TIDMFLO

RNS Number : 7251K

Flowtech Fluidpower PLC

30 August 2023

WEDNESDAY, 30 AUGUST 2023

FLOWTECH FLUIDPOWER PLC

("Flowtech", the "Group" or "Company")

"a world of motion"

Our aim is to provide our customers with power, motion & control solutions,

from a single component to integrated engineering systems, in the most cost-effective

way, harnessing the best global brands & products, services and engineers

in the market.

2023 HALF-YEAR REPORT

For the six months ended 30 June 2023

"Despite increasingly challenging economic conditions, overall Group revenue

increased by 2.8% in the period with a more positive performance in our solutions

and services segments and a weaker performance in the product distribution

segment, as previously reported. We have continued to make positive progress

on working capital management, continuing to improve our debt position whilst

maintaining tight cost controls.

We expect these market headwinds to continue through H2 23 and into 2024 but

I am pleased to report good progress is being made in deploying an immediate

performance improvement plan and the refreshed strategy, strengthening the

leadership team and simplifying the operating model building the capabilities

to deliver mid-term scalable growth in a highly fragmented market."

Mike England, Chief Executive Officer

TRADING AND OPERATIONAL HIGHLIGHTS

===================================================================

* Revenue increased by 2.8% with varying performance

across segments

* Sustained strong gross margin of 35.5% (H1 22 36.3%)

* Inflationary pressures partially offset by cost

savings initiatives

* Underlying operating profit of GBP3.4m, a decrease of

GBP0.9m on the comparative period

* GBP4.3m decrease in net debt (pre-leases)

Half year Half year Year ended

ended ended 31 December 2022

FINANCIAL HIGHLIGHTS 30 June 30 June 2022 Audited

2023 Unaudited

Unaudited

=========================================== =========== ============== ==================

* Revenue GBP59.1m GBP57.5m GBP114.8m

* Gross profit % 35.5% 36.3% 35.7%

* Underlying EBITDA* GBP5.0m GBP5.8m GBP11.6m

* Underlying operating profit** GBP3.4m GBP4.3m GBP8.6m

* Operating profit / (loss) GBP2.4m GBP3.6m (GBP4.4m)

* Profit / (loss) before tax GBP1.6m GBP3.1m (GBP5.6m)

* Earnings per share (basic) 2.28p 4.24p (10.17p)

* Net debt*** GBP15.4m GBP19.7m GBP16.0m

* Underlying EBITDA is profit before interest, taxation, depreciation and separately

disclosed items.

** Underlying operating profit is operating profit for continuing operations

before separately disclosed items (note 3).

*** Net debt is bank debt less cash and cash equivalents. It excludes lease

liabilities under IFRS 16.

RESULTS PRESENTATION:

Today, 30 August 2023, at 10.00am (BST) CEO Mike England and CFO Russell Cash

will provide a 'live' presentation via the Investor Meet Company platform

(IMC) at:

https://www.investormeetcompany.com/flowtech-fluidpower-plc/register-investor

Website: www.investormeetcompany.com

===============================================================================

FLOWTECH FLUIDPOWER PLC 2023 HALF-YEAR REPORT

For the six months ended 30 June 2023

2023 HALF-YEAR FINANCIAL PERFORMANCE AND DIVISIONAL ANALYSIS

Revenue by current Six Six months % Year

segment months ended Change ended

ended 30 June 2022 31 December

30 (re-stated**) 2022

June GBP000 (re-stated**)

2023 GBP000

GBP000

=================================== ================== ========================= ================== =========================

Flowtech (Product

Distribution) 26,606 28,192 -5.6% 53,273

Fluidpower Group

Solutions 22,019 19,749 11.5% 40,368

Fluidpower Group

Services 10,445 9,516 9.8% 21,125

=================================== ================== ========================= ================== =========================

Total Group revenue 59,070 57,457 2.8% 114,766

=================================== ================== ========================= ================== =========================

Gross profit % 35.5% 36.3% 35.7%

=================================== ================== ========================= ================== =========================

Underlying segment operating Six months Return Six months Return Year Return

profit* on revenue on revenue on revenue

ended ended ended

30 June 30 June 31 December

2023 2022 2022

% (re-stated) % (re-stated) %

GBP000 GBP000 GBP000

========================================== ======================= ====================== ======================== ====================== ======================== ======================

Flowtech (Product

Distribution) 2,275 8.6% 3,617 12.8% 6,206 11.7%

Fluidpower Group Solutions 2,462 11.2% 2,707 13.7% 5,086 12.6%

Fluidpower Group Services 1,202 11.5% 234 2.5% 1,804 8.5%

Central costs (2,515) (2,245) (4,510)

========================================== ======================= ====================== ======================== ====================== ======================== ======================

Underlying operating

profit* 3,424 4,313 8,586

========================================== ======================= ====================== ======================== ====================== ======================== ======================

* Underlying operating profit is operating profit for continuing operations

before separately disclosed items (note 3).

** H1 22 and FY 22 figures have been re-stated to reflect the movement of

certain revenue streams between segments, however there is no impact on

Group profitability.

