TIDMJSE

RNS Number : 2459N

Jadestone Energy PLC

19 January 2023

Acquisition of interest in Sinphuhorm gas field onshore

Thailand

19 January 2023-Singapore: Jadestone Energy plc ("Jadestone", or

the "Company") an independent oil and gas production company

focused on the Asia-Pacific region, is pleased to announce that it

has executed a sale and purchase agreement (the "Agreement") with

Salamander Energy (S.E. Asia) Limited (the "Seller"), an affiliate

of PT Medco Energi Internasional Tbk, to acquire the Seller's

interest in three legal entities, which collectively own a 9.52%

non-operated interest in the producing Sinphuhorm gas field and a

27.2% interest in the Dong Mun gas discovery onshore northeast

Thailand. The headline cash consideration is US$32.5 million, to be

funded from the Company's cash resources.

Highlights

-- Jadestone is acquiring 4.6 mmboe[1] of 2P Reserves as at an

effective date of 1 January 2022. Based on the headline

consideration of US$32.5 million[2], this represents an acquisition

cost of US$7.1/boe.

! It is anticipated that, due to the effective date of 1 January

2022, the cash consideration on completion will be approximately

US$26.4 million plus working capital.

! Positive cash flow generation from a well-understood

reservoir; stable and predictable gas production of approximately

1,600 boe/d net to Jadestone, based on current rates.

-- Gas is contracted under a long-term high take-or-pay gas

sales agreement with PTT as the buyer at a price linked to high

sulphur fuel oil. Recent gas nominations have consistently exceeded

the daily contract quantity.

-- A first direct step to create significant natural gas

production within Jadestone's portfolio over the medium-term.

-- Scope 1 and 2 GHG intensity of Sinphuhorm operations is

estimated at 7.5kg/boe of CO(2) e, significantly lower than the

upstream average, with the operator exploring plans to develop a

carbon, capture and storage project at the field.

-- Establishes a low-cost platform for growth in Thailand, while

re-engaging directly with PTTEP, Thailand's National Oil Company,

at the same time providing further diversification of the Company's

production base.

-- Sinphuhorm operating costs are approximately US$3/boe and

will decrease the Company's overall unit operating costs.

-- The acquired assets will be managed from Jadestone's existing

Southeast Asia offices, with no incremental G&A expense and

there are very limited abandonment obligations (currently estimated

at c.US$2 million net) associated with the assets.

-- The 9.52% interest in Sinphuhorm generated approximately

US$20 million (unaudited) of EBITDA in 2022.

-- Jadestone estimates payback on the acquisition in circa three

and a half years, with returns significantly in excess of the

Company's hurdle rates.

-- Jadestone sees potential to enhance value through further

infill drilling on the Sinphuhorm field and the potential

development of the Dong Mun discovery.

-- Management believes further equity in the Sinphuhorm gas

field could become available in the near-term.

Paul Blakeley, President and CEO, commented:

"While modest in scale, this opportunistic tuck-in acquisition

is low cost, low emissions intensity and very low decline

production from the onshore Sinphuhorm gas field. The asset is an

excellent addition to our portfolio, diversifying our existing

production base, and is a first important step towards building a

significant natural gas position within our portfolio as part of

our energy transition strategy. Furthermore, these assets carry

minimal abandonment liabilities and are administered under very

attractive Thai I PSC terms with recent extensions to both the

licence and the GSA.

The asset is highly predictable and reliable, running at close

to 100% uptime in 2022 and with a high take-or-pay to a regional

power station for electricity generation. We see upside from

further infill drilling within Sinphuhorm, with wells planned in

2023 and 2024, and the potential development of the Dong Mun gas

discovery, which is 100% owned by APICO, and which represents

upside beyond the consideration paid. Establishing a presence in

Thailand, as well as re-engaging directly with PTTEP, will also

leave us well-positioned to capitalise on further potential asset

divestments that we see coming to market in the near-term."

A short presentation on the acquisition is available on the

Company's website at

https://www.jadestone-energy.com/investor-relations/presentations-communication/

.

Overview of the acquisition

APICO LLC ("APICO"), a joint venture company, holds a 35%

interest in the Sinphuhorm gas field. Jadestone will acquire

interests in three entities (one being APICO directly) in order to

acquire a 27.2% interest in APICO, which equates to the 9.52%

interest in the Sinphuhorm gas field. APICO also owns a 100%

interest in the L27/43 concession, which contains the Dong Mun gas

discovery, and 100% of the L15/43 concession, which is due to be

relinquished.

PTTEP, the exploration and production arm of the Thailand state

oil company PTT, operates the Sinphuhorm gas field development with

an effective 80.5% interest. Exxon owns the remaining 10%

interest.

The acquisition is scheduled to close in February 2023 following

specific corporate actions of the Seller.

