TIDMMRIT

RNS Number : 6917S

Merit Group PLC

08 November 2023

8 November 2023

Merit Group plc

("Merit", the "Company" or "the Group")

UNAUDITED INTERIM RESULTS TO 30 SEPTEMBER 2023

Merit Group plc (AIM: MRIT), the data and intelligence business,

announces its unaudited interim results for the half year ended 30

September 2023.

Financial Highlights

-- Accelerating revenue growth; Revenue from Continuing

Operations of GBP9.9m up 9.3% (H1 FY23: GBP9.1m) (1)

-- Adjusted EBITDA increased by 67% to GBP1.8m (H1 FY23: Adj

EBITDA GBP1.1m)

-- Adjusted EBITDA margin increased by six percentage points

from 12.1% to 18.5%

-- Net cash generated from continuing operating activities of

GBP0.7m (H1 FY23: GBP0.4m)

-- Return to profit before tax of GBP0.5m (H1 FY23: loss of

GBP0.3m) , representing 1.47 pence per share.

-- Net Debt (2) of GBP2.5m as at 30 September 2023, (31 March

2023: GBP2.6m) with total available debt facilities of GBP4.0m.

Continuing Operations (1)

H1 FY24 H1 FY23

30 Sep 23 30 Sep Change (6)

22 (1)

Revenue GBP9.9m GBP9.1m 9.3%

Gross profit GBP4.7m GBP4.3m 10.7%

Gross margin (3) 47.9% 47.4%

Adjusted EBITDA (4) GBP1.8m GBP1.1m 66.6%

Net margin (5) 18.5% 12.1%

Profit/(loss) before tax GBP0.5m (GBP0.3m)

Basic Earnings per share 1.47p (1.82p)

1. Comparative figures for the six-month period to 30 September

2022 have been restated to remove Discontinued Operations as

outlined in Note 5.

2. Net debt comprises the aggregate of gross debt, excluding

IFRS16 lease liabilities, and cash and cash equivalents as outlined

in Note 11.

3. Gross margin is Gross profit as a percentage of Revenue.

4. Adjusted EBITDA is calculated as earnings before interest,

tax, depreciation, amortisation of intangible assets, share-based

payments and non-recurring items.

5. Net margin is Adjusted EBITDA as a percentage of Revenue.

6. Year-on-year percentage change figures are calculated on

unrounded numbers.

Operational Highlights

-- Expanded sales team in Merit Data & Technology now

delivering new customers underpinning accelerating growth; 13.3%

revenue growth in H1 FY24 compared to 7.8% in the preceding half

year.

-- Margin improvement program within Merit Data & Technology

has already delivered a six percentage point improvement in EBITDA

margins to 19.5%.

-- Ongoing investment in AI initiatives, in which the business

has a five-year track record, is delivering both cost

competitiveness and further margin improvement opportunities.

-- Dods Political Intelligence has begun the acceleration of its

revenue growth, achieving 2.7%, up from 0.4% in the first half of

last year.

-- With GBP3.5m of revenue Dods PI delivered an Adjusted EBITDA

of GBP1.1m, up 20%, and an operating profit of GBP0.7m, up 175%,

demonstrating its strong operational gearing.

-- Group Adjusted EBIT was GBP0.9m in H1 FY24, up from a loss of

GBP0.3m in H1 FY23.

David Beck, CEO of Merit Group plc, said;

"We are pleased to able to announce further progress and a very

good set of first half numbers, including a return to profit before

tax. Despite challenging economic conditions, the Group is

accelerating its revenue growth whilst also increasing its margins.

Both operating businesses are working to detailed growth plans

which, when combined with their high levels of subscription or

recurring revenue and operational gearing, is helping to drive

profitability faster than revenue growth.

"The Group's deep technology skills and increasing use of AI to

drive both new revenue opportunities and operational efficiencies

gives the Board further confidence in the business' ability to

build on the progress already achieved."

Mark Smith, Chairman, commented;

"With the Group's restructuring complete the focus is now on

growth and driving shareholder value. Small listed companies do not

always see their value fully reflected in their share prices, the

Board of Merit recognises that it has a duty to all shareholders to

maximise value."

For further information, please contact:

Merit Group plc

David Beck - CEO 020 7593 5500

Philip Machray - CFO

www.meritgroupplc.com

Canaccord Genuity Limited (Nomad and Broker)

Bobbie Hilliam 020 7523 8150

Harry Pardoe

This announcement is released by Merit Group plc and contains

inside information for the purposes of Article 7 of the Market

Abuse Regulation (EU) 596/2014 ("MAR"), and is disclosed in

accordance with the Group's obligations under Article 17 of MAR.

With the publication of this announcement, this information is now

considered to be in the public domain.

For the purposes of MAR and Article 2 of Commission Implementing

Regulation (EU) 2016/1055, this announcement is being made on

behalf of the Group by David Beck, Chief Executive Officer.

BUSINESS AND OPERATIONAL REVIEW

The Group had a very good first half and is benefitting from the

restructuring of both its operations and cost base achieved in the

prior year. Despite challenging economic conditions, in the first

half year the Group has delivered revenue growth and an increase in

Adjusted EBITDA from Continuing Operations to GBP1.8m, compared to

GBP1.1m in the prior year. Both operating divisions, Merit Data

& Technology (Merit D&T) and Dods Political Intelligence

(Dods) performed strongly.

The revenue growth in both operating businesses combined with

cost efficiencies has helped drive an Adjusted EBITDA margin

improvement of six percentage points in Merit D&T and four

percentage points in Dods.

The Group has returned to a Profit before tax of GBP0.5m in the

half year (H1 FY23: loss before tax of GBP0.3m), a significant

improvement driven in part by the reduction in depreciation of

right-of-use assets following the successful disposal of the

Group's excess London office space at the end of the previous

financial year.

Merit Data & Technology

The Merit Data & Technology (Merit D&T) business has

long-standing customers that provide the business with high levels

of recurring revenue. We provide a range of data and intelligence

products and services, as well as data solutions to a loyal

customer base. The business uses its proprietary technology and AI

skills to gather and enhance industry intelligence and marketing

data.

Merit D&T saw strong and accelerating revenue growth in the

first half, up 13.3% to GBP6.4m from GBP5.6m in H1 FY23. Adjusted

EBITDA of GBP1.2m in the first half benefitted from t he recovery

in the Sterling/INR exchange rate and compares to the GBP0.7m in

the same period in the previous year .

The upgraded sales and marketing function within Merit D&T

that was recruited and expanded in FY23 is helping to generate new

customers and new revenue from existing customers across all areas

of the business. The business secured new clients in Pythian, Media

42, Hyve and ION, and has also secured additional work from

existing clients Jato, Lloyds List Intelligence and Wilmington

amongst others.

With the increasing acceptance of AI tools as a driver of

business efficiency Merit D&T is able to actively pursue new

revenue opportunities from customers seeking to implement AI

solutions. The business is also using increasing amounts of AI

within its own operations; reducing costs to make it even more

price competitive and to continue to deliver margin

improvements.

Dods Political Intelligence

Dods is a provider of mission critical UK and European policy

and political data and intelligence to approximately 800

subscribers. Dods is the UK's industry leader with an enviable

reputation for the comprehensiveness of its service and the quality

of its analysis and consultancy. The business benefits from

subscription revenues from a large, diverse and loyal subscriber

base of blue-chip customers.

