TIDMDELT

RNS Number : 2164A

Deltic Energy PLC

19 January 2024

Prior to publication, the information contained within this

announcement was deemed by the Company to constitute inside

information as stipulated under the UK Market Abuse Regulation.

With the publication of this announcement, this information is now

considered to be in the public domain.

Deltic Energy Plc / Index: AIM / Epic: DELT / Sector: Natural

Resources

19 January 2024

Deltic Energy Plc ("Deltic" or "the Company")

Pensacola Update and Competent Person's Report

Deltic Energy Plc, the AIM-quoted natural resources investing

company with a high impact exploration and appraisal portfolio

focused on the Southern North Sea, is pleased to present the

results of a Competent Person's Report (or "CPR") in relation to

the Pensacola Discovery on Licence P2252 in the Southern North Sea

in which Deltic holds a 30% interest.

Following completion of post-well analysis of data collected by

the 41/05a-2 discovery well, Deltic commissioned RPS Energy Ltd (or

"RPS") to undertake a technical review of the volumes and a

commercial review of the Pensacola discovery. This independent

assessment of Contingent Resources builds on the Company's previous

estimates of technically recoverable volumes and for the first time

illustrates the commercial potential of the Pensacola discovery

based on two potential development scenarios - a gas and oil (or

"combined") development and a gas only development. A copy of the

Summary CPR Report can be found here:

http://www.rns-pdf.londonstockexchange.com/rns/2164A_1-2024-1-18.pdf

Highlights

-- Maiden Contingent Resource estimate completed for the

Pensacola Zechstein Reef discovery by RPS, a leading provider of

CPR services in the UK

-- RPS estimates the Pensacola structure to contain gross P50

Hydrocarbons Initially in Place of 326 MMboe, in-line with Deltic's

previous estimate of 342 MMboe

-- RPS estimates 2C Contingent Resources, net to Deltic, of 21.8

MMboe in the combined case and 15 MMboe in the gas only case

-- Based on the two development scenarios assessed, RPS

estimates a 2C Post Tax NPV10 of USD$205M net to Deltic (combined

case) and USD$199M net to Deltic (gas only case)

-- These project NPV10 valuations equate to approximately 169p - 174p per Deltic share

-- Subsequent to the CPR work, appraisal well data from the

analogous Crosgan Zechstein discovery has been released that

supports the potential for thicker, higher quality reservoir across

the crest of Pensacola

-- Progress continues to be made on both the Pensacola and

Selene farm-out processes with a significant level of interest from

industry

Hydrocarbons Initially in Place

Prior to the drilling of an appraisal well, which is currently

planned for late 2024, RPS estimates of the Hydrocarbons Initially

in Place, as discovered by the 41/05a-2 well, are summarised in the

table below.

Hydrocarbon Type Units Gross Hydrocarbons Initially

in Place (6)

Low (P90) Best High Mean

(P50) (P10)

----------- -------- ------- -----

Free Gas(1) ,(2) Bscf 194 384 663 411

--------- ----------- -------- ------- -----

Oil (STOIIP)(2) MMstb 87 239 482 266

--------- ----------- -------- ------- -----

Associated Gas (2,3) Bscf 49 135 276 152

--------- ----------- -------- ------- -----

MMboe

Oil Equivalent (4,5) 128 326 636 360

--------- ----------- -------- ------- -----

(1) Raw gas - includes inerts

(2) Probabilistic sum of the hydrocarbons on the flank and

crest of the structure, volumes of which have been estimated

separately.

(3) Associated gas is gas dissolved in the oil leg

(4) Conversion rate of 6,000 Scf per boe.

(5) Arithmetic sum of hydrocarbons above.

(6) Deltic has a 30% working interest in Licence P2252 which

contains the Pensacola discovery and is operated by Shell

Possible Developments

Prior to the drilling of the planned appraisal well, a number of

uncertainties in relation to the potential development of the oil

volumes discovered at Pensacola remain and therefore Deltic

provided RPS with two possible development scenarios as summarised

below:

-- A combined oil and gas development requiring two separate

production platforms and six horizontal wells (three gas and three

oil producers) with hydrocarbons exported to Teesside via a new

pipeline.

-- A lower capex gas only development scenario comprising three

horizontal development wells producing via a normally unmanned

installation exporting gas through a new pipeline to Teesside.

Capital and operational costs for both scenarios were estimated

for Deltic by S&P Global and reviewed by RPS as part of the CPR

process. The gas only scenario assumes significantly lower capital

expenditure than that required to support the combined oil and gas

development.

