NewRiver REIT PLC Refinancing of Revolving Credit Facility (6097T)

16 Noviembre 2023 - 1:00AM

UK Regulatory

TIDMNRR

RNS Number : 6097T

NewRiver REIT PLC

16 November 2023

NewRiver REIT plc

("NewRiver" or the "Company" or the "Group")

Refinancing of Revolving Credit Facility

NewRiver is pleased to announce that it has refinanced its

Revolving Credit Facility ("RCF" or "facility").

-- New GBP100 million facility, with a GBP50 million accordion available

subject to lender approval (previous facility GBP125 million with

a GBP50 million accordion)

-- Maturity has been extended from August 2024 to November 2026 with

option to extend the facility by two additional one-year terms (to

November 2028), subject to lender approval

-- Annual cost has reduced as headline margin and quantum both reduced

-- All four banks in the previous facility have continued to support

NewRiver in the new facility, being Barclays Bank PLC, HSBC UK Bank

plc, National Westminster Bank plc and Santander UK plc

The Company was advised by Rothschild & Co.

Will Hobman, Chief Financial Officer commented: "We are pleased

that the strength of our financial position, best-in-class asset

management platform and well positioned portfolio have been

recognised by our key bank lenders, who have each chosen to

continue to support the long-standing relationships we have

established with them. By extending the RCF term for at least a

further three years we will continue to benefit from access to

additional liquidity and at the same time by reducing the size and

margin of the RCF we have been able to do so at a reduced overall

cost."

Ends

+44 (0)20 3328

NewRiver REIT plc 5800

Allan Lockhart (Chief Executive)

Will Hobman (Chief Financial Officer)

+44 (0)20 7251

FGS Global 3801

Gordon Simpson

James Thompson

About NewRiver

NewRiver REIT plc ('NewRiver') is a leading Real Estate

Investment Trust specialising in buying, managing and developing

resilient retail assets throughout the UK.

Our GBP0.6 billion UK wide portfolio covers 7 million sq ft and

comprises 26 community shopping centres and 12 conveniently located

retail parks occupied by tenants predominately focused on essential

goods and services. Our objective is to own and manage the most

resilient retail portfolio in the UK, focused on retail parks, core

shopping centres, and regeneration opportunities in order to

deliver long-term attractive recurring income returns and capital

growth for our shareholders.

NewRiver has a Premium Listing on the Main Market of the London

Stock Exchange (ticker: NRR). Visit www.nrr.co.uk for further

information.

LEI Number: 2138004GX1VAUMH66L31

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCFZMMMNKGGFZM

(END) Dow Jones Newswires

November 16, 2023 02:00 ET (07:00 GMT)

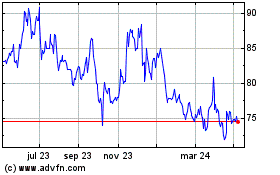

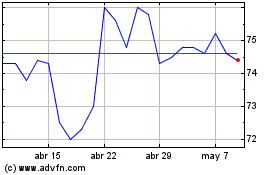

Newriver Reit (LSE:NRR)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Newriver Reit (LSE:NRR)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024