TIDMCTO

RNS Number : 1171F

TClarke PLC

06 July 2023

THIS ANNOUNCEMENT, AND THE INFORMATION CONTAINED IN IT, IS

RESTRICTED AND IS NOT FOR RELEASE, PUBLICATION, DISTRIBUTION OR

FORWARDING, IN WHOLE OR IN PART, DIRECTLY OR INDIRECTLY, IN OR INTO

THE UNITED STATES, AUSTRALIA, CANADA, THE REPUBLIC OF SOUTH AFRICA,

JAPAN OR ANY OTHER JURISDICTION IN WHICH SUCH PUBLICATION, RELEASE

OR DISTRIBUTION WOULD BE UNLAWFUL.

FURTHER, THIS ANNOUNCEMENT IS FOR INFORMATION PURPOSES ONLY AND

IS NOT AN OFFER OF SECURITIES IN ANY JURISDICTION.

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF ARTICLE 7 OF EU REGULATION 596/2014 (AS AMED) (WHICH FORMS PART

OF DOMESTIC UK LAW PURSUANT TO THE EUROPEAN UNION (WITHDRAWAL) ACT

2018 (AS AMED)). UPON THE PUBLICATION OF THIS ANNOUNCEMENT VIA A

REGULATORY INFORMATION SERVICE, THIS INSIDE INFORMATION IS NOW

CONSIDERED TO BE IN THE PUBLIC DOMAIN.

6 July 2023

TClarke plc

Oversubscribed Placing to raise GBP10.7 million

TClarke plc ("TClarke", the "Group" or the "Company"), the

Building Services Group, is pleased to announce that it has

conditionally raised gross proceeds of GBP10.7 million by way of an

oversubscribed placing of new Ordinary Shares in the Company by

Cenkos Securities plc ("Cenkos") to certain institutional and other

investors (the "Placing ") in order to fund significant further

expansion beyond 2023.

Highlights

-- Oversubscribed Placing to raise gross proceeds of GBP10.7

million at the Placing Price , subject to TClarke shareholder

approval.

-- The issue price of 122 pence per Ordinary Share (the "Placing

Price") represents a discount of approximately 14% to the closing

mid-market price per existing TClarke ordinary share of 141.5 pence

on 5 July 2023.

-- Board remains highly con dent that the Group will

successfully deliver its growth strategy such that the Group's

revenues will exceed GBP500m for the first time in the current

financial year, in doing so achieving the three year revenue growth

strategy set out by the Board in March 2021.

-- With the Group's forward order book now standing at GBP781m

(2022: GBP586m), the net proceeds of the Placing will further

strengthen the Group's balance sheet and will provide additional

resources with which to capture and deliver additional identified

short to medium term attractive contract opportunities in the

London business - in doing so driving further growth and margin

expansion.

-- The Directors anticipate significant earnings accretion

deployment of the net Placing proceeds into the delivery of

anticipated near term contract wins.

-- The Company's largest shareholder, Regent Gas Holdings Ltd,

has subscribed for 4,000,000 Placing Shares at the Placing

Price.

-- Cenkos is acting as Sole Broker in connection with the Placing.

The Placing is conditional, inter alia, upon approval by

Shareholders of the Resolutions and the placing agreement between

Cenkos and the Company becoming unconditional and not being

terminated. A circular, which will contain the notice of a general

meeting of the Company to put the necessary Resolutions to

Shareholders (the "General Meeting") is being posted to

Shareholders today (the "Circular") and will also be available on

the Company's website www.tclarke.co.uk . The same definitions

apply throughout this announcement as are applied in the

Circular.

The General Meeting will be held at 30 St. Mary Axe, London EC3A

8BF on 24 July 2023 at 9.00 a.m.

Shareholders must submit their votes by proxy no later than 9.00

a.m. on 20 July 2023.

Current Trading, Outlook and Use of Placing Proceeds

The Company announced on 10 May 2023 that trading in the early

months of 2023 financial had been strong. Trading since that

announcement has continued to be strong and the Board remains

highly con dent that the Group will successfully deliver its growth

strategy such that the Group's revenues will exceed GBP500m for the

first time in the current financial year, in doing so achieving the

three year revenue growth strategy set out by the Board in March

2021. The Group is GBP4.5m net cash positive as at 30 June

2023.