REVENUE

Revenue increased by 2.8% in H1 23 compared to H1 22. The growth

achieved in both the Solutions (11.5%) and Services (9.8%) segments

was pleasing; this served to mitigate the impact of a disappointing

performance within the Product Distribution segment where revenue

declined by 5.6%. The second quarter of the year provided more

challenging trading conditions across each segment than the first

quarter.

Gross profit margin

Our gross profit margin remains strong at 35.5% (H1 22 36.3%);

the modest movement relates primarily to the change in sales mix

due to divisional margins being lower in the Solutions and Service

segment as compared to the Product Distribution segment.

OPERATING Costs

Underlying operating costs have increased by GBP1.0m (6.2%),

compared to the comparative 2022 period. Approximately two thirds

of our cost base relate to people costs; our average number of

employees in H1 23 decreased by 5.8% compared to H1 22 but this was

offset by inflation on wages and other costs alongside the impact

of investment in senior personnel (building future capability and

scale).

UNDERLYING OPERATING PROFIT

Underlying operating profit of GBP3.4m is a decrease of GBP0.9m

from the comparative period (H1 22: GBP4.3m).

The performance of the Product Distribution segment was

disappointing, as explained under the "Trading Review" section

below. We are pleased with the performance in the Solutions and

Services divisions which both continued to show strong growth at

attractive margins.

NET DEBT

Net debt (pre-lease debt) was GBP15.4m at 30 June 2023 (H1 22:

GBP19.7m), with headroom of GBP9.6m under the Group's banking

facilities. Key to achieving this reduction was a GBP3.9m reduction

in inventory levels. We expect this trend to continue as we benefit

from a less volatile supply chain environment. If leases are taken

into account, the reduction in Group debt was GBP5.1m.

TRADING REVIEW

We have highly skilled and capable people, passionate about

providing the highest levels of technical and engineering expertise

and customer service. In a technical industrial market, this is a

source of competitive advantage. Positive progress has been made in

H1 23 building our people capabilities including increased

investment in training, learning and development, investment in

health, safety and wellbeing and supporting them through these more

challenging economic times. We thank our people for their continued

commitment and dedication.

In our Product Distribution segment (which accounts for 45% of

Group revenue), the performance has been disappointing for over 12

months continuing through H1 23 with revenue decline of 5.6%. This

is in part due to the more volatile economic and industrial

landscape but also due to internal challenges resulting from the

consolidation of five businesses into one during 2021/2022

including the closure of the Leicester Distribution Centre,

consolidating inventory into the main Skelmersdale Distribution

Centre. Whilst this consolidation has enabled improved scale and

efficiency, aspects of this integration have impacted some parts of

the customer experience. Interventions are in flight to address

this to ensure we have quickly returned to the levels of high

service expected by our customers including further improvements to

our website, catalogue, commercial discipline and our service.

In our Solutions and Services segments, we are pleased with the

performance with H1 23 revenue growth of 11%. We have improved the

focus in offering a wide range of engineering services, further

building our reputation for delivering technical products,

designing, manufacturing and supporting our distributors,

industrial end users and original equipment manufacturers across

our geographies.

Our international businesses in the Island of Ireland and

Benelux which contribute c.28% of Group revenue have continued to

perform well. Ireland in particular, where we have consolidated our

two businesses into one has seen revenue growth in H1 23 of 19%.

Our two businesses in Benelux have made a positive contribution of

16% return on revenues and we see further opportunity here to drive

greater synergy and to further increase market share gains.

Group Gross Margin performance was stable, and management has

remained focused ensuring we stay ahead of supplier price rises and

service labour costs during a continued inflationary market. There

is though gross profit impact resulting from the revenue mix

between the higher gross margin Product Distribution segment and

the Solutions and Services segment. We see further opportunity for

gross margin enhancement across the Group by improving our

commercial effectiveness, pricing discipline and building greater

procurement capability.

Our cost management remains disciplined and whilst we have taken

all necessary action to react to inflationary market pressures, we

continue to support our highly skilled and talented workforce and

build enhanced capabilities as we look to underpin our mid-term

strategy to deliver scalable and sustainable growth and value

creation. However, we see significant further opportunity for

delivering efficiencies across the Group as we scale through the

deployment of our refreshed strategy, further simplifying the

operating model, underpinned by investment in improved automation,

technology and processes.

We have continued to focus on cash and optimising our working

capital which resulted in the GBP5.1m reported reduction in net

debt. As we look forward, our focus will remain on achieving

further working capital optimisation and improved cash efficiencies

across the Group whilst seeking to improve overall stock

availability and service by adopting a more rigorous approach to

inventory and supplier management.

STRATEGY

We are pleased to report good progress in implementing an

immediate Performance Improvement Plan and the refreshed strategy

(our journey to the future), across the Group.

i) Performance Improvement Plan

The Performance Improvement Plan focusses on near-term

performance improvement to quickly deliver a more customer centric,

lean and scalable platform for growth. It consists of three key

components;

a) Simple - we are implementing a simple operating model

releasing the full potential of our people and our

capabilities,

b) Customer centric - moving decision making and activities to

be more centred around the customer with a renewed growth focus

across all channels, and

c) Scalable - Re-focusing on doing the basics brilliantly whilst

improving our operational and technology infrastructure to power

future growth.

ii) Refreshed strategy

Our refreshed strategy (our journey to the future) sets out our

ambition and has two key components;

a) A world of motion - We will expand on our product and

engineering capabilities across the wider power, motion and control

sector. In doing so, we increase our market share opportunity in

Europe from cGBP10bn to cGBP30bn. We will target two times market

growth rate. This also serves to future proof the Group with a

focus on new emerging technologies.

b) The power of one - we will release the full potential,

scalability and efficiency of the Group by transitioning to a

single brand and operating model. We will launch a simplified value

proposition for our target customers.

