TIDMEPIC

RNS Number : 6047J

Ediston Property Inv Comp PLC

14 December 2022

Ediston Property Investment Company plc

(the 'Company')

(LEI: 213800JRL87EGX9TUI28)

FULL YEAR RESULTS AND NOTICE OF AGM

Ediston Property Investment Company plc (LSE: EPIC), a UK-listed

Real Estate Investment Trust (REIT) investing in commercial

property throughout the UK, announces its full year results for the

year ended 30 September 2022.

The Company also announces that its 2022 Annual General Meeting

will be held on Friday, 24 February 2023 at 2.00 p.m. at the

offices of Ediston Investment Services Limited at 1 St Andrew

Square, Edinburgh, EH2 2BD.

The Company's Annual Report and Financial Statements for the

year ended 30 September 2022 and the formal Notice of the Annual

General Meeting will be posted to shareholders and in accordance

with Listing Rule 9.6.1 copies of the documents have been submitted

to the UK Listing Authority and will shortly be available to view

on the Company's corporate website at

https://www.epic-reit.com/literature/ and have also been submitted

to the UK Listing Authority and will be shortly available for

inspection from the National Storage Mechanism at:

https://data.fca.org.uk/#/nsm/nationalstoragemechanism

Year to 30 September 2022:

Operational

- Sold four office assets and two leisure assets for GBP69.5m.

- 15 lease transactions completed with a contracted rent of GBP2.5m per annum.

- 98.2% of rent due was collected.

- Portfolio is now 100% in retail warehousing, in line with the

new investment strategy, with cash available for further investment

at the appropriate time.

Key Performance Indicators and Financial

2022 2021

---------------------------------- --------- ---------

NAV total return 11.5% 9.6%

Annualised dividend per shares 5.00p 4.42p

Average premium/discount of share

price to NAV -17.9% -22.1%

Share price total return -2.3% 54.6%

EPRA vacancy rate 6.5% 8.6%

Ongoing charges 1.4% 1.4%

Total assets GBP313.7m GBP303.0m

Weighted average unexpired lease 4.5 years 5.0 years

term

EPRA NAV per share 94.9p 89.6p

Rent collected in the year 98.2% 95.7%

Dividend Cover 81.2% 119.0%

Anticipated Financial Calendar 2023

January 2023 Announcement of Net Asset Value as at 31

December 2022

24 February Annual General Meeting

2023

------------------------------------------

April 2023 Announcement of Net Asset Value as at 31

March 2023

------------------------------------------

May 2023 Publication of Half Yearly Report for the

six months to 31 March 2023

------------------------------------------

July 2023 Announcement of Net Asset Value as at 30

June 2023

------------------------------------------

October 2023 Announcement of Net Asset Value as at 30

September 2023

------------------------------------------

December 2023 Publication of Annual Report for the year

to 30 September 2023

------------------------------------------

It is the intention of the Board that dividends will continue to

be announced and paid monthly.

Enquiries

Will Barnett Investec Bank plc 0207 597 5873

Ediston Properties

Calum Bruce Limited 0131 225 5599

Ruth Wright JTC 0203 893 1011

Ben Robinson Kaso Legg Communications 0203 995 6672

Stephanie Ross Kaso Legg Communications 0203 995 6676

Chairman's Statement

OVERVIEW

The sale of the office and leisure properties has increased the

retail warehouse exposure in the property portfolio from 74.1% to

100% of our invested assets. At the year end, the Company held

GBP31.0m in the debt disposal account earmarked specifically for

reinvestment, as well as GBP50.2m in its operational account.

In my interim statement in May, I commented that, whilst the

retail warehouse market had flourished in the first part of the

year, the macro-economic position was becoming more challenging due

to world events and rising inflation. Behind this caution was the

expectation of higher interest rates and a squeeze on business

investment and consumer spending to bring inflation under control.

This has happened against a background of political chaos in the

UK.

The consequent spike in gilt rates has created a wave of fear in

real estate markets as investors grapple with the pricing

implications of needing higher returns on equity to compensate, and

much higher borrowing costs than anticipated. This is reflected in

the widened discounts across the closed-ended sector.

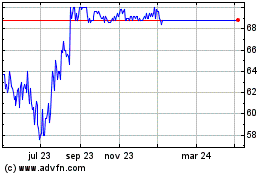

For the Company, the most obvious and immediate impact has been

the deterioration in the share price, which has moved down from

78.8 pence per share at the half year to 67.6 pence at the year

end. Due to a reduction in property values, the Company has seen a

fall in Net Asset Value at 30 September, following five quarters of

increases.

There are no doubt more real estate bumps in the road to

navigate over coming months, with a slowing economy and rising

interest rates. A sizeable one in the short term will be the impact

of the expected mark down in market valuations at the end of

December, based on transactional evidence over the quarter.

External geopolitical factors will also remain a significant factor

in determining the direction of the economy. The Board will

continue to manage risk proactively and where possible ensure the

Company is as resilient as it can be to whatever lies ahead.

Despite the economic and political difficulties that emerged in

2022, the Company, with its new investment focus and cash to

invest, should emerge from this period of disruption in a strong

position.

INVESTMENT AND SHARE PRICE PERFORMANCE

The Company's Net Asset Value (NAV) per share increased by 5.9%

with an annualised NAV total return as at 30 September 2022 of

11.5%. Like-for-like property values increased by 10.3% over the

period.

Despite the increase in NAV, the share price has declined 8.4%

over the year from 73.8 pence to 67.6 pence. Allowing for the

payment of the dividend, the share price total return was

-2.3%.

The increase in NAV for the year was driven by the improvement

in valuations in the retail warehouse portfolio due to a

combination of yield shift and the gains from asset management

initiatives. Some of this value was lost in the last quarter due to

markets falling back on economic concerns, the general rise in

borrowing costs and the political turmoil. The sale of the office

portfolio was completed below the September 2021 valuation, and was

a drag on performance for the year. However, the sale was prescient

as it is highly likely that, if these assets had not been sold, the

current valuation of the offices would be below the sale value,

creating a larger offset to the retail warehouse gains.

INVESTMENT STRATEGY

Asset Allocation

The completion of the office sales and the disposal of the two

leisure assets during the year has shifted the asset mix from 74.1%

to 100% invested in the retail warehouse sector. Uninvested cash

resources will be invested into the sector, maintaining a 100%

exposure for the foreseeable future and in line with the revised

strategy. The Investment Manager had intended for the Company to be

fully invested by the half year. However, due to the uncertainty

and re-pricing of the market, it was decided that it was prudent to

hold cash until the right opportunities were available, and the

extent of the correction was more visible.

In considering retail warehouse investments, it is important to

note that the sector is not one homogenous group of assets.

Investment performance can be influenced by many factors, including

planning restrictions on users, tenant focus, tenant mix, size and

layout of units, the size of the overall scheme, availability of

car parking, accessibility, the nature of the catchment, supply of

competing space, property management, sustainability factors, the

affordability of the prevailing rent, opportunities to add space

and alternative use values. The dispersion of returns can be

significant across the sector, accentuating the importance of stock

selection and an experienced Investment Manager.

Given the focus on the sector, the Investment Manager has

provided more information in its review later on in this report.

