TIDMIVPB TIDMIVPG TIDMIVPM TIDMIVPU

LEI: 549300JZQ39WJPD7U596

Invesco Select Trust plc

Annual Financial Report for the year ended 31 May 2022

The following text is extracted from the Annual Financial Report of the Company

for the year ended 31 May 2022. All page numbers below refer to the Annual

Financial Report which will be made available on the Company's website.

Financial Performance

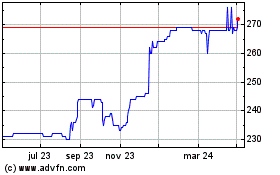

Cumulative Total Returns(1)(3)

To 31 May 2022

One Three Five

UK Equity Share Portfolio Year Years Years

Net Asset Value 6.8% 25.9% 21.1%

Share Price 3.0% 13.6% 10.4%

FTSE All-Share Index 8.3% 18.4% 22.2%

One Three Five?

Global Equity Income Share Portfolio Year Years Years

Net Asset Value 9.6% 39.0% 47.9%

Share Price 4.4% 30.0% 37.3%

MSCI World Index (£) 7.4% 43.0% 62.9%

One Three Five?

Balanced Risk Allocation Share Portfolio Year Years Years

Net Asset Value 0.3% 21.8% 26.1%

Share Price -5.2% 11.6% 15.7%

Composite Benchmark Index(2) -6.1% 11.8% 20.3%

ICE BoA Merrill Lynch 3 month LIBOR plus 5% 5.1% 16.1% 27.3%

per annum

One Three Five?

Managed Liquidity Share Portfolio Year Years Years

Net Asset Value -0.3% 4.5% 6.1%

Share Price -4.0% -2.0% -2.0%

Year end Net Asset Value, Share Price and Discount

Net Asset Share

Value Price

Share Class (pence) (pence) Discount

UK Equity 194.35 175.00 (10.0)%

Global Equity Income 249.00 229.00 (8.0)%

Balanced Risk Allocation 169.87 154.50 (9.0)%

Managed Liquidity 106.92 97.00 (9.3)%

(1) Alternative Performance Measure (APM). See Glossary of Terms and

Alternative Performance Measures on pages 116 to 119 of the financial report

for details of the explanation and reconciliations of APMs.

(2) With effect from 1 June 2021, the benchmark adopted by the Balanced Risk

Allocation Portfolio is comprised of 50% 30-year UK Gilts Index, 25% GBP hedged

MSCI World Index (net) and 25% GBP hedged S&P Goldman Sachs Commodity Index.

Prior to this, the benchmark was ICE BoA Merrill Lynch 3 month LIBOR plus 5%

per annum. Accordingly, both the new and old benchmark are shown.

(3) Source: Refinitiv/Bloomberg.

Chairman's Statement

Highlights

- UK Equity Share, Global Equity Income Share and Balanced Risk Allocation

Share Portfolios delivered positive NAV performance over the period, with the

Global Equity Income and Balanced Risk Allocation Share Portfolios

outperforming their respective benchmark indices.

- Dividends rose to 6.70p per UK Equity Share, 7.15p per Global Equity Income

Share and 1.00p per Managed Liquidity Share.

- Net assets in the Global Equity Income Share Portfolio increased to £62.6m,

with net conversions into that portfolio.

- Period of consolidation following completion of the business combination with

Invesco Income Growth Trust in April 2021, one of the results of which are

lower ongoing charges.

The Company

The Company's investment objective is to provide shareholders with a choice of

investment strategies and policies, each intended to generate attractive

risk-adjusted returns.

The Company's share capital comprises four share classes: UK Equity Shares,

Global Equity Income Shares, Balanced Risk Allocation Shares and Managed

Liquidity Shares, each of which has its own separate portfolio of assets and

attributable liabilities.

The investment objectives and policies of each of the portfolios are set out on

pages 39 to 41.

The Company's structure enables shareholders to adjust asset allocation to

reflect their views of the prevailing market outlook. As set out on page 2,

shareholders have the opportunity to convert between share classes, free of

capital gains tax, every three months.

Performance

It was pleasing to note, given the global macroeconomic backdrop, that three of

the four portfolios delivered positive NAV performance, with the Global Equity

Income Share Portfolio and Balanced Risk Allocation Share Portfolio

outperforming their respective benchmarks over the period.

The UK Equity Share Portfolio has been jointly managed by Ciaran Mallon and

James Goldstone over the period. The portfolio saw positive NAV total return

performance during the year, although underperformed the benchmark by 1.5%. The

NAV total return of the UK Equity Share Portfolio over the year was 6.8%, which

compares with the total return of 8.3% from the FTSE All-Share Index. The share

price total return was 3.0%. Market sentiment continued to be dominated by the

ongoing impact of the pandemic on the economy and inflationary pressures,

particularly around energy costs, which were then worsened by the war in

Ukraine.

The Global Equity Income Portfolio, managed by Stephen Anness, also saw

positive NAV total return performance, outperforming the benchmark total return

by 2.2%. The NAV total return of the Global Equity Income Share Portfolio over

the year was 9.6%, which compares with the total return from the MSCI World

Index (£) of 7.4%. The share price total return was 4.4%. The portfolio's stock

selection remained strong, particularly in the US and UK, where overweight

exposure to consumer staples was a positive element to performance.

The Balanced Risk Allocation Portfolio, by its very nature, has a combination

of equities, bonds and commodities exposures. It is managed by Invesco's Global

Asset Allocation Team, based in Atlanta. During the period under review, NAV

total return of the Balanced Risk Allocation Share Portfolio was 0.3%, which

outperformed the total return from its composite benchmark by 6.4%. The share

price total return was -5.2%. The positive NAV performance was largely driven

by the portfolio's exposure to commodity markets, particularly energy

commodities and industrial metals, due to a combination of strong demand

twinned with supply constraints.

The NAV total return on the Managed Liquidity Portfolio, managed by Derek

Steeden, was -0.3%. The portfolio's return has been impacted by the effect of

rising interest rates to combat increasing inflation. It is important to note

that although this share class has a lower risk profile than the Company's

other three share classes, it is not designed to be a cash fund, and as such is

not without risk to capital. The share price total return was -4.0%.

Balanced Risk Allocation Benchmark Change

As reported in the 2021 Annual Financial Report and effective 1 June 2021, a

new benchmark has been used. This new comparator benchmark is a composite whose

components are approximate proxies for the portfolio's holdings and is a blend

comprising 50% 30-year UK Gilts Index, 25% GBP hedged MSCI World Index (net)

and 25% GBP hedged S&P Goldman Sachs Commodity Index (all total return).

Gearing and Structure

The UK Equity and Global Equity Income portfolios are able to employ gearing by

means of a bank loan facility. Your Board has renewed this facility at a level

of £40 million to allow the Portfolio Managers to employ gearing, if desired,

across the two equity portfolios.

The Company continues to retain its innovative capital structure, offering

investors the opportunity to switch (on a quarterly basis) between its UK

Equity, Global Equity Income, Balanced Risk Allocation and Managed Liquidity

share classes in order to position their portfolios for changing investment

conditions.

Dividends

We have continued to apply the dividend policy adopted six years ago, and

supported by shareholder advisory votes, whereby for both UK Equity and Global

Equity Income Shares, dividends are paid by way of three equal interim

dividends declared in July, October and January with a 'wrap-up' fourth interim

declared in April. For the year under review the first three dividends declared

for the UK Equity Shares were 1.50p per share and for the Global Equity Income

Shares 1.55p per share. The fourth interim dividends were 2.20p per share for

the UK Equity Shares, bringing the total to 6.70p per share for the year (2021:

6.65p), and 2.50p per share for the Global Equity Income Shares, bringing that

total to 7.15p (2021: 7.10p) per share for the year.

The Company's dividend policy permits the payment of dividends in the UK

Equity, Global Equity Income and Managed Liquidity portfolios from capital.