Overview of the acquired assets

The Sinphuhorm gas field was discovered in 1983 and commenced

production in 2006. The reservoir is the Permian age fractured

carbonate Pha Nok Khao formation, which contains dry gas with a low

gas condensate ratio of c.4 bbls/mmcf.

The field has been developed with eleven wells, of which ten are

currently producing, drilled from three surface pads in the central

and southern part of the field. Further development well locations

have also been identified. Pressure depletion trends confirm lower

connectivity between the northern and southern parts of the field,

with further development potential existing to the north as a

result. The field produced an average of 97 mmcfd in 2022. A total

of 506 bcf of gas and 2.1 mmbbls of condensate had been produced by

31 December 2021, equating to a 46% recovery factor.

The Sinphuhorm well pads are tied back to a central gas plant

with 140 mmcfd capacity and the ability to stabilise small amounts

of condensate. The plant, with its simple design, enjoys high

reliability, uptime and performance, with a 16-year track record of

safe operations. Operating costs are very low at c.US$3/boe and

decommissioning costs net to the acquired 9.52% interest are

estimated at approximately US$2 million.

Gas from Sinphuhorm is exported via a 64 kilometre pipeline to

the Nam Phong power plant, the largest in northeast Thailand.

Sinphuhorm gas is contracted under a long-term take-or-pay GSA with

PTT, as the gas buyer. The current GSA extends over the remaining

term of the concession, which expires in March 2031. Gas demand has

consistently exceeded 90 mmcfd over the last four years and is

expected to remain strong in the foreseeable future amid declining

regional supplies and high import prices. The Sinphuhorm gas price

is linked to high sulphur fuel oil. Sinphuhorm condensate is sold

to PTT under a long-term condensate sales agreement.

A project to boost compression at the field is already underway

with a gross cost estimate of US$62 million and is expected to be

onstream in Q3 2024. In addition, further infill wells are planned

in 2023 and 2024. Management estimates that at 31 December 2021,

the field contained gross 2P reserves of 288 bcf of gas and 0.82

mmbbls of condensate (27 bcf and 0.08 mmbbls net to Jadestone).

ERCE, Jadestone's reserve auditors, have reviewed management's

methodology and assessment of Sinphuhorm 2P reserves.

Sinphuhorm 2P reserves at 31 December 2021

Licences Field 2P Gross 2P Working Net 2P reserves Operator

Gas Reserves Gross interest attributable

(bcf) Condensate to Jadestone

Reserves (mmboe)

(mmbbls)

EU5

EU-1 Sinphuhorm 288 0.82 9.52% 4.6 PTTEP

------------ -------------- ------------ ---------- ---------------- ---------

Dong Mun 2C resources at 31 December 2021 (based on APICO

estimates)

Licences Field 2C Gross Gas Working Net 2C Resources Operator

Resources (bcf) interest attributable

to Jadestone

(mmboe)

L27/43 Dong Mun 56 27.2% 2.5 APICO

---------- ----------------- ---------- ----------------- ---------

Natural gas from Sinphuhorm plays a critical role in meeting the

increasing demand for cleaner-burning fuel as the Thailand energy

market and economy transitions to a lower carbon future. The

operations at Sinphuhorm have a Scope 1&2 GHG emissions

intensity of 7.5 kg CO2(e) /boe, well below the global upstream

average. The operator of the Sinphuhorm has stated publicly[3] that

it plans to explore the potential for a carbon, capture and storage

project at the field, which could reduce absolute emissions and

intensity even further.

The Dong Mun field is an undeveloped discovery in the L27/43

concession (100% APICO) approximately 80km southeast of Sinphuhorm.

Gas was tested in the PNK carbonate formation (same reservoir

setting as Sinphuhorm) with APICO estimating 56 bcf gross 2C

contingent resources for the discovery. APICO is considering

developing Dong Mun through a phased approach - initially through a

compressed natural gas scheme and then a small-scale LNG

development.

For further information, please contact:

Jadestone Energy plc

Paul Blakeley, President and CEO +65 6324 0359 (Singapore)

Bert-Jaap Dijkstra, Chief Financial Officer +44 7713 687467 (UK)

Phil Corbett, Investor Relations Manager

ir@jadestone-energy.com

Stifel Nicolaus Europe Limited (Nomad, +44 (0) 20 7710 7600 (UK)

Joint Broker)

Callum Stewart

Jason Grossman

Ashton Clanfield

Jefferies International Limited (Joint +44 (0) 20 7029 8000 (UK)

Broker)

Tony White

Will Soutar

Camarco (Public Relations Advisor) +44 (0) 203 757 4980 (UK)

Georgia Edmonds jse@camarco.co.uk

Elfie Kent

Billy Clegg

About Jadestone Energy

Jadestone Energy plc is an independent oil and gas company

focused on the Asia-Pacific region. It has a balanced, low risk,

full cycle portfolio of development, production and exploration

assets in Australia, Malaysia, Indonesia and Vietnam.

