TIDMCOD

RNS Number : 4651R

Compagnie de Saint-Gobain

26 October 2023

The worldwide leader

in light & sustainable construction

Solid performance in Q3 2023

New record margin expected in 2023

-- Sequential price stability in Q3 2023, generating a positive price-cost spread

-- Volumes in Q3 2023 in line with expectations for the year

-- Further proof of the Group's resilience in a difficult environment

-- Share buyback of EUR540m so far this year, ahead of target

-- 2023 outlook: new record operating margin expected in 2023,

double-digit for the third consecutive year

Like-for-like sales were stable over the nine-month period to

September 30, 2023 despite a contraction of 3.1% in the third

quarter of the year versus third-quarter 2022 given the more

difficult pricing comparison basis due to the price increases

implemented proactively in the last few years. In a less

inflationary environment prices rose by 5.9% over the nine-month

period and by 1.9% in the third quarter, reflecting overall

sequential price stability since the start of the year, generating

a positive price-cost spread once again.

In a difficult macroeconomic environment, the Group continued to

outperform its markets thanks to the pertinence of its strategic

positioning at the heart of energy and decarbonization challenges

and to the strength of its local organization by country, which

enables it to offer comprehensive solutions to its customers.

Thanks to its recent acquisitions and investments, the Group has

successfully repositioned itself on North America, Asia and

emerging countries, and construction chemicals. These markets with

strong growth outlooks now represent two-thirds of the Group's

operating income. Construction chemicals overall posted organic

growth of 3.1% over the nine-month period.

In line with expectations for the year, volumes were down by

5.9% over the nine-month period and by 5.0% over the third quarter

(including a negative working day effect of around 2%), with a

moderate slowdown in markets reflecting a contrasting situation: a

marked decline in new construction but good resilience overall in

renovation. In each local market, the Group is taking the proactive

commercial and industrial measures necessary to continue to

outperform its markets and maintain its excellent operating

performance achieved since 2019.

On a reported basis, sales were down by 4.9% to EUR36.5 billion

over the nine-month period and by 10.5% to EUR11.6 billion over the

third quarter, with negative currency effects of 2.2% over the

nine-month period and 3.9% in the third quarter, and negative Group

structure impacts of 2.7% over the nine-month period and 3.5% in

the third quarter.

Group structure impacts result from the ongoing optimization of

the Group's profile, both in terms of disposals - mainly in

distribution (UK, Poland and Denmark), glass processing activities,

Crystals & Detectors and ceramics for the steel industry - and

in terms of acquisitions, mainly in construction chemicals (GCP

Applied Technologies "GCP", Impac in Mexico, Matchem in Brazil and

Best Crete in Malaysia), exterior products in Canada (Kaycan and

Building Products of Canada) and insulation (U.P. Twiga in India).

The integration of recent acquisitions is progressing well, helping

us to achieve the expected synergies.

Segment performance (like-for-like sales)

Northern Europe: limited decline in sales thanks to better

resilience in renovation

Sales in the Northern Europe region were down by 5.0% over the

nine-month period and by 7.6% in the third quarter (including a

negative working day effect of around 2%) amid a continued slowdown

in new construction, while renovation (around 55% of sales) proved

more resilient. After several quarters in which volumes fell

sharply, the volume decline eased in the third quarter of 2023

compared to the second against a lower comparison basis. Prices

continued to be well managed against a higher comparison basis and

in a less inflationary environment.

In Nordic countries, the sharp drop in the new construction

market, especially in Sweden and Norway, was partly offset by our

strong exposure to the renovation market. The world's first

carbon-neutral (scope 1 and 2) plasterboard production at the

Group's Fredrikstad plant in Norway allowed Saint-Gobain to further

differentiate its offer. The UK progressed slightly and captured

market share thanks to its strong positioning in façade and

interior solutions, and also benefited from an optimized portfolio

following the divestment of its distribution businesses. Germany

continued to suffer in a difficult macroeconomic context which

weighed on new construction. After a sharp decline in volumes of

around 15% in the first half, Eastern Europe improved in the third

quarter, driven by its comprehensive range of interior and exterior

solutions.