What does come through from the analysis is the strength of the

Company's income stream. The credit rating of 85.0% of the tenant

line-up is rated by Dun & Bradstreet as having a lower than

average risk of business failure. The average rent passing

(including the smaller coffee and kiosk units, which command higher

rents but ignoring vacant units) is GBP14.72 per sq. ft. The

Company is aware that many of its retailers are making money from

this rental base and, with void levels low, it augurs well for

rental growth.

What makes the sector especially interesting is that the

investment story is much more than the attractive levels of rent

and capital value as:

1) click-and-collect continues to grow, with out-of-town parks

well placed to provide this function;

2) retailers remain attracted to the better configured space on

retail parks;

3) new revenue opportunities exist from creating new spaces such

as drive-thru units and electrical vehicle (EV) charging points;

and

4) densities can be increased with the potential for introducing

other uses.

Sustainability

I am delighted that the Company is embracing its sustainability

responsibilities and has made further progress during the year in

charting its way to net zero. The Sustainability Working Group,

comprising the team from the Investment Manager, Savills, Imogen

Moss and myself, is proving effective in maintaining the required

momentum. It is satisfying that the Investment Manager has secured

another green star to last year's rating following the Company's

participation in the 2022 GRESB survey.

The ESG activities are more fully described within the report.

This is more detailed disclosure than the previous year and

hopefully informative for shareholders.

PORTFOLIO ACTIVITY

It has been an exceptionally busy year, with the Investment

Manager's report providing full information. The key highlights

are:

1) Sales

The four office assets in Bath, Birmingham, Newcastle and

Edinburgh, and the leisure assets at Hartlepool and Telford, were

sold. The total capital raised from the six transactions was

GBP69.5m. The sales achieved one of the key strategic objectives

set last year.

2) Asset Management

The strategic priorities of protecting rent and enhancing NAV

were achieved. Fifteen lease transactions involving GBP2.5m of rent

were completed during the year, with one further deal concluding

post the year end. The void management target was also achieved

with the reduction in the EPRA Vacancy Rate from 8.6% to 6.5%. This

all contributed to the value of the retail warehouse assets

improving during the year.

RENT COLLECTION

In total, 98.2% of rent due was collected at the year end.

Contracted rent had fallen at the year end from 12 months ago due

to the loss of income from the office and leisure property sales

and the deferral of the reinvestment of the sale proceeds. The

objective is to replace as much of this income as possible through

reinvestment in suitable retail warehouse assets.

GEARING AND CASH RESOURCES

The Company's total debt is unchanged at GBP111.1m, at a blended

'all-in' fixed rate of 2.9%. The loans do not mature until 2025 and

2027. Gearing on 30 September 2022 was 35.41% of total assets, a

slight decrease from last year end. Gearing is within investment

policy limits and covenants.

As at 30 September 2022, the Company held GBP81.2m of cash. Of

this sum, GBP31.0m is contained within the security pool and

consent from the lender is required where Loan-to-Value (LTV)

levels at the time the funds are utilised is above 35%.

DIVIDS

In my report last year, I stated the Board's commitment to a

covered dividend and the prospect of further dividend progress as

contracted rental income continued to improve. I also highlighted

that the likely mismatch between sales and reinvestment could lead

to a period of uncovered dividends and that,if prudent to do so,

the shortfall would be made up from reserves.

Delaying the reinvestment of capital from the sales has meant

the period of uncovered dividend has become longer than was

anticipated. The Board believes the way the Company has responded

to the changed market conditions is both responsible and

appropriate. The Company is well funded to continue to pay the

current monthly dividend. It is the intention of the Board to

maintain the dividend at 5.0 pence per share. The expectation

remains that when the available capital is invested the dividend

will be covered.

LONG-TERM GROWTH STRATEGY

The Board's immediate focus is on NAV per share with the active

management of the current assets and ensuring that capital is

invested on an accretive basis for the medium term. Longer term,

the Board would like to grow the equity base of the Company to

improve liquidity, lower the cost base per share and enlarge the

investment opportunity set, but this will depend in no small part

on the recovery of the Company's share price rating.

Although the issue of new equity is unlikely in the short term,

due to the share price being at a discount to NAV, the Board is

asking shareholders to renew our non-pre-emptive authority of 10%,

so that we are in a better position to use 'tap issuance' if we

were able to do so. We will consider other means of raising capital

if there are substantial acquisitions to be financed. In any fund

raising, the interests of existing shareholders will be of

paramount importance in how we price and structure any new issuance

or take on any new gearing.

BOARD MATTERS

I would like to thank the Board, Investment Manager and all the

agents that provide services to the Company for their hard

work.

We have made some Board changes during the year as part of our

succession plan. I would like to welcome Karyn Lamont, who joined

the Board on 1 September, as our new Audit and Risk Committee

Chair. She will stand for election at the AGM in February 2023.

Karyn is a chartered accountant, a former audit partner at PwC and

an experienced non-executive director on other collective funds,

including as audit chair. Imogen Moss became the Senior Independent

Director on 1 June this year. These changes result from Robin

Archibald stepping down from both these positions to enable a

well-managed handover and transition to take place before he

retires from the Board at the AGM in 2023.

Robin has been on the Board since the Company floated in October

2014. During his time of service he has made an immense

contribution to the management oversight of the Company, and I

would like to thank him not only for that but also for all the wise

counsel and support he has given me personally. I know Robin will

remain active in the Investment Trust sector with his other board

appointments and we wish him well with these roles.

The end of my tenure is also in sight, having joined the Board

at the same time as Robin. The Board has asked me to continue as

Chairman in the coming year and I will, therefore, stand for

election at the forthcoming AGM. It is my intention to stand down

no later than the AGM in 2024 and between now and then will work

with my fellow directors on identifying a new Chair.

The Board has not revised its base remuneration levels in five

years. The only modifications to Board remuneration in that period

related to changes in roles and the introduction of the

arrangements relating to Robin Archibald's remuneration. The

Remuneration Committee has concluded that a modest increase is now

justified based on its assessment of market rates following the

recruitment process undertaken this year. The proposed increases

are significantly below the rate of inflation over the last five

years. Shareholders are being asked to approve an increase in the

remuneration cap to GBP275,000, giving the Board the flexibility it

might need over its composition in future years and to manage

succession.

ANNUAL GENERAL MEETING (AGM)

Shareholders are invited to attend the Company's AGM to be held

at 1 St Andrew Square, Edinburgh EH2 2BD on 24 February 2023.

Those shareholders who are unable to attend the AGM in person

are encouraged to raise any questions in advance with the

Administrator at epic.reit@jtcgroup.com (please include 'EPIC AGM'

in the subject heading). Questions must be received by 5.00 p.m. on

10 February 2023. Any questions received will be replied to by

either the Investment Manager or Board, via the Administrator,

before the AGM. A shareholder presentation will be made available

on the Company website following the AGM, updating shareholders on

the activities of the Company.

OUTLOOK

The decision to delay the reinvestment of the sales proceeds

from the office and leisure disposals has undoubtedly put the

Company in a better position to take advantage of the current

market uncertainty and setback in asset valuations. We can expect

some interesting and attractive opportunities to arise over the

coming months, given the expected further falls in market

valuations. Real estate markets are now much quicker to adjust than

in the past so these opportunities could come quickly. However, the

Investment Manager has no specific timetable in mind for the

reinvestment and will be led by opportunity and to the extent that

the market has re-priced. The timing will also be driven by the

need to ensure the Company remains financially resilient to the

effects of any sustained market downturn.