With total income of the Company increasing to £6.99m (2021: £3.18m) the

contribution from capital required for the Company's dividends to meet the

Board's target level was reduced from 2021 levels. For the Global Equity Income

Shares a contribution from capital of approximately 2.30p per share was

required to achieve the dividend level (2021: 3.15p per share). For the UK

Equity Shares a contribution from capital of approximately 0.7p per share was

required to achieve the dividend level (2021: 2.75p per share).

We intend to continue with the policy of a partial augmentation from capital

where appropriate and investors are again being given advisory votes on it.

However, whereas in recent years we have set a target of at least maintaining

the dividend level from year to year for each of the equity portfolios, we did

not set dividend targets in 2022 due to the uncertainty of income flows as a

result of the pandemic. With the current uncertainty of future income flows,

due in particular to the risk of entering a period of global recession, the

Directors have not set dividend targets for the year to 31 May 2023.

The first interim dividends declared in respect of the year to May 2023, which

will be paid on 15 August 2022 to shareholders on the register on 22 July 2022,

were 1.50p per share for UK Equity Shares, 1.55p per share for Global Equity

Income Shares.

The Board has also declared an interim dividend for the year ended 31 May 2023,

payable as noted above, of 1.00p per share for Managed Liquidity Shares. This

is payable from retained revenue reserves. Given the quantum involved it is

unlikely that such payments will be more frequent than annually and may indeed

be less frequent.

It continues to be the case that in order to maximise the capital return on the

Balanced Risk Allocation Shares, the Directors only intend to declare dividends

on this share class to the extent required, having taken into account the

dividends paid on the other Share classes, to maintain the Company's status as

an investment trust. No dividends have been paid on the Balanced Risk

Allocation Shares over the period.

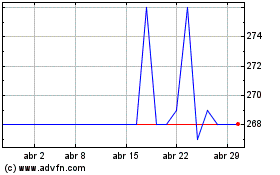

Discount Policy

The Company adopted a discount control policy for all four share classes in

January 2013, whereby the Company offers to issue or buy back shares of all

classes with a view to maintaining the prices of the shares at close to their

respective net asset values. Your Board remains committed to its utilisation,

although it has stepped back at times since the onset of the Ukraine conflict,

in light of market volatility, and discounts have been somewhat wider than

before, in line with discounts generally across the investment trust market.

The ongoing implementation of this policy is dependent upon the Company's

authority to buy back shares, and the Directors' authority to issue shares for

cash on a non pre-emptive basis, being renewed at general meetings of the

Company.

As discussed below, the Company is seeking a class consent from the

shareholders of the UK Equity and Balanced Risk Allocation share classes to

cancel their respective share premium accounts. This will give the Company

ample scope to continue share buybacks.

Share Capital Movements

During the year to 31 May 2022 the Company bought back and placed in treasury

11,996,500 UK Equity Shares at an average price of 184.1p, 583,000 Global

Equity Income Shares at an average price of 227.7p, 165,000 Balanced Risk

Allocation Shares at an average price of 165.5p and 63,000 Managed Liquidity

Shares at an average price of 104.0p. Other than in connection with the share

conversion process, no shares were issued during the year. In addition, no

shares were sold from treasury and no treasury shares were cancelled. Since the

year-end a further 687,000 UK Equity Shares and 295,000 Global Equity Income

Shares have been bought back into treasury. The Board intends to use the

Company's buy back and issuance authorities when this will benefit existing

shareholders; and to operate the discount control policy mentioned above; and

will ask shareholders to renew the authorities as and when appropriate.

Share Class Conversions

The Company enables shareholders to adjust their asset allocation to reflect

their views of future market returns. Shareholders have the opportunity to

convert their holdings of shares into any other class of Share, without

incurring any tax charge (under current legislation). The conversion dates for

the forthcoming year are as follows: 1 August 2022; 1 November 2022; 1 February

2023; and 2 May 2023. The total number of Share class conversions that have

occurred over the year's conversion opportunities resulted in net flows of £5.0

million out of the UK Equity Share Portfolio; of £4.8 million into the Global

Equity Income Share Portfolio; of £0.5 million into the Balanced Risk

Allocation Share Portfolio; and £0.3 million out of the Managed Liquidity Share

Portfolio. Should you wish to convert shares at any of these dates, conversion

forms, which are available on the Manager's website at www.invesco.co.uk/

investmenttrusts, or CREST instructions must be received at least ten days

before the relevant conversion date.

Cancellation of the UK Equity and Balanced Risk Allocation Share Premium

Accounts

In addition to the usual business to be conducted at the AGM, the Board is

recommending that the share premium accounts of the UK Equity Share Class and

the Balanced Risk Allocation Share Class are cancelled. This will give the

Company greater flexibility, subject to financial performance, to make

distributions and/or to make purchases of its own shares. The proposal will be

implemented by means of a Capital Reduction, which will not involve any

distribution or repayment of capital and will not reduce the underlying net

assets of the Company. In addition, due to the provisions of the Articles of

Association of the Company, the Company will seek a class consent from the

shareholders of the UK Equity Share Class and the Balanced Risk Allocation

Share Class in respect of the proposed cancellation of the reserves at class

meetings to be held immediately prior to the AGM (see below). Full details of

the proposal can be found on pages 105 to 111 and in my letter to shareholders

set out in the Appendix on pages 112 to 113.

Annual General Meeting ('AGM')

I am pleased to invite all our shareholders to the Company's AGM which will be

held in person at 43-45 Portman Square, London, W1H 6LY at 11.30am on 4 October

2022.

As well as the Company's formal business, there will be a presentation from the

UK Equity and Global Equity Income Portfolio Managers. Shareholders will have

the opportunity to put questions to the Directors and UK Equity and Global

Equity Income Portfolio Managers. Light refreshments will be available.

Shareholders may bring a guest to these meetings. To register your interest in

attending, please contact us at investmenttrusts@invesco.com.

For those unable to make it in person, we will be posting video updates from

all the Portfolio Managers on our website ahead of the AGM.

The business of the AGM is summarised in the Directors' Report on page 60. It

is recommended that shareholders exercise their votes by means of registering

them with the Company's registrar ahead of the meeting, online or by completing

paper proxy forms, and appoint the Chairman of the meeting as their proxy. The

Board has considered all the resolutions proposed in the Notice of the AGM and

believe they are in the best interests of shareholders and the Company as a

whole. Accordingly, the Directors recommend that shareholders vote in favour of

each resolution, as will the Directors in respect of their own shareholdings.

I look forward to meeting as many of you as possible at the AGM.

Outlook

Many of the challenges that impacted your Company's portfolios over the last

year continue to make their presence felt. The lack of preparedness for the

re-opening of the economy post-pandemic has resulted in global supply chain

issues and contributed to the current inflationary environment. It was hoped

that higher levels of inflation would be a transitory issue, with a lower peak;

forecasts are now indicating a 'higher for longer' environment. Central banks

were caught somewhat on the back foot and have had to act more quickly, and

raise rates more strongly, than they might otherwise have done. The economic

environment remains uncertain in the short term, with a risk of a global

recession, and a cost of living crisis which is resulting in industrial action

being seen in many sectors.

There are a number of geopolitical tensions, both in the UK, with the current

Conservative leadership contest and Brexit overhang, and on the global stage.

The horrific conflict in the Ukraine continues and, sadly, a peaceful

resolution feels further out than originally hoped. The effect of the war is

having a global impact on energy and food prices.

Market volatility looks to remain heightened for some time as we wait to see

how the current economic and political uncertainties play out. Your Company's

UK Equity and Global Equity Income Portfolios continue to be run in a style

that maintains 'balance'. Your Portfolio Managers continue to see attractive

investment opportunities and target portfolio returns driven by the performance

of the individual underlying companies they have selected. Additionally, income

is an important constituent of the total return of the equity portfolios. Your

Portfolio Managers have a strong belief in the ability of equities to protect

the investor from the effects of inflation in the long term.

