TIDMCTPE

RNS Number : 1305K

CT Private Equity Trust PLC

23 August 2023

To: Stock Exchange For immediate release:

23 August 2023

CT Private Equity Trust PLC

LEI: 2138009FW98WZFCGRN66

Unaudited results for the half year ended 30 June 2023

Financial Highlights

-- Share price total return for the six-month period of 15.3%.

-- During the six-month period the portfolio valuation rose 0.7%

prior to exchange rate movements.

-- NAV of 680.75p per Ordinary Share as at 30 June 2023

reflecting a total return for the six-month period of -2.3%.

-- Total quarterly dividends of 13.96p per Ordinary Share year

to date representing an increase of 12.9% from the same period last

year.

-- Quarterly dividend of 6.95p paid on 31 July 2023

-- Quarterly dividend of 7.01p to be paid on 31 October 2023

-- Dividend yield of 5.8% based on the period end share price (1).

-- As at 30 June 2023 net debt was GBP55.2 million equivalent to a gearing level of 10.0%.

(1) Calculated as dividends of 6.62p paid on 31 January 2023,

6.79p paid on 28 April 2023, 6.95p paid on 31 July 2023 and 7.01p

payable on 31 October 2023, divided by the Company's share price of

473.00p as at 30 June 2023.

Chairman's Statement

Introduction

This report is for the six-month period ended 30 June 2023. At

the period end the Net Asset Value ("NAV") of CT Private Equity

Trust PLC ("the Company") was GBP495.9 million giving a NAV per

share of 680.75p. Taking account of dividends paid the NAV total

return for the six-month period was -2.3%. With the share price

discount having decreased from 40.5% at 31 December 2022 to 30.5%

at 30 June 2023, the share price total return for the period was an

impressive 15.3%. These compare to a return of 2.6% for the FTSE

All-Share Index for the same period.

At the midpoint in the year the Company's NAV is down slightly.

Most of this movement is attributable to currency movements with

sterling having been relatively strong against both the euro and

the dollar. This reduces, in sterling terms, the value of the

non-UK investments which is approximately half of our portfolio.

The underlying performance of the portfolio is broadly flat which

given the substantial economic challenges that are present

internationally, demonstrates an innate resilience in the companies

comprising your portfolio. Our best protection and defence against

economic headwinds is through maintaining and renewing a

well-diversified portfolio of companies with business models based

on medium and longer term growth in demand for their products or

services. This coupled with buying price discipline on the part of

our managers and their investment partners provides the basis for

steady growth in value over the long term.

The specific pressures brought about by higher inflation and

interest rates and the consequent impacts on demand affect our

portfolio companies in different ways. Those with direct exposure

to raw material cost increases or to consumer demand are more

quickly and immediately impacted. Others are more dependent on

fluctuations in business confidence and the associated propensity

for senior managers to make investments decisions. The value of

private companies is linked to these factors and is influenced by

the availability and cost of capital focussed on the sector.

Changes can take some time to be reflected in valuations with a

resulting general smoothing effect. Longer term factors also have a

large part to play. Private Equity increasingly finds its way into

long term investment portfolios as the appreciation of this mode of

investment becomes more widespread by many types of investment

decision-makers. When asked, most categories of investors express a

desire to have a higher proportion of their portfolios in private

equity. Your Company provides an excellent conduit to high quality

private equity investments which is accessible to all types of

investors. The recent 'Mansion House Reforms' announced by the UK

Chancellor of the Exchequer are broadly in accord with the

objective of increasing investment in private equity.

Dividends

In accordance with the Company's stated dividend policy, the

Board declares a quarterly dividend of 7.01p per ordinary share,

payable on 31 October 2023 to Shareholders on the register on 6

October 2023 with an ex-dividend date of 5 October 2023. Together

with the last three dividends paid this represents a dividend yield

of 5.8% based on the period end share price.

Financing

The Company has a GBP95 million multi-currency revolving credit

facility and a term loan of EUR25 million. At 30 June 2023 exchange

rates, these borrowing facilities, which will mature in June 2024,

result in a total borrowing capacity of approximately GBP116.5

million.

As at 30 June 2023, the Company had cash of GBP13.3 million.

With borrowings of GBP68.5 million from the facilities, net debt

was GBP55.2 million, equivalent to a gearing level of 10.0% (31

December 2022: 0.7%). The total of outstanding undrawn commitments

at 30 June 2023 was GBP209 million and, of this, approximately

GBP25 million is to funds where the investment period has

expired.

Outlook

The broad range of investments provides exposure to many diverse

business and economic trends and as previously noted is a source of

resilience and protection against external pressures. The progress

of our underlying companies so far this year against their original

business plans and investment theses is encouraging and provides

scope for positive developments in the second half of 2023.

Richard Gray

Chairman

Manager's Review

Introduction

The first half of the year has seen excellent dealflow for us

and some evidence of a slowdown in dealmaking activity generally.

The companies in the portfolio are essentially in good shape with

the macroeconomic pressures being managed, on the whole,

successfully. Realisations continue to be made at good prices, but

the volumes are down from the very strong previous two years. The

maturing element of the portfolio remains substantial and this

should provide realisations in the second half.

New Investments

Eight new fund commitments were made during the first half. Most

of these have been previously highlighted. Collectively they cover

the mid-market internationally and will lead to strong exposure to

innovative products and technologies, for example in software and

in energy transition as well as to other niche businesses in the

broader consumer and industrial sectors. In each case the funds are

managed by highly skilled and motivated managers whom we know

well.

GBP8 million has been committed to Kester Capital III, a UK

focussed lower mid-market buyout manager whom we have backed before

in two previous funds and in a number of co-investments.

$8 million has been committed to MidOcean VI, a US mid-market

buyout fund whom we have backed through one of our other funds

before.

GBP8 million has been committed to Axiom I, a debut mid-market

enterprise software fund, where we know the principals from earlier

in their careers.

EUR5 million has been committed to Magnesium Capital I, a

European energy transition fund, led by an emerging manager with

which we have co-invested before.

EUR5 million has been committed to Hg Mercury 4, a lower

mid-market software and services fund investing in Europe and North

America, following on from our commitment to another fund series,

Hg Saturn 3 which was committed to last year.

EUR8 million has been committed to Wisequity VI, the latest fund

by one of the leading Italian mid-market buyout managers.

EUR10 million has been committed to Montefiore Expansion Fund

following our previous commitments to Montefiore Fund IV and Fund

V. The manager, Montefiore, has elected to split its fund series in

two and the Company has elected to invest in the lower mid-market

fund, which will make investments in companies with enterprise

values of between EUR25 million and EUR100 million in the service

sector mainly in France.

EUR2.7 million has been committed to KKA Fund II, the lower

mid-market German emerging manager.

Our dealflow of co-investments remains strong and during the

first half we completed seven new co-investments. These also give

an international spread across a diverse range of niche

businesses.

We have invested GBP2.5 million in the MVM-led life sciences

company GT Medical. This company has developed an innovative brain

cancer treatment consisting of bioresorbable tiles with embedded

radioactive caesium seeds. The tiles are placed next to the tumour

cavity and are eventually fully absorbed by the body. Clinical

trials are ongoing to prove the efficacy of this treatment.

