TIDMHSP

RNS Number : 6601A

Hargreaves Services PLC

24 January 2024

HARGREAVES SERVICES PLC

(the "Group", the "Company" or "Hargreaves")

Interim Results for the six months ended 30 November 2023

Strong period for Services with revenue and margin improvements;

Interim dividend increased six-fold.

Hargreaves Services plc (AIM: HSP), a diversified group

delivering key projects and services to the industrial and property

sectors, announces its interim results for the six months ended 30

November 2023.

As anticipated the slowdown in performance within HRMS, combined

with the progress on the pension buy out, has facilitated a

material increase in the interim dividend in both absolute and

percentage terms, whilst the Services business, with over 60 term

and framework contracts, has delivered another period of solid

underlying growth.

KEY FINANCIAL RESULTS Unaudited Unaudited

Six Months Six Months

ended ended

30 Nov 30 Nov 2022

2023

Revenue GBP110.2m GBP116.5m

------------ -------------

EBITDA* GBP12.3m GBP12.9m

------------ -------------

Profit before tax ("PBT")** GBP2.7m GBP18.7m

------------ -------------

EPS 5.2p 52.2p

------------ -------------

Interim Dividend 18.0p 3.0p

------------ -------------

Cash and cash equivalents GBP18.7m GBP18.1m

------------ -------------

Leasing debt GBP28.8m GBP30.6m

------------ -------------

Net Asset Value GBP197.5m GBP196.2m

------------ -------------

Net Assets per Share 605p 603p

------------ -------------

* EBITDA is calculated as Operating Profit after adding back

depreciation and amortisation.

** PBT decrease reflects the reduction in contribution from

HRMS, timing of sales in Land and impact of a one off gain in the

prior period

HIGHLIGHTS

-- Group revenue reduced by GBP6.3m due to several post period

end completions within Hargreaves Land.

-- Services revenue rose by 1.6%, supported by over 60 term and

framework contracts.

-- Decrease in PBT due to reduction in contribution from HRMS and

timing of sales completions within Hargreaves Land.

-- Receipt of GBP8m cash from investment in HRMS in the period,

with cash returns from HRMS now expected to remain around GBP7m

per annum (up from GBP4m).

-- Cash of GBP18.7m, compared to GBP18.1m at Nov 2022 with investment

in Land assets being offset by additional cash receipt from

HRMS.

-- Interim dividend increased six-fold following an increase in

cash receipts from HRMS and imminent elimination of annual payments

to service the pension scheme liability.

OUTLOOK

-- Services has over 90% of revenues secured under contract for

the year ending 31 May 2024, cementing its continued delivery

of sustainable and reliable profits into the future.

-- Stronger outlook for HRMS with changes to gate fees and the

impact of EU sanctions on pig iron expected to give a significant

improvement to profitability in the second half and FY25.

-- Land poised to deliver its best ever full year result with several

post-period end completions secured.

Commenting on the interim results, Group Chair Roger McDowell

said: "I am delighted we continue to deliver value for our

shareholders through a substantial increase in the interim

dividend. This demonstrates not only the value created by the

strategic initiative set out at the year end to remove the pension

liability but also the recurring revenue stream generated by the

Group's Services business unit underpinned by the substantial cash

returns from our German joint venture and good prospects for

Land.

"We are optimistic about the outlook for the business in the

second half as Services continues to provide a robust underpinning

to trading with over 90% of revenue already secured for the

financial year. We anticipate positive pricing in Germany in the

second half and Land is poised to deliver its best ever full year

performance."

Investor presentation

Gordon Banham, Group Chief Executive, Stephen Craigen, Chief

Financial Officer and David Anderson, Group Property Director, will

provide a live presentation on the Company's interim results via

the Investor Meet Company platform today at 4:30pm GMT.

For further details:

Hargreaves Services www.hsgplc.co.uk

Gordon Banham, Chief Executive Tel: 0191 373 4485

Officer

Stephen Craigen, Chief Financial

Officer

Walbrook PR (Financial Tel: 020 7933 8780 or hargreavesservices@walbrookpr.com

PR & IR) Mob: 07980 541 893 / 07747 515 393

Paul McManus, Louis Ashe-Jepson, 07884 664 686

Charlotte Edgar

Singer Capital Markets (Nomad and Corporate

Broker) Tel: 020 7496 3000

Sandy Fraser, Phil Davies, Sam Butcher

About Hargreaves Services plc ( www.hsgplc.co.uk )

Hargreaves Services plc is a diversified group delivering

services to the industrial and property sectors, supporting key

industries within the UK and South East Asia. The Company's three

business segments are Services, Hargreaves Land and an investment

in a German joint venture, Hargreaves Raw Materials Services GmbH

("HRMS"). Services provides critical support to many core

industries including Energy, Environmental, UK Infrastructure and

certain manufacturing industries through the provision of materials

handling, mechanical and electrical contracting services, logistics

and major earthworks. Hargreaves Land is focused on the sustainable

development of brownfield sites for both residential and commercial

purposes. HRMS trades in specialist commodity markets and owns DK

Recycling und Roheisen GmbH ("DK"), a specialist recycler of steel

waste material. Hargreaves is headquartered in County Durham and

has operational centres across the UK, as well as in Hong Kong and

a joint venture in Duisburg, Germany.

