TIDMHSP

RNS Number : 6976I

Hargreaves Services PLC

09 August 2023

Hargreaves Services plc

("Hargreaves", the "Company", or the "Group")

Results for the year ended 31 May 2023

Hargreaves Services plc (AIM: HSP), a diversified group

delivering services to the industrial and property sectors,

announces its results for the year ended 31 May 2023.

Renewable energy land asset valuation and realisation plan

The Group has had its portfolio of renewable energy land assets,

comprising three wind farm leases, six access agreements and two

solar farm leases, valued by Jones Lang LaSalle Limited at 30 June

2023. This valuation placed an expected Market Value at

Commissioning of Development*** of between GBP27.2m and GBP28.9m.

These assets exclude the Westfield site where an Energy from Waste

plant is being constructed by a third party. These renewable energy

land assets are held at cost in the Balance Sheet at GBP6.6m. It is

the Board's intention to realise the value within these renewable

energy land assets over the next five years and repatriate proceeds

to shareholders.

Financial results

The Group has maintained its momentum, with the continued

expansion of a robust recurring revenue base in Services delivering

both revenues marginally ahead and underlying profit before tax

above market expectations and providing a strong foundation for

future growth.

KEY FINANCIAL RESULTS

Year ended 31 May 2023 2022

Revenue GBP211.5m GBP177.9m

Underlying Profit Before Tax ("UPBT")** GBP27.3m GBP30.4m*

Profit from joint ventures (net of tax) GBP16.3m GBP25.9m*

Share of Profit Before Tax from continuing GBP27.2m GBP32.2m*

operations

EBITDA** GBP21.8m GBP13.6m

Basic underlying EPS from continuing operations** 86.3p 96.1p*

Proposed Final Dividend 6.0p +7.1% 5.6p

Proposed Additional Dividend from HRMS 12.0p 12.0p

Cash and cash equivalents GBP21.9m GBP13.8m

Net Assets GBP201.0m +11.8% GBP179.8m*

Net Assets per Share** 618p 553p*

HIGHLIGHTS

-- Revenue increased 18.9% to GBP211.5m (2022: GBP177.9m) due to organic growth in Services

-- UPBT above expectations at GBP27.3m (2022: GBP30.4m),

decrease due to expected reduction in profitability in German Joint

Venture, HRMS, offset by growth in both Services and Hargreaves

Land

-- Services UPBT increased 61.8% to GBP12.3m (2022: GBP7.6m)

-- Hargreaves Land UPBT increased 85.7% to GBP3.9m (2022: GBP2.1m)

-- Services business has over ten new term and framework

contracts, taking total to over 60 providing visibility of 70% of

next year's expected revenue

* The prior year numbers have been restated following a

correction of the allowability of certain expenses for corporate

tax in a joint venture for the year ended 31 May 2022 and prior

years. The net effect of the changes for the year ended 31 May 2022

was a decrease in the opening balance of the investment in joint

ventures of GBP966,000 and a decrease in the share of profit in

joint ventures (net of tax) of GBP2,321,000 which has subsequently

decreased the closing investment in joint ventures by GBP3,287,000.

Please refer to Note 7.

** The basis of Underlying profit before tax, EBITDA, Net Assets

per Share and basic underlying EPS is set out in Note 8. The

calculation of Net Assets per Share includes the renewable energy

land assets at cost.

*** M arket Value at COD - represents the price at which the

portfolio would change hands between a willing buyer and a willing

seller, neither being under any compulsion to buy or sell and both

having reasonable knowledge of the relevant facts.

Commenting on the preliminary results, Acting Group Chair Nigel

Halkes said: "The Group has maintained its strong momentum built

over the last few years and continues to demonstrate its resilience

in the current challenging economic environment. The growth of a

robust recurring revenue base in Services is particularly pleasing

and has provided the bedrock of performance for the Group. The

outlook for the Group's operations for the coming year and beyond

is strong with over 60 term and framework contracts and 70% of

revenue for the year already secured. The Group remains focused on

its strategy to create, deliver and realise value for shareholders,

and I look forward to executing on our value realisation plans in

our renewable energy land asset portfolio in the medium term."

Analyst briefing

A briefing open to analysts will take place on Wednesday 9

August 2023 at 9.30 am. To register and for more details please

contact Walbrook PR on hargreavesservices@walbrookpr.com .

Investor presentation

Gordon Banham, Group Chief Executive, David Anderson, Group

Property Director and Stephen Craigen, Group Financial Controller

and Group Finance Director, will provide a live presentation on the

Company's preliminary results via the Investor Meet Company

platform on 9 August 2023 at 4.30 pm BST.

The presentation is open to all existing and potential

shareholders. Questions can be submitted pre-event via your

Investor Meet Company dashboard up until 9 am the day before the

meeting or at any time during the live presentation.

Investors can sign up to Investor Meet Company for free here

.

For further details:

Hargreaves Services www.hsgplc.co.uk

Gordon Banham, Chief Executive Tel: 0191 373 4485

Stephen Craigen, Group Finance Director

Walbrook PR (Financial PR & Tel: 020 7933 8780 or hargreavesservices@walbrookpr.com

IR) Mob: 07980 541 893 / 07584 391 303 /

Paul McManus / Lianne Applegarth 07747 515 393

/

Louis Ashe-Jepson

Singer Capital Markets (Nomad and Corporate Tel: 020 7496 3000

Broker)

Sandy Fraser / Justin McKeegan

About Hargreaves Services plc ( www.hsgplc.co.uk )

Hargreaves Services plc is a diversified group delivering

services to the industrial and property sectors, supporting key

industries within the UK and South East Asia. The Company's three

business segments are Services, Hargreaves Land and an investment

in a German joint venture, Hargreaves Raw Materials Services GmbH

(HRMS). Services provides critical support to many core industries

including Energy, Environmental, UK Infrastructure and certain

manufacturing industries through the provision of materials

handling, mechanical and electrical contracting services, logistics

and major earthworks. Hargreaves Land is focused on the sustainable

development of brownfield sites for both residential and commercial

purposes. HRMS trades in specialist commodity markets and owns DK

Recycling, a specialist recycler of steel waste material.

Hargreaves is headquartered in County Durham and has operational

centres across the UK, as well as in Hong Kong and a joint venture

in Duisburg, Germany.

Chair's Statement

Nigel Halkes, Acting Group Chair

Strategic Focus

The Group has remained focused on its strategy to create,

deliver and realise value for shareholders. Over recent years

progress has been made on the creation of value opportunities,

notably the winning of new Services contracts and by identifying

opportunities for renewable energy assets on some of our land which

has limited alternative development potential. Additionally, the

Group has delivered high quality trading results highlighted by

solid organic growth within Services. On 25 July 2023, I announced

that the Board has identified opportunities for value realisation,

as set out below:

Renewable Energy Land Asset Valuation and Realisation Plan

A key focus over the last few years has been the identification

of several thousand acres of the Group's land which is now under

lease to third parties for the construction of wind farms as well

as other renewable energy assets and the granting of access to

third party wind farm projects. Collectively, these have the

potential to generate over 700MW of clean electricity. The Group

has rights to receive index linked ground rents from these assets,

most of which are linked to the underlying price of the electricity

they generate.

The first wind farm on our land became operational earlier this

year at Dalquhandy. Similar land assets within the renewable land

portfolio have increasing index linked rental income coming on

stream over the next few years resulting in a growing and

meaningful annual return to the Group. Most of these renewable

energy land assets have planning permission and approved dates for

grid connections, significantly de-risking the projected income

profile.