We have also invested GBP4.1 million (80% of our expected

investment in the business) in LeadVenture, a leading SaaS provider

of digital retailing, digital storefronts, e-commerce, proprietary

data and vertical ERP dealer management software (DMS). The

company's customers are in the non-auto sector such as RVs,

agriculture machinery and transportation. The lead for the

investment is San Francisco based True Wind Capital.

GBP2.7 million (c.50% of our expected investment in the

business) has been invested in Cardo, a Wales based provider of

repair, maintenance and upgrading services mainly to the social

housing sector. Much of the impetus comes from the transition of

this housing stock to become more energy efficient and sustainable.

The deal is led by Buckthorn whom we have co-invested with several

times and who specialise in energy transition investments.

GBP2.7 million (c.80% of our total GBP3.3 million commitment)

has been invested alongside August Equity in StarTraq, a provider

of software to police forces and local authorities allowing them to

efficiently issue and process speeding tickets. The technology has

an increasing range of applications with, for example, the

capability of capturing accurately on camera drivers who are using

handheld mobile phones whilst driving. The company also has a large

untapped market opportunity internationally where it already has a

small foothold.

In addition, we have also invested GBP1.2 million (c.75% of a

total GBP1.7 million commitment) alongside August Equity in One

Touch, a market leading software provider serving the social care

market. This software allows carers to meet client requirements

more efficiently and the care companies themselves to manage their

staff productively in what is a closely regulated sector.

GBP7.8 million has been invested in the Volpi led co-investment

in Cyclomedia (a total EUR10 million commitment). Volpi has been

invested in this Netherlands headquartered provider of intelligent

street-level geospatial data and information solutions since 2018

and we are effectively rolling over and slightly increasing our

exposure to this high performing asset. Cyclomedia's client base

includes local municipalities who require comprehensive, accessible

and digitally formatted information on properties within their

areas, mainly for the purposes of local taxation and rates. From

its Northern European base, the company has begun a process of

expansion internationally and Volpi believe that there is

considerable further growth to be achieved.

GBP6.5 million (100% of $8.0 million commitment) has been

invested in Asbury Carbons, a US based producer of milled graphite

products with a diverse range of industrial applications. The

investment is led by New York based Mill Rock Capital and Asbury is

an intriguing opportunity to revitalise a long-established company

with operational improvements and product extensions.

In addition to these new commitments and co-investments our

funds portfolio continues to make new investments according to

their respective strategies and geographic focus.

Some of the more notable ones are as follows.

In the UK SEP VI called GBP1.1 million for its first two

investments; Cresset (drug discovery software used in the design of

small molecules) and Pelion (an internet of things connectivity

business). Kester Capital has called GBP0.6 million for MAP Patient

(leader in market access consulting services to the pharmaceutical

and biotech sectors which accelerates patient access to

ground-breaking medicines, devices and diagnostics). In different

sectors, Piper Equity has called GBP0.6 million for jewellery

company Monica Vinader as it continues with this investment from

one fund to the next and GBP0.5 million for tourist excursion

company Rabbie's Trail Burners. Inflexion VI called GBP0.7 million

for a follow-on investment in K2 the IT recruitment specialist

which is acquiring a US company which focuses on enterprise

integrations. Our new investment in Magnesium Capital I (UK based

manager, pan-European fund) called GBP2.0 million immediately,

investing GBP1.7 million in three investments having been

warehoused by the manager. Apposite Healthcare III called GBP1.2

million for various follow-ons, the largest being GBP0.8 million in

Riverdale, the UK dentistry provider. Kester II called GBP0.9

million for DC Byte, the market intelligence and analytics provider

for data centre operators and developers.

In Germany, DBAG VIII called GBP0.5 million for Metalworks which

designs and manufactures high quality fashion accessories such as

belt buckles, fasteners and studs for luxury fashion brands. In

Central Europe, Avallon III called GBP0.6 million for TES the Czech

based electro-mechanical engineering company which was acquired

from fund investment ARX.

There was notable activity in the Nordic region with Summa III

calling GBP0.7 million in total, with GBP0.5 million for Velsera (a

combination of three health tech companies focussed on healthcare

data analytics). Procuritas VII called GBP1.9 million for Werksta,

We Select and Nordic Biomarker. Werksta is an automotive repair

shop chain which the Company previously had exposure to in

Procuritas Fund V. We Select is a digital recruitment firm which

integrates social media to its platform and Nordic Biomarker

produces advanced reagents for IVD coagulation analysers which

tests blood for abnormalities. Verdane XI called GBP0.4 million for

Apoteka, a fulfilment provider to the largest online pharmacy in

Denmark and Fashion Cloud, a B2B software company for the apparel

and footwear industry.

In the US, Level 5 Capital Partners II drew GBP2.6 million for

four investments, KidStrong, Restore, GoDog and 2U Laundry. The

fund had invested in these following the first close and we

invested via the second close, giving us excellent visibility into

the performance of the assets thus far. Level 5 concentrates on

consumer-focussed franchise growth investments and is based in

Atlanta, Georgia. UK based manager HG, called GBP0.9 million in HG

Saturn 3, for investments in IFS / Workwave, the US ERP and payroll

group.

The total of new investments for both funds and co-investments

in the first half is GBP74.6 million which is considerably ahead of

last year where at the same point we were at GBP37.3 million. It is

likely that the amount deployed for 2023 will exceed the total for

2022 (GBP88 million) but it will probably be in line with the

overall increase in the size of the portfolio.

Realisations

There have been many realisations across the portfolio in the

first half. The staged sell down of our remaining positions in the

now listed Ashtead Technology have generated GBP7.4 million. There

is a further GBP5 million still to be realised as market conditions

allow. So far the investment has achieved more than 2.5x cost and

an IRR of 19%. Kester Capital II returned GBP2.7 million (4.8x, 60%

IRR) from the sale of Vixio, the leader in the provision of

regulator and compliance intelligence to the payments market. Our

longstanding partner Inflexion have had a series of exits across

their range of funds. GBP1.6 million was returned from travel

company Scott Dunn where the holding period coincided with a crisis

for the industry due to the pandemic (1.4x, 4% IRR). GBP1.1 million

came in from the sale of software services company Mobica where

Inflexion's Partnership Capital Fund has made an excellent return

(5.6x, 29% IRR). GBP0.7 million was returned from international

foreign exchange specialist Global Reach Group (3.1x, 19% IRR).

Lastly Inflexion also exited the social media and influencer

marketing agency Goat returning GBP0.5 million (3.9x, 78% IRR).

As noted above, Piper exited jewellery company Monica Vinader

returning GBP0.4 million in a sale to Bridgepoint (2.1x, 11% IRR).

Piper have continued in the investment alongside Bridgepoint in

Piper VII.

Volpi have sold Medinet (insourced solutions provider to the

healthcare sector) returning GBP1.7 million (3.2x cost, 18% IRR).

