TIDMECHO

RNS Number : 2312O

Echo Energy PLC

29 September 2023

Certain of the information contained within this announcement is

deemed by the Company to constitute inside information as

stipulated under The Market Abuse Regulation (EU 596/2014) pursuant

to the Market Abuse (Amendment) (EU Exit) Regulations 2018. Upon

the publication of this announcement via a Regulatory Information

Service ("RIS"), this inside information is now considered to be in

the public domain.

29 September 2023

Echo Energy plc

("Echo Energy", "Echo" or the "Company")

Publication of Annual Report and Accounts, Notice of General

Meeting

Resumption of Share Trading and Equity Raise

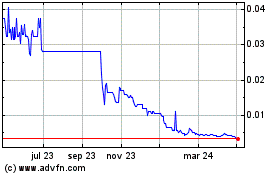

Echo Energy PLC is pleased to announce its results for the year

ended 31 December 2022. In a separate announcement being issued

today, the Company will also publish its interim results for the

period ended 30 June 2023. The Company understand that following

publication of its results, the suspension its Shares from trading

on the AIM market of the London Stock Exchange will be lifted at

7.30am on Monday 2 October 2023.

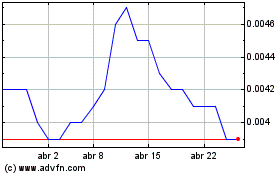

Furthermore, the Company is pleased to announce an equity raise,

following the approach from an existing shareholder, to raise gross

proceeds of GBP80,000 through the issue of 285,714,286 new ordinary

shares in the Company at an issue price of 0.028p per new ordinary

share, being the last closing price of the Company's ordinary

shares prior to their suspension.

The proceeds from the share issue will enable the Company's

existing financial resources to be focused on pursuing the

previously announced growth strategy and application for the new

ordinary shares, which will rank pari passu with the Company's

existing ordinary shares, to be admitted to AIM at 8.00 a.m. on or

around 6 October 2023 ("Admission").

Following Admission, the Company's total issued ordinary share

capital will consist of 5,961,717,451 Ordinary Shares with one

voting right per share. The Company does not hold any Ordinary

Shares in treasury. Accordingly, the total number of voting rights

in the Company is 5,961,717,451. The above figure of 5,961,717,451

may be used by shareholders as the denominator for the calculations

by which they will determine if they are required to notify their

interest in, or a change to their interest in the Company under the

FCA's Disclosure Guidance and Transparency Rules.

The Company also announces that following completion of due

diligence and identification of other more exciting opportunities

which it is actively pursuing, that it has declined to take forward

its previously announced option to farm into an opportunity in

Columbia.

In conjunction with the announcement of the results for the year

ended 31 December 2022, the Company is pleased to confirm that its

audited 2022 Annual report and accounts have now been published,

are being sent to shareholders and are available on the Company's

website at www.echoenergyplc.com together with a notice convening a

general meeting of the Company to be held at 14.00 on 31 October

2023 at the offices of Field Fisher LLP, Riverbank House, 2 Swan

Lane, London EC4R 3TT.

Following the successful completion of the transaction to

partially divest of the Company's assets in Argentina, Echo has

undertaken a rigorous cost reduction programme with ongoing fixed

G&A costs reduced by approximately 40%. Cash management remains

a priority and the Company continues to work with suppliers and

creditors closely. Total cash, cash equivalent and other short term

liquid assets (after the placing) are circa GBP415,000 of which

approximately GBP230,000 is held in shares of Interoil Exploration

and Production ASA and the cash balance after receipt of the

placing proceeds will be approximately GBP185,000.

Progress at the Company's assets in Argentina continues with the

operator finalising investment plans to increase production in

conjunction with improved commercial arrangements to reflect the

improving energy market outlook and prices in Argentina and

globally. Gross production in August was approximately 1,600 BOEPD

(c. 80 BOEPD net to Echo's 5% interest) .

The Company is actively pursuing long term growth strategies and

expects to make announcements updating on these efforts in the

future.

Change of Name of Nominated Adviser

The Company also announces that its Nominated Adviser has

changed its name to Cavendish Securities plc following completion

of its own corporate merger.

Echo Energy via Vigo Consulting

Martin Hull, Chief Executive Officer

Vigo Consulting (IR & PR Advisor)

Patrick d'Ancona

Finlay Thomson +44 (0) 20 7390 0230

Cavendish Securities (Nominated Adviser)

Ben Jeynes

Adrian Hadden +44 (0) 20 7397 8900

Zeus (Corporate Broker)

Simon Johnson +44 (0) 20 3829 5000

Chairman's and Chief Executive Officer's Statement

Chairman and Chief Executive Statement:

Echo Energy, similar to many companies in the oil and gas

sector, faced exceptional challenges during recent years, with the

global pandemic impacting all aspects of the Company's operations

and finances in Argentina. The Company emerged from the COVID-19

period (during which the assets were sub economic) with a large

creditor position, 100%+ per annum inflation in Argentina and

Argentine currency exchange controls, which have prevented funds

being withdrawn from the country without significant penalties. As

a result of these factors, the raising of additional equity for an

Argentine business was challenging and the Company took the

decision in November 2022 to partially sell its Santa Cruz Sur

portfolio.

This partial sale enabled to the Company to:

-- Address its near-term funding challenges by providing near

term cash, enabling the Company to transfer to Buyers the

significant in-country creditors which had built up during the

COVID-19 period and providing access to funding for the Santa Cruz

assets.

-- Benefit from continued exposure (both directly through the

retained 5% working interest, the contingent payments, the further

5% option and the indirect holding in the Operator) to a

well-funded Santa Cruz portfolio, with the concessions likely to be

extended as a result of the provision of guarantee.

The Company, now with significantly reduced creditors and a

heavily reduced cost base, sits with a 5% interest in a producing

Santa Cruz Sur portfolio and an equity position in the operator

InterOil Exploration and Production ASA. In addition to the

divestment the Company successfully completed a restructuring of

its legacy debt position, converting the majority of previously

outstanding debt into equity, substantially improving the balance

sheet and providing the additional flexibility to best manage the

financial requirements going forward. The Board see significant

opportunities at this point in the economic cycle to secure new

energy assets at attractive valuations and is currently exploring a

number of these opportunities.

James Parsons Martin Hull

Non-Executive Chairman Chief Executive Officer

Financial Review

Income Statement

The Group's loss from continuing operations for the year to 31

December 2022 was US $4.4 million (2021: US $1.9 million) and total

Group loss including discontinued operations was of US $9.6million

(2021: US $11.8 million).

For the year ended 31 December 2022, Group revenue (including

within discontinued operations) was US $14.1 million (2021: US

$11.1 million), The spilt between the two commodity revenue sources

were;

Ø Oil sales - US $ 5.4 million (2021: $4.1 million)

Ø Gas sales- US $ 8.7 million (2021: $7.0 million)

The increase in Oil sales was a result of some wells re-opening

and production increasing combined with price increases.

Group operational costs (including within discontinued

operations) were US $18.3 million (2021: US $13.4 million).,

Ø Exploration expenses of US $0.3 million (2021: US $0.2

million) relates to on-going business development activity in Latin

America before the decision was made to divest of the SCS

operations.

Ø Gross administration expenses were US $3.0 million (2021: US

$2.5 million)

Ø Finance costs are largely composed of interest payable and

unwinding of discount costs of US $3.0 million (2021: US $3.4

million), and the amortisation of debt fees.

Balance Sheet

Careful management of cash balances, successful debt

renegotiation and equity fund raises supported business flexibility

and stability. The Group ended the year with US $1.1 million cash

at bank compared to the prior year balance of US $0.7 million.