The Balanced Risk Allocation Portfolio aims to deliver equity-like returns but

with half the volatility of equity markets; it seeks to give some protection to

investors from market falls and inflation, with exposures across growth,

defensive and real return assets. The Managed Liquidity Portfolio offers a

higher degree of security for those with a more conservative outlook; its

investments may be impacted by interest rates as well as other factors.

I believe that the choice and diversification offered by your Company's four

portfolios provide investors with additional flexibility and thus a level of

protection against market downsides. Shareholders are able to position their

investment into the asset classes where they expect to see the greatest

returns, or use the Company's share classes as a tool to diversify investment

exposure. The ability to change allocation to the Company's investment

portfolios, without crystallising a taxable gain, also provides the option to

use the Company as a 'lifestyling' investment, as the ratios of exposures to

the four asset classes can be altered on a quarterly, or far less frequent

basis, according to risk appetite.

Your Company's structure and portfolios continue to be well positioned to

negotiate the market challenges and opportunities that lie ahead.

Victoria Muir

Chairman

3 August 2022

UK Equity Share Portfolio Managers' Report

Q How has the portfolio performed in the twelve months to 31 May 2022?

A The portfolio has underperformed its benchmark over the twelve months to 31

May 2022, with a net asset value return of +6.8%. Over the same period the FTSE

All-Share Index rose +8.3% (both total return, in sterling terms). For most of

the twelve-month period market sentiment continued to be dominated by the

ongoing effects of the pandemic on the economy. As the period continued

attention swiftly turned to the ever-increasing inflation figures being

reported, driven higher by increases in the prices of imported goods and large

increases in the costs of energy, all of which have been exacerbated by the war

in Ukraine. Unfilled job vacancies also increased inflationary pressures

further as wages rose to attract applicants. The combination of these factors

has increased the cost of living for the end consumer and to try and curb the

rapidly rising rate of inflation the Bank of England has raised interest rates

several times since December.

Q What have been the key contributors and detractors to performance over the

year?

A Over the period, positive performance relative to the benchmark was seen in

six out the eleven sectors that the portfolio is invested in and stock

selection in industrials and consumer staples sectors was generally strong. At

a sector level the biggest contribution to positive performance versus the FTSE

All-Share Index over the twelve-month period was the portfolio's overweight to

the utilities sector. The portfolio's holdings of Drax, National Grid and SSE

performed strongly and were all in the top five best performing stocks on a

relative basis versus the FTSE All-Share Index. Drax rose strongly on higher

electricity prices and recognition from the market following the transition

from coal fired electricity production to sustainably sourced biomass along

with the potential for carbon capture and storage technology. Drax is a unique

UK listed asset with impressive sustainability credentials and an ambition to

become a carbon negative business by 2030.

National Grid performed strongly largely due to the attractive inflation

protected revenues in large parts of the company. Additionally, there is an

added appreciation of the potential growth in the business as a result of the

increased electrification of the economy and the resultant grid infrastructure

required. Similarly, SSE was a strong performer as elements of the company's

revenues are inflation protected and it will also benefit from the

electrification theme and higher energy prices.

The portfolio's overweight to the industrials sector performed well on a

relative basis. The holdings of Ultra Electronics, Bunzl and Chemring all

performed well. UItra Electronics received a bid approach from Cobham in July

2021. Over the course of the rest of the year the position was reduced before

exiting fully in March this year. Bunzl the outsourcing specialist and supplier

of disposable products released its full year results in February. Although the

company experienced a decline in demand for personal protection equipment,

which had been strong throughout the depths of the pandemic, this decline was

offset by a recovery in business activity and success in passing on

inflationary price increases. The company also made some strategic acquisitions

as part of its continuing and successful growth strategy.

RELX which has activities in areas such as science journals, risk analytics,

legal databases and exhibitions continued its recovery from Covid-19 which saw

the events and exhibition part of the business effectively close due to the

pandemic and travel restrictions. Results released in February illustrated that

growth had been seen from all four divisions of its business and selective

acquisitions had supplemented their organic growth strategy.

The portfolio's underweight to consumer staples was helpful as large

international branded staples producers Unilever and Reckitt Benckiser, which

are not held in the portfolio, were weaker over the period as was supermarket

delivery company Ocado. This was helpful for relative performance versus the

FTSE All-Share Index.

Naturally there were some weaker performances in the portfolio. The largest

detractor on a sector basis was healthcare where biotherapeutics company

PureTech Health was weaker despite good progress in the development of many of

its products. There has been no negative news but a de-rating of US

biotechnology companies as technology shares have fallen has been unhelpful.

The company aims to address significant areas of un-met medical need with novel

and lower risk route to market products and approaches, along the

brain-immuno-gut axis and has an encouraging pipeline of treatments.

Apart from RELX, mentioned previously, other consumer discretionary stocks have

been under pressure due to the rise in the cost of living. Clothing retailer

Next has been no exception and whilst the company has experienced strong

trading over the twelve-month period the share price has been weaker and has

detracted from relative performance. Similarly, JD Sports Fashion had been

trading well but a sudden management change and general concerns about the

retail sector have also weighed on the share price. Restaurant Group had some

modest downgrades earlier in the year and despite some costs being hedged there

are concerns that some cost inflation will be passed on to the consumer in

price adjustments.

In the basic materials sector the gold holdings were weaker over the period.

Historically gold has been a good hedge against inflation and with inflation

likely to remain at elevated levels for longer than probably anticipated, we

believe this position will provide some diversification benefits in the months

to come and have an attractive yield.

The price of crude oil has risen sharply over the twelve months period as

supply has struggled to keep up with recovering demand post pandemic. The

portfolio is slightly underweight the energy sector compared to the benchmark

weighting, and specifically Shell, which performed strongly. Consequently, this

was a headwind to relative performance.

Year end

Total Portfolio

Key Contributors Impact % Weight %

Ultra Electronics +0.98 -

Drax +0.97 2.9

National Grid +0.54 4.7

SSE +0.37 4.4

RELX +0.36 4.1

Year end

Total Portfolio

Key Detractors Impact % Weight %

Next -1.26 4.4

PureTech Health -0.99 0.7

Shell -0.79 5.6

JD Sports Fashion -0.71 1.2

Restaurant Group -0.70 0.6

Q How has gearing impacted the performance and what is your strategy going

forward?

A The use of gearing in the portfolio over the period enhanced overall

performance. Net gearing at the start of the twelve-month period was around 6%

and this was increased to approaching 12% towards the half year mark before

reducing to just below 11% at the end of the period. This level is below the

limit of 25% set by the Board.

The level of gearing is under regular review and the strategy used to ascertain

the appropriate level for the portfolio is unchanged. We are comfortable that

the current level of gearing provides an opportunity to enhance the portfolio's

returns relative to the FTSE All-Share Index when considering a wider macro

view and the opportunities in the portfolio. Looking to the future, our view

remains that UK companies remain attractively valued compared to other

developed markets such as the US.

Q How has the portfolio evolved over the period and how is it currently

positioned?

A There have been no material adjustments to the positioning of the portfolio

although there has been some trading to adjust for the level of gearing over

the period. The holding of Fevertree was reduced and subsequently exited early

in the period and following the bid for Ultra Electronics the holding was sold

and the capital redeployed elsewhere in the portfolio.

The holdings of Young & Co's Brewery and CVS the veterinary services group were

reduced over the period. The opportunity was taken to add to the portfolio's

existing position in PRS REIT when the company raised money in September 2021

to acquire pipeline assets comprising six sites with the potential for 670 new

homes.

Hiscox the insurer was added to the portfolio early in the twelve-month review

period whilst Cranswick, the pork, poultry, and food products producer, has

been a very recent new addition. The holding of Essentra, the packaging

products and specialist component manufacturer, was also added to around the

same time and performed strongly following a business review that resulted in

the disposal of its packaging business. An encouraging fourth quarter update

followed by full year results gave rise to some share price volatility. Post

the review period end the disposal of the packaging business has been confirmed

with the stated intention that most of the cash proceeds will to be used to

strengthen the balance sheet.

