TIDMJEL

RNS Number : 5107K

Jersey Electricity PLC

21 December 2022

JERSEY ELECTRICITY plc

Financial Results Summary

Year Ended 30 September 2022

At a meeting of the Board of Directors held on 20 December 2022,

the final accounts for the year ended 30 September 2022 were

approved and have been published on our website

(www.jec.co.uk).

The financial information set out in this summary does not

constitute the statutory accounts for the year ended 30 September

2022, or 2021, but is derived from those accounts. Statutory

accounts for 2021 have been delivered to the Jersey Registrar of

Companies, and those for 2022 will be delivered in early 2023. The

auditor reported on the accounts for both years and their reports

were unmodified.

A final dividend of 10.80p on the Ordinary and 'A' Ordinary

shares in respect of the year ended 30 September 2022 was

recommended (2021: 10.20p) . Together with the interim dividend of

7.60p (2021: 7.20p) the proposed total dividend declared for the

year was 18.40p on each share (2021: 17.40p).

The final dividend will be paid on 23 March 2023 to those

shareholders registered on 17 February 2023 (not 16 February as

earlier stated). A dividend on the 5% cumulative participating

preference shares of 1.5% (2021: 1.5%) payable on 3 July 2023 was

also recommended.

The Annual General Meeting will be held on 8 March 2022 at 2.00

pm at the Powerhouse, Queen's Road, St Helier, Jersey.

M.P. Magee

Finance Director

Direct telephone number: 01534 505201

Email: mmagee@jec.co.uk

20 December 2022

The Powerhouse

PO Box 45

Queens Road

St Helier

Jersey JE4 8NY

JERSEY ELECTRICITY plc

Financial Results Summary

Year ended 30 September 2022

The Chair, Phil Austin, comments:

The turmoil that beset international energy markets in late 2021

has intensified further due to the escalating conflict between

Russia and Ukraine, leading to a previously unthinkable global

energy crisis. This has presented major new challenges to energy

companies post the pandemic, sending wholesale prices soaring and

threatening supply security throughout Europe. Jersey Electricity

is not immune to these challenges, but we have shown resilience,

returning a strong Group performance and protecting our customers

from the huge retail price rises seen elsewhere, without Government

intervention.

PERFORMANCE

Group revenue for the year at GBP117.4m was 1% lower than last

year and profit before tax was GBP10.6m against GBP19.1m in 2021.

If the non-cash upside from the revaluation of investment

properties is excluded in both years, the underlying year-on-year

profit before tax is GBP9.6m against GBP13.0m in 2021, a fall of

26%. This year's financial performance reflects the effects of

COVID-19 post the pandemic. Coupled with a mild winter, a return to

more normal patterns of work and behaviour has reduced demand, with

both unit volume sales in Energy, and Retail revenues, down on last

year as electricity consumption and Powerhouse product sales

returned to historical levels. The Board has recommended a final

dividend for the year of 10.80p, a 6% rise on the previous year,

payable on 23 March 2023. Our target return on assets continues to

be 6%-7% over the long term and was 4.2% this year, but 6.2% on a

rolling five-year basis.

ENERGY MARKETS

Elsewhere, the scale of the energy crisis has prompted

Governments across Europe to intervene, each in their own way, to

mitigate the impact of the rising prices on their citizens. In the

UK, such Government intervention averted a proposed 80%

year-on-year increase in energy prices in October when Ofgem was

due to raise the regulated price cap to GBP3,549. The new Energy

Price Guarantee now limits this cap to GBP2,500 a year until April

2023 when the cap will be increased to GBP3,000, prompting a

further 20% price rise.

Although our hedging and risk mitigation policies have so far

sheltered Jersey customers from such material price increases, we

are not immune to these market forces. We therefore implemented a

4% tariff rise from 1 January 2022 and a further 5% increase from 1

July 2022, at which time we announced a further 5% tariff increase

effective from 1 January 2023 to give our customers some degree of

certainty for the coming winter period.

CLIMATE CHANGE

Despite the current challenges presented by the global energy

crisis, climate change remains the biggest challenge we all face.