However, it will mean the payment of an uncovered dividend in

the meantime.

The immediate focus is on managing the existing assets to

protect the NAV per share and ensure the income is maximised to

reduce the extent of the uncovered dividend. The Investment Manager

did an excellent job in this regard during the COVID-19 Crisis and

is well-positioned to do so during a period of economic

difficulty.

The attractiveness of large parts of the retail warehouse sector

was recognised by investors in the early part of the year and the

consequent increase in buying activity started to drive yields down

and prices up. The general correction in the last quarter has

brought this to an end for the moment. However, the fundamentals

remain attractive with many of the tenants in the sector making

money from the rebased rents, void levels are low and the

click-and-collect model continues to grow in popularity.

There is good prospect that investor interest will return when

confidence improves and pressure on asset sales is reduced as

open-ended property fund redemptions normalise. This will not only

benefit the Company's NAV but should also flow through to an

improved share price and a reduction in the discount. Whether this

will be evident in the second half of the new financial year will

remain to be seen. Nevertheless, the Board is confident that the

Company will be able to emerge from the current turbulence in a

strong position to reap the benefits of better times ahead.

William Hill

Chairman

Investment Manager's Review

It has been a busy year for the Company, which has seen

improvement across several areas. The NAV has increased, the EPRA

Vacancy Rate has fallen, rent collection has improved further and

15 asset management transactions have been completed.

The revised strategy to sell office and leisure assets to focus

investment on the retail warehouse sector has been successfully

completed. During the period, all six of the office and leisure

assets were sold, meaning the Company now only holds retail

warehouse assets and has cash available for reinvestment.

The first half of the financial year saw positive momentum build

across the portfolio, driven by the continued recovery of the

retail warehouse market. Yields hardened as investors recognised

the attributes of the retail warehouse sector and tenants continued

to lease space.

The Interim Report cautioned that headwinds were building, which

they did, and they are now affecting the Company. Rising inflation,

interest rates and energy costs, coupled with political

instability, have reduced consumer confidence and put a squeeze on

household incomes. Reductions in disposable income could affect the

retail market, including retail warehousing. Discretionary spending

and the purchasing of 'big-ticket' items will be particularly

affected. The fact that the Company's portfolio is underpinned by

convenience-led tenants, has low average rents and a reduced

vacancy rate is important and should help make the portfolio more

defensive to these reductions in consumer spending.

If retailers are impacted, there is an increased likelihood of

them using Company Voluntary Arrangements (CVAs) and other

insolvency processes to reduce costs. The Company is in a better

position to deal with these challenges than it was during the

COVID-19 Crisis, which it weathered well in terms of sustaining

income.

However, the increase in gilt yields has put all property

valuations under downward pressure. The Company's property

portfolio reduced in value by 2.5%, on a like-for-like basis, at 30

September 2022. Further, larger declines are likely as the property

market reprices due to the rise in gilt yields. The expectation is

that the property portfolio will fall in value as at 31 December

2022, with the potential for further volatility thereafter.

Despite the more measured short-term outlook, the fundamentals

of the retail warehouse sector remain robust. Supply of available

space is low, tenant demand is holding up, occupiers are still

doing deals and we continue to identify and complete asset

management transactions that secure income.

We expect the retail warehouse sector to be the most resilient

and flexible part of the retail market, which can adapt to the

changing needs of tenants and the integration of their omnichannel

strategies. Having sold assets and with cash in the bank, the

Company is well placed to capitalise on any investment

opportunities that are identified in a re-priced market, but only

at the right time and price for the Company.

Property Valuation

The Company's property portfolio is valued by Knight Frank on a

quarterly basis throughout the year. As at 30 September 2022 it was

valued at GBP231.4m, a like-for-like increase of 10.3% over the

reporting period. The increase was driven by falling yields in the

retail warehouse portfolio, albeit there was a decrease in the

property valuation in the final quarter as some of the yield

improvement was reversed.

EPRA Vacancy Rate

During the period the EPRA Vacancy Rate decreased from 8.6% to

6.5%. This was due to the sale of the office at St. Philips Point

in Birmingham, which had vacant floors, and the letting of vacant

units in the retail warehouse portfolio. Letting the remaining

vacant units remains a key focus.

Rent

Over the year, the Company's contracted rent has reduced from

GBP20.8m to GBP16.2m. This is principally because of the sale of

the office and leisure properties, and the fact that the sales

proceeds have not been reinvested. It is anticipated that the

income will be replaced when suitable assets are acquired.

Rent collection for the year, as at 30 September 2022, was

98.2%, an improvement from 95.7% in the prior year.

Implementing the revised strategy

Last year the Company announced its strategy to sell its office

and leisure assets to focus on the retail warehouse sector. During

the period, the Company sold its four office assets in Bath,

Birmingham, Edinburgh and Newcastle for a headline price of

GBP61.9m. This was 3.3% below the property valuations at the time

of the sales. Once deductions for topped up rents and rent-free

periods were factored in, the net receipt to the Company was

GBP60.0m.

The Company also disposed of its two leisure units, both of

which were let to Mecca Bingo. The Lanyard, Hartlepool, was sold

for GBP2.6m. This was 16.4% above the valuation. The second leisure

property, Southwater Square, Telford, was sold to an owner occupier

for GBP5.0m, which was 67% above the property valuation.

The next phase of investment activity will be focused on the

retail warehouse sector. Whilst the Company recognises the benefits

of being fully invested, the deterioration in the market, coupled

with the economic and political challenges, means that it is

carefully reviewing opportunities to ensure that the cash is

deployed in appropriate assets, at the correct price, at the right

time. Despite the recent challenges, we still believe the prospects

are attractive for retail warehousing, both in absolute terms and

relative to other sectors of the real estate market.

Portfolio activity

The Company has continued to deliver asset management

transactions across the portfolio, which have helped reduce the

EPRA Vacancy Rate and secure the Company's income stream.

During the period the Company completed 15 transactions across

the office, leisure and retail warehouse assets.

Thirteen of the 15 deals were completed in the retail warehouse

assets, securing GBP1.8m of rent per annum, of which GBP0.6m was

additional rent. These are summarised as follows:

- at Kingston Retail Park in Hull, The Range signed a 15-year lease on a 14,500 sq. ft. unit;

- also at Hull, Greggs signed a 10-year lease with a five-year

tenant break option on a 2,000 sq. ft. unit;

- at Prestatyn Shopping Park, The Tech Edge leased a vacant unit

of 1,300 sq. ft. on a five-year lease;

- at Clwyd Retail Park, Rhyl, Now to Bed leased 8,017 sq. ft. on a three-year lease;

- at Barnsley, Bensons downsized from a unit of 10,000 sq. ft.

into one of 5,036 sq. ft. and signed a five-year lease;

- Jysk then signed a 10-year lease with a five-year break option on the unit vacated by Bensons;

- in one other deal at Barnsley, One Below, occupying a 4,996

sq. ft. unit on a short-term lease, committed to the park for five

years;

- at Widnes Shopping Park, Card Factory signed a five-year

lease, without break, on a 1,590 sq. ft. unit;

- at Stirling, Harry Corry signed a five-year lease extension on

its 9,968 sq. ft. unit, meaning its lease will now expire in

February 2027;

- also at Stirling, Pets at Home agreed to remove its break

option, due in 2024, meaning the lease now expires in June 2029;

and

- in a third deal at Stirling, existing tenant Bensons signed an

agreement for lease on a 9,977 sq. ft. unit. On completion of

landlord works it will sign a 10-year lease.