We have received the final tranche from the sale of apprenticeship

and training company Babington, which was GBP0.7 million, bringing

the final return to 0.9x cost. There was a distribution of GBP1.3

million from F&C European Capital Partners which was acquired

last year in a secondary transaction.

The flow of realisations has continued in Continental Europe. In

Spain, Corpfin IV returned GBP4.0 million (6.1x, 51% IRR) from the

sale of care company Grupo 5. There have been a number of exits

from our French managed funds. Chequers XVI exited Paris based

landfill site operator Environnement Conseil Travaux (ECT)

returning GBP0.8 million. Chequers XVII sold premium zips business

Riri returning GBP1.2 million (2.4x, 34% IRR). Chequers XVI have

sold Italy based Bozzetto (speciality chemicals for the textiles

industry) returning GBP0.5 million (4.3x cost, 28% IRR). Chequers

XVII has exited MTA (HVAC equipment), which is also Italy based,

returning GBP0.7 million (3.2x cost, 40% IRR). Also in France,

Ciclad 4 exited wine drums company H&A Location returning

GBP0.7 million with an excellent return of 8x cost. Ciclad 5 has

sold specialist vehicle axle manufacturer Paillard (1.8x cost, 10%

IRR) and has refinanced Edeis (engineering project management)

returning an aggregate GBP0.7 million. In Germany DBAG's various

funds have achieved a number of exits. GBP0.4 million came in from

speciality chemicals producer Heytex (1.2x cost). GBP1.0 million

was returned from Italian company Pmflex a leading European

manufacturer of electrical installation conduits (2.3x, 65% IRR).

DBAG also sold prison phone communications company Telio returning

GBP0.5 million. DBAG VII have sold Cloudflight (IT services

provider focussed on digitalisation and cloud-based transformation)

returning GBP1.1 million (4.4x cost, 52% IRR). In Central Europe

ARX exited electro-mechanical engineering company TES in the sale

to a consortium including Avallon noted above. This returned GBP1.2

million (2.7x, 40% IRR). In Finland workplace booth company Framery

is staging a strong post covid recovery and has been refinanced

returning GBP0.3 million.

In total realisations for the first six months were GBP39.8

million. This is around 80% of the cumulative total at this point

last year.

Valuation Movements

There were many valuation changes over the first half although

none of them were individually large and before accounting for

exchange rate changes the net effect was essentially neutral.

Around 85% of valuations were based on 31 March 2023 with only 15%

up to date at 30 June. Of the June valuations received at the time

of writing there was not much of a trend with little change.

The largest uplift in the period was for pet shop chain Jollyes

(+GBP2.2 million) which continues to trade well in what has proven

to be a defensive sector. Ashtead Technology which is now listed

and is being realised has seen a rising share price and this led to

an uplift over the first half of GBP1.1 million. Our co-investment

in radiotherapy company Amethyst was up by GBP0.7 million as the

company makes good progress. In our funds portfolio there have been

a number of moderate increases driven largely by exits and good

underlying trading. These include Kester Capital II (+GBP1.0

million), Chequers Capital XVII (+GBP0.9 million), August Equity V

(+GBP0.8 million) and ArchiMed II (+GBP0.6 million). The ArchiMed

II uplift reflected the imminent sale, now completed, of gene

therapy transvective reagent company Polyplus to Sartorius. This

achieved over 4.0x cost and an IRR of over 60%.

There were a number of downgrades over the first half.

Ambio, the active pharmaceutical ingredient (API) company based

in the USA and China, was down by GBP2.8 million. This is due to

the putative Hong Kong listing being postponed and some headwinds

from a slow recovery from lockdown and delays in shipments

resulting from an industrial accident in March which has affected

production.

Our large holding in electrical components company Sigma is down

by GBP1.4 million conservatively reflecting the potential impact of

the global slowdown on trading.

Our energy services holdings in TWMA (-GBP1.2 million) has seen

a reduction in business in the USA as a result of lower gas prices

which has caused a modest undershoot on forecasted profit, although

its substantial new contracts in the UAE are expected to

significantly boost rig count and profitability next year.

There has been some pressure on the valuations of companies

which are consumer facing. Bomaki (Italian restaurant chain) is

down by GBP1.2 million reflecting soft sales performance, a

negative consumer environment and higher than expected raw material

costs. Weird Fish, our UK based casual clothing company, is down by

GBP1.7 million as the company continues to suffer from a reduction

in e-commerce sales. Omlet, the chicken coop company, has seen

revenues and EBITDA under pressure due to weak consumer confidence

and it is down by GBP0.7 million. Specialist care home and schools

company Orbis is down by GBP0.7 million as a result of

underperformance of the core Welsh business which has encountered

staffing problems.

Very few funds recorded notable declines with Agilitas 2015

(-GBP1.0 million) and Corsair VI (-GBP0.8 million) down slightly

over the first half.

Financing

As drawdowns and co-investment activity has exceeded

realisations and associated distributions so far this year we are

using more of the revolving credit facility with net debt at

GBP55.2 million at 30 June 2023. This is gearing of 10% which is

well within the comfortable range. The balance between new

investments and realisations is monitored closely. Although the

current facility does not expire until June 2024 we are already

engaging with lenders to discuss terms and the size of a new

facility.

The pound has strengthened against both the euro and the dollar

over the first half and the impact of currency movements is around

2% of starting NAV which accounts for most of the valuation

movement.

Outlook

The slight decline in this overall valuation and the limited

change seen in the latest June valuations is not surprising given

the ongoing challenges in most economies where there is a

background of high inflation and rising interest rates and sluggish

growth at best. Most businesses within our portfolio continue to

grow both revenues and profits at rates which are consistent with

achieving the original investment theses. There are specific

exceptions, generally but not exclusively, in consumer facing

sectors, where we are relatively lightly invested, and where

pressures on demand have been anticipated for some time. For a

significant number of companies forecasts have shifted to the right

which again is unsurprising given the post covid slowdown. Business

confidence is the key determinant of the deal making environment in

the private equity sector and while this has definitely moderated,

it remains for the most part robust.

After a number of very active years a reduction in deal making

is to be expected and in the latest figures it can be seen that

this is clearly happening. At the micro level this manifests itself

as transactions taking longer to conclude than usual or dropping

away completely often when financing fails to materialise. We have

seen a few postponements of much heralded exits and this trend may

well continue. The vast majority of our investee companies are

involved in markets where there is long term growth and where they

have some form of advantage over their competitors. These factors

coupled with strong management supplemented by experienced private

equity leadership gives our portfolio an excellent chance of

overcoming current challenges and delivering strong returns for our

shareholders over the long term.