As part of the strategy, we are focused on delivering a

measurable value creation plan consisting of defined strategic

focus areas to deliver mid-teens underlying operating profit

margin.

The Performance Improvement Plan and refreshed strategy is

enabled by the formation of a new, diverse and highly skilled

leadership team organised into a functional, country led structure

where we are building greater core competence and capabilities.

Five of the previous leadership team have exited the business and

the new team, consisting of a strong mix of existing and new

talent, has now been appointed; a number of the new members of the

team are already operating within the business with the final three

leaders onboarding in October. The a ccountability of this team

will be to deliver the defined areas of strategic focus, known

internally as growth engines.

The immediate priority is on short-term 'self-help'

interventions to deliver improved performance throughout H2 23 and

into 2024 focused on improvements in a) our growth capabilities

(including our marketing, digital and sales capabilities), b) our

core service and delivery capabilities (doing the basics

brilliantly) and c) simplifying how we work (to deliver greater

speed, agility and efficiencies).

OUTLOOK

We expect external economic headwinds to continue to bite

through H2 23 and into 2024 with continued slowdown in industrial

output and production. We have deployed a number of focused

interventions to address weaker performing areas underpinned by a

change in leadership and capability and providing greater clarity

on our forward strategy and plans. Our people are motivated and

committed to delivering high performance and whilst we expect H2 23

to remain challenging, we are optimistic in our outlook in building

our momentum and capabilities into 2024 and beyond through the

deployment of our refreshed strategy.

By order of the Board

29 August 2023

CONSOLIDATED INCOME STATEMENT

For the six months ended 30 June 2023

Notes Unaudited Unaudited Audited

============================================ ======

Six months Six months Year ended

ended ended

============================================ ======

30 June 30-June 31-December

2023 2022 2022

GBP000 GBP000 GBP000

============================================ ====== =========== =========== ============

Continuing operations

======

Revenue 59.070 57,457 114,766

======

Cost of sales (38,089) (36,611) (73,792)

============================================ ====== =========== =========== ============

Gross profit 20,981 20,846 40,974

======

Distribution expenses (2,288) (2,159) (4,428)

============================================ ====== =========== =========== ============

Administrative expenses before separately

disclosed items: (15,269) (14,374) (27,960)

- separately disclosed items 3 (987) (690) (12,966)

============================================ ====== =========== =========== ============

Total administrative expenses (16,256) (15,064) (40,926)

Operating profit / (loss) 2,437 3,623 (4,380)

Financial expenses (813) (474) (1,192)

============================================ ====== =========== =========== ============

Profit / (loss) from continuing operations

before tax 1,624 3,149 (5,572)

Taxation 4 (220) (542) (680)

============================================ ====== =========== =========== ============

Profit / (loss) from continuing operations 1,404 2,607 (6,252)

============================================ ====== =========== =========== ============

Earnings per share 5

Basic earnings per share - continuing

operations 2.28p 4.24p (10.17p)

============================================ ====== =========== =========== ============

Diluted earnings per share - continuing

operations 2.28p 4.19p (10.17p)

============================================ ====== =========== =========== ============

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

For the six months ended 30 June 2023

Unaudited Unaudited Audited

Six months Six months Year ended

ended ended

30 June 30-June 31-December

2023 2022 2022

GBP000 GBP000 GBP000

======================== =========== ============

Profit for the period 1,404 2,607 (6,252)

Other comprehensive income

Items that will be reclassified subsequently

to profit or loss

-Exchange differences on translating foreign

operations (225) 153 318

============================================== ======================== =========== ============

Total comprehensive income in the period 1,179 2,760 (5,934)

============================================== ======================== =========== ============

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

At 30 June 2023

Unaudited Unaudited Audited

30 June 30 June 31 December

2023 2022 2022

GBP000 GBP000 GBP000

========================================= ---------- ---------- -------------

Assets

Non-current assets

Goodwill 53,092 63,164 53,092

Other intangible assets 2,979 4,107 3,523

Right of use assets 5,921 6,805 6,091

Property, plant, and equipment 7,900 6,904 7,234

========================================= ========== ========== =============

Total non-current assets 69,892 80,980 69,940

========================================= ========== ========== =============

Current assets

Inventories 30,843 34,731 31,486

Trade and other receivables 25,257 24,293 24,620

Prepayments 1,130 1,129 387

Cash and cash equivalents 4,446 273 3,972

========================================= ========== ========== =============

Total current assets 61,676 60,426 60,465

========================================= ========== ========== =============

Liabilities

Current liabilities

Interest bearing borrowings - - 19,967

Lease liability 1,453 1,868 1,705

Trade and other payables 20,248 20,539 19,569

Tax Payable 1,123 1,154 1,219

========================================= ========== ========== =============

Total current liabilities 22,824 23,561 42,460

========================================= ========== ========== =============

Net current assets 38,852 36,865 18,005

========================================= ========== ========== =============

Non-current liabilities

Interest-bearing borrowings 19.889 19,947 -

Lease liability 4,705 5,178 5,008

Provisions 339 302 317

Deferred tax liabilities 1,196 1,437 1,281

========================================= ========== ========== =============

Total non-current liabilities 26,129 26,864 6,606

========================================= ========== ========== =============

Net assets 82,615 90,981 81,339

========================================= ========== ========== =============

Equity directly attributable to owners

of the parent

Share capital 30,746 30,746 30,746

Share premium 60,959 60,959 60,959

Other reserves 187 187 187

Shares owned by the Employee Benefit

Trust (EBT) (124) (141) (124)