CHAIR'S STATEMENT

Introduction

The six-month period to 30 November 2023 has been a time of

contrasts across our three business segments, yet the Board is

confident the overall trend leans solidly towards the positive. We

have seen the momentum within our Services business continue, with

increased earthmoving and engineering activity driving growth in

both revenue and margin. Sales within Hargreaves Land have been

slow, impacted by the wider property market. However, with several

post period end completions we remain confident that Land is poised

to deliver its best full year result to date. Whilst HRMS has

delivered a loss for the period driven by the difficult economic

circumstances in Germany and a low point in the cycle, we have

started to see an increase in cash return from the joint venture

and have visibility of a return to profitability in the second

half.

Strategic Progress

The Board outlined two areas of strategic focus in the Annual

Report and Accounts for the year ended 31 May 2023. They were the

plan to realise value from the Group's renewable energy land assets

over the next five years and to progress the buy out of the Group's

defined benefit pension scheme. I am pleased to report several

developments with each of these strategic initiatives, as detailed

below.

Renewable Energy Land Assets

The team continues to prepare the Group's renewable energy land

assets into suitable portfolios for realisation in the medium term.

We have seen good progress on the permitting, development and

commissioning of the underlying assets by the third-party

operators. The timing of portfolio asset sales will be determined

by the commencement of energy production as the team look to

optimise the realisation values. Notwithstanding this, we expect to

go to market with the first package of assets for sale in the year

ending 31 May 2025.

Pension Scheme

Considerable headway has also been made on the project to buy

out the Group's defined benefit pension scheme, which will remove

the requirement to pay an ongoing GBP1.8m per annum to support the

deficit. Our most recent estimate is that the cash cost to buy out

the scheme will be no more than GBP9m with the payment expected to

be made in the first half of calendar year 2024 out of existing

cash reserves.

This action means that the Group will no longer be required to

make annual payments to the scheme and all benefit payments will be

managed by the insurer. I am pleased to confirm that once the

payment has been made the main objective to cease annual

contributions into the scheme will be achieved and it is this

annual cash flow saving that has been used to support the increase

in the sustainable dividend to our shareholders.

Results

Revenue for the Group decreased by 5.4% to GBP110.2m (2022:

GBP116.5m) due to several sales within Hargreaves Land completing

post period end. This resulted in a reduction in revenue from

GBP8.7m to GBP0.7m for Hargreaves Land. The Group's PBT also

decreased from GBP18.7m to GBP2.7m. Much of this can be attributed

to the reduction in contribution from HRMS, as had been

anticipated, and the impact of a GBP2m one-off gain in the first

half of the prior year. EBITDA was GBP12.3m (Nov 2022: GBP12.9m),

the reduction on the comparative period being due to the timing of

sales within Hargreaves Land. As a result of this timing and the

profile of activity with HRMS, we expect the second half of the

year to be much stronger than the first.

Services Underlying Growth

Whilst the Group has seen a reduction in both revenue and PBT

compared to the six months ended 30 November 2022, this masks the

strong performance of the Services business, which is less impacted

by the timing of individual events. EBITDA attributable to the

Services business has increased to GBP15.9m (2022: GBP13.9m)

reflecting the robust and resilient nature of the 60+ term and

framework contracts in place.

The business remains unaffected by recent announcements

regarding the future of the HS2 project, in particular the

cancellation of the Northern leg between Birmingham and Manchester,

as this phase had not been contracted and our forecasts had not

included this aspect of the scheme. The Services project pipeline

remains diverse, with limited reliance on the success of one

specific scheme.

Cash return from HRMS

As expected, it has been a slower start to the year for HRMS

than we have observed in recent times. The substantial profits that

it has been able to generate over the last two years were not

expected to be sustainable and the Board always anticipated that

profit levels would reduce once commodity prices softened.

As highlighted in previous updates, the reduction in activity

and commodity prices has been reflected in reduced working capital

consumption, resulting in a cash release by HRMS. The Group

received an GBP8m distribution from HRMS during the first half

(2022: GBP4m) and we expect the cash repatriation from Germany to

be sustainable at no less than GBP7m per annum. This cash inflow

will be used to support the substantial increase in the interim

dividend.

Cash and debt

As at 30 November 2023 the Group held cash of GBP18.7m compared

with GBP21.9m on 31 May 2023 (Nov 2022: GBP18.1m). This decrease is

due, in part, to the continued investment in Land assets ahead of

contracted sales.

The only debt held by the Group is leasing debt for specific

plant items which was GBP28.8m at 30 November 2023 (Nov 2022:

GBP30.6m). This decrease reflects the regular leasing payments to

reduce the liability in the ordinary course of business.

Dividend

In line with the announcement made on 21 December 2023, due to

the progress made with the buy out of the pension scheme liability,

combined with the additional sustainable cash receipt from HRMS the

Board is confirming an historic six-fold increase in the interim

dividend. The interim dividend of 18.0p (2022: 3.0p) reflects the

cash generative nature of the Group and the continued expectation

of recurrent cash returns from HRMS. The 18.0p interim dividend

represents 50% of the Board's expected full year dividend.

