 7,631 8,646

Disposals - (961) (961)

Other 410 - 410

-------------------------- ---------- -------------- -------

At 31 March 2023 13,720 127,280 141,000

-------------------------- ---------- -------------- -------

Net book values

At 31 March 2023 27,237 33,116 60,353

-------------------------- ---------- -------------- -------

At 31 March 2022 27,815 34,986 62,801

-------------------------- ---------- -------------- -------

Cost

At 1 April 2021 40,357 151,831 192,188

Additions during the year 163 4,216 4,379

Disposals (410) (451) (861)

-------------------------- ---------- -------------- -------

At 31 March 2022 40,110 155,596 195,706

-------------------------- ---------- -------------- -------

Accumulated depreciation

At 1 April 2021 11,632 113,444 125,076

Charge for year 1,073 7,528 8,601

Disposals (410) (362) (772)

-------------------------- ---------- -------------- -------

At 31 March 2022 12,295 120,610 132,905

-------------------------- ---------- -------------- -------

Net book values

At 31 March 2022 27,815 34,986 62,801

-------------------------- ---------- -------------- -------

At 31 March 2021 28,725 38,387 67,112

-------------------------- ---------- -------------- -------

The net book value of land and buildings includes GBP2,169,000

(2022 - GBP2,169,000) for land which is not depreciated.

Included within plant and equipment are assets in the course of

construction with a net book value of GBP385,000 (2022 -

GBP1,043,000) which are not depreciated.

7 Commitments and contingencies

2023 2022

GBP000 GBP000

---------------------------------------------------- ------- -------

Capital commitments contracted for by the group but

not provided for in the financial statements 1,799 1,637

---------------------------------------------------- ------- -------

The group does not insure against the potential cost of product

warranty or recall. Accordingly, there is always the possibility of

claims against the group for quality related issues on parts

supplied to customers. As at 31 March 2023, the directors do not

consider any significant liability will arise in respect of any

such claims (2022 - GBPnil).

8 Pensions

The company operates two defined benefit pension schemes which

were closed to future accruals at 6 April 2009. The funded status

of these schemes at 31 March 2023 was a surplus of GBP10,413,000

(2022 - GBP9.932,000). On 24 March 2020, the Trustees of the

schemes completed a bulk annuity insurance buy-in with Aviva Life

& Pensions UK Limited thus providing certainty and security for

all members of the schemes. The buy-in secures an insurance asset

from Aviva that fully matches, subject to final price adjustment of

the bulk annuity pricing, the remaining pension liabilities of the

schemes. The buy-in covers the investment, longevity, interest rate

and inflation risks in respect of the schemes and therefore

substantially reduces the pension risk to the company.

The pension surplus has not been recognised as the group does

not have an unconditional right to receive returns of contributions

or refunds under the scheme rules.

9 Preliminary statement

The financial information set out above does not constitute the

company's statutory financial statements for the years ended 31

March 2023 or 2022 but is derived from those financial statements.

Statutory financial statements for 2022 have been delivered to the

Registrar of Companies and those for 2023 will be delivered

following the company's Annual General Meeting. The auditors have

reported on those financial statements; their reports were

unqualified, did not include references to any matters to which the

auditors drew attention by way of emphasis without qualifying their

reports and did not contain statements under Section 498 of the

Companies Act 2006.

The annual report and financial statements will be posted to

shareholders on 23 June 2023 and will be available on the company's

website, www.castings.plc.uk, from 26 June 2023.

Appendix 1 - Principal Risks and Uncertainties

In common with all trading businesses, the group is exposed to a

variety of risks in the conduct of its normal business

operations.

The directors regularly assess the principal risks facing the

entity. Whilst it is difficult to completely quantify every

material risk that the group faces, below is a summary of those

risks that the directors believe are most significant to the

group's business and could have a material impact on future

performance, causing it to differ materially from expected or

historic achieved results. Information is also provided as to how

the risks are, where possible, being managed or mitigated.