On a sectoral basis and relative to the FTSE All-Share Index, we remain

over-weight consumer discretionary and utilities stocks. The overweight to

utilities offers an inflation-linked return that in our view continues to

remain underappreciated. Exposure to the energy sector is slightly reduced from

twelve months ago but we maintain that these companies continue to stand to

benefit from elevated oil prices as growth in supply continues to be

outstripped by demand post pandemic. We remain under-weight consumer staples

which we see as expensive, and financials in general.

Previously we have spoken to five broad investment themes that the portfolio is

exposed to. It is best to think of these themes as an outcome of the investment

process rather than a conscious element of the portfolio construction. Our

conviction is very much in these key stocks that are spread across "UK

Domestics" (28% of the value of the portfolio), "International Value" (31%),

"International Growth" (22%), "Recovery" (7%) and "Transformers" (12%). When

comparing these weightings to those of twelve months ago the only change is the

tilt to "International Value" versus "International Growth" which has shifted

approximately 5% as we favour shorter duration value orientated stocks.

Q What is your outlook for the next twelve months and beyond? Why invest in the

UK now?

A Overall, we remain positive on the outlook for UK equities despite the

current fear of entrenched inflation and higher interest rates which has

created a significant amount of market volatility. Furthermore, we strongly

believe in the ability of equities to protect an investor from the effects of

inflation in the long run.

Short term volatility and uncertainty look set to continue in the months to

come and consequently a balanced portfolio that can perform in a range of

economic and market regimes is our continuing objective. This balance is

expected to reduce the reliance on unpredictable economic or market outcomes

and leave the performance of the portfolio to be driven by the performance of

the individual companies we have selected within it.

Since the Brexit vote in 2016 UK shares have underperformed other global

markets but, many of these UK listed companies are often largely international

businesses trading at a discount to their international peers. An improvement

in outlook for UK corporate earnings and for nominal growth should, in an

undervalued market, boost the outlook for UK listed equities. However, in the

current environment it is difficult to predict that this will transpire and

whilst we have seen consumer demand remain strong and company order books

healthy, concerns are centred around supply challenges. If the economic outlook

does improve, and we think it will, key beneficiaries will likely include high

quality, cash generative businesses, which form a significant part of our

portfolios.

Should the discount to international peers continue there is an increased

likelihood that interest in UK companies from international buyers might

materialise through merger and acquisition activity. Relative weakness in

sterling versus the US dollar also potentially increases the attractiveness of

UK assets.

We remain confident in the long-term prospects of the companies that we own in

the UK Equity Portfolio which comprises our highest conviction, best ideas. The

portfolio is concentrated around high quality, cash generative businesses, with

strong liquidity that are likely to further enhance their competitive

positions, and this leaves us feeling conservatively optimistic for the year

ahead in 2022.

James Goldstone & Ciaran Mallon

Joint Portfolio Managers

3 August 2022

UK Equity Share Portfolio List of Investments

AT 31 May 2022

Ordinary shares listed in the UK unless stated otherwise

Market

Value % of

Company Sector? £'000 Portfolio

Shell Oil, Gas and Coal 8,871 5.6

National Grid Gas, Water and Multi-Utilities 7,520 4.7

SSE Electricity 6,968 4.4

Next Retailers 6,942 4.4

BP Oil, Gas and Coal 6,552 4.1

RELX Media 6,440 4.1

AstraZeneca Pharmaceuticals and Biotechnology 6,035 3.8

Barclays Banks 5,735 3.6

Barrick Gold - Canadian Listed Precious Metals and Mining 5,539 3.5

PRS REIT Real Estate Investment Trusts 5,057 3.2

Top Ten Holdings 65,659 41.4

Newmont - US Listed Precious Metals and Mining 4,809 3.0

Drax Electricity 4,623 2.9

British American Tobacco Tobacco 4,455 2.8

Bunzl General Industrials 3,954 2.5

Experian Industrial Support Services 3,897 2.5

Legal & General Life Insurance 3,873 2.4

Ferguson Industrial Support Services 3,411 2.3

Vodafone Telecommunications Service 3,295 2.1

Providers

Tesco Personal Care, Drug and Grocery 3,215 2.0

Stores

Young & Co's Brewery - Travel and Leisure 3,044 1.9

Non-VotingAIM

Top Twenty Holdings 104,235 65.8

United Utilities Gas, Water and Multi-Utilities 3,015 1.9

Smith & Nephew Medical Equipment and Services 2,851 1.8

Croda International Chemicals 2,772 1.8

Chemring Aerospace and Defence 2,701 1.7

Ashtead Industrial Transportation 2,432 1.5

Phoenix Life Insurance 2,425 1.5

Coats General Industrials 2,382 1.5

Compass Consumer Services 2,319 1.5

Whitbread Travel and Leisure 2,240 1.4

Barratt Developments Household Goods and Home 2,135 1.3

Construction

Top Thirty Holdings 129,507 81.7

Essentra Industrial Support Services 2,118 1.3

JTC Investment Banking and Brokerage 1,984 1.3

Services

NicholsAIM Beverages 1,860 1.2

JD Sports Fashion Retailers 1,823 1.2

Babcock International Aerospace and Defence 1,796 1.1

Future Media 1,781 1.1

Hiscox Non-Life Insurance 1,643 1.0

Hays Industrial Support Services 1,608 1.0

Sirius Real Estate Real Estate Investment and 1,601 1.0

Services

Chesnara Life Insurance 1,538 1.0

Top Forty Holdings 147,259 92.9

XPS Pensions Investment Banking and Brokerage 1,502 0.9

Services

Jupiter Fund Management Investment Banking and Brokerage 1,410 0.9

Services

CVSAIM Consumer Services 1,359 0.9

Treatt Chemicals 1,225 0.8

DFS Furniture Retailers 1,219 0.8

PureTech Health Pharmaceuticals and Biotechnology 1,178 0.7

Johnson ServiceAIM Industrial Support Services 1,079 0.7

Restaurant Group Travel and Leisure 933 0.6

Lancashire Non-Life Insurance 845 0.5

Sherborne Investors (Guernsey) C Investment Banking and Brokerage 324 0.2

Services

Top Fifty Holdings 158,333 99.9

Cranswick Food Producers 117 0.1

Total Holdings 51 (2021: 51) 158,450 100.0

AIM Investments quoted on AIM.

? FTSE Industry Classification Benchmark.

Global Equity Income Share Portfolio Manager's Report

Q How did the portfolio perform in the year under review?

A The net asset value of the portfolio grew in the year to 31 May, by 9.6%,

this exceeded the return of the comparator benchmark which increased in value

by 7.4%, (both total return, in sterling terms).

Through the summer and autumn of 2021 as parts of the world global equity

markets were strong; most economies around the world continued to rebound from

the Covid-19 epidemic. Inflation began to pick up due to the continuing

disruption of supply chains, especially in Asia, and strong consumer demand.

Both monetary and fiscal policies in the developed economies around the world

eased as authorities prioritised growth in the wake of the enforced shutdowns

during 2020. Hopes remained that the pick-up seen in inflation, post pandemic,

would prove transitory.

However, through the early winter and into 2022 price pressure increased in a

range of commodities, in particular oil and gas and food. In the US and Europe

labour was increasingly scarce, in part due to large numbers of older workers

leaving the labour force post pandemic. Wage inflation also began to increase

sharply. The response of central banks, particularly the Federal Reserve has

been to tighten monetary policy. Elsewhere in the world, the continuation of

China's policy of 'zero covid' has led to a series of rolling lockdowns across

the country which has seriously impinged on industrial production and exports

(from ports such as Shanghai for example). A combination of rising inflation

and interest rates has led to increased fears of recession amongst investors,

hence global equity markets and especially those stocks trading on very high

valuations (such as in the technology sector) were particularly weak.