The interim dividend will be paid on 11 April 2024 to

shareholders on the register on 22 March 2024.

Outlook

The first half of the year has seen solid progress on our two

key strategic goals, resulting in a substantial increase in the

return of value to shareholders. The Group continues to trade in

line with market expectations (as refreshed in December 2023). The

Services business has continued to demonstrate its reliable and

resilient earnings stream. Whilst it was a subdued first half of

the year for Hargreaves Land, the sales expected to complete in the

second half of the year leave that business unit in a strong

position to deliver its best ever full year results. We anticipate

a gradual recovery in Germany from the low point in the first half

and the additional sustainable cash receipt from HRMS means we are

also well placed to realise long-term value for our

shareholders.

Roger McDowell

Chairman

24 January 2024

CHIEF EXECUTIVE'S REVIEW

GBP'm Services Land HRMS Central Total

Costs

Revenue (Nov 2023) 109.5 0.7 - - 110.2

--------- ------ ------ -------- ------

Revenue (Nov 2022) 107.8 8.7 - - 116.5

--------- ------ ------ -------- ------

Profit/(loss) before tax

(Nov 2023) 7.8 (1.0) (1.9) (2.2) 2.7

--------- ------ ------ -------- ------

Profit/(loss) before tax

(Nov 2022) 8.5 1.6 10.8 (2.2) 18.7

--------- ------ ------ -------- ------

Services

The Services business delivered first half revenues of GBP109.5m

(2022: GBP107.8m) and a PBT of GBP7.8m (2022: GBP8.5m). The growth

in revenue is due to increased earthmoving activities and

additional engineering works on certain contracts.

The comparative period includes a non-recurring gain of GBP2m

relating to asset realisations. There is no such gain in the

results to 30 November 2023. As such, the like-for-like comparison

is a PBT of GBP7.8m with a comparative result of GBP6.5m. This

represents an improvement in the net margin from 6.0% to 7.1%. Much

of this improvement in margin has been due to the increased

activities at HS2, accompanied by further enabling works at the

Sizewell C nuclear project.

As has been the case in previous years, the full year result for

Services is likely to be weighted towards the first six months of

the financial year. This is due to the earthmoving season

predominantly taking place during the first half, as well as the

annual GBP1m receipt from Tungsten West being received in June

23.

The Services business continues to deliver good-quality,

resilient, recurring profits and remains focused on delivering

services to our four key market sectors: Energy; Environmental;

Industrial; and Infrastructure.

Contract Security

The Services business continues to be the main driver of

performance within the Group, holding over 60 term and framework

contracts with high quality customers giving excellent visibility

of revenue. The period has seen further contract successes, in

particular the award and commencement of a three-year materials

handling contract at Port of Tyne.

The largest single contract within the Group is the earthmoving

contract for EKFB on HS2, which is now in its second full year of

operation. This has been a key driver for growth over the past

couple of years and the Board expects there to be at least another

two full earthmoving seasons of full-scale activity. Looking

forward, focus for the Group remains on securing positions on Lower

Thames Crossing and Sizewell C. During the period, the Group has

been awarded a number of contracts for essential enabling works at

Sizewell C, which places Hargreaves in the best possible position

to be able to secure the main contract for earthmoving when it is

tendered.

Engineering Capability

The Group has had a lot of success in building and developing

its capability in mechanical engineering. The first half of the

year has seen the successful commissioning of a five-section

conveyor solution, which has materially reduced the carbon

emissions on our section of HS2. Additionally, the team is nearing

completion of a significant Lime Silo and Dosing Plant for the

Skanska Costain Strabag Joint Venture ("SCS"). Both of these

schemes represent material projects, and the business is well

placed to secure further projects of this kind.

Whilst inflation has abated somewhat in recent months, it

remains relatively high and has been so through the period. The

Group's contractual positions have continued to protect it from

margin erosion, as demonstrated by the substantial increase in

underlying margin within Services.

Services remains the core generator of revenue and cash flow for

the Group. With a secure book of recurring contracted revenue, the

business is in a strong position to deal with the ongoing economic

and political uncertainties.

Hargreaves Land

Land

Hargreaves Land recorded revenue of GBP0.7m (2022: GBP8.7m) and

a loss before tax of GBP1.0m (2022: profit of GBP1.6m). The

variation in both revenue and profit before tax is due to the

timing of sales at Blindwells. Whilst the comparative period saw

the completion of a plot sale at Blindwells, no such completion

occurred in the six months to 30 November 2023, in part due to the

trends experienced in the general property markets. However, the

underlying activity within the business unit has been high in terms

of developing opportunities.

Preparatory works have been completed to enable the sale of a

previously exchanged 20-acre plot to Avant Homes, which is expected

to complete before the end of January 2024. The deal will see the

Group receive total proceeds of GBP18.5m payable in four

instalments over three years.

The Unity Joint Venture saw the completion of the construction

of a forward funded 191,000 sq ft logistics unit ahead of

programme. Additionally, terms have been agreed for the sale of two

plots to McDonalds and Starbucks, which further demonstrates the

desirability of this key location.

