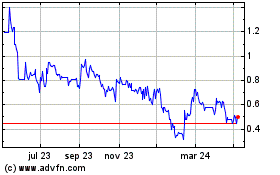

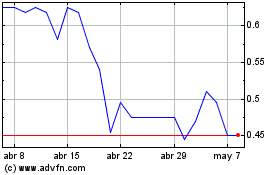

TIDMEME

RNS Number : 7329Z

Empyrean Energy PLC

16 September 2022

This announcement contains inside information

Empyrean Energy PLC / Index: AIM / Epic: EME / Sector: Oil &

Gas

16 September 2022

Empyrean Energy PLC ('Empyrean' or 'the Company')

Final Results

Empyrean Energy is pleased to announce its final results for the

year ended 31 March 2022 (" Report and Accounts "). The full Report

and Accounts will be made available on the Company's website in the

coming days.

As announced on 2 September 2022, the Company was unable to

publish the Company's 2022 Report and Accounts together with the

Notice of Annual General Meeting (" AGM "). Given that the Company

is required to hold an AGM each year within six months of its

financial year end, the Company's 2022 AGM will be held on 27

September 2022.

An announcement confirming the posting of the Report and

Accounts and Notice of General Meeting to approve the Report and

Accounts will be made in due course.

Highlights

Block 29/11, Pearl River Mouth Basin, China (EME 100% reverting

to 49% upon commercial discovery)

Reporting period

-- Empyrean and its partner China National Offshore Oil

Corporation (" CNOOC "), along with its technical service providers

CNOOC Enertech and China Oilfield Services Limited (" COSL ")

completed significant pre-drilling operational, technical and

permitting work throughout the year to enable the safe drilling of

the Jade prospect post reporting year end.

Post-Reporting period

-- LH 17-2-1 Jade well spudded and reached final total depth of

2,849 metres Measured Depth ("MD") during April 2022. No oil pay

was encountered in the target reservoir and demobilisation

operations were completed.

-- Post-well analysis at Jade confirmed reservoir quality better

than pre-drill estimate with regional seal confirmed and depth

conversion approach validated. Based on post-drill technical

evaluation, and CNOOC-assisted migration pathways assessment,

Empyrean decided to enter the second phase of exploration with the

aim to drill the larger Topaz prospect.

-- Topaz Drill Program targeted to commence in 2023.

Duyung PSC Project, Indonesia (EME 8.5%)

Reporting period

-- Prevailing strong gas prices have enabled the operator Conrad

Petroleum Ltd ("Conrad") to advance Gas Sales Agreement ("GSA")

negotiations with multiple interested parties.

-- Conrad has also been working with SKK Migas to enable an

upgrade to the Plan of Development ("POD") that was approved

following the discovery of Mako. Following the successful appraisal

of Mako, Gaffney Cline and Associates ("GCA") upgraded its resource

assessment for Mako and the new POD is expected to be finalised

once Ministerial approval is obtained.

-- Mako is one of the largest gas discoveries in the West Natuna

Sea and the largest undeveloped resource in the area.

Sacramento Basin, California USA (EME 25-30%)

-- Evaluation on the project is ongoing and the Company will

continue to work with its joint venture partners in reviewing and

assessing any further technical and commercial opportunities in

Sacramento, particularly in light of strong gas prices.

Corporate

Reporting period

-- Placement and Convertible Note funding of US$10.14 million

(GBP7.62 million) secured in December 2021 to partially fund Jade

Prospect drilling.

-- Placement to raise US$6.92 million (GBP5.02 million) completed in July 2021.

Post-Reporting period

-- Placement to raise US$2.25 million (GBP1.83 million) completed in May 2022.

Empyrean CEO Tom Kelly said , "Empyrean's key focus during the

year was completing the necessary activities required in

preparation for the drilling of the initial exploration well at

Jade under the PSC terms.

While the end result was not the one we had hoped for at Jade,

the achievement of safely drilling the well on time and on budget

was a credit to Empyrean's team and a great reflection of the

excellent teamwork, expertise, professionalism and cooperation

between the Company, its partner CNOOC, and its technical service

providers CNOOC Enertech and COSL.

Importantly, post the drilling at Jade, Empyrean has been able

to combine our excellent quality 3D seismic data with the confirmed

well data from Jade resulting in post well analysis that has

improved the validity of the Topaz prospect as a robust and large

drilling target of approximately 891 million barrels in place

(P10). We have therefore made the decision to enter into an

agreement for the second phase of exploration on Block 29/11 with

the aim to drill Topaz before June 2024.

In Indonesia, Empyrean looks forward to maximising the value

from its interest in the Mako Gas Field which would strengthen the

Company's balance sheet and help fund the drilling of Topaz.

In California, while activity and expenditure was limited during

the year, the operator Sacgasco continues to evaluate the project

and Empyrean will review and assess any further technical and

commercial opportunities as they come to hand, particularly in

light of strong gas prices for gas sales in the Sacramento

Basin.

As always, the Company continually assesses other financing and

strategic alternatives to provide it with additional working

capital as and when required, including through the sale or partial

sale of existing assets, through joint ventures of existing assets

or through further equity or debt funding. The Company has also

successfully restructured its convertible note.

In addition to its existing projects, Empyrean continues to

assess a number of additional oil and gas projects that it believes

may enhance a balanced portfolio of opportunity and will update

shareholders as required.

While the Board and management share the disappointment of the

Jade well result with its shareholders, it moves forward with

renewed optimism, with good news due from Indonesia and the

learnings from Jade further de-risking Topaz which standalone has

the potential to be a Company changer."

Chairman's Statement

It was another busy year for Empyrean on its portfolio of

exploration projects during the year, primarily in China.

After an enormous amount of hard work preparing for the drilling

of the Jade prospect in China, the Company was clearly disappointed

that the drilling program post year end did not result in the

discovery of commercial hydrocarbons at the Jade Prospect.

Unfortunately, this is the nature of exploration and we take the

good with the bad.

Nevertheless, post-well evaluation in conjunction with CNOOC has

provided invaluable further interpretation of the critical elements

of effective regional oil migration pathways, with positive

implications for the second target on Block 29/11, the Topaz

prospect.

We also expect good news in the near term from Indonesia with

GSA negotiations advanced and the prospect of Empyrean realising

significant value from its interest there to follow the conclusion

of the GSA process.

As always, I would like to thank the Board, management and staff

for their efforts during the year. Empyrean retains a positive

outlook for the future and is setting its sights on value creation

from Indonesia and the further de-risked drill opportunity in

China.

Patrick Cross

Non-Executive Chairman

15 September 2022

Extract from Strategic Report

Business Overview and Likely Future Developments

The Company and its partners continued to progress exploration

and development activities at its projects during the year.

Empyrean and its partner CNOOC, along with its technical service

providers CNOOC Enertech and COSL, completed significant

pre-drilling operational, technical and permitting work throughout

the reporting period to enable to safe drilling, although

ultimately unsuccessful drilling of the Jade prospect post

reporting year end.

Post-well analysis at Jade however has confirmed reservoir

quality is better than pre-drill estimates with regional seal

confirmed and the depth conversion approach validated. As a part of

post-well evaluation, CNOOC geochemical and basin modelling experts

together with Empyrean have interpreted the critical elements of

effective regional oil migration pathways leading to positive

implications for the Topaz prospect, and ultimately the decision to

proceed with the second phase of exploration at Block 29/11, being

the drilling of the Topaz Prospect before June 2024.