The balance sheet reflects the Board's commitment in December

2022, to divest of the SCS operations. Accordingly, assets and

liabilities of the operations in Argentina have been separated out

within the balance sheet and the accounts.

Post Balance Sheet

Note 25 to 27 provides more detail around some of the extensive

debt restructuring in 2022, as well as raising funds through share

issues.

In particular, the reduction in amount, extension of the

repayment date for the Euro bonds to 2032 and reduction in interest

rate from 8% to 2% relieve a funding pressure on the business.

This Strategic Report was approved by the Board on 29 September

2023 and signed on its behalf by:

Martin Hull

Chief Executive Officer

29 September 2023

Financial Statements

Consolidated Statement of Comprehensive Income

Year ended 31 December 2022

Year to Year to

31 December 31 December

Notes 2022 2021

US $ US $

--------------------------------------- -------- ------------- ---------------

Continuing operations

Revenue 4 86 23,318

Cost of sales 5 - -

--------------------------------------- -------- ------------- ---------------

Gross profit 86 23,318

Exploration expenses - -

Administrative expenses (2,951,806) (2,454,739)

Operating loss 6 (2,951,720) (2,431,421)

Financial income 8 1,618,844 4,105,983

Financial expense 9 (2,981,409) (3,630,649)

Derivative financial gain - 62,477

--------------------------------------- -------- ------------- ---------------

Loss before tax (4,314,285) (1,893,610)

Taxation 12 (68,142) -

--------------------------------------- -------- ------------- ---------------

Loss from continuing operations (4,382,427) (1,893,610)

Discontinued operations

Loss after taxation for the year

from discontinued operations 11 (5,204,409) (9,876,301)

--------------------------------------- -------- ------------- ---------------

(9,586,836

Loss for the year ) (11,769,911)

Other comprehensive income:

Other comprehensive income to be

reclassified to profit or loss in

subsequent periods (net of tax)

Exchange difference on translating

foreign operations - 211,820

--------------------------------------- -------- ------------- ---------------

Total comprehensive loss for the (9,586,836

year ) ( 11,558,091)

--------------------------------------- -------- ------------- ---------------

Loss attributable to: (9,586,836 ( 11,558,091

Owners of the parent ) )

--------------------------------------- -------- ------------- ---------------

Total comprehensive loss attributable

to: (9,586,836 ( 11,558,091

Owners of the parent ) )

--------------------------------------- -------- ------------- ---------------

Loss per share (US cents) 13

Basic (0.50) (0.78)

--------------------------------------- -------- ------------- ---------------

Diluted (0.50) (0.78)

--------------------------------------- -------- ------------- ---------------

Loss per share (cents) for continuing

operations

Basic (0.27) (0.15)

--------------------------------------- -------- ------------- ---------------

Diluted (0.27) (0.15)

--------------------------------------- -------- ------------- ---------------

The notes form an integral part of these financial

statements.

Consolidated Statement of Financial Position

Year ended 31 December 2022

31 December 31 December

Notes 2022 2021

US $ US $

Total

--------------------------------- -------- -------------- --------------

Non-current assets

Property, plant and equipment 15 2,299 2,674,405

Intangibles assets 16 - 7,131,907

--------------------------------- -------- -------------- --------------

2,299 9,806,312

--------------------------------- -------- -------------- --------------

Current Assets

Inventories 18 - 1,365,225

Trade and other receivables 19 769,551 2,108,438

Cash and cash equivalents 20 1,132,616 742,339

--------------------------------- -------- -------------- --------------

1,902,166 4,216,002

Assets of disposal group

held for sale 10 18,739,291 --

Total Assets 20,643,756 14,022,314

Current Liabilities

Trade and other payables 22 (1,329,991) (16,023,500)

(1,329,991) (16,023,500)

Liabilities of disposal

group held for sale 10 (29,620,264) -

Non-current liabilities

Loans due in over one

year 26 (5,463,301) (28,768,380)

Provisions 27 - (3,039,911)

(5,463,301) (31,808,291)

Total Liabilities (36,413,556) (47,831,791)

--------------------------------- -------- -------------- --------------

Net Liabilities (15,769,800) (33,809,477)

--------------------------------- -------- -------------- --------------

Equity attributable to

equity holders of the

parent

Share capital 24 19,795,863 7,209,086

Shares not issued 24 97,523 -

Share premium 25 83,790,504 64,977,243

Capital contribution 7,212,492 -

reserve

Warrant reserve 24 1,433,428 12,177,786

Share option reserve 24 644,560 1,522,499

Foreign currency translation

reserve (3,481,041) (3,531,587)

Retained earnings (125,263,129) (116,164,504)

Total Equity (15,769,800) (33,809,477)

--------------------------------- -------- -------------- --------------

These financial statements were authorised for issue and

approved by the board of directors on 29 September 2023

Martin Hull

Company registration number 05483127

The notes form an integral part of these financial

statements.

Company Statement of Financial Position

Year ended 31 December 2022

31 December 31 December

Notes 2022 2021

US $ US $

-------------------------------- -------- -------------- -------------

Non-current assets

Property, plant and

equipment 15 1 2,177

Intangible assets 16 - 445,585

Interest in subsidiary

undertakings 17 1,562,321 16,005,044

Amounts receivable

from Group undertakings 10 - 11,813,525

-------------------------------- -------- -------------- -------------

1,562,322 28,266,330

-------------------------------- -------- -------------- -------------

Current assets

Other receivables 19 234,178 172,589

Cash and cash equivalents 20 146,928 37,007

-------------------------------- -------- -------------- -------------

381,106 209,596

-------------------------------- -------- -------------- -------------

Total assets 1,943,428 28,475,926

Current liabilities

Trade and other payables 22 (944,369) (864,697)

(944,369) (864,697)

-------------------------------- -------- -------------- -------------

Non-current liabilities

Loans due in over

one year 26 (5,463,301) (28,768,380)

-------------------------------- -------- -------------- -------------

Total Liabilities (6,407,670) (29,633,077)

-------------------------------- -------- -------------- -------------

Net Liabilities (4,464,242) (1,157,151)

-------------------------------- -------- -------------- -------------

Equity

Share capital 24 19,795,863 7,209,086

Shares not issued 24 97,523 -

Share premium 25 83,790,504 64,977,243

Capital contribution 7,212,492 -

reserve

Warrant reserve 24 1,433,428 12,177,786

Share option reserve 24 644,560 1,522,499

Foreign currency translation

reserve (2,228,569) (2,255,402)

Retained earnings (115,210,043) (84,788,363)

Equity Shareholders'

Funds (4,464,242) (1,157,151)

-------------------------------- -------- -------------- -------------

These financial statements were authorised for issue and

approved by the board of directors on 29 September 2023.

The Company has not presented its own profit and loss account.

Its loss for the year was

US $30,909,889 (2021: US $10,045,487).

Martin Hull

Company registration number 05483127

The notes form an integral part of these financial

statements.