Whilst rumours were rife of a Russian incursion into Ukraine through the early

part of 2022, most market participants viewed it as unlikely, sadly they (and

we) were wrong. The onset of all out war in Europe for the first time in 75

years has further fuelled commodity prices, as well as increasing geopolitical

uncertainty which has a negative impact on asset values.

Q Given weakness in markets so far this year are you surprised at the positive

returns achieved?

A Whilst markets were down (in sterling terms) 6.5% in the first five months

of 2022, they were up 14.8% in the last seven months of 2021. It really has

been a year where optimism about the earnings and economic growth prospects has

been rapidly replaced by pessimism driven by the prospect for rising interest

rates and inflation, and thus a risk of a global recession.

Another factor to remember is the relative weakness of sterling particularly

against the US dollar which bolstered the valuation of our US dollar

denominated assets, and hence supported net asset value in sterling terms.

Q What were the key contributors and detractors to performance?

A Overall, for the portfolio during the period our stock selection delivered

outperformance. Stock selection was especially strong in the US and Europe and

weak in Asia. We maintained an underweight position in the energy sector

through the period, this was clearly negative given the strong increase in the

oil and gas price. However, over the medium term we see upside in these

companies capped by increasingly punitive tax regimes, and a shift toward

renewable technologies. We are not minded to add to positions now.

Key individual holdings for us included Coca-Cola and PepsiCo which performed

well as the global economy reopened through 2021, and through the more

difficult start to 2022 where their strong brand recognition and historic

strength during periods of weak economic growth were valued by investors.

Overall, our overweight exposure to consumer staples was a positive for the

portfolio.

Elsewhere, our insurance holdings, Zurich Financial and Progressive were also

relatively strong. Once again, their relative insulation from an economic

recession made their shares attractive, as did very strong balance sheets and

above average and growing dividend yields.

We started the period with a position in Meta Platforms (formally known as

Facebook). It performed well, but we grew more concerned around a variety of

governance and social issues as well as its valuation. We disposed of the

holding in the autumn of 2021, a few months before it announced some weak user

datapoints. Such was its weight in the benchmark that not owning through this

period made it one of our key winners in terms of relative performance.

On the negative side, as we described in the half-year management report, our

holding in Tencent, the Chinese based social media, gaming and payments

platform was weak during the late summer of 2021 in response to the tightening

of regulations relating to privacy and online gaming. We have maintained a

position, albeit a reduced one, as we continue to believe the company offers

significant upside. By contrast we disposed of our holding in NetEase, the pure

play Chinese gaming company, as we saw increased restrictions limiting any

share price upside.

One of the most frustrating holdings for us over the year has been Verallia.

Our holding in the French based producer of glass bottlers and containers was

built up through the fourth quarter of 2021. It is a key player in a highly

concentrated industry and a leader in recycling and the reduction of CO2 in

production. Nevertheless, natural gas continues to be essential for production

and the sharp rise in costs fuelled fears over a squeeze on its margins. The

share price has therefore been weak. We remain comfortable that cost increases

can be passed onto customers and the company remains a core holding in the

portfolio.

As mentioned earlier, despite rising tensions in the early part of 2022, we did

not expect a Russian invasion of Ukraine, hence we continued to maintain a

modest position in Sberbank, the leading Russian financial institution. The

market was steadily pricing in the prospect of a war in Ukraine and

consequently the value of Sberbank fell dramatically, with a final write-down

in early March of approximately £35,000 or 6 basis points. As such it was a key

detractor over the period.

Year end

Total Portfolio

Key Contributors Impact % Weight %

Lundin Energy +1.43 3.2

Coca Cola +1.09 4.7

Progressive +0.86 2.5

Standard Chartered +0.73 3.5

Meta Platforms Inc +0.70 -

Year end

Total Portfolio

Key Detractors Impact % Weight %

Tencent -1.51% 2.4

Apple -1.01% -

Sberbank - ADR -0.96% -

Verallia -0.85% 4.6

NetEase -0.71% -

Q How has the portfolio evolved over the period?

A The portfolio has evolved steadily over the year. Whilst our holdings in the

industrial segment of the market have increased somewhat it is primarily due to

the addition of Kone, a Finnish based elevator and escalator manufacturer whose

earnings streams are highly predictable due to the large service and

maintenance component.

We have significantly cut back exposure to the consumer staples sector,

including some of our strong performers such as Coca-Cola, and sold out of

Diageo and Colgate Palmolive. Strong relative performance for the sector means

it now trades at a significant premium to the market. We prefer to deploy

capital to areas we perceive some positive asymmetry in valuation.

Our exposure to big ecommerce and internet names has reduced as we have sold

Meta Platforms and significantly reduced our holding in Alphabet (the parent of

Google). However toward the end of the period we added a position in Universal

Music, the leading global recoding and rights label which was trading at what

we believe to be a discount to its intrinsic value, offers an attractive

dividend and we expect to prove a relatively non-cyclical income stream if we

head to a recession in 2023.

We remain heavily overweight the financial sector, but not in banks where our

key positions remain JPMorgan Chase and Standard Chartered. Our key overweight

remains the insurance sector where we see strong dividend income streams and

valuations which remain attractive with somewhat less risk than banks. Our

holding in 3i, the UK based private equity group, is a key position in the

fund. 3i 's largest holding is a European based discount retailer, Action,

where we see a strong runway for growth for several years ahead of us.

Q What about the healthcare sector? You remain very underweight.

A Healthcare is one of our largest sector underweight positions compared to

benchmark. During the year we disposed of Roche, the Swiss pharmaceutical

company, but added a modest position in Danaher, the US based medical device

and equipment company.

Our caution on the sector stems from the operating environment facing the

sector. Due to patent laws which confer exclusivity on developed medicines for

typically 10-15 years, large pharmaceutical companies continually need to

reinvent themselves, as they have become larger, so it becomes more difficult

to grow as newly developed medicines simply replace those losing patent

protection. Combine that with ongoing price pressure (especially in the US),

makes in our view for an unattractive mix where we struggle to find companies

we want to own.

We do own Novartis, another leading Swiss pharmaceutical company. Whilst its

earnings growth is likely to be modest in the coming three years, it is in our

view relatively low risk, it has a very strong balance sheet and is likely to

pay a growing dividend which is currently worth around 4% per year.

Q How does your analysis of ESG risks impact your stock selection and portfolio

construction?

A We view analysing ESG risks as a key part of our investment process. As

active, fundamental managers we consider every key aspect of a company's true

worth, including material ESG considerations because we believe that the most

sustainable way to make money is to buy companies for less than they are worth.

Establishing an estimated 'fair value' of a company is therefore essential and

this entails incorporating ESG aspects into our investment methodology. We take

a holistic approach where a company's ESG credentials are scrutinised alongside

traditional financial and qualitative aspects to derive a fair value. All

companies face challenges regarding ESG and therefore we have to consider

materiality (the impact of ESG factors on fair value), and ESG momentum (the

potential for ESG improvement over time). Both can influence a stock's

potential returns and our conviction levels in an investment. As shareholders

we actively engage with companies to enhance the value of our investments. We

encourage companies to create sustainable value and mitigate risks in relation

to their corporate activities. This can include prompting them to improve

governance structures, make better asset allocation decisions, instilling

sustainable practices and policies, and providing better disclosure. This

reinforces our fundamental belief that responsible investing demands a

long-term view and that a stakeholder-centric culture of ownership and

stewardship is at the heart.

Further details of the Manager's ESG process, together with examples, are shown

on page 34 to 38.

Q What is your outlook for equity markets over the coming year?

