TIDMDLN

RNS Number : 3334Y

Derwent London PLC

04 May 2023

4 May 2023

Derwent London plc ("Derwent London" / "the Group")

FIRST QUARTER BUSINESS UPDATE

STRONG OPERATIONAL PROGRESS

Paul Williams, Chief Executive of Derwent London, said:

"London, particularly the West End, is busy and people are back

in the office. Occupier demand continues to favour amenity-rich,

well designed and sustainable space, evidenced by a strong Q1 with

GBP17.1m of new lettings across our portfolio on average 6.6% above

ERV. Our EPRA vacancy rate has reduced to 4.9% and we have made

good progress at our on-site developments."

Summary

Portfolio

-- Letting activity in Q1 totalled GBP17.1m at an average 6.6%

above December 2022 ERV. Key transactions in the period were:

o One Oxford Street W1 - 22,200 sq ft flagship retail letting to

Uniqlo

o 25 Baker Street W1 - 106,100 sq ft pre-let to PIMCO two years

ahead of completion

o The Featherstone Building EC1 - 31,100 sq ft letting to Buro

Happold

-- EPRA vacancy rate reduced to 4.9% at 31 March 2023 (31 December 2022: 6.4%)

-- Disposal in January of 19 Charterhouse Street EC1 for

GBP53.6m (after costs), GBP0.6m above December 2022 book value

Developments

-- Following the pre-let to PIMCO, 25 Baker Street W1 is 56%

pre-let or sold and construction works are now above ground

(completion due H1 2025)

-- At Network W1, demolition and piling are now complete and

basement works are underway (completion due H2 2025)

Financial position at 31 March 2023

-- EPRA LTV 23.1%(1) (31 December 2022: 23.9%)

-- Cash and undrawn facilities of GBP610m (31 December 2022: GBP577m)

(1) LTV based on 31 December 2022 property values and includes

the Group's share of joint ventures

For further information, please contact:

Derwent London Paul Williams, Chief Executive

Tel: +44 (0)20 7659 3000 Damian Wisniewski, Chief Financial

Officer

Robert Duncan, Head of Investor

Relations

Brunswick Group Nina Coad

Tel: +44 (0)20 7404 5959 Emily Trapnell

Webcast and conference call

There will be a webcast and conference call for investors and

analysts at 09.00 BST today. To participate in the call, please

register here .

Operational update (Appendices 1 & 2)

New leases totalling GBP17.1m on 190,600 sq ft of space were

achieved in Q1 2023 on average 6.6% above December 2022 ERV (8.3%

above ERV excluding short-term lettings). The weighted average

lease term (to break) of these lettings is 12.0 years. Key

transactions include:

-- One Oxford Street W1 (Soho Place) : 22,200 sq ft flagship

retail unit let to Uniqlo, comprising a base rent (subject to

annual indexation) plus turnover top-up, in line with December 2022

ERV.

-- 25 Baker Street W1 : 106,100 sq ft pre-let to PIMCO at an

annual rent of GBP11.0m, significantly above December 2022 ERV. The

development is scheduled for completion in H1 2025.

-- The Featherstone Building EC1 : 31,100 sq ft to Buro Happold

at an annual rent of GBP2.3m, in line with December 2022 ERV.

These transactions reflect the evolving nature of London's

office market. We believe our buildings are well placed to capture

current and future demand as the way businesses use their office

space changes in this dynamic environment.

Our EPRA vacancy rate reduced from 6.4% at 31 December 2022 to

4.9% at 31 March 2023, with GBP1.8m of rent either signed in Q2 to

date or under offer.

For the March quarter day, office rent collected to date stands

at 98%.

Capital recycling (Appendix 3)

In January, we announced the disposal of 19 Charterhouse Street

EC1 for net proceeds of GBP53.6m to a private investor. The

disposal price represents a 4.6% net initial yield out to lease

expiry in mid-2025 and was GBP0.6m ahead of the December 2022 book

value.

Development progress (Appendix 4)

The 25 Baker Street W1 project remains on budget and programme

with construction works now well above ground. Following the

pre-let to PIMCO in Q1 2023, the commercial element is now 56%

pre-let or pre-sold. We have fixed 97% of construction costs of the

office element (80% of the total) with the residential fit-out

costs still to be finalised.

