TIDMMONY

RNS Number : 8572G

Moneysupermarket.com Group PLC

24 July 2023

24 July 2023

Moneysupermarket.com Group PLC interim results for the six

months ended 30 June 2023

Strong brands and technology platforms drive good trading in

mixed markets

6 months ended 30

June 2023 2022 Growth %

Group revenue GBP213.8m GBP193.2m 11

---------- ---------- ---------

Adjusted EBITDA * GBP67.7m GBP56.6m 20

---------- ---------- ---------

Profit after tax GBP41.0m GBP33.7m 22

---------- ---------- ---------

Adjusted basic EPS

** 8.3p 7.0p 19

---------- ---------- ---------

Basic EPS 7.6p 6.1p 25

---------- ---------- ---------

Operating cashflow GBP41.1m GBP45.9m (10)

---------- ---------- ---------

Net debt *** GBP54.4m GBP69.1m (21)

---------- ---------- ---------

Interim dividend 3.2p 3.1p 3

---------- ---------- ---------

Good trading performance

-- Revenue up 11%, gross margin maintained at 68%; and adjusted EBITDA up 20%.

- Insurance up 23% led by car, winning share in a growing market

rebounding from FCA General Insurance Pricing regulations.

- Travel continued strong recovery in Insurance and Ice Travel Group.

- Headwinds from interest rates hit loans and mortgage

conversion; cost of living impacted broadband.

-- Ready for energy switching return - historically a market

leader. No significant return expected in 2023.

-- Cost discipline in face of inflation - rise in operating costs kept to 3%.

-- Strong cash conversion - GBP41.1m of operating cashflow during the period.

-- Returned to dividend growth - 3% increase to 3.2p, reflecting

our strategic progress, confidence in growth prospects and

continued good cash generation.

Continued s trategic progress

-- Development of data capabilities, common technology and

scalable platforms has laid foundation to start to enhance customer

retention and cross-selling:

- Starting roll out of proprietary 'Dialogue' platform to

improve speed of enquiry across products.

- Trialling a MoneySuperMarket cash rewards and loyalty club: 'SuperSaveClub'.

- Adding "MSE ChatGPT" and testing personalised notifications on the MoneySavingExpert App.

-- Leading platforms for Pay Per Click, Search Engine

Optimisation and Customer Relationship Management now installed and

delivering value.

Peter Duffy, CEO of Moneysupermarket Group, said:

"Our purpose is to help everyone save money on their household

bills, and this has never been more vital as cost-of-living

pressures bite. But it has got to be easy to use our site. And

that's where we've made good progress. The tech behind our trusted

brands has been modernised and made increasingly common across the

Group. The more scalable it is, the more efficient our business is

and the more we can invest in new tools and personalised features

that help people save on more of their bills."

Outlook

This is a strong first half performance, particularly in

Insurance where we have won market share in a growing switching

market. We expect the trends seen in Insurance and Money in the

period to continue. As we said before, we do not expect significant

revenues from energy switching this year. The continued strategic

progress and measures we are taking to drive growth, gives the

Board confidence the Group will be towards the upper end of market

expectations for the year.

Results presentation

A presentation for investors and analysts will be available from

7am at

http://corporate.moneysupermarket.com/Investors/results-centre .

A Q&A session will be held at

9.30am with Peter Duffy (CEO) and Niall McBride (CFO). This

session can be accessed via

https://edge.media-server.com/mmc/p/2j63qs24 .

For further information, contact:

Niall McBride, Chief Financial Officer Niall.McBride@m oneysupermarket.com / 0203 826 4667

Alvaro Aguilar, Strategy & IR Director Alvaro.Aguilar@moneysupermarket.com / 0203 846 2760

Emma Darke, Head of Investor Relations

Emma.Darke@moneysupermarket.com / 0203 846 2434

William Clutterbuck, H/Advisors Maitland W illiam.Clutterbuck@h-advisors.global / 07785 292617

About Moneysupermarket Group

Moneysupermarket Group is a successful digital marketplace

business, driven by a clear purpose of helping households save

money. The Group operates a tech-led savings platform supporting

leading UK brands including price comparison (MoneySupermarket),

cashback (Quidco), a consumer finance content led brand

(MoneySaving Expert) and a B2B business (Decision Tech). Our

purpose is to help households save money by giving them access to

free online tools that enable them to compare and switch products.

We operate a marketplace business model, matching consumers to

providers in an efficient way for both sides. Consumers can come to

a single site, answer a simple question set and let us do the work

of providing them with a wide choice of relevant products. For

providers it is a cost-effective and flexible way to access

millions of customers.

Cautionary note regarding forward looking statements

This announcement includes statements that are forward looking

in nature. Forward looking statements involve known and unknown

risks, assumptions, uncertainties and other factors which may cause

the actual results, performance or achievements of the Company to

be materially different from any future results, performance or

achievements expressed or implied by such forward looking

statements. Except as required by the Listing Rules, Disclosure

Guidance and Transparency Rules and applicable law, the company

undertakes no obligation to update, revise or change any

forward-looking statements to reflect events or developments

occurring on or after the date such statements are published.

Notes:

*Adjusted EBITDA is operating profit before depreciation,

amortisation and impairment and adjusted for other non-underlying

costs as detailed on page 7. This is consistent with how business

performance is measured internally.

**Adjusted basic earnings per share is profit before tax

adjusted for amortisation of acquisition related intangible assets

and other non-underlying costs, divided by the number of weighted

average shares. A reconciliation of adjusted basic earnings per

share to the interim financial statements is included in note

5.

***Net debt is cash and cash equivalents of GBP20.2m (2022:

GBP28.5m) less borrowings of GBP63.0m (2022: GBP84.0m), deferred

consideration of GBP9.8m (2022: GBP13.6m) and loan notes payable to

Podium's non-controlling interest of GBP1.8m (2022: GBPnil). It

does not include lease liabilities.

Quarter 2 trading and H1 performance

Revenue for the 3 Revenue for the 6 months

months ended 30 June ended 30 June 2023

2023

GBPm Growth %* GBPm Growth %*

--------- ---------- --------------

Insurance 55.0 23 105.6 23

Money 25.0 (12) 51.9 (2)

Home Services 9.1 (6) 18.7 (1)

Travel 6.2 28 11.6 42

Cashback 13.9 (1) 29.0 1

Inter-vertical

eliminations* (1.7) 122 (3.0) 114

Total 107.5 7 213.8 11

--------- ------------ ---------- --------------

* Growth % reflects changes to the comparative revenue for each

vertical for the 3 months and 6 months ended 30 June 2022 to align

with the change in presentation of inter-vertical eliminations (see

note 2)

Revenue in the second quarter ended 30 June grew 7%, driven by

strong trading in Insurance and Travel.

-- In Insurance, car and home insurance rebounded to double

digit growth following introduction of the FCA General Insurance

Pricing regulations last year.

-- Money was affected by rising interest rates making loans and

mortgages more expensive. While banking performance (current

accounts and savings products) remained robust in the quarter, it

is lapping a period with very strong savings and current account

deals last year.

-- In Home Services, we saw a fall in broadband switching market

volumes. Mobiles continued in double digit growth, helped by

attractive offers from providers.

-- Travel continued to recover with revenue returning towards

2019 pre-pandemic levels in the quarter. Note that travel insurance

is contained within Insurance.

-- In Cashback, online retail headwinds and the cost-of-living

pressures hit discretionary spending. Travel categories continued

to grow; general retail and broadband products were down.

Business review

Over the last two years, we have developed our advanced data

capabilities, common technology and scalable platforms. Our

efficient acquisition platforms, SA360 for Pay Per Click ('PPC'),

Contentful for Search Engine Optimisation ('SEO') and Braze for

Customer Relationship Management ('CRM') are installed and in use,

attracting customers in a cost-effective way. From this foundation,

we are introducing or trialling more impactful propositions for our

customers as part of our customer retention and cross-sell

strategy.