Southern Europe - Middle East & Africa: slight growth in

sales supported by resilience in renovation

The Southern Europe - Middle East & Africa Region saw a

slight rise of 1.0% in sales over the nine-month period and a fall

of 2.7% in the third quarter (including a negative working day

effect of around 2%), thanks to good resilience in renovation

(almost 70% of sales), while the new construction market continued

to slow. Prices continued to be well managed against a higher

comparison basis and in a less inflationary environment.

Saint-Gobain continued to outperform its market in France,

thanks to its strong exposure to renovation, supported by a

favorable regulatory environment. The announcement by the French

government in October that it is to double its MaPrimeRénov'

household renovation stimulus package to EUR5 billion in 2024,

along with its objective of a three-fold increase in the number of

complete renovations to 200,000 per year from 2024, illustrate the

country's commitment to accelerate energy-efficiency renovation of

existing buildings and to reduce CO(2) emissions in the

construction sector. The rollout of Saint-Gobain's low-carbon, high

value-added solutions for its customers is also accelerating.

In Spain and Italy, sales were stable in broadly resilient

construction markets. Middle East and Africa posted strong growth,

especially in Egypt and Turkey.

Americas: slight sales growth driven by North America

The Americas delivered organic growth at 2.2% over the

nine-month period and at 0.1% in the third quarter, buoyed by the

volume increase in North America.

- North America progressed by 5.0% over the nine-month period

(up 11.0% as reported, with the integration of Kaycan, Building

Products of Canada and GCP's waterproofing membranes) and by 4.0%

in the third quarter. The price effect gradually lessened due to

the high comparison basis but rose sequentially thanks to the price

increase in the roofing business this summer. Volumes were stable

over the nine-month period but have returned to growth since the

second quarter. The Group saw further market share gains thanks to

its comprehensive, differentiated range of interior and exterior

light construction solutions. The new construction market has

stabilized since the start of the year. The integration of GCP and

Kaycan is progressing well, helping us to achieve the expected

synergies. We finalized the Building Products of Canada acquisition

more quickly than expected, as of September 1, 2023, allowing

Saint-Gobain to reinforce its unique industry-leading position in

Canada, with a comprehensive range of interior and exterior

solutions. In light of the favorable growth outlook, investments in

additional capacity are continuing in North America. In September

2023, the Group signed a new renewable electricity supply

agreement, its third since 2021: these three agreements will allow

it to cover more than 70% of its electricity requirements in North

America by the end of 2024 and to achieve a 70% reduction in its

scope 2 emissions (versus 2017).

- Latin America was down by 5.5% over the nine-month period and

by 10.7% in the third quarter. Brazil continues to weigh on sales

in a difficult macroeconomic environment, although the Central

Bank's interest rate cut as from early August, along with inflation

coming under control and the announcement of the "New Growth

Acceleration Program" - incorporating a large construction sector

component with financing for social housing - point to an

improvement as from the end of the year. Mexico continued to

benefit from the successful integration of Impac in construction

chemicals (waterproofing) and its comprehensive solutions offer.

The other countries in the Region were driven by an increase in

sales prices, an enriched offer and mix, and a geographic footprint

and product range extended by bolt-on acquisitions.

Asia-Pacific: good sales momentum

The Asia-Pacific Region reported organic growth at 5.1% over the

nine-month period and at 3.0% in the third quarter, with good

momentum in volumes and a high comparison basis for prices.

India posted another strong performance and captured market

share on the back of its global solutions-based approach, its

integrated and innovative range of solutions, the successful

integration of recent acquisitions in insulation (Rockwool India

Pvt Ltd. and U.P. Twiga) and the start-up of new capacity. Through

its sustainable construction solutions, Saint-Gobain continues to

play a pioneering role in promoting low-carbon buildings in the

country. China enjoyed further good growth momentum despite a more

difficult market, on the back of market share gains in light

construction and renovation with the successful start-up of new

capacity in the center of the country. South-East Asia stabilized

against a high comparison basis and in Malaysia benefited from an

enriched range of solutions, helping to strengthen its presence on

the light construction market.

High Performance Solutions (HPS): good resilience in sales

HPS sales progressed 3.5% over the nine-month period and fell

2.1% in the third quarter in slowing markets overall.