Following the exploration success that was achieved in Indonesia

and the significant resource upgrade of the Mako gas field, the

operator is in the process of negotiating a gas sales agreement

which would enable Empyrean to maximise shareholder value from its

interest in the project. Recent strong gas prices and a solid

demand forecast in the south-east Asian region provides additional

momentum and urgency.

In California operator Sacgasco continues to evaluate the

project(s) in light of strong gas prices for gas sales in the

Sacramento Basin. Empyrean is content to work with its joint

venture partners in reviewing and assessing any further technical

and commercial opportunities as they are presented, while keeping

expenditures to a minimum, currently consisting mainly of meeting

cash calls for joint venture overheads.

Further details on these activities are provided in the

Operations and Outlook section below.

The Company raised funds through a series of placements during

the year and post year end, and also through the entering of a

Convertible Note Agreement pursuant to which the Company received

gross proceeds of US$5.4 million (GBP4.0 million) (the "

Convertible Note "). The funds raised were to support the current

exploration programs and for working capital purposes.

The Board and management recognise that exploration for

hydrocarbons is a risky venture and there will be failures and

challenges along with successes. As a result, the Company's

strategy is to continue to add value for shareholders by building a

diverse portfolio of drilling opportunities in commercially

attractive jurisdictions. The Company has a team with a proven

track record of finding hydrocarbons and advancing projects through

exploration, appraisal and into production. Oil and Gas prices have

steadily risen since the negative impact of the COVID-19 outbreak

and the current business strategy of the Company remains sound and

value accretive.

Management continually evaluate project opportunities that meet

strict investment guidelines with an aim of adding value for all

shareholders.

Operations and Outlook

As at 31 March 2022 the Company has the following interests:

The Company has an interest in Block 29/11 offshore China (100%

during exploration and 49% upon any commercial discovery). Empyrean

is the operator with 100% of the exploration rights of the

1800km(2) permit during the exploration phase of the project.

Empyrean completed a 608km(2) 3D seismic acquisition survey in

August 2017 and comprehensive processing and interpretation of the

3D seismic data, in addition to further geological work, has

confirmed the structural viability and substantial prospective

(un-risked) resources at the three key prospects ( "Jade, Topaz and

Pearl" ). These internal estimates were subsequently independently

audited and revised upwards. Migration studies, seismic inversion

work and the identification of well-defined gas clouds over the

three prospects further enhanced the technical merits of the Jade

and Topaz prospects in 2019 and during the current year the

Company, along with CNOOC and its service providers, completed the

substantial pre-drilling operational, technical and permitting work

to enable to safe drilling of the Jade prospect post reporting year

end.

Post the financial year end, the Company completed drilling at

the Jade prospect, which reached final total depth of 2,849 metres

MD on 27 April 2022. The interpretation from logging while drilling

(" LWD" ) and mud logging equipment indicated no oil pay in the

target reservoir and the demobilization activities were then

completed.

Post Jade well evaluation work confirmed reservoir quality and

the regional seal and following a CNOOC assisted oil migration

pathways assessment, the Company has committed to enter this second

phase of exploration with the aim to drill Topaz.

Topaz remains a world class conventional oil target in the Jade

prospect, to which GCA assigned a Geological Chance of Success (

"GCoS" ) of 30%. The Topaz prospect has a GCA audited mean in place

potential of 506 MMbbl and a P10 in place upside of 891 MMbbl.

Following the Jade prospect, Topaz prospect is the second of the

three identified prospects within Block 29/11, which also contains

the Pearl prospect. The combined 2018 audited mean in place

potential of the Topaz and Pearl prospects is 659 MMbbl and a P10

in place upside of 1,193 MMbbl.

The Company holds a 8.5% direct interest in the 1,100km(2)

Duyung PSC, offshore Indonesia, operated by Conrad.

The main asset in the permit is the Mako shallow gas discovery,

which has Gross 2C (contingent) resources of 495 Bcf (87.5 MMboe)

of recoverable dry gas and 3C resources of 817 Bcf (144.4 MMboe),

as upgraded by an independent audit conducted during 2020. The

appraisal well, Mako South-1, was spudded in June 2017 with results

exceeding expectations encountering excellent reservoir quality

rock with high permeability sands. Following approval from the

Indonesian regulator of a detailed Plan of Development the JV

partners conducted a successful drilling campaign comprising two

wells, Tambak-1 and Tambak-2 wells, which demonstrated the presence

of well developed, high quality reservoir sandstones with a common

gas water contact across the Mako structure. Following the

successful drilling campaign the operator engaged GCA to complete

an independent resource audit for the Mako Gas Field, which

resulted in a significant resource upgrade in May 2020 and

confirmed Mako as one of the largest gas fields ever discovered in

West Natuna Basin.

An updated Plan of Development has been approved by SKK Migas

and is awaiting Ministerial Approval, and includes uplifted GIIP

estimates. The expected conclusion of GSA negotiations will mark a

further important step toward the final investment decision to

develop and commercialise the field, and for Empyrean to maximise

value from its interest.

In 2017 the Company entered into an agreement with ASX-listed

Sacgasco Limited ( "Sacgasco" ), a Sacramento Basin focused natural

gas developer and producer, to test a group of projects in the

Sacramento Basin California, including two mature, multi-TcF gas

prospects in Dempsey (EME 30%) and Alvares (EME up to 25%) and

further identified follow up prospects along the Dempsey trend (EME

up to 30%).

Following completion of an appraisal and exploration well,

Dempsey 1-15, the operator tested multiple gas zones with

comprehensive testing of selected zones failing to sustain gas

flow. Following the Demspey drilling campaign, the joint venture

integrated the subsurface data with regional geology and seismic

data to evaluate additional targets with thicker reservoir units

for future drilling along the "Dempsey trend", in which Empyrean

could earn a 30% interest.

The operator matured Borba prospect was the next drilling

opportunity at the project. In October 2020 Empyrean notified

Sacgasco that it would not be participating in the proposed

drilling of the Borba prospect under the timeframes and terms

proposed by Sacgasco.

The Company will continue to work with its joint venture

partners in reviewing and assessing any further technical and

commercial opportunities as they relate to the project,

particularly in light of strong gas prices for gas sales in the

Sacramento Basin.

The Company also has a 58.084% working interest in the Eagle Oil

Pool Development Project asset in California and a 10% working

interest in the Riverbend Project in Texas. Further detailed

analysis on all projects is provided in the Operational Review on

page 15.

Cyber Fraud Incident

As announced to the market, in December 2021 the Company made a

payment totalling US$1.98 million to COSL, representing a 10%

deposit on the dry hole cost component of the Integrated Drilling

Contract (" IDC ") signed with COSL; however, the Company was

subsequently informed that this payment was not received by COSL

and had been paid to a fraudulent third party as a result of an

impersonation fraud perpetrated against the Company.

The Company then worked with its bank, the recipient bank and

the police authorities in three jurisdictions to initiate actions

including the freezing of the recipient bank account and the

commencement of recovery actions.

Empyrean commenced legal proceedings in the Singapore courts

against the company believed to have committed the fraud and

obtained an injunction order on 21 January 2022 to freeze its

assets and obtain further banking information. Empyrean will

continue to take the necessary steps and is taking legal advice for

the purpose of pursuing recovery of the funds involved in the

fraud. Empyrean continues to cooperate with the Singapore Police

investigation into the fraud. Empyrean has taken the steps above,

upon legal advice, in order to escalate the recovery process.

Empyrean has also reviewed its internal control policies

including overseas and domestic payment processes and has added

further authority approvals and procedures for all material

payments.