Consolidated Statement of Changes in Equity

Year ended 31 December 2022

Foreign

Capital Share currency

Share Shares Share contribution Warrant option translation

Retained capital to be premium reserve reserve reserve reserve Total

earnings US $ issued US $ US $ US $ US $ US $ equity

US $ US US $

$

--------------- -------------- ----------- -------- ----------- -------------- ------------- ------------ ------------- -------------

1 January 2021 (104,772,035) 6,288,019 - 64,961,905 - 11,373,966 1,417,285 (3,319,767) (24,050,627)

Loss for the

year (1,681,991) - - - - - - (1,681,991)

Discontinued

operations (9,876,301) - - - - - - (9,876,301)

Exchange

Reserve - - - - - - (211,820) (211,820)

--------------- -------------- ----------- -------- ----------- -------------- ------------- ------------ ------------- -------------

Total

comprehensive

loss

for the year (11,558,292) - - - - - - (211,820) (11,770,112)

New shares

issued - 646,265 - 813,207 - - - 1,459,472

Warrants

exercised - 274,803 - 105,484 - (19,362) - - 360,925

Warrants - - - (823,182) - 823,182 - - -

Share issue

costs - - - (80,173) - - (80,173)

Share options

lapsed 165,824 - - - - - (165,824) - -

Share-based

payments - - - - - - 271,038 - 271,038

--------------- -------------- ----------- -------- ----------- -------------- ------------- ------------ ------------- -------------

31 December

2021 (116,164,503) 7,209,087 - 64,977,241 - 12,177,786 1,522,499 (3,531,587) (33,809,477)

--------------- -------------- ----------- -------- ----------- -------------- ------------- ------------ ------------- -------------

1 January 2022 (116,164,503) 7,209,086 - 64,977,243 - 12,177,786 1,522,499 (3,531,587) (33,809,477)

Loss for the

year (4,382,425) - - - - - - (4,382,425)

Discontinued

operations (5,204,409) - - - - - - (5,204,409)

Exchange

Reserve - - - - - - 50,546 50,546

Total

comprehensive

loss

for the year (9,586,834) - - - -- - - 50,546 (9,536,288)

New shares

issued - 12,586,777 - 7,521,415 - - - 20,108,192

Capital

contribution

on debt

restructuring - - - - 7,212,492 - - - 7,212,492

Cash received

for shares

not issued 97,523 97,523

Warrants

lapsed (547,488) - - - - 547,488 - - -

Warrants

issued - - - 11,291,846 - (11,291,846) - - -

Share options

lapsed 1,035,696 - - - - - (1,035,696) - -

Share-based

payments - - - - - - 157,757 - 157,757

--------------- -------------- ----------- -------- ----------- -------------- ------------- ------------ ------------- -------------

31 December

2022 (125,263,129) 19,795,863 97,523 83,790,504 7,212,492 1,433,428 644,560 (3,481,041) (15,769,800)

--------------- -------------- ----------- -------- ----------- -------------- ------------- ------------ ------------- -------------

The notes form an integral part of these financial

statements.

Company Statement of Changes in Equity

Year ended 31 December 2022

Foreign

Capital currency

Retained Share Shares Share contribution Warrant Share translation

earnings capital to be Premium reserve reserve option reserve Total

US $ US $ issued US $ US $ US $ reserve US $ equity

US US $ US $

$

--------------- -------------- ----------- -------- ----------- -------------- ------------- ------------ ------------ -------------

1 January 2021 (82,993,147) 6,288,019 64,961,905 11,373,966 1,417,285 (2,255,402) (1,207,374)

Loss for the

year (1,961,039) - - - - - (1,961,039)

New shares

issued - 646,264 813,207 - - - 1,459,471

Warrants

exercised - 274,803 105,484 (19,362) - - 360,925

Warrants

issued - - (823,182) 823,182 - - -

Share issue

costs - - (80,171) - - (80,171)

Share options

lapsed 165,824 - - - (165,824) - -

Share-based

payments - - - 271,038 - 271,038

--------------- -------------- ----------- -------- ----------- -------------- ------------- ------------ ------------ -------------

31 December

2021 (84,788,362) 7,209,086 64,977,243 12,177,786 1,522,499 (2,255,402) (1,157,151)

--------------- -------------- ----------- -------- ----------- -------------- ------------- ------------ ------------ -------------

1 January 2022 (84,788,362) 7,209,086 64,977,243 12,177,786 1,522,499 (2,255,402) (1,157,151)

Loss for the

year (30,115,152) - - - - - (30,115,152)

Discontinued

operations (794,736) - - - - - (794,736)

Exchange

reserve 26,834 26,834

--------------- -------------- ----------- -------- ----------- -------------- ------------- ------------ ------------ -------------

Total

comprehensive

loss for the

year (30,909,889) - - - - 26,834 (30,883,055)

New shares

issued - 12,586,777 7,521,415 - - - 20,108,192

Capital

contribution

on debt

restructuring 7,212,492 7,212,492

Cash received

for shares

not issued 97,523 97,523

Warrants

lapsed (547,488) - - - 547,488 - - -

Warrants

issued - - 11,291,846 (11,291,846) - - -

Share options

lapsed 1,035,696 - - - (1,035,696) - -

Share-based

payments - - - - 157,757 - 157,757

--------------- -------------- ----------- -------- ----------- -------------- ------------- ------------ ------------ -------------

31 December ( 115,210,043

2022 ) 19,795,863 97,523 83,790,504 7,212,492 1,433,428 644,560 (2,228,569) (4,464,242)

--------------- -------------- ----------- -------- ----------- -------------- ------------- ------------ ------------ -------------

Share premium represents the amounts subscribed for share

capital in excess of the nominal value of the shares issued, net of

cost of issue.

Capital Contribution Reserve represents a contribution to Group

made as part of the 2022 debt restructuring, through forgiveness of

debt.

Warrant reserve represents the cumulative fair value of share

warrants granted which are not lapsed, cancelled or exercised.

Share options reserve represents the cumulative fair value of

share options granted.

Foreign currency translation reserve arises on the retranslation

of the prior period results and financial position of foreign

operations into presentation currency.

Retained earnings represents the cumulative net gains and losses

recognised in the income statement.

The notes form an integral part of these financial statements

.

Consolidated Statement of Cash Flows

Year ended 31 December 2022

Year to Year to

31 December 31 December

2022 2021

US $ US $

------------------------------------------- --- ------------- -------------

Cash flows from operating activities

( 1,893,811

Loss from continuing operations (4,382,425) )

Loss from discontinued operations (5,204,409) (9,664,481)

------------------------------------------------ ------------- -------------

(9,586,834) (11,558,292)

Adjustments for:

Depreciation and depletion of

property, plant and equipment 16,537 127,656

Depreciation and depletion of

intangible assets 1,419,193 1,498,431

Loss on disposal of property,

plant and equipment - 1,858

Impairment of intangible assets 506,818 -

and goodwill

Share-based payments 157,757 271,038

Right of use liability - -

Financial income - (4,355,334)

Financial expense 2,980,994 8,993,432

Exchange differences (1,582,441) (5,612,490)

Derivative financial gain - (62,477)

------------------------------------------------ ------------- -------------

Total adjustments 3,498,858 862,114

Decrease/(Increase) in inventory 863,196 (823,995)

(Increase)/Decrease in other receivables 978,758 5,120,825

increase in trade and other payables 2,150,092 5,072,974

------------------------------------------------ ------------- -------------

Total working capital movement 3,992,046 9,369,804

Net cash used in operating activities (2,095,912) (1,326,374)

Cash flows from investing activities

Purchase of intangible assets (61,233) (118,716)

Purchase of property, plant and

equipment (217,578) (251,226)

------------------------------------------------ ------------- -------------

Net cash used in investing activities (278,811) (369,942)

Cash flows from financing activities

Interest received - 249,351

Bank fees and other finance costs - (169,991)

Issue of share capital 2,714,574 1,459,472

Share issue costs - (80,171)

Warrants exercise - 360,925

------------------------------------------------ ------------- -------------

Net cash from financing activities 2,714,574 1,819,586

------------------------------------------------ ------------- -------------

Net increase in cash and cash equivalents 339,853 123,270

Cash and cash equivalents at 1

January 742,339 682,159

------------------------------------------------ ------------- -------------

Foreign exchange gains/(losses)

on cash and cash equivalents 50,424 (63,090)

------------------------------------------------ ------------- -------------

Cash and cash equivalents at 31

December 1,132,616 742,339

------------------------------------------------ ------------- -------------

The notes form an integral part of these financial

statements.