In the first half the Continuing Operations of Dods grew revenue

by 2.7% to GBP3.5m and made Adjusted EBITDA of GBP1.1m against

GBP0.9m in the same period last year. An adjusted EBITDA margin of

30.9% was flattered by the inclusion of Other Operating Income (not

included in revenue) from the provision of transitional services to

the businesses that were disposed of in November 2022. Those

transitional services arrangements have largely come to an end and

will therefore not recur in the second half, a normalised first

half margin taking out the other operating income and associated

costs would be circa 25%.

The increased focus on, and investment in, the Dods business to

focus on growth commenced with the recruitment of a new Director of

Sales and Marketing at the end of the first half. The newly

restructured business now benefits from a three year growth plan

underpinned by new customer research and investment in further

product and service improvements. New customers in the period

include Drax, Thakeham Homes, The Royal College of Surgeons and the

German Animal Welfare Association.

Central

Central costs continue to be closely managed; despite some

inflationary pressures in the costs of professional fees and

insurance, central costs reduced by 8% year-on-year to GBP0.5m in

the first half.

In contrast to prior years, the Group reports no non-recurring

items in the period, reflecting the substantial completion of the

Group's restructuring.

Outlook

Despite challenging economic conditions, the Group is

accelerating its revenue growth whilst also increasing its margins.

Both operating businesses are delivering improved results by

working to detailed growth plans which, when combined with their

high levels of subscription or recurring revenue, maximises their

natural operational gearing.

The Group's deep technology skills and increasing use of AI to

drive both new revenue opportunities and operational efficiencies

gives the Board further confidence in the business' ability to

build on the progress already achieved.

David Beck

CEO

Merit Group plc

FINANCIAL REVIEW

On 30 November 2022, the Group completed the disposal of the

Media, Events and Training operations of its Dods segment

(together, the "MET Operations") for a cash consideration of GBP4.5

million to Political Holdings Limited.

On 12 January 2023, the Group completed the disposal of the

trade and assets of Le Trombinoscope SAS, the Paris-based

activities of the Dods segment ("Le Trombinoscope") to Trombimedia

Limited for GBP0.1 million cash consideration.

As a consequence of the disposals, the activities of the MET

Operations and Le Trombinoscope have been classified as

Discontinued Operations within the Consolidated Income Statement

and therefore excluded from the presentation of items on a

Continuing Operations basis in prior periods to provide a

like-for-like comparator.

Income Statement - Continuing Operations

The Group's revenue from Continuing Operations increased by 9.3%

to GBP9.9m (H1 FY23: GBP9.1m).

Revenues from Merit Data and Technology (MD&T) were GBP0.8m

higher than the equivalent prior half year (H1 FY24: GBP6.4m

compared to H1 FY23: GBP5.6m), representing an increase of 13%.

Dods revenues for the period increased by 3% to GBP3.5m (H1 FY23:

GBP3.4m).

Gross profit for the period increased to GBP4.7m compared to the

prior period (H1 FY23: GBP4.3m). Gross margin increased from 47% to

48%, driven by the Group's improving revenue growth and operational

gearing.

Adjusted EBITDA increased by GBP0.7m to GBP1.8m (H1 FY23:

GBP1.1m) due to strong revenue growth, operational gearing, and the

net GBP0.2m benefit of transitional services provided to the

disposed MET business during the period.

The return to operating profit, from a loss of GBP0.6m in H1

FY23 to a profit of GBP0.9m, reflects the increase in Adjusted

EBITDA, a reduction in depreciation following the disposal of the

Shard lease in the prior year and the lack of non-recurring

charges. The Group's operating profit is stated after a

right-of-use assets charge of GBP0.4m (H1 FY23: GBP0.7m), an

amortisation on acquired intangibles under business combinations of

GBP0.3m (H1 FY23: GBP0.3m), a charge for intangible assets

amortisation of GBP0.1m (H1 FY23: GBP0.2m) and a charge for

depreciation of tangible assets of GBP0.1m (H1 FY23: GBP0.3m).

The net finance expense for the year of GBP0.3m compares to a

net finance credit of GBP0.1m in H1 FY23, reflecting the increase

in interest rates and the impact of foreign exchange hedging.

The profit for the year from Continuing Operations, after a tax

charge of GBP0.2m (H1 FY23: GBP0.2m), amounted to GBP0.4m (H1 FY23:

GBP0.4m loss).

Earnings and Dividends

Earnings per share (basic and diluted) from Continuing

Operations in the period were 1.47 pence (H1 FY23: loss of 1.82

pence, basic and diluted) and were based on the profit for the

period of GBP0.4m (H1 FY23: GBP0.4m loss) with a weighted average

number of shares in issue during the period of 23,956,124.

Adjusted earnings per share, both basic and diluted, from

Continuing Operations in the period were 3.16 pence (H1 FY23: loss

of 0.49 pence) and were based on the adjusted profit after tax for

the period of GBP0.8m (H1 FY23: loss of GBP0.1m).

Total Earnings per share, both basic and diluted, in the period

were 1.47 pence (H1 FY23: loss of 4.17 pence) and were based on the

profit after tax for the period of GBP0.4m (H1 FY23: loss of

GBP1.0m).

Whilst the Company's focus remains on maintaining financial

flexibility and repositioning the business for future growth, the

Board is not proposing a dividend (H1 FY23: GBPnil).

Going Concern

The Directors have considered the position and projections of

the Group for the purpose of assessing Going Concern and remain

satisfied with the Group's funding and liquidity position.

Statement of Financial Position

Assets

Non-current assets of GBP37.7m (31 March 2023: GBP37.7m)

comprise goodwill of GBP26.9m (31 March 2023: GBP26.9m), intangible

assets of GBP7.6m (31 March 2023: GBP7.9m), property, plant and

equipment of GBP0.4m (31 March 2023: GBP0.3m), IFRS 16

rights-of-use assets of GBP2.2m (31 March 2023: GBP1.9m),

investments of GBP0.5m (31 March 2023: GBP0.4m) and deferred tax

assets amounting to GBP0.5m (31 March 2023: GBP0.5m). Movements in

the year reflect amortisation and depreciation charges in the

period offset by the addition of a new London premises lease

(GBP0.7m).

Current assets comprise Trade and other receivables of GBP5.5m

(31 March 2023: GBP5.5m) and cash balances.

The Group had a cash balance of GBP1.1m at the period end (31

March 2023: GBP2.1m), reduced as the group actively manages the

level of RCF drawing to minimise interest costs. Net debt amounted

to GBP2.5m at the period end (31 March 2023: GBP2.6m).

Total assets of the Group were GBP44.3m (31 March 2023:

GBP45.3m).

Liabilities

Current liabilities of GBP9.7m (31 March 2023 GBP10.8m) comprise

Trade and other payables of GBP6.1m (31 March 2023: GBP6.6m), bank

loans and borrowings of GBP2.9m (31 March 2023: GBP3.4m), IFRS16

lease liabilities of GBP0.6m (31 March 2023: GBP0.7m) and defined

benefit pension liabilities of GBP0.1m (31 March 2023:

GBP0.1m).