Operational Review

For much of the 2022 financial year Empyrean was focused on

completing the necessary technical, operational and permitting work

required for the commencement of drilling operations at the first

of its targets at Block 29/11, offshore China, being the Jade

Prospect. The drilling of the Jade Prospect followed several years

of methodical, targeted technical evaluation and de-risking

activities. However disappointingly, the Jade well proved to be

unsuccessful with no oil pay encountered.

The Company's corporate objective remains to build a significant

asset portfolio across the Asian region and with the Jade well

evaluation work confirming reservoir quality and the regional seal

and following a CNOOC assisted oil migration pathways assessment,

the Company has committed to the second phase of exploration in

China with the aim to drill the large-scale Topaz prospect.

Empyrean is excited about the significant value potential of its

interest in Indonesia. Following the discovery of high quality gas

in the first exploration well and successful appraisal program, the

project has been further supported by increasingly strong gas

prices in the Asian region. As a result, the Company anticipates

that the operator will conclude the current negotiations of the GSA

in the near term. Execution of the GSA would enable Empyrean to

maximise shareholder value from its interest in the project.

Empyrean also has a 25-30% working interest in a package of gas

projects in the Sacramento Basin, onshore California. The Company

remains an active joint venture partner and will assess the

technical and commercial merits of other prospects or proposals as

they are presented.

Empyrean has retained an interest in the Riverbend Project (10%

WI) located in the Tyler and Jasper counties, onshore Texas and a

58.084% WI in the Eagle Oil Pool Development Project, located in

the prolific San Joaquin Basin onshore, Southern California. No

technical work has been undertaken on these projects during the

year.

China Block 29/11 Project (100% WI)

Background

Block 29/11 is located in the prolific Pearl River Mouth Basin,

offshore China approximately 200km Southeast of Hong Kong. The

acquisition of this block heralded a new phase for Empyrean when it

became an operator with 100% of the exploration rights of the

permit during the exploration phase of the project. In the event of

a commercial discovery, CNOOC will have a back in right to 51% of

the permit.

Following the completion and interpretation of the 3D seismic

data acquired on Block 29/11, the prospective resources (un-risked)

of all three prospects on the Block (Jade, Topaz and Pearl) were

independently validated, by GCA, who completed an audit of the

Company's oil in place estimates in November 2018. Prior to the

drilling of the Jade Prospect in April 2022, the total mean oil in

place estimates on the three prospects was 884 MMbbl on an

un-risked basis.

Jade Prospect Drill Program

Subsequent to year end, the Company commenced the drilling of

the LH 17-2-1 well to test the first of the three prospects noted

above, the Jade Prospect in Block 29/11, offshore China.

On 10 April 2022 LH 17-2-1 spudded and on 27 April 2022 reached

final total depth of 2,849 metres in Zhuhai Sandstone formation.

The interpretation from LWD and mud logging data indicated no oil

pay in the target reservoir. The wireline logs confirmed the

initial interpretation of no oil pay seen on LWD.

Post Well Jade Well Analysis and Implications for Topaz

Prospect

Following the Jade drilling program, comprehensive post well

analysis by Empyrean and CNOOC confirmed the Jade well intersected

carbonate reservoir as prognosed with better parameters than

pre-drill estimates with total thickness of 292m and porosity in

the range of 25 to 27%. In addition, the Jade well penetrated thick

and effective regional seal facies and the reservoir top was

encountered within the depth conversion range. These parameters can

now be more confidently mapped across Empyrean's 3D data set. Jade

well failed due to access to effective migration pathways.

As a result, reservoir, seal and trap validity of the Topaz

prospect has been enhanced by the Jade well data.

As a part of post-well evaluation, CNOOC geochemical and basin

modelling experts provided excellent assistance in assessing the

critical elements of effective regional oil migration pathways,

leading to positive implications for the Topaz prospect. Based on

several oil discoveries in the area, CNOOC has identified the

following three key elements for effective regional oil

migration.

1. Presence of a deep sag for oil generation

2. Presence of a deep fault for efficient vertical migration

that has reactivated at the peak time of oil expulsion (10Ma)

3. Presence of a carrier bed for lateral migration to the prospect

Implications for the Topaz Prospect

Post-well evaluation indicates the Topaz prospect has the

potential for oil charge from two kitchen/source rocks, the Baiyun

North and Baiyun East sags.

Topaz prospect has an additional oil migration pathway from

Baiyun East Sag. This sag has been bio-marked as the proven source

rock for all four CNOOC light oil discoveries to the immediate West

of Block 29/11.

Baiyun North Sag was mapped by the 2017 3D seismic data and is

located within Block 29/11 immediately south and down dip of the

Topaz prospect and it has all three key elements required for

successful oil migration. It is a deep sag that is in the timing

and depth window for oil generation, and Empyrean has identified a

suitable deep fault for efficient vertical migration that

reactivated at the peak time of oil expulsion approximately 10

million years ago (10Ma). Finally, a thick carrier bed exists for

lateral migration to the Topaz prospect. This carrier bed has been

confirmed during the drilling of the Jade well and is mapped on

Empyrean's 3D data set.

The Topaz prospect has an additional oil migration pathway from

Baiyun East Sag. This sag has been bio-marked as the proven source

rock for all four CNOOC light oil discoveries to the immediate West

of Block 29/11.

Post well analysis indicates that the gas shows within the "gas

cloud" zone in the overburden at the Jade well are now interpreted

have migrated from Baiyun North Sag via reactivation of a nearby

fault, approximately 800m away rather than coming from basinal

faults extending into Baiyun East Sag which is approximately 20km

away. The identification of this nearby fault that extends into the

Baiyun North Sag is now the most likely explanation for the gas

shows in the Jade well.

This interpretation enhances the prospects of Baiyun North Sag

as a potentially valid additional source rock and, in turn, the

likelihood of the Topaz prospect having access to two mature source

rocks/kitchens.

Conclusions and the Entering of Second Phase of Exploration

Being able to combine excellent quality 3D seismic data with the

confirmed well data and post well analysis has resulted in the

improved validity of the Topaz prospect as a robust and large

drilling target (approximately 891 million barrels in place (P10)

per below table). Based on post drill technical evaluation, and

CNOOC-assisted migration pathways assessment, Empyrean decided to

enter the second phase of exploration and drill the larger Topaz

prospect, estimated to occur in 2023.

Block 29/11 Oil in place (MMbbl) audited by GCA

Prospect P90 P50 P10 Mean GCoS

Topaz 211 434 891 506 30%

---- ---- ---- ----- -----

Pearl 38 121 302 153 15%

---- ---- ---- ----- -----

Figure 1: Block 29/11, Pearl River Basin, Offshore China

Cautionary Statement: The volumes presented in this announcement

are STOIIP estimates only. A recovery factor needs to be applied to

the undiscovered STOIIP estimates based on the application of a

future development project. The subsequent estimates, post the

application of a recovery factor, will have both an associated risk

of discovery and a risk of development. Further exploration,

appraisal and evaluation is required to determine the existence of

a significant quantity of potentially movable hydrocarbons.

Duyung PSC, Indonesia (8.5% WI)

Background

In April 2017, Empyrean acquired a 10% shareholding in WNEL from

Conrad Petroleum, which held a 100% Participating Interest in the

Duyung Production Sharing Contract ( "Duyung PSC" ) in offshore

Indonesia and is the operator of the Duyung PSC.

In early 2019, both the operator, Conrad Petroleum, and Empyrean

divested part of their interest in the Duyung PSC to AIM-listed

Coro Energy Plc. Following the transaction, Empyrean's interest

reduced from 10% to 8.5% interest in May 2020, having received cash

and shares from Coro. As part of this completion process WNEL made

a direct transfer of its interest in the Duyung PSC to Empyrean and

the other owners, who now hold their interest in the Duyung PSC

directly.

