NewRiver REIT PLC Q3 Company Update (0556A)

18 Enero 2024 - 1:00AM

UK Regulatory

TIDMNRR

RNS Number : 0556A

NewRiver REIT PLC

18 January 2024

NewRiver REIT plc

("NewRiver" or the "Company")

Third Quarter Company Update

Continued strong operational performance

Allan Lockhart, Chief Executive, commented : "Our strong

operational performance continued into the third quarter,

reflecting that our occupational market is, in our opinion, in its

best shape for five years. This view is endorsed by the Christmas

trading results reported to date by NewRiver's top 10 retailers,

including B&M, M&S, Boots, Superdrug and Sainsburys, which

have been excellent. The continued importance of the physical store

is becoming increasingly clear to best-in-class retailers, be they

omni-channel operators with a clear understanding of the role of

the physical store in the fulfilment of online orders, or retailers

operating right-sized store-based models.

We delivered another quarter of positive leasing performance, a

further expansion of our Capital Partnerships and have seen an

increase in potential acquisition opportunities delivering

attractive returns which we believe will be supportive of the

future growth of our business. In the meantime, our activities

continue to be underpinned by our clear strategy, well-positioned

portfolio and the strength of our balance sheet."

Strong operational metrics underpinning growth potential

-- Record occupancy maintained at 97.9%

-- Continued strong leasing performance during Q3 with 222,900 sq

ft of leasing transactions; long-term transactions +2.6% vs previous

rent and +1.6% vs ERV; year to date in FY24 we have completed

587,500 sq ft of leasing transactions; long-term transactions

+6.8% vs previous rent and +1.5% vs ERV

-- Maintained consistently high leasing retention rate of 97%

-- Average rent remains affordable at GBP11.70 per sq ft

-- Rent collection stable at 97% vs 97% at the equivalent point in

FY23

-- Capital Partnerships expanded further in Q3: appointed to manage

an additional large retail park taking the total number of assets

managed on behalf of M&G Real Estate to 17 retail parks and two

shopping centres

-- Major regeneration planning application submitted in Grays to

redevelop the shopping centre for a high-density residential-led

redevelopment of up to 850+ homes

-- Further progress made with Work Out disposal programme: of the

four assets identified for disposal by the end of FY24, one disposal

has now completed, one disposal has exchanged and one is under

offer

-- GRESB score improved to 72 from 70 and maintained Gold Level for

EPRA Sustainability Best Practice Recommendations

Balance sheet strength maintained and Investment Grade Credit

Rating reaffirmed by Fitch Ratings

-- Refinanced GBP100 million undrawn Revolving Credit Facility to

extend maturity to November 2026 at reduced cost

-- Fully unsecured balance sheet with interest rate fixed at 3.5%

on drawn debt and no maturity on drawn debt until March 2028

-- Cost of drawn debt compares favourably to portfolio Net Initial

Yield of 7.9% as at 30 September 2023, one of the highest spreads

in the real estate sector

-- Strength of balance sheet position recognised in December 2023

when Fitch Ratings reaffirmed our Long-Term Issuer Default Rating

(IDR) at 'BBB' with a Stable Outlook, senior unsecured rating

(relating to GBP300 million unsecured 2028 bond) at 'BBB+' and

Short-Term IDR at 'F2'

For further information

+44 (0)20 3328

NewRiver REIT plc 5800

Allan Lockhart (Chief Executive)

Will Hobman (Chief Financial

Officer)

+44 (0)20 7251

FGS Global 3801

Gordon Simpson

James Thompson

About NewRiver

NewRiver REIT plc ('NewRiver') is a leading Real Estate

Investment Trust specialising in buying, managing and developing

resilient retail assets throughout the UK.

Our GBP0.6 billion UK wide portfolio covers 6.4 million sq ft

and comprises 25 community shopping centres and 12 conveniently

located retail parks occupied by tenants predominately focused on

essential goods and services. In addition we manage 18 retail parks

and 5 shopping centres on behalf of Capital Partners, taking our

total Assets Under Management to GBP1.3 billion. Our objective is

to own and manage the most resilient retail portfolio in the UK,

focused on retail parks, core shopping centres, and regeneration

opportunities in order to deliver long-term attractive recurring

income returns and capital growth for our shareholders.

NewRiver has a Premium Listing on the Main Market of the London

Stock Exchange (ticker: NRR). Visit www.nrr.co.uk for further

information.

LEI Number: 2138004GX1VAUMH66L31

Forward-looking statements

The information in this announcement may include forward-looking

statements, which are based on current projections about future

events. These forward-looking statements reflect the directors'

beliefs and expectations and are subject to risks, uncertainties

and assumptions about NewRiver REIT plc (the 'Company'), including,

amongst other things, the development of its business, trends in

its operating environment, returns on investment and future capital

expenditure and acquisitions, that could cause actual results and

performance to differ materially from any expected future results

or performance expressed or implied by the forward-looking

statements.

None of the future projections, expectations, estimates or

prospects in this announcement should be taken as forecasts or

promises nor should they be taken as implying any indication,

assurance or guarantee that the assumptions on which such future

projections, expectations, estimates or prospects have been

prepared are correct or exhaustive or, in the case of the

assumptions, fully stated in the announcement. As a result, you are

cautioned not to place reliance on such forward-looking statements

as a prediction of actual results or otherwise. The information and

opinions contained in this announcement are provided as at the date

of this document and are subject to change without notice. No one

undertakes to update publicly or revise any such forward looking

statements. No statement in this announcement is or is intended to

be a profit forecast or profit estimate or to imply that the

earnings of the Company for the current or future financial years

will necessarily match or exceed the historical or published

earnings of the Company.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

QRTFLFSRLEIDLIS

(END) Dow Jones Newswires

January 18, 2024 02:00 ET (07:00 GMT)

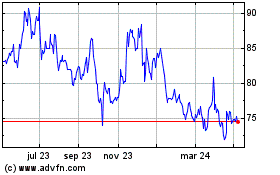

Newriver Reit (LSE:NRR)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

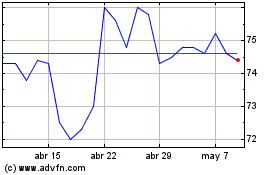

Newriver Reit (LSE:NRR)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024