We have recently commissioned the first independent valuation of

these renewable energy land assets by Jones Lang LaSalle Limited

("JLL"). This review has placed a Market Value Today*** in the

range of between GBP21.6m and GBP23.1m on these assets as at 30

June 2023 with a Market Value at Commissioning of Development

("COD")*** expectation in the range of GBP27.2m to GBP28.9m for

when the assets commence generation, which is at various points

over the period to January 2027. The board intends to commission

this valuation on an annual basis. These investment property assets

are held on the Balance Sheet at an historic cost of GBP6.6m,

resulting in a substantial gain to be realised. These assets

exclude the Westfield site where an Energy from Waste ("EfW") plant

is being constructed by a third party.

It is the intention of the Board to realise the value of these

renewable energy land assets over the next five years in an orderly

manner and to repatriate proceeds to shareholders. This is a clear

demonstration of the Group's strategy to create, deliver and then

realise value for shareholders and I am pleased that this

particular initiative is now moving into the realisation phase.

Pension Schemes

The Group currently pays GBP1.9m per annum in deficit reduction

contributions relating to two legacy defined benefit pension

schemes. Recent movements in gilt yields and the underlying

performance of scheme assets have substantially narrowed the gap

between scheme assets and liabilities. The Board estimates that a

figure in the region of GBP15m would be sufficient to buy out these

schemes and transfer the liabilities to an appropriate insurer. I

can confirm that the Group has now instructed the Trustees of the

schemes to progress towards a full buy out of the liability,

subject to obtaining satisfactory terms from the insurance market.

This may take up to 18 months to complete. The Board expects this

will be funded from existing cash resources.

Financial Results

I am pleased to report another strong set of results for the

Group. Underlying Profit before Tax ("UPBT")** was GBP27.3m (2022:

GBP30.4m*), GBP3.1m lower than the prior year due to the expected

and previously announced reduction in profitability from the

Group's investment in the German joint venture, Hargreaves Raw

Material Services GmbH ("HRMS") due to the anticipated reduction in

commodity prices from elevated levels recorded in the previous

year.

Whilst the contribution from HRMS has fallen from GBP25.0m to

GBP15.5m*, a reduction of GBP9.5m, both the Services business and

Hargreaves Land have seen substantial growth in profits to mitigate

the softening commodity markets which have impacted the German

business.

Group EBITDA** grew by 60.3% to GBP21.8m (2022: GBP13.6m),

driven by improved performance within Services. Profit before Tax

from Continuing Operations was GBP27.2m (2022: GBP32.2m*). Basic

underlying earnings per share from continuing operations** was

86.3p (2022: 96.1p*). Basic earnings per share was 85.9p (2022:

106.6p*).

Cash and leasing debt

On 31 May 2023 the Group held cash in the bank of GBP21.9m

(2022: GBP13.8m). The increase in cash compared with the prior year

is predominantly due to the repayment of a GBP15m loan from HRMS,

which was advanced in the prior year to allow the Joint Venture to

maximise profits from the temporary boom in commodity prices.

The Group's debt relates solely to leasing arrangements for the

acquisition of fixed assets. At the year end the balance of the

debt was GBP36.4m (2022: GBP18.4m). The increase relates to the

investment in plant and machinery required to undertake the

earthmoving works on the HS2 contract.

Dividend

In April 2023, the Group paid an interim dividend of 3.0p, which

was an increase of 7.1% on the prior year. The Group has continued

to trade well throughout the second half of the year and the Board

is proposing a final dividend of 6.0p (2022: 5.6p) taking the full

year underlying dividend to 9.0p (2022: 8.4p) which represents an

increase of 7.1%.

In addition to the final dividend of 6.0p, the Board is also

proposing an additional dividend of 12.0p per share (2022: 12.0p)

relating to cash to be repatriated from HRMS. This, combined with

the full year underlying dividend of 9.0p, takes the total dividend

to 21.0p (2022: 20.4p), an overall increase of 2.9%.

If approved at the Annual General Meeting, the final dividend of

6.0p and the additional dividend of 12.0p will be paid on 30

October 2023 to all shareholders on the register at the close of

business on 22 September 2023. The shares will become ex-dividend

on 21 September 2023.

Board changes

As previously announced, Roger McDowell has taken a temporary

sabbatical for personal reasons from the beginning of June 2023 and

I have assumed his responsibility as Chair until his return, which

is anticipated to be in September 2023. Also as reported

previously, John Samuel has informed the Board of his intention to

step down as Group Finance Director to pursue other opportunities.

He will be succeeded as Group Finance Director by Stephen Craigen

(39), Group Financial Controller, with effect from 9 August 2023,

the date on which John will leave the Board. Stephen joined the

Board on 1 August 2023. David Hankin, a qualified solicitor and in

house Legal Counsel, will be appointed Company Secretary on 9

August 2023.

Outlook

The Group has maintained the momentum it has built over the last

few years and has demonstrated its resilience, particularly within

the Services operations, in the face of a challenging economic

environment. The Balance Sheet remains free from bank debt and

third party security and continues to provide a strong and stable

platform for growth.

The outlook for the Group's trading activities for the coming

year and beyond is strong with 70% of expected revenue for the year

in the Services business already secured and with Hargreaves Land

having exchanged unconditional contracts for a large plot at

Blindwells which is scheduled to complete in January 2024.

Furthermore, the realisation plans for certain renewable energy

land assets has the potential to deliver substantial incremental

value for shareholders over the next few years.

Nigel Halkes

Acting Chair

8 August 2023

* The prior year numbers have been restated following a

correction of the allowability of certain expenses for corporate

tax in a joint venture for the year ended 31 May 2022 and prior

years. The net effect of the changes for the year ended 31 May 2022

was a decrease in the opening balance of the investment in joint

ventures of GBP966,000 and a decrease in the share of profit in

joint ventures (net of tax) of GBP2,321,000 which has subsequently

decreased the closing investment in joint ventures by GBP3,287,000.

Please refer to Note 7.

** The basis of Underlying profit before tax, EBITDA and basic

underlying EPS is set out in Note 8.

*** Valuation definitions

Market Value Today - Market Value Today takes the Market Value

at COD and applies an appropriate reduction to reflect the inherent

risk of delivery that would likely arise between a willing buyer

and a willing seller based on the circumstances as they were at 30

June 2023.

Market Value at COD - represents the price at which the

portfolio would change hands between a willing buyer and a willing

seller, neither being under any compulsion to buy or sell and both

having reasonable knowledge of the relevant facts.

Group Business Review

Gordon Banham, Group Chief Executive

CHIEF EXECUTIVE'S REVIEW

GBP'm Services Hargreaves HRMS Unallocated Total

Land

Revenue (2023) 200.9 10.6 - - 211.5

--------- ----------- ----- ------------ ------

Revenue (2022) 162.8 15.1 - - 177.9

--------- ----------- ----- ------------ ------

Underlying Profit/(Loss)

before Tax** (2023) 12.3 3.9 15.5 (4.4) 27.3

--------- ----------- ----- ------------ ------

Underlying Profit/(loss)

before Tax* (2022) 7.6 2.1 25.0 (4.3) 30.4

--------- ----------- ----- ------------ ------

Profit/(loss) before

tax from continuing operations

(2023) 12.2 3.9 15.5 (4.4) 27.2

--------- ----------- ----- ------------ ------

Profit before tax from

continuing operations

*(2022) 9.4 2.1 25.0 (4.3) 32.2

--------- ----------- ----- ------------ ------

* The prior year numbers have been restated following a

correction of the allowability of certain expenses for corporate

tax in a joint venture for the year ended 31 May 2022 and prior

years. The net effect of the changes for the year ended 31 May 2022

was a decrease in the opening balance of the investment in joint

ventures of GBP966,000 and a decrease in the share of profit in

joint ventures (net of tax) of GBP2,321,000 which has subsequently

decreased the closing investment in joint ventures by GBP3,287,000.

Please refer to Note 7

** The basis of Underlying profit before tax and basic

underlying EPS is set out in Note 8 .