Hamish Mair

Investment Manager

Columbia Threadneedle Investment Business Limited

Portfolio Summary

Ten Largest Holdings Total Valuation % of Total Portfolio

As at 30 June 2023 GBP'000

============================= ======================== ===============================

Sigma 15,803 2.9

============================= ======================== ===============================

Inflexion Strategic Partners 15,346 2.8

============================= ======================== ===============================

Coretrax 13,220 2.4

============================= ======================== ===============================

Jollyes 11,937 2.2

============================= ======================== ===============================

TWMA 10,004 1.8

============================= ======================== ===============================

Aurora Payment Solutions 9,761 1.8

============================= ======================== ===============================

Bencis V 9,669 1.7

============================= ======================== ===============================

SEP V 9,618 1.7

============================= ======================== ===============================

Apposite Healthcare II 9,191 1.7

============================= ======================== ===============================

ATEC (CETA) 8,875 1.6

============================= ======================== ===============================

113,424 20.6

======================================================= ===============================

Portfolio Holdings

Investment Geographic Focus Total % of Total

Valuation Portfolio

GBP'000

================================== ================= ========== ==========

Buyout Funds - Pan European

Apposite Healthcare II Europe 9,191 1.7

F&C European Capital Partners Europe 8,523 1.5

Stirling Square Capital II Europe 7,726 1.4

Apposite Healthcare III Europe 7,187 1.3

Agilitas 2015 Fund Northern Europe 5,071 0.9

ArchiMed II Western Europe 5,004 0.9

Astorg VI Western Europe 3,042 0.6

Magnesium Capital 1 Europe 1,931 0.4

Volpi III Northern Europe 1,342 0.2

Silverfleet European Dev Fund Europe 1,232 0.2

Agilitas 2020 Fund Europe 1,204 0.2

TDR Capital II Western Europe 1,159 0.2

TDR II Annex Fund Western Europe 998 0.2

ArchiMed MED III Global 678 0.1

Med Platform II Global 363 0.1

Volpi Capital Northern Europe 76 -

Wisequity VI Italy 29 -

Total Buyout Funds - Pan European 54,756 9.9

===================================================== ========== ==========

Buyout Funds - UK

Inflexion Strategic Partners United Kingdom 15,346 2.8

August Equity Partners V United Kingdom 8,663 1.6

Axiom 1 United Kingdom 6,247 1.1

August Equity Partners IV United Kingdom 6,055 1.1

Inflexion Supplemental V United Kingdom 5,967 1.1

Apiary Capital Partners I United Kingdom 5,929 1.1

Inflexion Buyout Fund V United Kingdom 5,799 1.1

Kester Capital II United Kingdom 4,118 0.7

Piper Private Equity VI United Kingdom 4,056 0.7

Inflexion Buyout Fund IV United Kingdom 3,790 0.7

Inflexion Enterprise Fund IV United Kingdom 3,064 0.6

Inflexion Partnership Capital II United Kingdom 2,874 0.5

FPE Fund II United Kingdom 2,689 0.5

FPE Fund III United Kingdom 2,327 0.4

Inflexion Enterprise Fund V United Kingdom 2,130 0.4

RJD Private Equity Fund III United Kingdom 1,921 0.3

Inflexion Buyout Fund VI United Kingdom 1,795 0.3

Inflexion Supplemental IV United Kingdom 1,759 0.3

GCP Europe II United Kingdom 1,456 0.3

Horizon Capital 2013 United Kingdom 1,253 0.2

Piper Private Equity VII United Kingdom 1,230 0.2

Primary Capital IV United Kingdom 1,197 0.2

Inflexion Partnership Capital I United Kingdom 1,188 0.2

Dunedin Buyout Fund II United Kingdom 975 0.2

Inflexion 2012 Co-Invest Fund United Kingdom 678 0.1

Kester Capital III United Kingdom 664 0.1

Inflexion 2010 Fund United Kingdom 405 0.1

Piper Private Equity V United Kingdom 395 0.1

August Equity Partners III United Kingdom 1 -

Total Buyout Funds - UK 93,971 17.0

===================================================== ========== ==========

Investment Geographic Focus Total % of Total

Valuation Portfolio

GBP'000

================================== ================= ========== ==========

Buyout Funds - Continental Europe

Bencis V Benelux 9,669 1.7

Aliante Equity 3 Italy 8,330 1.5

DBAG VII DACH 5,171 0.9

Vaaka III Finland 5,106 0.9

Capvis III CV DACH 5,008 0.9

Italian Portfolio Italy 4,926 0.9

Montefiore IV France 4,644 0.8

Summa II Nordic 4,298 0.8

Chequers Capital XVII France 4,103 0.7

DBAG VIII DACH 4,012 0.7

Procuritas VI Nordic 3,926 0.7

Avallon MBO Fund III Poland 3,585 0.7

Verdane Edda Nordic 3,370 0.6

ARX CEE IV Eastern Europe 3,020 0.5

Montefiore V France 2,917 0.5

Corpfin Capital Fund IV Spain 2,761 0.5

Capvis IV DACH 2,540 0.5

Procuritas Capital IV Nordic 2,534 0.5

Procuritas VII Nordic 2,401 0.4

NEM Imprese III Italy 2,341 0.4

Summa I Nordic 2,250 0.4

Corpfin V Spain 1,787 0.3

DBAG Fund VI DACH 1,629 0.3

Vaaka II Finland 1,566 0.3

Vaaka IV Finland 1,419 0.3

Portobello Fund III Spain 1,159 0.2

Summa III Northern Europe 952 0.2

Avallon MBO Fund II Poland 935 0.2

DBAG VIIB DACH 925 0.2

Verdane XI Northern Europe 821 0.2

Chequers Capital XVI France 791 0.1

DBAG VIIIB DACH 643 0.1

PineBridge New Europe II Eastern Europe 444 0.1

Ciclad 5 France 374 0.1

Procuritas Capital V Nordic 288 0.1

Gilde Buyout Fund III Benelux 92 -

Capvis III DACH 50 -

N+1 Private Equity Fund II Iberia 42 -

Ciclad 4 France 18 -

DBAG Fund V DACH 5 -

Total Buyout Funds - Continental

Europe 100,852 18.2

===================================================== ==========

Private Equity Funds - USA

Blue Point Capital IV North America 7,808 1.4

Camden Partners IV United States 3,407 0.6

Stellex Capital Partners North America 3,069 0.6

Graycliff III United States 3,043 0.6

Graycliff IV North America 2,778 0.5

Blue Point Capital III North America 2,675 0.5

Level 5 Fund II United States 2,602 0.5

MidOcean VI United States 756 0.1

Blue Point Capital II North America 152 -

HealthpointCapital Partners III United States 122 -

Total Private Equity Funds - USA 26,412 4.8

===================================================== ========== ==========

Investment Geographic Total % of

Focus Valuation Total

GBP'000 Portfolio

======================================== =============== ========== ==========

Private Equity Funds - Global

Corsair VI Global 4,279 0.8

Hg Saturn 3 Global 1,059 0.2

PineBridge GEM II Global 921 0.2

F&C Climate Opportunity Partners Global 728 0.1

PineBridge Latin America II South America 56 -

AIF Capital Asia III Asia 39 -

Warburg Pincus IX Global 3 -

Total Private Equity Funds - Global 7,085 1.3

========================================================= ========== ==========

Venture Capital Funds

SEP V United Kingdom 9,618 1.7

MVM V Global 4,276 0.8

Kurma Biofund II Europe 2,262 0.4

SEP IV United Kingdom 1,545 0.3

Northern Gritstone United Kingdom 1,040 0.2

SEP VI Europe 979 0.2

Pentech Fund II United Kingdom 436 0.1

SEP II United Kingdom 275 -

Life Sciences Partners III Western Europe 248 -