A Truly, this is one of the hardest outlooks to call in my career. Peak to

trough market corrections have ranged from 12-35% over the past 40 years, so

far in 2022 equity markets are currently down 22% (in US dollar terms) On the

one hand I look at a market where the correction from highs achieved in late

December 2021 makes it seem that we are already discounting a mild to moderate

recession. On the other, we are yet to see material downgrades to earnings

expectations, and markets were correcting from a high valuation base.

Our most optimistic scenario is that interest rate rises in the US have already

begun to slow the economy. More will follow in coming months. Mortgage rates

have risen sharply in recent months which has a relatively quick impact on the

housing market. Providing energy prices stabilise, and hopefully begin to fall

by year end, we may be close to a peak in inflation during this cycle. Markets

may well recover strongly toward year end as the market perceives an end to the

monetary policy tightening cycle.

However, we must acknowledge that structural changes in the global economy,

such as a declining availability of labour, together with rising inflationary

expectations throughout most major markets and ongoing shortages of key

commodities, will maintain significant inflationary pressure despite rising

interest rates. Furthermore, we remain concerned that inflationary expectations

are becoming embedded in the labour market. As a result, central banks may be

forced to raise interest rates to higher levels than is currently expected and

create a material slowdown in economic activity to choke off inflationary

pressure. Equity markets could stay under pressure until well into 2023.

We feel our process is well positioned to cope with either the optimistic or

pessimistic scenarios, although in the latter we must acknowledge markets may

have further downside and our objective will be to deliver outperformance

relative to benchmark. We will continue to focus on our process; seeking to

identify competitively advantaged businesses, with no obvious ESG risks, who

generate substantial free cashflow and effectively allocate capital either to

growing the business or return it to shareholders. We seek to buy these

companies at a discount to their long-term intrinsic value.

Stephen Anness

Portfolio Manager

3 August 2022

Global Equity Income Share Portfolio List of Investments

AT 31 May 2022

Ordinary shares unless stated otherwise

At

Market

Value % of

Company Sector? Country £'000 Portfolio

3i Diversified Financials United 3,634 5.4

Kingdom

American Tower Real Estate United 3,499 5.2

States

Microsoft Software and Services United 3,425 5.1

States

Coca-Cola Food, Beverage and Tobacco United 3,163 4.7

States

Verallia Materials France 3,116 4.6

AIA Insurance Hong Kong 2,708 4.0

Broadcom Semiconductors and United 2,568 3.8

Semiconductor Equipment States

Standard Chartered Banks United 2,381 3.5

Kingdom

Zurich Insurance Insurance Switzerland 2,204 3.3

Lundin Energy Energy Sweden 2,167 3.2

Top Ten Holdings 28,865 42.8

Link REIT Real Estate Hong Kong 2,130 3.1

Taiwan Semiconductor Semiconductors and Taiwan 1,998 3.0

Manufacturing Semiconductor Equipment

KKR & Co Diversified Financials United 1,742 2.6

States

Progressive Insurance United 1,695 2.5

States

Union Pacific Transportation United 1,681 2.5

States

Novartis Pharmaceuticals, Biotechnology Switzerland 1,669 2.5

and Life Sciences

Universal Music Media and Entertainment Netherlands 1,661 2.5

TencentR Media and Entertainment China 1,620 2.4

Melrose Industries Capital Goods United 1,584 2.3

Kingdom

Herc Holdings Capital Goods United 1,577 2.3

States

Top Twenty Holdings 46,222 68.5

RELX Commercial and Professional United 1,574 2.3

Services Kingdom

Kone - B Shares Capital Goods Finland 1,555 2.3

PepsiCo Food, Beverage and Tobacco United 1,477 2.2

States

JPMorgan Chase Banks United 1,436 2.1

States

The TJX Companies Retailing United 1,318 1.9

States

Alphabet Media and Entertainment United 1,250 1.8

States

Home Depot Retailing United 1,212 1.8

States

Amazon Retailing United 1,191 1.7

States

Installed Building Consumer Durables and Apparel United 1,159 1.7

Products States

Canadian Pacific Railway Transportation Canada 1,112 1.6

Top Thirty Holdings 59,506 87.9

Texas Instruments Semiconductors and United 1,044 1.5

Semiconductor Equipment States

Accenture - A Shares Software and Services United 998 1.5

States

Nvidia Semiconductors and United 981 1.5

Semiconductor Equipment States

Samsung Electronics - Technology Hardware and South Korea 981 1.5

preference shares Equipment

Rolls-Royce Capital Goods United 817 1.2

Kingdom

Berkeley Consumer Durables and Apparel United 749 1.1

Kingdom

Danaher Pharmaceuticals, Biotechnology United 728 1.1

and Life Sciences States

Volkswagen - preference Automobiles and Components Germany 722 1.1

shares

Ping An InsuranceH Insurance China 698 1.0

Nestlé Food, Beverage and Tobacco Switzerland 406 0.6

Top Forty Holdings 67,630 100.0

SberbankUQ - ADR Banks Russia - -

Total Holdings 41 (2021: 67,630 100.0

40)

UQ Unquoted due to delisting of Russian securities.

ADR American Depositary Receipt - are certificates that represent shares in

the relevant stock and are issued by a US bank. They are denominated and pay

dividends in US dollars.

H H-Shares - shares issued by companies incorporated in the People's

Republic of China ('PRC') and listed on the Hong Kong Stock Exchange.

R Red Chip Holdings - holdings in companies incorporated outside the

PRC, listed on the Hong Kong Stock Exchange, and controlled by PRC entities by

way of direct or indirect shareholding and/or representation on the board.

? MSCI and Standard & Poor's Global Industry Classification Standard.

Balanced Risk Allocation Share Portfolio Manager's Report

Investment Objective

The investment objective of the Balanced Risk Allocation Share Portfolio is to

provide shareholders with an attractive total return in differing economic

environments, and with low to moderate correlation to equity and bond market

indices by gaining exposure to three asset classes: debt securities, equities,

and commodities.

Q How has the strategy performed in the year under review?

A The Balanced Risk Allocation Share Portfolio posted a strong return of 0.3%

over the fiscal year, outperforming the benchmark by 6.4%. The past twelve

months to the end of May 2022 were characterized by consumers unleashing

pent-up demand, fuelled by expiring Covid-19 lockdowns and highly accommodative

fiscal and monetary policy. The elevated demand coupled with ongoing supply

chain issues led to the rise of meaningful and persistent inflation across

developed economies. At the turn of the year, the Russian invasion of Ukraine

further stoked inflation as persistently high demand was now met with supply

constraints due to sanctions on Russian energy, metal and fertilizer exports as

well as fears of poor crop yields on planting delays and adverse weather

conditions. Central banks were forced to shift their characterisation of

inflation as transitory and act through a combination of rate increases and

quantitative tightening efforts to try to catch up to the growing threat. The

inflationary environment strongly benefitted commodities, particularly energy

and agriculture which were top contributors while metals generated smaller

contributions. Equities produced tepid results as early period gains were

surrendered on geopolitical concerns and fears that central bank tightening

could lead to slowing growth and potentially recession. Fixed income exposures

performed poorly as the combination of interest rate hikes and high inflation

overwhelmed any potential gains from geopolitical concerns.

Q What were the biggest contributors and detractors to performance?

A Exposure to commodity markets was the lone positive contributor to results.

Energy commodities delivered the strongest performance due to strong demand,

followed by agriculture where the largest contributions came from cotton,

soybean oil and wheat. Industrial metals benefitted from Russia's attack on

Ukraine as Russian sanctions magnified already existing supply constrains in

aluminium. Copper prices sold off towards the end of the period, resulting in a

minor loss, on fears of a slowdown in growth. Precious metals detracted due to

rising interest rates and a rising US dollar. Silver declined more than gold as

it traded in sympathy with weakness in China and the broader industrial metals

complex.