Services

The Services business delivered a 23.4% increase in revenue to

GBP200.9m (2022: GBP162.8m), due in the most part to the increase

in activity on the HS2 contract which accounted for GBP20.5m of the

increase. The remaining increase has come from mechanical and

electrical engineering project works, which is an area of the

business which has performed particularly well in the year, and

from growth in industrial services in Hong Kong.

The business unit recorded an underlying profit before tax of

GBP12.3m (2022: GBP7.6m), an increase of over 60% on the prior

year. This included a non-recurring profit of GBP3.2m from the

disposal of certain plant and equipment. The remaining growth of

GBP1.5m represents an underlying improvement of 19.7% year on

year.

HS2

The year ended 31 May 2023 represented the first full year of

operations on HS2, which commenced in the second half of the

previous financial year. Revenue from activities on HS2 was

GBP54.1m in the year (2022: GBP33.6m), which represents 26.9%

(2022: 20.6%) of the total Services revenue.

The Group is contracted to the EKFB Joint Venture to carry out

the major earthworks on the C2/3 sections of HS2, predominantly in

Buckinghamshire. I am pleased to report that the contract has

performed very well in the year, with all required plant and

machinery now acquired and on site and at peak operations over 400

workers were at the location. In addition to earthmoving, the Group

has supplied EKFB with a 650m, five section conveyor to facilitate

the removal of surplus material in a highly efficient way and

contributing to a substantial reduction in carbon emissions.

Continued contract success

A key aspect of the Services business unit is its resilience and

stability, which is derived from its strong contract base with high

quality customers. During the last financial year we have seen more

success in this area as the Services business has signed more than

ten term and framework contracts. These contract wins have taken

the total number of term and framework contracts within the

Services business to over 60, which provides an excellent underpin

for the Group. These contracts secure approximately 70% of expected

revenue for the year ending 31 May 2024. Additionally, t he

Services business has excellent growth opportunities in a number of

major infrastructure projects, including Lower Thames Crossing and

Sizewell C, alongside further mechanical engineering works for

industrial clients.

Additionally, the Services business has good resilience to the

current inflationary pressures. Most term contracts include a form

of price escalation, particularly in relation to fuel increases for

our logistics operations. The main HS2 contract is a target cost

reimbursable fee arrangement so that increases in defined costs are

recovered. With inflation in the UK rising rapidly and persisting

over the past 12 months, the business has seen the benefit of these

clauses in mitigating the impact of such risks.

The Group continues to monitor the situation at Tungsten West

plc ("TW") regarding the tungsten mine in Devon. As previously

reported, Hargreaves has a strong contractual position with TW

which would provide the potential for substantial growth should TW

be successful in raising sufficient funds to commence mining

activities. The recent announcement by TW regarding their raising

of funds ensured the receipt of the annual GBP1m fee, which was

paid as due in June 2023. The future of the project remains

dependent on TW raising substantial additional monies. The Group

remains in close contact with TW.

Hargreaves Land

Hargreaves Land recorded revenue of GBP10.6m (2022: GBP15.1m)

and a Profit before Tax of GBP3.9m (2022: GBP2.1m) for the year.

This represents an increase of 86% over the prior year, which is

reflective of the business converting several development

opportunities in the year. Despite this increase in profitability,

the result is somewhat lower than the Board was anticipating

earlier in the year as uncertainty over the housing market resulted

in certain sales being delayed into the new financial year.

Our flagship project at Blindwells has been the most impacted by

these delays, however, I am pleased to announce that we have

exchanged unconditional contracts for the sale of a 20 acre plot to

Avant Homes (Scotland) Limited for consideration of GBP18.5m. The

sale is scheduled to complete in January 2024 with payments

structured into four equal instalments over a three year period,

with the first payable on completion.

The Board considers the delays experienced in the year to be

reflective of the wider slowdown in the housebuilding market and

therefore will only represent a timing delay on the project. The

Board remains confident that the overall profitability of the

scheme is not materially affected. The site remains a long term,

regular profit stream for Hargreaves Land, with Phase 1 which is

expected to be completed by 2032. Once Phase 1 is completed, there

is a second Phase for which outline planning for a further 1,400

homes on land owned by the Group is currently being progressed.

Progress has continued at Unity in Yorkshire, with construction

on one of the major logistics units, which was announced last year,

progressing well. The Unity Joint Venture remains independently

funded without recourse to Hargreaves.

Pipeline

A key strength of the Hargreaves Land business is the size and

quality of its pipeline of development opportunities with

significant progress having been made during the last twelve

months. In the year ended 31 May 2023 Hargreaves Land exchanged

contracts on schemes with a combined Gross Development Value

("GDV") of over GBP190m, which is anticipated to deliver returns in

excess of 15%.

These opportunities are spread across the residential,

commercial and logistics sectors, which ensures that the business

does not become over reliant on any particular industry segment.

Additionally, these arrangements form part of the capital light

model that the business is adopting for future schemes, removing

the need for material investment into assets to be held for long

periods.

Pipeline Summary Number of Residential Square Footage Estimated

sites plots (Commercial) GDV

Residential (planning

allocated) 6 5,700 n/a GBP200m

---------- ------------ --------------- ----------

Residential (planning

promotion) 7 2,850 n/a GBP120m

---------- ------------ --------------- ----------

Commercial (planning allocated) 6 n/a 5,700,000 GBP620m

---------- ------------ --------------- ----------

Renewables Energy Land Assets

The Group continues to act as a landlord for several wind farm

and other renewable energy assets, which could generate over 700MW

of clean electricity. The first wind farm on our land became

operational earlier this year at Dalquhandy. The remaining similar

land assets have increasing rental income streams which are due to

come on board over the next few years. These renewable energy land

assets have planning permission and approved dates for grid

connections, significantly de-risking the projected income

profile.

The renewable energy land portfolio continues to be an area of

great focus for the Board. We have seen the first independent

valuation of the portfolio undertaken in the year by JLL, which has

provided a Market Value at COD of over GBP27m for all existing

renewable energy schemes, excluding the Westfield site, where a

third party is constructing an EfW plant. The Board is committed to

ensuring that the value created within the Group is optimised,

realised and then repatriated to shareholders over the coming

years.

In addition to the renewable energy land assets which are well

progressed, the Group continues to look at longer term

opportunities for renewable energy projects on its land. There are

a further nine schemes under discussion which could generate over

800MW of energy. These schemes are medium term growth

opportunities.

HRMS

The Group's share of post-tax profits from HRMS was GBP15.5m

(2022: GBP25.0m*) which is a reduction of 38%. The corresponding

contribution for the year ended 31 May 2021 was GBP13.6m, which

demonstrates that the Joint Venture has made the most of the high

commodity prices observed throughout late 2021 and 2022 and that

the market has returned to more normal levels. Despite this

reduction, the comparison with two years ago is more relevant as

market conditions then were more comparable to today.

The trading business has seen a 38% reduction in total traded

volume from 1,637kt to 1,020kt in the current year coupled with a

reduction in commodity prices. This softening of commodity prices

and reduction in volumes has meant a reduction in the level of

working capital that HRMS requires. As such HRMS has been able to

repay the GBP15m short term working capital loan that the Group

provided in the previous financial year. At present there is no

further requirement for funding to be provided by the Group to

HRMS. The Board expects further cash repatriation from HRMS as

inventory levels reduce in the trading business.

The Carbon Pulverisation Plant ("CPP") continues to breakeven as

it has done since it was completed. It remains fully operational

but is not expected to move into profitability until year ending 31

May 2025 at the earliest as it is impacted by the economic

uncertainties within the German economy which have delayed the

expected transition away from brown lignite coal.

In DK Recycling und Roheisen GmbH ("DK"), zinc, which is an

important output, has fallen from peaks of over $4,500 per tonne in

April 2022 to around $2,400 today, reducing profitability.