TClarke's forward order book has been replenished and so far

during 2023 it has been strengthened significantly. The forward

order book now stands at GBP 781m (2022: GBP 586m). TClarke is

well-positioned to manage additional revenues in our various market

sectors, having proactively invested in resources and capacity to

support the Group's growth ambitions.

Whilst maintaining the Group's strict and selective approach to

tendering, the Group is experiencing increased visibility in

revenues outside of London and an increasing number of attractive

contract opportunities in the London region. The Board is therefore

encouraged by the strength of the Group's position in the

market.

The net proceeds of the Placing will further strengthen the

Group's balance sheet and will provide additional resources with

which to capture and deliver identified short to medium term

attractive contract opportunities in the London region - in doing

so driving further growth and margin expansion.

TClarke will be reporting its half year results for the six

months ended 30 June 2023 on 13 July 2023.

As a result, the Board considers the Placing to be in the best

interests of the Company and the Group's Shareholders as a

whole.

Further details on the Placing are set out below.

Admission, Settlement, Dealings and Total Voting Rights

The Placing Shares will, when issued, be credited as fully paid

and rank pari passu in all respects with each other and with the

Existing Ordinary Shares, including, without limitation, the right

to receive all dividends and other distributions declared, made or

paid after the date of issue.

Applications have been made to the Financial Conduct Authority

(the "FCA") for admission of the Placing Shares to the premium

listing segment of the Official List maintained by the FCA and to

London Stock Exchange plc ("LSE") for admission of the Placing

Shares to trading on LSE's main market for listed securities

("Admission"). Admission and settlement of the Placing Shares is

expected to take place on or around 8.00 a.m. on 25 July 2023.

Following Admission, the Company will have a total of 52,850,780

Ordinary Shares in issue. There are no Ordinary Shares held in

treasury and therefore the total number of voting rights in the

Company is expected to be 52,850,780. This is the figure that may

be used by Shareholders in the Company as the denominator for the

calculations by which they will determine if they are required to

notify their interest in, or change to their interest in, the share

capital of the Company under the Financial Conduct Authority's

Disclosure Guidance and Transparency Rules.

For further information, please contact:

+44 (0) 20 7997

TClarke PLC 7400

Mark Lawrence, Chief Executive Officer http://www.tclarke.co.uk

Trevor Mitchell, Finance Director

+44 (0) 20 7397

Cenkos Securities plc (Sole Broker) 8900

Ben Jeynes / Max Gould / Hamish Waller (Corporate

Finance)

Dale Bellis / Jasper Berry (Sales)

+44 (0) 20 3735

RMS Partners 6551

Simon Courtenay

Expected Timetable of Principal Events

Announcement of the Placing 7.00 a.m. on 6 July 2023

Publication of the Circular 6 July 2023

------------------------------------

Latest time and date for receipt 9.00 a.m. on 20 July 2023

of Forms of Proxy for the

General Meeting

------------------------------------

General Meeting 9.00 a.m. on 24 July 2023

------------------------------------

Admission and commencement 8.00 a.m. on 25 July 2023

of the dealings in the Placing

Shares

------------------------------------

Expected date for CREST accounts As soon as possible after Admission

to be credited in respect on 25 July 2023

of the Placing Shares

------------------------------------

Recommendation and voting intentions

The Directors believe the Placing and the passing of the

Resolutions to be in the best interests of the Company and its

Shareholders, taken as a whole. Accordingly, the Directors

unanimously recommend that Shareholders vote in favour of the

Resolutions as all of the Directors intend so to do in respect of

their beneficial shareholdings amounting to an aggregate of

1,109,104 Existing Ordinary Shares , representing approximately

2.5% of the Company's Existing Ordinary Shares.

In addition, Regent Gas Holdings Ltd has confirmed to the

Company that it intends to vote in favour of all Resolutions, with

the exception of Resolution 1 under which they are not entitled to

vote as per the Listing Rules, in respect of its beneficial

interest in 7,366,407 Existing Ordinary Shares, representing

approximately 16.7% of the Company's Existing Ordinary Shares.