Contingent Resources and Valuation of the Combined Gas and Oil

Development

The Contingent Resources (development pending) associated with

the oil and gas development scenario for Pensacola as estimated by

RPS are summarised in the table below:

Hydrocarbon Units Full Field Gross Deltic Net Working

Type Resources (1,2) Interest (3)

1C 2C 3C 1C 2C 3C

-------- -------- -------- ------- ------ -------

Gas Bscf 113.6 313.0 616.7 34.1 93.9 185.0

--------- -------- -------- -------- ------- ------ -------

Oil MMstb 4.7 19.8 50.9 1.4 5.9 15.3

--------- -------- -------- -------- ------- ------ -------

Condensate MMstb 0.2 0.6 1.4 0.1 0.2 0.4

--------- -------- -------- -------- ------- ------ -------

MMboe

Oil Equivalent (4) 23.9 72.6 155.1 7.2 21.8 46.5

--------- -------- -------- -------- ------- ------ -------

(1) Gross field contingent resources (100% basis) after economic

limit test after removal of 10% CO(2) and fuel and flare gas

(2) Chance of Development ("Pd") is the estimated probability

that a known accumulation, once discovered, will be commercially

developed. At this early stage in the project, given the understanding

of the range of volumes, of oil in particular, and the development

options still being considered, RPS consider assigning a chance

of development is premature

(3) Deltic holds a 30% working interest in P2252 which is

operated by Shell

(4) Conversion rate of 6,000 Scf per boe

Net Present Value ("NPV") estimates as of 1 January 2024 for the

combined oil and gas development as calculated by RPS, based on RPS

(Q4 2023) long term forecasts for Brent Crude (for oil and

condensate sales) and UK National Balancing Point (NBP) for sales

gas, are summarised below:

Combined ELT Date Post-Tax NPV - Net to Deltic(1)

Oil and USD$ Million (money of the day) at

Gas Case different Discount Rates

Discount Rate 0% 10% 12% 15%

--------- --------- --------- ---------

1C 2036 (29) (114) (121) (127)

--------- --------- --------- --------- ---------

2C 2048 792 205 148 84

--------- --------- --------- --------- ---------

3C 2058 2,236 566 437 296

--------- --------- --------- --------- ---------

(1) Deltic holds a 30% working interest in P2252

Contingent Resources and Valuation of the Gas Only

Development

The Contingent Resources (development pending) associated with

the gas only development scenario for Pensacola as estimated by RPS

are summarised in the table below:

Hydrocarbon Units Full Field Gross Deltic Net Working

Type Resources (1,2) Interest (3)

1C 2C 3C 1C 2C 3C

-------- -------- -------- ------- ------ -------

Gas Bscf 112.4 296.8 631.7 33.7 89.0 189.5

--------- -------- -------- -------- ------- ------ -------

Condensate MMstb 0.2 0.6 1.5 0.1 0.2 0.4

--------- -------- -------- -------- ------- ------ -------

MMboe

Oil Equivalent (4) 18.9 50.0 106.7 5.7 15.0 32.0

--------- -------- -------- -------- ------- ------ -------

(1) Gross field contingent resources (100% basis) after economic

limit test after removal of 10% CO(2) and fuel and flare gas

(2) Chance of Development ("Pd") is the estimated probability

that a known accumulation, once discovered, will be commercially

developed. At this early stage in the project, given the understanding

of the range of volumes, of oil in particular, and the development

options still being considered, RPS consider assigning a chance

of development is premature

(3) Deltic holds a 30% working interest in P2252 which is

operated by Shell

(4) Conversion rate of 6,000 Scf per boe

Net Present Value ("NPV") estimates as of 1 January 2024 for the

gas only development as calculated by RPS , based on RPS (Q4 2023)

long term forecasts for Brent Crude (for oil and condensate sales)

and UK National Balancing Point (NBP) for sales gas, are summarised

below:

Gas Only ELT Date Post-Tax NPV - Net to Deltic (1)

Case USD$ Million (money of the day) at

different Discount Rates

Discount Rate 0% 10% 12% 15%

------------ -------- -------- --------

1C 2034 124 20 8 (6)

--------- ------------ -------- -------- --------

2C 2044 599 199 158 111

--------- ------------ -------- -------- --------

3C 2058 1,664 412 323 226

--------- ------------ -------- -------- --------

(1) Deltic holds a 30% working interest in P2252

The gas only scenario recovers less hydrocarbons than the

combined case development but has a significantly lower capital and

operational cost base, resulting in similar 2C NPV10 valuations to

the combined development scenario.

Post CPR Regional Update

The 41/05a-2 well targeted the flank of the Pensacola structure

proving the presence of thinner flank dolomites sourced from the

erosion of dolomites deposited up-dip over the crest of the

structure. While thicker, better quality reservoir is predicted to

be present updip, the properties of the dolomite reservoir over the

crestal part of the field are one of the main uncertainties in the

estimate of both hydrocarbons in place and contingent resources for

Pensacola.

Following completion of the CPR, the North Sea Transition

Authority released summary well information for the Crosgan

Zechstein appraisal well drilled in early 2023 by ONE-Dyas, with

its JV partner Shell. Crosgan, located approximately 60km to the

east of Pensacola, is highly analogous to the Pensacola discovery

and the appraisal well (42/15a-4) drilled on the crest of the

Crosgan reef structure is reported to have encountered a

Hauptdolomit reservoir that was 140m thick and which flowed at a

maximum rate of 26.5 MMscf/day on test.