At Prestatyn Shopping Park, JD Sports signed a 10-year lease

with breaks at years four and seven on a 7,623 sq. ft. unit, which

was previously occupied by New Look. New Look was occupying the

unit on a turnover rent basis following the approval of its CVA.

Under the terms of the CVA landlords were entitled to break the

leases.

We considered that the terms of the CVA were below market, so we

took the opportunity to exercise the break clause and identified JD

Sports as a more suitable tenant for the space. The rent received

from JD Sports is 44.0% higher than the rent being paid by New

Look.

At Coatbridge, Glasgow, we completed an AFL with existing tenant

B&Q, to secure them on the park for a further 10 years. B&Q

had a lease expiry in December 2022. As part of the transaction,

B&Q will downsize from 102,000 sq. ft. to 79,960 sq. ft. Aldi

has signed an AFL for a 20,000 sq. ft. unit which will be created

in the space vacated by B&Q. Planning permission has been

obtained for the change to food use. On completion of the landlord

works, Aldi will enter into a 20-year lease without break, subject

to five-yearly rent reviews linked to RPI.

One asset management transaction completed in each of the office

and leisure portfolio. Both properties were then sold during the

period.

At the office in Newcastle, Citygate II, UNW LLP signed an

extension to its leases, to expire in March 2032, with a tenant

break option in March 2027.

At Hartlepool, Mecca Bingo signed a 10-year reversionary lease

with a seven-year tenant break option on its 31,284 sq. ft unit.

The lease expiry date was extended to September 2032, with a break

option in September 2029.

Post period end activity

Post period end, at Wombwell Lane Retail Park, Barnsley, B&M

agreed to extend its occupation at the park by 10 years.

The lease now expires in September 2037 and the passing rent

increased by 6.0%. To facilitate the deal, B&M was granted a

15-month rent-free period. This underscores B&M's commitment to

the location.

Outlook

Despite the growing economic and property market headwinds,

there is still occupational demand for the Company's properties.

There is interest in not only the Company's vacant units, but also

in let units where we are trying to accommodate the demand by right

sizing tenants to secure their ongoing occupation. The fact that we

can modify units to match tenant requirements demonstrates the

flexibility offered by retail warehouse parks.

Protecting income and growing it where possible remains a key

focus. There will be challenges to contend with, but with a

reshaped portfolio (with no office or leisure exposure), a good

tenant line up, a low vacancy rate (6.5%) an attractive WAULT (4.5

years) and ongoing asset management opportunities, the Company has

a robust platform on which to build. Further, the Company has cash

available for investment into a re-priced market, at the

appropriate time.

Calum Bruce

Investment Manager

Property Portfolio as at 30 September 2022

Market

value

range

Location Name Sub-sector (GBPm) Tenure

========== ================== ================ ======= =========

Widnes Widnes Shopping Retail Warehouse 35-40 Leasehold

Park

========== ================== ================ ======= =========

Prestatyn Prestatyn Shopping Retail Warehouse 25-30 Freehold

Park

========== ================== ================ ======= =========

Stirling Springkerse Retail Warehouse 25-30 Heritable

Retail Park

========== ================== ================ ======= =========

Hull Kingston Retail Retail Warehouse 20-25 Freehold

Park

========== ================== ================ ======= =========

Rhyl Clwyd Retail Retail Warehouse 15-20 Freehold

Park

========== ================== ================ ======= =========

Sunderland Pallion Retail Retail Warehouse 15-20 Freehold

Park

========== ================== ================ ======= =========

Wrexham Plas Coch Retail Retail Warehouse 15-20 Freehold

Park

========== ================== ================ ======= =========

Coatbridge B&Q Retail Warehouse 15-20 Heritable

========== ================== ================ ======= =========

Haddington Haddington Retail Retail Warehouse 15-20 Heritable

Park

========== ================== ================ ======= =========

Daventry Abbey Retail Retail Warehouse 10-15 Leasehold

Park

========== ================== ================ ======= =========

Barnsley Wombwell Lane Retail Warehouse 10-15 Freehold

Retail Park

========== ================== ================ ======= =========

Finance Report

The positive net asset value performance this year has been

driven by general yield improvement in the retail warehouse

portfolio, combined with the effect of the 15 asset management

transactions completed. The strategic decision to sell the

remaining office and leisure properties has provided significant

cash reserves. This gives the Company funds to deploy at the right

time and at the right level, as well as retaining sufficient cash

to manage operationally through current economic uncertainty.

Rental Income

During the year, 98.2% of contracted income was collected (2021:

95.7%), of which 86.9% was collected within seven days. The

remaining 1.8% is expected to be collected. This is an improvement

on prior years and is also better than the collection rates

pre-pandemic. The focus on rent collection continues to contribute

to the improvement in payment rates.

The Company's contracted rent at the year end was GBP16.2m

(2021: GBP20.8m).

The decrease in the year can be largely explained by the sale of

the office and leisure properties which contributed GBP5.1m to the

contracted rent, offset by the asset management initiatives

completed in the year.

Rent free periods as a percentage of contracted rent at the year

end was 3.1% (2021: 9.3%) which equates to GBP0.5m (2021: GBP1.9m).

This has fallen due to tenants coming out of their rent-free

periods and the effect of the office disposals where there were a

number of rent-free periods in place.

The portfolio continues to provide long-term stability to the

Company's income. This is demonstrated by 85.0% of our tenants

having a lower than average risk of business failure, according to

Dun & Bradstreet. The EPRA Vacancy Rate has fallen from 8.6% to

6.5% due to the letting of vacant units in the period and the sale

of the office in Birmingham which had some vacant space. The WAULT

at year end was 4.5 years (2021: 5.0 years). The decrease was due

to the passing of another year offset by the 15 asset management

transactions completed in the year. The disposals also impacted on

the ability to show a like-for-like comparison.

Income Statement

Rental income for the year was GBP16.4m (2021: GBP17.4m). This

decrease of GBP1.0m was due to the disposal of several assets in

the year, which have yet to be replaced, offset partially by asset

management transactions.

Revenue expenditure in the year was GBP4.8m (2021: GBP3.0m),

including GBP2.1m property specific expenditure and GBP1.7m

relating to the Investment Manager's fee. Net financing costs were

GBP3.0m (2021: GBP3.1m), a decrease on the prior year due to the

sale proceeds earning some interest in the year. Revenue profit

decreased to GBP8.6m (2021: GBP11.3m). This decrease of 23.9% is

largely due to the fall in rental income following the sale of all

the office and leisure assets, plus the increase in property

expenditure which relates to GBP1.1m of voids paid in the year and

for costs relating to transactions which have not concluded.

Administration expenses are GBP0.6m higher due to the increases in

investment manager fees and other operational costs in the year,

such as auditors' fees.