Merger reserve 293 293 293

Merger relief reserve 3,646 3,646 3,646

Currency translation reserve (66) 66 159

Retained losses (13,026) (4,775) (14,527)

========================================= ========== ========== =============

Total equity attributable to the owners

of the parent company 82,615 90,981 81,339

========================================= ========== ========== =============

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

For the six months ended 30 June 2022

Share Share Other Shares Merger Merger Currency Retained Total

capital premium reserves owned reserve relief translation losses equity

by EBT reserve reserve

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

Six months ended

30 June 2023

Unaudited

=============================================================================================

Balance at 1 January

2023 30,746 60,959 187 (124) 293 3,646 159 (14,527) 81,339

======== ======== ========= ======= ======== ======== ============ ========= ========

Profit for the period 1,404 1,404

======== ======== ========= ======= ======== ======== ============ ========= ========

Other comprehensive

income (225) - (225)

======== ======== ========= ======= ======== ======== ============ ========= ========

Total comprehensive

income for the year (225) 1,404 1,179

======== ======== ========= ======= ======== ======== ============ ========= ========

Transaction with

owners

======== ======== ========= ======= ======== ======== ============ ========= ========

Share options settled

======== ======== ========= ======= ======== ======== ============ ========= ========

Share-based payment

charge 97 97

======== ======== ========= ======= ======== ======== ============ ========= ========

Balance at 30 June

2023 30,746 60,959 187 (124) 293 3,646 (66) (13,026) 82,615

======== ======== ========= ======= ======== ======== ============ ========= ========

Six months ended

30 June 2022

unaudited

=============================================================================================

Balance at 1 January

2022 30,746 60,959 187 (276) 293 3,646 (286) (7,267) 88,002

======== ======== ========= ======= ======== ======== ============ ========= ========

Profit for the period 2,607 2,607

======== ======== ========= ======= ======== ======== ============ ========= ========

Other comprehensive

income - - - - - - 352 (199) 153

======== ======== ========= ======= ======== ======== ============ ========= ========

Total comprehensive

income for the year - - - - - - 352 2,408 2,760

======== ======== ========= ======= ======== ======== ============ ========= ========

Transaction with

owners

======== ======== ========= ======= ======== ======== ============ ========= ========

Share-based payment

charge 135 (19) 116

======== ======== ========= ======= ======== ======== ============ ========= ========

Share options settled - - - - - - - 103 103

======== ======== ========= ======= ======== ======== ============ ========= ========

Balance at 30 June

2022 30,746 60,959 187 (141) 293 3,646 66 (4,775) 90,981

======== ======== ========= ======= ======== ======== ============ ========= ========

Twelve months ended

31 December 2022

audited

=============================================================================================

Balance at 1 January

2022 30,746 60,959 187 (276) 293 3,646 (286) (7,267) 88,002

======== ======== ========= ======= ======== ======== ============ ========= ========

Profit or the year - - - - - - - (6,252) (6,252)

======== ======== ========= ======= ======== ======== ============ ========= ========

Other comprehensive

income - - - - - - 318 - 318

======== ======== ========= ======= ======== ======== ============ ========= ========

Total comprehensive

income for the year - - - - - - 318 (6,252) (5,934)

======== ======== ========= ======= ======== ======== ============ ========= ========

Transaction with

owners:

======== ======== ========= ======= ======== ======== ============ ========= ========

Shares options settled - - - 152 - - - (25) 127

======== ======== ========= ======= ======== ======== ============ ========= ========

Share-based payment

charge - - - - - - - 372 372

======== ======== ========= ======= ======== ======== ============ ========= ========

Dividends paid - - - - - - - (1,228) (1,228)

======== ======== ========= ======= ======== ======== ============ ========= ========

Transfers between

reserves - - - - - - 127 (127) -

======== ======== ========= ======= ======== ======== ============ ========= ========

Total transactions

with owners - - - 152 - - 127 (1,008) (729)

======== ======== ========= ======= ======== ======== ============ ========= ========

Balance at 31 December

2022 30,746 60,959 187 (124) 293 3,646 159 (14,527) 81,339

======== ======== ========= ======= ======== ======== ============ ========= ========

CONSOLIDATED STATEMENT OF CASH FLOWS

For the six months ended 30 June 2023

Note Unaudited Unaudited Audited

Six months Six months Year ended

ended ended

30 June 30 June 31 December

2023 2022 2022

GBP000 GBP000 GBP000

Net cash from operating activities 6 3,607 (2,505) 5,014

=============================================== ===== =========== =========== ============