In December 2023, Hargreaves Land completed the sale of the

Energy from Waste (EfW) ground lease investment at Westfield in

Scotland for consideration of GBP7.6m. The sale represents the

disposal of eight acres out of the 50 available developed acres at

Westfield, allowing for future sales to occur at the site.

Finally, contracts have been exchanged in December 2023 on a

28-acre site at Maltby, Rotherham for the sale of 185 residential

plots for gross proceeds of GBP4.9m.

Renewables

The Group's renewable energy land assets have continued to be a

core focus for the business, with realisations expected to be in

excess of GBP25m once they are sufficiently mature. At present

210MW of wind assets are operational on land owned by the

Group.

It is expected that this will increase to over 930MW of

operational wind assets and battery storage by the end of calendar

year 2025, with a further 2,165MW of wind, solar and battery assets

beyond 2025 subject to agreed terms and exchange of contracts. We

have seen a significant increase in the appetite for battery

storage in recent months, with 1,495MW of further opportunities

added to the pipeline since our Annual Report and Accounts in

August 2023.

The first tranche of renewable energy land asset sales is being

prepared to go to market in FY25. This is likely to include around

400MW of wind assets, which should be sufficiently mature by that

stage.

HRMS

HRMS recorded a post-tax loss of GBP1.9m (2022: profit of

GBP10.8m) for the six months ended 30 November 2023. This

substantial reduction has been driven by a number of contributing

factors. First, the principal market for the business is Germany,

which is currently in a technical recession and has seen many of

the joint venture's clients operate on reduced shift patterns,

therefore requiring lower levels of raw materials. Subsequently

this has impacted HRMS' trading activities.

Second, zinc prices have dropped to around EUR2,500 per tonne

compared to highs of over EUR4,000 in the previous period. Zinc is

a key output of the steel waste recycling process within DK, a

subsidiary of HRMS. Whilst 60% of the zinc output is hedged, the

reduction in spot prices realised on the remaining 40% has put

pressure on the result.

Third, pig iron prices have been very low during the period

whilst coke pricing (a key input) has remained high. This disparity

between pig iron and coke pricing reflects the absence of an

embargo on imports into Europe of Russian pig iron, suppressing the

sales price of pig iron whilst coke pricing has been supported by

an embargo on Russian product.

Despite the headwinds encountered by the joint venture during

the first half of the financial year, there are two key factors

that give confidence for a turnaround. First, the 12th package of

sanctions against Russia, which was recently announced by the EU,

includes the restriction of "steel-making raw materials", including

pig iron. This is expected to result in an increase in pig iron

selling prices achievable by DK.

Second, a key input of the pig iron production at DK is steel

waste dusts. DK charges a gate fee for accepting the dusts, which

it then recycles into pig iron and zinc. Many of the suppliers of

steel dusts are on long term contracts, however, several are up for

renewal and renegotiation in 2024 and there is expectation that

many will see substantial increases in the gate fee. The Board

believes that these changes alone will be sufficient to return the

joint venture to profitability during the second half of the

financial year.

The reduction in trading activity has reduced working capital

consumption, leading to an increased cash receipt from HRMS of

GBP8m (2022: GBP4m) in the first half of the financial year. As

reported on 21 December 2023, the management of HRMS has agreed to

maintain this level of cash return to the Group for the foreseeable

future. The Board has confidence in the sustainability of this cash

flow, at no less than GBP7m per annum, to the Group based on the

future likely base level of profitability from the trading

activities within HRMS, which are not linked to the steel waste

recycling activities.

ESG

The Group continues to make positive strides with regard to ESG

and has recently appointed its first Head of ESG. This appointment

will spearhead the Group's efforts to minimise our impact on the

environment whilst also championing our ESG credentials, which will

be crucial to unlocking new opportunities for Hargreaves.

Furthermore, the Group was awarded the prestigious HS2 EKFB

sustainability award for the second year running as a recognition

of our efforts to reduce carbon emissions through our Plant Idle

Time campaign.

Summary

The Services business' low capital model has continued to

improve margin and grow underlying profitability through efficient

contract management and engineering innovation. With over 90% of

revenues secured under contract for the year ending 31 May 2024,

the Services business can continue to deliver sustainable and

reliable profits into the future.

Hargreaves Land has not been immune to the difficulties in the

UK property market, however, this was expected and the post-period

end completion of the Westfield EfW ground lease and the exchange

of contracts at Maltby demonstrate the value in the underlying

portfolio, as well as the ability of the team to realise these

opportunities for shareholders. The outlook is also positive, with

Hargreaves Land poised to deliver its best ever full year

result.

Whilst the trading performance of HRMS has been disappointing,

the confirmation of an increased cash flow from HRMS is very

welcome and will be used to support the increased dividend to

shareholders. The changes to gate fees and the impact of the

recently announced EU sanctions on Russian pig iron imports are in

combination expected to result in a significant improvement in the

profitability of HRMS in FY25.

Overall, I remain optimistic about the value creation potential

within the Group and, with no bank debt on the Balance Sheet, I

firmly believe there are substantial opportunities to optimise and

realise further value for shareholders in the coming years.