We continued to fulfil our purpose of saving households money,

and in the first half, the Group saved households an estimated

GBP1.3bn.

MoneySuperMarket ('MSM') is a well trusted "go-to" brand for

price comparison, ahead of our peer group for customer

satisfaction. Direct to site traffic is up more than 25%,

reflecting the success of the MoneySuperSeven advertising campaign.

MSM had 11.3m active users in the 12 months to 30 June 2023. We

continued to drive brand support and build on the MoneySuperSeven

marketing campaign with the launch of a new and well-received

advert starring Dame Judi Dench.

MoneySavingExpert ('MSE' ) continues to help millions of

consumers with information and tools to save money, particularly

valuable during the current cost of living crisis. We've seen

strong uptake with MSE App downloads and nearly 9 million people

receive Martin Lewis's weekly tip email.

Quidco is one of the UK's leading cashback sites. Leveraging the

strength of the Group and using our B2B capabilities, we are now

powering Quidco comparison journeys for car insurance, launched in

February, and home insurance, launched in June, in addition to

broadband, travel and pet insurance.

Ice Travel Group ('ITG') continues to benefit from the

combination of TravelSupermarket and Icelolly.com as the travel

market continues to recover strongly post-pandemic, returning

towards 2019 levels.

The Group is committed to becoming Operational Net Zero by 2030.

We continue to evolve our sustainability strategy and are working

on obtaining approval and verification of our carbon emissions

targets by the Science Based Target initiative with the aim of

submitting our targets by the end of the year. We will continue to

disclose our environmental impact via the Carbon Disclosure

Project, for which we obtained a "C" rating and maintain our

'Beyond Carbon Neutral' status, with our commitment of offsetting

150% of our carbon emissions.

We have maintained our focus on Diversity Equity Inclusion and

Belonging, with a variety of programmes to support colleagues

mental and physical wellbeing, attract diverse talent to our

business and promote awareness.

Strategic progress

-- Efficient acquisition

Our efficient acquisition platforms, SA360 for PPC, Contentful

for SEO and Braze for CRM are installed and being used to attract

users cost-effectively.

We continue to improve the efficiency of our paid search

advertising making more use of our first party data and machine

learning capabilities in SA360. We frequently add new datapoints

and refine and test bidding strategies to continuously improve PPC

performance.

SEO brings substantial volumes of free search traffic to our

sites and remains a dynamic area. In 2023 we extended successful

techniques that worked from MSM to other brands in the Group.

Contentful, the market leading tool we use for SEO is supporting

our strength in core channels, for example we've grown our market

leading position in Broadband in a challenging market

environment.

Braze, our CRM tool, has enabled greater customer engagement

through bespoke email marketing. Using Braze, we can deliver

tailored messages to our users based on progress of their enquiry.

This allows us to find new opportunities to contact our users when

they are in the market. Making our communications more relevant has

improved our conversion rates on campaigns by 9%pts.

-- Retain and grow

The foundations laid since 2021 in our data capability, common

technology and scalable platforms has given us a solid foundation

to deliver customer retention and cross selling. We want to retain

users and help them switch more of their household bills with us,

ultimately increasing customer lifetime value. We do this with

timely reminders and an easier and rewarding experience for

returning users.

We are creating a club that rewards loyalty, the

"SuperSaveClub". The pilot for the SuperSaveClub was launched in

May and we are trialling the reward and loyalty scheme to help

households find even more ways to save. SuperSaveClub members

receive rewards when they buy selected products and get rewards for

referring friends. The Club includes a SuperSave Price Promise

which promises to price match and more if the customer finds a

better deal elsewhere. SuperSaveClub and the Price Promise and are

being trialled in home, car, annual travel insurance and broadband.

The SuperSaveClub also gives access to offers powered through

Quidco, leveraging the breadth of our group.

To simplify the experience for returning users we are rolling

out Dialogue, a proprietary platform that reduces the number of

questions a customer has to complete for each additional product

enquiry. Our proprietary technology stack builds a shared profile

for users across more than one channel meaning for example,

customers wanting to compare a loan or credit card problem can

answer just 3 additional questions instead of 16, whilst still

meeting all the requirements of regulators and providers. We have

launched Dialogue on Loans, Credit Cards, Quidco Compare for Home

and Motor and our SuperSaveClub. Dialogue will not only enable a

simpler user experience by cutting the number of questions, but

also prompt a switch in other products as we highlight to customers

where they could save on further bills.

We continue to develop the MSE App to offer a suite of more

personalised experiences that will help users be in control of

their finances and help them save across a broader range of

categories. We have launched a "single sign on" capability which

will help users by bringing MSE's different clubs and services into

a single account. We have added "Bill Buster", the App's Open

Banking service that finds personalised opportunities to save and

notifies the user when they could save from switching broadband and

mobile tariffs. Our Braze CRM capability has enabled us to push

urgent and relevant MSE content to App users, helping to grow

traffic and foster a habit-forming relationship with the App. It

has also enabled us to test personalised notifications, based on

users' spending habits and interests. Most recently we launched our

prototype 'MSE ChatGPT' on the app so users can interrogate

MoneySavingExpert content via AI technology.

-- Expanding our offer

We continue to grow and expand the portfolio of the Group with

new propositions, distribution routes and channels. In the first

half of 2023 we have made progress in bringing the strength of our

technology and data platform to Quidco and expanded our newest B2B

and tenancy offers. 'Tenancy' is a featured position for a provider

on a site page.

We are expanding the range of services we offer to providers.

Revenue from tenancy, which enables providers to promote their

brands in designated spots on our sites, is up 48%. After starting

this in Money in 2022, tenancy is now live in all our key

verticals. We have extended the range of placements beyond our

results pages, giving providers exposure at different points of the

user journey.

Our Group technology now powers Quidco Compare journeys car and

home, launched in the first half, adding to Home Services, travel

and pet insurance launched in 2022. Braze, the Group CRM platform

is also managing communications with Quidco members, improving

efficiency and personalisation of our offering.

Key performance indicators

The Board reviews key performance indicators (KPIs) to assess

the performance of the business against the Group's strategy. The

KPIs are largely brand focused and therefore span multiple

segments. We measure six key strategic KPIs: estimated group

customer savings, group marketing margin, MSM and MSE net promoter

score, MSM active users, MSM revenue per active user and MSM

cross-channel enquiry.

We will continue to evaluate and broaden the KPIs as needed to

ensure they provide visibility of our strategic progress under a

framework that measures the strength of the Group and our

brands.

30 June 30 June

2023 2022

--------------------------------- -------- --------

Estimated Group customer savings GBP1.3bn GBP0.9bn

Group marketing margin 58% 57%

MSM and MSE net promoter score 71 72

MSM active users 11.3m 10.8m

MSM revenue per active user GBP17.64 GBP15.86

MSM cross-channel enquiry 20.6% 20.6%

--------------------------------- -------- --------

Estimated Group customer savings: This is calculated by

multiplying sales volume by the market average price per

product

based on external data compared to the cheapest deal in the

results table for core

channels. Savings for non-core channels are estimated by

applying the savings for

core channels proportionally to non-core revenue. The cashback

earned by Quidco members is included in this KPI.

Group marketing margin: The inverse relationship between Group

revenue and total marketing spend

represented as a percentage. Total marketing spend is the direct

cost of sales plus

distribution expenses.

MSM and MSE net promoter score: The 12 monthly rolling average

NPS (1 July 2022 - 30 June 2023 inclusive) measured by YouGov Brand

Index service Recommend Score weighted by revenue for MSM and

MSE to create a combined NPS.