These positive well results further support Deltic's view that a

thicker, higher quality reservoir is likely to be present across

the crest of the Pensacola structure. The information from the

Crosgan offset well will be considered in future volumetric reviews

along with additional information collected during the drilling of

the Pensacola appraisal well later this year.

Farm-out Process Update

As previously communicated, Deltic continues to work on a number

of potential options to both realise value and mitigate exposure to

future drilling expenditure on both Pensacola and Selene and has

received a significant level of interest. Deltic is continuing to

engage with a number of different counterparties in relation to a

range of potential transactions on both of these assets and looks

forward to updating the market in due course.

Graham Swindells, Chief Executive of Deltic Energy,

commented:

"RPS's validation of our technical assessment of the Pensacola

discovery is another step forward for Deltic as we progress towards

drilling the appraisal well in late 2024. In particular, we are

pleased with the potential valuation that RPS ascribe to the

discovery net to Deltic, particularly within the context of our

current share price. It's clear that Pensacola is a regionally

significant hydrocarbon accumulation and we will continue to work

with our partners at Shell and ONE-Dyas to mature the opportunity

and optimise the potential development scenarios as we go

forward."

**S**

For further information please contact the following:

Deltic Energy Plc Tel: +44 (0) 20 7887

2630

Graham Swindells / Andrew Nunn / Sarah McLeod

Allenby Capital Limited (Nominated Adviser) Tel: +44 (0) 20 3328

5656

David Hart / Alex Brearley (Corporate Finance)

Stifel Nicolaus Europe Limited (Joint Broker) Tel: +44 (0) 20 7710

7600

Callum Stewart / Simon Mensley / Ashton

Clanfield

Canaccord Genuity Limited (Joint Broker) Tel: +44 (0) 20 7523

Adam James / Ana Ercegovic 8000

Vigo Consulting (IR Adviser) Tel: +44 (0) 20 7390

0230

Patrick d'Ancona / Finlay Thomson / K endall

Hill

Reporting Standard

Estimates of resources have been prepared in accordance with the

PRMS as the standard for classification and reporting.

Qualified Person's Review

Andrew Nunn, a Chartered Geologist and Chief Operating Officer

of Deltic, is a "Qualified Person" in accordance with the Guidance

Note for Mining, Oil and Gas Companies, June 2009 as updated 21

July 2019, of the London Stock Exchange. Andrew has reviewed and

approved the information contained within this announcement.

Glossary of Technical Terms

API: a measure of the density of

crude oil, as defined by the

American Petroleum Institute

1C: represents the low case estimates

of Contingent Resources as defined

by PRMS

-----------------------------------------

2C: represents the best case estimates

of Contingent Resources as defined

by PRMS

-----------------------------------------

3C: represents the high case estimates

of Contingent Resources as defined

by PRMS

-----------------------------------------

Bscf: Billion Standard Cubic Feet

-----------------------------------------

Contingent Resources: those quantities of petroleum

which are estimated, on a given

date, to be potentially recoverable

from known accumulations, but

which are not currently considered

to be commercially recoverable,

as defined by PMRS

-----------------------------------------

ELT: Economic Limit Test. The economic

limit is defined as the production

rate at the time when the maximum

cumulative net cash flow occurs

for a project.

-----------------------------------------

Mean or Pmean: Reflects a mid-case volume estimate

of resource derived using probabilistic

methodology. This is the mean

of the probability distribution

for the resource estimates and

may be skewed by resource numbers

with relatively low probabilities

-----------------------------------------

MMboe or million barrels of million barrels of oil equivalent.

oil equivalent: Gas is converted at a conversion

rate of 6,000 Scf per boe

-----------------------------------------

MMstb: million stock tank barrels

-----------------------------------------

MMscf: million standard cubic feet

-----------------------------------------

P90 resource: reflects a volume estimate that,

assuming the accumulation is

developed, there is a 90% probability

that the quantities actually

recovered will equal or exceed

the estimate. This is therefore

a low estimate of resource

-----------------------------------------

P50 resource: reflects a volume estimate that,

assuming the accumulation is

developed, there is a 50% probability

that the quantities actually

recovered will equal or exceed

the estimate. This is therefore

a median or best case estimate

of resource

-----------------------------------------

P10 resource: Reflects a volume estimate that,

assuming the accumulation is

developed, there is a 10% probability

that the quantities actually

recovered will equal or exceed

the estimate. This is therefore

a high estimate of resource

-----------------------------------------

PRMS: the June 2018 Society of Petroleum

Engineers ("SPE") Petroleum

Resources Management System

-----------------------------------------

Scf: standard cubic feet

-----------------------------------------

Stb: stock tank barrel

-----------------------------------------

STOIIP: stock tank oil initially in

place

-----------------------------------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDSFLFUAELSESF

(END) Dow Jones Newswires

January 19, 2024 02:00 ET (07:00 GMT)

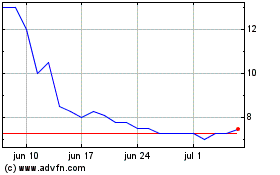

Deltic Energy (LSE:DELT)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Deltic Energy (LSE:DELT)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024