The Duyung PSC covers an offshore permit of approximately

1,100km2 in the prolific West Natuna Basin. The main asset in the

permit is the Mako shallow gas field that was discovered in 2017,

and comprehensively appraised in 2019.

Figure 2: Mako Gas field, Duyung PSC, Indonesia

During October and November 2019, a highly successful appraisal

drilling campaign was conducted in the Duyung PSC. The appraisal

wells confirmed the field-wide presence of excellent quality gas in

the intra-Muda reservoir sands of the Mako Gas Field. However,

testing of the deeper Tambak prospect in the Lower Gabus interval

found these sandstones to have low gas saturations and attempts to

collect fluid samples and pressure data demonstrated low

permeabilities.

Following on from the highly successful appraisal drilling

campaign, Conrad engaged GCA to complete an independent resource

audit for the Mako Gas Field which confirmed a significant resource

upgrade for the Mako Gas Field and confirmed Mako to be one of the

largest undeveloped gas fields in the West Natuna Basin and is

currently by far the largest undeveloped resource in the immediate

area.

The GCA estimates of gross (full field) recoverable dry gas

audited in the 2020 GCA Audit are:

Contingent 2020 GCA Audit

Resource Estimates

Bcf

---------------

1C (Low Case) 287

---------------

2C (Mid Case) 495

---------------

3C (High

Case) 817

---------------

The full field resources above are classified in the 2020 GCA

Audit as contingent. Gas volumes are expected to be upgraded to

reserves when certain commercial milestones are achieved, including

execution of a Gas Sale Agreement ( "GSA" ) and a final investment

decision ( "FID" ).

SKK Migas (the Indonesian regulator) accepted the significantly

uplifted estimates of GIIP, which are broadly in line with the

independent resource audit by GCA.

The SKK Migas Accepted Mako Gas in Place estimates are:

GROSS (100%) GIIP (BSCF) Updated

Reservoir Low Best High

---------- ------------ -----------

Upper Sand 358 525 687

---------- ------------ -----------

Lower Sand 26 41 78

---------- ------------ -----------

Total 384 566 766

---------- ------------ -----------

3C (High Case) 392 817 108

---------- ------------ -----------

The Mako Gas Field is located close to the West Natuna pipeline

system and gas from the field can be marketed to buyers in both

Indonesia and in Singapore.

Current Status

During the current year regional gas prices in Europe and South

East Asia have remained strong and that macro environment is

creating incentive for the negotiations of the current Heads of

Agreements for gas offtake at Mako to be negotiated to a binding

GSA.

Multi Project Farm-in in Sacramento Basin, California (25%-30%

WI)

Background

In May 2017, Empyrean agreed to farm-in to a package of

opportunities including the Dempsey and Alvares prospects in the

Northern Sacramento Basin, onshore California. The rationale for

participating in this potentially significant gas opportunity was a

chance to discover large quantities of gas in a relatively 'gas

hungry' market. Another attractive component of the deal was the

ability to commercialise a potential gas discovery using existing

gas facilities that are owned by the operator.

The first prospect that was drilled in 2018 was the Dempsey

Prospect. Whilst several potentially gas bearing zones were

intersected in the well, comprehensive testing of selected zones

failed to sustain gas flow. Following the Dempsey drilling

campaign, the joint venture integrated the subsurface data with

regional geology and seismic data to evaluate additional targets

with thicker reservoir units for future drilling along the "Dempsey

trend", in which Empyrean could earn a 30% interest.

The operator matured Borba prospect was the next prospect

drilled however in 2020 Empyrean notified Sacgasco that it would

not be participating in this drilling campaign.

The Company will continue to work with its joint venture

partners in reviewing and assessing any further technical and

commercial opportunities as they relate to the project but given

the current status and presence of impairment indicators the

Company took the conservative measure of fully impairing

expenditure incurred at the project as at the reporting date.

Riverbend Project (10%)

Located in Jasper County, Texas, USA, the Cartwright No.1

re-entry well produces gas and condensate from the arenaceous

Wilcox Formation.

The Cartwright No.1 well is currently virtually suspended

producing only nominal amounts of gas condensate.

Little or no work has been completed on the project in the year

and no budget has been prepared for 2022/23 whilst the Company

focuses on other projects. The Company previously fully impaired

the carrying value of the asset and any subsequent expenditure,

mainly for license fees, has been expensed through the profit and

loss statement.

Eagle Oil Pool Development Project (58.084% WI)

The Eagle Oil Pool Development Projects is located in the

prolific San Joaquin Basin onshore, southern California.

No appraisal operations were carried out during this period. It

is anticipated that, should there be a sustained improvement in the

oil price, a vertical well test of the primary objective, the

Eocene Gatchell Sand, followed by a horizontal appraisal well,

would be the most likely scenario.

Little or no work has been completed on the project in the year

and no budget has been prepared for 2022/23 whilst the Company

focuses on other projects. The Company previously fully impaired

the carrying value of the asset and any subsequent expenditure,

mainly for license fees, has been expensed through the profit and

loss statement.

The information contained in this report was completed and

reviewed by the Company's Executive Director (Technical), Mr

Gajendra (Gaz) Bisht, who has over 30 years' experience as a

petroleum geoscientist.

Definitions

2C: Contingent resources are quantities of petroleum estimated,

as of a given date, to be potentially recoverable from known

accumulations by application of development projects, but which are

not currently considered to be commercially recoverable. The range

of uncertainty is expressed as 1C (low), 2C (best) and 3C

(high).

Bcf: Billions of cubic feet

MMbbl : Million Barrels of Oil

*Cautionary Statement: The estimated quantities of oil that may

potentially be recovered by the application of a future development

project relates to undiscovered accumulations. These estimates have

both an associated risk of discovery and a risk of development.

Further exploration, appraisal and evaluation is required to

determine the existence of a significant quantity of potentially

movable hydrocarbons.

Extract from Director's Report

Going Concern

The Company's principal activity during the year has been the

acquisition and development of its exploration projects. At the

year end the Company had a cash balance of US$19,000 (2021:

US$150,000) and made a loss after income tax of US$8.11 million

(2021: loss of US$ 0.95 million).

The Directors have prepared cash flow forecasts for the Company

covering the period to 31 December 2023 and these demonstrate that

the Company will require further funding within the next 12 months.

In June 2022, the Company entered into an agreement with CNOOC to

drill an exploration well on the Topaz prospect in China, by 12

June 2024, which includes a payment of US$250,000 to CNOOC. It is

estimated that the cost of drilling this well would be

approximately US$12 million. In addition, the Company is required

to repay the principal owing on the Convertible Note prior to 1

December 2022, being GBP3.3 million as at the date of this report,

in accordance with the restructured terms announced to the market

on 10 May 2022. The Convertible Note is secured by a senior first

ranking charge over the Company, including it's 8.5% interest in

the Duyung PSC and Mako Gas Field.

In May 2022 US$2.25 million was raised through an equity

placement to complete further post well analysis of the Jade well,

satisfy any further costs associated with the Jade drill, conduct a

comprehensive oil migration study in conjunction with CNOOC for

potential oil charge to the Topaz prospect, and for the Company's

general working capital requirements. However, in order to meet the

well commitment at Topaz and also to meet the repayment terms of

the Convertible Note, the Company is required to raise further

funding either through equity or the sale of assets and as at the

date of this report the necessary funds are not in place.

The Directors are however optimistic that the full funding

commitments for the Topaz well and the Convertible Note will be

met, having a successful track record of equity (and debt) funding

including funding the recently drilled Jade well.