MSM active users: The number of unique accounts running

enquiries in our core seven channels for MSM

(car insurance, home insurance, life insurance, travel

insurance, credit cards, loans and

energy) in the last 12-month period.

MSM revenue per active user: The revenue for the core seven MSM

channels divided by the number of active users for the last 12

months.

MSM cross-channel enquiry: The proportion of MSM active users

that enquire in more than one of our core channels

within a 12 month period.

Estimated customer savings increased to GBP1.3bn in the half

driven by strong car insurance volumes and increased savings for

customers from each sale as premiums rose.

The small increase in marketing margin reflects movements in

gross margin, described below, and the timing of brand marketing

spend.

Trust and satisfaction in our brands remained strong despite a

slight decrease in NPS to 71.

Active user numbers rose by 0.5m to 11.3m driven by strong car

performance and the recovery of travel insurance, partly offset by

a modest decline in energy enquiries as the switching market

remained closed.

Revenue per active user grew by GBP1.78p to GBP17.64p with a mix

away from Energy (which currently has negligible conversion because

of a lack of switchable tariffs) and into other higher average

revenue per user channels. Travel insurance in particular showed

higher enquiry volumes and conversion as it recovered following the

pandemic.

The cross-channel enquiry rate was unchanged at 20.6% with

declining energy enquiries compensated by combinations of other

channels, primarily insurance.

Financial review

Group revenue increased 11% to GBP213.8m (2022: GBP193.2m), with

profit after tax increasing 22% to GBP41.0m (2022: GBP33.7m). When

reviewing performance, the Board reviews several adjusted measures,

including adjusted EBITDA which increased 20% to GBP67.7m (2022:

GBP56.6m) and basic adjusted EPS which increased 19% to 8.3p (2022:

7.0p), as shown in the table below.

Extract from the Consolidated Statement of Comprehensive

Income

for the six months ended 30 June

2023 2022 Growth

GBPm GBPm %

------------------------------ ------ ------ ------

Revenue 213.8 193.2 11

Cost of sales (68.4) (62.0) 10

------------------------------ ------ ------ ------

Gross profit 145.4 131.2 11

Operating costs (89.7) (87.4) 3

------------------------------ ------ ------ ------

Operating profit 55.7 43.8 27

Amortisation and depreciation 12.0 12.8 (6)

EBITDA 67.7 56.6 20

------------------------------ ------ ------ ------

Reconciliation to adjusted EBITDA*:

EBITDA 67.7 56.6 20

Adjusted EBITDA 67.7 56.6 20

------------------------------------- ---- ----

Adjusted earnings per share**:

* basic (p) 8.3 7.0 19

* diluted (p) 8.2 7.0 18

------------------------------------- ---- ----

*See footnote on page 2 for definition of Adjusted EBITDA

**A reconciliation of adjusted EPS is included within note

5.

Alternative performance measures

We use a number of alternative (non-Generally Accepted

Accounting Practice ("non-GAAP")) financial measures which are not

defined within IFRS. The Board reviews adjusted EBITDA and adjusted

EPS alongside GAAP measures when reviewing the performance of the

Group. Executive management bonus targets include an adjusted

EBITDA measure and the long-term incentive plans include an

adjusted basic EPS measure.

The adjustments are separately disclosed and are usually items

that are non-underlying to trading activities and that are

significant in size. Alternative performance measures used within

these statements are accompanied with a reference to the relevant

GAAP measure and the adjustments made. These measures should be

considered alongside the IFRS measures.

Revenue

for the six months ended 30 June

2023 2022* Growth

GBPm GBPm %

----------------------------- ----- ----- ------

Insurance 105.6 85.9 23

Money 51.9 53.0 (2)

Home Services 18.7 18.8 (1)

Travel 11.6 8.2 42

Cashback 29.0 28.7 1

Inter-vertical eliminations* (3.0) (1.4) 114

Total 213.8 193.2 11

------------------------------ ----- ----- ------

* The comparative revenue for the period ended 30 June 2022 has

been restated to align with the change in presentation of

inter-vertical eliminations. The inter-vertical eliminations

revenue line reflects transactions where revenue in Cashback and

Travel has also been recorded as cost of sales in other

verticals.

Revenue grew 11% in the half, with double digit growth in

Insurance and Travel offsetting headwinds in other verticals.

Insurance

Insurance revenue increased 23% with all channels in growth and

particularly strong performance in car, the group's largest

insurance channel.

Following the introduction of the FCA General Insurance pricing

regulations which reduced the switching market in 2022, the rebound

in the switching market, rising insurance premiums and the squeeze

on consumer finances, created favourable switching conditions in

car and continued recovery in home.

Travel insurance continued to perform well, in double digit

growth for the half and remains the second-largest insurance

channel by revenue, having surpassed its 2019 level.

Money

Money revenue in Q1 was up 9%, but in Q2, performance lapped a

period last year with particularly attractive banking products

contributing to '23 revenues in Money being overall 2% lower in

H1.

Rising interest rates impacted conversion in loans and

mortgages. This was partly offset by good demand and product

availability in credit cards where we also launched initiatives to

improve user journeys .

Banking performance remained strong, with attractive incentives

to switch available in current accounts.

Home Services

Home Services revenue was down 1%, with less broadband switching

in the market and indications consumers are exiting contracts

because of the cost-of-living pressures. This was mostly offset by

continued double digit growth in mobiles, where attractive deals

were available.

Despite more stable wholesale energy prices in Q2, MSM hosted a

limited size deal in March. Revenues from this were immaterial.

1(st) July was the first time the Energy Price Cap ('EPC') had

fallen below the Energy Price Guarantee ('EPG') since the EPG

inception in October 2022. However, volatility remains in wholesale

energy markets and as yet, only limited deals have been in

market.

Travel

Travel, comprising our Icelolly and TravelSupermarket brands,

continued to grow double digit for the half, up 41% as it continued

its rebound from pandemic related disruption, returning towards

2019 levels.

Cashback

Quidco grew 1% despite continuing headwinds in online retail,

with rising costs of living impacting discretionary spending.

Travel categories continued to grow; general retail and broadband

products were down.

Gross profit

We maintained our gross margin of 68.0%, with gross profit up

11% to GBP145.4m. The margin reflects the strong performance in

insurance and was offset by smaller declines in other verticals

including Money, where rising interest rates impacted conversion in

mortgages and loans, and Home Services, where a weaker broadband

market impacted conversion. Several new B2B contracts won in the

half had a dilutive effect on margin.

Operating costs

for the six months ended 30 June

2023 2022 Growth

GBPm GBPm %

------------------------------------------------------ ---- ---- ------

Distribution expenses 20.6 21.5 (4)

Administrative expenses 69.1 65.9 5

------------------------------------------------------- ---- ---- ------

Operating costs 89.7 87.4 3

------------------------------------------------------- ---- ---- ------

Within administration expenses:

Amortisation of technology related intangible assets 4.4 5.1 (15)

Amortisation of acquisition related intangible assets 5.5 5.2 6

Depreciation 2.1 2.5 (15)

------------------------------------------------------- ---- ---- ------

Amortisation and depreciation 12.0 12.8 (6)

------------------------------------------------------- ---- ---- ------

Operating costs were 3% up on last year reflecting cost

discipline in the face of inflationary pressures.

Distribution costs are 4% down in the half, reflecting marketing

phasing for the second half. We plan to hold distribution costs

flat for the full year, including absorbing additional investment

in the Icelolly brand.

Administrative expenses increased by 5%, driven partly by the

consolidation of Podium post the acquisition of a majority stake in

December 2022. Efficiency gains from simplifying the organisation

and improving our technology estate continued to help offset wider

inflationary pressures and talent market headwinds.