Company Statement of Cash Flows

Year ended 31 December 2022

Year to Year to

31 December 31 December

2022 2021

US $ US $

--------------------------------------- ------------- -------------

Cash flows from operating activities

Loss from continuing operations (5,081,487) (1,961,039)

Loss from discontinued operations - -

--------------------------------------- ------------- -------------

Loss before taxation (5,081,487) (1,961,039)

Adjustments for:

Depreciation of property, plant

and equipment 2,176 5,862

Impairment of intangible assets

and goodwill 506,818 118,716

Share-based payments 157,757 271,038

Exchange differences (1,582,441) -

Financial expense 2,980,994 (475,965)

Derivative financial gain - (62,477)

---------------------------------------- ------------- -------------

(2,065,304 (142,826)

(Increase)/Decrease in other

receivables (61,589) (16,555)

(Decrease)/Increase in trade

and other payables (79,672) (142,872)

Decrease/(Increase) in amounts

owing by subsidiary undertakings 454,680 690,583

---------------------------------------- ------------- -------------

472,763 531,156

Net cash used in operating activities (6,674,028) (1,572,709)

Cash flows from investing activities

Purchase of intangible assets (61,233) (118,716)

Net cash (used in)/from investing

activities (61,233) (118,716)

Cash flows from financing activities

Issue of share capital 2,714,574 1,459,472

Share issue costs - (80,171)

---------------------------------------- ------------- -------------

Net cash from financing activities 2,617,052 1,379,301

---------------------------------------- ------------- -------------

Net (decease)/increase in cash

and cash equivalents 109,922 (312,124)

Cash and cash equivalents at

1 January 37,008 437,230

---------------------------------------- ------------- -------------

Foreign exchange gains/(losses)

on cash and cash equivalents - (88,099)

---------------------------------------- ------------- -------------

Cash and cash equivalents at

31 December 146,930 37,008

---------------------------------------- ------------- -------------

The notes form an integral part of these financial

statements.

Notes to the Financial Statements

Year ended 31 December 2022

1. Accounting Policies

General Information

The Company is registered, and domiciled, in England and Wales

and incorporated under the Companies Act 2006. The nature of the

Company's operations and its principal activities are set out in

the Directors' Report.

The financial information set out above does not constitute the

Group's statutory financial statements for 2022 or 2021 but is

derived from these financial statements. Statutory financial

statements for 2021 have been delivered to the Registrar of

Companies and those for 2022 will be delivered shortly. The

statutory financial statements for the year ended 31 December 2022

included a disclaimer of opinion. Further details are included in

the independent auditors' report included within the financial

statements.

The Company's functional currency is the United States dollar

(US $). Transactions arising in currencies other than the US $ are

translated at average exchange rates for the relevant accounting

period, with material transactions being accounted at the rate of

exchange on the date of the transaction.

The Group presents its financial information in US $. The

results and position of subsidiary undertakings that have a

different functional currency to US $ are treated as follows:

Ø Assets and liabilities for each financial reporting date

presented are translated at the closing rate of that financial

reporting period.

Ø Income and expenses for each income statement (including

comparatives) is translated at exchange rates at the dates of

transactions. For practical reasons, the Company applies straight

average exchange rates for the period.

Ø All resulting changes are recognised as a separate component

of equity.

Ø Equity items are translated at exchange rates at the dates of

transactions.

The principal accounting policies are summarised below:

(a) Basis of preparation

The financial statements have been prepared in accordance with

UK-adopted international accounting standards. These financial

statements are for the year 1 January 2022 to 31 December 2022. The

comparatives shown are for the year 1 January 2021 to 31 December

2021

New standards and interpretations not applied

At the date of authorisation of these financial statements, a

number of standards and interpretations were in issue but not yet

effective. The directors do not anticipate that the adoption of

these standards and interpretations, or any amendments to existing

standards as a result of the annual improvements cycle, will have a

material effect on the financial statements in the year of initial

application.

(b) Basis of consolidation

The Group financial statements consolidate the financial

statements of the Company and its subsidiaries under the

acquisition method. The financial statements of subsidiaries are

included in the consolidated financial statements from the date

that control commences until the date control ceases. Control is

achieved where the Company has the power to govern the financial

and operating policies of an investee entity so as to obtain

benefits from its activities.

(c) Joint Arrangements

A joint arrangement is one in which two or more parties have

joint control. Joint control is the contractually agreed sharing of

control of an arrangement, which exists only when decisions about

the relevant activities require the unanimous consent of the

parties sharing control. Certain of the Group's licence interests

are held jointly with others. Accordingly, when the company holds a

majority stake, the Group accounts for its share of assets,

liabilities, income and expenditure of these joint operations,

classified in the appropriate statement of financial position and

income statement headings.

Where the Group's interest is in a minority, relinquishing

control and having only a right to profits, with an indemnity

against future costs, the Group account on an investment basis,

only recognising income on receipt of, effectively, dividend

income.

(d) Revenue

Revenue comprises the invoice value of goods and services

supplied by the Group, net of value added taxes and trade

discounts. Revenue is recognised in the case of oil and gas sales

when goods are delivered and title has passed to the customer. This

generally occurs when the product is physically transferred into a

pipeline or vessel. Echo recognised revenue in accordance with IFRS

15. Our joint venture partner markets gas and crude oil on our

behalf. Gas is transferred via a metred pipeline into the regional

gas transportation system, which is part of national transportation

system, control of the gas passes at the point at which the gas

enters this network, this is the point at which gas revenue would

be recognised. Gas prices vary from month to month based on

seasonal demand from customer segments and, production in the

market as a whole. Our partner agrees pricing with their portfolio

of gas clients based on agreed pricing mechanisms in multiple

contracts. Some pricing is regulated by government such as domestic

supply. Oil shipments are priced in advance of a cargo and revenue

is recognised at the point at which cargoes are loaded onto a

shipping vessel at terminal.

(e) Property, plant and equipment

Property, plant and equipment is stated at cost, or deemed cost

less accumulated depreciation, and any recognised impairment loss.

Depreciation is charged so as to write off the cost or valuation of

assets less any residual value over their estimated useful lives,

using the straight- line method, on the following bases:

Fixtures & fittings 12% to 33.3% straight-line

Oil and gas properties are depleted on a unit of production

basis commencing at the start of commercial production or

depreciated on a straight-line basis over the relevant asset's

estimated useful life. Expenditure is depreciated on a unit of

production basis; the depletion charge is calculated according to

the proportion that production bears to the recoverable reserves

for each property. Depreciation will not be charged on an asset in

the course of construction, depreciation commences when the asset

is brought into use and will be depleted according to the

proportion that production bears to the recoverable reserves for

each property.

(f) Property right of use asset

The Group recognises a right-of-use asset and a lease liability

at the lease commencement date. The right of use lease is initially

measured at cost, which comprises the initial amount of the lease

liability adjusted for any lease payments made at or before

commencement date plus any initial direct costs incurred and an

estimate of costs to dismantle and remove the underlying asset. The

right-of-use asset is subsequently depreciated using the

straight-line method from the commencement date to the earlier of

the end of the useful life of the right-of-use asset or the end of

the lease term. The lease liability is initially measured at the

present value of the lease payments that are not paid at the

commencement date discounted using the incremental borrowing rate

of the individual Company which is the lessee.