Gordon Banham

Group Chief Executive

24 January 2024

Condensed Consolidated Statement of Profit and Loss and Other

Comprehensive Income

for the six months ended 30 November 2023

Unaudited Unaudited Audited

six months six months year

ended ended ended

30 November 30 November 31

May

2023 2022 2023

Note GBP000 GBP000 GBP000

-------------------------------------------------------- ----- ------------ ------------ ----------

Revenue 110,171 116,475 211,459

Cost of sales (88,943) (94,782) (172,402)

-------------------------------------------------------- ----- ------------ ------------ ----------

Gross profit 21,228 21,693 39,057

Other operating income - 2,844 4,918

Administrative expenses (16,127) (16,561) (32,178)

-------------------------------------------------------- ----- ------------ ------------ ----------

Operating profit 5,101 7,976 11,797

Finance income 818 504 1,612

Finance expense (1,473) (823) (2,565)

Share of (loss)/profit in joint ventures (net

of tax) (1,714) 11,053 16,311

-------------------------------------------------------- ----- ------------ ------------ ----------

Profit before tax 2,732 18,710 27,155

Taxation 5 (1,035) (1,562) 771

-------------------------------------------------------- ----- ------------ ------------ ----------

Profit for the period 1,697 17,148 27,926

-------------------------------------------------------- ----- ------------ ------------ ----------

Other comprehensive income/(expense)

Items that will not be reclassified to profit

or loss

Remeasurements of defined benefit pension plans - - (4,645)

Tax recognised on items that will not be reclassified

to profit or loss - - 1,161

Items that are or may be reclassified subsequently

to profit or loss

Foreign exchange translation differences 528 1,406 1,130

Share of other comprehensive income of joint

ventures (net of tax) - - 1,912

Other comprehensive income/(expense) for the

period, net of tax 528 1,406 (442)

Total comprehensive income for the period 2,225 18,554 27,484

-------------------------------------------------------- ----- ------------ ------------ ----------

Profit attributable to:

Equity holders of the company 1,706 16,962 27,915

Non-controlling interest (9) 186 11

-------------------------------------------------------- ----- ------------ ------------ ----------

Profit for the period 1,697 17,148 27,926

-------------------------------------------------------- ----- ------------ ------------ ----------

Total comprehensive income for the period attributable

to:

Equity holders of the company 2,234 18,368 27,473

Non-controlling interest (9) 186 11

-------------------------------------------------------- ----- ------------ ------------ ----------

Total comprehensive income for the period 2,225 18,554 27,484

-------------------------------------------------------- ----- ------------ ------------ ----------

GAAP measures

Basic earnings per share (pence) 7 5.22 52.15 85.85

Diluted earnings per share (pence) 7 5.14 51.09 84.13

------------------------------------ ----- ------ ------

Condensed Consolidated Balance Sheet

as at 30 November 2023

Unaudited Unaudited Audited

30 November 30 November 31 May

2023 2022 2023

Note GBP000 GBP000 GBP000

---------------------------------------- ----- ------------ ------------ ----------

Non-current assets

Property, plant and equipment 10,822 10,392 10,861

Right of use assets 34,157 35,305 39,815

Investment property 15,267 13,672 14,074

Intangible assets including goodwill 5,589 5,949 5,685

Investments in joint ventures 9 73,226 70,541 74,282

Deferred tax assets 14,214 9,657 14,753

Trade receivables - 4,224 -

Retirement benefit surplus 9,111 11,467 8,474

---------------------------------------- ----- ------------ ------------ ----------

162,386 161,207 167,944

---------------------------------------- ----- ------------ ------------ ----------

Current assets

Inventories 44,192 33,872 39,302

Trade and other receivables 82,474 86,109 71,609

Contract assets 5,058 6,081 5,114

Cash and cash equivalents 18,718 18,102 21,859

---------------------------------------- ----- ------------ ------------ ----------

150,442 144,164 137,884

---------------------------------------- ----- ------------ ------------ ----------

Total assets 312,828 305,371 305,828

---------------------------------------- ----- ------------ ------------ ----------

Non-current liabilities

Other Interest-bearing loans and

borrowings (13,874) (17,460) (20,839)

Retirement benefit obligations (2,839) (2,666) (2,902)

Provisions (3,829) (5,898) (4,120)

Deferred tax liabilities (3,853) (2,419) (3,417)

---------------------------------------- ----- ------------ ------------ ----------

(24,395) (28,443) (31,278)

---------------------------------------- ----- ------------ ------------ ----------

Current liabilities

Other Interest-bearing loans and

borrowings (14,913) (13,140) (15,511)

Trade and other payables (64,545) (58,792) (47,427)

Provisions (11,268) (8,844) (10,467)

Income tax liability (212) - (154)

---------------------------------------- ----- ------------ ------------ ----------

(90,938) (80,776) (73,559)

---------------------------------------- ----- ------------ ------------ ----------

Total liabilities (115,333) (109,219) (104,837)

---------------------------------------- ----- ------------ ------------ ----------

Net assets 197,495 196,152 200,991

---------------------------------------- ----- ------------ ------------ ----------