Summary

Hargreaves has continued to trade well despite challenging

economic conditions both in the UK and Europe. The business has a

strong balance sheet, from which we remain focused on unlocking and

realising value for shareholders and I look to the future with

optimism.

Gordon Banham

Group Chief Executive

8 August 2023

Consolidated Statement of Profit and Loss

and Other Comprehensive Income

for the year ended 31 May 2023

Restated

*

2023 2022

Continuing operations Note GBP000 GBP000

-------------------------------------------------------- ---- --------- ---------

Revenue 2 211,459 177,908

Cost of sales (172,402) (148,458)

-------------------------------------------------------- ---- --------- ---------

Gross profit 39,057 29,450

Other operating income 4,918 1,298

Administrative expenses (32,178) (24,520)

-------------------------------------------------------- ---- --------- ---------

Operating profit 11,797 6,228

Analysed as:

Operating profit (before exceptional items and

amortisation charges) 11,972 4,474

Exceptional items 3 - 1,754

Amortisation of intangible assets (175) -

-------------------------------------------------------- ---- --------- ---------

Operating profit 11,797 6,228

-------------------------------------------------------- ---- --------- ---------

Finance income 1,612 823

Finance expense (2,565) (770)

Share of profit in joint ventures (net of tax)* 16,311 25,879

-------------------------------------------------------- ---- --------- ---------

Profit before tax* 27,155 32,160

Taxation 4 771 347

-------------------------------------------------------- ---- --------- ---------

Profit for the year from continuing operations* 27,926 32,507

Profit for the year from discontinued operations 5 - 2,000

-------------------------------------------------------- ---- --------- ---------

Profit for the year* 27,926 34,507

-------------------------------------------------------- ---- --------- ---------

Other comprehensive income/(expense)

Items that will not be reclassified to profit

or loss

(Loss)/gain in defined benefit pension schemes (4,645) 5,955

Tax recognised on items that will not be reclassified

to profit or loss 1,161 (1,488)

Items that are or may be reclassified subsequently

to profit or loss

Foreign exchange translation differences 1,130 313

Effective portion of changes in fair value of

cash flow hedges - 41

Tax recognised on items that are or may be reclassified

subsequently to profit or loss - (8)

Share of other comprehensive income of joint

ventures, (net of tax) 1,912 3,070

-------------------------------------------------------- ---- --------- ---------

Other comprehensive (expense)/income for the

year, net of tax (442) 7,883

-------------------------------------------------------- ---- --------- ---------

Total comprehensive income for the year* 27,484 42,390

-------------------------------------------------------- ---- --------- ---------

Profit/(loss) attributable to:

Equity holders of the Company* 27,915 34,719

Non-controlling interest 11 (212)

------------------------------------------------------ ------ ------

Profit for the year* 27,926 34,507

------------------------------------------------------ ------ ------

Total comprehensive income/(expense) attributable

to:

Equity holders of the Company* 27,473 42,602

Non-controlling interest 11 (212)

------------------------------------------------------ ------ ------

Total comprehensive income for the year* 27,484 42,390

------------------------------------------------------ ------ ------

Basic earnings per share (pence)* 6 85.85 106.63

Diluted earnings per share (pence)* 6 84.13 103.48

Continuing basic earnings per share (pence)* 6 85.85 100.45

Diluted continuing basic earnings per share (pence)* 6 84.13 97.48

Non-GAAP Measures

------------------------------------------------------ ------ ------

Basic underlying earnings per share from continuing

operations (pence)* 6 86.28 96.06

Diluted underlying earnings per share from continuing

operations (pence)* 6 84.55 93.22

------------------------------------------------------ ------ ------

* The prior year numbers have been restated following a

correction of the allowability of certain expenses for corporate

tax in a joint venture for the year ended 31 May 2022 and prior

years. The net effect of the changes for the year ended 31 May 2022

was a decrease in the opening balance of the investment in joint

ventures of GBP966,000 and a decrease in the share of profit in

joint ventures (net of tax) of GBP2,321,000 which has subsequently

decreased the closing investment in joint ventures by GBP3,287,000.

Please refer to Note 7. Earnings per share for the prior year have

also been restated. Please refer to Note 6.

Group Balance Sheet

at 31 May 2023

Group

------------------------------------- ----------------------

Restated*

2023 2022

GBP000 GBP000

------------------------------------- --------- -----------

Non-current assets

Property, plant and equipment 10,861 9,938

Right-of-use assets 39,815 22,062

Investment property 14,074 8,298

Intangible assets including goodwill 5,685 4,824

Investments in joint ventures* 74,282 55,096

Deferred tax assets 14,753 11,063

Trade receivables - 4,224

Retirement benefit surplus 8,474 10,382

-------------------------------------- --------- -----------

167,944 125,887

------------------------------------- --------- -----------

Current assets

Inventories 39,302 30,476

Trade and other receivables 71,609 88,574

Contract assets 5,114 6,752

Cash and cash equivalents 21,859 13,773

-------------------------------------- --------- -----------

137,884 139,575

------------------------------------- --------- -----------

Total assets* 305,828 265,462

-------------------------------------- --------- -----------

Non-current liabilities

Other interest-bearing loans and

borrowings (20,839) (11,045)

Retirement benefit obligations (2,902) (2,703)

Provisions (4,120) (2,344)

Deferred tax liabilities (3,417) (1,920)

(31,278) (18,012)

------------------------------------- --------- -----------

Current liabilities

Other interest-bearing loans and

borrowings (15,511) (7,326)

Trade and other payables (47,427) (50,727)

Provisions (10,467) (9,440)

Income tax liability (154) (108)

(73,559) (67,601)

------------------------------------- --------- -----------

Total liabilities (104,837) (85,613)

-------------------------------------- --------- -----------

Net assets* 200,991 179,849

-------------------------------------- --------- -----------

Equity attributable to equity

holders of the Parent

Share capital 3,314 3,314

Share premium 73,972 73,972

Other reserves 211 211

Translation reserve (689) (1,819)

Merger reserve 1,022 1,022

Hedging reserve 318 318

Capital redemption reserve 1,530 1,530

Share-based payment reserve 2,388 2,029

Retained earnings* 119,136 99,494

------------------------------- ------- -------

201,202 180,071

Non-controlling interest (211) (222)

------------------------------- ------- -------

Total equity* 200,991 179,849

------------------------------- ------- -------

* The prior year numbers have been restated following a

correction of the allowability of certain expenses for corporate

tax in a joint venture for the year ended 31 May 2022 and prior

years. The net effect of the changes for the year ended 31 May 2022

was a decrease in the opening balance of the investment in joint

ventures of GBP966,000 and a decrease in the share of profit in

joint ventures (net of tax) of GBP2,321,000 which has subsequently

decreased the closing investment in joint ventures by GBP3,287,000.

Please refer to Note 7 .