Exposure to equities detracted from results as four of the six markets in which

the portfolio invests saw prices decline. UK equities were the top contributor

to results in the period as relatively higher exposures to energy, materials,

and aerospace and defence names held up well amid the rise in commodity prices

and the Russian invasion of Ukraine. European shares fell on the Russian

invasion and concerns that the conflict would at least have a negative impact

on economic activity and, at worst, could potentially see further spread in the

region. US small caps saw prices fall as the heightened volatility had

investors cutting risks in higher-beta exposures. Emerging markets fared poorly

on fears of China decoupling from the US and renewed Covid-19 lockdowns.

Exposure to government bonds was the largest detractor from performance with

all six markets producing negative results. Despite ongoing geopolitical

turmoil and another Covid-19 outbreak in China, there was little demand for

government bonds as a haven. Rather, the highest inflation in multiple decades

and soaring commodity prices had fixed income investors fretting over how

aggressive central banks would be in their efforts to curb inflation.

Q How did the tactical allocation perform?

A The tactical allocation detracted from results with losses in equities and

commodities offsetting gains from underweights across bonds. Tactical equity

disappointed primarily due to ill-timed overweights at the beginning of the

year. Tactical commodities detracted largely due to underweights across energy

for most of the period. Tactical bonds contributed due to timely underweights

towards the end of the period.

Q What is your 30-day outlook?

A The current period is one of the toughest environments for investors in some

years. Stocks have experienced their second bear market in just over two years,

and bonds posted two consecutive negative quarters for the first time in four

decades. While commodities have offered some diversification benefits this

year, concerns about central bank efforts to curtail inflation have sparked

fear of declining economic growth, which has hit prices in economically

sensitive complexes like energy and industrial metals. Should the growth scare

materialize alongside evidence of peaking inflation, bonds may be the more

interesting asset class.

Tactical positioning for July includes underweights in emerging markets,

Europe, Japan and US equities, while UK equities are overweight. In fixed

income, the portfolio is overweight Canada, Germany, Japan, the US and

Australia and neutral in the UK. In commodities, the portfolio is underweight

all exposures except Brent crude oil and gasoline.

Scott Wolle

Portfolio Manager

3 August 2022

Balanced Risk Allocation Share Portfolio List of Derivative Instruments

AT 31 May 2022

Notional

Notional Exposure

Exposure as % of

£'000 Net Assets

Government Bond Futures:

Australia 1,670 23.6

Germany 1,289 18.2

Canada 876 12.4

US 772 10.9

Japan 461 6.5

UK 232 3.3

Total Bond Futures (6) 5,300 74.9

Commodity Futures:

Energy

Brent crude 267 3.8

Gasoline 266 3.8

WTI crude 264 3.7

Natural gas 203 2.9

Low sulphur gasoline 190 2.7

New York Harbor ultra-low sulphur diesel 136 1.9

Agriculture

Soyabean 201 2.8

Cotton 194 2.7

Soyabean meal 165 2.3

Soyabean oil 110 1.6

Wheat 86 1.2

Coffee 69 1.0

Corn 60 0.8

Sugar 53 0.7

Precious Metals

Gold 293 4.1

Silver 86 1.2

Industrial Metals

Copper 189 2.7

Aluminium 172 2.4

Total Commodity Futures (18) 3,004 42.3

Equity Futures:

UK 686 9.7

Japan 588 8.3

Emerging markets 297 4.2

Europe 227 3.2

US small cap 222 3.1

Total Equity Futures (5) 2,020 28.5

Total Derivative Instruments (29) 10,324 145.7

Target Annualised Risk

The targeted annualised risk (volatility of monthly returns) for the portfolio

as listed above is analysed as follows:

Asset Class Risk Contribution

Equities 2.9% 37.1%

Commodities 2.9% 36.6%

Fixed Income 2.1% 26.3%

7.9% 100.0%

List of Investments

Market %

Yield value of

% £'000 Portfolio

Short Term Investments

Invesco Liquidity Funds plc - Sterling 0.96 3,512 56.3

UK Treasury Bill - 0% 19 Sep 2022 0.90 747 12.0

UK Treasury Bill - 0% 07 Nov 2022 1.33 547 8.8

UK Treasury Bill - 0% 01 Aug 2022 0.40 499 8.0

UK Treasury Bill - 0% 31 Oct 2022 1.25 448 7.2

UK Treasury Bill - 0% 15 Aug 2022 0.90 276 4.4

UK Treasury Bill - 0% 24 Oct 2022 1.15 199 3.2

Total Short Term Investments 6,228 99.9

Hedge Funds(1)

Harbinger Streamline Offshore Fund 5 0.1

Total Hedge Funds 5 0.1

Total Fixed Asset Investments 6,233 100.0

(1) The hedge fund investments are residual holdings of the previous

investment strategy, which are awaiting realisation of underlying investments.

During the year the prior residual holdings (4 classes) were consolidated into

one holding in a new vehicle.

Derivative instruments held in the Balanced Risk Allocation Share Portfolio are

shown on the previous page. At the year end all the derivative instruments held

in the Balanced Risk Allocation Share Portfolio were exchange traded futures

contracts. Holdings in futures contracts that are not exchange traded are

permitted as explained in the investment policy on page 40.

Managed Liquidity Share Portfolio Manager's Report

Q How does the portfolio generate returns?

A The investment objective of the portfolio is to produce an appropriate level

of income return combined with a high degree of security. We aim to generate

returns by investing mainly in sterling-based high quality debt securities and

similar assets but with the flexibility to invest in assets with a greater

weighted average maturity than a money market fund. Accordingly the value of

the Portfolio may rise or fall.

The majority of the portfolio is invested in the iShares £ Ultrashort Bond ETF.

We reviewed the ETF universe in December 2021 and elected to retain this ETF.

We also hold a portion of the portfolio in the Sterling Liquidity Portfolio of

Invesco Liquidity Funds plc. to meet short term payment obligations.

The iShares £ Ultrashort Bond ETF invests in Sterling denominated investment

grade corporate bonds and quasi-government bonds, aiming to track performance

of the Markit iBoxx GBP Liquid Investment Grade Ultrashort Index and has a

weighted average maturity of around one year.

Q What has the performance of your portfolio been over the last year?

A The Managed Liquidity Portfolio NAV total return for the year ended 31 May

2022 was -0.3%.

The need to begin to raise interest rates to cool demand began as western

economies rebounded more sharply than expected from Covid-19 restrictions. The

inflationary effect of this was expected to be transitory, but was brought into

much sharper relief by Russia's invasion of Ukraine on 24 February. Sadly, the

considerable humanitarian crisis may last some time. Disruption to global

movements of oil, gas and foods could last several years as supply chains

re-adjust. The impact on prices continues to transmit through markets with UK

CPI inflation hitting 9.1% in May. Central banks are now catching up with

substantial interest rate hikes and as a result bond prices have fallen, with

one year interest rates up 1.5% over the year.

This portfolio has a substantially shorter duration of around 0.2 years and so

has been protected to a large extent. Nevertheless, a small fall in NAV is

expected as the impact of rising interest rates more than offset the income

yield of the portfolio.

Q What's the outlook for returns given high inflation and rising interest

rates?

A Higher short term rates have increased the portfolio's yield, with the

average coupon within the iShares £ Ultrashort Bond ETF standing at 1.8% at the

end of June, vs UK base rate of 1.25%. A further six UK central bank interest

rate rises are priced into markets by the end of 2022 (four in the US and

Eurozone). While visibility on price demand and wage growth is weaker than

usual, there are signs that inflation is peaking and growth slowing, as

consumers pull back on spending and companies experience higher input costs.

Should central banks and governments be successful in limiting inflation and/or

should growth slow more abruptly than expected, we could see rates rise by less

than is currently priced, which would lift bond prices.

We continue to expect the portfolio to deliver a meaningful pickup over base

rates while providing ready access to capital with a high degree of security.