Adjusting items*

for the six months ended 30 June

2023 2022 Growth

GBPm GBPm %

------------------------------------------------------ ---- ---- ------

Amortisation of acquisition related intangible assets 5.5 5.2 6

------------------------------------------------------- ---- ---- ------

* Amortisation of acquisition related intangible assets is not

included in EBITDA and therefore is only included as an adjusting

item in the adjusted EPS calculation.

Amortisation of acquisition related intangible assets relates to

technology, brands and customer / member relationships arising on

the acquisitions of MSE, Decision Tech, CYTI, Quidco and Podium as

well as the combination of TravelSupermarket and Icelolly, in prior

years. These assets are being amortised over periods of three to

ten years. The charge has increased this year due to the

acquisition of Podium in December 2022.

Dividends

The Board has recommended a return to dividend growth with a 3%

increase to the interim dividend to 3.2 pence per share (2022:

3.1p). This reflects the ongoing good cash conversion of the

business, strong balance sheet and the Board's confidence in the

future prospects of the Group.

The interim dividend will be paid on 8 September 2023 to

shareholders on the register on 4 August 2023.

Tax

The effective tax rate of 23.1% is below the UK standard rate of

25.0%. This is primarily due to the change in tax rate from 19.0%

in April 2023, which has resulted in a blended rate for the year of

23.5%. The effective tax rate is lower than this blended rate due

to an adjustment in respect of the prior period which has reduced

the tax charge. Last year, the effective rate of 20.0% was above

the standard rate of 19.0% due to the impact of expenses not

deductible for tax.

Earnings per share

Basic reported earnings per share for the six months ended 30

June 2023 was 7.6p (2022: 6.1p). The increase from last year is

higher than the increase in EBITDA due to lower depreciation and

amortisation partially offset by higher taxation and finance

costs.

Adjusted earnings per share is based on profit before tax before

the adjusting items detailed above. A tax rate of 23.5% (2022:

19.0%) is applied to calculate adjusted profit after tax. The tax

rate this year reflects the change in standard rate from 19.0% to

25.0% in April 2023. Adjusted basic earnings per ordinary share

increased by 19% to 8.3p per share (2022: 7.0p) which is driven by

the increase in EBITDA.

Cashflow and balance sheet

At 30 June 2023, the Group had net assets of GBP210.5m (30 June

2022: GBP196.8m) which included cash and cash equivalents of

GBP20.2m (30 June 2022: GBP28.5m). The Group had net current

liabilities of GBP41.9m (30 June 2022: GBP36.1m) primarily due to

its borrowings falling due within one year of GBP48.0m (30 June

2022: GBP49.0m).

The Group generated operating cash flows of GBP41.1m (30 June

2022: GBP45.9m) and finished the period with a net debt position of

GBP54.4m (30 June 2022: GBP69.1m). Net debt includes GBP63.0m (30

June 2022: GBP84.0m) of borrowings, GBP9.8m (30 June 2022:

GBP13.6m) of deferred consideration and GBP1.8m (30 June 2022:

GBPnil) of loan notes. Deferred consideration in relation to the

Quidco acquisition will be due in H2 subject to legal and

regulatory conditions under the terms of the agreement.

Refinancing of the Revolving Credit Facility (RCF) was delivered

in June, increasing the size of the facility to GBP125m from GBP90m

and extending the maturity from three years to up to five years

providing greater flexibility for the Group. The Group's external

debt comprises GBP28m (30 June 2022: GBP39m) drawn down on the RCF

and GBP35m (30 June 2022: GBP45m) outstanding on an amortising

loan.

The working capital outflow of GBP13.1m comprises an increase in

receivables of GBP20.1m driven by higher revenue compared to the

final quarter of 2022, partially offset by an increase in payables

of GBP7.0m, primarily due to the timing of supplier payments as

well as an increase in trade related spend categories.

Cash outflows on investing activities of GBP6.0m relates to cash

capital expenditure.

Capital expenditure

Capital expenditure was GBP6.0m (2022: GBP5.9m) of which

technology spend was GBP5.6m (2022: GBP5.8m). For the year, we

expect technology capex to be in the region of GBP13m.

We expect the technology amortisation charge for the year to be

in the region of GBP9m, excluding acquired intangibles.

Directors' responsibility statement in respect of the

half-yearly financial report

Each of the directors, whose names and functions are listed

below, confirms that, to the best of his or her knowledge:

-- the condensed set of financial statements has been prepared

in accordance with IAS 34 Interim Financial Reporting as adopted

for use in the UK;

-- the interim management report includes a fair review of the information required by:

(a) DTR 4.2.7R of the Disclosure Guidance and Transparency

Rules, being an indication of important events that have occurred

during the first six months of the financial year and their impact

on the condensed set of financial statements; and a description of

the principal risks and uncertainties for the remaining six months

of the year; and

(b) DTR 4.2.8R of the Disclosure Guidance and Transparency

Rules, being related party transactions that have taken place in

the first six months of the current financial year and that have

materially affected the financial position or performance of the

Group during that period; and any changes in the related party

transactions described in the last annual report that could do

so.

Name Function

Robin Freestone Chair

Peter Duffy Chief Executive Officer

Niall McBride Chief Financial Officer

Caroline Britton Senior Independent Non-Executive Director

Sarah Warby Independent Non-Executive Director

Lesley Jones Independent Non-Executive Director

Rakesh Sharma Independent Non-Executive Director

Mary Beth Christie Independent Non-Executive Director

Consolidated statement of comprehensive income

for the six months ended 30 June 2023 and 30 June 2022

Note 2023 2022

GBPm GBPm

Revenue 2 213.8 193.2

Cost of sales (68.4) (62.0)

---------- ---------

Gross profit 145.4 131.2

Distribution expenses (20.6) (21.5)

Administrative expenses (69.1) (65.9)

Operating profit 55.7 43.8

Finance expense 3 (2.4) (1.7)

Profit before taxation 53.3 42.1

Taxation 4 (12.3) (8.4)

---------- ---------

Profit for the period 41.0 33.7

Other comprehensive income - 0.6

Total comprehensive income for

the period 41.0 34.3

========== =========

Profit attributable to:

Owners of the Company 40.7 33.0

Non-controlling interest 11 0 .3 0.7

---------- ---------

Profit for the period 41.0 33.7

========== =========

Total comprehensive income attributable

to:

Owners of the company 40.7 33.6

Non-controlling interest 11 0 .3 0.7

---------- ---------

Total comprehensive income for

the period 41 .0 34.3

========== =========

Earnings per share:

Basic earnings per ordinary share

(pence) 5 7.6 6.1

Diluted earnings per ordinary

share (pence) 5 7.6 6.1

Consolidated statement of financial position

as at 30 June 2023, 31 December 2022 and 30 June 2022

Note 30 June 31 December 30 June

2023 2022 2022

GBPm GBPm GBPm

Assets

Non-current assets

Property, plant and equipment 33.7 35.4 37.3

Intangible assets and goodwill 7 275.6 279.9 283.9

Equity accounted investments - - 0.1

Other investments 5 .5 5.5 8.1

-------- ------------

Total non-current assets 314.8 320.8 329.4

-------- ------------ --------

Current assets

Trade and other receivables 82.2 63.5 79.3

Prepayments 9.7 8.3 8.9

Current tax assets 0.4 - -

Cash and cash equivalents 20.2 16.6 28.5

--------

Total current assets 112.5 88.4 116.7

-------- ------------

Total assets 427.3 409.2 446.1

======== ============ ========

Liabilities

Non-current liabilities

Borrowings 8 15.0 30.0 35.0

Other payables 26.4 27.7 37.1

Deferred tax liabilities 21.0 22.5 24.4

-------- ------------ --------

Total non-current liabilities 62.4 80.2 96.5

-------- ------------ --------

Current liabilities

Trade and other payables 106.4 99.5 103.2

Borrowings 8 48.0 14.0 49.0

Current tax liabilities - 0.8 0.6

--------

Total current liabilities 154.4 114.3 152.8

-------- ------------ --------

Total liabilities 216.8 194.5 249.3

-------- ------------ --------

Equity

Share capital 0.1 0.1 0.1

Share premium 205.4 205.4 205.4

Reserve for own shares (2.7) (2.4) (2.4)