Environmental Technologies Fund Europe 61 -

SEP III United Kingdom 43 -

MVM VI Global 4 -

Total Venture Capital Funds 20,787 3.7

========================================================= ========== ==========

Direct - Quoted

Ashtead United Kingdom 5,185 0.9

Total Direct - Quoted 5,185 0.9

========================================================= ========== ==========

Secondary Funds

The Aurora Fund Europe 670 0.1

======================================== =============== ========== ==========

Total Secondary Funds 670 0.1

========================================================= ========== ==========

Direct Investments/Co-investments

Sigma United States 15,803 2.9

Coretrax United Kingdom 13,220 2.4

Jollyes United Kingdom 11,937 2.2

TWMA United Kingdom 10,004 1.8

Aurora Payment Solutions United States 9,761 1.8

ATEC (CETA) United Kingdom 8,875 1.6

San Siro Italy 8,631 1.6

AccuVein United States 8,356 1.5

Amethyst Radiotherapy Europe 7,802 1.4

Cyclomedia Netherlands 7,779 1.4

Velos IoT (JT IoT) United Kingdom 6,818 1.2

Leader96 Bulgaria 6,704 1.2

Swanton United Kingdom 6,682 1.2

Prollenium North America 6,615 1.2

Rosa Mexicano United States 6,363 1.2

Asbury Carbons North America 6,338 1.1

Weird Fish United Kingdom 5,867 1.1

Family First United Kingdom 5,436 1.0

Walkers Transport United Kingdom 5,257 0.9

Cybit (Perfect Image) United Kingdom 5,116 0.9

Cyberhawk United Kingdom 5,055 0.9

Orbis United Kingdom 4,894 0.9

123Dentist Canada 4,755 0.9

Dotmatics United Kingdom 4,537 0.8

Omlet United Kingdom 4,371 0.8

1Med Switzerland 4,364 0.8

Agilico (DMC Canotec) United Kingdom 4,000 0.7

Contained Air Solutions United Kingdom 3,969 0.7

LeadVenture United States 3,847 0.7

PathFactory Canada 3,754 0.7

Habitus Denmark 3,597 0.7

MedSpa Partners Canada 3,549 0.6

Ambio Holdings United States 3,450 0.6

Avalon United Kingdom 3,402 0.6

Alessa (Tier1 CRM) Canada 3,399 0.6

Collingwood Insurance Group United Kingdom 3,034 0.5

StarTraq United Kingdom 2,702 0.5

CARDO Group (Sigma II) United Kingdom 2,661 0.5

Vero Biotech United States 2,518 0.5

Neurolens United States 2,418 0.4

GT Medical United States 1,884 0.3

Bomaki Italy 1,756 0.3

Rephine United Kingdom 1,674 0.3

OneTouch United Kingdom 1,246 0.2

TDR Algeco/Scotsman Europe 246 -

Total Direct Investments/Co-investments 244,446 44.1

========================================================= ========== ==========

Total Portfolio 554,164 100.0

========================================================= ========== ==========

CT Private Equity Trust PLC

Statement of Comprehensive Income for the

half year ended 30 June 2023

Unaudited

Revenue Capital Total

GBP'000 GBP'000 GBP'000

---------------------------------------------- --------- --------- ---------

Income

Losses on investments held at fair value - (10,390) (10,390)

Exchange gains - 1,643 1,643

Investment income 1,167 - 1,167

Other income 389 - 389

---------------------------------------------- --------- --------- ---------

Total income 1,556 (8,747) (7,191)

---------------------------------------------- --------- --------- ---------

Expenditure

Investment management fee - basic fee (234) (2,110) (2,344)

Investment management fee - performance - - -

fee

Other expenses (563) - (563)

---------------------------------------------- --------- --------- ---------

Total expenditure (797) (2,110) (2,907)

---------------------------------------------- --------- --------- ---------

Profit/(loss) before finance costs and

taxation 759 (10,857) (10,098)

Finance costs (192) (1,722) (1,914)

---------------------------------------------- --------- --------- ---------

Profit/(loss) before taxation 567 (12,579) (12,012)

Taxation - - -

Profit/(loss) for period/total comprehensive

income 567 (12,579) (12,012)

Return per Ordinary Share 0.78p (17.27)p (16.49)p

---------------------------------------------- --------- --------- ---------

The total column is the profit and loss account of the

Company.

All revenue and capital items in the above statement derive from

continuing operations.

CT Private Equity Trust PLC

Statement of Comprehensive Income for the

half year ended 30 June 2022

Unaudited

Revenue Capital Total

GBP'000 GBP'000 GBP'000

---------------------------------------------- --------- --------- ---------

Income

Gains on investments held at fair value - 26,375 26,375

Exchange losses - (1,028) (1,028)

Investment income 1,890 - 1,890

Other income 60 - 60

---------------------------------------------- --------- --------- ---------

Total income 1,950 25,347 27,297

---------------------------------------------- --------- --------- ---------

Expenditure

Investment management fee - basic fee (224) (2,012) (2,236)

Investment management fee - performance

fee - (5,283) (5,283)

Other expenses (533) - (533)

---------------------------------------------- --------- --------- ---------

Total expenditure (757) (7,295) (8,052)

---------------------------------------------- --------- --------- ---------

Profit before finance costs and taxation 1,193 18,052 19,245

Finance costs (120) (1,077) (1,197)

---------------------------------------------- --------- --------- ---------

Profit before taxation 1,073 16,975 18,048

Taxation - - -

Profit for period/total comprehensive income 1,073 16,975 18,048

Return per Ordinary Share 1.45p 22.99p 24.44p

---------------------------------------------- --------- --------- ---------

The total column is the profit and loss account of the

Company.

All revenue and capital items in the above statement derive from

continuing operations.

CT Private Equity Trust PLC

Statement of Comprehensive Income for the

year ended 31 December 2022

Audited

Revenue Capital Total

GBP'000 GBP'000 GBP'000

-------------------------------------------- --------- --------- ---------

Income

Gains on investments held at fair value - 77,330 77,330

Exchange losses - (2,083) (2,083)

Investment income 4,550 - 4,550

Other income 186 - 186

-------------------------------------------- --------- --------- ---------

Total income 4,736 75,247 79,983

-------------------------------------------- --------- --------- ---------

Expenditure

Investment management fee - basic fee (464) (4,172) (4,636)

Investment management fee - performance

fee - (5,402) (5,402)

Other expenses (1,077) - (1,077)

-------------------------------------------- --------- --------- ---------

Total expenditure (1,541) (9,574) (11,115)

-------------------------------------------- --------- --------- ---------

Profit before finance costs and taxation 3,195 65,673 68,868

Finance costs (254) (2,294) (2,548)

-------------------------------------------- --------- --------- ---------

Profit before taxation 2,941 63,379 66,320

Taxation - - -

Profit for year/total comprehensive income 2,941 63,379 66,320

Return per Ordinary Share 4.01p 86.42p 90.43p

-------------------------------------------- --------- --------- ---------

The total column is the profit and loss account of the

Company.