Derek Steeden

Portfolio Manager

3 August 2022

Managed Liquidity Share Portfolio List of Investments

AS AT 31 MAY

2022 2021

Market Market

Value % of Value % of

£'000 Portfolio £'000 Portfolio

Invesco Liquidity Funds plc - 130 9.0 140 7.7

Sterling

iShares - Sterling Ultrashort Bond 1,315 91.0 1,669 92.3

UCITS ETF

1,445 100.0 1,809 100.0

Environmental, Social and Corporate Governance ('ESG') statement from the

Managers

UK Equity Share Portfolio & Global Equity Income Share Portfolio

Ciaran Mallon

UK Equities Fund Manager

James Goldstone

UK Equities Fund Manager

Stephen Anness

Global Equities Fund Manager

What does ESG mean to us?

. Investing in stocks which have good Environmental, Social and Governance

('ESG') momentum behind them can be a positive way for our portfolios to

potentially generate returns in excess of the benchmark

. We draw upon ESGintel, Invesco's proprietary tool, which helps us to

better understand how companies are addressing ESG issues

. Engaging with companies to understand corporate strategy today in order to

assess how this could evolve in the future

. Monitoring how companies are performing from an ESG perspective and if the

valuations fairly reflect the progress being made

Our focus as active fund managers is always on finding mispriced stocks and ESG

integration underpins our investment process.

The incorporation of ESG into our investment process considers ESG factors as

inputs into the wider investment process as part of a holistic consideration of

the investment risk and opportunity, from valuation through investment process

to engagement and monitoring. The core aspects of our ESG philosophy include:

materiality; ESG momentum; and engagement.

. Materiality refers to the consideration of ESG issues that are financially

material to the company we are analysing.

. The concept of ESG Momentum, or improving ESG performance over time,

indicates the degree of improvement of various ESG metrics and factors and help

fund managers identify upside in the future. We find that companies which are

improving in terms of their ESG practices may enjoy favourable financial

performance in the longer term.

. Engagement is part of our responsibility as active owners which we take

very seriously, and we see engagement with companies as an opportunity to

encourage continual improvement. Dialogue with portfolio companies is a core

part of the investment process for our investment team. As such, we often

participate in board level dialogue and are instrumental in giving shareholder

views on management, corporate strategy, transparency, and capital allocation

as well as wider ESG aspects.

ESG integration is an ongoing strategic effort to systematically incorporate

ESG Factors into fundamental analysis. The aim is to provide a 360 degree

evaluation of financial and non-financial materially relevant considerations

and to help guide the portfolio strategy.

Our investment process has four stages. In this report we go through in detail

how ESG is integrated into each stage of our process.

Idea Generation

We believe it is important to spread our nets as wide as possible when trying

to come up with stock ideas which may find their way into our portfolios. We

remain open minded as to the type of companies we will consider. This means not

ruling out companies just because they happen to be unpopular at that time and

vice versa. ESG can create opportunities too - for example, the benefits of

moving towards more sustainable sources of energy like wind, solar and

hydroelectric power generation. This was one of the reasons we became

interested in some of our utility holdings which are held in the UK portfolio.

This highlights the importance of opportunities brought about by ESG and not

just the risks. Investing in stocks which have the right ESG momentum behind

them - by focussing on fundamentals and the broader investment landscape - can

be a unique way for our portfolios to potentially generate returns in excess of

the benchmark as those businesses that have got ESG momentum behind them have

the potential to be rerated.

Fundamental Research & ESG Analysis

Research is at the core of what we do. Our fundamental analysis covers many

drivers, for example, corporate strategy, market positioning, competitive

dynamics, the macroeconomic environment, financials, regulation, valuation,

and, of course, ESG considerations, which guide our analysis throughout.

We use a variety of tools from different providers to measure ESG factors. In

addition, at Invesco, we have developed ESGintel, Invesco's proprietary tool

built by our Global ESG research team in collaboration with our Technology

Strategy Innovation and Planning (SIP) team.

ESGintel provides fund managers with environmental, social and governance

insights, metrics, data points and direction of change. In addition, ESGintel

offers fund managers an internal rating on a company, a rating trend, and a

rank against sector peers. The approach ensures a targeted focus on the issues

that matter most for sustainable value creation and risk management.

This provides a holistic view on how a company's value chain is impacted in

different ways by various ESG topics, such as compensation and alignment,

health and safety, and low carbon transition/ climate change.

We always try to meet with a company prior to investment. Based on our

fundamental research, including any ESG findings, we focus on truly

understanding the key drivers and, most importantly, the path to change. This

helps us better understand corporate strategy today and how this could evolve

in the future. Today, the subject of ESG is increasingly part of these

discussions, led by us.

Portfolio Construction

We aim to create a well-diversified portfolio of active positions that reflect

our assessment of the potential upside for each stock weighted against our

assessment of the risks. Sustainability and ESG factors will be assessed

alongside other fundamental drivers of valuation. The impact of any new

purchases will need to be considered at a portfolio level. How will it affect

the shape of the portfolio having regard to objectives, existing positions,

overall size of the portfolio, liquidity and conviction?

We do not seek out stocks which score well on internal or third party research

simply to reduce portfolio risk.

Ongoing Monitoring

Our fund managers and analysts continuously monitor how the stocks are

performing as well as considering possible replacements. Is the company

performing from an ESG perspective and are the valuations fairly reflecting the

progress being made or not?

How do we monitor our holdings from an ESG perspective? Again, the same

resources used during the fundamental stage are available to us. Our regular

meetings with the management teams of the companies we own provides an ideal

platform to discuss key ESG issues, which will be researched in advance. We

draw on our own knowledge as well as relevant analysis from our ESG team and

data from our previously mentioned proprietary system ESGintel which allows us

to monitor progress and improvement against sector peers. Outside of company

management meetings we constantly discuss as a team all relevant ESG issues,

either stimulated internally or from external sources.

Additional ESG analysis is carried out by the team, when warranted, on

particular companies. Such cases would be those that are more controversial,

considered to be higher risk and viewed poorly by ESG providers, resulting in a

valuation discount. We don't just look at the specific issue considered to be

higher risk either, for example the environmental risk of an oil company, but

all areas of ESG. This means undertaking extensive analysis of social and

governance policies and actions at the same time.

Challenge, Assessing & Monitoring Risk

In addition, there are two more formal ways in which our portfolios are

monitored:

There is a rigorous semi-annual review process which includes a meeting led by

the ESG team to assess how our portfolios are performing from an ESG

perspective. This ensures a circular process for identifying flags and

monitoring of improvements over time. These meetings are important in capturing

issues that have developed and evolved whilst we have been shareholders.

There is also the 'CIO challenge', a formal review meeting held between the

Henley Investment Centre's Chief Investment Officer (CIO) and each fund

manager. This review includes a full breakdown of the ESG performance using

Sustainalytics and ISS data, such as the absolute ESG performance of the

portfolio, relative performance to benchmarks, stocks exposed to severe

controversies, top and bottom ESG performers, carbon intensity and trends. The

ESG team review the ESG data and develop stock specific or thematic ESG

questions. The ESG performance of the portfolio is discussed with the CIO using

the data and the stock specific questions to analyse the fund manager's level

of ESG integration. The aim of these meetings is not to prevent a fund manager

from holding any specific stock: rather, what matters is that the fund manager

can evidence understanding of ESG issues and show that they have been taken

into consideration when building the investment case.

Climate Risk

UK Equity Portfolio

A core aspect of our philosophy on ESG issues is the concept of ESG momentum,

or improving ESG performance over time. We find that companies which are

improving in terms of their ESG practices may enjoy favourable financial

performance in the longer term. At first glance it might appear that the

development of the UK Equity Share Portfolio has been at odds with such aims:

as indicated by ISS Scope 1 + 2 measures, Carbon intensity has increased

between by 7% from January 2020 to May 2022 and stands at 171.9, some 9% higher

than the FTSE All-Share Index. However, looking deeper into the detail of the

underlying data, tells a very different tale.

. The carbon intensity of the UK Equity Share Portfolio has over the same