The Company has a 100% operated working interest in the Stag

oilfield and in the Montara project, both offshore Australia. Both

the Stag and Montara assets include oil producing fields, with

further development and exploration potential. The Company also has

a 16.67% non-operated interest in the North West Shelf Oil Project

offshore Western Australia, comprising four oil fields containing

significant upside potential through potential infill drilling and

life extension activities.

The Company has interests in four oil producing licences

offshore Peninsular Malaysia; two operated and two non-operated

positions, and has signed an agreement to acquire a non-operated

interest in the Sinphuhorm producing gas field onshore

Thailand.

Further, the Company has a 100% operated working interest in two

gas development blocks in Southwest Vietnam, and an operated 100%

interest in the Lemang PSC, onshore Sumatra, Indonesia, which

includes the Akatara gas field development, where first production

is expected in the first half of 2024.

Led by an experienced management team with a track record of

delivery, who were core to the successful growth of Talisman's

business in Asia, the Company is pursuing an acquisition strategy

focused on growth and creating value through identifying,

acquiring, developing and operating assets in the Asia-Pacific

region.

Jadestone Energy plc (LEI: 21380076GWJ8XDYKVQ37) is listed on

the AIM market of the London Stock Exchange (AIM: JSE). The Company

is headquartered in Singapore. For further information on the

Company please visit www.jadestone-energy.com.

Cautionary Statements

This announcement may contain certain forward-looking statements

with respect to the Company's expectations and plans, strategy,

management's objectives, future performance, production, reserves,

costs, revenues and other trend information. These statements are

made by the Company in good faith based on the information

available at the time of this announcement, but such statements

should be treated with caution due to inherent risks and

uncertainties. These statements and forecasts involve risk and

uncertainty because they relate to events and depend upon

circumstances that may occur in the future. There are a number of

factors which could cause actual results or developments to differ

materially from those expressed or implied by these forward-looking

statements and forecasts. The statements have been made with

reference to forecast price changes, economic conditions and the

current regulatory environment. Nothing in this announcement should

be construed as a profit forecast. Past share performance cannot be

relied upon as a guide to future performance. The Company does not

assume any obligation to publicly update the information, except as

may be required pursuant to applicable laws.

The technical information contained in this announcement has

been prepared in accordance with the June 2018 guidelines endorsed

by the Society of Petroleum Engineers, World Petroleum Congress,

American Association of Petroleum Geologists and Society of

Petroleum Evaluation Engineers Petroleum Resource Management

System.

A. Shahbaz Sikandar of Jadestone Energy plc, Group Subsurface

Manager with a Masters degree in Petroleum Engineering, and who is

a member of the Society of Petroleum Engineers and has worked in

the energy industry for more than 25 years, has read and approved

the technical disclosure in this regulatory announcement.

The information contained within this announcement is considered

to be inside information prior to its release, as defined in

Article 7 of the Market Abuse Regulation No. 596/2014 which is part

of UK law by virtue of the European Union (Withdrawal) Act

2018.

Glossary

2C Resources best estimate contingent resource, being quantities

of hydrocarbons which are estimated, on a given date,

to be potentially recoverable from known accumulations

but which are not currently considered to be commercially

recoverable

2P Reserves the sum of proved and probable reserves. Denotes

the best estimate scenario of reserves

------------------------------------------------------------

bbl barrel of oil

------------------------------------------------------------

bcf billion cubic feet of gas

------------------------------------------------------------

boe barrel of oil equivalent

------------------------------------------------------------

CO(2) e carbon dioxide equivalent

------------------------------------------------------------

EBITDA earnings before interest, tax depreciation and amortisation

------------------------------------------------------------

G&A general and administrative costs

------------------------------------------------------------

GHG greenhouse gas

------------------------------------------------------------

GSA gas sales agreement

------------------------------------------------------------

mmbbls million barrels

------------------------------------------------------------

mmboe million barrels of oil equivalent

------------------------------------------------------------

mmcf million cubic feet of gas

------------------------------------------------------------

mmcfd million cubic feet per day of gas

------------------------------------------------------------

PSC production sharing contract

------------------------------------------------------------

PTTEP PTT Exploration and Production Public Company Limited

------------------------------------------------------------

[1] Management estimate reviewed by ERCE

[2] Based on an effective date of 1 January 2022

[3]

https://www.bangkokpost.com/business/2351281/pttep-allocates-300m-for-ccs-facility

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ACQGPUAWGUPWUQB

(END) Dow Jones Newswires

January 19, 2023 02:00 ET (07:00 GMT)

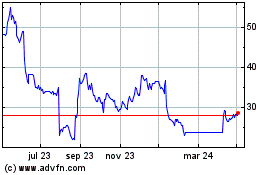

Jadestone Energy (LSE:JSE)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

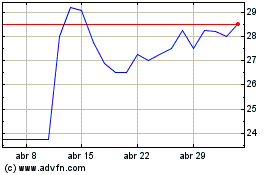

Jadestone Energy (LSE:JSE)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024