All revenue and capital items in the above statement derive from

continuing operations.

CT Private Equity Trust PLC

Amounts Recognised as Dividends

Six months Six months

ended 30 ended 30

June 2023 June 2022

(unaudited) (unaudited)

GBP'000 GBP'000 Year ended

31 December

2022

(audited)

GBP'000

Quarterly Ordinary Share dividend of 5.27p

per share for the quarter ended 30 September

2021 - 3,897 3,897

------------- ------------- --------------

Quarterly Ordinary Share dividend of 5.65p

per share for the quarter ended 31 December

2021 - 4,177 4,178

------------- ------------- --------------

Quarterly Ordinary Share dividend of 6.05p

per share for the quarter ended 31 March

2022 - - 4,407

------------- ------------- --------------

Quarterly Ordinary Share dividend of 6.31p

per share for the quarter ended 30 June

2022 - - 4,596

------------- ------------- --------------

Quarterly Ordinary Share dividend of 6.62p 4,822 - -

per share for the quarter ended 30 September

2022

------------- ------------- --------------

Quarterly Ordinary Share dividend of 6.79p 4,946 - -

per share for the quarter ended 31 December

2022

------------- ------------- --------------

9,768 8,074 17,078

------------- ------------- --------------

CT Private Equity Trust PLC

Balance Sheet

As at 30 June As at 30 As at 31

2023 June 2022 December

(unaudited) 2022

(unaudited) (audited)

GBP'000 GBP'000 GBP'000

----------------------------------- -------------- ------------- ------------

Non-current assets

Investments at fair value through

profit or loss 554,164 500,851 528,557

Current assets

Other receivables 704 280 389

Cash and cash equivalents 13,343 22,377 34,460

----------------------------------- -------------- ------------- ------------

14,047 22,657 34,849

Current liabilities

Other payables (3,782) (8,110) (7,411)

Interest-bearing bank loan (68,534) (16,124) (16,618)

----------------------------------- -------------- ------------- ------------

(72,316) (24,234) (24,029)

----------------------------------- -------------- ------------- ------------

Net current (liabilities)/assets (58,269) (1,577) 10,820

Non-current liabilities

Interest-bearing bank loan - (20,867) (21,702)

----------------------------------- -------------- ------------- ------------

Net assets 495,895 478,407 517,675

----------------------------------- -------------- ------------- ------------

Equity

Called-up ordinary share capital 739 739 739

Share premium account 2,527 2,527 2,527

Special distributable capital

reserve 10,026 10,026 10,026

Special distributable revenue

reserve 31,403 31,403 31,403

Capital redemption reserve 1,335 1,335 1,335

Capital reserve 449,865 432,377 471,645

Shareholders' funds 495,895 478,407 517,675

----------------------------------- -------------- ------------- ------------

Net asset value per Ordinary

Share 680.75p 656.75p 710.65p

----------------------------------- -------------- ------------- ------------

CT Private Equity Trust PLC

Statement of Changes in Equity

Share Share Special Special Capital Capital Revenue Total

Capital Premium Distributable Distributable Redemption Reserve Reserve

Account Capital Revenue Reserve

Reserve Reserve

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

For the six months ended 30 June 2023 (unaudited)

Net assets at 1 January

2023 739 2,527 10,026 31,403 1,335 471,645 - 517,675

Buyback of ordinary - - - - - - - -

shares

Profit for the period/total

comprehensive income - - - - - (12,579) 567 (12,012)

Dividends paid - - - - - (9,201) (567) (9,768)

Net assets at 30

June 2023 739 2,527 10,026 31,403 1,335 449,865 - 495,895

------------------ ---- ------ ------- ------- ------ -------- --------

For the six months ended 30 June 2022 (unaudited)

Net assets at 1 January

2022 739 2,527 15,040 31,403 1,335 422,403 - 473,447

Buyback of ordinary

shares - - (5,014) - - - - (5,014)

Profit for the period/total

comprehensive income - - - - - 16,975 1,073 18,048

Dividends paid - - - - - (7,001) (1,073) (8,074)

Net assets at 30

June 2022 739 2,527 10,026 31,403 1,335 432,377 - 478,407

------------------ ---- ------ ------- ------- ------ -------- --------

For the year ended 31 December 2022 (audited)

Net assets at 1 January

2022 739 2,527 15,040 31,403 1,335 422,403 - 473,447

Buyback of ordinary

shares - - (5,014) - - - - (5,014)

Profit for the period/total

comprehensive income - - - - - 63,379 2,941 66,320

Dividends paid - - - - - (14,137) (2,941) (17,078)

Net assets at 31

December 2022 739 2,527 10,026 31,403 1,335 471,645 - 517,675

------------------ ---- ------ ------- ------- ------ -------- --------

CT Private Equity Trust PLC

Cash Flow Statement

Six months Six months Year ended

ended ended

30 June 30 June 31 December

2023 2022 2022

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

------------------------------------- -------------- -------------- --------------

Operating activities

Loss/profit before taxation (12,012) 18,048 66,320

Adjustments for:

Gain on disposals of investments (21,084) (21,950) (62,951)

Loss/(gain) on amount of

fair value movement 31,474 (4,425) (14,379)

Exchange differences (1,643) 1,028 2,083

Finance costs 1,914 1,197 2,548

Increase in other receivables (4) (46) (2)

(Decrease)/increase in other

payables (4,253) 1,239 358

------------------------------------- -------------- -------------- --------------

Net cash outflow from operating

activities (5,608) (4,909) (6,023)

------------------------------------- -------------- -------------- --------------

Investing activities

Purchases of investments (74,468) (37,294) (88,593)

Sales of investments 38,471 45,865 120,413

Net cash (outflow)/inflow

from investing activities (35,997) 8,571 31,820

------------------------------------- -------------- -------------- --------------

Financing activities

Drawdown of bank loans, 31,437 - -

net of costs

Arrangement cost of loan

facility (28) (28) (28)

Interest paid (1,426) (772) (1,919)

Buyback of ordinary shares - (5,014) (5,014)

Equity dividends paid (9,768) (8,074) (17,078)

------------------------------------- -------------- -------------- --------------

Net cash inflow/(outflow)

from financing activities 20,215 (13,888) (24,039)

------------------------------------- -------------- -------------- --------------

Net (decrease)/increase

in cash and cash equivalents (21,390) (10,226) 1,758

Currency gains/(losses) 273 (99) -

------------------------------------- -------------- -------------- --------------

Net (decrease)/increase

in cash and cash equivalents (21,117) (10,325) 1,758

Opening cash and cash equivalents 34,460 32,702 32,702

------------------------------------- -------------- -------------- --------------

Closing cash and cash equivalents 13,343 22,377 34,460

------------------------------------- -------------- -------------- --------------

Directors' Statement of Principal Risks and Uncertainties

The principal risks identified in the Annual Report and Accounts

for the year ended 31 December 2022 were:

-- Economic, macro and political;

-- Liquidity and capital structure;

-- Regulatory;

-- Personnel issues;

-- Fraud and cyber;

-- Market;

-- ESG; and

-- Operational.