At Network W1, the on-site works are making good progress with

demolition and piling works complete and basement works

underway.

Sustainability

New Minimum Energy Efficiency Standards (MEES) legislation for

commercial buildings came into effect in April 2023, requiring an

EPC of E or above. Our portfolio was already 100% compliant. In

addition, we are 85.7% compliant with 2027 MEES legislation (EPC C

or above) and 65.3% compliant with expected 2030 legislation (EPC B

or above).

Finance

Net debt decreased to GBP1,225.2m at 31 March 2023 from

GBP1,257.2m at 31 December 2022 with net disposal proceeds of

GBP53.6m offsetting capital expenditure in the period of GBP29.1m.

Payment of the final dividend of 54.5p per share is due on 2 June

2023.

The EPRA LTV ratio reduced through Q1 to 23.1% based on 31

December 2022 valuations, including the Group's share of joint

ventures, from 23.9% at 31 December 2022. Interest cover for Q1

2023 was 4.2 times (FY 2022: 4.2 times) and cash and undrawn

facilities totalled GBP610m at the quarter end. Neither of the

Group's revolving credit facilities, which total GBP550m, were

drawn at 31 March 2023. Accordingly, 100% of Group debt remains at

fixed rates, with a weighted average interest rate of 3.13% on a

cash basis. Our next refinancing is in October 2024, an GBP83m

secured facility with a coupon of 3.99%.

Appendix 1: Leasing activity in Q1 2023

Let Performance against

Dec 22 ERV (%)

Area Income

sq ft GBPm pa Open market Overall(1)

-------- --------- ------------ -----------

Q1 2023 190,600 17.1 8.3 6.6

-------- --------- ------------ -----------

(1) Includes short-term lettings at properties earmarked for

redevelopment

Appendix 2: Principal lettings in Q1 2023

Total annual Rent free

Property Tenant Area Rent rent Lease term Lease break equivalent

sq ft GBP psf GBPm Years Year Months

--------------- -------- ------------- ---------------- ----------- ------------ --------------

25 Baker

Street W1 PIMCO 106,100 103.40 11.0 15 - 37

The

Featherstone 24, plus 12

Building EC1 Buro Happold 31,100 74.40 2.3 15 10(1) if no break

Tea Building Jones Knowles 12, plus 12

E1 Ritchie 8,100 60.00 0.5 10 5 if no break

1 Soho Place

W1 Uniqlo 22,200 Confidential Confidential(2) 10 5 12

--------------- -------- ------------- ---------------- ----------- ------------ --------------

(1) There is an additional break at year 5 on level eight

subject to a 12-month rent penalty payable by the tenant

(2) Rent comprises base rent which is subject to annual

indexation, plus a turnover top-up

Appendix 3: Major disposals in Q1 2023

Property Date Area Net proceeds Net Net rental

sq ft GBPm yield income

% GBPm pa

19 Charterhouse Street EC1 Q1 2023 63,200 53.6 4.6 2.6

--------- ------- ------------- ------- -----------

Appendix 4: Major on-site development pipeline

Project Total 25 Baker Street W1 Network W1

Completion H1 2025 H2 2025

Office (sq ft) 350,000 218,000 132,000

Residential (sq ft) 52,000 52,000 -

Retail (sq ft) 33,000 28,000 5,000

Total area (sq ft) 435,000 298,000 137,000

Est. future capex(1) (GBPm) 324 217(3) 107

Total cost(2) (GBPm) 708 463 245

ERV (c.GBP psf) - 90 87.5

ERV (GBPm pa) 30.3 18.4(3) 11.9

Pre-let/sold area (sq ft) 137,100 137,100 (4) -

------------------------------------------- ------------------- ----------------

Embodied carbon intensity (kgCO2e/sqm)(5) c.600 c.530

------------------------------------------- ------------------- ----------------

Target BREEAM rating Outstanding Outstanding

------------------------------------------- ------------------- ----------------

Target NABERS rating 4 Star or above 4 Star or above

------------------------------------------- ------------------- ----------------

Green Finance Elected To be elected

------------------------------------------- ------------------- ----------------

(1) As at 31 December 2022. (2) Comprising book value at

commencement, capex, fees and notional interest on land, voids and

other costs. 25 Baker Street W1 includes a profit share to

freeholder, The Portman Estate. (3) Long leasehold, net of 2.5%

ground rent.