Condensed Consolidated Balance Sheet (continued)

as at 30 November 2023

Unaudited Unaudited Audited

30 November 30 November 31 May

2023 2022 2023

GBP000 GBP000 GBP000

--------------------------------------- ------------ ------------ --------

Equity attributable to equity holders

of the parent

Share capital 3,314 3,314 3,314

Share premium 73,982 73,972 73,972

Other reserves 211 211 211

Translation reserve (161) (413) (689)

Merger reserve 1,022 1,022 1,022

Hedging reserve 318 318 318

Capital redemption reserve 1,530 1,530 1,530

Share-based payment reserve 2,540 2,216 2,388

Retained earnings 114,959 114,018 119,136

---------------------------------------- ------------ ------------ --------

197,715 196,188 201,202

Non-controlling interest (220) (36) (211)

---------------------------------------- ------------ ------------ --------

Total equity 197,495 196,152 200,991

---------------------------------------- ------------ ------------ --------

Condensed Consolidated Statement of Changes in Equity

for the six months ended 30 November 2022

Share Share Translation Hedging Other Capital Merger Share-based Retained Total Non-controlling Total

capital premium reserve reserve reserves redemption reserve payment earnings parent interest Equity

reserve reserve equity

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

Balance at 1

June 2022 3,314 73,972 (1,819) 318 211 1,530 1,022 2,029 102,781 183,358 (222) 183,136

-------- -------- ------------ -------- --------- ----------- -------- ------------ --------- -------- ---------------- --------

Total

comprehensive

income for

the period

Profit for the

period - - - - - - - - 16,962 16,962 186 17,148

Other

comprehensive

income

Foreign

exchange

translation

differences - - 1,406 - - - - - - 1,406 - 1,406

Total other

comprehensive

income - - 1,406 - - - - - - 1,406 - 1,406

-------- -------- ------------ -------- --------- ----------- -------- ------------ --------- -------- ---------------- --------

Total

comprehensive

income for

the period - - 1,406 - - - - - 16,962 18,368 186 18,554

-------- -------- ------------ -------- --------- ----------- -------- ------------ --------- -------- ---------------- --------

Transactions

with owners

recorded

directly in

equity

Equity settled

share-based

payment

transactions - - - - - - - 187 - 187 - 187

Dividends paid - - - - - - - - (5,725) (5,725) - (5,725)

Total

contributions

by and

distributions

to owners - - - - - - - 187 (5,725) (5,538) - (5,538)

Balance at 30

November 2022 3,314 73,972 (413) 318 211 1,530 1,022 2,216 114,018 196,188 (36) 196,152

-------- -------- ------------ -------- --------- ----------- -------- ------------ --------- -------- ---------------- --------

Condensed Consolidated Statement of Changes in Equity

for the six months ended 30 November 2023

Share Share Translation Hedging Other Capital Merger Share-based Retained Total Non-controlling Total

capital premium reserve reserve reserves redemption reserve payment earnings parent interest Equity

reserve reserve equity

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

Balance at 1 June

2023 3,314 73,972 (689) 318 211 1,530 1,022 2,388 119,136 201,202 (211) 200,991

-------- -------- ------------ -------- --------- ----------- -------- ------------ --------- -------- ---------------- --------

Total

comprehensive

income/(expense)

for the period

Profit/(loss) for

the period - - - - - - - - 1,706 1,706 (9) 1,697

Other

comprehensive

income

Foreign exchange

translation

differences - - 528 - - - - - - 528 - 528

-------- -------- ------------ -------- --------- ----------- -------- ------------ --------- -------- ---------------- --------

Total other

comprehensive

income - - 528 - - - - - - 528 - 528

-------- -------- ------------ -------- --------- ----------- -------- ------------ --------- -------- ---------------- --------

Total

comprehensive

income/(expense)

for the period - - 528 - - - - - 1,706 2,234 (9) 2,225

-------- -------- ------------ -------- --------- ----------- -------- ------------ --------- -------- ---------------- --------

Transactions with

owners recorded

directly in

equity

Issue of shares - 10 - - - - - - - 10 - 10

Equity settled

share-based

payment

transactions - - - - - - - 152 - 152 - 152

Dividends paid - - - - - - - - (5,883) (5,883) - (5,883)

Total

contributions by

and

distributions

to owners - 10 - - - - - 152 (5,883) (5,721) - (5,721)

Balance at 30

November 2023 3,314 73,982 (161) 318 211 1,530 1,022 2,540 114,959 197,715 (220) 197,495

-------- -------- ------------ -------- --------- ----------- -------- ------------ --------- -------- ---------------- --------

Condensed Consolidated Cash Flow Statement

for the six months ended 30 November 2023

Unaudited Unaudited

six months six months Audited

ended ended year

ended

30 November 30 November 31

May

2023 2022 2023

GBP000 GBP000 GBP000

--------------------------------------------------------------- ------------ ---------

Cash flows from operating activities

Profit for the period 1,697 17,148 27,926

Adjustments for:

Depreciation and impairment of property, plant and

equipment and right-of-use assets 7,128 4,932 14,570

Net finance expense 655 319 953

Amortisation of intangible assets 96 - 175

Share of loss/(profit) in joint ventures (net of tax) 1,714 (11,053) (16,311)