Retained earnings (62.3) (58.1) (77.0)

Other reserves 63.7 63.7 65.7

-------- ------------ --------

Equity attributable to the

owners of the Company 204.2 208.7 191.8

Non-controlling interest 11 6 .3 6.0 5.0

-------- ------------ --------

Total equity 210.5 214.7 196.8

-------- ------------ --------

Total equity and liabilities 427.3 409.2 446.1

======== ============ ========

Consolidated statement of changes in equity

for the period ended 30 June 2023, 31 December 2022 and 30 June

2022

Equity

attributable

to the

Reserve owners

Share Share for own Retained Other of the Non-controlling Total

capital premium shares earnings reserves Company interest Equity

GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm

At 1 January

2022 0.1 205.4 (2.6) (64.7) 65.1 203.3 4.3 207.6

--------- ---------- --------- ---------- ---------- ------------- ---------------- --------

Profit for the

period - - - 33.0 - 33.0 0.7 33.7

Other

comprehensive

income - - - - 0.6 0.6 - 0.6

--------- ---------- --------- ---------- ---------- ------------- ---------------- --------

Total

comprehensive

income - - - 33.0 0.6 33.6 0.7 34.3

Exercise of LTIP

awards - - 0.2 (0.2) - - - -

Equity dividends - - - (46.2) - (46.2) - (46.2)

Share-based

payments - - - 1.1 - 1.1 - 1.1

--------- ---------- --------- ---------- ---------- ------------- ---------------- --------

At 30 June 2022 0.1 205.4 (2.4) (77.0) 65.7 191.8 5.0 196.8

--------- ---------- --------- ---------- ---------- ------------- ---------------- --------

At 1 July 2022 0.1 205.4 (2.4) (77.0) 65.7 191.8 5.0 196.8

--------- ---------- --------- ---------- ---------- ------------- ---------------- --------

Profit for the

period - - - 35.3 - 35.3 0.3 35.6

Other

comprehensive

income - - - (0.6) (2.0) (2.6) - (2.6)

--------- ---------- --------- ---------- ---------- ------------- ---------------- --------

Total

comprehensive

income - - - 34.7 (2.0) 32.7 0.3 33.0

Acquisition of

subsidiary with

non-controlling

interest - - - - - - 0.7 0.7

Purchase of

shares

by employee

trusts - - (0.3) - - (0.3) - (0.3)

Exercise of LTIP

awards - - 0.3 (0.3) - - - -

Equity dividends - - - (16.6) - (16.6) - (16.6)

Share-based

payments - - - 1.1 - 1.1 - 1.1

At 31 December

2022 0.1 205.4 (2.4) (58.1) 63.7 208.7 6.0 214.7

--------- ---------- --------- ---------- ---------- ------------- ---------------- --------

At 1 January 2023 0.1 205.4 (2.4) (58.1) 63.7 208.7 6.0 214.7

---- ------ ------ ------- ----- ------- ----- -------

Profit for the

period - - - 40.7 - 40.7 0.3 41.0

Other comprehensive - - - - - - - -

income

---- ------ ------ ------- ----- ------- ----- -------

Total comprehensive

income - - - 40.7 - 40.7 0.3 41.0

Purchase of shares

by employee trusts - - (0.5) - - (0.5) - (0.5)

Exercise of LTIP

awards - - 0.2 (0.2) - - - -

Equity dividends - - - (46.2) - (46.2) - (46.2)

Share-based payments - - - 1.5 - 1.5 - 1.5

---- ------ ------ ------- ----- ------- ----- -------

At 30 June 2023 0.1 205.4 (2.7) (62.3) 63.7 204.2 6 .3 210.5

---- ------ ------ ------- ----- ------- ----- -------

Consolidated statement of cash flows

for the six months ended 30 June 2023 and 30 June 2022

2023 2022

GBPm GBPm

Operating activities

Profit for the period 41.0 33.7

Adjustments to reconcile Group

profit to net cash flow from operating

activities:

Amortisation of intangible assets 9.9 10.3

Depreciation of property, plant

and equipment 2.1 2.5

Net finance costs 2.4 1.7

Equity settled share-based payment

transactions 1.5 1.1

Taxation expense 12.3 8.4

Changes in trade and other receivables (20.1) (13.6)

Changes in trade and other payables 7.0 10.7

Taxation paid (15.0) (8.9)

Net cash flow from operating activities 41.1 45.9

-------- --------

Investing activities

Acquisition of property, plant and

equipment (0.4) (0.4)

Acquisition of intangible assets (5.6) (5.5)

Acquisition of subsidiaries, net

of cash acquired - (1.0)

Acquisition of investments - (0.1)

Net cash used in investing activities (6.0) (7.0)

-------- --------

Financing activities

Dividends paid (46.2) (46.2)

Purchase of shares by employee trusts (0.5) -

Proceeds from borrowings 40.0 44.0

Repayment of borrowings (21.0) (17.5)

Interest paid (2.4) (1.8)

Repayment of lease liabilities (1.4) (1.4)

Net cash used in financing activities (31.5) (22.9)

Net increase in cash and cash equivalents 3 .6 16.0

Cash and cash equivalents at 1 January 16.6 12.5

-------- --------

Cash and cash equivalents at 30

June 20.2 28.5

======== ========

Notes

1. Basis of preparation

Moneysupermarket.com Group PLC (the Company) is a public limited

company registered and domiciled in England and Wales and listed on

the London Stock Exchange.

The financial statements are prepared on the historical cost

basis. Comparative figures presented in the financial statements

represent the six months ended 30 June 2022.

The financial statements have been prepared on the same basis as

those for the year ended 31 December 2022.

Statement of compliance

This condensed set of financial statements has been prepared in

accordance with IAS 34 - Interim Financial Reporting as adopted for

use in the UK.

The annual financial statements of the group are prepared in

accordance with UK-adopted international accounting standards. As

required by the Disclosure Guidance and Transparency Rules of the

Financial Conduct Authority, the condensed set of financial

statements has been prepared applying the accounting policies and

presentation that were applied in the preparation of the company's

published consolidated financial statements for the year ended 31

December 2022.

These condensed consolidated interim financial statements were

approved by the board of directors on 21 July 2023.

Going concern

The Directors have prepared the condensed set of consolidated

interim financial statements on a going concern basis for the

following reasons.

As at 30 June 2023, the Group's external debt comprised an

amortising loan (with a balance outstanding of GBP35m, repayable by

October 2024) and a revolving credit facility ('RCF'), (of which

GBP28m of the GBP125m available was drawn down). In June 2023, the

RCF was increased from GBP90m to GBP125m and its term was extended

from three to four years, with the option of a further year. This

means that the current RCF is due for renewal in June 2027 unless

the option of an additional year is taken. Since 30 June 2023, no

further amounts have been drawn down on the RCF and repayments of

GBP7.5m have been made. The operations of the business have been

impacted by macroeconomic uncertainty caused by high inflation and

rising interest rates, as well as the continued impact of high

wholesale prices on the energy switching market. However, the Group

remains profitable, cash generative and compliant with the

covenants of the bank loan and RCF.