:

Group Statement of Changes in Equity

for year ended 31 May 2023

Share- Restated*

Capital based Restated* Total Restated*

Share Share Translation Hedging Other redemption Merger payment Retained Parent Non-controlling Total

capital premium reserve reserve reserves reserve reserve reserve earnings equity interest equity

Group GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

----------------- ------- ------- ----------- ---------- -------- ---------- ------- ------- --------- --------- --------------- ---------

At 1 June 2021 3,314 73,955 (2,132) 285 211 1,530 1,022 1,680 63,475 143,340 (10) 143,330

Total

comprehensive

income/(expense)

for

the year

Profit/(loss) for

the year* - - - - - - - - 34,719 34,719 (212) 34,507

Other

comprehensive

income - - 313 33 - - - - 7,537 7,883 - 7,883

----------------- ------- ------- ----------- ---------- -------- ---------- ------- ------- --------- --------- --------------- ---------

Total

comprehensive

income/(expense)

for

the year* - - 313 33 - - - - 42,256 42,602 (212) 42,390

----------------- ------- ------- ----------- ---------- -------- ---------- ------- ------- --------- --------- --------------- ---------

Transactions with

owners recorded

directly

in equity

Issue of shares - 17 - - - - - - - 17 - 17

Equity-settled

share-based

payment

transactions - - - - - - - 349 - 349 - 349

Dividends paid - - - - - - - - (6,237) (6,237) - (6,237)

----------------- ------- ------- ----------- ---------- -------- ---------- ------- ------- --------- --------- --------------- ---------

Total

contributions

by and

distributions

to owners - 17 - - - - - 349 (6,237) (5,871) - (5,871)

----------------- ------- ------- ----------- ---------- -------- ---------- ------- ------- --------- --------- --------------- ---------

At 31 May 2022* 3,314 73,972 (1,819) 318 211 1,530 1,022 2,029 99,494 180,071 (222) 179,849

----------------- ------- ------- ----------- ---------- -------- ---------- ------- ------- --------- --------- --------------- ---------

At 1 June 2022* 3,314 73,972 (1,819) 318 211 1,530 1,022 2,029 99,494 180,071 (222) 179,849

Total comprehensive

income/(expense) for

the year

Profit for the year - - - - - - - - 27,915 27,915 11 27,926

Other comprehensive

income/(expense) - - 1,130 - - - - - (1,572) (442) - (442)

--------------------------- ----- ------ ------- --- --- ----- ----- ----- ------- ------- ----- -------

Total comprehensive

income for the year - - 1,130 - - - - - 26,343 27,473 11 27,484

--------------------------- ----- ------ ------- --- --- ----- ----- ----- ------- ------- ----- -------

Transactions with

owners recorded directly

in equity

Equity-settled share-based

payment transactions - - - - - - - 359 - 359 - 359

Dividends paid - - - - - - - - (6,701) (6,701) - (6,701)

--------------------------- ----- ------ ------- --- --- ----- ----- ----- ------- ------- ----- -------

Total contributions

by and distributions

to owners - - - - - - - 359 (6,701) (6,342) - (6,342)

--------------------------- ----- ------ ------- --- --- ----- ----- ----- ------- ------- ----- -------

At 31 May 2023 3,314 73,972 (689) 318 211 1,530 1,022 2,388 119,136 201,202 (211) 200,991

--------------------------- ----- ------ ------- --- --- ----- ----- ----- ------- ------- ----- -------

* The prior year numbers have been restated following a

correction of the allowability of certain expenses for corporate

tax in a joint venture for the year ended 31 May 2022 and prior

years. The net effect of the changes for the year ended 31 May 2022

was a decrease in the opening balance of the investment in joint

ventures of GBP966,000 and a decrease in the share of profit in

joint ventures (net of tax) of GBP2,321,000 which has subsequently

decreased the closing investment in joint ventures by GBP3,287,000.

Please refer to Note 7 .

Group Cash Flow Statement

for year ended 31 May 2023

Group

----------------------------------------- ---------------------

Restated*

2023 2022

GBP000 GBP000

----------------------------------------- -------- -----------

Cash flows from operating activities

Profit for the year from continuing

operations* 27,926 32,507

Adjustments for:

Depreciation and impairment of

property, plant and equipment

and right-of-use assets 14,570 8,666

Amortisation of goodwill and intangible

assets 175 -

Net finance expense/(income) 953 (53)

Share of profit in joint ventures

(net of tax)* (16,311) (25,879)

Profit on sale of property, plant

and equipment, investment property

and right-of-use assets (4,718) (1,298)

Equity-settled share-based payment

expenses 359 349

Income tax credit (771) (347)

Contributions to defined benefit

pension schemes (2,426) (2,002)

Translation of non-controlling

interest and investments 482 202

20,239 12,145

Change in inventories (8,827) (3,308)

Change in trade and other receivables 23,290 (19,256)

Change in trade and other payables (4,563) 903

Change in provisions and employee

benefits 2,713 1,000

------------------------------------------ -------- -----------

32,852 (8,516)

Interest received 1,127 34

Interest paid (2,192) -

Income tax paid (281) (44)

------------------------------------------ -------- -----------

Net cash inflow/(outflow) from

operating activities 31,506 (8,526)

------------------------------------------ -------- -----------

Cash flows from investing activities

Proceeds from sale of property,

plant and equipment 6,565 801

Proceeds from sale of investment

property 266 1,407

Proceeds from sale of right of

use assets 81 78

Acquisition of property, plant

and equipment (3,442) (1,479)

Acquisition of investment property (5,783) (1,070)

Acquisition of right of use assets (85) (163)

Payment for acquisition of subsidiaries,

net of cash acquired (1,447) -

Dividends received from joint

ventures - 3,917

Net cash (outflow)/inflow from

investing activities in continuing

operations (3,845) 3,491

------------------------------------------ -------- -----------

Net cash inflow from investing

activities in discontinued operations - 2,000

------------------------------------------ -------- -----------

Net cash (outflow)/inflow from

investing activities (3,845) 5,491

------------------------------------------ -------- -----------

Cash flows from financing activities

Principal elements of lease payments (12,721) (5,531)

Dividends paid (6,701) (6,237)

Net cash outflow from financing

activities (19,422) (11,768)

------------------------------------------ -------- -----------

Net increase/(decrease) in cash

and cash equivalents 8,239 (14,803)

Cash and cash equivalents at 1

June 13,773 28,303

Effect of exchange rate fluctuations

on cash held (153) 273

------------------------------------------ -------- -----------

Cash and cash equivalents at

31 May 21,859 13,773

------------------------------------------ -------- -----------

* The prior year numbers have been restated following a

correction of the allowability of certain expenses for corporate

tax in a joint venture for the year ended 31 May 2022 and prior

years. The net effect of the changes for the year ended 31 May 2022

was a decrease in the opening balance of the investment in joint

ventures of GBP966,000 and a decrease in the share of profit in

joint ventures (net of tax) of GBP2,321,000 which has subsequently

decreased the closing investment in joint ventures by GBP3,287,000.

Please refer to Note 7.

Notes

1 Basis of preparation and status of financial information

The financial information set out above has been prepared and

approved by the Directors in accordance with the recognition and

measurement criteria of international accounting standards in

conformity with the requirements of the Companies Act 2006.

The financial information set out above does not constitute the

Group's statutory accounts for the years ended 31 May 2023 or 31

May 2022. Statutory accounts for 2022 have been delivered to the

Registrar of Companies, and those for 2023 will be delivered in due

course. The auditor has reported on those accounts; their reports

were (i) unqualified, (ii) did not include a reference to any

matters to which the auditor drew attention by way of emphasis

without qualifying their report and (iii) did not contain a

statement under section 498 (2) or (3) of the Companies Act

2006.

The accounting policies set out below have, unless otherwise

stated, been applied consistently to all periods presented in these

consolidated financial statements.

The Group has restated the 31 May 2022 Consolidated Statement of

Profit and Loss and Other Comprehensive Income, Group Balance

Sheet, Group Statement of Changes in Equity, and Group Cash Flow

Statement following a correction of the allowability of certain

expenses for corporate tax in a joint venture for the year ended 31

May 2022 and prior years. The net effect of the changes for the

year ended 31 May 2022 was a decrease in the opening balance of the

investment in joint ventures of GBP966,000 and a decrease in the

share of profit in joint ventures (net of tax) of GBP2,321,000

which has subsequently decreased the closing investment in joint

ventures by GBP3,287,000. Please refer to Note 7.