These risks are described in more detail under the heading

"Principal Risks" within the Strategic Report in the Company's

Annual Report and Accounts for the year ended 31 December 2022.

At present the global economy continues to suffer considerable

disruption due to inflationary pressures, the war in Ukraine and

the after effects of the COVID-19 pandemic. The Directors continue

to review the key risk matrix for the Company which identifies the

risks that the Company is exposed to, the controls in place and the

actions being taken to mitigate them.

It is also noted that:

-- An analysis of the performance of the Company since 1 January

2023 is included within the Chairman's Statement and the Manager's

Review.

-- The Company's five-year borrowing facility is composed of a

EUR25 million term loan and a GBP95 million multi-currency

revolving credit facility. As at 30 June 2023 borrowings were

GBP68.5 million. The interest rate payable is variable.

-- Note 8 details the Board's consideration for the continued

applicability of the principle of Going Concern when preparing this

report.

On behalf of the Board

Richard Gray

Chairman

Statement of Directors' Responsibilities in Respect of the Half

Yearly Financial Report

We confirm that to the best of our knowledge:

-- the condensed set of financial statements have been prepared

in accordance with applicable UK-adopted International Accounting

Standards on a going concern basis and give a true and fair view of

the assets, liabilities, financial position and return of the

Company;

-- the Chairman's Statement, Investment Manager's Review and the

Directors' Statement of Principal Risks and Uncertainties (together

constituting the Interim Management Report) include a fair review

of the information required by the Disclosure Guidance and

Transparency Rule ('DTR') 4.2.7R, being an indication of important

events that have occurred during the first six months of the

financial year and their impact on the financial statements;

-- the Directors' Statement of Principal Risks and Uncertainties

is a fair review of the principal risks and uncertainties for the

remainder of the financial year; and

-- the half-yearly report includes a fair review of the

information required by DTR 4.2.8R, being related party

transactions that have taken place in the first six months of the

current financial year and that have materially affected the

financial position or performance of the Company during the period,

and any changes in the related party transactions described in the

last Annual Report that could do so.

On behalf of the Board

Richard Gray

Chairman

Notes (unaudited)

1. The condensed company financial statements have been prepared

on a going concern basis in accordance with International Financial

Reporting Standard ('IFRS') IAS 34 'Interim Financial Reporting'

and the accounting policies set out in the statutory accounts for

the year ended 31 December 2022. The condensed financial statements

do not include all of the information and disclosures required for

a complete set of IFRS financial statements and should be read in

conjunction with the financial statements for the year ended 31

December 2022, which were prepared in accordance with the Companies

Act 2006 and UK adopted international accounting standards.

2. Earnings for the six months to 30 June 2023 should not be

taken as a guide to the results for the year to 31 December

2023.

3. Investment management fee:

Six months to 30 Six months to 30 Year ended 31 December

June 2023 June 2022 (unaudited) 2022 (audited)

(unaudited)

Revenue Capital Total Revenue Capital Total Revenue Capital Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------- --------- --------- --------- --------- --------- --------- --------- --------- ---------

Investment

management

fee - basic fee 234 2,110 2,344 224 2,012 2,236 464 4,172 4,636

Investment

management

fee - performance

fee - - - - 5,283 5,283 - 5,402 5,402

234 2,110 2,344 224 7,295 7,519 464 9,574 10,038

------------------- --------- --------- --------- --------- --------- --------- --------- --------- ---------

4. Finance costs :

Six months to 30 Six months to 30 Year ended 31 December

June 2023 June 2022 (unaudited) 2022 (audited)

(unaudited)

Revenue Capital Total Revenue Capital Total Revenue Capital Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------ --------- --------- --------- --------- --------- --------- --------- --------- ---------

Interest payable

on bank loans 192 1,722 1,914 120 1,077 1,197 254 2,294 2,548

5. The return per Ordinary Share is based on a net loss on ordinary activities after taxation of GBP12,012,000 (30 June 2022 - profit GBP18,048,000; 31 December 2022 - profit GBP66,320,000) and on 72,844,938 (30 June 2022-73,847,912; 31 December 2022 -73,342,303) shares, being the weighted average number of Ordinary Shares in issue during the period.

6. The net asset value per Ordinary Share is based on net assets

at the period end of GBP495,895,000 (30 June 2022 - GBP478,407,000;

31 December 2022 - GBP517,675,000) and on 72,844,938 (30 June 2022

- 72,844,938; 31 December 2022 - 72,844,938 shares, being the

number of Ordinary Shares in issue at the period end.

7. The fair value measurements for financial assets and

liabilities are categorised into different levels in the fair value

hierarchy based on inputs to valuation techniques used. The

different levels are defined as follows:

Level 1 reflects financial instruments quoted in an active

market.

Level 2 reflects financial instruments whose fair value is

evidenced by comparison with other observable current market

transactions in the same instrument or based on a valuation

technique whose variables includes only data from observable

markets.

Level 3 reflects financial instruments whose fair value is

determined in whole or in part using a valuation technique based on

assumptions that are not supported by prices from observable market

transactions in the same instrument and not based on available

observable market data.

Level Level Level Total

1 2 3

GBP'000 GBP'000 GBP'000 GBP'000

---------------------------------- -------- ---------- -------- ----------

30 June 2023

Financial assets

Investments 5,185 - 548,979 554,164

Financial liabilities

Multi-currency revolving credit

facility - (47,413) - (47,413)

Term loan - (21,430) - (21,430)

30 June 2022

Financial assets

Investments 570 - 500,281 500,851

Financial liabilities

Multi-currency revolving credit

facility - (16,124) - (16,124)

Term loan - (21,510) - (21,510)

31 December 2022

Financial assets

Investments 5,477 - 523,080 528,557

Financial liabilities

Multi-currency revolving credit

facility - (16,618) - (16,618)

Term loan - (22,166) - (22,166)

There were no transfers between levels in the fair value

hierarchy in the period ended 30 June 2023. Transfers between

levels of the fair value hierarchy are deemed to have occurred at

the date of the event that caused the transfer.

Valuation techniques

Quoted fixed asset investments held are valued at bid prices

which equate to their fair values. When fair values of publicly

traded equities are based on quoted market prices in an active

market without any adjustments, the investments are included within

Level 1 of the hierarchy. The Company invests primarily in private

equity funds and co-investments via limited partnerships or similar

fund structures. Such vehicles are mostly unquoted and in turn

invest in unquoted securities. The fair value of a holding is based

on the Company's share of the total net asset value of the fund or

share of the valuation of the co-investment calculated by the lead

private equity manager on a quarterly basis. The lead private

equity manager derives the net asset value of a fund from the fair

value of underlying investments. The fair value of these underlying

investments and the Company's co-investments is calculated using

methodology which is consistent with the International Private

Equity and Venture Capital Valuation Guidelines ('IPEG'). In

accordance with IPEG these investments are generally valued using

an appropriate multiple of maintainable earnings, which has been

derived from comparable multiples of quoted companies or recent

transactions. The Columbia Threadneedle private equity team has

access to the underlying valuations used by the lead private equity

managers including multiples and any adjustments. The Columbia

Threadneedle private equity team generally values the Company's

holdings in line with the lead managers but may make adjustments

where they do not believe the underlying managers' valuations

represent fair value. On a quarterly basis, the Columbia

Threadneedle private equity team present the valuations to the

Board. This includes a discussion of the major assumptions used in

the valuations, which focuses on significant investments and

significant changes in the fair value of investments. If considered

appropriate, the Board will approve the valuations.

