TIDMEML

RNS Number : 5838N

Emmerson PLC

26 September 2023

Emmerson PLC / Ticker: EML / Index: AIM / Sector: Mining

26 September 2023

Emmerson PLC ("Emmerson" or the "Company")

Interim Results for the six months ended 30 June 2023

Emmerson, which is developing the world class Khemisset Potash

Project in Morocco ("Khemisset" or the "Project"), is pleased to

announce its Interim Results for the six month period ended 30 June

2023 (the "Period").

Highlights

-- Update on environmental permit and financing set out in Q3

update announcement on 21 September 2023

-- Financial results for the six months to 30 June 2023 reflect

expenditure on technical workstreams and administrative/corporate

support costs

-- Loss for the period of US$1.6 million

-- Cash balance at 30 June 2023 was US$4.2 million, after total

expenditure of US$2.5 million in the period. Cash reserves of

US$3.5 million as at the time of this report.

Activities During the Period

The Company's priority during the Period was advancing

discussions with government officials towards obtaining

environmental approval for the Khemisset Project in Morocco.

Currently, Emmerson is awaiting a session of the Ministerial

Committee to consider the matter, and although management remains

confident of a favourable outcome based on discussions to date, the

timing of the meeting is not certain, particularly following the

devastating earthquake in Morocco, which has, understandably, been

the main focus of government attention.

Financial Review

As the Company continues in its phase of exploration and

development, the results are relatively straightforward, and

reflect a loss for the period of US$1.6 million (30 June 2022:

US$1.5 million), primarily as a result of administration and

corporate costs.

Net cash of US$2.5 million was spent in the period (30 June

2022: US$5.3 million), consisting of the net impact of the

administration costs and working capital movements of US$2.2

million, capitalised development costs of US$0.5 million, and

US$0.2 million net proceeds of employee share option exercises.

Financing and Cash Position

At the time of this report, the Company has cash reserves of

US$3.5 million, sufficient to cover the remaining Basic Engineering

costs and working capital commitments for at least the next 12

months.

Outlook for 2023

For the balance of the year, the Company's focus will remain on

obtaining the environmental approval for the Project, putting in

place a new funding agreement with its Strategic Investors, and

finalising optimisation work ahead of a Bankable Feasibility

Study.

For further information, please visit www.emmersonplc.com ,

follow us on Twitter (@emmerson_plc), or contact:

Emmerson PLC +44 (0) 207 138

Graham Clarke / Jim Wynn / Charles Vaughan 3204

Liberum Capital Limited (Nominated Advisor

and Joint Broker) +44 (0)20 3100

Scott Mathieson / Matthew Hogg / Kane Collings 2000

Shard Capital (Joint Broker) +44 (0)20 7186

Damon Heath / Isabella Pierre 9927

BlytheRay (Financial PR and IR) +44 (0) 207 138

Tim Blythe / Megan Ray / Said Izagaren 3204

Notes to Editors

Emmerson is focused on advancing the Khemisset project

("Khemisset" or the "Project") in Morocco into a low cost, high

margin supplier of potash, and the first primary producer on the

African continent. With an initial 19-year life of mine, the

development of Khemisset is expected to deliver long-term

investment and financial contributions to Morocco including the

creation of permanent employment, taxation, and a plethora of

ancillary benefits. As a UK-Moroccan partnership, the Company is

committed to bringing in significant international investment over

the life of the mine.

Morocco is widely recognised as one of the leading phosphate

producers globally, ranking third in the world in terms of tonnes

produced annually, and the development of this mine is set to

consolidate its position as the most important fertiliser producer

in Africa. The Project has a large JORC Resource Estimate (2012) of

537Mt @ 9.24% K2O, with significant exploration potential, and is

perfectly located to support the expected growth of African

fertiliser consumption whilst also being located on the doorstep of

European markets. The need to feed the world's rapidly increasing

population is driving demand for potash and Khemisset is well

placed to benefit from the opportunities this presents. The

Feasibility Study released in June 2020 indicated the Project has

the potential to be among the lowest capital cost development stage

potash projects in the world and also, as a result of its location,

one of the highest margin projects. This delivered outstanding

economics, including a post-tax NPV(8) of approximately US$1.4

billion using industry expert Argus' price forecasts.