Profit on sale of property, plant and equipment, investment

property and right-of-use assets - (2,844) (4,718)

Equity settled share-based payment expense 152 187 359

Income tax expense/(credit) 1,035 1,562 (771)

Contributions to defined benefit pension schemes (589) (1,170) (2,426)

Retranslation of foreign denominated assets and liabilities (122) 31 482

--------------------------------------------------------------- ------------ ------------ ---------

11,766 9,112 20,239

Change in inventories (4,890) (3,398) (8,827)

Change in trade and other receivables (10,889) 4,314 23,290

Change in trade and other payables 17,156 6,622 (4,563)

Change in provisions and employee benefits 509 2,867 2,713

--------------------------------------------------------------- ------------ ------------ ---------

13,652 19,517 32,852

Interest received 818 504 1,127

Interest paid (1,585) (775) (2,192)

Income tax received/(paid) 2 28 (281)

--------------------------------------------------------------- ------------ ------------ ---------

Net cash inflow from operating activities 12,887 19,274 31,506

--------------------------------------------------------------- ------------ ------------ ---------

Cash flows from investing activities

Proceeds from sale of property, plant and equipment 110 4,565 6,565

Proceeds from sale of investment property - 146 266

Proceeds from sale of ROU assets 12 54 81

Acquisition of property, plant and equipment (1,466) (1,730) (3,442)

Acquisition of investment property (770) (5,377) (5,783)

Acquisition of right of use assets - (54) (85)

Payment for acquisition of subsidiaries, net of cash

acquired - (1,447) (1,447)

--------------------------------------------------------------- ------------ ------------ ---------

Net cash outflow from investing activities (2,114) (3,843) (3,845)

--------------------------------------------------------------- ------------ ------------ ---------

Cash flows from financing activities

Principal elements of lease payments (8,027) (5,519) (12,721)

Dividends paid (5,883) (5,725) (6,701)

--------------------------------------------------------------- ------------ ------------ ---------

Net cash outflow from financing activities (13,910) (11,244) (19,422)

--------------------------------------------------------------- ------------ ------------ ---------

Net (decrease)/increase in cash and cash equivalents (3,137) 4,187 8,239

Cash and cash equivalents at the start of the period 21,859 13,773 13,773

Effect of exchange rate fluctuations on cash held (4) 142 (153)

--------------------------------------------------------------- ------------ ------------ ---------

Cash and cash equivalents at the end of the period 18,718 18,102 21,859

--------------------------------------------------------------- ------------ ------------ ---------

NOTES TO THE CONDENSED CONSOLIDATED INTERIM FINANCIAL

INFORMATION

1. Basis of preparation

The condensed consolidated interim financial information set out

in this statement for the six months ended 30 November 2023 and the

comparative figures for the six months ended 30 November 2022 is

unaudited. This financial information does not constitute statutory

accounts as defined in Section 435 of the Companies Act 2006. It

does not comply with IAS 34 'Interim Financial Reporting', as is

permissible under the rules of the Alternative Investment

Market.

The condensed consolidated interim financial information, which

is neither audited nor reviewed, has been prepared in accordance

with the measurement and recognition criteria of UK-adopted

international accounting standards. This statement does not include

all the information required for the annual financial statements

and should be read in conjunction with the financial statements of

the Group as at and for the year ended 31 May 2023.

There are no new IFRS which apply to the condensed consolidated

interim financial information.

2. Accounting policies

The accounting policies applied in preparing the condensed

consolidated interim financial information are the same as those

applied in the preparation of the annual financial statements for

the year ended 31 May 2023, as described in those financial

statements.

3. Status of financial information

The comparative figures for the financial year ended 31 May 2023

are not the Group's statutory consolidated financial statements for

that financial year. The statutory financial accounts for the

financial year ended 31 May 2023 have been reported on by the

company's auditor and delivered to the Registrar of Companies. The

report of the auditor was (i) unqualified, (ii) did not include a

reference to any matters to which the auditor drew attention by way

of emphasis without qualifying their report, and (iii) did not

contain a statement under section 498 (2) or (3) of the Companies

Act 2006.

4. Principal risks and uncertainties

The principal risks and uncertainties affecting the Group are

unchanged from those set out in the Group's accounts for the year

ended 31 May 2023. The Directors have reviewed financial forecasts

and are satisfied that the Group has adequate resources to continue

in operational existence for the foreseeable future. Accordingly,

the Group continues to adopt the going concern basis in preparing

the condensed consolidated interim financial information.

5. Taxation

UK income tax for the period is charged at 25% (2022: 19%). The

effective tax rate, after removing the impact of joint ventures is

23.3% (2022: 20.4%), representing an estimate of the annual

effective rate for the full year to 31 May 2024. This rate is lower

than the standard rate of UK income tax due to the impact of

overseas tax which applies a lower tax rate.

6. Dividends

The final dividend of 6.0p and additional dividend of 12.0p per

ordinary share, proposed in the 2023 Annual Report and Accounts and

approved by the shareholders at the Annual General Meeting on 25

October 2023, was paid on 30 October 2023.

