Gross written premiums from external customers and non-current

assets, as attributed to individual countries in which the Group

operates, are as follows:

2014 2013

Gross Gross

written Non-current written Non-current

premiums assets premiums assets

GBP000 GBP000 GBP000 GBP000

United Kingdom 237,821 123,971 298,898 73,329

Australia 40,083 257 45,669 918

Canada 39,365 2,407 41,172 1,338

Ireland 11,528 - 13,606 74

--------------- ------------------- -------------- -------------------

328,797 126,635 399,345 75,659

--------------- ------------------- -------------- -------------------

Gross written premiums are allocated based on the country in which the insurance contracts

are issued. Non-current assets exclude rights arising under insurance contracts, deferred

tax assets, pension assets and financial instruments and are allocated based on where the

assets are located.

Acquisition of business

On 15 April 2014, South Essex Insurance Brokers Limited acquired

the assets of Lansdown Insurance Brokers (hereafter referred to as

Lansdown). Lansdown is an insurance broker across a variety of

classes of business, with a particular specialism in blocks of

flats and apartments and high net worth homes. Lansdown was

acquired as part of the Group's strategy to identify new market

sectors in which to grow, either organically or through

acquisition, and is included within the Broking and Advisory

segment.

The amounts recognised in respect of the identifiable assets

acquired are as set out in the table below.

GBP000

Property, plant and equipment 12

Intangible assets 1,166

-------

Total identifiable assets 1,178

-------

Goodwill 4,392

-------

Total consideration 5,570

-------

Satisfied by:

Cash 5,000

Contingent consideration

arrangement 570

-------

Total consideration 5,570

-------

The net cash outflow arising on acquisition was

GBP5,000,000.

The goodwill of GBP4,392,000 arising from the acquisition

consists of intangible assets not qualifying for separate

recognition, such as workforce, synergies and new business

opportunities. None of the goodwill is expected to be deductible

for income tax purposes.

The fair value of the identifiable intangible assets of

GBP1,166,000 consists of the value of customer relationships and

brand acquired.

The contingent consideration arrangement requires GBP2,100,000

of retained commission income to be received for the twelve months

to 15 April 2015, with the potential amount of the future payment

that the Group could be required to make being between GBPnil and

GBP1,000,000.

The fair value of the contingent consideration of GBP570,000 was

estimated based on current commission forecasts, without

discounting as the payment is payable after exactly one year from

the date of acquisition.

No material acquisition-related costs were incurred in relation

to the transaction.

Lansdown contributed GBP1,046,000 revenue and GBP555,000 to the

Group's profit before tax for the period between the date of

acquisition and the balance sheet date. If the acquisition of

Lansdown had been completed on the first day of the financial year,

Group revenues for the period would have been GBP333,634,000 and

Group profit before tax would have been GBP48,405,000.

Current assets held for sale

Ecclesiastical Financial Advisory Services Limited ceased to

offer new mortgages following a strategic review in 2007, although

it continued to administer the existing book. During the current

year management have decided to dispose of the mortgage book in

order to more clearly focus their attention on the current elements

of the business.

After the end of the financial year the Company entered into an

agreement to transfer its legacy mortgage business to Holmesdale

Building Society. The transfer was completed on 1 February

2015.

The current assets held for sale consist of mortgages secured on

residential property.

2014

GBP000

Cost at 1 January 7,892

Repayments and redemptions (1,022)

Market value adjustment (666)

--------

Carrying value at 31 December 6,204

--------

The effective interest rate on the mortgages is 4.71% (2013:

4.42%).

Clients have the option to redeem mortgages before the end of

the mortgage term. The Directors consider that the carrying value

approximates to fair value.

There are no debts which are past due at the reporting date and

no amounts have been impaired during the current or prior year.

The major class of assets comprising the operations classified

as held for sale is financial investments.

Contingent liabilities

As reported in the 2013 annual report and accounts, the Group is

in correspondence with HM Revenue and Customs regarding the

treatment of its preference share capital for group tax purposes.

While the issue is still not fully resolved, further correspondence

has brought more clarity and we now believe that we have adequately

provided for any additional tax cost to the Group. We no longer

believe that there is a contingent liability in respect of this

issue in addition to the amount provided.

Related party transactions

Transactions between the Company and its subsidiaries, which are

related parties, have been eliminated on consolidation.

Charitable grants to the ultimate parent company are disclosed

in the consolidated statement of changes in equity.

Full disclosure of related party disclosures is included in note

33 to the full financial statements.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR PKQDDABKDPNB

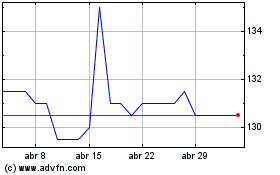

Ecclesiastl.8fe (LSE:ELLA)

Gráfica de Acción Histórica

De May 2024 a Jun 2024

Ecclesiastl.8fe (LSE:ELLA)

Gráfica de Acción Histórica

De Jun 2023 a Jun 2024