Non-current liabilities of GBP2.5m (31 March 2023 GBP2.8m)

comprise bank loans and borrowings of GBP0.6m (31 March 2023:

GBP1.3m), IFRS16 lease liabilities of GBP1.6m (31 March 2023:

GBP1.2m) and defined benefit pension liabilities of GBP0.3m (31

March 2023: GBP0.2m).

Movement in the year primarily reflect the repayment of GBP1.2m

of bank loans and borrowings, the repayment of GBP0.5m of IFRS16

lease liabilities and the addition of GBP0.7m of IFRS16 lease

liabilities in respect of the new London premises lease.

Capital and reserves

Total equity increased by GBP0.3m to GBP32.1m (31 March 2023:

GBP31.8m), reflecting the retained profit for the period.

Cash flows, liquidity and capital resources

Net cash generated by operations was an GBP0.8m inflow in the

period by comparison to an GBP0.0m in H1 FY23 (GBP0.6m from

Continuing operations). After tax, net cash used in operating

activities amounted to GBP0.7m (H1 FY23: outflow of GBP0.2m in

total of which Continuing Operations generated GBP0.4m and

Discontinued Operations used GBP0.6m).

Investing activities, primarily related to the addition of IT

equipment, leasehold improvements within the new London premises

and the internal development of software amounted to GBP0.2m in the

period, compared to GBP0.2m in the prior period which was offset by

GBP0.5m of proceeds from the disposal of Associates.

Total financing outflows were GBP1.4m in the period (H1 FY23;

GBP0.5m) as the group significantly reduced gross bank debt. This

comprised GBP1.9m used in the servicing of bank debt and interest

and capital repayments on leases, offset by the receipt of GBP0.5m

in the period in respect of recoverable VAT paid on the disposal of

the Shard lease in the prior period.

Net debt amounted to GBP2.5m at the period end (31 March 2023:

GBP2.6m).

At 30 September 2023, the Group had bank debt of GBP3.5m (31

March 2023: GBP4.7m) comprising amounts owed on term loans and

amounts drawn on a revolving credit facility (RCF).

The Group had a term loan with GBP0.8m outstanding (31 March

2023: GBP0.9m) taken out in July 2022 over a five-year period, with

interest at 4.75% over Bank of England interest rate. A further

GBP1.2m (31 March 2023: GBP1.8m) was outstanding on a GBP1.8m term

loan taken out in March 2023 over an 18-month period, to part-fund

disposal of the Shard lease. This loan has the same interest rates

and covenants as the Group's existing term loan.

In addition, the Group had a GBP2.0m RCF facility available

through to September 2027, of which GBP1.5m was drawn at the period

end (31 March; GBP2.0m). Due to its revolving nature, this loan is

all shown as due within one year.

Phil Machray

Chief Financial Officer

Condensed consolidated income statement

For the half year ended 30 September 2023

Unaudited

Unaudited Half year Audited

Half year ended Year ended

Continuing Operations (1) Note ended 30 Sept 31 Mar 2023

30 Sept 2022 GBP'000

2023 (restated

GBP'000 (1) )

GBP'000

----------------------------------------- -------- ------------ ----------- --------------

Revenue 3 9,899 9,055 18,585

Cost of sales (5,154) (4,767) (10,033)

------------------------------------------ ------- ------------ ----------- --------------

Gross profit 4,745 4,288 8,552

Administrative expenses (4,170) (4,861) (12,628)

Other operating income 293 - 416

Operating profit/(loss) from

Continuing Operations 868 (573) (3,660)

Memorandum:

Adjusted EBITDA(2) 3 1,829 1,098 2,652

Depreciation of property, plant

and equipment (88) (301) (620)

Depreciation of right-of-use

assets (406) (661) (1,313)

Amortisation of intangible assets

acquired through business combinations (294) (294) (587)

Amortisation of software intangible

assets (142) (161) (314)

------------ ----------- --------------

Adjusted EBIT(3) 899 (319) (182)

Share-based payments (31) (31) (63)

Non-recurring items 4

Loss on disposal of investments

in Associates - - (303)

Losses on disposal of Shard

lease - - (2,927)

People-related costs - (150) (123)

Other non-recurring items - (73) (62)

Operating profit/(loss) from

Continuing Operations 868 (573) (3,660)

Net finance credit/(expense) (339) 68 (249)

Share of profit of Associate - 252 252

------------------------------------------ ------- ------------ ----------- --------------

Profit/(loss) before tax from

Continuing Operations 529 (253) (3,657)

Income tax (charge)/credit (176) (182) 88

------------------------------------------ ------- ------------ ----------- --------------

Profit/(loss) for the period

from Continuing Operations 353 (435) (3,569)

Loss/(profit) from Discontinued

Operations - (564) 884

Profit/(loss) for the period 353 (999) (2,685)

------------------------------------------ ------- ------------ ----------- --------------

(1) Comparative figures for the half year ended 30 September

2022 have been restated to reflect Continuing Operations only as

outlined in Note 5.

(2) Adjusted EBITDA is defined as the operating profit/(loss)

after adding back depreciation, amortisation, share-based payments,

and non-recurring items.

(3) Adjusted EBIT is defined as the operating profit/(loss0

after adding back share-based payments and non-recurring items.

Earnings per share (pence)

Basic and Diluted p per share p per share p per share

Continuing Operations 6 1.47p (1.82p) (14.90p)

Discontinued Operations 6 - (2.35p) 3.69p

------------------------- ------------ ------------ ------------

Basic total 6 1.47p (4.17p) (11.21p)

------------------------- ------------ ------------ ------------

The notes on pages 13 to 27 form part of these unaudited interim

results.

Condensed consolidated statement of comprehensive income

For the half year ended 30 September 2023

Unaudited Unaudited Audited

Half year Half year Year ended

ended ended 31 Mar 2023

30 Sept 30 Sept GBP'000

2023 2022

GBP'000 GBP'000

------------------------------------------- ----------- ----------- -------------

Profit/(loss) for the period 353 (999) (2,685)

Items that may be subsequently

reclassified

to Profit and loss:

Foreign currency translation:

Exchange differences on translation

of foreign operations 2 21 (27)

Loss reclassified to profit and

loss on disposal of foreign operations - - (48)

------------------------------------------- ----------- ----------- -------------

2 21 (75)

Remeasurement of defined benefits

obligation (31) 36 45

------------------------------------------- ----------- ----------- -------------

Other comprehensive income for

the period (29) 57 (30)

------------------------------------------- ----------- ----------- -------------

Total comprehensive profit/(loss)

for the period 324 (942) (2,715)

------------------------------------------- ----------- ----------- -------------

The notes on pages 13 to 27 form part of these unaudited interim

results.