Going Concern

The Group's financing is not dependent on bank borrowings,

however the group has access to a GBP12m invoice discounting

facility, which is currently undrawn and will remain in place until

31 October 2024. Notwithstanding that, a rigorous review of cash

flow forecasts including testing for a range of challenging

downside sensitivities has been undertaken. Mitigating strategies

to these sensitivities considered by the Board exclude any remedies

which are not entirely within the Group's control. As a result, and

after making appropriate enquiries including reviewing budgets and

strategic plans, the Directors have a reasonable expectation that

both the Company and the Group have adequate resources to continue

in operational existence for the foreseeable future. Accordingly,

the Board continues to adopt the going concern basis in preparing

the Annual Report and Accounts.

These results were approved by the Board of Directors on 8

August 2023.

2 Segmental Information

The following analysis by industry segment is presented in

accordance with IFRS 8 on the basis of those segments whose

operating results are regularly reviewed by the Board of Directors

(the Chief Operating Decision Maker as defined by IFRS 8) to assess

performance and make strategic decisions about allocation of

resources.

The sectors distinguished as operating segments are Services,

Hargreaves Land, Unallocated and HRMS.

-- Services: Provides materials handling, mechanical and

electrical engineering, land restoration, logistics and bulk

earthmoving into the energy, environmental, infrastructure and

industrial sectors.

-- Hargreaves Land: The development and realisation of value

from the land portfolio including rental income from investment

properties and the share of profit of the Unity joint venture.

-- Unallocated: The corporate overhead contains the central

functions that are not devolved to the individual business

units.

-- Hargreaves Raw Materials Services ("HRMS"): The Group's share

of its German joint venture, which includes Hargreaves Services

Europe Limited, which is the parent company of HRMS and DK.

These segments are combinations of subsidiaries and joint

ventures. They have separate management teams and provide different

products and services. The four operating segments are also

reportable segments.

The segment results, as reported to the Board of Directors, are

calculated under the principles of IFRS. Performance is measured on

the basis of underlying profit/(loss) before tax, which is

reconciled to profit/(loss) before tax in the tables below:

Hargreaves

Services Land Unallocated HRMS Total

2023 2023 2023 2023 2023

GBP000 GBP000 GBP000 GBP000 GBP000

------------------------------------- -------- ---------- ----------- -------- ---------

Revenue

Total revenue 202,958 10,608 - - 213,566

Intra-segment revenue (2,107) - - - (2,107)

------------------------------------- -------- ---------- ----------- -------- ---------

Revenue from external customers 200,851 10,608 - - 211,459

------------------------------------- -------- ---------- ----------- -------- ---------

Operating profit/(loss) (before

exceptional items and amortisation) 14,326 3,011 (5,365) - 11,972

Share of profit in joint ventures

(net of tax) - 841 - 15,470 16,311

Net finance (expense)/income (1,956) 44 959 - (953)

Amortisation charge (175) - - - (175)

---------- ----------- --------

Profit/(loss) before taxation

from continuing operations 12,195 3,896 (4,406) 15,470 27,155

Taxation (231) 629 373 - 771

------------------------------------- -------- ---------- ----------- -------- ---------

Profit/(loss) after taxation 11,964 4,525 (4,033) 15,470 27,926

------------------------------------- -------- ---------- ----------- -------- ---------

Depreciation charge 14,295 110 165 - 14,570

------------------------------------- -------- ---------- ----------- -------- ---------

Capital expenditure 33,690 6,083 235 - 40,008

------------------------------------- -------- ---------- ----------- ---------

Net assets/(liabilities)

Segment assets 94,111 73,920 63,515 - 231,546

Segment liabilities (85,028) (6,623) (13,186) - (104,837)

------------------------------------- -------- ---------- ----------- -------- ---------

Segment net assets 9,083 67,297 50,329 - 126,709

Joint ventures - 5,675 - 68,607 74,282

------------------------------------- -------- ---------- ----------- -------- ---------

Total net assets 9,083 72,972 50,329 68,607 200,991

------------------------------------- -------- ---------- ----------- -------- ---------

Unallocated net assets of GBP50.3m include cash and cash

equivalents of GBP21.9m, net deferred tax asset of GBP11.3m,

amounts due from joint ventures of GBP11.2m, amounts due to joint

ventures of GBP4.1m, a net pension asset of GBP5.6m and other

corporate items (GBP4.4m asset).

Hargreaves Restated* Restated*

Services Land Unallocated HRMS Total

2022 2022 2022 2022 2022

GBP000 GBP000 GBP000 GBP000 GBP000

----------------------------------- -------- ---------- ----------- --------- ---------

Revenue

Total revenue 163,800 15,100 - - 178,900

Intra-segment revenue (992) - - - (992)

----------------------------------- -------- ---------- ----------- --------- ---------

Revenue from external customers 162,808 15,100 - - 177,908

----------------------------------- -------- ---------- ----------- --------- ---------

Operating profit/(loss) (before

exceptional items) 8,011 1,211 (4,748) - 4,474

Share of profit in joint ventures

(net of tax)* - 858 - 25,021 25,879

Net finance (expense)/income (468) 58 463 - 53

Exceptional items 1,754 - - - 1,754

----------------------------------- -------- ---------- ----------- --------- ---------

Profit/(loss) before taxation

from continuing operations* 9,297 2,127 (4,285) 25,021 32,160

Taxation 3,343 (3,546) 550 - 347

----------------------------------- -------- ---------- ----------- --------- ---------

Profit/(loss) after taxation* 12,640 (1,419) (3,735) 25,021 32,507

----------------------------------- -------- ---------- ----------- --------- ---------

Depreciation and impairment charge (8,344) (100) (222) - (8,666)

----------------------------------- -------- ---------- ----------- --------- ---------

Capital expenditure (13,507) (1,165) (154) - (14,826)

----------------------------------- -------- ---------- ----------- --------- ---------

Net assets/(liabilities)

Segment assets 79,155 62,505 68,706 - 210,366

Segment liabilities (70,104) (7,391) (8,118) - (85,613)

----------------------------------- -------- ---------- ----------- --------- ---------

Segment net assets 9,051 55,114 60,588 - 124,753

Joint ventures* - 4,836 - 50,260 55,096

----------------------------------- -------- ---------- ----------- --------- ---------

Total net assets* 9,051 59,950 60,588 50,260 179,849

----------------------------------- -------- ---------- ----------- --------- ---------

Unallocated net assets of GBP60.6m include cash and cash

equivalents of GBP13.8m, deferred tax asset of GBP11.1m, amounts

due from Jointly Controlled Entities of GBP29.3m, a net pension

asset of GBP7.7m, deferred tax liability of GBP1.9m and other

corporate items (GBP0.6m asset).

* The prior year numbers have been restated following a

correction of the allowability of certain expenses for corporate

tax in a joint venture for the year ended 31 May 2022 and prior

years. The net effect of the changes for the year ended 31 May 2022

was a decrease in the opening balance of the investment in joint

ventures of GBP966,000 and a decrease in the share of profit in

joint ventures (net of tax) of GBP2,321,000 which has subsequently

decreased the closing investment in joint ventures by GBP3,287,000.

Please refer to Note 7.

3 Exceptional Items

The Group incurred one exceptional item in the year ended 31 May

2022 as follows:

2023 2022

GBP000 GBP000

----------------------------------------------------- ------- -------

Exceptional item in Administrative expenses

Release of accrual relating to a liability from the

year ended 31 May 2015 - 1,754

----------------------------------------------------- ------- -------

Total exceptional item in Administrative expenses - 1,754

----------------------------------------------------- ------- -------

Total - 1,754

----------------------------------------------------- ------- -------

In the year ended 31 May 2022, an aged accrual dating from the

year ended 31 May 2015 totalling GBP1,754,000 was released as the

potential for payment had lapsed due to time.