(g) Other intangible assets - exploration and evaluation

costs

Exploration and evaluation (E&E) expenditure comprises costs

which are directly attributable to researching and analysing

exploration data. It also includes the costs incurred in acquiring

mineral rights, the entry premiums paid to gain access to areas of

interest and amounts payable to third parties to acquire interests

in existing projects. When it has been established that a mineral

deposit has development potential, all costs (direct and applicable

overhead) incurred in connection with the exploration and

development of the mineral deposits are capitalised until either

production commences or the project is not considered economically

viable. In the event of production commencing, the capitalised

costs are amortised over the expected life of the mineral reserves

on a unit of production basis. Other pre-trading expenses are

written off as incurred. Where a project is abandoned or is

considered to be of no further interest, the related costs are

written off.

(h) Impairment of tangible and intangible assets excluding

goodwill

At the date of each statement of financial position, the Group

reviews the carrying amounts of its tangible and intangible assets

to determine whether there is any indication that those assets have

suffered an impairment loss. If any such indication exists, the

recoverable amount of the asset is estimated in order to determine

the extent of the impairment loss (if any). Where it is not

possible to estimate the recoverable amount of an individual asset,

the Group estimates the recoverable amount of the cash-generating

unit ("CGU") to which the asset belongs.

The recoverable amount is the higher of fair value less costs to

sell or value in use. In assessing value in use, the estimated

future cash flows are discounted to their present value using a

pre-tax discount rate that reflects the current market assessments

of the time value of money and the risks specific to the asset. If

the recoverable amount of an asset (or CGU) is estimated to be less

than its carrying amount, the carrying amount of the asset is

reduced to its recoverable amount. An impairment loss is recognised

immediately in profit or loss, unless the relevant asset is carried

at a revalued amount, in which case the impairment loss is treated

as a revaluation decrease.

Where an impairment loss subsequently reverses, the carrying

amount of the asset is increased to the revised estimate of its

recoverable amount, but so that the increased carrying amount does

not exceed the carrying amount that would have been determined had

no impairment loss been recognised for the asset (CGU) in prior

years. A reversal of an impairment loss is recognised immediately

in profit or loss, unless the relevant asset is carried at a

re-valued amount, in which case the reversal of the impairment loss

is treated as a revaluation increase.

(i) Discontinued operations, assets and businesses held for

sale

Cash flows and operations that relate to a major component of

the business or geographical region that has been sold or is

classified as held for sale are shown separately from continuing

operations.

Assets and businesses classified as held for sale are measured

at the lower of carrying amount and fair value less costs to sell.

No depreciation is charged on assets and businesses classified as

held for sale.

Assets and businesses are classified as held for sale if their

carrying amount will be recovered or settled principally through a

sale transaction rather than through continuing use. This condition

is regarded as being met only when the sale is highly probable and

the assets or businesses are available for immediate sale in their

present condition. Management must be committed to the sale, which

should be expected to qualify for recognition as a completed sale

within one year from the date of classification.

Finance income or costs are included in discontinued operations

only in respect of financial assets or liabilities classified as

held for sale or derecognised on sale.

(j) Taxation

Current taxation

Current tax assets and liabilities for the current and prior

periods are measured at the amount expected to be recovered from,

or paid to, the tax authorities. The tax rates and the tax laws

used to compute the amount are those that are enacted, or

substantively enacted, by the balance sheet date.

Deferred taxation

Deferred tax is the tax expected to be payable or recoverable on

differences between the current year amounts of assets and

liabilities in the financial statements and the corresponding tax

basis used in the computation of taxable profit.

Deferred tax assets are recognised to the extent the temporary

difference will reverse in the foreseeable future and it is

probable that future taxable profit will be available against which

the asset can be utilised.

(k) Taxation (continued)

Deferred tax is recognised for all deductible temporary

differences arising from investments in subsidiaries, branches and

associates, and interests in joint ventures, to the extent it is

probable that the temporary difference will reverse in the

foreseeable future.

(l) Conversion of foreign currency

Foreign currency transactions are translated at the average

exchange rates over the year, material transactions are recorded at

the exchange rate ruling on the date of the transaction. Assets and

liabilities are translated at the rates prevailing at the balance

sheet date. The Group has significant transactions and balances

denominated in Euros and GBP. The year-end exchange rate to USD was

US $1 to GBP GBP0.8292 and US $1 to EUR0.8869 (2021: US $1 to GBP

GBP0.7388, US $1 to EUR0.8790) US $1 to ARS $147.423 2021: US $1 to

ARS $102.397) and the average exchange rate during 2022 was US $1

to GBP GBP0.8019 (2021: US $1 to GBP GBP0. 7253).

In the Company financial statements, the income and expenses of

foreign operations are translated at the exchange rates ruling at

the dates of the transactions. The assets and liabilities of

foreign operations, both monetary and non-monetary, are translated

at exchange rates ruling at the balance sheet date. The reporting

currency of the Company and group is United Stated Dollars (US

$).

(m) Share-based payments

The fair value of equity instruments granted to employees is

charged to the income statement, with a corresponding increase in

equity. The fair value of share options is measured at grant date,

using the binomial option pricing model or Black-Scholes pricing

model were considered more appropriate, and spread over the period

during which the employee becomes unconditionally entitled to the

award. The charge is adjusted to reflect the number of shares or

options that vest.

(n) Financial instruments

Financial assets and financial liabilities are recognised on the

Group's balance sheet when the Group becomes a party to the

contractual provisions of the instrument.

Trade and other receivables

Trade and other receivables are initially measured at fair value

and are subsequently reassessed at the end of each accounting

period.

Cash and cash equivalents

Cash and cash equivalents comprise cash in hand and demand

deposits.

Financial liabilities and equity

Financial liabilities and equity instruments issued by the Group

are classified according to the substance of the contractual

arrangements entered into and the definitions of a financial

liability and an equity instrument. An equity instrument is any

contract that evidences a residual interest in the assets of the

Group after deducting all of its liabilities. The accounting

policies adopted for specific financial liabilities and equity

instruments are set out below.

Trade payables

Trade payables are initially measured at fair value and are

subsequently measured at amortised cost, using the effective

interest rate method.

(n) Financial instruments

Equity instruments

Financial instruments issued by the Group are treated as equity

only to the extent that they meet the following two conditions, in

accordance with IAS 32:

-- They include no contractual obligations upon the Group to

deliver cash or other financial assets or to exchange financial

assets or financial liabilities with another party under conditions

that are potentially unfavourable to the Group; and

-- Where the instrument will or may be settled in the Group's

own equity instruments, it is either a non-derivative that includes

no obligation to deliver a variable number of the Group's own

equity instruments or is a derivative that will be settled by the

Group exchanging a fixed amount of cash or other financial assets

for a fixed number of its own equity instruments.

To the extent that this definition is not met, the financial

instrument is classified as a financial liability.

(o) Borrowings

Borrowings are recognised initially at the fair value of the

proceeds received which is determined using a discount rate which

reflects the cost of borrowing to the Group. In subsequent periods

borrowings are recognised at amortised costs, using an effective

interest rate method. Any difference between the fair value of the

proceeds costs and the redemption amount is recognised as a finance

cost over the period of the borrowings.

(p) Inventory

Echo has chosen to value crude oil inventories, a commodity

product, at net realisable value, the value is based on a

discounted observable year-end market price. Other inventory items

are valued at the lower of net realisable value and cost.

(q) Going Concern

The financial information has been prepared assuming the Group

will continue as a going concern. Please see note 2 Accounting

Estimates and Judgements for an extended disclosure on this

issue.