Condensed consolidated statement of financial position

As at 30 September 2023

Unaudited

Unaudited 30 Sept 2022 Audited

Note 30 Sept 2023 (restated*) 31 Mar 2023

GBP'000 GBP'000 GBP'000

--------------------------------- ------- ---------------- -------------- --------------

Non-current assets

Goodwill 8 26,919 27,642 26,919

Intangible assets 9 7,566 8,679 7,908

Property, plant and equipment 10 381 1,673 341

Right-of-use assets 2,198 4,869 1,874

Investments 474 997 450

Deferred tax assets 184 346 184

Total non-current assets 37,722 44,206 37,676

Current assets

Trade and other receivables 5,503 4,102 5,502

Loan receivable - 140 -

Cash and cash equivalents 1,069 1,834 2,144

6,572 6,076 7,646

Assets held for resale - 3,591 -

--------------------------------- ------- ---------------- -------------- --------------

Total current assets 6,572 9,667 7,646

--------------------------------- ------- ---------------- -------------- --------------

Total assets 44,294 53,873 45,322

--------------------------------- ------- ---------------- -------------- --------------

Current liabilities

Trade and other payables 6,085 6,168 6,648

Defined benefit pension

obligation 77 84 76

Bank loan/RCF 11 2,910 2,200 3,373

Lease liability 11 597 1,640 678

Liabilities directly associated - 3,101 -

with assets classified as

held for resale

Total current liabilities 9,669 13,193 10,775

Non-current liabilities

Deferred tax liability - - -

Pension obligation 312 232 249

Bank loan/RCF 11 621 2,800 1,342

Lease liability 11 1,583 4,153 1,202

Total non-current liabilities 2,516 7,185 2,793

--------------------------------- ------- ---------------- -------------- --------------

Capital and reserves

Issued capital 12 6,708 6,708 6,708

Share premium 1,067 1,067 1,067

Retained profit/(loss) 10,700 12,033 10,347

Redemption reserve 13,680 13,680 13,680

Translation reserve (122) (28) (124)

Other reserves (28) (6) 3

Share option reserve 104 41 73

Total equity 32,109 33,495 31,754

Total equity and liabilities 44,294 53,873 45,322

--------------------------------- ------- ---------------- -------------- --------------

* Comparative figures for the financial position as at 30

September 2022 have been restated to present deferred tax assets

within Non-current assets as outlined in Note 16.

The notes on pages 13 to 27 form part of these unaudited interim

results.

Condensed consolidated statement of changes in equity

For the half year ended 30 September 2023

Share Capital Share Total

Share premium Retained redemption Translation Other option shareholders'

capital reserve(1) earnings reserve(2) reserve(3) reserves reserve(4) funds

Unaudited GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

----------------- --------- ------------ ---------- ------------ ------------- ---------- ------------ ---------------

At 1 April 2022 6,708 1,067 13,032 13,680 (49) (42) 10 34,406

Total

comprehensive

income:

Loss for the

six-month

period

to 30

September

2022 - - (999) - - - (999)

Currency

translation

differences - - - - 21 - - 21

Remeasurement

of defined

benefits

obligations - - - - - 36 - 36

Share-based

payments - - - - - - 31 31

At 30 September

2022 6,708 1,067 12,033 13,680 (28) (6) 41 33,495

----------------- --------- ------------ ---------- ------------ ------------- ---------- ------------ ---------------

Total

comprehensive

income:

Loss for the

six-month

period

to 31 March

2023 - - (1,686) - - - (1,686)

Currency

translation

differences - - - - (96) - - (96)

Remeasurement

of defined

benefits

obligations - - - - - 9 - 9

Share-based

payments - - - - - - 32 32

At 31 March 2023 6,708 1,067 10,347 13,680 (124) 3 73 31,754

----------------- --------- ------------ ---------- ------------ ------------- ---------- ------------ ---------------

Total

comprehensive

income:

Profit for the

six-month

period

to 30

September

2023 - - 353 - - - 353

Currency

translation

differences - - - - 2 - - 2

Remeasurement

of defined

benefits

obligations - - - - - (31) - (31)

Share-based

payments - - - - - - 31 31

----------------- --------- ------------ ---------- ------------ ------------- ---------- ------------ ---------------

At 30 September

2023 6,708 1,067 10,700 13,680 (122) (28) 104 32,109

----------------- --------- ------------ ---------- ------------ ------------- ---------- ------------ ---------------

1 The share premium reserve represents the amount paid to the

Company by shareholders above the nominal value of shares

issued.

2 The capital redemption reserve is a non-distributable reserve

created on cancellation of deferred shares.

3 The translation reserve comprises foreign currency translation

differences arising from the translation of financial statements of

the Group's foreign entities into Sterling.

4 The share option reserve represents the cumulative expense

recognised in relation to equity-settled share-based payments.

The notes on pages 13 to 27 form part of these unaudited interim

results.

Condensed consolidated statement of cash flows

For the half year ended 30 September 2023

Unaudited Unaudited Audited

Half year Half year Year ended

Note ended ended 31 Mar 2023

30 Sept 30 Sept GBP'000

2023 2022

GBP'000 GBP'000

Cash generated by operations 7 836 6 1,325

Taxation paid (181) (163) (429)

-------------------------------------- ------- ----------- ----------- -------------

Net cash (used in)/generated

from operating activities 655 (157) 896

-------------------------------------- ------- ----------- ----------- -------------

Cash flows from investing

activities

Interest and similar income

received 18 40 77

Additions to intangible assets (94) (108) (175)

Additions to property, plant

and equipment (128) (132) (69)

Acquisition of investments (24) - -

Proceeds from disposal of Associates - 410 654

Proceeds on disposal of operations - - 3,846

Repayment of long-term loan

by Associate - 70 210

-------------------------------------- ------- ----------- ----------- -------------

Net cash raised/(used) in

investing activities (228) 280 4,543

-------------------------------------- ------- ----------- ----------- -------------

Cash flows from financing

activities

Interest and similar expenses

paid (215) (153) (378)

Payment of lease liabilities (494) (967) (1,901)

Payment on disposal of lease

liabilities 462 - (3,683)

Net drawdowns/(repayments)

of bank facility (1,184) 622 337

Net cash raised/(used) in

financing activities (1,431) (498) (5,625)

-------------------------------------- ------- ----------- ----------- -------------

Net decrease in cash and cash

equivalents (1,004) (375) (186)

Opening cash and cash equivalents 2,144 2,321 2,321

Effect of exchange rate fluctuations

on cash held (71) (112) 9

-------------------------------------- ------- ----------- ----------- -------------

Closing cash at bank 1,069 1,834 2,144

-------------------------------------- ------- ----------- ----------- -------------

Comprised of:

Cash and cash equivalents 1,069 1,834 2,144

Closing cash at bank 1,069 1,834 2,144

-------------------------------------- ------- ----------- ----------- -------------

The notes on pages 13 to 27 form part of these unaudited interim

results.

1. General information

Nature of operations

The principal activities of Merit Group plc and its subsidiaries

(the "Group") is the creation and aggregation of high-quality data

and intelligence information and the provision of data technology

services.

The Group operates primarily in the UK, Europe and India.

Merit Group plc is a Company incorporated in England and Wales

and listed on the Alternative Investment Market (AIM) in London.

The registered office of the Company and head office of the Group

is 9(th) Floor, The Shard, 32 London Bridge Street, London SE1

9SG.

Basis of preparation

This condensed set of financial statements has been prepared in

accordance with IAS 34 Interim Financial Reporting as adopted by

the UK. The annual financial statements of the Group are prepared

in accordance with International Financial Reporting Standards

(IFRSs) in conformity with the requirements of the Companies Act

2006. As required by AIM Rules, the condensed set of financial

statements has been prepared applying accounting policies and

presentation that were applied in the preparation of the Group's

published consolidated financial statements for the year ended 31

March 2023.