If either of the Resolutions are not passed at the General

meeting, the Placing will not proceed.

Related Party Transactions

Regent Gas Holdings Ltd is a related party of the Company for

the purposes of the Listing Rules as it is a substantial

shareholder of the Company.

Pursuant to, and on the terms of, the Placing, Regent Gas

Holdings Ltd has subscribed for 4,000,000 Placing Shares at the

Placing Price, raising gross proceeds of approximately GBP4.9

million.

The above transaction is a related party transaction requiring

shareholder approval under LR 11.1.7. Relevant details will be set

out in the Circular to be sent to shareholders in connection with

the Placing and shareholder approval for such participation will be

sought at the general meeting of the Company to be held to approve

the issue of the Placing Shares.

Details of the Placing and the Placing Agreement

Under the terms of a placing agreement entered into on 6 July

2023, between Cenkos and the Company (the "Placing Agreement"),

Cenkos has conditionally agreed to use its reasonable endeavours to

procure subscribers for the Placing Shares to raise GBP10.7

million.

Cenkos has conditionally placed the Placing Shares with certain

institutional and other investors at the Placing Price. The Placing

is not being underwritten by Cenkos.

The Placing has raised net proceeds of GBP10.1 million through

the Placing of the Placing Shares at the Placing Price. The Placing

Price represents a discount of approximately 14% to the closing

mid-market price per existing TClarke ordinary share of 141.5 pence

on 5 July 2023, being the latest practicable date prior to the date

of this announcement.

The Placing Shares will represent approximately 16.6% of the

Company's enlarged issued ordinary share capital on Admission.

The Placing is conditional on, inter alia:

-- the passing of the Resolutions at the General Meeting;

-- the Placing Agreement not having been terminated in

accordance with its terms prior to Admission of the Placing

Shares;

-- Admission becoming effective by no later than 8.00 a.m. on 25

July 2023 or such later time and/or date as the Company and Cenkos

may agree (being no later than 8.00 a.m. on 7 August 2023).

The Placing Agreement contains customary warranties given by the

Company to Cenkos as to matters in relation to, inter alia, the

accuracy of information in this Announcement and other matters

relating to the Company and its business. In addition, the Company

has provided a customary indemnity to Cenkos in respect of

liabilities arising out of or in connection with the Placing.

Cenkos is entitled to terminate the Placing Agreement in certain

circumstances prior to Admission including where any of the

warranties are found not to be true or are materially inaccurate or

are misleading in any respect, the failure of the Company to comply

in any material respect with any of its obligations under the

Placing Agreement, the occurrence of certain force majeure events

or a material adverse change in the business of the Group or in

financial or trading position or prospects of the Group or the

Company.

General Meeting

The Board is seeking the approval of Shareholders at the General

Meeting to allot the Placing Shares. The Placing is conditional,

inter alia, on the passing of the Resolutions by Shareholders at

the General Meeting.

Important Notices

The distribution of this Announcement and any other

documentation associated with the Placing into jurisdictions other

than the United Kingdom may be restricted by law. Persons into

whose possession these documents come should inform themselves

about and observe any such restrictions. Any failure to comply with

these restrictions may constitute a violation of the securities

laws or regulations of any such jurisdiction. In particular, such

documents should not be distributed, forwarded to or transmitted,

directly or indirectly, in whole or in part, in, into or from the

United States, Australia, Canada, Japan or the Republic of South

Africa or any other jurisdiction where to do so may constitute a

violation of the securities laws or regulations of any such

jurisdiction (each a "Restricted Jurisdiction").

This Announcement is not an offer of securities for sale into

the United States. The Placing Shares have not been and will not be

registered under the US Securities Act 1933 as amended (the "US

Securities Act") or with any securities regulatory authority of any

state or other jurisdiction of the United States and, accordingly,

may not be offered, sold, resold, taken up, transferred, delivered

or distributed, directly or indirectly, within the United States

except pursuant to an applicable exemption from, or in a

transaction not subject to, the registration requirements of the US

Securities Act and in compliance with any applicable securities

laws of any state or other jurisdiction of the United States. There

will be no public offer of the Placing Shares in the United

States.