Cash flow from investing activities

=====

Acquisition of property, plant, and equipment (1,340) (683) (1,645)

=====

Acquisition of intangible assets - (62) (212)

Proceeds from sale of property, plant,

and equipment 3 34 65

=============================================== ===== =========== =========== ============

Net cash used in investing activities (1,337) (711) (1,792)

=============================================== ===== =========== =========== ============

Cash flows from financing activities

Repayment of lease liabilities (880) (830) (1,673)

Interest on lease liabilities (116) (118) (227)

Other interest (776) (336) (925)

Proceeds from sale of shares held by EBT - 155 172

Dividends paid - - (1,228)

=============================================== ===== =========== =========== ============

Net cash generated from / (used in) financing

activities (1,772) (1,129) (3,881)

=============================================== ===== =========== =========== ============

Net change in cash and cash equivalents 498 (4,345) (659)

Cash and cash equivalents at start of

period 3,972 4,562 4,562

=====

Exchange differences on cash and cash

equivalents (24) 56 69

=============================================== ===== =========== =========== ============

Cash and cash equivalents at end of period 4,446 273 3,972

=============================================== ===== =========== =========== ============

Short-term Long-term Lease liabilities Total

borrowings borrowings

GBP000 GBP000 GBP000 GBP000

============ ============ ================== =======

At 1 January 2023 19,967 - 6,713 26,680

Cash flows

Repayment - - (880) (880)

Movement between short-term and long-term (19,967) 19,967 - -

Other movements - (78) 358 280

Non-cash

Foreign exchange - - (33) (33)

=========================================== ============ ============ ================== =======

At 30 June 2023 - 19,889 6,158 26,047

=========================================== ============ ============ ================== =======

NOTES TO THE HALF-YEAR REPORT

For the six months ended 30 June 2023

1. General information

===================================================================================

The principal activity of Flowtech Fluidpower plc (the "Company") and its

subsidiaries (together, the "Group") is the distribution of engineering

components and assemblies, concentrating on the fluid power industry. The

Company is a public limited company incorporated and domiciled in the United

Kingdom. The address of its registered office is Bollin House, Wilmslow,

SK9 1DP.

The registered number is 09010518.

As permitted, this Half-year report has been prepared in accordance with

the AIM rules and not in accordance with IAS 34 "Interim Financial Reporting".

The consolidated financial statements are prepared under the historical

cost convention, as modified by the revaluation of certain financial instruments.

This consolidated Half-year report and the financial information for the

six months ended 30 June 2023 does not constitute full statutory accounts

within the meaning of section 434 of the Companies Act 2006 and are unaudited.

This unaudited Half-Year Report was approved by the Board of Directors on

29 August 2023.

The Group's financial statements for the year ended 31 December 2022 have

been filed with the Registrar of Companies. The Group's auditor's report

on these financial statements was unqualified and did not contain a statement

under section 498 (2) or (3) of the Companies Act 2006.

Electronic communications

The Company does not intend to bulk print and distribute hard copies of

this Half-year report, although copies can be requested by contacting: The

Company Secretary, Flowtech Fluidpower plc, Bollin House, Bollin Walk, Wilmslow,

SK9 1DP. Email: info@flowtechfluidpower.com .

The Board believes that by utilising electronic communication it delivers

savings to the Company in terms of administration, printing and postage,

and environmental benefits through reduced consumption of paper and inks,

as well as speeding up the provision of information to shareholders. News

updates, regulatory news, and financial statements can be viewed and downloaded

from the Group's website https://www.flowtechfluidpower.com .

2. aCCOUNTING POLICIES

=============================================================================================

2.1 Basis of preparation

The financial information set out in this consolidated Half-year report

has been prepared under International Accounting Standards in conformity

with the requirements of the IFRIC interpretations issued by the International

Accounting Standards Board (IASB) and the Companies Act 2006 and in accordance

with the accounting policies which will be adopted in presenting the Group's

Annual Report and Financial Statements for the year ended 31 December 2023.

These are consistent with the accounting policies used in the Financial

Statements for the year ended 31 December 2022.

2.2 Going concern

The financial statements are prepared on a going concern basis. The Directors

believe this to be the most appropriate basis for the following reasons:

* The Group generated underlying operating profit of

GBP3.4m.

* The Group is financed by revolving credit facilities

totaling GBP20m (extended to February 2026) and GBP5m

overdraft facility,

repayable on demand.

* The Group has operated, and is expected to continue

to operate, well within its Banking facilities.

The Directors have revisited the forecasts and continue to anticipate a

profitable performance in the second half of 2023. Updated cash flow forecasts

continue to show the business operating well within the limits of its Banking

facilities.

Naturally, these forecasts include a number of key assumptions notably relating,

inter alia, to revenue, margins, costs and working capital. In any set of

forecasts there are inherent risks relating to each of these assumptions.

If future trading performance significantly underperformed expectations,

management believe there would be the ability to mitigate the impact of

this by careful management of the Group's cost base and working capital

and that this would assist in seeking to ensure all bank covenants were

complied with and the business continued to operate well within its aggregate

GBP25m banking facility. The Group therefore continues to adopt the going

concern basis in preparing its financial statements.