Condensed Consolidated Statement of Comprehensive Income

for the six months ended 30 June 2023

US$'000 6 months to 6 months to 12 months to

30 Jun 2023 30 Jun 2022 31 Dec 2022

Notes (Unaudited) (Unaudited) (Audited)

Administrative expenses 3 (1,386) (1,244) (2,581)

Share-based payment expense (199) (53) (256)

Net foreign exchange loss (43) (81) (356)

Operating loss (1,628) (1,378) (3,193)

Finance cost (6) - -

Loss before tax (1,634) (1,378) (3,193)

Income tax (1) - (5)

-------------------------------------------------------- ------ ------------- ------------- -------------

Loss for the period attributable to equity owners (1,635) (1,378) (3,198)

-------------------------------------------------------- ------ ------------- ------------- -------------

Other comprehensive income

Exchange gain/(loss) on translating foreign operations 146 (84) (45)

Total comprehensive loss attributable to equity owners (1,489) (1,462) (3,243)

-------------------------------------------------------- ------ ------------- ------------- -------------

Loss per share (cents) 4 (0.16) (0.15) (0.34)

Condensed Consolidated Statement of Financial Position at 30

June 2023

US$'000 30 June 2023 30 June 2022 31 Dec 2022

Notes (Unaudited) (Unaudited) (Audited)

Non-current assets

Intangible assets 5 19,239 16,489 18,607

Property, plant and equipment 38 39 43

--------------------------------------------------- ------ -------------

Total non-current assets 19,277 16,528 18,650

Current assets

Trade and other receivables 1,304 1,126 1,181

Cash and cash equivalents 4,179 4,535 6,670

--------------------------------------------------- ------ ------------- ------------- ------------

Total current assets 5,483 5,661 7,851

Total assets 24,760 22,189 26,501

--------------------------------------------------- ------ ------------- ------------- ------------

Current liabilities

Trade and other payables (351) (1,005) (1,032)

Total current liabilities (351) (1,005) (1,032)

Net assets 24,409 21,184 25,469

--------------------------------------------------- ------ ------------- ------------- ------------

Shareholders equity attributable to equity owners

Share capital 35,145 29,025 34,733

Share-based payment reserve 2,427 2,163 2,470

Reverse acquisition reserve 2,234 2,234 2,234

Retained earnings (15,211) (11,867) (13,636)

Translation reserve (186) (371) (332)

--------------------------------------------------- ------ ------------- ------------- ------------

Total equity 24,409 21,184 25,469

--------------------------------------------------- ------ ------------- ------------- ------------

Condensed Consolidated Statement of Changes in Equity for the

six months ended 30 June 2023

US$'000 Share Share-based Reverse Retained earnings Translation Total equity

Capital payment reserve acquisition reserve

reserve

Balance at 1

January 2022 28,993 2,113 2,234 (10,489) (287) 22,564

Loss for the

period - - - (1,378) - (1,378)

Other

comprehensive

loss:

FX on translating

foreign

operations - - - - (84) (84)

-------- ----------------- ----------------- ----------------- ----------------- ------------

Total

comprehensive

loss - - - (1,378) (84) (1,462)

Fair value of

share options - 53 - - - 53

Share options and

warrants

exercised 3 (3) - - - -

Issue of shares

for cash 29 - - - - 29

-------- ----------------- ----------------- ----------------- ----------------- ------------

Balance at 30

June 2022 29,025 2,163 2,234 (11,867) (371) 21,184

-------- ----------------- ----------------- ----------------- ----------------- ------------

Balance at 1

January 2022 28,993 2,113 2,234 (10,489) (287) 22,564

Loss for the year - - - (3,198) - (3,198)

Other

comprehensive

loss:

FX on translating

foreign

operations - - - - (45) (45)

-------- ----------------- ----------------- ----------------- ----------------- ------------

Total

comprehensive

income - - - (3,198) (45) (3,243)

Fair value of

share options - 256 - - - 256

Share issued to

settle

obligations 25 - - - - 25

Share issued for

cash 6,106 - - - - 6,106

Cost of issuing

shares - cash (267) - - - - (267)

Cost of issuing

shares -

warrants (283) 283 - - - -

Options exercised

for cash 28 - - - - 28

Options exercised

cashless 131 (131) - - - -

Transfer for

options expired

in 2021 - (51) - 51 - -

-------- ----------------- ----------------- ----------------- ----------------- ------------

Balance at 31

December 2022 34,733 2,470 2,234 (13,636) (332) 25,469

-------- ----------------- ----------------- ----------------- ----------------- ------------

Balance at 1

January 2023 34,733 2,470 2,234 (13,636) (332) 25,469

Loss for the

period - - - (1,635) - (1,635)

Other

comprehensive

gain:

FX on translating

foreign

operations - - - - 146 146

-------- ----------------- ----------------- ----------------- ----------------- ------------

Total

comprehensive

loss - - - (1,635) 146 (1,489)

Fair value of

share options - 206 - - - 206

Options exercised

for cash 225 (62) - 60 - 223

Options exercised

cashless 187 (187) - - - -

Balance at 30

June 2023 35,145 2,427 2,234 (15,211) (186) 24,409

-------- ----------------- ----------------- ----------------- ----------------- ------------