The Placing Shares are being offered and sold only in "offshore

transactions" outside the US in reliance on, and in accordance

with, Regulation S under the US Securities Act. The Placing Shares

have not been approved or disapproved by the US Securities and

Exchange Commission, any state securities commission in the US or

any other US regulatory authority, nor have any of the foregoing

authorities passed upon or endorsed the merits of the offering of

the Placing Shares or the accuracy or adequacy of this

Announcement. Any representation to the contrary is a criminal

offence in the US. In addition, offers, sales or transfers of the

securities in or into the US for a period of time following

completion of the Placing by a person (whether or not participating

in the Placing) may violate the registration requirement of the

Securities Act.

The Placing Shares have not been and will not be registered

under the relevant laws of any state, province or territory of any

Restricted Jurisdiction and may not be offered, sold, resold, taken

up, transferred, delivered or distributed, directly or indirectly,

within any Restricted Jurisdiction except pursuant to an applicable

exemption from registration requirements. There will be no public

offer of Placing Shares.

This Announcement is for information purposes only and does not

constitute or form part of any offer to issue or sell, or the

solicitation of an offer to acquire, purchase or subscribe for, any

securities in any jurisdiction and should not be relied upon in

connection with any decision to subscribe for or acquire any of the

Placing Shares (as the case may be). In particular, this

Announcement does not constitute or form part of any offer to issue

or sell, or the solicitation of an offer to acquire, purchase or

subscribe for, any securities in the United States.

This Announcement has been issued by, and is the sole

responsibility of, the Company. No person has been authorised to

give any information or to make any representations other than

those contained in this Announcement and, if given or made, such

information or representations must not be relied on as having been

authorised by the Company or Cenkos. Subject to the Listing Rules

of the FCA, the issue of this Announcement shall not, in any

circumstances, create any implication that there has been no change

in the affairs of the Company since the date of this Announcement

or that the information contained in it is correct at any

subsequent date.

Cenkos, which is authorised and regulated in the United Kingdom

by the Financial Conduct Authority, is acting exclusively for the

Company and no one else in connection with the Placing and will not

regard any other person (whether or not a recipient of this

Announcement) as a client in relation to the Placing and will not

be responsible to anyone other than the Company for providing the

protections afforded to its clients or for providing advice in

relation to the Placing or any matters referred to in this

Announcement.

Apart from the responsibilities and liabilities, if any, which

may be imposed on Cenkos by the Financial Services and Markets Act

2000 or the regulatory regime established thereunder, Cenkos does

not accept any responsibility whatsoever for the contents of this

Announcement, and makes no representation or warranty, express or

implied, for the contents of this Announcement, including its

accuracy, completeness or verification, or for any other statement

made or purported to be made by it, or on its behalf, in connection

with the Company or the Placing Shares or the Placing, and nothing

in this Announcement is or shall be relied upon as, a promise or

representation in this respect whether as to the past or future.

Cenkos accordingly disclaims to the fullest extent permitted by law

all and any liability whether arising in tort, contract or

otherwise (save as referred to above) which it might otherwise have

in respect of this Announcement or any such statement.

No statement in this Announcement is intended to be a profit

forecast or profit estimate for any period and no statement in this

Announcement should be interpreted to mean that earnings or

earnings per share of the Company for the current or future

financial years would necessarily match or exceed the historical

published earnings or earnings per share of the Company.

This Announcement may include statements that are, or may be

deemed to be, "forward-looking statements". These forward-looking

statements can be identified by the use of forward-looking

terminology, including the terms "believes", "estimates", "plans",

"projects", "anticipates", "expects", "intends", "may", "will", or

"should" or, in each case, their negative or other variations or

comparable terminology. These forward-looking statements include

matters that are not historical facts. They appear in a number of

places throughout this Announcement and include statements

regarding the Directors' current intentions, beliefs or

expectations concerning, among other things, the Company's results

of operations, financial condition, liquidity, prospects, growth,

strategies and the Company's markets. By their nature,

forward-looking statements involve risk and uncertainty because

they relate to future events and circumstances. Actual results and

developments could differ materially from those expressed or

implied by the forward-looking statements. Forward-looking

statements may and often do differ materially from actual results.