The directors have proposed an interim dividend of 18.0p per

share (2022: 3.0p) which will be paid on 11 April 2024 to

shareholders on the register at the close of business on 22 March

2024. This will be paid out of the Company's available

distributable reserves. In accordance with IAS 1, dividends are

recorded only when paid and are shown as a movement in equity

rather than as a charge in the income statement.

7. Earnings per share

Six months ended Six months ended Year ended 31 May

30 November 2023 30 November 2022 2023

Unaudited Unaudited Audited

Earnings EPS DEPS Earnings EPS DEPS Earnings EPS DEPS

GBP000 Pence Pence GBP000 Pence Pence GBP000 Pence Pence

Basic earnings

per share 1,706 5.22 5.14 16,962 52.15 51.09 27,926 85.85 84.13

Weighted average

number of shares

(000's) 32,659 33,217 32,528 33,200 32,528 33,193

------------------- --------- --------- --------- --------- --------- --------- --------- --------- ---------

The calculation of diluted earnings per share is based on the

profit for the period attributable to equity holders of the Company

and on the weighted average number of ordinary shares in issue in

the period adjusted for the dilutive effect of the share options

outstanding. The effect on the weighted average number of shares is

558,000 (2022: 672,000), the effect on basic earnings per ordinary

share is 0.08p (2022: 1.06p).

8. Segmental information

Operating segments are reported in a manner consistent with the

internal reporting provided to the chief operating decision-maker.

The chief operating decision-maker has been identified as the Board

of Directors since they are responsible for strategic decisions.

HRMS represents the Groups share of its German joint venture, which

includes Hargreaves Services Europe Limited which is the parent

company of HRMS and DK.

Services Hargreaves Unallocated HRMS Total

Land

Unaudited Unaudited Unaudited Unaudited Unaudited

30 November 30 November 30 November 30 November 30 November

2023 2023 2023 2023 2023

GBP000 GBP000 GBP000 GBP000 GBP000

------------------------------ ------------ ------------ ------------ ------------ ------------

Revenue

Total revenue 110,327 673 - - 111,000

Intra-segment revenue (829) - - - (829)

------------------------------ ------------ ------------ ------------ ------------ ------------

Revenue from external

customers 109,498 673 - - 110,171

------------------------------ ------------ ------------ ------------ ------------ ------------

Operating profit/(loss) 8,913 (1,284) (2,528) - 5,101

Share of profit/(loss)

in joint ventures (net

of tax) - 173 - (1,887) (1,714)

Net finance (expense)/income (1,092) 108 329 - (655)

Profit/(loss) before tax 7,821 (1,003) (2,199) (1,887) 2,732

------------------------------ ------------ ------------ ------------ ------------ ------------

Services Hargreaves Unallocated HRMS Total

Land

Unaudited Unaudited Unaudited Unaudited Unaudited

30 30 30 30 30

November November November November November

2022 2022 2022 2022 2022

GBP000 GBP000 GBP000 GBP000 GBP000

------------------------------ ---------- ----------- ------------ ---------- ----------

Revenue

Total revenue 108,000 8,700 - - 116,700

Intra-segment revenue (225) - - - (225)

------------------------------ ---------- ----------- ------------ ---------- ----------

Revenue from external

customers 107,775 8,700 - - 116,475

------------------------------ ---------- ----------- ------------ ---------- ----------

Operating profit/(loss) 9,147 1,331 (2,502) - 7,976

Share of profit in

joint ventures (net

of tax) - 242 - 10,811 11,053

Net finance (expense)/income (642) 28 295 - (319)

Profit/(loss) before

tax 8,505 1,601 (2,207) 10,811 18,710

------------------------------ ---------- ----------- ------------ ---------- ----------

9. Investments in joint ventures

Tower Regeneration Hargreaves Waystone Interests Total

Limited Services Hargreaves in immaterial

Europe Limited LLP joint ventures

GBP000 GBP000 GBP000 GBP000 GBP000

------------------------------- ------------------- --------------- ----------- --------------- -------

At 1 June 2023 - 68,607 5,751 (76) 74,282

Group's share of (loss)/profit

in joint ventures (net of

tax) - (1,887) 173 - (1,714)

Exchange differences - 646 - 12 658

At 30 November 2023 - 67,366 5,924 (64) 73,226

------------------------------- ------------------- --------------- ----------- --------------- -------

10. Condensed consolidated interim financial information

The condensed consolidated interim financial information was

approved by the Board of Directors on 24 January 2024. Copies of

this interim statement will be sent to all shareholders and will be

available to the public from the Group's registered office.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR EXLFLZFLZBBX

(END) Dow Jones Newswires

January 24, 2024 02:00 ET (07:00 GMT)

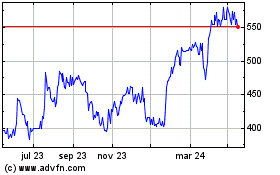

Hargreaves Services (LSE:HSP)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

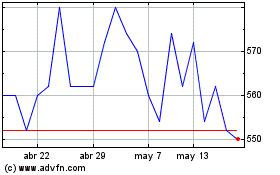

Hargreaves Services (LSE:HSP)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025