It is the belief of the Board that there are likely value

catalysts throughout the next 12 months leading up to drilling -

including maximising the value of its interest at the Mako Gas

field and activities leading into the intended drilling of the

Topaz Prospect. There are a number of key milestones for the

Project, each of which brings the Project closer to production.

Each milestone reduces risk and increases the value of the Project.

The major milestones are approval by the Indonesian Government of a

revised Plan of Development that is currently before them, signing

of the GSA(s), completion of front-end engineering design, final

investment decision and production. Empyrean's interest can be sold

at any stage but with two of these major milestones due imminently

without any further funding required, it is the Board's current

intention to at least achieve those milestones before considering a

sale versus funding through to production.

The Directors note that if the well commitment is not met in the

timeframe advised then either a renegotiation of the commitment

timing will be required or the licence could be relinquished.

The Directors have therefore concluded that it is appropriate to

prepare the Company's financial statements on a going concern

basis; however, in the absence of additional funding being in place

at the date of this report, these conditions indicate the existence

of a material uncertainty which may cast significant doubt over the

Company's ability to continue as a going concern and, therefore,

that it may be unable to realise its assets and discharge its

liabilities in the normal course of business.

The financial statements do not include the adjustments that

would result if the Company was unable to continue as a going

concern.

Post Balance Sheet Events

Significant events post reporting date were as follows:

On 1 April 2022, the Company issued 18,750,000 Ordinary Shares

at a conversion price of 8.0p per share under the existing

Convertible Loan Note Agreement, as announced on 28 March 2022. The

partial conversion reduced the amount owing on the Convertible Note

by US$1.97 million (GBP1.5 million).

In April 2022, Empyrean announced that the Jade well had reached

a final total depth of 2,849 metres MD and the interpretation from

logging while drilling (LWD) and mud logging equipment indicated no

oil pay in the target reservoir. As a result of the unsuccessful

well at Jade, Empyrean has, in accordance with applicable

accounting standards, written off all historical expenditure

incurred on Block 29/11 and also the dry hole costs associated with

the Jade drilling program subsequent to year end, together being

US$22.04 million.

In May 2022, Empyrean completed a Placing to raise US$2.25

million (GBP1.83 million) with funds raised under this Placing to

primarily be used to complete further post well analysis of the

Jade well, satisfy any further costs associated with the Jade

drilling, conduct a comprehensive oil migration study in

conjunction with CNOOC for potential oil charge to the Topaz

prospect, and for the Company's general working capital

requirements.

In May 2022, following the announcement regarding the Jade well

on 27 April 2022, the Company and the Lender proactively entered

discussions to amend the key repayment terms of the Convertible

Note, which included the right by the Lender to redeem the

Convertible Note within five business days of the announcement of

the results of the Jade well. The parties agreed the following key

amendments to the terms of the Convertible Note:

1. The face value of the Convertible Note is increased to GBP3.3 million;

2. The Company may, at its sole and absolute discretion, redeem

the Convertible Note at any time;

3. The Lender will not redeem the Notes prior to 31 July 2022;

4. If a binding GSA is entered into with regard to the Mako Gas

Discovery in Indonesia on or before 31 July 2022, the Lender will

not redeem the Convertible Note prior to 1 December 2022, with

interest accruing thereafter at a rate of GBP330,000 per calendar

month;

5. If a binding GSA is not entered into with regard to the Mako

Gas Discovery in Indonesia on or before 31 July 2022, the Lender

may redeem the Convertible Note at any time thereafter, in which

circumstances the face value of the Convertible Note will be

reduced to GBP2.67 million;

6. If the Company completes a sale of its interest in the Mako

Gas Discovery, it will redeem the Convertible Note

contemporaneously with that agreement; and

7. The Company will not execute any agreement in respect of a

sale of its interest in the Mako Gas Discovery if the proceeds are

less than the expected value of the Convertible Note on the date of

completion of that agreement.

In June 2022, Empyrean announced that following the completion

of post well analysis at Jade it would be entering the second phase

of exploration with the aim to drill the Topaz prospect at its 100%

owned Block 29/11 permit, offshore China. The second phase of

exploration requires the payment to CNOOC of US$250,000 and the

work obligation is the drilling of an exploration well within 2

years.

In September 2022, the Company announced that the partners in

the Duyung PSC had approved the updated POD and have secured

alignment with SKK Migas on the plan. The POD has been submitted to

the Indonesian Ministry of Energy and Mineral Resources for

approval and an Operator commissioned Competent Persons Report has

been prepared by GCA for the Mako development.

No other matters or circumstances have arisen since the end of

the financial year which significantly affected or could

significantly affect the operations of the Company, the results of

those operations, or the state of affairs of the Company in future

financial years.

Statement of Comprehensive Income

For the Year Ended 31 March 2022

2022 2021

Notes US$'000 US$'000

Revenue - -

-------- --------

Expenses

Administrative expenses (377) (351)

Compliance fees (302) (225)

Directors' remuneration 4 (402) (387)

Foreign exchange differences 3 (518) 20

Impairment - exploration and evaluation

assets 8 (4,127) (3)

Cyber fraud loss 3 (1,981) -

Total expenses (7,707) (946)

Operating loss 3 (7,707) (946)

Finance expense 5 (402) (7)

Loss from continuing operations before

taxation (8,109) (953)

Tax expense in current year 6 (1) -

-------- --------

Loss from continuing operations after

taxation (8,110) (953)

-------- --------

Total comprehensive loss for the year (8,110) (953)

======== ========

Loss per share from continuing operations

(expressed in cents)

- Basic 7 (1.43)c (0.20)c

- Diluted (1.43)c (0.20)c

The accompanying accounting policies and notes form an integral

part of these financial statements.

Statement of Financial Position

As at 31 March 2022

Company Number: 05387837 2022 2021

Notes US$'000 US$'000

Assets

Non-Current Assets

Exploration and evaluation assets 8 24,907 14,643

Total non-current assets 24,907 14,643

Current Assets

Trade and other receivables 9 36 36

Corporation tax receivable 6 - 358

Cash and cash equivalents 19 150

--------- ---------

Total current assets 55 544

Liabilities

Current Liabilities

Trade and other payables 10 1,299 667

Provisions 140 111

Convertible loan notes 11 4,125 -

Derivative financial liabilities 12 722 -

Total current liabilities 6,286 778

Net Current Liabilities (6,231) (234)

--------- ---------

Net Assets 18,676 14,409

========= =========

Shareholders' Equity

Share capital 14 1,809 1,398

Share premium reserve 41,285 29,408

Warrant and share-based payment reserve 576 487

Retained losses (24,994) (16,884)

--------- ---------

Total Equity 18,676 14,409

========= =========

The accompanying accounting policies and notes form an integral

part of these financial statements.

Statement of Cash Flows

For the Year Ended 31 March 2022

2022 2021

Notes US$'000 US$'000

Operating Activities

Payments for operating activities (1,240) (831)

Receipt of corporation tax 358 -

--------- --------

Net cash outflow for operating activities 13 (882) (831)

Investing Activities

P ayments for exploration and evaluation 8 (14,391) (1,159)

Payments due to cyber fraud (1,981) -

Net cash outflow for investing activities (16,372) (1,159)

Financing Activities

Issue of ordinary share capital 11,805 2,094

Proceeds from exercise of warrants 623 -

Proceeds from borrowings 11 5,412 -

Payment of finance costs (271) -

Payment of equity issue costs (463) (163)

--------- --------

Net cash inflow from financing activities 17,106 1,931

Net decrease in cash and cash equivalents (148) (59)

Cash and cash equivalents at the start

of the year 150 189

Forex gain/(loss) on cash held 17 20

--------- --------

Cash and Cash Equivalents at the End

of the Year 19 150

========= ========

The accompanying accounting policies and notes form an integral

part of these financial statements.