(r) Government assistance grants

Government assistance grants such as the Coronavirus Job

Retention Scheme (CJRS) which relates to staff who have been

furloughed due to COVID-19 are recognised as income and have been

included in the consolidated statement of comprehensive income as

other income. During 2021, the Group received grants totalling US

$23,118 for furloughed staff. Grants ceased, in line with

Government policy, during H2 of 2021.

2. Accounting Estimates and Judgements

Going Concern

The financial information has been prepared assuming the Group

will continue as a going concern. Under the going concern

assumption, an entity is ordinarily viewed as continuing in

business for the foreseeable future with neither the intention nor

the necessity of liquidation, ceasing trading or seeking protection

from creditors pursuant to laws or regulations.

The consolidated statement of financial position at 31 December

2022 again shows a negative net asset position. Moreover, after

persistent difficulties, the board made the difficult decision in

late 2022 to divest its operating assets in Argentina. This

decision came to fruition in June 2023 when, apart from a small 5%

retention holding, Echo Energy sold its interest in the SCS assets

to its joint venture partner and obtained a full, 100%, indemnity

against any future costs arising from those SCS operations.

The cash received from that sale was sufficient to partly, but

not fully, pay down backlog creditors. Further, the delay in

publishing the December 2022 Annual Report gave rise to an

automatic suspension of the trading in the company's shares on AIM,

preventing any equity fund raising until the Annual Report is

published and the suspension lifted.

Nevertheless, the directors have held positive discussions with

potential financial intermediaries with a view to raise additional

funding and also are in advanced negotiations to acquire a number

of assets including outside South America to replace the SCS

assets.

Consequently, the directors consider the going concern

assumption continues to be appropriate although there remain

material uncertainties as to;

1. Successfully raising sufficient funds.

2. Finding an appropriate investment within a suitable timescale

3. That investment being sufficiently cash-positive to fund the Group going forwards.

Use of Estimate and Judgements

The preparation of financial statements in conforming with

adopted IFRSs requires management to make judgements, estimates and

assumptions that affect the reported amounts of assets and

liabilities as well as the disclosure of contingent assets and

liabilities as at the balance sheet date and the reported amount of

revenues and expenses during the period. Actual outcomes may differ

from those estimates. The key sources of uncertainty in estimates

that have a significant risk of causing

material adjustment to the carrying amounts of assets and

liabilities, within the next financial year, are the impairment of

assets and the Group's going concern assessment.

Amounts Capitalised to the Consolidated Statement of Financial

Position

In accordance with the Group policy, expenditures are

capitalised only where the Group holds a licence interest in an

area. All expenditure relating to the Bolivian company has been

expensed to the statement of comprehensive income, as the Group has

not yet been assigned any licence interests in the country. The

Group has capitalised its participation in the SCS assets.

Prior to the decision to dispose of the majority of its SCS

interest, expenses incurred in the UK relating to SCS were

capitalised. All such capitalised UK costs were then impaired to

nil value following the disposal decision.

Valuation of Assets

In line with the requirements of IFRS 5, management have

considered impairment in the assets held for sale by comparing the

expected fair value less costs to sell (which was agreed in June

2023 and the carrying value of the disposal group. On the basis the

fair value less costs to sell were in excess of the carrying value

of the disposal group no impairments were considered necessary.

The parent company's investment in subsidiary has been written

down to the fair value less costs to sell as the value achieved is

indicative of the value at the balance sheet date and the majority

of the activity of the subsidiaries is linked to the discontinued

operations.

Management have impaired $506,818 of intangible assets which

were costs associated with asset capitalised in the parent company.

This intangible has not been disposed of but is linked to the

activities of the discontinued operations and therefore have been

fully impaired at 31 December 2022.

Functional currency

The groups principal activities, prior to the criteria of

discontinued operation being met, are undertaken in Argentina.

Judgement is required to assess to the functional currency of the

group's subsidiaries. Consistent with previous years, management

have determined that the functional currency is USD on the basis

that revenues, a portion of the cost base and financing activities

are denominated in USD. If a different judgement was made and if

Argentine Peso was considered the functional currency management

would need to consider the impacts of IAS 29. On the basis the

activities have been discontinued, this judgement will not impact

the group significantly in future accounting periods.

Settlement of financial liabilities

As detailed in Note 26, during the year the company renegotiated

and / or settled certain financial liabilities. These were on

favourable terms to the group judgement is required to assess

whether the counterparties to the liabilities were acting in their

capacity as shareholders of the group. On the basis of the

favourable terms management have determined they were acting in

their capacity as shareholders and have accounted for the

renegotiation or settlement accordingly as detailed in Note 26.

C ARRYING VALUE OF INVESTMENT IN SUBSIDARIES

An impairment provisions has been made on the carrying value of

investment in subsidiaries, writing them down to the disposal value

achieved on the sale of the underlying SCS interests in June

2023.

3. Business Segments

The Group has adopted IFRS 8 Operating Segments. Per IFRS 8,

operating segments are regularly reviewed and used by the board of

directors being the chief operating decision maker for strategic

decision-making and resources allocation, in order to allocate

resources to the segment and assess its performance.

At the balance sheet date, there is only one business segment,

being the company, its activity disclosed in within continuing

operations.

Activity in Argentina, being the Santa Cruz Sur operations are

set out within discontinued operations within note 10.

Activity within the group's Bolivian subsidiary is

immaterial.

4. Revenue

Year to Year to

31 December 31 December

2022 2021

US $ US $

Oil revenue - -

Gas revenue - -

Other income 86 23,318

Total Revenue 86 23,318

--------------- ------------- -------------

Revenue for 2022 all derives from discontinued operations held

for resale and is shown in Note 10.

5. Cost of Sales

Year to Year to

31 December 31 December

2022 2021

US $ US $

Production costs - -

Selling and distribution costs - -

Movement in stock of crude oil - -

Depletion - -

Total Costs - -

------------------------------- ------------- -------------

Cost of sales for 2022 all derives from discontinued operations

held for resale and is shown in Note 10

6. Expenses and Auditor's Remuneration

Year to Year to

31 December 31 December

2022 2021

US $ US $

----------------------------------------------- ------------- -------------

The operating loss is stated after charging

the following amounts:

Depreciation of property, plant and equipment

- owned 92 127,656

Loss on disposal of property, plant and

equipment - 1,858

Fees payable to the Company's auditor

for the audit of the Company's annual

accounts 60,587 53,977

Fees payable to the overseas auditor and

its associates for other services:

* Corporate finance services - 11,456

* Audit and subsidiaries 10,502 10,499

Share-based payments - 271,038

----------------------------------------------- ------------- -------------

7. Staff Costs and Numbers

The average number of persons employed by the Group during the

year including executive directors is analysed below:

Year to Year to

31 December 31 December

2022 2021

---------------- ------------- -------------

Administration 10 7

---------------- ------------- -------------

Group employment costs - all employees including executive

directors:

Year to Year to

31 December 31 December

2022 2021

US $ US $

--------------------------------------- ------------- -------------

Wages and salaries 1,159,651 1,066,589

Social security costs 147,922 131,487

Pension contributions 37,574 45,764

Share-based payments - equity-settled 157,757 271,038

--------------------------------------- ------------- -------------

Total 1,502,904 1,514,878

--------------------------------------- ------------- -------------

Directors' remuneration is set out in the Directors Remuneration

Report of this report.

Remuneration of Key Personnel is set out in the table below.