The group does not operate a formal internal audit function;

however, risk management is overseen by senior management and group

risk registers are maintained and regularly reviewed, alongside

factors which may result in changes to risk assessments or require

additional mitigation measures to be implemented.

External consultants are used to assess design and effectiveness

of controls relating to IT security to provide specialist support

to management in this area.

Key risks arising or increasing in impact are reviewed at both

group and subsidiary board meetings.

The impact of each risk set out below has been described as

increased, stable or decreased dependent upon whether the business

environment and group activity has resulted in a change to the

potential impact of that risk.

Several principal risks have been removed which have been key

themes in the last few years. As the conditions of the United

Kingdom's exit from the European Union seems to be largely

concluded and the resulting changes embedded, it is no longer

considered a principal risk to the business as a standalone issue.

Similarly, with vaccination programmes largely successful in major

markets, COVID-19 has also been removed as a principal risk. Both

issues remain subject to review as part of the group's internal

risk review process.

Risk description Impact Mitigation and control

Technological change

--------------------------------- --------------------------------- --------------------------------

Customers continue to Stable The strategic focus of

invest in the development The group continues to the group is evaluated

of electric and hydrogen work with key customers regularly through group

powered vehicles to move producing the next generation board meetings.

away from internal combustion of ICE commercial vehicles, Consideration is given

engines ('ICE'). whilst monitoring opportunities to what opportunities

The initial phase of for the future. might be available within

this is focussed on passenger alternative light-weight

cars and smaller, short-range metals (e.g aluminium),

trucks which are not value added opportunities

key markets for the group. and also replacement

However, the continued technologies for heavy-duty

development of new technology trucks.

does present a medium-term The group's electricity

risk to the group as contracts are fully Renewable

c. 30% of group revenue Energy Guarantees of

arises from the supply Origin ('REGO') backed

of cast iron powertrain and the gas contracts

components. will be from 1 October

It is important to note 2023. This provides a

that such a change also platform for the group

presents an opportunity to support our customers

for the group to evolve Green Iron aspirations.

its product offering,

as has always been the

case over the years.

--------------------------------- --------------------------------- --------------------------------

Operational and commercial

--------------------------------- --------------------------------- --------------------------------

The group's revenues Stable The group's operations

are principally derived The operational and commercial are set up in such a

from the commercial vehicle activity of the business way as to ensure that

markets which can be is driven by customer variation in demand can

subject to variations demand. Demand has the be accommodated and rapidly

in patterns of demand. potential to change rapidly responded to.

Commercial vehicle sales dependent upon the significant Demand is closely reviewed

are linked to technological variable factors in the by senior management

factors (for example macroeconomic environment on a constant basis.

emissions legislation) such as conflict in Ukraine,

and economic growth. supply chain issues or

changing regulatory positions.

--------------------------------- --------------------------------- --------------------------------

Market competition

--------------------------------- --------------------------------- --------------------------------

Commercial vehicle markets Stable Whilst there can be no

are, by their nature, Erosion of market share guarantee that business

highly competitive, which could result in loss will not be lost on price,

has historically led of revenue and profit. we are confident that

to deflationary pressure we can remain competitive.

on selling prices. This The group continues to

pressure is most pronounced mitigate this risk through

in cycles of lower demand. investment in productivity,

A number of the group's with a strong focus on

customers are also adopting cost and customer value.

global sourcing models

with the aim to reduce

bought-out costs.

--------------------------------- --------------------------------- --------------------------------

Customer concentration, programme dependencies and relationships

------------------------------------------------------------------------------------------------------

The group has relationships Stable We build strong relationships

with key customers in The loss of, or deterioration with our customers to

the commercial vehicle in, any major customer develop products to meet

market which form the relationship could have their specific needs.

majority of the customer a material impact on

base. the group's results.