Statement of Changes in Equity

For the Year Ended 31 March 2022

Share Share Warrant Retained Total

Capital Premium & Share- Losses Equity

Reserve Based Payment

Reserve

Notes US$'000 US$'000 US$'000 US$'000 US$'000

Balance at 1 April

2020 1,291 27,811 153 (15,931) 13,324

========= ========= =============== ========== ==========

Loss after tax for

the year - - - (953) (953)

Total comprehensive

loss for the year - - - (953) (953)

--------- --------- --------------- ---------- ----------

Contributions by

and distributions

to owners

Shares issued in

the period 14 107 1,760 227 - 2,094

Equity issue costs - (163) - - (163)

Share-based payment

expense - - 100 - 100

Finance expense

(share-based) - - 7 - 7

--------- --------- --------------- ---------- ----------

Total contributions

by and distributions

to owners 107 1,597 334 - 2,038

--------- --------- --------------- ---------- ----------

Balance at 1 April

2021 1,398 29,408 487 (16,884) 14,409

========= ========= =============== ========== ==========

Loss after tax for

the year - - - (8,110) (8,110)

Total comprehensive

loss for the year - - - (8,110) (8,110)

--------- --------- --------------- ---------- ----------

Contributions by

and distributions

to owners

Shares issued in

the period 14 378 11,427 - - 11,805

Partial conversion

of convertible note 23 896 - - 919

Exercise of warrants 10 613 - - 623

Equity issue costs - (463) - - (463)

Issue of placement

warrants - (596) - - (596)

Share-based payment

expense - - 66 - 66

Finance expense

(share-based) - - 23 - 23

Total contributions

by and distributions

to owners 411 11,877 89 - 12,377

Balance at 31 March

2022 1,809 41,285 576 (24,994) 18,676

========= ========= =============== ========== ==========

The accompanying accounting policies and notes form an integral

part of these financial statements.

Notes to the Financial Statements

For the Year Ended 31 March 2022

Note 1. Statement of Significant Accounting Policies

Basis of preparation

The Company's financial statements have been prepared in

accordance with United Kingdom adopted International Accounting

Standards ("UK adopted IAS") and Companies Act 2006. The principal

accounting policies are summarised below. The financial report is

presented in the functional currency, US dollars and all values are

shown in thousands of US dollars (US$'000), unless otherwise

stated.

The preparation of financial statements in compliance with UK

adopted IAS requires the use of certain critical accounting

estimates. It also requires Company management to exercise judgment

in applying the Company's accounting policies. The areas where

significant judgments and estimates have been made in preparing the

financial statements and their effect are disclosed below.

Basis of measurement

The financial statements have been prepared on a historical cost

basis, except for derivative financial instruments, which are

measured at fair value through profit or loss.

Nature of business

The Company is a public limited company incorporated and

domiciled in England and Wales. The address of the registered

office is 2(nd) Floor, 38-43 Lincoln's Inn Fields London, WC2A 3PE.

The Company is in the business of financing the exploration,

development and production of energy resource projects in regions

with energy hungry markets close to existing infrastructure. The

Company has typically focused on non-operating working interest

positions in projects that have drill ready targets that

substantially short cut the life-cycle of hydrocarbon projects by

entering the project after exploration concept, initial exploration

and drill target identification work has largely been

completed.

Going concern

The Company's principal activity during the year has been the

acquisition and development of its exploration projects. At the

year end the Company had a cash balance of US$19,000 (2021:

US$150,000) and made a loss after income tax of US$8.11 million

(2021: loss of US$0.95 million).

The Directors have prepared cash flow forecasts for the Company

covering the period to 31 December 2023 and these demonstrate that

the Company will require further funding within the next 12 months.

In June 2022, the Company entered into an agreement with CNOOC to

drill an exploration well on the Topaz prospect in China, by 12

June 2024, which includes a payment of US$250,000 to CNOOC. It is

estimated that the cost of drilling this well would be

approximately US$12 million. In addition, the Company is required

to repay the principal owing on the Convertible Note prior to 1

December 2022, being GBP3.3 million as at the date of this report,

in accordance with the restructured terms announced to the market

on 10 May 2022. The Convertible Note is secured by a senior first

ranking charge over the Company, including it's 8.5% interest in

the Duyung PSC and Mako Gas Field.

In May 2022 US$2.25 million was raised through an equity

placement to complete further post well analysis of the Jade well,

satisfy any further costs associated with the Jade drill, conduct a

comprehensive oil migration study in conjunction with CNOOC for

potential oil charge to the Topaz prospect, and for the Company's

general working capital requirements. However in order to meet the

well commitment at Topaz and also to meet the repayment terms of

the Convertible Note, the Company is required to raise further

funding either through equity or the sale of assets and as at the

date of this report the necessary funds are not in place.

The Directors are however optimistic that the full funding

commitments for the Topaz well and the Convertible Note will be

met, having a successful track record of equity (and debt) funding

including funding the recently drilled Jade well.

It is the belief of the Board that there are likely share price

catalysts throughout the next 12 months leading up to drilling -

including maximising the value of its interest at the Mako Gas

field and activities leading into the intended drilling of the

Topaz Prospect. There are a number of key milestones for the

Project, each of which brings the Project closer to production.

Each milestone reduces risk and increases the value of the Project.

The major milestones are approval by the Indonesian Government of a

revised Plan of Development that is currently before them, signing

of the GSA(s), completion of front-end engineering design, final

investment decision and production. Empyrean's interest can be sold

at any stage but with two of these major milestones due imminently

without any further funding required, it is the Board's current

intention to at least achieve those milestones before considering a

sale versus funding through to production.

The Directors note that if the well commitment is not met in the

timeframe advised then either a renegotiation of the commitment

timing will be required or the licence could be relinquished.

The Directors have therefore concluded that it is appropriate to

prepare the Company's financial statements on a going concern

basis, however, in the absence of additional funding being in place

at the date of this report, these conditions indicate the existence

of a material uncertainty which may cast significant doubt over the

Company's ability to continue as a going concern and, therefore,

that it may be unable to realise its assets and discharge its

liabilities in the normal course of business.

The financial statements do not include the adjustments that

would result if the Company was unable to continue as a going

concern.

Adoption of new and revised standards

(a) New and amended standards adopted by the Company:

There were no new standards effective for the first time for

periods beginning on or after 1 April 2021 that have had a

significant effect on the Company's financial statements.

(b) Standards, amendments and interpretations that are not yet

effective and have not been early adopted:

Any standards and interpretations that have been issued but are

not yet effective, and that are available for early application,

have not been applied by the Company in these financial statements.

International Financial Reporting Standards that have recently been

issued or amended but are not yet effective have been assessed by

the Company and are not considered to have a significant effect on

the Company's financial statements.

Tax

The major components of tax on profit or loss include current

and deferred tax.

(a) Current tax

Tax is recognised in the income statement. The current tax

charge is calculated on the basis of the tax laws enacted at the

statement of financial position date in the countries where the

Company operates.

(b) Deferred tax

Deferred tax assets and liabilities are recognised where the

carrying amount of an asset or liability in the statement of

financial position differs to its tax base. Recognition of deferred

tax assets is restricted to those instances where it is probable

that taxable profit will be available, against which the difference

can be utilised. The amount of the asset or liability is determined

using tax rates that have been enacted or substantively enacted by

the reporting date and are expected to apply when the deferred tax

liabilities/(assets) are settled/(recovered). The Company has

considered whether to recognise a deferred tax asset in relation to

carried-forward losses and has determined that this is not

appropriate in line with IAS 12 as the conditions for recognition

are not satisfied.