Year to Year to

31 December 31 December

2022 2021

US $ US $

-------------------------- ------------- -------------

Wages and salaries 541,915 583,974

Social security costs 61,098 103,329

Bonus - 59,288

Pension Contributions 12,239 25,099

Private Health Insurance 5,963 13,107

Share-Based Payments 157,757 244,383

-------------------------- ------------- -------------

Total 621,215 1,029,180

-------------------------- ------------- -------------

8. Financial Income

Year to Year to

31 December 31 December

2022 2021

US $ US $

--------------------------- ------------- -------------

Interest income 622 249,351

Net foreign exchange gain 1,618,222 4,105,983

--------------------------- ------------- -------------

Total 1,618,884 4,355,334

--------------------------- ------------- -------------

9. Financial Expense

Year to Year to

31 December 31 December

2022 2021

US $ US $

------------------------------------------ ------------- -------------

Interest payable 415 11,912

Net foreign exchange losses - 5,122,810

Unwinding of discount on long- term loan 2,980,994 3,394,647

Unwinding of abandonment provision - 59,955

Bank fees and overseas transaction tax - 170,007

------------------------------------------ ------------- -------------

Total 2,981,409 8,993,432

------------------------------------------ ------------- -------------

10. Discontinued Operations

In November 2022 the company committed to selling virtually all

of its interest in the Santa Cruz oil and gas operations in

Argentina to its joint-venture partner Interoil. A term of the sale

was for Echo to relinquish any management and accounting in respect

of the joint venture, instead receiving a profit share in

proportion to the remaining 5% holding in the joint venture,

effectively as investment income.

The sale was completed on 26 June 2023, satisfied by GBP750,000

in cash, shares to the value of GBP400,000 in Interoil and

GBP150,000 investment in Echo Energy PLC shares by Interoil. At 31

December 20222 the Argentinian operations were classified as a

disposal group held for sale and as discontinued operations.

With the classification as discontinued operations, the Santa

Cruz operations in Argentina have been excluded from the segmental

note (note 3).

The results of the Argentinian operations for the year are

presented below

31 December 31 December

2022 2021

US $ US $

Revenue

Oil revenue 5,365,928 4,060,802

Gas revenue 8,748,402 7,036,861

Other income - 3,707

----------------------------------- -------------- --------------

14,114,331 11,101,369

----------------------------------- -------------- --------------

Cost of sales

Production costs (16,933,985) (12,024,454)

Selling and distribution costs - (1,684,320)

Movement in stock of crude oil - 181,274

Depletion (1,419,193) (1,620,279)

----------------------------------- -------------- --------------

Total cost of sales (18,353,178) (15,147,779)

----------------------------------- -------------- --------------

Gross loss (4,238,847) (4,046,410)

Exploration expenses (287,919) (205,651)

Impairment of plant and equipment (506,818) -

Administrative expenses (578,011) (510,807)

Operating loss from discontinued

operations (5,611,595) (4,762,869)

Finance revenue - 249,351

Finance expense (788,847) (5,362,783)

Foreign exchange gain 1,208,083 -

----------------------------------- -------------- --------------

Loss for the year before taxation

from discontinued operations (5,192,359) (9,876,301)

----------------------------------- -------------- --------------

Deferred tax asset write-off (12,050) -

----------------------------------- -------------- --------------

Loss for the year after taxation

from discontinued operations (5,204,409) (9,876,301)

----------------------------------- -------------- --------------

The major classes of assets and liabilities of the Argentinian

operations classified as held for sale as at 31 December 2022 are

as follows

31 December 2022

US $

Assets

Property, plant and equipment 2,658,382

Intangible assets 5,267,129

Inventories 716,794

Joint venture receivables 9,729,937

Other receivables 279,012

Prepayments 87,916

Cash 121

Assets of disposal group held for sale 18,739,291

--------------------------------------------- -------------------

Liabilities

Trade and other payables (14,095)

Joint venture payables 26,594,448

Provisions 3,039,911

Liabilities of disposal group held for sale 29,620,264

--------------------------------------------- -------------------

Net liabilities (10,880,974)

--------------------------------------------- -------------------

The net cash flows of the Argentinian operations were

31 December 31 December

2022 2021

US $ US $

Net cash flow from operating activites (5,830,067) (434,026)

Net cash flow from investing activities (217,578) -

Net cash flow from financing activites - 249,351

----------------------------------------- ------------ ------------

Net cash outflow (6,047,645) (184,675)

----------------------------------------- ------------ ------------

11 . Joint Arrangements

As described in both the strategic and governance reports, in

particular in the Financial Review, Echo has joint arrangements

within the SCS concessions. Previously, the Group accounted for its

share of assets, liabilities, income and expenditure of these joint

operations in accordance with its equity interest in each, being

70% of the SCS working interest. Joint venture assets and

liabilities were separately disclosed throughout the financial

statements.

As set out in Note 10, in December 2022 to the decision was made

to divest the SCS concessions, following which, in June 2023 that

interest was reduced to a 5% holding and the joint arrangement

thereby has been treated in the accounts as discontinued

operations.

12. Taxation

Year to Year to

31 December 31 December

2022 2021

US $ US $

------------------------------------------- ------------- -------------

Tax on profit on ordinary activities

Taxation charged based on profits for the - -

period

UK corporation tax based on the results - -

for the period

Deferred tax asset write-off in Bolivian

subsidiary 68,142

------------------------------------------- ------------- -------------

Total tax expense in income statement 68,142 -

------------------------------------------- ------------- -------------

Reconciliation of the Tax Expense

The tax assessed for the year is different from the standard

rate of corporation tax in the UK of 19% (2021: 19%). The

references are explained below:

Year to Year to

31 December 31 December

2022 2021

US $ US $

------------------------------------------------ ------------- -------------

Loss on ordinary activities before taxation (4,382,425) (11,770,112)

Loss from discontinued operations (5,204,409) -

------------------------------------------------ ------------- -------------

Loss for the year before tax (9,586,834) (11,770,112)

------------------------------------------------ ------------- -------------

Loss on ordinary activities multiplied by

standard rate of corporation tax in the

UK of 19% (1,821,498) (2,236,321)

Effects of:

Expenses disallowed for tax purposes 92 40,246

Deferred tax not provided - tax losses carried

forward 1,821,406 2,196,075

Deferred tax asset in Bolivian subsidiary 68,142 -

written off

------------------------------------------------ ------------- -------------

Total current tax 68,142 -

------------------------------------------------ ------------- -------------

The parent entity has tax losses available to be carried

forward, and further tax losses are available in certain

subsidiaries. With anticipated substantial lead times for the

Group's projects, and the possibility that these may expire before

their use, it is not considered appropriate to anticipate an asset

value for them. The amount of tax losses carried forward for which

a deferred tax asset has not been recognised is US $50,533,098

(2021: US $48,711,692)

No amounts have been recognised within tax on the results of the

equity-accounted joint ventures.

13. Loss Per Share

The calculation of basic and diluted loss per share at 31

December 2022 was based on the loss attributable to ordinary

shareholders. The weighted average number of ordinary shares

outstanding during the year ended 31 December 2022 and the effect

of the potentially dilutive ordinary shares to be issued are shown

below.

Year to Year to

31 December 31 December

2022 2021

Net loss for the year (US $) before exchange

on translating foreign operations (9,586,834) (1,893,811)

---------------------------------------------- -------------- --------------

Net loss on continuing operations (US ( 4,382,425

$) ) (9,876,301)

---------------------------------------------- -------------- --------------

Basic weighted average ordinary shares

in issue during the year (No.) 1,909,205,746 1,270,891,563

---------------------------------------------- -------------- --------------

Diluted weighted average ordinary shares

in issue during the year (No.) 1,909,205,746 1,270,891,563

---------------------------------------------- -------------- --------------

Loss per share (cents)

Basic and diluted (cents) (0.50) (0.15)

---------------------------------------------- -------------- --------------

Loss per share on continuing operations

(cents) (0.23) (0.78)

---------------------------------------------- -------------- --------------

In accordance with IAS 33 and as the entity is loss making,

including potentially dilutive share options in the calculation

would be anti-dilutive.