4 Taxation

Recognised in the Income Statement

2023 2022

GBP000 GBP000

--------------------------------------------------------- ------- -------

Current tax

Current year 187 212

Adjustments for prior years 24 (4)

--------------------------------------------------------- ------- -------

Current tax expense 211 208

--------------------------------------------------------- ------- -------

Deferred tax

Origination and reversal of temporary timing differences 2,382 1,542

Adjustments for prior years (3,364) (2,097)

--------------------------------------------------------- ------- -------

Deferred tax credit (982) (555)

--------------------------------------------------------- ------- -------

Tax credit in Income Statement (excluding share of tax

of equity accounted investees) (771) (347)

--------------------------------------------------------- ------- -------

The deferred tax adjustment in respect of prior years of

GBP3,364,000 (2022: GBP2,097,000) relates to losses assumed to be

utilised in the previous year, which were ultimately retained.

Recognised in Other Comprehensive Income

2023 2022

GBP000 GBP000

-------------------------------------------------------- ------- -------

Deferred tax expense

Effective portion of changes in fair value of cash flow

hedges - (8)

Remeasurements of defined benefit pension schemes (1,161) (1,488)

-------------------------------------------------------- ------- -------

(1,161) (1,496)

-------------------------------------------------------- ------- -------

Reconciliation of Effective Tax Rate

Restated*

2023 2022

GBP000 GBP000

------------------------------------------------------- ------- ---------

Profit for the year from continuing operations* 27,926 32,507

Total tax credit (771) (347)

------------------------------------------------------- ------- ---------

Profit before taxation from continuing operations* 27,155 32,160

------------------------------------------------------- ------- ---------

Tax using the UK corporation tax rate of 20.00% (2022:

19.00%)* 5,431 6,110

Effect of tax rates in foreign jurisdictions (159) 37

Tax effect of joint ventures* (3,100) (4,753)

Changes in unrecognised tax losses (616) 136

Non-deductible expenses 776 407

Other temporary trading differences 237 (183)

Adjustment in respect of previous periods (3,340) (2,101)

------------------------------------------------------- ------- ---------

Effective total tax credit (771) (347)

------------------------------------------------------- ------- ---------

* The prior year numbers have been restated following a

correction of the allowability of certain expenses for corporate

tax in a joint venture for the year ended 31 May 2022 and prior

years. The net effect of the changes for the year ended 31 May 2022

was a decrease in the opening balance of the investment in joint

ventures of GBP966,000 and a decrease in the share of profit in

joint ventures (net of tax) of GBP2,321,000 which has subsequently

decreased the closing investment in joint ventures by GBP3,287,000.

Please refer to Note 7.

Adjustment in respect of previous periods includes the impact of

the "super deduction" of 130% on qualifying fixed asset additions,

which resulted in losses that were expected to be utilised in the

May 2022 computations being retained.

The UK corporation tax rate increased from 19.00% on 1 April

2023, therefore a blended rate of 20.00% has been used (2022:

19.00%).

Factors That May Affect Future Current and Total Tax Charges

Following the March 2022 budget, the corporate tax rate

increased from 19% to 25% on 1 April 2023. The deferred tax

balances at 31 May 2023 and 31 May 2022 have been calculated based

on the rate substantively enacted at the balance sheet date of

25%.

5 Discontinued Operations

All discontinued operations results are attributable to equity

holders. For the year ended 31 May 2023, there were no discontinued

operations. For the year ended 31 May 2022, the Group's

discontinued operations made a profit of GBP2,000,000 after tax

during the year.

The profit from discontinued operations in the prior year

represents the contingent consideration received following the

disposal of Brockwell Energy Limited ("Brockwell"). The Company

disposed of the whole of its shareholding in Brockwell on 19

October 2018 with contingent consideration of GBP2m which was

received in the year ended 31 May 2022. There are no remaining

balances relating to this matter.

2023 2022

GBP000 GBP000

------------------------------------------------- ------- -------

Proceeds from disposal of subsidiary - 2,000

Profit before tax of discontinued operations - 2,000

Current tax charge - -

Profit for the year from discontinued operations - 2,000

------------------------------------------------- ------- -------

6 Earnings per Share

The calculation of earnings per share ("EPS") is based on the

profit for the year attributable to equity holders and on the

weighted average number of shares in issue and ranking for dividend

in the year.

Restated*

2023 2022

--------------------------------- ------------------------ ------------------------

Earnings EPS DEPS Earnings EPS DEPS

GBP000 Pence Pence GBP000 Pence Pence

--------------------------------- -------- ------ ------ -------- ------ ------

Underlying earnings per

share from continuing

operations* 28,066 86.28 84.55 31,086 96.06 93.22

Exceptional items, fair

value adjustments, amortisation

and impairment (net of

tax) (140) (0.43) (0.42) 1,421 4.39 4.26

--------------------------------- -------- ------ ------ -------- ------ ------

Continuing basic earnings

per share* 27,926 85.85 84.13 32,507 100.45 97.48

Discontinued operations - - - 2,000 6.18 6.00

--------------------------------- -------- ------ ------ -------- ------ ------

Basic earnings per share* 27,926 85.85 84.13 34,507 106.63 103.48

--------------------------------- -------- ------ ------ -------- ------ ------

Weighted average number

of shares 32,528 33,193 32,362 33,347

--------------------------------- -------- ------ ------ -------- ------ ------

The calculation of weighted average number of shares includes

the effect of own shares held of 611,118 (2022: 611,118).

The calculation of diluted earnings per share ("DEPS") is based

on the profit for the year and the weighted average number of

ordinary shares in issue in the year. The potentially dilutive

effect of the share options outstanding (effect on weighted average

number of shares) is 665,549 (2022: 985,056); effect of basic

earnings per ordinary share in the current year is 1.72p (2022:

3.15p). Effect on underlying earnings per ordinary share is 1.73p

(2022: 2.84p). Effect on discontinued operations per ordinary share

for 2023 is nil (2022: 0.18p).

* The prior year numbers have been restated following a

correction of the allowability of certain expenses for corporate

tax in a joint venture for the year ended 31 May 2022 and prior

years. The net effect of the changes for the year ended 31 May 2022

was a decrease in the opening balance of the investment in joint

ventures of GBP966,000 and a decrease in the share of profit in

joint ventures (net of tax) of GBP2,321,000 which has subsequently

decreased the closing investment in joint ventures by GBP3,287,000.

Please refer to Note 7.

Basic, continuing basic, underlying and diluted earnings per

share for the prior year have also been restated. The amount of the

correction for basic and diluted earnings per share was a decrease

of 7.2p and 7.0p per share respectively. The amount of the

correction for continuing basic and diluted earnings per share was

a decrease of 7.2p and 7.0p per share respectively. The amount of

the correction for underlying and diluted earnings per share was a

decrease of 7.2p and 7.0p per share respectively.

7 Restatement relating to the year ended 31 May 2022

The prior year numbers have been restated following a correction

of the allowability of certain expenses for corporate tax in a

joint venture for the year ended 31 May 2022 and prior years. The

net effect of the changes for the year ended 31 May 2022 was a

decrease in the opening balance of the investment in joint ventures

of GBP966,000 and a decrease in the share of profit in joint

ventures (net of tax) of GBP2,321,000 which has subsequently

decreased the closing investment in joint ventures by

GBP3,287,000.

Basic and diluted earnings per share for the prior year have

also been restated. The amount of the correction for basic and

diluted earnings per share was a decrease of 7.2p and 7.0p per

share respectively.