3. OPERATING SEGMENTS

======================

The operations of the business are reviewed based on three

segments - Flowtech, Fluidpower Group Solutions and Fluidpower

Group Services (as explained in note 2.18 of the Annual report

2022). These operating segments are monitored by the Group's Chief

Operating Decision Maker and strategic decisions are made on the

basis of adjusted segment operating results. Inter-segment revenue

arises on the sale of goods between Group undertakings.

Segment information for the reporting periods is as follows:

Half year ended 30 June 2023 Flowtech Fluidpower Fluidpower Inter-segmental Central Total

Group Group Services transactions Costs continuing

Solutions GBP000 GBP000 operations

GBP000 GBP000 GBP000 GBP000

Income statement - continuing

operations:

Revenue from external customers 26,606 22,019 10,445 - - 59,070

Inter segment revenue 1,177 541 375 (2,093) -

Total revenue 27,783 22,560 10,820 (2,093) 59,070

Underlying operating result* 2,275 2,462 1,202 - (2,515) 3,424

Net financing costs (34) (75) (3) - (701) (813)

Underlying segment result 2,241 2,387 1,199 - (3,216) 2,611

Separately disclosed items

(see below) (205) (307) (66) (409) (987)

Profit before tax 2,036 2,080 1,133 - (3,625) 1,624

Specific disclosure items

Depreciation on owned plant

,property and equipment 477 83 85 - - 645

Depreciation on right-of-use

assets 386 394 35 - 65 880

Amortisation 200 288 57 - - 545

Reconciliation of underlying

operating result to operating

profit:

Underlying operating result* 2,275 2,462 1,202 - (2,515) 3,424

Separately disclosed items

(see below) (205) (307) (66) - (409) (987)

Operating profit/ (loss) 2,070 2,155 1,136 - (2,924) 2,437

================================= ========= =========== ================ ================ ======== ============

(*) Underlying operating result is continuing operations'

operating profit before separately disclosed items

The Directors believe that the Underlying Operating Profit

provides additional useful information on underlying trends to

Shareholders. The term 'underlying' is not a defined term under

IFRS and may not be comparable with similarly titled profit

measurements reported by other companies. A reconciliation of the

underlying operating result to operating result from continuing

operations is shown below. The principal adjustments made are in

respect of the separately disclosed items as detailed later in this

note; the Directors consider that these should be reported

separately as they do not relate to the performance of the

segments.

Segment information for the half year ended June 2022 has been

re-stated following the movement of Primary Components, excluding

OEM customers, from Fluidpower Group Solutions to Flowtech, as this

reflects the information reported to the Chief Operating Decision

Maker. Segment information for the year ended December 2022 has

also been restated to include sales from OEM customers within the

Solutions segment. Some overheads costs relating to Divisional

management have been re-categorised as segment operating overheads

to present a more comparable segment result. The re-statement of

the prior year periods does not impact Group profitability.

(*) Underlying operating result is continuing operations'

operating profit before separately disclosed items

Half year ended 30 June 2022 Flowtech Fluidpower Fluidpower Inter-segmental Central Total

Group Group Services transactions

Solutions

(re-stated) GBP000 GBP000 GBP000 costs continuing

operations

GBP000 GBP000 GBP000

Income statement - continuing

operations:

Revenue from external

customers 28,192 19,749 9,516 - - 57,457

Inter segment revenue 863 652 409 (1,924) - -

Total revenue 29,055 20,401 9,925 (1,924) - 57,457

Underlying operating result* 3,617 2,707 234 - (2,245) 4,313

Net financing costs (72) (31) (8) - (363) (474)

Underlying segment result 3,545 2,676 226 - (2,608) 3,839

Separately disclosed items

(see below) (108) (335) (57) - (190) (690)

Profit before tax 3,437 2,340 169 - (2,798) 3,149

Specific disclosure items

Depreciation on owned plant

,property and equipment 509 77 85 - - 671

Depreciation on right-of-use

assets 355 322 72 - 99 848

Amortisation 108 307 57 - - 472

Reconciliation of underlying

operating result to operating

profit:

Underlying operating result* 3,617 2,707 234 - (2,245) 4,313

Separately disclosed items

(see below) (108) (335) (57) - (190) (690)

Operating profit/ (loss) 3,509 2,372 177 - (2,435) 3,623

=============================== ========== ============ =============== ================= ========= =============

Reconciliation of re-stated Flowtech Fluidpower Fluidpower Inter-segmental Central Total

segment information for the Group Group Services transactions costs continuing

half year ended 30 June 2022 Solutions GBP000 GBP000 operations

to prior year report GBP000 GBP000 GBP000 GBP000

========= ============ =============== ================= ========= =============

Revenue as per prior year

report 27,614 21,842 9,925 (1,924) 57,457

Revenue from Primary components

non-OEM customers categorised

to Flowtech Segment 1,441 (1,441) - - - -

Total re-stated revenue 29,055 20,401 9,925 (1,924) - 57,457

Underlying operating results

in prior year report 3,725 2,952 328 - (2,692) 4,313

Underlying operating result

for Primary Components

categorised

to Flowtech Segment 10 (10) - - - -

Re-allocation of costs between

segments (118) (235) (94) - 447 -

Underlying operating results,

re-stated 3,617 2,707 234 - (2,245) 4,313

================================ ========= ============ =============== ================= ========= =============