We remain optimistic about the future, however, and the

opportunities a net-zero Jersey will bring. Our low-carbon,

Smart-enabled grid provides a strong platform to support the

Government of Jersey's net-zero 2050 carbon ambitions. In addition,

increased digitalisation of our systems is enabling us to map

scenarios and calculate the investment needed in the network.

Publication of the Government's Carbon Neutral Roadmap in May gives

us confidence to make these investments and ensure we are

well-placed to meet future challenges.

In April 2022, the UK became the first G20 country to introduce

legislation making it mandatory for large businesses to disclose

climate-related financial information in line with the Taskforce on

Climate-related Financial Disclosures (TCFD) recommendations.

Jersey Electricity supports these recommendations and is working

towards full compliance.

ENERGY SECURITY

Although last year's French fishing dispute, which raised

questions about energy sovereignty and the security of imported

power supplies, has been resolved, the global energy crisis has

kept us focused on the issue. To mitigate the supply security

threats the energy crisis is causing in Europe, from where we

imported 95% of our power this year, we have modelled various

scenarios and evaluated our mitigations for technical failures to

the submarine cables and other disruptions to supply. We have also

established contingency plans to implement increased local

emergency generation if required.

To increase energy sovereignty longer term, we are reviewing our

energy sourcing strategies, with more detailed investigations into

the viability of offshore wind generation which has fallen

significantly in cost.

IN CONCLUSION

I would like to thank our entire 'JE family' for their hard

work, commitment and dedication this past year which has presented

renewed challenges post COVID-19. I am immensely proud of what we

have achieved together and the progress we have made on the course

we have set. I also thank my fellow Board members for their hard

work and commitment, and our shareholders for their support. I

remain confident the Company and its people can take advantage of

the opportunities the future holds and meet the challenges it will

demand of us all.

Financial Highlights 2022 2021

Revenue GBP117.4m GBP118.6m

Profit before tax GBP10.6m GBP19.1m

Earnings per share 27.17p 52.73p

Dividend paid per share 17.80p 16.90p

Final proposed dividend per share 10.80p 10.20p

Net cash GBP17.4m GBP13.1m

----------------------------------- ------------ -----------

Group revenue for the year to 30 September 2022 at GBP117.4m was

1% lower than in the previous financial year. Energy revenues at

GBP89.7m were marginally lower than the GBP89.8m achieved in 2021.

Lower unit sales of electricity were linked to a milder winter and

the positive uplift from increased home working, due to COVID-19,

in the previous year. This was offset by a 4% tariff rise from

January 2022 and a 5% rise from 1 July 2022. Revenue in the

Powerhouse retail business decreased 6% from GBP19.8m in 2021 to

GBP18.7m. Revenue in the Property business at GBP2.3m was at the

same level as last year. Revenue from JEBS, our building services

business, remained at the same level as 2021 at GBP3.4m. Revenue in

our other businesses at GBP3.3m, was in line with the prior

year.

Cost of sales at GBP77.2m was GBP3.1m higher than last year with

an increase in wholesale electricity prices offset by the lower

revenue level in our Powerhouse Retail business.

Operating expenses at GBP29.3m were GBP0.7m lower than last

year. The fall is largely due to GBP1.8m incurred in the previous

financial year for a non-cash ex-gratia award for pensions in

service, in our defined benefits pension offset by the increased

spend in systems and people, associated with the de-carbonisation

vision for the Island.

Profit before tax for the year to 30 September 2022 was GBP10.6m

against GBP19.1m in 2021. However, if the non-cash upside from

revaluation of investment properties is excluded in both years the

underlying year on-year profit before tax was GBP9.6m in 2022

against GBP13.0m in 2021, a decrease of 26%.

Profit in our Energy business, at GBP7.5m, was below the

GBP10.7m achieved in 2021, largely due to lower unit sales volumes.