- Businesses serving global construction customers saw a 40%

rise in sales as reported, mainly due to the integration of GCP as

of October 1, 2022. The upbeat trends in Chryso and GCP sales

continued, spurred by the innovation drive for decarbonization in

the construction sector, notably with innovative solutions (for

example CO2ST(R) and EnviroMix(R) ) for developing cement and

concrete mixes with a much lighter carbon footprint. Chryso

reported further strong growth, up double-digit over the quarter,

led by emerging countries. GCP's margins rallied sharply in line

with its integration plan, thanks to the efficiency of the new

organization and to global supply chain and industrial

optimizations. By the end of the year, Chryso will finalize the

acquisition of Adfil (fibers for concrete reinforcement) helping to

reduce the concrete's carbon footprint. However, Adfors'

reinforcement solutions contracted amid the marked slowdown in new

construction in Europe.

- Mobility sales progressed, buoyed by both the continued

gradual catch-up in sales prices and by an outperformance linked to

its strong technological positioning on electric vehicles. The

growth dynamic slowed in Europe at the end of the period against a

higher comparison basis resulting from the sharp upturn in the same

prior-year period, but remained favorable in the Americas and

Asia.

- Businesses serving Industry held firm in slowing industrial

markets, mainly in Europe, thanks to sales prices and to demand for

cutting-edge materials and decarbonization technologies.

2023 outlook

In a difficult macroeconomic environment, Saint-Gobain continues

to demonstrate its resilience and its strong operating performance,

achieved year after year since 2019 thanks to its focused strategy

and its proactive commercial and industrial initiatives. The Group

continues to focus on developing sustainable and innovative

solutions with a positive impact, supported by strong innovation

and investments for growth.

2023 will therefore mark another successful year for

Saint-Gobain, with the continued implementation of its "Grow &

Impact" priorities.

The Group confirms its assumptions for its markets in 2023, with

contrasting trends: a marked decline in new construction in certain

regions but good resilience overall in renovation.

Amid a moderate market slowdown, Saint-Gobain is targeting for

full-year 2023 a new record operating margin, double-digit for the

third consecutive year.

Financial calendar

A conference call will be held at 6:30pm (Paris time) on October

26, 2023:

please dial +44 12 1281 8004 or +1 718 705 8796 or +33 1 70 91

87 04.

- Site visits for investors and analysts: November 13 and 14,

2023 in France (Paris region).

- 2023 results: February 29, 2024, after close of trading on the

Paris stock market.

Glossary :

- Indicators of organic growth and like-for-like changes in

sales/operating income reflect the Group's underlying performance

excluding the impact of:

-- changes in Group structure, by calculating indicators for the

year under review based on the scope of consolidation of the

previous year (Group structure impact);

-- changes in foreign exchange rates, by calculating indicators

for the year under review and those for the previous year based on

identical foreign exchange rates for the previous year (impact at

constant exchange rates);

-- changes in applicable accounting policies.

- Operating margin = operating income divided by sales.

- Share buyback: amount of shares bought back in 2023, as of

October 26, net of offsetting employee share creation

Important disclaimer - forward-looking statements:

This press release contains forward-looking statements with

respect to Saint-Gobain's financial condition, results, business,

strategy, plans and outlook. Forward-looking statements are

generally identified by the use of the words "expect",

"anticipate", "believe", "intend", "estimate", "plan" and similar

expressions. Although Saint-Gobain believes that the expectations

reflected in such forward-looking statements are based on

reasonable assumptions as at the time of publishing this document,

investors are cautioned that these statements are not guarantees of

its future performance. Actual results may differ materially from

the forward-looking statements as a result of a number of known and

unknown risks, uncertainties and other factors, many of which are

difficult to predict and are generally beyond Saint-Gobain's

control, including but not limited to the risks described in the

"Risk Factors" section of Saint-Gobain's 2022 Universal

Registration Document and the main risks and uncertainties

presented in the half-year 2023 financial report, both documents

being available on Saint-Gobain's website ( www.saint-gobain.com ).

Accordingly, readers of this document are cautioned against relying

on these forward-looking statements. These forward-looking

statements are made as of the date of this document. Saint-Gobain

disclaims any intention or obligation to complete, update or revise

these forward-looking statements, whether as a result of new

information, future events or otherwise, except as required by

applicable laws and regulations.

This press release does not constitute any offer to purchase or

exchange, nor any solicitation of an offer to sell or exchange

securities of Saint-Gobain.