Foreign currency translation

Transactions denominated in foreign currencies are translated

into US dollars at contracted rates or, where no contract exists,

at average monthly rates. Monetary assets and liabilities

denominated in foreign currencies which are held at the year-end

are translated into US dollars at year-end exchange rates. Exchange

differences on monetary items are taken to the Statement of

Comprehensive Income. Items included in the financial statements

are measured using the currency of the primary economic environment

in which the Company operates (the functional currency).

Oil and gas assets: exploration and evaluation

The Company applies the full cost method of accounting for

Exploration and Evaluation ("E&E") costs, having regard to the

requirements of IFRS 6 Exploration for and Evaluation of Mineral

Resources. Under the full cost method of accounting, costs of

exploring for and evaluating oil and gas properties are accumulated

and capitalised by reference to appropriate cash generating units

("CGUs"). Such CGUs are based on geographic areas such as a

concession and are not larger than a segment. E&E costs are

initially capitalised within oil and gas properties: exploration

and evaluation. Such E&E costs may include costs of license

acquisition, third party technical services and studies, seismic

acquisition, exploration drilling and testing, but do not include

costs incurred prior to having obtained the legal rights to explore

an area, which are expensed directly to the income statement as

they are incurred, or costs incurred after the technical

feasibility and commercial viability of extracting a mineral

resource are demonstrable, which are reclassified as development

and production assets.

Property, Plant and Equipment ("PPE") acquired for use in

E&E activities are classified as property, plant and equipment.

However, to the extent that such PPE is consumed in developing an

intangible E&E asset, the amount reflecting that consumption is

recorded as part of the cost of the intangible E&E asset.

Intangible E&E assets related to exploration licenses are not

depreciated and are carried forward until the existence (or

otherwise) of commercial reserves has been determined. The

Company's definition of commercial reserves for such purpose is

proven and probable reserves on an entitlement basis.

The ultimate recoupment of the value of exploration and

evaluation assets is dependent on the successful development and

commercial exploitation, or alternatively, sale, of the exploration

and evaluation asset.

Impairment tests are carried out on a regular basis to identify

whether the asset carrying values exceed their recoverable amounts.

There is significant estimation and judgement in determining the

inputs and assumptions used in determining the recoverable

amounts.

The key areas of judgement and estimation include:

-- Recent exploration and evaluation results and resource estimates;

-- Environmental issues that may impact on the underlying tenements; and

-- Fundamental economic factors that have an impact on the

planned operations and carrying values of assets and

liabilities.

Financial instruments

Financial assets and liabilities are recognised in the statement

of financial position when the Company becomes party to the

contractual provision of the instrument.

(a) Financial assets

The Company's financial assets consist of financial assets at

amortised cost (trade and other receivables, excluding prepayments,

and cash and cash equivalents) and financial assets classified as

fair value through profit or loss. Financial assets at amortised

cost are initially measured at fair value and subsequently at

amortised cost and attributable transaction costs are included in

the initial carrying value. Financial assets designated as fair

value through the profit or loss are measured at fair value through

the profit or loss at the point of initial recognition and

subsequently revalued at each reporting date. Attributable

transactions costs are recognised in profit or loss as incurred.

Movements in the fair value of derivative financial assets are

recognised in the profit or loss in the period in which they

occur.

(b) Financial liabilities

All financial liabilities are classified as fair value through

the profit and loss or financial liabilities at amortised cost. The

Company's financial liabilities at amortised cost include trade and

other payables and its financial liabilities at fair value through

the profit or loss include the derivative financial liabilities.

Financial liabilities at amortised cost, are initially stated at

their fair value and subsequently at amortised cost. Interest and

other borrowing costs are recognised on a time-proportion basis

using the effective interest method and expensed as part of

financing costs in the statement of comprehensive income.

Derivative financial liabilities are initially recognised at fair

value of the date a derivative contract is entered into and

subsequently re-measured at each reporting date. The method of

recognising the resulting gain or loss depends on whether the

derivative is designated as a hedging instrument, and if so, the

nature of the item being hedged. The Company has not designated any

derivatives as hedges as at 31 March 2021 or 31 March 2022.

(c) Impairment for financial instruments measured at amortised

cost

Impairment provisions for financial instruments are recognised

based on a forward looking expected credit loss model in accordance

with IFRS 9. The methodology used to determine the amount of the

provision is based on whether there has been a significant increase

in credit risk since initial recognition of the financial asset.

For those where the credit risk has not increased significantly

since initial recognition of the financial asset, twelve month

expected credit losses along with gross interest income are

recognised. For those for which credit risk has increased

significantly, lifetime expected credit losses along with the gross

interest income are recognised. For those that are determined to be

credit impaired, lifetime expected credit losses along with

interest income on a net basis are recognised.

Convertible loan notes ("CLNs")

The component parts of convertible loan notes issued by the

Company are classified separately as financial liabilities and

equity in accordance with the substance of the contractual

arrangements and the definitions of a financial liability and an

equity instrument, where material.

At the date of issue, the fair value of the liability component

is estimated using the prevailing market interest rate for a

similar non-convertible instrument. This amount is recorded as a

liability on an amortised cost basis using the effective interest

method until extinguished upon conversion or at the instrument's

maturity date.

The conversion option is determined by deducting the amount of

the liability component from the fair value of the compound

instrument as a whole. Where material, this is recognised and

included as a financial derivative where the convertible loan notes

are issued in a currency other than the functional currency of the

Company because they fail the fixed for fixed criteria in IAS 32.

The conversion option is recorded as a financial liability at fair

value through profit or loss and revalued at each reporting

date.

Share capital

Ordinary shares are classified as equity. Incremental costs

directly attributable to the issue of new shares or options are

shown in equity as a deduction, net of tax, from the proceeds.

Share-based payments

The Company issues equity-settled share-based payments to

certain employees. Equity-settled share-based payments are measured

at fair value at the date of grant. The fair value determined at

the grant date of the equity-settled share-based payments is

expensed over the vesting period, based on the Company's estimate

of shares that will eventually vest. The fair value of options is

ascertained using a Black-Scholes pricing model which incorporates

all market vesting conditions. Where equity instruments are granted

to persons other than employees, the income statement is charged

with the fair value of goods and services received.

The Company has also issued warrants on placements which form

part of a unit. These warrants do not fall into the scope of IFRS 2

Share Based Payments because there is no service being provided and

are assessed as either a financial liability or equity. If they

fail the fixed for fixed criteria in IAS 32 Financial Instruments:

Presentation, they are classified as financial liability and

measured in accordance with IFRS 9 Financial Instruments.

Critical accounting estimates and judgements

The Company makes judgements and assumptions concerning the

future that impact the application of policies and reported

amounts. The resulting accounting estimates calculated using these

judgements and assumptions will, by definition, seldom equal the

related actual results but are based on historical experience and

expectations of future events. The judgements and key sources of

estimation uncertainty that have a significant effect on the

amounts recognised in the financial statements are discussed

below.

Critical estimates and judgements

The following are the critical estimates and judgements that

management has made in the process of applying the entity's

accounting policies and that have the most significant effect on

the amounts recognised in the financial statements.

(a) Carrying value of exploration and evaluation assets

(judgement)

The Company monitors internal and external indicators of

impairment relating to its exploration and evaluation assets.