Our target return on assets employed continues to be in the 6%-7%

range over the longer-term and was 4.2% in 2022 against 5.9% in

2021, but 6.2% on a rolling 5-year basis. Unit sales volumes

decreased by 4% from 639m to 613m kilowatt hours, due to milder

than normal weather, combined with the previous year having

benefited from home-working linked to the pandemic. In the

financial year we imported 95.3% of our requirements from France

(2021: 95.2%) and generated 0.3% of our electricity on-Island from

our solar and diesel plant (2021: 0.4%). The remaining 4.4% (2021:

4.4%) of our electricity was purchased from the local Energy from

Waste plant. A customer tariff rise of 4% was instigated on 1

January 2022 and a subsequent 5% increase took place in July 2022

and notice was given that a further 5% rise would take place on 1

January 2023.

The GBP1.4m profit in our Property division, excluding the

impact of investment property revaluation, was at the same level as

last year. Our investment property portfolio moved up in value by

GBP1.0m to GBP28.8m, based on advice from our external consultants,

who review the position annually. This increase compared to GBP6.1m

in the 2020/21 financial year was due primarily to a restructuring

of the lease arrangement for our largest tenant, whereby the

existing break clause was moved to a later date, post commercial

discussions, which materially moved the valuation upwards. The

increase in this financial year was due to continued buoyant market

conditions in the residential sector.

Our Powerhouse retail business saw profits fall 23% from GBP1.5m

to GBP1.2m. However, this is in the context that in the previous

financial year profits rose by 30% by when COVID-19 continued to

influence the behaviours, and spending patterns of local customers,

for example, due to less travel taking place over that year.

JEBS, our building services unit, produced a profit of GBP0.3m,

being marginally ahead of 2021.

Our other business units (Jersey Energy, Jendev, Jersey Deep

Freeze and fibre optic lease rentals) produced profits of GBP0.5m

being GBP0.1m lower than last year.

The net interest cost in 2022 was GBP1.3m being GBP0.1m lower

than 2021 due to a higher level of interest received on deposits.

The taxation charge at GBP2.1m was lower than the previous year,

due to lower profits.

Group basic and diluted earnings per share , at 27.17p, compared

to 52.73p in 2021 due to decreased profitability.

Dividends paid in the year, net of tax, rose by 5%, from 16.90p

in 2021 to 17.80p in 2022. The proposed final dividend for this

year is 10.80p, a 6% rise on the previous year. Dividend cover, at

1.6 times, was lower than the comparable 3.1 times in 2021 due

mainly to the large non-cash increase in the revaluation of

investment properties in 2021.

Net cash flows from operating activities at GBP21.2m was GBP1.2m

lower than in 2021. Investing activities, at GBP11.1m was GBP1.9m

higher than GBP9.2m last year. Dividends paid were GBP5.5m compared

to GBP5.3m in 2021. The resultant position was that net cash at the

year-end was GBP17.4m, being GBP30.0m of borrowings offset by

GBP47.4m of cash and cash equivalents, which was GBP4.3m more than

last year.

Consolidated Income Statement 2022 2021

For the year ended 30 September 2022 GBP000 GBP000

Revenue 117,421 118,608

Cost of sales (77,242) (74,159)

--------- ---------

Gross Profit 40,179 44,449

Revaluation of investment properties 1,020 6,055

Operating expenses (29,293) (29,991)

--------- ---------

Group operating profit 11,906 20,513

Finance income 218 112

Finance costs (1,523) (1,540)

Profit from operations before taxation 10,601 19,085

Taxation (2,135) (2,794)

--------- ---------

Profit from operations after taxation 8,466 16,291

========= =========

Attributable to:

Owners of the Company 8,326 16,155

Non-controlling interests 140 136

--------- ---------

8,466 16,291

========= =========

Earnings per share

- basic and diluted 27.17p 52.73p

Consolidated Statement of Comprehensive 2022 2021

Income

GBP000 GBP000

Profit for the year 8,466 16,291

Items that will not be reclassified subsequently

to profit or loss:

Actuarial gain on defined benefit scheme 8,976 14,803

Income tax relating to items not reclassified (1,795) (2,961)

-------- --------

7,181 11,842

Items that may be reclassified subsequently

to profit or loss:

Fair value gain/(loss) on cash flow hedges 4,815 (3,116)

Income tax relating to items that may be

reclassified (963) 623

-------- --------

3,852 (2,493)

Total comprehensive income for the year 19,499 25,640

Attributable to:

Owners of the Company 19,359 25,504

Non-controlling interests 140 136

-------- --------

19,499 25,640

Consolidated Balance Sheet as at 30 September 2022

2022 2021

GBP 000 GBP 000

NON-CURRENT ASSETS

Intangible assets 967 933

Property,plant and equipment 216,235 216,550

Right of use assets 3,280 3,113

Investment properties 28,830 27,810

Trade and other receivables 300 308

Retirement benefit asset 26,434 18,761

Derivative financial instruments 2,640 108

Other investments 5 5

------------------ -----------------

Total non-current assets 278,691 267,588

--------------------------------------- ------------------ -----------------

CURRENT ASSETS

-------------------------------------- ------------------ -----------------

Inventories 7,173 6,909

Trade and other receivables 19,934 18,000

Derivative financial instruments 483 -

Cash and cash equivalents 47,397 43,136

Total current assets 74,987 68,045

------------------ -----------------

Total assets 353,678 335,633

--------------------------------------- ------------------ -----------------

LIABILITIES

-------------------------------------- ------------------ -----------------

Trade and other payables 21,043 18,373

Current tax liabilites 2,088 3,020

Lease liabilities 69 72

Derivative financial instruments 330 1,256

Total current liabilities 23,530 22,721

------------------ -----------------

NET CURRENT ASSETS 51,457 45,324

---------------------------------------

NON-CURRENT LIABILITIES

-------------------------------------- ------------------ -----------------

Trade and other payables 25,162 24,006

Lease liabilities 3,251 3,035

Derivative financial instruments - 874

Financial liabilities - preference

shares 235 235

Borrowings 30,000 30,000

Deferred tax liabilities 32,126 29,321

Total non-current liabilities 90,774 87,471

------------------ -----------------

Total liabilities 114,304 110,192

------------------ -----------------

Net assets 239,374 225,441

--------------------------------------- ------------------ -----------------

EQUITY

-------------------------------------- ------------------ -----------------

Share capital 1,532 1,532

Revaluation reserve 5,270 5,270

ESOP reserve (38) (79)

Other reserves 2,234 (1,618)

Retained earnings 230,232 220,178

Equity attributable to owners of the

company 239,230 225,283

Non-controlling interests 144 158

------------------ -----------------

Total equity 239,374 205,039

--------------------------------------- ------------------ -----------------

Consolidated Statement of Changes in Equity for the year ended

30 September 2022

Share Revaluation ESOP *Other Retained Total

capital reserve reserve reserves earnings

GBP GBP GBP GBP

000 GBP 000 000 000 000 GBP 000

At 1 October 2021 1,532 5,270 (79) (1,618) 220,178 225,283

Total recognised income

and expense for the year - - - - 8,326 8,326

Amortisation of employee

share option scheme - - 41 - - 41

Movement on hedges (net

of tax) - - - 3,852 - 3,852

Actuarial gain on defined

benefit scheme (net of

tax) - - - - 7,181 7,181

Equity dividends - - - - (5,453) (5,453)

At 30 September 2022 1,532 5,270 (38) 2,234 230,232 239,230

======== ================== =========== ========== ============= ========

At 1 October 2020 1,532 5,270 (120) 875 197,359 204,916

Total recognised income

and expense for the year - - - - 16,155 16,155

Amortisation of employee

share option scheme - - 41 - - 41

Movement on hedges (net

of tax) - - - (2,493) - (2,493)

Actuarial gain on defined

benefit scheme (net of

tax) - - - - 11,842 11,842

Equity dividends - - - - (5,178) (5,178)

At 30 September 2021 1,532 5,270 (79) (1,618) 220,178 225,283

======== ================== =========== ========== ============= ========

Consolidated Statement of Cash Flows 2022 2021

for the year ended 30 September 2022 GBP000 GBP000

CASH FLOWS FROM OPERATING ACTIVITIES

Operating profit 11,906 20,513

Depreciation and amortisation charges 11,094 10,924

Share based reward charges 41 41

Gain on revaluation of investment property (1,020) (6,055)

Pension operating charge less contributions

paid 1,303 3,357

Deemed interest income from hire purchase 50 -

arrangements

Profit on sale of property, plant and

equipment (7) (6)