The financial statement line items have been restated as

follows:

Group Balance Sheet (Extract)

As previously

Reported at Opening Balance 1 June 2021

1 June 2021 Decrease (Restated)

Investments in jointly

controlled entities 31,187 (966) 30,221

Net Assets 144,296 (966) 143,330

----------------------- ---------------------- ---------------------- -------------------------

Retained earnings 64,441 (966) 63,475

Total Equity 144,296 (966) 143,330

----------------------- ---------------------- ---------------------- -------------------------

As previously

Reported at Opening Balance Decrease in the 31 May 2022

31 May 2022 Decrease Period (Restated)

Investments in jointly

controlled entities 58,383 (966) (2,321) 55,096

Net Assets 183,136 (966) (2,321) 179,849

----------------------- ---------------------- ---------------------- ------------------------- ------------------

Retained earnings 102,781 (966) (2,321) 99,494

Total Equity 183,136 (966) (2,321) 179,849

----------------------- ---------------------- ---------------------- ------------------------- ------------------

Consolidated Statement of Profit and Loss and Other

Comprehensive Income (Extract)

As previously

Reported at Decrease in the 31 May 2022

31 May 2022 Period (Restated)

Share of profit in joint ventures

(net of tax) 28,200 (2,321) 25,879

Profit before Tax 34,481 (2,321) 32,160

---------------------------------------- -------------------- ---------------------- ------------------

Taxation 347 - 347

---------------------------------------- -------------------- ---------------------- ------------------

Profit from Continuing Operations 34,828 (2,321) 32,507

---------------------------------------- -------------------- ---------------------- ------------------

Profit for the year from discontinuing

operations 2,000 - 2,000

---------------------------------------- -------------------- ---------------------- ------------------

Profit for the year 36,828 (2,321) 34,507

---------------------------------------- -------------------- ---------------------- ------------------

Other comprehensive income:

Total Comprehensive income for the

year 44,711 (2,321) 42,390

---------------------------------------- -------------------- ---------------------- ------------------

Profit attributable to:

Equity holders of the company 37,040 (2,321) 34,719

Non-controlling interest (212) - (212)

Profit for the year 36,828 (2,321) 34,507

---------------------------------------- -------------------- ---------------------- ------------------

Total comprehensive income attributable

to:

Equity holders of the company 44,923 (2,321) 42,602

Non-controlling interest (212) - (212)

Profit for the year 44,711 (2,321) 42,390

---------------------------------------- -------------------- ---------------------- ------------------

Group Statement of Changes in Equity (Extract)

Total Parent Non-Controlling

Retained Earnings Equity Interest Total Equity

As Previously Reported

At 1 June 2021 64,441 144,306 (10) 144,296

Opening Balance

Adjustment (966) (966) - (966)

-------------------------- ------------------------ ------------------- ---------------------- -------------------

Adjusted Balance at

1 June 2021 63,475 143,340 (10) 143,330

-------------------------- ------------------------ ------------------- ---------------------- -------------------

Profit/(loss) for the

year

As Previously Reported

At 31 May 2022 37,040 37,040 (212) 36,828

Decrease in the current

period (2,321) (2,321) - (2,321)

-------------------------- ------------------------ ------------------- ---------------------- -------------------

Adjusted Balance at

31 May 2022 34,719 34,719 (212) 34,507

-------------------------- ------------------------ ------------------- ---------------------- -------------------

Total comprehensive income/(expense)

for the year

As Previously Reported

At 31 May 2022 44,577 44,923 (212) 44,711

Decrease in the current

period (2,321) (2,321) - (2,321)

-------------------------- ------------------------ ------------------- ---------------------- -------------------

Adjusted Balance at

31 May 2022 42,256 42,602 (212) 42,390

-------------------------- ------------------------ ------------------- ---------------------- -------------------

Closing Balance at 31

May 2022

As Previously Reported

At 31 May 2022 102,781 183,358 (222) 183,136

Opening Balance

Adjustment (966) (966) - (966)

Decrease in the current

period (2,321) (2,321) - (2,321)

-------------------------- ------------------------ ------------------- ---------------------- -------------------

Adjusted Balance at

31 May 2022 99,494 180,071 (222) 179,849

-------------------------- ------------------------ ------------------- ---------------------- -------------------

8 Alternative Performance Measures Glossary

This report provides alternative performance measures ("APMs"),

which are not defined or specified under the requirements of

International Financial Reporting Standards. The Board believes

that these APMs provide readers with important additional

information on the business.

Alternative Performance

Measure Definition and Purpose

-------------------------- ---------------------------------- -------------------- ---------------

Underlying profit before Represents the profit before tax prior to exceptional

tax ("UPBT") items, fair value adjustments, impairment and amortisation

of intangible assets, and, in accordance with International

Accounting Standards, includes the Group's share

of the post-tax profit of its German joint venture.

This measure is consistent with how the business

measures performance and is reported to the Board.

2023 2022

GBP000 GBP000

---------------------------------- -------------------- ---------------

Profit before tax from continuing

operations* 27,155 32,160

Exceptional items (see Note 3) - (1,754)

Amortisation of intangible assets 175 -

Underlying Profit before Tax* 27,330 30,406

----------------------------------- -------------------- ---------------

Basic underlying earnings Profit attributable to the equity holders of the

per share Company prior to exceptional items, impairment

and amortisation of intangible assets and fair

value gains on acquisition after tax divided by

the weighted average number of ordinary shares

during the financial year adjusted for the effects

of any potentially dilutive options. See Note 6.

-------------------------- --------------------------------------------------------------------------

EBITDA EBITDA is defined as profit before tax from continuing

operations prior to charges for depreciation, amortisation

and impairment and interest and excludes the share

of profit from joint ventures and gains and losses

on the sale of fixed assets.

2023 2022

GBP'000 GBP'000

----------------------------------- --------- ---------

Profit before tax from continuing

operations* 27,155 32,160

Depreciation and impairment 14,570 8,666

Amortisation of intangible assets 175 -

Net finance expense / (income) 953 (53)

Share of profit in joint ventures

(net of tax)* (16,311) (25,879)

Profit on sale of fixed assets (4,718) (1,298)

----------------------------------- --------- ---------

EBITDA 21,824 13,596

----------------------------------- --------- ---------

-------------------------- --------------------------------------------------------------------------

Net Asset Value per Represents the Net Asset value of the Group divided

share by the number of shares in issue less those shares

held in treasury. Calculated as follows:

-------------------------- --------------------------------------------------------------------------

2023 2022

---------------------------------- -------------------- ---------------

Total shares in issue 33,138,756 33,138,756

Less shares in treasury (611,118) (611,118)

----------------------------------- ------------------------- -------------------- ---------------

Shares for calculation 32,527,638 32,527,638

----------------------------------- ------------------------- -------------------- ---------------

Net Asset Value per

Balance Sheet* GBP200,991,000 GBP179,849,000

----------------------------------- ------------------------- -------------------- ---------------

Net Asset Value per

share* GBP6.18 GBP5.53

----------------------------------- ------------------------- -------------------- ---------------

* The prior year numbers have been restated following a

correction of the allowability of certain expenses for corporate

tax in a joint venture for the year ended 31 May 2022 and prior

years. The net effect of the changes for the year ended 31 May 2022

was a decrease in the opening balance of the investment in joint

ventures of GBP966,000 and a decrease in the share of profit in

joint ventures (net of tax) of GBP2,321,000 which has subsequently

decreased the closing investment in joint ventures by GBP3,287,000.

Please refer to Note 7.

9 Posting of Report & Accounts

The Group confirms that the annual report and accounts for the

year ended 31 May 2023 will be posted to shareholders as soon as

practicable and a copy will be made available on the Group's

website:

www.hsgplc.co.uk

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR PPMATMTTMBAJ

(END) Dow Jones Newswires

August 09, 2023 02:00 ET (06:00 GMT)

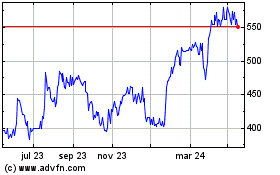

Hargreaves Services (LSE:HSP)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

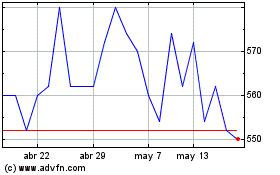

Hargreaves Services (LSE:HSP)

Gráfica de Acción Histórica

De May 2023 a May 2024