The Directors have prepared cash flow forecasts for the Group

for a period of at least 12 months from the date of approval of the

condensed set of consolidated interim financial statements. The

Directors note the Group's net current liability position and have

also considered the effect of potential cost-of-living trading

headwinds and recession and competition such as new entrants upon

the Group's business, financial position, and liquidity in severe,

but plausible, downside scenarios. The scenarios modelled take into

account the potential downside trading impacts from recession,

sustained cost-of-living increases, competitive pressures and any

one-off cash impacts on top of a base scenario derived from the

Group's latest forecasts. The severe, but plausible, downside

scenarios modelled, under a detailed exercise at a channel level,

included minimal recovery over the period of the cash flow

forecasts and in the most severe scenarios reflected some of the

possible cost mitigations that could be taken. The impact these

scenarios have on the financial resources, including the extent of

utilisation of the available debt arrangements and impact on

covenant calculations has been modelled. The possible mitigating

circumstances and actions in the event of such scenarios occurring

that were considered by the Directors included cost mitigations

such as a reduction in the ordinary dividend payment, a reduction

in operating expenses or the slowdown of capital expenditure. A

reverse stress test has also been performed, which assumes the

maximum available drawdown of borrowings, whilst maintaining

covenant compliance.

The scenarios modelled and the reverse stress test showed that

the Group will be able to operate at adequate levels of liquidity

for at least the next 12 months from the date of signing the

condensed set of consolidated interim financial statements. The

Directors, therefore, consider that the Group has adequate

resources to continue in operational existence for at least 12

months from the date of approval of the condensed set of

consolidated interim financial statements and have prepared them on

a going concern basis.

2. Segmental information

Below we report a measure of profitability at segment level that

reflects the way performance is assessed internally. The Group has

a number of teams, capabilities and infrastructure which are used

to support all verticals e.g. data platform and brand marketing.

These are shared costs of the Group rather than "central costs". We

have concluded there is no direct or accurate basis for allocating

these costs to the operating segments and therefore they are

disclosed separately, which is how they are presented to the Chief

Operating Decision Maker.

The Group's reportable segments are Insurance, Money, Home

Services, Travel and Cashback. These segments represent individual

trading verticals which are reported separately for revenue and

directly attributable expenses. Net finance costs, tax and net

assets are only reviewed by the Chief Operating Decision Maker at a

consolidated level and therefore have not been allocated between

segments. All assets held by the Group are located in the UK.

The following summary describes the products and services in

each segment.

Segment Products and services

------------- --------------------------------------------------------------

Insurance Customer completes transaction for insurance policy

on any of the following: provider website, our website

or a telephone call.

Money Customer completes transaction for money products such

as credit cards, loans and mortgages on provider website.

Home Services Customer completes transaction for home services products

such as energy and broadband on provider website.

Travel Customer completes transaction for travel products

on provider website or our website.

Cashback Customer completes transaction for retail, telecommunications,

services and travel products with a cashback incentive

on merchant website. Customer receives confirmed cashback

incentive on our site.

------------- --------------------------------------------------------------

Segment

Home Shared Inter-vertical

Insurance Money Services Travel Cashback costs eliminations Total

GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm

------------------------- --------- ------ --------- ------ -------- ------ ---------------- -------

Period ended 30

June 2023

Revenue 105.6 51.9 18.7 11.6 29.0 - (3.0) 213.8

Directly attributable

expenses (45.3) (16.9) (6.2) (8.2) (24.0) (48.5) 3.0 (146.1)

------------------------- --------- ------ --------- ------ -------- ------ ---------------- -------

Adj. EBITDA contribution 60.3 35.0 12.5 3.4 5.0 (48.5) - 67.7

Adj. EBITDA contribution 67 67 29

margin* 57 % % % % 17 % - 32 %

Depreciation and

amortisation (12.0)

Net finance costs (2.4)

Profit before tax 53.3

Taxation (12.3)

------------------------- --------- ------ --------- ------ -------- ------ ---------------- -------

Profit for the period 41.0

------------------------- --------- ------ --------- ------ -------- ------ ---------------- -------

Segment

Home Shared Inter-vertical

Insurance Money Services Travel Cashback costs eliminations** Total

GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm

------------------------- --------- ------ --------- ------ -------- ------ ---------------- -------

Period ended 30

June 2022**

Revenue 85.9 53.0 18.8 8.2 28.7 - (1.4) 193.2

Directly attributable

expenses (37.5) (16.1) (7.5) (4.8) (23.3) (48.8) 1.4 (136.6)

------------------------- --------- ------ --------- ------ -------- ------ ---------------- -------

Adj. EBITDA contribution 48.4 36.9 11.3 3.4 5.4 (48.8) - 56.6

Adj. EBITDA contribution 42

margin* 56 % 70% 60% % 19 % - 29%

Depreciation and

amortisation (12.8)

Net finance costs (1.7)

Profit before tax 42.1

Taxation (8.4)

------------------------- --------- ------ --------- ------ -------- ------ ---------------- -------

Profit for the period 33.7

------------------------- --------- ------ --------- ------ -------- ------ ---------------- -------

* Adjusted EBITDA contribution margin is calculated by dividing

adjusted EBITDA contribution by revenue.

** The comparative revenue and directly attributable expenses

for the period ended 30 June 2022 have been restated to align with

the change in presentation of inter-vertical eliminations. The

inter-vertical eliminations revenue line reflects transactions

where revenue in Cashback and Travel has also been recorded as cost

of sales in other verticals.

Insurance adjusted EBITDA contribution margin increased from 56%

to 57%, mixing into higher margin channels and effective cost

control.

Money saw a reduction in adjusted EBITDA contribution margin

from 70% to 67%, primarily reflecting the Podium acquisition at the

end of last year.

Home Services adjusted EBITDA contribution margin improved from

60% to 67%, with a temporary reduction due to redistribution of

operating costs relating to the energy market.

Travel adjusted EBITDA contribution margin declined from 42% to

29% with reduced marketing spend in the prior year when the sector

was early in its post-covid recovery.

Margin for Cashback is significantly lower than other verticals

as a large proportion of commission is paid out to members as

cashback. Adjusted EBITDA contribution margin decreased from 19% to

17% reflecting increased investment in growth.

Shared costs stayed broadly flat year on year with disciplined

cost control offsetting inflation.

3. Finance expense

2023 2022

GBPm GBPm

Revolving credit facility 0.5 0.5

Bank loan 1.3 0.6

Leases 0.5 0.5

Loan notes 0.1 -

2.4 1.7

====== ===========

4. Taxation

The effective tax rate of 23.1% is below the UK standard rate of

25.0%. This is primarily due to the change in tax rate in April

2023, which has resulted in a blended rate for the year of 23.5%.

The effective tax rate is lower than this blended rate due to an

adjustment in respect of the prior period which has reduced the tax

charge. For the six months ended 30 June 2022, the effective rate

was 20% which was above the standard rate of 19.0% due to the

impact of expenses not deductible for tax.

2023 2022

GBPm GBPm

Current tax

Current tax on income for the period 14 .3 9.4

Adjustments in respect of prior (0.4) -

periods

13.9 9.4

------ ------

Deferred tax

Origination and reversal of temporary

differences (1.6) (1.0)

(1.6) (1.0)

------ ------

12.3 8.4

====== ======

5. Earnings per share

Basic earnings per share

Basic earnings per share is calculated by dividing the profit or

loss for the period attributable to ordinary equity holders of the

Company, by the weighted average number of ordinary shares

outstanding during the period. The Company's own shares held by

employee trusts are excluded when calculating the weighted average

number of ordinary shares outstanding.

Diluted earnings per share

Diluted earnings per share is calculated by dividing the profit

or loss for the period attributable to ordinary equity holders of

the Company, by the weighted average number of ordinary shares

outstanding during the period plus the weighted average number of

ordinary shares that would be issued on the conversion of all

dilutive potential ordinary shares into ordinary shares.