For the year ended 31 December Flowtech Fluidpower Fluidpower Inter-segmental Central Total

2022 Group Group Services transactions

Solutions

(re-stated) GBP000 GBP000 GBP000 costs continuing

operations

GBP000 GBP000 GBP000

Income statement - continuing

operations:

Revenue from external customers 53,273 40,368 21,125 - - 114,766

Inter segment revenue 1,706 1,008 868 (3,582) -

Total revenue 54,979 41,376 21,993 (3,582) 114,766

Underlying operating result* 6,206 5,086 1,804 - (4,510) 8,586

Net financing costs (141) (68) (5) - (978) (1,192)

Underlying segment result 6,065 5,018 1,799 - (5,488) 7,394

Separately disclosed items

(see below) (8,240) (785) (3,329) - (612) (12,966)

Profit / (loss) before tax (2,175) 4,233 (1,530) - (6,100) (5,572)

Specific disclosure items

Depreciation and impairment

on owned plant, property and

equipment 867 157 179 - 2 1,205

Depreciation on right-of-use

assets 707 695 73 - 195 1,670

Impairment of goodwill 7,105 - 2,967 - - 10,072

Impairment of acquired

intangibles - - 168 - - 168

Amortisation 230 683 124 - - 1,037

Reconciliation of underlying

operating result to operating

profit:

Underlying operating result* 6,206 5,086 1,804 - (4,510) 8,586

Separately disclosed items

(see below) (8,240) (785) (3,329) - (612) (12,966)

Operating profit/ (loss) (2,034) 4,301 (1,525) - (5,122) (4,380)

================================= ========== ============ =============== ================= ========= =============

(*) Underlying operating result is continuing operations'

operating profit before separately disclosed items

Reconciliation of re-stated Flowtech Fluidpower Fluidpower Inter-segmental Central Total

segment information for the Group Group Services transactions costs continuing

year ended 31 December 2022 Solutions GBP000 GBP000 operations

to prior year report GBP000 GBP000 GBP000 GBP000

Revenue as per prior year

report 57,271 39,084 21,993 (3,582) - 114,766

Revenue from former Primary

components OEM customers

categorised

from the Flowtech Segment (2,292) 2,292 - - - -

Total re-stated revenue 54,979 41,376 21,993 (3,582) - 114,766

Underlying operating results

in prior year report 6,887 4,405 1,804 - (4,510) 8,586

Underlying operating result

from Primary Components OEM

customers categorised from

the Flowtech Segment (681) 681 - - - -

Underlying operating results,

re-stated 6,206 5,086 1,804 - (4,510) 8,586

================================== ========= =========== ================ ================ ======== ============

Six months Six months Year ended

ended ended 31 December

30 June 30 June 2022

2023 2022 GBP000

SEPARATELY DISCLOSED ITEMS GBP000 GBP000

============================================ ====================== ====================== ========================

Separately disclosed items

within administrative

expenses:

Acquisition costs 8 3 10

Amortisation of acquired

intangibles 452 472 943

Impairment of acquired

intangibles - - 168

Impairment of goodwill - - 10,072

Share-based payment costs 97 103 372

Restructuring costs 430 112 1,401

============================================ ====================== ====================== ========================

Total 987 690 12,966

============================================ ====================== ====================== ========================

* Acquisition costs relate to outline research into

potential acquisition opportunities which are

presented to us

* Share-based payment costs relate to the provision

made in accordance with IFRS 2 "Share-based payment"

following the issue of share options to employees

* Restructuring costs related to restructuring

activities of an operational nature following

acquisition of business units and other restructuring

activities in established businesses. Costs include

restructuring advice, service contract termination

costs and employee redundancies

4. TAXATION

============================================================================================

Six months Six months Year ended

ended ended 31 December

30 June 30 June 2022

2023 2023 GBP000

GBP000 GBP000

=================================================== =========== =========== =============

Current tax on income for the period - continuing

operations:

UK tax 61 511 734

Overseas tax 265 211 185

Adjustments in respect of prior periods/ other

differences - (89) 9

Deferred tax charge (106) (91) (248)

=================================================== =========== =========== =============

Total taxation 220 542 680

=================================================== =========== =========== =============

The taxation for the period has been calculated by applying the estimated

tax rate for the financial year ending 31 December 2023.

5. EARNINGS PER SHARE

============================================================================================================================================================================================

Basic earnings per share is calculated by dividing the earnings attributable

to ordinary shareholders by the weighted average number of ordinary shares

outstanding during the period. For diluted earnings per share the weighted

average number of ordinary shares in issue is adjusted to assume conversion

of all dilutive potential ordinary shares. The dilutive shares are those share

options granted to employees where the exercise price is less than the average

market price of the Company's ordinary shares during the period. For diluted

loss per share the weighted average number of ordinary shares in issue is

not adjusted.