The condensed consolidated financial statements are neither

audited in accordance with International Standards on Auditing (UK)

nor subject to review as per International Standard on Review

Engagements (ISRE) 2410. The comparative figures for the year ended

31 March 2023 have been extracted from the Group's statutory

accounts for that financial period. Those accounts have been

reported on by the Company's auditor and delivered to the registrar

of companies. The report of the auditor was (i) unqualified, (ii)

did not include a reference to any matters to which the auditor

drew attention by way of emphasis without qualifying their report,

and (iii) did not contain a statement under section 498(2) or (3)

of the Companies Act 2006.

Going concern

The Directors have considered the financial projections of the

Group, including cash flow forecasts and the availability of

committed bank facilities for the coming 12 months. They are

satisfied that the Group has adequate resources for the foreseeable

future and that it is appropriate to continue to adopt the going

concern basis in preparing these interim financial statements.

Approval date

The condensed set of interim financial statements have been

prepared on a going concern basis and were approved by the Board on

7 November 2023.

2. Critical accounting estimates and judgements

When preparing financial statements, the Group makes estimates

and judgements concerning the future. These estimates and

judgements are typically based on historical experience and

expectations of future events that are believed to be reasonable at

the time. In the future, by definition, actual events and

experience may deviate from these estimates and judgements.

The Directors considered the critical accounting judgements and

estimates applied in the condensed consolidated financial

statements were the same as those applied in the Group's last

statutory accounts for the year ended 31 March 2023.

3. Segmental information

Business segments

The Group considers that it has two operating business segments,

Merit Data & Technology (MD&T) and Dods, plus a

(non-revenue generating) central corporate segment.

The Merit Data & Technology business segment focuses on the

provision of data and intelligence, including marketing data, and

the provision of data-related technology, including data

engineering, machine learning, software development, and technology

resourcing.

The Dods business segment concentrates on the provision of key

information and insights into the political and public policy

environments around the UK and the European Union.

The central corporate segment contains the activities and costs

associated with the Group's head office and PLC listing.

The following table provides an analysis of the Group's segment

revenue by business segment.

Unaudited

Unaudited Half year Audited

Half year ended Year ended

Continuing Operations(1) ended 30 Sept 31 Mar 2023

30 Sept 2022 GBP'000

2023 (restated(1)

GBP'000 )

GBP'000

---------------------------- ------------ -------------- --------------

Merit Data & Technology 6,376 5,626 11,644

Dods 3,523 3,429 6,941

9,899 9,055 18,585

---------------------------- ------------ -------------- --------------

No client accounted for more than 10 percent of total

revenue.

Unaudited

Group Revenue by stream Unaudited Half year Audited

Half year ended Year ended

Continuing Operations(1) ended 30 Sep 2022 31 Mar 2023

30 Sep 2023 (restated(1) GBP'000

GBP'000 )

GBP'000

---------------------------- -------------- -------------- --------------

Data and Intelligence 3,414 2,981 6,743

Data Technology 2,962 2,645 4,901

Political Intelligence 3,523 3,429 6,941

9,899 9,055 18,585

---------------------------- -------------- -------------- --------------

(1) Prior periods have been restated to present Continuing

Operations only as outlined in Note 5.

Unaudited half year ended MD&T Dods Central Total

30 Sep 2023 30 Sep 30 Sep 30 Sep 30 Sep

Business segment profit before 2023 2023 2023 2023

tax GBP'000 GBP'000 GBP'000 GBP'000

Continuing Operations

------------------------------------- ---------- ---------- ---------- ----------

Adjusted EBITDA 1,241 1,087 (499) 1,829

Depreciation of property,

plant and equipment (55) (33) - (88)

Depreciation of right-of-use

assets (260) (146) - (406)

Amortisation of intangible

assets acquired through business

combinations (255) (39) - (294)

Amortisation of software intangible

assets - (142) - (142)

Share based payments - - (31) (31)

Operating profit/(loss) 671 727 (530) 868

Net finance income/(expense) (80) (45) (214) (339)

------------------------------------- ---------- ---------- ---------- ----------

Profit/(loss) before tax

from Continuing Operations 591 682 (744) 529

------------------------------------- ---------- ---------- ---------- ----------

Unaudited half year ended Dods Total

30 Sep 2022

Business segment profit before MD&T 30 Sep Central 30 Sep

tax

30 Sep 2022 30 Sep 2022

Continuing Operations(1) 2022 (restated(1) 2022 (restated(1)

) )

GBP'000 GBP'000 GBP'000 GBP'000

------------------------------------- ---------- --------------- ---------- ----------------

Adjusted EBITDA 733 907 (542) 1,098

Depreciation of property,

plant and equipment (140) (161) - (301)

Depreciation of right-of-use

assets (281) (211) (169) (661)

Amortisation of intangible

assets acquired through business

combinations (255) (39) - (294)

Amortisation of software intangible

assets - (161) - (161)

Share based payments - - (31) (31)

Non-recurring items

People-related costs (34) (23) (93) (150)

Other non-recurring items - (48) (25) (73)

------------------------------------- ---------- --------------- ---------- ----------------

Operating profit/(loss) 23 264 ( 860) (573)

Net finance income/(expense) 45 11 12 68

Share of profit of Associate - - 252 252

------------------------------------- ---------- --------------- ---------- ----------------

Profit/(loss) before tax

from Continuing Operations 68 275 ( 596) (253)

------------------------------------- ---------- --------------- ---------- ----------------

(1) Prior periods have been restated to present Continuing

Operations only as outlined in Note 5.

Audited year ended 31 Mar MD&T Dods Central Total

2023 31 Mar 31 Mar 31 Mar 31 Mar

Business segment profit before 2023 2023 2023 2023

tax GBP'000 GBP'000 GBP'000 GBP'000

Continuing Operations

------------------------------------- ---------- ---------- ---------- ----------

Adjusted EBITDA 1,809 1,838 (995) 2,652

Depreciation of property,

plant and equipment (252) (368) - (620)

Depreciation of right-of-use

assets (552) (517) (244) (1,313)

Amortisation of intangible

assets acquired through business

combinations (510) (77) - (587)

Amortisation of software intangible

assets - (314) - (314)

Share based payments - - (63) (63)

Non-recurring items

Profits and losses on disposals - - (3.230) (3,230)

People-related costs (35) 10 (98) (123)

Other non-recurring items - - (62) (62)

------------------------------------- ---------- ---------- ---------- ----------

Operating profit/(loss) 460 572 (4,692) (3,660)

Net finance income/(expense) 83 (226) (106) (249)

Share of profit of Associate - - 252 252

------------------------------------- ---------- ---------- ---------- ----------

Profit/(loss) before tax

from Continuing Operations 543 346 (4,546) (3,657)

------------------------------------- ---------- ---------- ---------- ----------

4. Non-recurring items

Unaudited

Unaudited Half year Audited

Half year ended Year ended

ended 30 Sep 2022 31 Mar 2023

Continuing Operations(1) 30 Sep 2023 (restated(1) GBP'000

GBP'000 )

GBP'000

------------------------------------------- --------------- -------------- --------------

Transaction-related non-recurring

items:

Loss on disposal of investments

in Associates - - (303)

Loss on disposal of Shard lease - - (2,927)

--------------- -------------- --------------

Profits and losses on disposals - - (3,230)

People-related costs - (150) (123)

Other:

- Professional services and consultancy - (73) (62)

- (223) (3,415)

----------------------------------------------------------- -------------- --------------

(1) Prior periods have been restated to present Continuing

Operations only as outlined in Note 5.