The positive movement in the value of our investment properties

of GBP15.9m, combined with a loss of GBP3.0m on the properties

sold, has enabled the Company to report a total profit of GBP21.5m.

The sale proceeds received for the office and leisure assets sold

during the year was GBP3.1m higher than their acquisition

costs.

2022 (GBPm) 2021 (GBPm)

============================================= =========== ===========

Rental and other income 16.4 17.4

Property expenditure (2.1) (1.0)

============================================= =========== ===========

Net rental income 14.3 16.4

Administration expenses (2.7) (2.0)

Net financing costs (3.0) (3.1)

============================================= =========== ===========

Revenue profit 8.6 11.3

Gain on revaluation of investment properties 15.9 4.6

Loss on sale of investment properties (3.0) 1.2

============================================= =========== ===========

Accounting profit after tax 21.5 17.1

============================================= =========== ===========

EPRA and diluted EPRA earnings per share 4.06p 5.34p

Dividend per share 5.00p 4.42p

Basic and diluted earnings per share 10.17p 8.10p

============================================= =========== ===========

EPRA performance measures

As a member of EPRA, we support EPRA's drive to bring

consistency to the comparability and quality of information

provided to investors and other key stakeholders of property

company reports. We therefore continue to include performance

measures, which are based on EPRA methodology.

It should be noted that there is no difference between the

Company's IFRS and EPRA NAV in this year's accounts, or in any of

our accounts to date.

2022 2021

================================================= ======= ========

EPRA earnings GBP8.6m GBP11.3m

EPRA earnings per share 4.06p 5.34p

Diluted EPRA earnings per share 4.06p 5.34p

EPRA NAV per share 94.86p 89.69p

EPRA cost ratio (including direct vacancy costs) 29.6% 18.4%

EPRA cost ratio (excluding direct vacancy costs) 23.6% 18.0%

EPRA net initial yield 5.9% 6.2%

EPRA topped up net initial yield 6.1% 6.9%

EPRA Vacancy Rate 6.5% 8.6%

================================================= ======= ========

Net Asset Value (NAV)

At 30 September 2022 our net assets were GBP200.5m, equating to

net assets per share of 94.86 pence (2021: 89.69 pence). This is

summarised in the table below:

Pence per

GBP million share

=========================================================== =========== =========

NAV at 30 September 2021 189.6 89.69

Increase in value of investment properties (net of capital

expenditure plus gain on sale and transaction costs) 12.9 6.11

Net earnings in the year 8.6 4.06

Less: dividends paid in the year (10.6) (5.00)

NAV at 30 September 2022 200.5 94.86

=========================================================== =========== =========

The NAV is predominantly represented by our investment

properties, which have a fair value of GBP231.4m at the year end.

This is included in the financial statements as Investment

Properties at GBP227.5m with the difference relating to lease

incentives. The remaining GBP27.0m of net liabilities is made up

of: i) (GBP110.4m) of debt; ii) GBP50.2m of cash and cash

equivalents; and iii) GBP33.2m of net current assets.

Debt

The Company has two debt facilities with Aviva Commercial

Finance Limited, totalling GBP111.1m, less amortised costs of

GBP0.7m. One facility, of GBP56.9m, will mature in 2025 and the

other, of GBP54.2m, will mature in 2027. The facilities have an

all-in blended, fixed interest rate of 2.86%. The Company is fully

compliant with all debt covenants and has significant headroom

against income and asset cover breach covenants. Property values

covering the two facilities would need to drop by more than 23% and

35% respectively, from the 30 September 2022 valuations, for the

LTV covenant to be breached.

Gearing (debt to total assets) was 35.4% at the year end (2021:

36.7%). Whilst this is higher than the Board's target range of

30-35%, it is in conformity with the Company's Investment Policy as

it lay within these boundaries when drawn down.

Further details are included in Note 13 of the financial

statements.

Cash

As at 30 September 2022, the Company had cash and cash

equivalents of GBP50.2m with a further GBP31.0m drawn and held in a

disposals account under the debt facility. Cash held is

significantly higher than usual due to the sales proceeds collected

in the year, from the sale of the office and leisure assets, which

will be used to assist with future asset management and investment

opportunities.

Dividends

The Company has paid monthly dividends at an annual rate of

5.00p per share. Historically, the Company has had covered

dividends but at year ended 30 September 2022, dividend cover was

81.2% (2021: 119.0%). Using the annual dividend of 5.00p per share

and the share price of 67.15p as at 30 September 2022, the

Company's dividend yield is 7.4%.

The Board declared a dividend of 0.4167 pence per share for the

month of September which was paid in October 2022 and expects to

continue with this consistent monthly rate in the near term.

The Company continues to monitor the aggregate distributions

made to ensure compliance with REIT regulations, which, with some

flexibility on timing, require a REIT to distribute 90% of

tax-exempt rental income as Property Income Distributions (PIDs): a

condition that the Company has met since inception.

Tax

As a REIT, income and capital gains from the property rental

business are exempt from corporation tax and the tax charge for the

year is, therefore, nil. The Company recovers all of its VAT

cost.

The Company continues to meet all the REIT requirements,

ensuring that REIT status is maintained.

Neelum Yousaf

Director of Finance, Ediston Investment Services Limited

Principal and Emerging Risks

The principal risks and emerging risks have all been reviewed in

detail, including the significant economic risks that might impact

the Company and the attainment of its investment objectives. The

Board recognises that there are risks and uncertainties that could

have a material effect on the Company's financial results. Under

the 2019 AIC Code of Corporate Governance (the 'AIC Code'),

directors of listed companies are required to confirm in the annual

report that they have performed a robust assessment of the

Company's emerging and principal risks, including those that would

threaten its business model, future income and asset value

performance, solvency or liquidity and pricing of the Company's

shares.

The Group's risk register is the core element of the risk

management process. The register is prepared, in conjunction with

the Board, by the Investment Manager and Administrator, is updated

regularly and is the assessment of all the detailed operational,

performance and other risks that might impact on the Company, and

how these risks are potentially mitigated by Board or third-party

service provider controls.

The Directors review and challenge the risk register on a

regular basis, assessing the likelihood of each risk, including

identifying emerging risks and significant changes to recognised

risks, the potential impact on the Group and the strength of

controls operating over each risk.

The Board tries to identify emerging risks, defined as potential

trends, sudden events or changing risks, which are characterised by

a high degree of uncertainty in terms of probability of occurrence

and possible effects on the Company - the COVID-19 pandemic, ESG

and events in Ukraine, with their economic impact being examples.

Once emerging risks become sufficiently clear, they may be treated

as specific risks and added to the Company's matrix of significant

risks.

The Board works closely with the Investment Manager and advisers

to the Company to try and manage the risks, including emerging

risks, as best as it can. The central aims remain to preserve net

income for the Company, maintain resilience in the Company's

day-to-day operations (including the Company meeting its regulatory

obligations and obligations to its stakeholders), preservation of

capital values and the price at which shares are traded where it

can, whilst looking to the longer term to try and find strategic

direction for positive rather than simply protective returns.

The impact of exposure to a particular sector, for example

retail, the impact of share price volatility on shareholder

returns, the effects of gearing (when returns are negative) and the

continuing risks of an uncertain economic and political environment

in the UK have all resulted in challenges, and emerging

opportunities, during the financial year. In particular, the change

in strategic direction has resulted in the disposal of the office

and leisure parts of the portfolio, meaning that the Company is now

focused on retail warehousing which proved more resilient during

the COVID-19 Crisis than other UK commercial property

categories.

