Eurocell plc Trading Update (2456S)

13 Julio 2022 - 1:00AM

UK Regulatory

TIDMECEL

RNS Number : 2456S

Eurocell plc

13 July 2022

13 July 2022

EUROCELL PLC

("Eurocell" or the "Group")

Trading Update - Good First Half and Trading in Line with

Expectations

Eurocell plc, the market leading, vertically integrated UK

manufacturer, recycler and distributor of innovative window, door

and roofline PVC products, provides the following update for the

six months ended 30 June 2022.

Trading Performance

The repair, maintenance and improvement (RMI) market remains

robust, with a greater emphasis on project specific work, rather

than the higher levels of maintenance activity experienced last

year. A backlog in planning permissions, driven by house moves, as

well as hybrid working and changing lifestyle patterns, continue to

support sales, partly funded by elevated levels of consumer

savings. In new build, the market continues to be strong, supported

by ongoing Government initiatives.

Our sales growth rates for the six months to 30 June 2022 were

as follows:

Sales growth vs 2021 vs 2019

Total Group 13% 40%

Profiles Division 17% 39%

Building Plastics Division 11% 40%

-------- --------

We have kept pace with an exceptionally strong comparative

period and have made substantial progress compared to the

equivalent period of 2019. We continue to take effective action to

offset input cost inflation, with a dynamic approach to selling

price increases and surcharges. Price therefore remains a key

driver of sales growth, but we believe resin costs have now

plateaued.

We believe we are continuing to take market share, reflecting

the impact of maturing branches, a widening product range

(including our outdoor living range of fencing, decking and garden

rooms) and excellent customer service, supported by our recent

investments in manufacturing and warehousing capacity and

technology, where operating efficiencies are improving. Our

pipeline of potential new fabricator customers is strong.

As a result of these factors, and notwithstanding uncertainty

over how the macroeconomic backdrop may impact future demand, we

continue to trade in line with expectations.

Net debt at 30 June 2022 on a pre-IFRS 16 basis was GBP15

million (31 December 2021: GBP11 million), which includes the

substantial impact of inflation on working capital.

Half Year Results

We look forward to providing a full update when we announce our

half year results for the six months ending 30 June 2022 on 1

September 2022.

Enquiries:

Eurocell plc

Mark Kelly, Chief Executive

Officer +44 (0) 1773 842 105

Michael Scott, Chief Financial

Officer +44 (0) 1773 842 140

Teneo

Ben Foster +44 (0) 777 624 0806

Camilla Cunningham +44 (0) 746 498 2426

END

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTBRGDRLXBDGDD

(END) Dow Jones Newswires

July 13, 2022 02:00 ET (06:00 GMT)

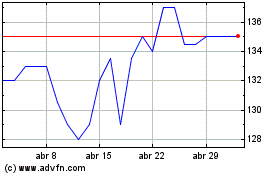

Eurocell (LSE:ECEL)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Eurocell (LSE:ECEL)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024