For further information, please visit www.saint-gobain.com

Appendix 1: Sales by Segment

9m 2022 9m 2023 Change on Change on Like-for-like

sales sales actual a comparable change

(in (in structure structure

EURm) EURm) basis basis

-------- -------- ----------- -------------- --------------

Northern Europe 12,556 9,696 -22.8% -8.9% -5.0%

Southern Europe - ME

& Africa 11,317 11,337 +0.2% +0.1% +1.0%

Americas 6,791 7,264 +7.0% +1.0% +2.2%

Asia-Pacific 1,601 1,587 -0.9% -2.0% +5.1%

High Performance Solutions 7,085 7,624 +7.6% +2.1% +3.5%

Internal sales and

misc -948 -988 --- --- ---

Group Total 38,402 36,520 -4.9% -2.2% +0.0%

----------- --------------

Q3 2022 Q3 2023 Change on Change on Like-for-like

sales sales actual a comparable change

(in (in structure structure

EURm) EURm) basis basis

-------- -------- ----------- -------------- --------------

Northern Europe 4,157 3,022 -27.3% -12.1% -7.6%

Southern Europe - ME

& Africa 3,491 3,361 -3.7% -3.8% -2.7%

Americas 2,514 2,480 -1.4% -4.9% +0.1%

Asia-Pacific 588 551 -6.3% -7.4% +3.0%

High Performance Solutions 2,485 2,461 -1.0% -5.7% -2.1%

Internal sales and

misc -314 -309 --- --- ---

Group Total 12,921 11,566 -10.5% -7.0% -3.1%

----------- --------------

Appendix 2: Contribution of prices and volumes to organic sales

growth by Segment

9-month 2023 Like-for-like Prices Volumes

change

Northern Europe -5.0% +6.4% -11.4%

Southern Europe - ME

& Africa +1.0% +7.7% -6.7%

Americas +2.2% +4.5% -2.3%

Asia-Pacific +5.1% +0.5% +4.6%

High Performance Solutions +3.5% +5.2% -1.7%

-------------- ------- --------

Group Total +0.0% +5.9% -5.9%

-------------- ------- --------

Q3 2023 Like-for-like Prices Volumes

change

Northern Europe -7.6% +1.5% -9.1%

Southern Europe - ME

& Africa -2.7% +3.6% -6.3%

Americas +0.1% +0.1% +0.0%

Asia-Pacific +3.0% -3.5% +6.5%

High Performance Solutions -2.1% +3.3% -5.4%

-------------- ------- --------

Group Total -3.1% +1.9% -5.0%

-------------- ------- --------

Appendix 3: Breakdown of organic sales growth and external

sales

9-month 2023, in % of Like-for-like % Group

total change

Northern Europe -5.0% 25.5%

Nordics -5.1% 11.7%

United Kingdom - Ireland +1.3% 4.7%

Germany - Austria -12.5% 2.9%

Southern Europe - ME

& Africa +1.0% 30.3%

France +0.2% 23.6%

Spain - Italy +0.8% 3.7%

Americas +2.2% 19.5%

North America +5.0% 14.5%

Latin America -5.5% 5.0%

Asia-Pacific +5.1% 4.1%

High Performance Solutions +3.5% 20.6%

Construction and industry -3.0% 13.0%

Mobility +15.2% 7.6%

Group Total +0.0% 100.0%

Q3 2023, in % of total Like-for-like % Group

change

Northern Europe -7.6% 25.2%

Nordics -7.7% 11.6%

United Kingdom - Ireland -2.4% 4.0%

Germany - Austria -18.7% 3.0%

Southern Europe - ME

& Africa -2.7% 28.3%

France -3.5% 21.8%

Spain - Italy -6.3% 3.6%

Americas +0.1% 21.0%

North America +4.0% 15.6%

Latin America -10.7% 5.4%

Asia-Pacific +3.0% 4.5%

High Performance Solutions -2.1% 21.0%

Construction and industry -7.0% 13.0%

Mobility +6.5% 8.0%

Group Total -3.1% 100.0%

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

QRTPPGPUUUPWGMQ

(END) Dow Jones Newswires

October 26, 2023 13:10 ET (17:10 GMT)

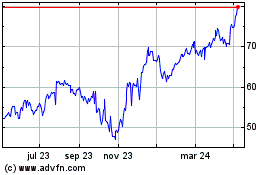

Compagnie De Saint-gobain (LSE:COD)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Compagnie De Saint-gobain (LSE:COD)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024