14 . Loss of the Parent Company

The parent company is not required to produce its own profit and

loss account (or IFRS equivalent) because of the exemption

provision in Section 408 of the Companies Act 2006.

15 . Property, Plant and Equipment (Group)

PPE - Fixtures

O&G & Fittings Total

Properties US $ US $

US $

---------------------- ------------- ------------- ------------

31 DECEMBER 2022

Cost

1 January 2022 2,873,147 95,397 2,968,544

Additions - 2,813 2,813

Reclassification of

assets of disposal

group held for sale

(note 10) (2,873,147) - (2,873,147)

----------------------- ------------- ------------- ------------

31 December 2022 - 98,210 98,210

----------------------- ------------- ------------- ------------

Depreciation

1 January 2022 202,718 91,421 294,139

Charge for the year 12,047 4,490 16,537

Reclassification of

assets of disposal

group held for sale

(note 10) (214,765) - (214,765)

31 December 2022 - 95,911 95,911

----------------------- ------------- ------------- ------------

Carrying amount

31 December 2022 - 2,299 2,299

----------------------- ------------- ------------- ------------

31 December 2021 2,670,429 3,976 2,674,405

----------------------- ------------- ------------- ------------

31 DECEMBER 2021

Cost

1 January 2021 2,621,921 97,255 2,719,176

Additions 251,226 - 251,226

Disposals - (1,858) (1,858)

----------------------- ------------- ------------- ------------

31 December 2021 2,873,147 95,397 2,968,544

----------------------- ------------- ------------- ------------

Depreciation

1 January 2021 79,941 86,542 166,483

Charge for the year 122,777 4,879 127,656

Disposals - - -

---------------------- ------------- ------------- ------------

31 December 2021 202,718 91,421 294,139

----------------------- ------------- ------------- --------------

Carrying amount

31 December 2021 2,670,429 3,976 2,674,405

----------------------- ------------- ------------- --------------

31 December 2020 2,541,980 10,713 2,552,693

----------------------- ------------- ------------- --------------

Included within property, plant and equipment are amounts of US

$nil (2021: US $996,505) in relation to assets in construction and

as a result these are not depreciated on the unit of production

basis; this commenced when they became available for use.

15. Property, Plant and Equipment (Company)

Fixtures

& Fittings

US $

--------------------- -------------

31 DECEMBER 2022

Cost

1 January 2022 92,903

Additions -

Disposals -

--------------------- -------------

31 December 2022 92,903

----------------------- -------------

Depreciation

1 January 2022 90,726

Charge for the year 2,176

Disposals -

31 December 2022 90,902

----------------------- -------------

Carrying amount

31 December 2022 1

----------------------- -------------

31 December 2021 2,177

----------------------- -------------

31 DECEMBER 2021

Cost

1 January 2021 92,903

Additions -

Disposals -

--------------------- -------------

31 December 2021 92,903

----------------------- -------------

Depreciation

1 January 2021 84,864

Charge for the year 5,862

Disposals -

31 December 2021 90,726

----------------------- -------------

Carrying amount

31 December 2021 2,177

----------------------- -------------

31 December 2020 8,039

----------------------- -------------

16. Intangible Assets (Group)

SCS Production

Assets

US $

------------------------------ -----------------

31 DECEMBER 2022

Cost

1 January 2022 10,875,022

Additions 61,233

Reclassification of

assets of disposal group

held for sale (note

10) (10,429,437)

31 December 2022 506,818

-------------------------------- -----------------

Depletion

1 January 2022 3,743,115

Depletion 1,419,193

Depreciation decommissioning -

assets

Impairment 506,818

Reclassification of

assets of disposal group

held for sale (note

10) (5,162,308)

31 December 2022 506,818

-------------------------------- -----------------

Carrying amount

31 December 2022 -

------------------------------ -----------------

31 December 2021 7,131,907

-------------------------------- -----------------

31 DECEMBER 2021

Cost

1 January 2021 10,756,306

Additions 118,716

Disposals -

Transfers -

------------------------------ -----------------

31 December 2021 10,875,022

-------------------------------- -----------------

Depletion and impairment

1 January 2021 2,244,684

Disposals -

Depletion 1,375,931

Depreciation decommissioning

assets 122,500

Impairment charge for -

the year

------------------------------ -----------------

31 December 2021 3,743,115

-------------------------------- -----------------

Carrying amount

31 December 2021 7,131,907

-------------------------------- -----------------

31 December 2020 8,511,622

-------------------------------- -----------------

All intangible assets relate to oil & gas activities. The

Group's oil & gas assets were assessed for impairment at 31

December 2022. The intangibles are held within one CGU, the SCS

licence concession.

In 2022, the Santa Cruz operations were reclassified as

Discontinued operations held for sale. No further general

impairment was considered necessary as the proceeds of the sale

exceed the net liabilities of the discontinued operations. However,

in exception, the value of UK costs capitalised up to the time of

the decision to sell of $506,818 was assessed as irrecoverable and

has been fully impaired.

16. Intangible Assets continued (Company)

Argentina Production

assets Total

US $ US $

-------------------------------- --------------------- --------

31 DECEMBER 2022

Cost

1 January 2022 445,585 445,585

Additions 61,233 61,233

31 December 2022 506,818 506,818

-------------------------------- --------------------- --------

Impairment

1 January 2022 - -

Provided 516,818 516,818

31 December 2022 506,818 506,818

-------------------------------- --------------------- --------

Carrying amount

31 December 2022 - -

-------------------------------- --------------------- --------

31 December 2021 445,585 445,585

-------------------------------- --------------------- --------

31 DECEMBER 2021

Cost

1 January 2021 326,869 326,869

Additions 118,716 118,716

31 December 2021 445,585 445,585

-------------------------------- --------------------- --------

Impairment

1 January 2021 - -

Impairment charge for the year - -

31 December 2021 - -

-------------------------------- --------------------- --------

Carrying amount

31 December 2021 445,585 445,585

-------------------------------- --------------------- --------

31 December 2020 326,869 326,869

-------------------------------- --------------------- --------

17 . Interest in Subsidiary Undertakings

Year to Year to

31 December 31 December

2022 2021

US $ US $

------------------- ------------- -------------

Cost

1 January 30,521,648 30,521,648

Additions in year - -

------------------- ------------- -------------

31 December 30,521,648 30,521,648

------------------- ------------- -------------

Impairment

1 January 14,516,604 14,516,604

Impairment 14,442,723 -

------------------- ------------- -------------

31 December 28,959,327 14,516,604

------------------- ------------- -------------

Carrying amount

31 December 1,562,321 16,005,044

------------------- ------------- -------------

Details of the subsidiaries are as follows:

Class % Country

Subsidiary of Share Owned of Nature of Business

Registration

Echo Energy Holdings (UK) Ordinary 100% England Holding company

Limited & Wales

Echo Energy Argentina Holdings Ordinary 100% England Holding company

Limited & Wales

Echo Energy Tapi Aike Limited Ordinary 100% England Holding company

& Wales

Eco Energy TA Op Limited Ordinary 100% England Holder of Argentinian

& Wales branch assets

Echo Energy C D & LLC Limited Ordinary 100% England Holding company

& Wales

Eco Energy CDL Op Limited Ordinary 100% England Holder of Argentinian

& Wales branch assets

Echo Energy Bolivia (Hold Ordinary 100% England Holding company

Co 1) Limited & Wales