People-related costs incurred in prior periods include deferred

cash consideration on the acquisition of Meritgroup Limited. Also

included are redundancy costs reflecting the effect of Group

initiatives to appropriately restructure the business.

Other non-recurring costs incurred in prior periods relate to

one-off consultancy and professional fees associated with the

rental review of the London premises.

5. Disposal

On 30 November 2022, the Group completed the disposal of the

Media, Events and Training operations of its Dods segment

(together, the "MET Operations") for a cash consideration of GBP4.5

million to Political Holdings Limited. These activities were

treated as Discontinued Operations within the unaudited interim

results for the period to 30 September 2022, as reported on 1

December 2022.

On 12 January 2023, the Group completed the disposal of the

trade and assets of Le Trombinoscope SAS, the Paris-based

activities of the Dods segment ("Le Trombinoscope"), to Trombimedia

Limited for GBP0.1 million cash consideration. These activities are

also treated as Discontinued Operations.

The activities of the MET Operations and Le Trombinoscope have

been classified as Discontinued Operations within the Consolidated

income statement and therefore excluded from the presentation of

items on a Continuing Operations basis. The unaudited half year for

the period to 30 September 2022, which included 6 months of both

MET operations and Le Trombinoscope, was previously presented to

exclude the MET Operations as Discontinued. It has now been further

restated to also exclude Le Trombinoscope as Discontinued

Operations.

The results of the Discontinued Operation for the year ended 31

March 2023, which include the results of the MET operations for 8

months and Le Trombinoscope for 9.5 months, are unchanged from

previously reported on 6 September 2023.

The results of the Discontinued Operations are as follows:

Unaudited

Unaudited Half year Audited

Half year ended Year ended

Discontinued Operations ended 30 Sept 2022 31 Mar 2023

30 Sept (restated*) GBP'000

2023 GBP'000

GBP'000

----------------------------------------- ------------- -------------- --------------

Revenue - 4,944 6,913

Cost of sales - (4,154) (5,861)

----------------------------------------- ------------- -------------- --------------

Gross profit - 790 1,052

Administrative expenses - (1,325) (1,450)

Operating loss - (535) (398)

Memorandum:

Adjusted EBITDA - (287) (69)

Depreciation of property, plant

and equipment - (45) (58)

Depreciation of right-of-use

assets - (19) (25)

Amortisation of intangible assets

acquired through business combinations - (137) (183)

Amortisation of software intangible

assets - (2) (8)

Non-recurring items: people-related

costs - (45) (55)

Operating loss - (535) (398)

Net finance expense - (29) (66)

Loss before tax - (564) (464)

Income tax credit - - 58

----------------------------------------- ------------- -------------- --------------

Loss for the period from Discontinued

Operations - (564) (406)

Profit on disposal of Discontinued

Operations after tax - - 1,290

----------------------------------------- ------------- -------------- --------------

(Loss)/Profit from Discontinued

Operations for the period - (564) 884

----------------------------------------- ------------- -------------- --------------

* Comparative figures for the half year ended 30 September 2022

have been restated to remove Discontinued Operations as above.

Cashflows generated by the Discontinued Operation for the period

were as follows:

Unaudited

Unaudited Half year Audited

Half year ended Year ended

Discontinued Operations ended 30 Sept 2022 31 Mar 2023

30 Sept (restated*) GBP'000

2023 GBP'000

GBP'000

---------------------------------------- ------------- -------------- --------------

Net cash (outflow) from operating

activities - (594) (1,621)

Net cash (outflow)/inflow from

investing activities - (2) 3,846

Net cash (outflow) from financing

activities - (48) (95)

---------------------------------------- ------------- -------------- --------------

Net increase/(decrease) in cash,

cash equivalents and bank overdrafts

from Discontinued Operations - (644) 2,130

---------------------------------------- ------------- -------------- --------------

* Comparative figures for the half year ended 30 September 2022

have been restated as above.

6. Earnings per share

Unaudited

Unaudited Half year Audited

Half year ended Year ended

ended 30 Sep 2022 31 Mar 2023

Continuing Operations(1) 30 Sep 2023 (restated(1) GBP'000

GBP'000 )

GBP'000

------------------------------------------- -------------- -------------- --------------

Profit/(loss) attributable

to shareholders 353 (435) (3,569)

Add: non-recurring items - 223 3,415

Add: amortisation of intangible

assets acquired through business

combinations 294 294 587

Add: net exchange losses/(gains) 79 (230) (297)

Add: share-based payment (credit)/expense 31 31 63

------------------------------------------- -------------- -------------- --------------

Adjusted post-tax profit/(loss)

from Continuing Operations

attributable to shareholders 757 (117) 199

------------------------------------------- -------------- -------------- --------------

(1) Comparative figures for the half year ended 30 September

2022 have been restated to present Continuing Operations only as

outlined in Note 5.

Unaudited

Unaudited Half year Audited

Half year ended Year ended

ended 30 Sep 2022 31 Mar 2023

Discontinued Operations 30 Sep 2023 (restated*) GBP'000

GBP'000 GBP'000

----------------------------------- --------------- ------------- --------------

(Loss)/profit attributable to

shareholders - (564) 884

Add: non-recurring items - 45 (2,019)

Add: amortisation of intangible

assets acquired through business

combinations - 137 183

Adjusted post-tax profit/(loss)

from Discontinued Operations

attributable to shareholders - (382) (952)

----------------------------------- --------------- ------------- --------------

* Comparative figures for the half year ended 30 September 2022

have been restated as outlined in Note 5.

Unaudited Unaudited Audited

Half year ended Half year Year ended

30 Sept 2023 ended 31 Mar 2023

Ordinary shares 30 Sept 2022 Ordinary

Ordinary shares

shares

------------------------------ ----------------- -------------- -------------

Weighted average number

of shares

In issue during the period

- basic 23,956,124 23,956,124 23,956,124

Adjustment for share options - - -

In issue during the period

- diluted 23,956,124 23,956,124 23,956,124

------------------------------ ----------------- -------------- -------------

Performance Share Plan (PSP) options over 1,420,791 Ordinary

shares have not been included in the calculation of diluted EPS for

any of the above dates because their exercise is contingent on the

satisfaction of certain criteria that had not been met at those

dates.

Unaudited

Unaudited Half year Audited

Half year ended ended Year ended

30 Sep 2023 30 Sep 2022 31 Mar 2023

Continuing Operations(1) Pence per share (restated(1) Pence per

) share

Pence per

share

--------------------------------- ------------------- -------------- --------------

Earnings per share - Continuing

Operations

Basic 1.47 (1.82) (14.90)

Diluted 1.47 (1.82) (14.90)

Adjusted earnings per share -

Continuing Operations

Basic 3.16 (0.49) 0.83

Diluted 3.16 (0.49) 0.83

---------------------------------- ------------------ -------------- --------------

(1) Comparative figures for the half year ended 30 September

2022 have been restated to present Continuing Operations only as

outlined in Note 5.