(4) Includes PIMCO pre-let, plus 19,000 sq ft courtyard retail

and 12,000 sq ft Gloucester Place offices pre-sale to The Portman

Estate. (5) Embodied carbon intensity estimate as at stage 4 or

5.

Notes to editors

Derwent London plc

Derwent London plc owns 70 buildings in a commercial real estate

portfolio predominantly in central London valued at GBP5.4 billion

as at 31 December 2022, making it the largest London office-focused

real estate investment trust (REIT).

Our experienced team has a long track record of creating value

throughout the property cycle by regenerating our buildings via

development or refurbishment, effective asset management and

capital recycling.

We typically acquire central London properties off-market with

low capital values and modest rents in improving locations, most of

which are either in the West End or the Tech Belt. We capitalise on

the unique qualities of each of our properties - taking a fresh

approach to the regeneration of every building with a focus on

anticipating tenant requirements and an emphasis on design.

Reflecting and supporting our long-term success, the business

has a strong balance sheet with modest leverage, a robust income

stream and flexible financing.

As part of our commitment to lead the industry in mitigating

climate change, Derwent London has committed to becoming a net zero

carbon business by 2030, publishing its pathway to achieving this

goal in July 2020. In 2019 the Group became the first UK REIT to

sign a Revolving Credit Facility with a 'green' tranche. At the

same time, we also launched our Green Finance Framework and signed

the Better Buildings Partnership's climate change commitment. The

Group is a member of the 'RE100' which recognises Derwent London as

an influential company, committed to 100% renewable power by

purchasing renewable energy, a key step in becoming a net zero

carbon business. Derwent London is one of the property companies

worldwide to have science-based carbon targets validated by the

Science Based Targets initiative (SBTi).

Landmark buildings in our 5.5 million sq ft portfolio include 1

Soho Place W1, 80 Charlotte Street W1, Brunel Building W2, White

Collar Factory EC1, Angel Building EC1, 1-2 Stephen Street W1,

Horseferry House SW1 and Tea Building E1.

In January 2022 we were proud to announce that we had achieved

the National Equality Standard - the UK's highest benchmark for

equality, diversity and inclusion. In October 2022, 80 Charlotte

Street won the BCO's Best National Commercial Workplace award 2022.

In March 2023 we placed in the top three of the Property Sector in

Management Today's Britain's Most Admired Companies awards 2022. In

2013 the Company launched a voluntary Community Fund which has to

date supported over 150 community projects in the West End and the

Tech Belt.

The Company is a public limited company, which is listed on the

London Stock Exchange and incorporated and domiciled in the UK. The

address of its registered office is 25 Savile Row, London, W1S

2ER.

For further information see www.derwentlondon.com or follow us

on Twitter at @derwentlondon

Forward-looking statements

This document contains certain forward-looking statements about

the future outlook of Derwent London. By their nature, any

statements about future outlook involve risk and uncertainty

because they relate to events and depend on circumstances that may

or may not occur in the future. Actual results, performance or

outcomes may differ materially from any results, performance or

outcomes expressed or implied by such forward-looking

statements.

No representation or warranty is given in relation to any

forward-looking statements made by Derwent London, including as to

their completeness or accuracy. Derwent London does not undertake

to update any forward-looking statements whether as a result of new

information, future events or otherwise. Nothing in this

announcement should be construed as a profit forecast.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDUOSNROOUVRAR

(END) Dow Jones Newswires

May 04, 2023 02:00 ET (06:00 GMT)

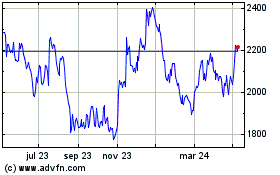

Derwent London (LSE:DLN)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

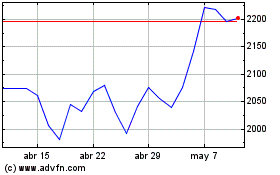

Derwent London (LSE:DLN)

Gráfica de Acción Histórica

De May 2023 a May 2024