Recent events in Ukraine and their impact on European economies,

coinciding with inflation and cost of living issues in most

developed economies, are presenting new challenges post the

pandemic lock downs, as is the prospect of increasing interest

rates to how returns might be earned.

For the purposes of reporting, the concentration is on the

medium to longer term for the significant changes that are

impacting on the UK commercial property sector. The eventual

outcomes are difficult to assess or predict with any accuracy but

are as challenging as most commercial property companies in UK will

have faced in recent decades and are likely to transform the way in

which office, retail and industrial property is used.

The Board, identifies risk under the following categories:

- investment strategy (including sustainability considerations) and performance;

- premium/discount level and share price volatility;

- financial, which includes the impact of gearing;

- regulatory;

- operational; and

- economic, governmental and exogenous risks outside the Company's control.

These categories of risk are broken into individual key risks

with an assessment of potential impact, controls and mitigation in

place and changes in that environment since the previous year end

and any other comments on the risk. The risks include those that

may be more remote but, should they arise, would have an impact,

given the nature of a property investment company with tangible

assets compared to a widely diversified listed equity portfolio,

health and safety being an example.

Details of the principal and emerging risks facing the Company

are set out in the following table .

Investment strategy and performance

Risk

Strategic direction of the Company and how and where it invests.

Controls and mitigation

Impact in place Change in the year

=================================== ================================== =================================

Deployment of the Company's The Board formally reviews Increased

capital in areas of the the Company's investment Following a strategic

market that are poorer objectives, policy and review, the Company has

in their return prospects strategies for achieving changed the focus of

or more affected by structural them on an annual basis, its investment to retail

changes and exogenous or more regularly, if warehouse assets, which

risks than other investment appropriate. This includes included the disposal

areas, with an adverse an examination of the of office and other assets

impact on income and Company's current situation, and re-deployment of

capital values, as well strengths and weaknesses, resultant cash.

as opportunity cost. and how this compares Exogenous risk has increased

Sustainability is a key with a wider UK commercial with inflation at highest

part of the investment property peer group. level for decades, rising

review process in making During its strategy sessions interest rates and the

and retaining investments the Board considers how geopolitical events in

and how they are developed. the assets are positioned Eastern Europe impacting

and might be better positioned on supply, including

for the longer term. energy and political

There has been increased security.

focus on sustainability

as evidenced by the reports

on this subject and the

establishment of a specific

working group as part

of the investment committee.

Each quarterly Board

meeting includes a detailed

discussion on asset and

income performance and

changes in the portfolio

as well as an assessment

of property market trends,

which is reported on

by the Investment Manager,

the Company's broker

and with input from the

valuer.

=================================== ================================== =================================

Risk

Significant exposure to a specific property sector, tenant, and geographic

location or to lease expiries.

Poor asset allocation.

Controls and mitigation

Impact in place Change in the year

=================================== ================================== =================================

Downturn in an area to The investment policy

which the Company has and its restrictions/limits Increased (by focusing

significant exposure are set by the Board on particular property

resulting in a reduction and are reviewed quarterly. sub-sector)

inthe capital value of The limits are monitored Heightened by recent

investment properties by the Investment Manager. exogenous events that

and a reduction in NAV. The Board and Investment have accelerated the

Significant tenant failure Manager also review, impact on certain property

causing a material reduction at least quarterly, other sectors - some more than

in revenue profits, impacting key metrics, such as others - but with an

on cash flow and dividends. principal property sector impact on all UK commercial

weightings, to ensure property.

these remain appropriate The Company's portfolio

even where there may has moved to a position

be no formal limits on where it is now 100%

exposure. invested in retail warehouse

Board approval memorandums assets. The retail warehouse

state whether there are assets are in good locations,

any concentration issues, with strong covenants,

which links in with overall at affordable rent levels

strategic imperatives. and have low voids. The

The AIFM and Depositary portfolio WAULT (30 September

monitor compliance with 2022) is 4.5 years.

the investment policy In adopting changes in

and will highlight any strategic direction,

breaches of concentration there is exposure to

limits. more retail tenants than

The Investment Manager was previously the case,

is proactive in monitoring as the office and leisure

developments in the retail assets have been sold.

industry, anticipating The Company is now focused,

issues, and where appropriate for the foreseeable future,

replacing struggling in a specific property

tenants with those with sector, whilst retaining

stronger covenants. Retail some capacity to apply

warehousing proved to more generalist exposure

be the most resilient at a future date.

of the retail sub-sectors,

and has seen increased

investment demand, which

has led to an increase

in property valuations

during the year.

=================================== ================================== =================================

Risk

Lack of investment opportunities reducing the ability to acquire properties

at the required return.

Poor investment decisions, incomplete due diligence and mistimed investment

of capital.

Controls and mitigation

Impact in place Change in the year

=================================== ================================== =================================

Inappropriate use of Regular review of property

capital that hinders performance against acquisition Increased (by focusing

investors' long-term and disposal plans. on single sector)

returns. Experienced Investment Following changes in

Reduction in revenue Manager who sources assets strategic direction,

profits, impacting on that meet agreed investment the Investment Manager

cash flow and dividends. criteria. Linkage with is tasked with investing

Cash drag from uninvested overall strategic objectives the available cash from

cash and interest cost for the Company. asset sales to achieve

on drawn down debt. The Investment Committee the Company's investment

scrutinises and approves objective. Re-deployment

all proposed acquisitions. of capital is made more

The Board reviews the difficult by the significant

portfolio performance economic risks affecting

at each quarterly meeting property and markets

and, through the Management generally.

Engagement Committee,

conducts a formal annual

review of the performance

of the Investment Manager.

Comprehensive profit

and cash flow forecasting

is undertaken, which

models the impact of

property transactions

at Group level and over

the medium to longer

term.

The Investment Manager

has recognised expertise

in the retail warehouse

sector and good connections

to assist investment

in that sub-sector.

There is a reduced fee

paid to the Investment

Manager for cash held

available for investment.

=================================== ================================== =================================

Risk

Sustainability of dividend payments.

Controls and mitigation

Impact in place Change in the year

=================================== ================================== =================================

The Company should, as Dividend level (and any Increased

far as practical, maintain prospective adjustments) The holding of cash post

dividend payments at is reviewed regularly asset sales has created

a sustainable level, by the Board. an uncovered dividend.

with adjustments upwards The Board aims to have There are sufficient

when it is financially a sustainable dividend reserves and cash to

appropriate to do so. and tries to only make maintain the dividend

Dividend cuts have a changes if they can be until the cash is reinvested.

dramatic impact on the sustained for the long There is a risk that

Company where sustainable term. this position could change

dividend is a substantial In times of market volatility, if there was a long delay

proportion of the total dividend level is reviewed or replacement assets

return package to shareholders. at least monthly, as provided insufficient

was the case during the income. Consistent monthly

COVID-19 Crisis when dividend at 5.00p annualised

income receipts appeared (increased in the previous

under pressure for the year from 4.00p annualised

commercial property sector but still down from a

as a whole. peak of 5.75p annualised

in 2019).