Condensed Consolidated Statement of Cash Flows for the six month

period ended 30 June 2023

6 months to 6 months to 12 months to

30 June 2023 30 June 2022 31 Dec 2022

(Unaudited) (Unaudited) (Audited)

US$'000 US$'000 US$'000

Cash flows from operating activities

Loss before tax (1,634) (1,378) (3,193)

Adjustments:

Foreign exchange 43 81 (205)

Taxation (1) - (5)

Share-based payment 199 53 256

Directors' remuneration settled in shares - - 25

Depreciation 5 2 (2)

Changes in working capital:

Increase in trade and other receivables (123) (355) (410)

Decrease in trade and other payables (681) (821) (803)

---------------------------------------------------- ------------- ------------------ ------------

Net cash flows used in operating activities (2,192) (2,418) (4,337)

---------------------------------------------------- ------------- ------------------ ------------

Cash flows from investing activities

Exploration expenditure (520) (2,934) (5,052)

Net cash flows used in investing activities (520) (2,934) (5,052)

---------------------------------------------------- ------------- ------------------ ------------

Cash flows from financing activities

Proceeds from issuing shares and warrants - - 6,106

Cost of issuing shares - - (267)

Proceeds from exercise of share options & warrants 230 29 28

Net cash flows generated from financing activities 230 29 5,867

---------------------------------------------------- ------------- ------------------ ------------

Decrease in cash and cash equivalents (2,482) (5,323) (3,522)

Cash and cash equivalents at beginning of period 6,670 10,032 10,032

Foreign exchange on cash and cash equivalents (9) (174) 160

---------------------------------------------------- ------------- ------------------ ------------

Cash and cash equivalents at end of period 4,179 4,535 6,670

---------------------------------------------------- ------------- ------------------ ------------

Notes to the Condensed Consolidated Financial Statements for the

six months ended 30 June 2023

1. General information

Emmerson PLC (the "Company") is a company incorporated and

domiciled in the Isle of Man, whose shares were admitted to the

Standard Listing segment of the Main market of the London Stock

Exchange on 15 February 2017. On 27 April 2021, the Ordinary Shares

of the Company were admitted to trading on AIM and the listing of

the Company's ordinary shares on the Official List and their

trading on the Main Market were cancelled.

The principal activity of the Company and its subsidiaries

(together "the Group") is the exploration, development and

exploitation of a potash development project in Morocco.

2. Basis of preparation

2.1 General

The Condensed Consolidated Financial Statements have been

prepared in accordance with the valuation and recognition

principles of UK-adopted International Accounting Standards. The

Condensed Consolidated Financial Statements for the six months

ended 30 June 2023 are unaudited and have not been reviewed by the

Group's auditor, and do not include all of the information required

for full annual financial statements.

They should be read in conjunction with the Company's annual

financial statements for the year ended 31 December 2022. The

principal accounting policies applied in the preparation of the

Condensed Consolidated Financial Statements are unchanged from

those disclosed in those statements. These policies have been

consistently applied to each of the periods presented.

The financial information of the Group is presented in US

Dollars, which is also the functional currency of the parent

Company and has been prepared under the historical cost convention.

The individual financial statements of each of the Company's wholly

owned subsidiaries are prepared in the currency of the primary

economic environment in which it operates (its functional

currency).

2.2 Basis of consolidation

The Consolidated Financial Statements comprise the financial

statements of the Company, Moroccan Salts Limited, Moroccan Salts

Limited's subsidiaries (the "MSL Group") and Khemisset UK Ltd

("KUK"). KUK, a wholly-owned subsidiary of the Company, was

incorporated in England and Wales under the Companies Act 2006 on 8

February 2023.

Subsidiaries are fully consolidated from the date of

acquisition, being the date on which the Group obtains control.

Control is achieved when the Group is exposed, or has rights, to

variable returns from its involvement with the investee and has the

ability to affect those returns through its power over the

investee.

Generally, there is a presumption that a majority of voting

rights result in control. To support this presumption and when the

Group has less than a majority of the voting or similar rights of

an investee, the Group considers all relevant facts and

circumstances in assessing whether it has power over an investee,

including:

-- The contractual arrangement with the other vote holders of the investee;

-- Rights arising from other contractual arrangements; and

-- The Group's voting rights and potential voting rights.

The Group re-assesses whether or not it controls an investee if

facts and circumstances indicate that there are changes to one or

more of the three elements of control. Subsidiaries are fully

consolidated from the date on which control is transferred to the

Group. They are deconsolidated from the date that control ceases.

Assets, liabilities, income and expenses of a subsidiary acquired

or disposed of during the period are included in the Group

Financial Statements from the date the Group gains control until

the date the Group ceases to control the subsidiary.