The interest-bearing bank loans are recognised in the Balance

Sheet at amortised cost in accordance with IFRS. The fair value of

the term loan is based on a marked to market basis. The fair value

is calculated using a discounted cash flow technique based on

relevant interest rates. The fair value of the multi-currency

revolving credit facility is not materially different to the

carrying value. The fair values of all of the Company's other

financial assets and liabilities are not materially different from

their carrying values in the balance sheet.

Significant unobservable inputs for Level 3 valuations

The Company's unlisted investments are all classified as Level 3

investments. The fair values of the unlisted investments have been

determined principally by reference to earnings multiples, with

adjustments made as appropriate to reflect matters such as the

sizes of the holdings and liquidity. The weighted average earnings

multiple for the portfolio as at 30 June 2023 was 11.6 times EBITDA

(Earnings Before Interest, Tax, Depreciation and Amortisation) (30

June 2022: 12.2 times EBITDA; 31 December 2022: 11.6 times

EBITDA).

The significant unobservable input used in the fair value

measurement categorised within Level 3 of the fair value hierarchy

together with a quantitative sensitivity analysis are shown

below:

Period ended Input Sensitivity Effect

used* on fair

value GBP'000

-------------- --------------------------- ------------ ---------------

Weighted average earnings

30 June 2023 multiple 1x 64,954

Weighted average earnings

30 June 2022 multiple 1x 52,813

31 December Weighted average earnings

2022 multiple 1x 61,833

-------------- --------------------------- ------------ ---------------

* The sensitivity analysis refers to an amount added or deducted

from the input and the effect this has on the fair value.

The fair value of the Company's unlisted investments is

sensitive to changes in the assumed earnings multiples. The

managers of the underlying funds assume an earnings multiple for

each holding. An increase in the weighted average earnings multiple

would lead to an increase in the fair value of the investment

portfolio and a decrease in the multiple would lead to a decrease

in the fair value.

The following table shows a reconciliation of all movements in

the fair value of financial instruments categorised within Level 3

between the beginning and the end of the period:

30 June 30 June 31 December

2023 2022 2022

GBP'000 GBP'000 GBP'000

-------------------------------- --------- --------- ------------

Balance at beginning of period 523,080 482,747 482,747

Purchases 74,468 37,294 88,593

Transfers - - (626)

Sales (37,140) (45,865) (117,003)

Gains on disposal 19,753 21,950 60,167

Holding losses/gains (31,182) 4,155 9,202

-------------------------------- --------- --------- ------------

Balance at end of period 548,979 500,281 523,080

-------------------------------- --------- --------- ------------

8. In assessing the going concern basis of accounting the

Directors have had regard to the guidance issued by the Financial

Reporting Council. They have considered the current cash position

of the Company, the availability of the Company's loan facility and

compliance with its banking covenants. They have also considered

period end cash balances and forecast cashflows, the operational

resilience of the Company and its service providers and the annual

dividend.

As at 30 June 2023, the Company had outstanding undrawn

commitments of GBP208.9 million. Of this amount, approximately

GBP24.9 million is to funds where the investment period has expired

and the Manager would expect very little of this to be drawn. Of

the outstanding undrawn commitments remaining within their

investment periods, the Manager would expect that a significant

amount will not be drawn before these periods expire. The Company

has a committed borrowing facility comprising a term loan of EUR25

million and a revolving credit facility of GBP95 million. This

facility is due to expire on 19 June 2024 when its five-year term

concludes.

At 30 June 2023 the Company had fully drawn the term loan of

EUR25 million and had drawn GBP47.4 million of the revolving credit

facility, leaving GBP47.6 million of the revolving credit facility

available. This available proportion of the facility can be used to

fund any shortfall between the proceeds received from realisations

and drawdowns made from funds in the Company's portfolio or funds

required for co-investments. Under normal circumstances this amount

of 'headroom' in the facility would be more than adequate to meet

any such shortfall.

At present the global economy continues to suffer disruption due

to inflationary pressures, the war in Ukraine and the after effects

of the COVID-19 pandemic and the Directors have given serious

consideration to the consequences of these for the private equity

market in general and for the cashflows and asset values of the

Company specifically over the next twelve months. The Company has a

number of loan covenants and at present the Company's financial

situation does not suggest that any of these covenants are close to

being breached.

Furthermore, the Directors have considered in detail a number of

remedial measures that are open to the Company which it may take if

such a covenant breach appears possible. These include reducing

commitments and raising cash through engaging with the private

equity secondaries market. The Managers have considerable

experience in the private equity secondaries market through the

activities of the Company and through the management of other

private equity funds. The Directors have considered other actions

which the Company may take in the event that a covenant breach was

imminent including taking measures to increase the Company's asset

base through an issuance of equity either for cash or pursuant to

the acquisition of other private equity assets. The Directors have

also considered the likelihood of the Company making alternative

banking arrangements with its current lender or another lender.

Having considered the likelihood of the events which could cause a

covenant breach and the remedies available to the Company, the

Directors are of the view that the Company is well placed to manage

such an eventuality satisfactorily.

Based on this information the Directors believe that the Company

has the ability to meet its financial obligations as they fall due

for a period of at least twelve months from the date of approval of

these financial statements. Accordingly, these financial statements

have been prepared on a going concern basis.

9. These are not statutory accounts in terms of Section 434 of

the Companies Act 2006 and have not been audited or reviewed by the

Company's auditors. The information for the year ended 31 December

2022 has been extracted from the latest published financial

statements which received an unqualified audit report and have been

filed with the Registrar of Companies. No statutory accounts in

respect of any period after 31 December 2022 have been reported on

by the Company's auditors or delivered to the Registrar of

Companies. The Half-Year Report will be available shortly at the

Company's website address, www.ctprivateequitytrust.com.

For more information, please contact:

Hamish Mair (Fund Manager) 0131 718 1184

hamish.mair@columbiathreadneedle.com

Scott McEllen (Company Secretary) 0131 718 1137

scott.mcellen@columbiathreadneedle.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR QLLFLXVLZBBV

(END) Dow Jones Newswires

August 23, 2023 02:00 ET (06:00 GMT)

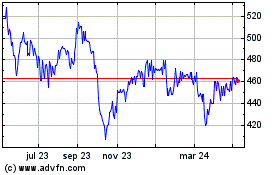

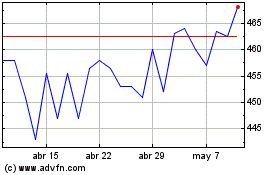

Ct Private Equity (LSE:CTPE)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Ct Private Equity (LSE:CTPE)

Gráfica de Acción Histórica

De May 2023 a May 2024