=================================== ================================== =================================

Premium/Discount level and share price volatility

Risk

Secondary market share price volatility and insufficient secondary

market liquidity to cope with secondary market selling.

Controls and mitigation

Impact in place Change in the year

=================================== ================================== =================================

The Company's share price The Board monitors closely Increased

could be impacted by the market in the Company's The Board and Investment

a range of factors, causing shares, including significant Manager continue to communicate

it to be higher than purchases and sales. with shareholders to

(at a premium) or lower Through the Investment reinforce the value approach

than (at a discount) Manager and the Company's taken to investing in

the underlying net asset broker, institutional UK commercial properties

value per share. Fluctuations investors are kept in and not least the resilience

in the share price may regular touch directly of the income from the

not be reflective of with developments in portfolio.

the underlying investment the Company, positive Having recovered following

portfolio and depend and negative. The broker the COVID-19 pandemic,

on supply and demand and Investment Manager recent market uncertainty

for the shares, market are in regular contact has caused the discount

conditions, general investor with existing shareholders to widen materially,

sentiment and other factors, and prospective shareholders in common with many other

including political and to try and maintain an closed-ended property

economic uncertainties. active market in the investment funds.

The Company does not Company's shares.

have a significant free The Company announces

float of shares and as portfolio and any other

has been apparent in significant activity

the past, relatively between its quarterly

small sales or purchases net asset value announcements

of shares can produce and publication of its

volatile pricing. In interim and final accounts.

common with many generalist The Company can allot

UK property vehicles, shares, and has done

the rating of the Company's so, where there has been

shares has been dramatically demand in the secondary

impacted since the advent market and issuance has

of the COVID-19 Crisis not been dilutive to

in the second quarter existing shareholders'

of 2020 and more recently interests.

by the geopolitical and The Company also takes

economic crisis. the annual authority

to buy back shares. However,

the Company's intention

is to be fully invested

and geared, so the use

of share buybacks would

require a change in the

strategic direction of

the Company, not least

in having liquidity in

the portfolio that could

only be found through

realising longer-term

assets.

The Board reviews the

strategic direction of

the Company regularly

to ensure that application

of the investment policy,

the returns generated

from it and the objectives

of the shareholders are

being met. The Company

has a Marketing Committee

that focuses on trade

in the Company's shares

and how the corporate

message is being communicated

to existing and prospective

new investors.

The Marketing Committee,

in consultation with

the PR consultant, undertakes

advertising (if appropriate)

and engages media (print

and online) where it

can, to try and raise

awareness of the Company

to retail investors who

could buy the Company's

shares via the platforms.

=================================== ================================== =================================

Financial

Risk

Gearing and non-compliance with debt facility terms.

Controls and mitigation

Impact in place Change in the year

=================================== ================================== =================================

Gearing will accentuate The Board reviews the Increased

returns if the cost of level of gearing on a Higher levels of cash

debt is less than the regular basis. reduce the impact of

equity returns or have The borrowing facilities falling values. However,

the reverse effect if have prescribed covenants it weakens the income

equity returns are less and the Board signs off cover until investment

than the cost of debt. quarterly returns to is made in income returning

A substantial fall in the debt provider on assets.

the property asset values asset and income cover. The Board will continue

or rental income levels The Investment Manager to monitor the level

could lead to a breach presents for Board review of gearing closely.

of financial covenants quarterly cash flow forecasts The Board is closely

within the Group's debt prepared from the level appraised of the level

funding arrangements. of detail of individual of cover over debt covenants

This could lead to a properties, tenants and on net income and asset

modification in the costs future rental projections. levels.

of funding or in extremis The Company has its portfolio There is no immediate

cancellation of debt reviewed and reported need to re-finance debt,

funding, if the Company on by an external valuer with the first tranche

is unable to service each quarter. not repayable until 2025.

the debt. The Board intends to However, the Board is

maintain gearing at 30% monitoring the debt market

of Company gross assets closely as it will need

at drawdown but will to plan appropriately

not exceed 35%, at the if re-financing terms

time of drawdown. are likely to be materially

In the current circumstances, adverse to those in place.

the level of gearing

has exceeded 35% but

the covenants, which

are based on Loan-to-Value

and income cover, remain

well covered.

Covenants are reviewed

on a regular basis. Compliance

certificates and reports

for the lender are prepared

on a quarterly basis

by the Investment Manager

then reviewed and signed

by a Director.

=================================== ================================== =================================

Regulatory

Risk

Non-compliance with laws, regulations and governance codes.

Controls and mitigation

Impact in place Change in the year

=================================== ================================== =================================

The Company is required The Company uses an experienced No change

to comply with REIT rules, tax adviser, auditor, Changes in the regulatory

the Listing Rules, Disclosure investment manager, broker, environment over the

Guidance and Transparency property managing agent, year have not had a significant

Rules, the UK and AIC property valuation agent, impact on the risk profile

Corporate Governance depositary, administrator of the Company.

Code, IFRS accounting and firm of solicitors

standards and UK legislation to provide advice and

(including the UK Bribery support throughout the

Act, Modern Slavery Act, year.

The Criminal Finances The Company and its agents

Act 2017, Market Abuse have a strong compliance

Regulations, GDPR and culture, with regular

Health & Safety regulations). risk reviews undertaken

by the Audit and Risk

Committee.

The resilience of the

key Company agents was

reviewed during the year.

No failings have arisen,

despite the more difficult

operating conditions

for many businesses.

=================================== ================================== =================================

Risk

REIT status and structure of the Company.

Controls and mitigation

Impact in place Change in the year

=================================== ================================== =================================

The Company and its two A REIT compliance schedule No change

operating subsidiaries is produced quarterly

must be managed in the by the Administrator

context of both REIT to ensure compliance.

regulations in relation REIT compliance is covered

to the property assets by external tax advisers,

held and income distributed including when major

and the structure of acquisitions are being

the Group, with income considered.

and costs allocated between

the subsidiaries and

the Company.

=================================== ================================== =================================

Operational

Risk

The Company is reliant on third-party service providers, including

Ediston as Investment Manager and AIFM and JTC (UK) Ltd as Administrator,

and key teams and individuals at these service providers. Failure

of the operational activities or internal controls at these service

providers, or exposure to cyber risk through them, could result in

adverse consequences for the Company.

Controls and mitigation

Impact in place Change in the year

=================================== ================================== =================================

Risk of failure in third-party The Board is ultimately No change

providers of services responsible for any actions

resulting in a material taken by the Company

adverse effect to the but relies on external

Company's financial position, agents to perform their

through operational inefficiency, duties competently. The

compliance breach or Audit and Risk Committee

reporting inadequacies, reviews the services

with reputational or provided for purposes

governance impacts as of accurate and timely

potential consequences financial and risk reporting;

to the Company as well. the Board for any compliance

or operational breaches;

and there is an annual

review by the Management

Engagement Committee

of all service providers.

Any significant failings

or breaches are brought

to the attention of the

Board when they occur

and are followed up for

rectification accordingly,

rather than having to

wait for the periodic

Board meeting cycle.

=================================== ================================== =================================

Economic, governmental & exogenous

Risk

Weak economic and/or political environment, including the impacts

of geo-political events, rising inflation and interest rates.