All intra-group balances, transactions, income and expenses and

profits and losses resulting from intra-group transactions that are

recognised in assets, are eliminated in full.

All the Group's companies have 31 December as their year-end.

Consolidated financial statements are prepared using uniform

accounting policies for like transactions.

2.3 Functional and presentational currency

The financial information of the Group is presented in US

Dollars, which is also the functional currency of the parent

Company, and has been prepared under the historical cost

convention. The individual financial statements of each of the

Company's wholly owned subsidiaries are prepared in the currency of

the primary economic environment in which it operates (its

functional currency).

2.4 Going concern

The Group's cash position at the date of this report is US$3.5

million. This amount is sufficient to cover all committed

expenditures for the twelve months. Additional expenditures related

to the development of the Khemisset Project which are not committed

and would not be covered by cash reserves would need to be financed

by fundraising in the future, however these expenditures are

discretionary, and the Directors are confident that any funds could

be raised from existing and new shareholders for such activities,

which would be value accretive to shareholders. Accordingly, the

Directors have adopted the going concern basis in preparing the

Interim Financial Statements.

2.5 Segment reporting and cyclicality

A business segment is a group of assets and operations engaged

in providing products or services that are subject to risks and

returns that are different from those of other business segments. A

geographical segment is engaged in providing products or services

within a particular economic environment that are subject to risks

and returns that are different from those of segments operating in

other economic environments.

The Directors consider the Group is engaged in a single segment

of business being the exploration activity of potash in one

geographical area, being the Khemisset Project in Morocco.

The interim results for the six months ended 30 June 2023 are

not necessarily indicative of the results to be expected for the

full year ending 31 December 2023. Due to the nature of the entity,

the operations are not affected by seasonal variations at this

stage.

3. Administrative fee and other expenses

US$'000 6 months to 6 months to 12 months to

30 Jun 2023 30 Jun 2022 31 Dec 2022

(Unaudited) (Unaudited) (Audited)

Directors' fees 333 292 601

Travel and accommodation 35 61 99

Auditors' remuneration 32 34 48

Employment costs 404 298 627

Professional and consultancy fees 361 559 715

Other expenses 221 - 491

Total Administrative Expenses 1,386 1,244 2,581

----------------------------------- ------------- ------------- -------------

4. Earnings per share

The calculation of the basic and diluted earnings per share is

based on the following data:

US$'000 6 months to 6 months to 12 months to

30 Jun 2023 30 Jun 2022 31 Dec 2022

(Unaudited) (Unaudited) (Audited)

Earnings

Loss from continuing operations for the period attributable to the equity

holders of the Company (1,635) (1,378) (3,198)

Number of shares

Weighted average number of ordinary shares for the purpose of basic and

diluted earnings per

share 1,016,540,028 915,425,829 939,716,598

-------------------------------------------------------------------------- -------------- ------------ ------------

Basic and diluted loss per share 0.16 cents 0.15 cents 0.34 cents

-------------------------------------------------------------------------- -------------- ------------ ------------

5. Intangible assets

The intangible assets consist of capitalised exploration and

evaluation expenditure, including the cost of acquiring the mining

license and research permits held by the Company's

subsidiaries.

30 Jun 2023 30 Jun 2022 31 Dec 2022

(Unaudited) (Unaudited) (Audited)

US$'000 US$'000 US$'000

Cost:

At the beginning of the period 18,607 13,555 13,555

Additions 520 2,934 5,052

Exchange differences 112 - -

As at end of period 19,239 16,489 18,607

-------------------------------- ------------ ------------ ------------

6. Related party transactions

Directors' consultancy fees

Robert Wrixon is a Director of the Company and provided

consulting services to the Company. During the period, Robert

Wrixon received fees of US$12k (year to 31 December 2022: US$71K).

The amount outstanding as at period-end was US$ nil (31 December

2022: US$ nil).

Hayden Locke is a Director of the Company and is a director of

Benson Capital Limited, which previously provided consulting

services to the Company. During the period, Benson Capital Limited

received total fees of US$ nil (year to 31 December 2022: US$95k).

The amount outstanding as at period end was US$ nil (31 December

2022: US$9K).

7. Post-balance sheet events

Moroccan earthquake

On Friday 8 September 2023, a magnitude 6.8 earthquake struck

Morocco. The epicentre was located in the High Atlas mountains,

approximately 70km south of Marrakech. Emmerson's project and

offices are located some distance away, and were not affected

directly.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR NKPBBABKDQCB

(END) Dow Jones Newswires

September 26, 2023 02:00 ET (06:00 GMT)

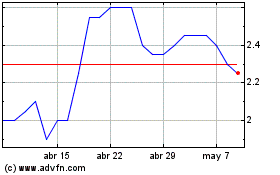

Emmerson (LSE:EML)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Emmerson (LSE:EML)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024