Management has considered whether any indicators of impairment have

arisen over certain assets relating to the Company's exploration

licenses. Management consider the exploration results to date and

assess whether, with the information available, there is any

suggestion that a commercial operation is unlikely to proceed. In

addition, management have considered the likely success of renewing

the licences, the impact of any instances of non-compliance with

license terms and are continuing with the exploration and

evaluation of the sites. After considering all relevant factors,

management were of the opinion that no impairment was required in

relation to the costs capitalised to exploration and evaluation

assets except for the below:

i) Empyrean and its China Block 29/11 partner CNOOC, along with

its technical service providers CNOOC Enertech and COSL, completed

significant pre-drilling operational, technical and permitting work

throughout the reporting period to enable to safe drilling,

although ultimately unsuccessful drilling of the Jade prospect post

reporting year end. As a result of the unsuccessful well at Jade,

Empyrean has, in accordance with applicable accounting standards,

written off all historical expenditure incurred on Block 29/11 and

also the dry hole costs associated with the Jade drilling program

subsequent to year end, together being US$22.04 million. At 31

March 2022, there were no conditions, facts or circumstances

present which lead the Company to believe the Jade well would be

dry, therefore it does not constitute an adjusting event under the

requirements of IAS 10 Events after the Reporting Period.

ii) While the Company will continue to work with its joint

venture partners in reviewing and assessing any further technical

and commercial opportunities as they relate to the Sacramento Basin

project, particularly in light of strong gas prices for gas sales

in the region, it has not budgeted for further substantive

exploration expenditure. As this is an impairment indicator under

IFRS 6, management has taken the decision to impair all expenditure

incurred on the project to date as at 31 March 2022.

iii) In light of current market conditions, little or no work

has been completed on the Riverbend or Eagle Oil projects in the

year and no substantial project work is forecast for either project

in 2022/23 whilst the Company focuses on other projects. Whilst the

Company maintains legal title it has continued to fully impair the

carrying value of the asset at 31 March 2022.

(b) Share based payments (judgement)

The Company has made awards of options and warrants over its

unissued share capital to certain employees as part of their

remuneration package. Certain warrants have also been issued to

shareholders as part of their subscription for shares and suppliers

for services received.

The valuation of these options and warrants involves making a

number of critical estimates relating to price volatility, future

dividend yields, expected life of the options and forfeiture rates.

These assumptions have been described in the more detail in Note

14.

Note 2. Segmental Analysis

The Directors consider the Company to have three geographical

segments, being China (Block 29/11 project), Indonesia (Duyung

PSC project) and North America (Sacramento Basin project),

which are all currently in the exploration and evaluation phase.

Corporate costs relate to the administration and financing

costs of the Company and are not directly attributable to the

individual projects. The Company's registered office is located

in the United Kingdom.

Details China Indonesia USA Corporate Total

US$'000 US$'000 US$'000 US$'000 US$'000

31 March 2022

Unallocated corporate

expenses - - - (1,599) (1,599)

-------- ---------- -------- ---------- --------

Operating loss - - - (1,599) (1,599)

Finance expense - - - (402) (276)

Impairment of oil and

gas properties - - (4,127) - (4,127)

Cyber fraud loss - - - (1,981) (1,981)

Loss before taxation - - (4,127) (3,982) (8,109)

Tax expense in current

year - - - (1) (1)

-------- ---------- -------- ---------- --------

Loss after taxation - - (4,127) (3,983) (8,110)

-------- ---------- -------- ---------- --------

Total comprehensive

loss for the financial

year - - (4,127) (3,983) (8,110)

======== ========== ======== ========== ========

Segment assets 20,662 4,245 - - 24,907

Unallocated corporate

assets - - - 55 55

-------- ---------- -------- ---------- --------

Total assets 20,662 4,245 - 55 24,962

======== ========== ======== ========== ========

Segment liabilities - - - - -

Unallocated corporate

liabilities - - - 6,286 6,286

-------- ---------- -------- ---------- --------

Total liabilities - - - 6,286 6,286

======== ========== ======== ========== ========

Details China Indonesia USA Corporate Total

US$'000 US$'000 US$'000 US$'000 US$'000

31 March 2021

Unallocated corporate expenses - - - (943) (943)

-------- ---------- -------- ---------- --------

Operating loss - - - (943) (943)

Finance expense - - - (7) (7)

Impairment of oil and gas

properties - - (3) - (3)

Loss before taxation - - (3) (950) (953)

Tax benefit in current - - - - -

year

-------- ---------- -------- ---------- --------

Loss after taxation - - (3) (950) (953)

-------- ---------- -------- ---------- --------

Total comprehensive loss

for the financial year - - (3) (950) (953)

======== ========== ======== ========== ========

Segment assets 6,537 4,052 4,054 - 14,643

Unallocated corporate assets - - - 544 544

-------- ---------- -------- ---------- --------

Total assets 6,537 4,052 4,054 544 15,187

======== ========== ======== ========== ========

Segment liabilities - - - - -

Unallocated corporate liabilities - - - 778 778

-------- ---------- -------- ---------- --------

Total liabilities - - - 778 778

======== ========== ======== ========== ========

Note 3. Operating Loss

2022 2021

US$'000 US$'000

The operating loss is stated after charging:

Audit and tax fees (94) (97)

Foreign exchange differences (518) 20

Impairment - exploration and evaluation

assets (4,127) (3)

Cyber fraud loss(a) (1,981) -

Auditor's Remuneration

Amounts paid to BDO LLP and their associates in respect of

both audit and non-audit services:

Fees payable to the Company's auditor

for the audit of the Company annual accounts 73 45

Fees payable to the Company's auditor

and its associates in respect of:

- Other services relating to taxation 12 14

-------- --------

Total auditor's remuneration 85 59

(a) In December 2021, the Company announced a payment totalling

US$1.98 million to COSL, representing a 10% deposit on the dry hole

cost component of the Integrated Drilling Contract ("IDC") signed

with COSL; however, the Company was subsequently informed that this

payment was not received by COSL and had been paid to an unknown

third party as a result of an impersonation fraud perpetrated

against the Company.

The Company then worked with its bank, the recipient bank and

the police authorities in three jurisdictions to initiate actions

including the freezing of the recipient bank account and the

commencement of recovery actions.

Empyrean has commenced legal proceedings in the Singapore courts

against the company believed to have committed the fraud and has

obtained an injunction order on 21 January 2022 to freeze its

assets and obtain further banking information. Empyrean will take

the necessary steps and is taking legal advice for the purpose of

pursuing recovery of the funds involved in the fraud. Empyrean

continues to cooperate with the Singapore Police investigation into

the fraud. Empyrean has taken the steps above, upon legal advice,

in order to escalate the recovery process.

Empyrean has also reviewed its internal control policies

including overseas and domestic payment processes and has added

further authority approvals and procedures for all material

payments.

Note 4. Directors' Emoluments

Fees and Salary Bonus Payment Social Security Short-Term Employment

Contributions Benefits (Total)

2022 2021 2022 2021 2022 2021 2022 2021

US$'000 US$'000 US$'000 US$'000 US$'000 US$'000 US$'000 US$'000

Non-Executive

Directors:

Patrick

Cross 25 24 - - 2 2 27 26

John Laycock 15 14 - - 1 1 16 15

Executive

Directors:

Thomas

Kelly(a) 304 291 - - - - 304 291

Gajendra

Bisht(b) 220 220 - - - - 220 220

Total 564 549 - - 3 3 567 552

-------- -------- -------- -------- -------- -------- ----------- -----------

Capitalised

to E&E(b) (165) (165) - - - - (165) (165)

-------- -------- -------- -------- -------- -------- ----------- -----------

Total

expensed 399 384 - - 3 3 402 387