Controls and mitigation

Impact in place Change in the year

=================================== ================================== =================================

Lower occupational demand Out of the Company's Increased

impacting on income, control to a large extent. Whilst the impacts of

cash flow, rental growth, Executing asset management the COVID-19 Crisis and

property valuations and initiatives remains a economic consequences

capital performance. high priority, and cash of it are better understood,

Reduced consumer spending, control continues to there are new headwinds

particularly on discretionary be a strong focus. This that means the economic

items and/ or 'big-ticket' ensures that the income and political environment

items, could impact tenants is maximised, and voids in the UK and beyond

and their ability to are minimised across remains uncertain.

pay rent. the property portfolio. War in Ukraine, rising

Rising inflation is causing Sensitivity analysis inflation, increasing

the price of goods and of the portfolio is undertaken interest rates, and the

materials used in construction regularly via a comprehensive cost of living crisis

to increase. Costs to cash flow model, which are all risks that have

refurbish or develop includes stress testing emerged during the period,

are increasing and many of cash flows and capital and which could have

contractors will only values against loan covenants a negative effect on

hold tender prices for and the operational requirements the property portfolio.

two weeks, as opposed of the business, including This may result in lower

to the usual four. the payment of monthly occupational demand and

The economic landscape dividends. lower rent collection

in most developed markets The Company carefully levels. It could also

is looking increasingly considers the budgets affect the terms on which

challenged despite relaxation and timing of developments/ debt is obtained. Although

of many of the COVID-19 refurbishment projects partially mitigated by

restrictions, causing to ensure that there the Company's good-quality

heightened uncertainty is enough contingency assets, low vacancy rate,

in listed and unlisted to allow for unexpected long WAULT and strong

markets and for UK commercial cost increases and/or covenants, the continuing

property. delays. uncertainty increases

The Board and Investment the risk to returns from

Manager regularly review the UK commercial property

the economic backdrop market as a whole.

and strategic implications

on the portfolio as regards

investment and disinvestment,

holding of cash, gearing

levels and operational

costs to try and protect

the Company, its net

income and its asset

value against external

challenges.

=================================== ================================== =================================

Directors' Responsibilities Statement

The Directors are responsible for preparing the Annual Report,

including the Director's Remuneration Report and the financial

statements in accordance with applicable law and regulations.

Company law requires the Directors to prepare financial

statements for each financial year. Under that law the Directors

have to prepare the Group Financial Statements in accordance with

UK-adopted international accounting standards and have elected to

prepare the parent company financial statements in accordance with

United Kingdom Generally Accepted Accounting Practice, including

FRS 101 'Reduced Disclosure Framework' (UK Accounting Standards and

applicable law).

Under company law the Directors must not approve the Group and

Company financial statements unless they are satisfied that they

give a true and fair view of the state of affairs and profit or

loss of the Group and the Company for that period. In preparing

these Financial Statements, the Directors are required to:

- select suitable accounting policies and then apply them consistently;

- make judgements and accounting estimates that are reasonable and prudent;

- state whether applicable UK-adopted international accounting

standards have been followed for the Group financial statements and

United Kingdom Accounting Standards, comprising FRS 101 have been

followed for the Company financial statements,, subject to any

material departures disclosed and explained in the Financial

Statements; and

- prepare the Financial Statements on the going concern basis

unless it is inappropriate to presume that the Group and Company

will continue in business.

The Directors are responsible for keeping adequate accounting

records that are sufficient to show and explain the Group's and

Company's transactions and disclose with reasonable accuracy at any

time the financial position of the Group and the Company and enable

them to ensure that the Financial Statements and the Directors'

Remuneration Report comply with the Companies Act 2006 and Article

4 of the IAS Regulation. They are also responsible for safeguarding

the assets of the Group and the Company and hence for taking

reasonable steps for the prevention and detection of fraud and

other irregularities.

The Directors are responsible for the maintenance and integrity

of the corporate and financial information included on the

Company's website. Legislation in the United Kingdom governing the

preparation and dissemination of financial statements may differ

from legislation in other jurisdictions.

The Directors consider the Annual Report and the Financial

Statements, taken as a whole, provide the information necessary to

assess the Group and Company's performance, business model and

strategy and are fair, balanced and understandable.

DIRECTORS' RESPONSIBILITY STATEMENT UNDER THE DISCLOSURE

GUIDANCE AND TRANSPARENCY RULES

To the best of our knowledge:

- the Group Financial Statements, prepared in accordance with

UK-adopted international accounting standards, give a true and fair

view of the assets, liabilities, financial position and profit or

loss of the Group and the undertakings included in the

consolidation taken as a whole;

- the Company Financial Statements, prepared in accordance with

United Kingdom Accounting Standards, comprising FRS 101, give a

true and fair view of the assets, liabilities and financial

position of the Company; and

- the Annual Report, including the Strategic Report and the

Directors' Report, includes a fair review of the development and

performance of the business and the position of the Group and

Company, together with a description of the principal risks and

uncertainties that they face.

DISCLOSURE OF INFORMATION TO THE AUDITOR

The Directors confirm that:

- so far as each Director is aware, there is no relevant audit

information of which the Group and Company's auditor is unaware;

and

- the Directors have taken all the steps that they ought to have

taken as Directors in order to make themselves aware of any

relevant audit information and to establish that the Group and

Company's Auditor is aware of that information.

William Hill

Chairman

13 December 2022

Consolidated Statement of Comprehensive Income

For the year ended 30 September 2022

Year ended 30 September Year ended 30 September

2022 2021

============================ ============================

Revenue Capital Total Revenue Capital Total

Notes GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

=========================== ===== ======== ======== ======== ======== ======== ========

Revenue

Rental income 16,426 - 16,426 17,371 - 17,371

=========================== ===== ======== ======== ======== ======== ======== ========

Total revenue 16,426 - 16,426 17,371 - 17,371

Unrealised gain on

revaluation of investment

properties 9 - 15,920 15,920 - 4,655 4,655

(Loss)/gain on sale

of investment properties

realised during the

year 9 - (3,014) (3,014) - 1,179 1,179

=========================== ===== ======== ======== ======== ======== ======== ========

Total income 16,426 12,906 29,332 17,371 5,834 23,205

=========================== ===== ======== ======== ======== ======== ======== ========

Expenditure

Investment management

fee 2 (1,703) - (1,703) (1,687) - (1,687)

Other expenses 3 (3,212) - (3,212) (1,914) - (1,914)

=========================== ===== ======== ======== ======== ======== ======== ========

Total expenditure (4,915) - (4,915) (3,601) - (3,601)

=========================== ===== ======== ======== ======== ======== ======== ========

Movement in expected

credit losses 11 51 - 51 615 - 615

=========================== ===== ======== ======== ======== ======== ======== ========

Profit before finance

costs and taxation 11,562 12,906 24,468 14,385 5,834 20,219

Net finance costs

Interest receivable 4 22 - 22 - - -

Interest payable 5 (3,003) - (3,003) (3,109) - (3,109)

=========================== ===== ======== ======== ======== ======== ======== ========

Profit before taxation 8,581 12,906 21,487 11,276 5,834 17,110

Taxation 6 - - - - - -

=========================== ===== ======== ======== ======== ======== ======== ========

Profit and total

comprehensive income

for the year 8,581 12,906 21,487 11,276 5,834 17,110