--------- --------

Operating cash flows before movement in

working capital 23,367 28,774

Working capital adjustments:

Increase in inventories (257) (881)

Increase in trade and other receivables (1,926) (2,263)

Increase in trade and other payables 4,444 904

--------- --------

Net movement in working capital 2,261 (2,240)

Interest paid (1,380) (1,395)

Preference dividends paid (9) (9)

Income taxes paid (3,020) (2,742)

--------- --------

Net cash flows from operating activities 21,219 22,388

CASH FLOWS FROM INVESTING ACTIVITIES

Purchase of property, plant and equipment (11,001) (8,513)

Investment in intangible assets (319) (805)

Deposit interest received 168 112

Net proceeds from disposal of fixed assets 7 6

--------- --------

Net cash flows used in investing activities (11,145) (9,200)

CASH FLOWS FROM FINANCING ACTIVITIES

Equity dividends paid (5,453) (5,178)

Dividends paid to non-controlling interest (154) (101)

Repayment of lease liabilities (206) (297)

--------- --------

Net cash flows used in financing activities (5,813) (5,576)

Net increase in cash and cash equivalents 4,261 7,612

Cash and cash equivalents at beginning

of year 43,136 35,520

Effect of foreign exchange rates - 4

Cash and cash equivalents at end of year 47,397 43,136

Notes to the accounts

Year ended 30 September 2022

1. Basis of Preparation

The consolidated financial statements of Jersey Electricity plc,

for the year ended 30 September 2022, have been prepared in

accordance with International Financial Reporting Standards (IFRS)

as adopted by the European Union (EU), including International

Accounting Standards and Interpretations issued by the

International Financial Reporting Interpretations Committee

(IFRIC). This is consistent with the accounting policies in the 30

September 2021 annual report and accounts and the 31 March 2022

interim report.

While the financial information included in this summary

announcement has been prepared in accordance with the appropriate

recognition and measurement criteria, this announcement does not

itself contain sufficient information to comply with IFRS. Full

financial statements that comply with IFRS have additionally been

published on our website; www.jec.co.uk.

Segmental information

Revenue and profit information are analysed between the business segments

as follows:

2022 2022 2022 2021 2021 2021

External Internal Total External Internal Total

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

Revenue

Energy 89,683 100 89,783 89,780 100 89,880

Building Services 3,365 780 4,145 3,399 645 4,044

Retail 18,695 41 18,736 19,808 68 19,876

Property 2,345 639 2,984 2,304 645 2,949

Other* 3,333 625 3,958 3,317 945 4,262

--------- --------- -------- --------- --------- --------

117,421 2,185 119,606 118,608 2,403 121,011

Intergroup elimination (2,185) (2,403)

-------- --------

Revenue 117,421 118,608

-------- --------

Operating profit

Energy 7,502 10,693

Building Services 266 217

Retail 1,174 1,533

Property 1,436 1,393

Other* 508 622

-------- --------

10,886 14,458

Revaluation of investment properties 1,020 6,055

Operating profit 11,906 20,513

-------- --------

*Other segment includes the divisions of Jersey Energy and

Jendev as well as Jersey Deep Freeze Limited, the Group's sole

subsidiary.

Materially, all the Group's operations are conducted within the

Channel Islands. All transfers between divisions are on an

arms-length basis.

The revaluation of investment properties is shown separately

from Property operating profit as this income is reflected solely

by a movement in reserves.

, the news service of the London Stock Exchange. RNS is approved by

the Financial Conduct Authority to act as a Primary Information

Provider in the United Kingdom. Terms and conditions relating to

the use and distribution of this information may apply. For further

information, please contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR UAUORUNUUUAA

(END) Dow Jones Newswires

December 21, 2022 08:33 ET (13:33 GMT)

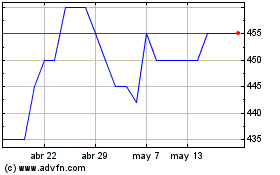

Jersey Electricity (LSE:JEL)

Gráfica de Acción Histórica

De Jun 2024 a Jul 2024

Jersey Electricity (LSE:JEL)

Gráfica de Acción Histórica

De Jul 2023 a Jul 2024