Basic and diluted earnings per share have been calculated on the

following basis:

2023 2022

GBPm GBPm

Profit after taxation attributable to the owners

of the Company 40.7 33.0

Basic weighted average ordinary shares in issue

(millions) 536.4 536.4

Dilutive effect of share-based instruments (millions) 2.4 0.7

------- ------

Diluted weighted average ordinary shares in issue

(millions) 538.8 537.1

======= ======

Basic earnings per ordinary share (pence) 7.6 6.1

Diluted earnings per ordinary share (pence) 7.6 6.1

Adjusted basic and diluted earnings per share are based on profit

before tax after adding back adjusting items. They have been

calculated as follows:

2023 2022

GBPm GBPm

Profit before tax 53.3 42.1

Adjusted for profit before tax attributable to

non-controlling interest (0.4) (0.9)

------- ------

Profit before tax attributable to the owners of

the Company 52.9 41.2

Amortisation of acquisition related intangible

assets 5.5 5.2

Amortisation of acquisition related intangible

assets attributable to non-controlling interest (0.4) (0.2)

58.0 46.2

Estimated taxation at 23.5%* (2022: 19%) (13.6) (8.8)

------- ------

Profit for adjusted EPS purposes 44.4 37.4

======= ======

Adjusted basic earnings per share (pence) 8.3 7.0

Adjusted diluted earnings per share (pence) 8.2 7.0

* Estimated taxation at 23.5% is derived from the standard rate

of corporation tax increasing from 19% to 25% in April 2023.

6. Dividends

2023 2022

GBPm GBPm

Equity dividends on ordinary shares:

Final dividend for 2022: 8.61 pence per share

(2021: 8.61 pence per share) 46.2 46.2

Proposed for approval (not recognised as a liability

as at 30 June):

Interim dividend for 2023: 3.20 pence per share

(2022: 3.10 pence per share) 17.2 16.6

7. Intangible assets

Market Customer Technology

related relationships related Goodwill Total

GBPm GBPm GBPm GBPm GBPm

Cost

At 1 January 2022 169.6 21.2 123.4 289.1 603.3

Additions - - 5.8 - 5.8

Transfers - 0.5 (0.5) -

-------- -------------- ---------- -------- -----

At 30 June 2022 169.6 21.2 129.7 288.6 609.1

======== ============== ========== ======== =====

Amortisation

At 1 January 2022 150.5 0.4 89.7 74.3 314.9

Charge for the period 1.5 1.0 7.8 - 10.3

-------- -------------- ---------- -------- -----

At 30 June 2022 152.0 1.4 97.5 74.3 325.2

======== ============== ========== ======== =====

Carrying value

At 1 January 2022 19.1 20.8 33.7 214.8 288.4

At 30 June 2022 17.6 19.8 32.2 214.3 283.9

======== ============== ========== ======== =====

Cost

At 1 January 2023 169.6 21.2 137.1 288.6 616.5

Additions - - 5.6 - 5.6

At 30 June 2023 169.6 21.2 142.7 288.6 622.1

======== ============== ========== ======== =====

Amortisation

At 1 January 2023 153.3 2.5 106.5 74.3 336.6

Charge for the period 1.0 1.1 7.8 - 9.9

At 30 June 2023 154.3 3.6 114.3 74.3 346.5

======== ============== ========== ======== =====

Carrying value

At 1 January 2023 16.3 18.7 30.6 214.3 279.9

At 30 June 2023 15.3 17.6 28.4 214.3 275.6

======== ============== ========== ======== =====

Goodwill is allocated to each vertical, or cash generating unit

('CGU'), as follows:

30 June 31 December 30 June

2023 2022 2022

GBPm GBPm GBPm

Insurance 46.5 46.5 46.5

Money 33.2 33.2 33.2

Home Services 54.8 54.8 54.8

Travel 11.5 11.5 11.5

Cashback 68.3 68.3 68.3

------- -------------- -------

214.3 214.3 214.3

======= ============== =======

The Group had significant balances relating to goodwill as at 30

June 2023 as a result of acquisitions of businesses in previous

years. Goodwill balances are tested annually for impairment or if

events or changes in circumstances indicate that the carrying

amount of these assets may not be recoverable.

In accordance with IAS 36 - Impairment of Assets, the Group has

considered whether there have been any indicators of impairment

during the six months ended 30 June 2023, which would require an

impairment review to be performed. The continued impact of high

inflation and rising interest rates on discretionary online spend

has been identified as an indicator of impairment in the Cashback

CGU. We have therefore performed an impairment test on this CGU

which demonstrated that the recoverable amount of the assets

allocated to it exceeds their carrying value by GBP14m.

The recoverable amount is a value in use derived from the latest

Board approved five-year forecast which requires the Group to make

judgements over key inputs. These are revenue growth, terminal

growth and the discount rate applied to cash flows.

The assumed terminal growth rate is 2.8% (31 December 2022:

2.7%) which is an average rate taken from the UK Gross Domestic

Product growth rates calculated by the Office for Budget

Responsibility. A compound annual revenue growth rate (CAGR) is

implied in the five year cashflow forecasts based on external

source market data and management's view of growth in the active

member base due to initiatives that are being introduced. A pre-tax

discount rate of 15.3% has been applied (31 December 2022: 15.5%).

This reflects a change in approach from the year end with regards

to the discount rate. The cashflow forecasts have been risk

adjusted and the risk premium that was previously applied to the

Cashback CGU has been removed. This decrease in the discount rate

has been offset by an increase in the underlying rate arising from

macroeconomic factors.

The value in use is sensitive to key assumptions such as the

discount rate and revenue. An increase in the discount rate to 16%

would reduce the headroom to GBP9m. A reduction in the revenue CAGR

by 30% would bring the headroom down to GBPnil.

No indicators of impairment were identified in respect of the

Group's other CGUs.

8. Borrowings

30 June 31 December 30 June

2023 2022 2022

GBPm GBPm GBPm

Non-current

Loan 15.0 30.0 35.0

======== ============ ========

Current

Revolving credit facility 28.0 4.0 39.0

Loan 20.0 10.0 10.0

-------- ------------ --------

48.0 14.0 49.0

======== ============ ========

In June 2023, the revolving credit facility was increased from

GBP90m to GBP125m and its term was extended from three years to up

to five years.

9. Related party transactions

Peter Duffy, Robin Freestone and Rakesh Sharma in total received

dividends from the Group totalling GBP23,108 (2022: Peter Duffy,

Robin Freestone, Scilla Grimble, James Bilefield and Sally James in

total received GBP27,560).

10. Commitments and contingencies

At 30 June 2023, the Group was committed to incur future capital

expenditure of GBP1.2m (2022: GBPnil).

Comparable with most companies of our size, the Group is a

defendant in a small number of disputes incidental to its

operations and from time to time is under regulatory scrutiny.

As a leading website operator, the Group occasionally

experiences operational issues as a result of technological

oversights that in some instances can lead to customer detriment,

dispute and potential cash outflows. The Group has a professional

indemnity insurance policy in order to mitigate liabilities arising

out of events such as this. The contingencies outlined above are

not expected to have a material adverse effect on the Group.

11. Non-controlling interest

The Group recognises two non-controlling interests, one in

respect of Ice Travel Group Limited and its two wholly owned

subsidiaries Travelsupermarket Limited and Icelolly Marketing

Limited (together "Ice Travel Group"), and secondly in respect of

Podium Solutions Limited.

The following table summarises the financial performance and

position of these companies at the period end before any

intra-group eliminations.