Unaudited

Unaudited Half year Audited

Discontinued Operations Half year ended ended Year ended

30 Sep 2023 30 Sep 2022 31 Mar 2023

Pence per share (restated*) Pence per

Pence per share

share

-------------------------------------------- --------------------- ------------- --------------

Earnings per share - Discontinued

Operations

Basic - (2.35) 3.69

Diluted - (2.35) 3.69

Adjusted earnings per share - Discontinued

Operations

Basic - (1.59) (3.97)

Diluted - (1.59) (3.97)

---------------------------------------------- ------------------- ------------- --------------

* Comparative figures for the half year ended 30 September 2022

have been restated as outlined in Note 5.

Unaudited Unaudited Audited

Half year ended Half year Year ended

30 Sep 2023 ended 31 Mar 2023

TOTAL Pence per share 30 Sep 2022 Pence per

Pence per share

share

----------------------------- ----------------- ------------- -------------

Earnings per share

Basic 1.47 (4.17) (11.21)

Diluted 1.47 (4.17) (11.21)

Adjusted earnings per share

Basic 3.16 (2.08) (3.14)

Diluted 3.16 (2.08) (3.14)

----------------------------- ----------------- ------------- -------------

7. Cash generated by operations

Unaudited Unaudited Audited

Half year Half year Year ended

ended ended 31 Mar 2023

30 Sept 30 Sept GBP'000

2023 2022

GBP'000 GBP'000

-------------------------------------- ----------- ----------- -------------

Cash flows from operating

activities

Profit/(loss) for the period 353 (999) (2,685)

Depreciation of property, plant

and equipment 88 346 678

Depreciation of right-of-use

assets 406 680 1,338

Amortisation of intangible

assets acquired through business

combinations 294 431 770

Amortisation of other intangible

assets 142 163 322

Share-based payments charge/(credit) 31 31 63

Share of profit of Associate - (252) (252)

Lease interest expense 64 161 298

Profit on disposal of operations

(before tax) - - (2,074)

Loss on disposal of IFRS16

finance lease - - 2,927

Loss on disposal and impairment

of investments in associates - - 303

Interest income (18) (40) (77)

Interest expense 215 153 378

Foreign exchange on operating

items 4 24 1

Income tax charge/(credit) 176 182 638

--------------------------------------- ----------- ----------- -------------

Operating cash flows before

movement in working capital 1,755 880 2,628

(Increase)/decrease in inventories 14 (16)

(Increase)/decrease in trade

and other receivables (463) (422) (1,520)

Decrease in trade and other

payables (456) (466) 233

--------------------------------------- ----------- ----------- -------------

Cash generated by operations 836 6 1,325

--------------------------------------- ----------- ----------- -------------

8. Goodwill

Unaudited Unaudited Audited

Half year Half year Year ended

ended ended 31 Mar 2023

30 Sep 2023 30 Sep 2022 GBP'000

GBP'000 GBP'000

----------------------------- ------------- ------------- -------------

Cost and net book value

Opening balance 26,919 28,911 28,911

Disposals in the year - - (1,992)

Reclassified as assets held - (1,269) -

for resale

----------------------------- ------------- ------------- -------------

Closing balance 26,919 27,642 26,919

----------------------------- ------------- ------------- -------------

9. Intangible assets

Assets acquired Under

through business Construction

combinations Software Capitalised Total

costs

GBP'000 GBP'000 GBP'000 GBP'000

--------------------------- ------------------ ----------- -------------- ---------

Cost

At 1 April 2022 28,042 6,074 - 34,116

Transferred from tangible

fixed assets - - 70 70

Additions - internally

generated - 101 74 175

Disposals (16,833) (3,999) - (20,832)

At 31 March 2023 11,209 2,176 144 13,529

Additions - internally

generated - - 94 94

At 30 September 2023 11,209 2,176 238 13,623

--------------------------- ------------------ ----------- -------------- ---------

Accumulated amortisation

At 1 April 2023 20,145 4,145 - 24,290

Charge for the year 770 322 - 1,092

Disposals (15,825) (3,936) - (19,761)

-------------------------- --------- -------- ---------

At 31 March 2023 5,090 531 - 5,621

Charge for the period 294 142 - 436

At 30 September 2023 5,384 673 - 6,057

-------------------------- --------- -------- ---------

Net book value

At 31 March 2022 - audited 7,897 1,929 - 9,826

At 31 March 2023 - audited 6,119 1,645 144 7,908

---------------------------- ------ ------ ---- ------

At 30 September 2023

- unaudited 5,825 1,503 238 7,566

---------------------------- ------ ------ ---- ------

10. Property, plant and equipment

IT Equipment

Leasehold and Fixtures

Improvements and Fittings Total

GBP'000 GBP'000 GBP'000

------------------------------ --------------- -------------- --------

Cost

At 1 April 2022 2,037 2,521 4,558

Transferred to tangible

fixed assets - (70) (70)

Additions - 69 69

Foreign exchange differences - (1) (1)

Disposals (2,037) (1,070) (3,107)

At 31 March 2023 - 1,449 1,449

Additions 21 107 128

At 30 September 2023 21 1,556 1,577

------------------------------- --------------- -------------- --------

Accumulated depreciation

At 1 April 2022 1,128 1,623 2,751

Charge for the year 209 469 678

Disposals (1,337) (984) (2,321)

At 31 March 2023 - 1,108 1,108

Charge for the period 2 86 88

At 30 September 2023 2 1,194 1,196

--------------------------- -------- ------ --------

Net book value

At 31 March 2022 - audited 909 898 1,807

At 31 March 2023 - audited - 341 341

At 30 September 2023 -

unaudited 19 362 381

----------------------------- ---- ---- ------

11. Net debt

Net debt comprises the aggregate of loans and borrowings,

excluding IFRS16 lease liabilities, and cash and cash equivalents,

as follows:

Unaudited Unaudited Audited

Half year Half year Year ended

ended ended 31 Mar 2023

30 Sep 2023 30 Sep 2022 GBP'000

GBP'000 GBP'000

------------------------------- ------------- ------------- -------------

Bank loan / RCF due within

one year 2,910 2,200 3,373

Bank loan due after more than

one year 621 2,800 1,342

------------------------------- ------------- ------------- -------------

3,531 5,000 4,715

Cash and cash equivalents (1,069) (1,834) (2,144)

------------------------------- ------------- ------------- -------------

Net Debt 2,462 3,166 2,571

------------------------------- ------------- ------------- -------------

Interest-bearing loans and borrowings

On 22 July 2022, the Company agreed new secured loan facilities

with Barclays which include:

-- Term Loan: a GBP3 million, five-year term loan, amortising on

a straight-line basis at GBP150,000 per quarter;

-- RCF: a GBP2 million non-amortising, revolving credit facility

for the five-year duration of the Term Loan;

-- Both the Term Loan and RCF accruing interest at 4.75% above

Bank of England base rate.