--------------------------------- --------------------------------- --------------------------------

Product quality and

liability

--------------------------------- --------------------------------- --------------------------------

The group's businesses Stable Whilst it is a policy

expose it to certain Fines or penalties could of the group to endeavour

product liability risks result in a loss of revenue, to limit its financial

which, in the event of additional costs and liability by contract

failure, could give rise reduced profits. in all long-term agreements

to material financial ('LTAs'), it is not always

liabilities. possible to secure such

limitations in the absence

of LTAs.

The group's customers

do require the maintenance

of demanding quality

systems to safeguard

against quality-related

risks and the group maintains

appropriate external

quality accreditations.

The group maintains insurance

for public liability-related

claims but does not insure

against the risk of product

warranty or recall.

--------------------------------- --------------------------------- --------------------------------

Foreign exchange

--------------------------------- --------------------------------- --------------------------------

The group is exposed Stable The group's foreign exchange

to foreign exchange risk The group is exposed risk is well-mitigated

on both sales and purchases to gains or losses that through commercial arrangements

denominated in currencies could be material to with key customers.

other than sterling, the group's financial Foreign exchange rate

being primarily euro results and can increase risk is sometimes partially

and US dollar. or decrease how competitive mitigated by using forward

the group's pricing is foreign exchange contracts.

to overseas markets. Such contracts are short

term in nature, matched

to contractual cash flows

and non-speculative.

--------------------------------- --------------------------------- --------------------------------

Equipment

--------------------------------- --------------------------------- --------------------------------

The group operates a Stable Whilst this risk cannot

number of specialist A large incident could be entirely mitigated

pieces of equipment, disrupt business at the without uneconomic duplication

including foundry furnaces, site affected and result of all key equipment,

moulding lines and CNC in significant rectification all key equipment is

milling machines which, costs or material asset maintained to a high

due to manufacturing impairments. standard and inventories

lead times, would be of strategic equipment

difficult to replace spares maintained.

sufficiently quickly The foundry facilities

to prevent major interruption at Brownhills and Dronfield

and possible loss of have similar equipment

business in the event and work can be transferred

of unforeseen failure. from one location to

another very quickly.

--------------------------------- --------------------------------- --------------------------------

Suppliers

--------------------------------- --------------------------------- --------------------------------

The group holds long-standing Stable Although the group takes

relationships with key The risk of a supplier's care to ensure alternative

suppliers and there is business interruption sources of supply remain

a risk that a business remains very high due available for materials

which the group is critically to the current global or services on which

dependent upon could business environment. the group's businesses

be subject to significant are critically dependent,

disruption and that this this is not always possible

could materially impact to guarantee without

the operations of the risk of short-term business

group. disruption, additional

There are specifically costs and potential damage

high risks of semi-conductor to relationships with

shortages in the supply key customers.

chain, COVID-19 outbreaks, The group continues to

disruption because of maintain productive dialogue

the conflict in Ukraine with key suppliers, working

or logistical delays. together to adjust to

changes to the business

environment.

--------------------------------- --------------------------------- --------------------------------

Commodity and energy

pricing

--------------------------------- --------------------------------- --------------------------------

The group is exposed Stable Wherever possible, prices

to the risk of price Changes to the pricing and quantities (except

inflation on raw materials of the group's commodity steel) are secured through

and energy contracts. and energy purchases long-term agreements

The principal metal raw could materially impact with suppliers. In general,

materials used by the the financial performance the risk of price inflation

group's businesses are of the group if no mitigating of these materials resides

steel scrap and various actions were taken. with the group's customers

alloys. The most important Power and raw material through price adjustment

alloy raw material inputs markets have become very clauses.

are premium graphite, volatile because of the Historically, energy

magnesium ferro-silicon, current conflict in Ukraine contracts have been locked

copper, nickel and molybdenum. and other associated in for at least 12 months.

supply issues. With the volatile power

market, following the

end of our fixed price

contract on 30 September

2022, the group entered

into a flexible power

agreement. When markets

permit, it would be the

intention to revert back

to a fixed contract.