Any forward-looking statements in this Announcement are based on

certain factors and assumptions,

including the Directors' current view with respect to future

events and are subject to risks relating to future events and other

risks, uncertainties and assumptions relating to the Company's

operations, results of operations, growth strategy and liquidity.

Whilst the Directors consider these assumptions to be reasonable

based upon information currently available, they may prove to be

incorrect. Save as required by applicable law or regulation, the

Company undertakes no obligation to release publicly the results of

any revisions to any forward-looking statements in this

Announcement that may occur due to any change in the Directors'

expectations or to reflect events or circumstances after the date

of this Announcement.

Information to Distributors

UK product governance

Solely for the purposes of the product governance requirements

contained within of Chapter 3 of the FCA Handbook Production

Intervention and Product Governance Sourcebook (the "UK Product

Governance Requirements"), and disclaiming all and any liability,

whether arising in tort, contract or otherwise, which any

"manufacturer" (for the purposes of the UK Product Governance

Requirements) may otherwise have with respect thereto, the Placing

Shares have been subject to a product approval process, which has

determined that such securities are: (i) compatible with an end

target market of investors who meet the criteria of retail

investors and investors who meet the criteria of professional

clients and eligible counterparties, each as defined in paragraph 3

of the FCA Handbook Conduct of Business Sourcebook; and (ii)

eligible for distribution through all distribution channels (the

"Target Market Assessment"). Notwithstanding the Target Market

Assessment, distributors (for the purposes of UK Product Governance

Requirements) should note that: (a) the price of the Placing Shares

may decline and investors could lose all or part of their

investment; (b) the Placing Shares offer no guaranteed income and

no capital protection; and (c) an investment in the Placing Shares

is compatible only with investors who do not need a guaranteed

income or capital protection, who (either alone or in conjunction

with an appropriate financial or other adviser) are capable of

evaluating the merits and risks of such an investment and who have

sufficient resources to be able to bear any losses that may result

therefrom. The Target Market Assessment is without prejudice to the

requirements of any contractual, legal or regulatory selling

restrictions in relation to the Placing. Furthermore, it is noted

that, notwithstanding the Target Market Assessment, Cenkos will

only procure investors who meet the criteria of professional

clients and eligible counterparties.

For the avoidance of doubt, the Target Market Assessment does

not constitute: (a) an assessment of suitability or appropriateness

for the purposes of Chapter 9A or 10A respectively of the FCA

Handbook Conduct of Business Sourcebook; or (b) a recommendation to

any investor or group of investors to invest in, or purchase, or

take any other action whatsoever with respect to the Placing

Shares.

Each distributor is responsible for undertaking its own target

market assessment in respect of the Placing Shares and determining

appropriate distribution channels.

Neither the content of the Company's website nor any website

accessible by hyperlinks to the Company's website is incorporated

in, or forms part of, this Announcement.

Certain figures contained in this Announcement, including

financial information, have been subject to rounding adjustments.

Accordingly, in certain instances, the sum or percentage change of

the numbers contained in this Announcement may not conform exactly

with the total figure given.

All references to time in this Announcement are to London time,

unless otherwise stated.

The Circular and the Notice of General Meeting have been

submitted to the Financial Conduct Authority and will shortly be

available for inspection via the National Storage Mechanism at

https://data.fca.org.uk/#/nsm/nationalstoragemechanism and will be

sent to those shareholders who have elected to receive paper

communications.

The Circular and the Notice of General Meeting will also be

available to view on the Company's website at www.tclarke.co.uk

.

The person responsible for arranging the release of this

announcement on behalf of the Company is Trevor Mitchell, Finance

Director

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IOEVELFBXDLZBBD

(END) Dow Jones Newswires

July 06, 2023 02:00 ET (06:00 GMT)

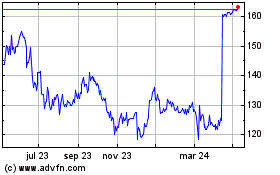

Tclarke (LSE:CTO)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Tclarke (LSE:CTO)

Gráfica de Acción Histórica

De May 2023 a May 2024