On 1 December 2022, the Company repaid and cancelled GBP2

million of the Term Loan following receipt of the proceeds of

disposals.

On 22 March 2023, the Company secured a further GBP1.8 million

18-month Term Loan, amortising on a straight-line basis at

GBP300,000 per quarter, in order to fund the disposal of the

Company's Shard lease.

12. Leases

Right-of-use Lease

assets liabilities

GBP'000 GBP'000

------------------------- ------------- -------------

As at 1 April 2022 5,660 (6,721)

Depreciation (1,338) -

Lease Interest - (298)

Lease payments(1) - 1,897

Disposal (2,448) 3,242

As at 31 March 2023 1,874 (1,880)

Addition 730 (730)

Depreciation (406) -

Lease Interest - (64)

Lease payments(1) - 494

As at 30 September 2023 2,198 (2,180)

Current (597)

Non-current (1,583)

-------------------------- ------------- -------------

The Consolidated income statement includes the following amounts

relating to leases:

Unaudited Unaudited Audited

Half year ended Half year Year ended

30 Sep 2023 ended 31 Mar 2023

GBP'000 30 Sep 2022 GBP'000

GBP'000

--------------------------------------------- ------------- ---------------

Depreciation charge of right-of-use

assets 406 680 1,338

Interest expense (included in finance

cost) 64 161 298

---------------------------------------- ---- ------------- -------------

The right-of-use assets relate to office space in four locations

and at the balance sheet date have remaining terms ranging up to 7

years.

There were GBPnil of expenses relating to diminutive payments

not included in the measurement of lease liabilities (H1 FY23:

GBPnil).

Lease liabilities includes liabilities in respect of IT

equipment with a cost of GBP77,000 (31 March 2023: GBP77,000).

These assets are capitalised within IT equipment (see Note 10).

13. Issued Share Capital

28p ordinary

shares Total

Number GBP'000

----------------------------------------- ------------- ----------

Issued share capital as at 30 September

2022 23,956,124 6,708

----------------------------------------- ------------- ----------

Issued share capital as at 31 March

2023 23,956,124 6,708

----------------------------------------- ------------- ----------

Issued share capital as at30 September

2023 23,956,124 6,708

----------------------------------------- ------------- ----------

14. Related party transactions

MET operations

The disposal of the MET Operations on 30 November 2022 was to

Political Holdings Limited. Political Holdings Limited is

considered a related party as it is controlled by Lord Ashcroft

KCMG PC, a substantial shareholder in the Company and Angela

Entwistle, a non-executive director of the Company, is a director

of Political Holdings Limited.

As part of the disposal of the MET Operations, the Group agreed

to provide transitional services to the Political Holdings Limited

group of companies covering areas such as occupancy, IT systems and

support and finance and accounting services. In total, the group

charged GBP293,364 for these services during the period (H1 FY23:

GBPnil), which has been recognised as Other Operating Income within

the Income Statement. At 30 September 2023, a balance of GBP14,563

(31 March 2023: GBP145,991) was outstanding in respect of invoicing

for these services.

Since its acquisition of the MET operations, the Political

Holdings Limited group has been a customer of MD&T and was

billed GBP56,476 (H1 FY23: GBPnil) during the period for marketing

and data services. At 30 September 2023, there was a balance of

GBP30,688 (31 March 2023: GBP16,094) due.

Further, as part of the disposal, the Group has continued to act

as agent for the Political Holdings Limited group, invoicing

customers, collecting book debts and paying for services under

contracts which were pending legal novation to Political Holdings

Limited group companies. During the period, revenue of GBP887,393

(H1 FY23: GBPnil) was invoiced, cash of GBP1,968,961 (H1 FY23:

GBPnil) was collected and payments for purchases and payroll

amounting to GBP769,009 (H1 FY23: GBPnil) were made by the Group on

behalf of Political Holdings Limited group companies. None of these

revenues or costs, all of which arises post disposal are recognised

within the Income Statement of the Group. At 30 September 2023,

GBP38,957 (31 March 2023: GBP233,053) of funds were held on trust

for Political Holdings Limited group companies.

Investments and Associates

During the period, the Group billed GBP125,800 (H1 FY23:

GBP131,000) for technology services to Acolyte Resource Group

Limited, a company in which the Group had a 13.5% investment, and

of which Cornelius Conlon is a Director. At 30 September 2023,

there was a balance of GBP78,400 (31 March 2023: GBP64,000)

due.

Meritgroup Limited acquisition

On acquisition of Meritgroup Limited, an arm's length

non-repairing 7-year lease was entered into between a Merit

subsidiary (Letrim Intelligence Services Private Limited) and Merit

Software Services Private Limited. Cornelius Conlon, a Director of

the Group, is the beneficial owner of Merit Software Services

Private Limited. The lease relates to the Chennai office of

MD&T. During the period, payments of GBP366,800 (H1 FY23:

GBP400,900) were made to Merit Software Services Private Limited in

relation to the lease and other property-related costs.

Other related party transactions

During the current and previous period, Deacon Street Partners

Limited, a company related by virtue of Angela Entwistle, a

Director of the Company also being a Director, invoiced GBP15,000

(H1 FY23: GBP15,000) to the Company for the services of Angela

Entwistle as a Non-Executive Director. At 30 September 2023 the

balance outstanding was GBP2,500 (31 March 2023: GBP2,500).

System1 Group plc, a company related by virtue of Philip

Machray, a Director of the Company also being a Director, is a

customer of MD&T and was billed GBP76,700 (H1 FY23: GBP55,900)

for Technology Resourcing Services. At 30 September 2023 the

balance outstanding was GBP12,100 (31 March 2023: GBP44,400).

15. Subsequent events

On 20 October 2023, the Group received GBP450,000 from Political

Holdings Limited, being the deferred consideration receivable on

the disposal of the MET Operations on 30 November 2022.

16. Prior period restatement

The consolidated statement of financial position for the period

ended 30 September 2022 has been restated to correctly classify

deferred tax assets of GBP346,000 as non-current assets. These were

previously included within Current assets as part of Trade and

other receivables.

The reclassification has no impact on Total assets, Total equity

and liabilities or Capital and reserves as at the 30 September

2022, nor the Comprehensive income for the period ended 30

September 2022.

The impact of the reclassification on items within the

Consolidated statement of financial position is as follows:

As previously

reported Change As restated

At 30 September 2022 GBP'000 GBP,000 GBP'000

Total non-current assets 43,860 346 44,206

Current assets 6,422 (346) 6,076

Assets held for resale 3,591 - 3,591

-------------------------- -------------- --------- ------------

Total current assets 10,013 (346) 9,667

Total assets 53,873 - 53,873

-------------------------- -------------- --------- ------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR BRBFTMTAMBAJ

(END) Dow Jones Newswires

November 08, 2023 02:00 ET (07:00 GMT)

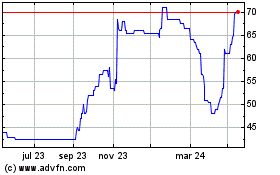

Merit (LSE:MRIT)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

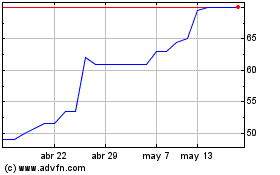

Merit (LSE:MRIT)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024