============================================================================================================================================================================================

Six months ended Six months ended Year ended

============

30 June 2023 30 June 2022 31 December 2022

============ ======================================================= ======================================================= ============================================================

Earnings Weighted Earnings Earnings Weighted Earnings Earnings Weighted Earnings

average per average per average per share

number share number share number

of shares of shares of shares

============

GBP000 000's Pence GBP000 000's Pence GBP000 000's Pence

============ ================= ================== ================ ================= ================== ================ =================== ================== ===================

Basic

earnings

per

share

Continuing

operations 1,404 61,493 2.28 2,607 61,493 4.24 (6,252) 61,493 (10.17)

============ ================= ================== ================ ================= ================== ================ =================== ================== ===================

Diluted

earnings

per share

Continuing

operations 1,404 61,673 2.28 2,607 62,236 4.19 (6,252) 61,770 (10.17)

============ ================= ================== ================ ================= ================== ================ =================== ================== ===================

Six months Six months Year ended

ended ended 31 December

30 June 30 June 2022

2023 2022 GBP000

GBP000 GBP000

============================================ ====================== ====================== ========================

Weighted average number of

ordinary shares

for basic and diluted earnings

per share 61,493 61,493 61,493

Impact of share options 180 743 277

============================================ ====================== ====================== ========================

Weighted average number of

ordinary shares

for diluted earnings per share 61,673 62,236 61,770

============================================ ====================== ====================== ========================

6. NET CASH FROM OPERATING ACTIVITIES

======================================================================================================================

Six months Six months Year ended

ended ended 31 December

30 June 30 June 2022

2023 2022 GBP000

GBP000 GBP000

============================================ ====================== ====================== ========================

Reconciliation of profit before taxation

to net cash flows from operations:

Profit / (loss) from continuing operations

before tax 1,624 3,149 (5,572)

Depreciation and impairment on property,

plant, and equipment 645 671 1,205

Depreciation on right-of-use assets (IFRS

16) 880 848 1,670

Impairment of right-of-use assets (IFRS16) - - 388

Release of lease liability (IFRS16) (387) - -

Finance costs 890 474 1,192

(Gain) / Loss on sale of plant and

equipment 2 (24) 57

Loan arrangement fee charged to income (77) - -

statement

Amortisation of intangible assets 545 472 1,037

Impairment of intangible assets - - 168

Impairment of goodwill - - 10,072

Settled share options - (40) (42)

Equity settled share-based payment charge 97 103 372

Exchange differences on non-cash balances (56) - 65

============================================ ====================== ====================== ========================

Operating cash inflow before changes in

working capital and provisions 4,163 5,653 10,612

Change in trade and other receivables (1,664) (3,316) (2,945)

Change in stocks 601 (4,099) (738)

Change in trade and other payables 804 (642) (1,702)

Change in provisions 24 (7) 7

============================================ ====================== ====================== ========================

Cash generated from operations 3,928 (2,411) 5,234

Tax paid / (reclaimed) (321) (94) (220)

============================================ ====================== ====================== ========================

Net cash generated / (used) from operating

activities 3,607 (2,505) 5,014

============================================ ====================== ====================== ========================

7. PRINCIPAL RISKS AND UNCERTAINTIES

=================================================================================

In common with all organisations, Flowtech faces risks which may affect

its performance. The Group operates a system of internal control and risk

management to provide assurance that we are managing risk whilst achieving

our business objectives. No system can fully eliminate risk and therefore

the understanding of operational risk is central to management processes.

The long-term success of the Group depends on the continual review, assessment,

and control of the key business risks it faces. The Directors set out in

the 2022 Annual Report and Financial Statements the principal risks identified

during this exercise, including quality control, systems and site disruption

and employee retention. The Board does not consider that these risks have

changed materially in the last six months.

8. FORWARD-LOOKING STATEMENTS

===============================================================================

This document contains certain forward-looking statements which reflect

the knowledge and information available to the Company during the preparation

and up to the publication of this document. By their very nature, these

statements depend upon circumstances and relate to events that may occur

in the future thereby involving a degree of uncertainty. Although the Group

believes that the expectations reflected in these statements are reasonable,

it can give no assurance that these expectations will prove to have been

correct. Given that these statements involve risks and uncertainties, actual

results may differ materially from those expressed or implied by these

forward-looking statements. The Group undertakes no obligation to update

any forward-looking statements whether because of new information, future

events or otherwise.

ENQUIRIES:

======================================= =============================================================================

Flowtech Fluidpower plc Registered Office:

Mike England, Chief Executive Officer Bollin House, Bollin Walk,

Russell Cash, Chief Financial Officer Wilmslow, Cheshire, SK9

Tel: +44 (0) 1695 52759 1DP

email:

info@flowtechfluidpower.co

m

website:

www.flowtechfluidpower.com

Liberum Capital Limited (Nominated

adviser and Sole Broker)

Richard Lindley / Ben Cryer / Will

King

Tel: 44 (0) 20 3100 2000

TooleyStreet Communications (IR

and media relations)

Fiona Tooley

Tel: +44 (0) 7785 703523 or email

: fiona@tooleystreet.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR UKVRROKUWUUR

(END) Dow Jones Newswires

August 30, 2023 02:00 ET (06:00 GMT)

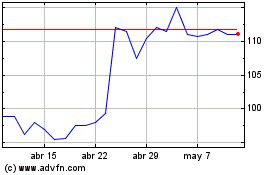

Flowtech Fluidpower (LSE:FLO)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Flowtech Fluidpower (LSE:FLO)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024