Management has worked

with customers during

the course of the year

to pass these costs through

in a timely manner.

--------------------------------- --------------------------------- --------------------------------

Information technology and systems reliability

------------------------------------------------------------------------------------------------------

The group is dependent Stable Whilst data within key

on its information technology Significant failures systems is regularly

('IT') systems to operate to the IT systems of backed up and systems

its business efficiently, the group as a result subject to virus protection,

without failure or interruption. of external factors could any failure of backup

The group continues to result in operational systems or other major

invest in IT systems disruption and a negative IT interruption could

to aid in the operational impact on customer delivery have a disruptive effect

performance of the group and reporting capabilities. on the group's business.

and its reporting capabilities. IT projects are reviewed

There are increasing and approved at board

global threats faced level and the group continues

by these systems as a to invest in IT security

result of sophisticated to improve our resilience

cyberattacks. and response towards

such threats.

The group engages with

external specialists

to regularly assess the

security of the IT network

and systems.

--------------------------------- --------------------------------- --------------------------------

Regulatory and legislative

compliance

--------------------------------- --------------------------------- --------------------------------

The group must comply Stable The group maintains a

with a wide range of Failure to comply with comprehensive range of

legislative and regulatory legislation could lead policies, procedures

requirements including to substantial financial and training programmes

modern slavery, anti-bribery penalties, business disruption, in order to ensure that

and anti-competition diversion of management both management and relevant

legislation, taxation time, personal and corporate employees are informed

legislation, employment liability and loss of of legislative changes

law and import and export reputation. and it is clear how the

controls. group's business is expected

to be carried out.

Whistleblowing procedures

and an open-door management

style are in place to

enable concerns to be

raised and addressed.

Specialist advice is

made available to management

when required to ensure

that the group is up

to date with changes

in regulation and legislation.

--------------------------------- --------------------------------- --------------------------------

Climate change

--------------------------------- --------------------------------- --------------------------------

The group's operations Stable The working group, formed

are energy-intensive It is expected that green last year, continues

and whilst the group taxes on energy and the to monitor and report

considers that its businesses compliance cost of meeting on developments with

provide fundamental components developing reporting regards to climate risk.

and services which will obligations for our stakeholders As part of the renewal

prove resilient in a will result in increased of energy contracts the

transition towards a energy prices and administrative group reviews whether

net zero economy, the expenses. investment in renewable

board recognises the energy sources would

group is likely to receive meet the group's investment

increased scrutiny in criteria and such proposals

the future in relation will continue to be considered

to emissions and climate on their commercial merits.

change. The group will continue

to engage with and understand

the needs of its stakeholders

with regard to climate

risk.

--------------------------------- --------------------------------- --------------------------------

People risk

--------------------------------- --------------------------------- --------------------------------

The group's operations Stable The group looks to provide

depend upon the availability The labour market has safe, stable and long-term

of both skilled and unskilled been extremely competitive employment at competitive

labour to operate manual during the year. rates of pay.

equipment and fulfil We invest in people development

our strategic goals. and utilise technology

Inability to attract and productivity gains

and retain talent could to ensure that our products

result in either a shortage remain competitively

of staff or a reduction priced.

in operating margins.

--------------------------------- --------------------------------- --------------------------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR ZXLFFXQLLBBZ

(END) Dow Jones Newswires

June 14, 2023 02:00 ET (06:00 GMT)

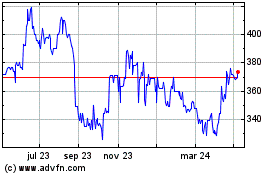

Castings (LSE:CGS)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

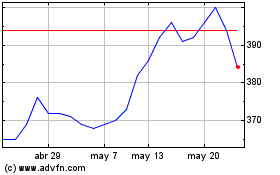

Castings (LSE:CGS)

Gráfica de Acción Histórica

De May 2023 a May 2024