At 30 June 2023 Podium Solutions Limited Ice Travel Group Total

------------------------ ---------------- -----

Non-controlling interest 48% 33%

------------------------ ---------------- -----

GBPm GBPm GBPm

Non-current assets* 2.7 14.4 17.1

Current assets 0.3 10.9 11.2

Non-current liabilities (1.9) (5.3) (7.2)

Current liabilities (0.3) (2.2) (2.5)

------------------------ ---------------- -----

Net assets 0.8 17.8 18.6

------------------------ ---------------- -----

Net assets attributable to non-controlling interest 0.4 5.9 6.3

======================== ================ =====

Revenue 0.2 11.4 11.6

(Loss)/profit (0.8) 2.0 1.2

Total comprehensive income (0.8) 2.0 1.2

======================== ================ =====

(Loss)/profit attributable to the non-controlling interest (0.4) 0.7 0.3

Total comprehensive income attributable to non-controlling

interest (0.4) 0.7 0.3

======================== ================ =====

Cash flows from operating activities 0.0 0.9 0.9

Cash flows from investing activities (0.0) (0.4) (0.4)

Cash flows from financing activities - (0.3) (0.3)

------------------------ ---------------- -----

Net increase in cash and cash equivalents 0.0 0.2 0.2

======================== ================ =====

At 30 June 2022 Podium Solutions Limited Ice Travel Group Total

------------------------ ---------------- -----

Non-controlling interest - 33%

------------------------ ---------------- -----

GBPm GBPm GBPm

Non-current assets* - 14.5 14.5

Current assets - 7.5 7.5

Non-current liabilities - (0.3) (0.3)

Current liabilities - (6.6) (6.6)

------------------------ ---------------- -----

Net assets - 15.1 15.1

------------------------ ---------------- -----

Net assets attributable to non-controlling interest - 5.0 5.0

======================== ================ =====

Revenue - 8.0 8.0

Profit - 2.2 2.2

Total comprehensive income - 2.2 2.2

======================== ================ =====

Profit attributable to the non-controlling interest - 0.7 0.7

Total comprehensive income attributable to non-controlling

interest - 0.7 0.7

======================== ================ =====

Cash flows from operating activities - 1.9 1.9

Cash flows from investing activities - (0.1) (0.1)

Cash flows from financing activities - (0.1) (0.1)

------------------------ ---------------- -----

Net increase in cash and cash equivalents - 1.7 1.7

======================== ================ =====

* Non-current assets for Travelsupermarket Limited include

GBP7.4m of goodwill that was recognised on the Group's balance

sheet prior to the acquisition of ITG.

Profit and total comprehensive income for the period in respect

of Podium Solutions Limited and Ice Travel Group includes

amortisation of intangibles relating to the acquisition of these

companies by the Group of GBP0.8m (2022: GBP0.3m). Included in the

profit and total comprehensive income attributable to the

non-controlling interest is GBP0.4m (2022: GBP0.2m) of amortisation

of acquired intangibles.

Appendix

Statutory Information

The financial information set out above does not constitute the

Company's statutory accounts for the six months ended 30 June 2023

or 30 June 2022 but is derived from those accounts. The auditor has

reported on those accounts; their reports were (i) unqualified,

(ii) did not include a reference to any matters to which the

auditor drew attention by way of emphasis without qualifying their

report and (iii) did not contain a statement under section 498 (2)

or (3) of the Companies Act 2006.

The Annual General Meeting took place on 4 May 2023. The interim

dividend will be paid on 8 September 2023 to shareholders on the

register at the close of business on 4 August 2023.

Presentation of figures

Certain figures contained in this announcement, including

financial information, have been subject to rounding adjustments.

Accordingly, in certain instances, the sum or percentage change of

the numbers contained in this announcement may not conform exactly

with the total figure given.

Independent Review Report to Moneysupermarket.com Group Plc

Conclusion

We have been engaged by Moneysupermarket.com Group plc ("the

company") to review the condensed set of financial statements in

the half-yearly financial report for the six months ended 30 June

2023 which comprises the consolidated statement of comprehensive

income, consolidated statement of financial position, consolidated

statement of changes in equity, consolidated statement of cash

flows and the related explanatory notes.

Based on our review, nothing has come to our attention that

causes us to believe that the condensed set of financial statements

in the half-yearly financial report for the six months ended 30

June 2023 is not prepared, in all material respects, in accordance

with IAS 34 Interim Financial Reporting as adopted for use in the

UK and the Disclosure Guidance and Transparency Rules ("the DTR")

of the UK's Financial Conduct Authority ("the UK FCA").

Basis for conclusion

We conducted our review in accordance with International

Standard on Review Engagements (UK) 2410 Review of Interim

Financial Information Performed by the Independent Auditor of the

Entity ("ISRE (UK) 2410") issued for use in the UK. A review of

interim financial information consists of making enquiries,

primarily of persons responsible for financial and accounting

matters, and applying analytical and other review procedures. We

read the other information contained in the half-yearly financial

report and consider whether it contains any apparent misstatements

or material inconsistencies with the information in the condensed

set of financial statements.

A review is substantially less in scope than an audit conducted

in accordance with International Standards on Auditing (UK) and

consequently does not enable us to obtain assurance that we would

become aware of all significant matters that might be identified in

an audit. Accordingly, we do not express an audit opinion.

Conclusions relating to going concern

Based on our review procedures, which are less extensive than

those performed in an audit as described in the Basis of conclusion

section of this report, nothing has come to our attention that

causes us to believe that the directors have inappropriately

adopted the going concern basis of accounting, or that the

directors have identified material uncertainties relating to going

concern that have not been appropriately disclosed.

This conclusion is based on the review procedures performed in

accordance with ISRE (UK) 2410. However, future events or

conditions may cause the Group to cease to continue as a going

concern, and the above conclusions are not a guarantee that the

Group will continue in operation.

Directors' responsibilities

The half-yearly financial report is the responsibility of, and

has been approved by, the directors. The directors are responsible

for preparing the half-yearly financial report in accordance with

the DTR of the UK FCA.

The annual financial statements of the Group are prepared in

accordance with UK-adopted international accounting standards.

The directors are responsible for preparing the condensed set of

financial statements included in the half-yearly financial report

in accordance with IAS 34 as adopted for use in the UK.

In preparing the condensed set of financial statements, the

directors are responsible for assessing the Group's ability to

continue as a going concern, disclosing, as applicable, matters

related to going concern and using the going concern basis of

accounting unless the directors either intend to liquidate the

Group or to cease operations, or have no realistic alternative but

to do so.

Our responsibility

Our responsibility is to express to the company a conclusion on

the condensed set of financial statements in the half-yearly

financial report based on our review. Our conclusion, including our

conclusions relating to going concern, are based on procedures that

are less extensive than audit procedures, as described in the Basis

for conclusion section of this report.

The purpose of our review work and to whom we owe our

responsibilities

This report is made solely to the company in accordance with the

terms of our engagement to assist the company in meeting the

requirements of the DTR of the UK FCA. Our review has been

undertaken so that we might state to the company those matters we

are required to state to it in this report and for no other

purpose. To the fullest extent permitted by law, we do not accept

or assume responsibility to anyone other than the company for our

review work, for this report, or for the conclusions we have

reached.

Jatin Patel

for and on behalf of KPMG LLP

Chartered Accountants

15 Canada Square

London

E14 5GL

21 July 2023

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR NKDBPPBKDQOB

(END) Dow Jones Newswires

July 24, 2023 02:00 ET (06:00 GMT)

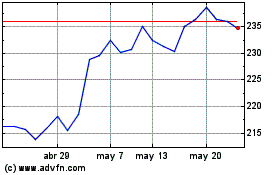

Moneysupermarket.com (LSE:MONY)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Moneysupermarket.com (LSE:MONY)

Gráfica de Acción Histórica

De May 2023 a May 2024