TIDMOIG

RNS Number : 0722O

Oryx International Growth Fund Ld

23 June 2010

ORYX INTERNATIONAL GROWTH FUND LIMITED ("Oryx" or the "Company")

FINAL RESULTS FOR THE YEAR ENDED 31 MARCH 2010

CHAIRMAN'S STATEMENT

As can be seen from the Investment Manager's report, the year under review has

thrown up some varied results. The overall net asset value per share rose by

32.9% to 222p, however, while this reflects a substantial rise from the lows of

2009, it is disappointing when compared to the rises in the indices.

With this result in mind, it is worth examining the makeup of the portfolio so

that the result can be put in context. The Company invests in companies where

the Investment Manager believes that the valuation is wrong and by instigating

action over a medium time frame, the value can be unlocked. The investments are

made into small to medium sized businesses. The results therefore reflect the

following factors.

In the market crash, the value of the quoted investments was marked down by the

market. While some of our investments have seen a re-rating, this is not uniform

across the board. We therefore anticipate that as the recovery hopefully takes

hold, some of the portfolio will be re-rated to reflect underlying value.

The second group, albeit very limited, are those companies that were adversely

affected by the recession. While this value may be recaptured, this will take

time.

The third group are those companies where management action has been instigated.

During the year disposals were made at good profits. There are a number of

potential negotiations in progress where we expect to see a good result in the

current year. While some of this potential may be reflected in the price, the

value is not normally fully recognised until a deal is finalised and announced.

The unlisted portfolio also represents a lag effect as valuations may only

reflect full value when they are ultimately sold.

These four factors have had a dampening effect on the portfolio during the year

ended 31st March 2010.

Since the year end, Castle Support Services, one of our largest holdings, has

been acquired at a premium to the share price at the end of March of 59%.

We have been using the powers granted at the last AGM to acquire shares. During

the year, 1,270,826 shares were acquired for cancellation. As the shares were

acquired for a discount, this has benefited all long term shareholders. The

closing discount however is still too wide. The Company will seek to renew these

powers at the next AGM. In line with our policy, no dividend will be paid for

the period.

It is very difficult to predict the future with the economy emerging tentatively

from recession, the banks still constrained from lending and business confidence

fragile. Your board believes that the portfolio has good prospects for value

creation as has been demonstrated with the recently completed disposal of Castle

Support Services Plc.

Nigel Cayzer

Chairman

22 June 2010

INVESTMENT ADVISER'S REPORT

During the twelve month period under review the net asset value of the Company

rose by 25.8% as compared to a rise in the FTSE of just under 51%. This

performance was obviously disappointing but needs to be seen in the context that

the unquoted portfolio which amounted to around 22.9% of the assets at the

beginning of the period was essentially flat. The quoted portfolio excluding

this therefore rose by approximately 45%.

Income for the period amounted to GBP12,238,319 (loss in 2009:GBP21,819,627).

During the year, 1,270,826 shares were acquired for cancellation. As the shares

were acquired for a discount, this has benefited all long term shareholders.

Quoted Portfolio:

The principal successes during the year where the performance rose on average by

100% were Dialight, RPC, BBA, Inspired Preference Shares, Catalyst Media Group,

Gleeson and Assetco. Sadly this was partly offset by the fact that the Fund's

two largest investments at the end of March 2009, Bavaria and Journey Group,

both fell and Journey Group by nearly 50% reducing the overall performance of

the quoted portfolio by nearly 5% relative to the Index.

During the period the holding in Avanti's equity was sold having risen by over

50% thereby reducing the Fund's exposure to the company given the large holding

in the senior debt which accrues interest at 20% per annum. Two new large

holdings, Chrysalis and Tenon were acquired and further details on these

investments can be found on pages 6 and 7 of this report.

Unquoted Portfolio:

The principal successes during the year were the uplift in Bionostics following

a third party transaction and the takeover of PVC Container. This unfortunately

was offset by the need to write off Payzone following very disappointing

operating results. Only one new investment was made during the period, Nastor,

which was the buyout of Celsis. To date, the company has significantly exceeded

expectations.

Conclusion:

The current outlook for the UK economy remains highly uncertain. The economic

recovery so far has been feeble and the Government deficit, which will need to

be financed, will crowd out other financial markets. Corporate profits are

generally expected to hold up because of the devaluation of Sterling and the

resultant recovery in exports. However, it is unlikely in these circumstances

the UK equity market will make significant progress over the next twelve months.

Nevertheless, a number of the Company's largest holdings are in discussions to

be acquired and should these talks be successful, the Fund should achieve

reasonable progress in the current year.

North Atlantic Value LLP

22 June 2010

TEN LARGEST EQUITY HOLDINGS

as at 31 March 2010

RPC Group Plc

Cost GBP3,697,810 (1,623,985 shares)

Market value GBP4,059,963 representing 8.11% of Net Asset Value

RPC is the largest company plastic packaging company in Europe. A new chairman

has restructured the business and this will lead to a significant improvement in

profitability over the next few years.

Chrysalis Group Plc

Cost GBP3,500,715 (3,500,000 shares)

Market value GBP3,675,000 representing 7.34% of Net Asset Value

Chrysalis Group's principal asset is a substantial music library which is

believed to be worth significantly above the current share price.

BBA Aviation Plc

Cost GBP3,833,691 (1,600,000 shares)

Market value GBP3,115,200 representing 6.23% of Net Asset Value

BBA Aviation's principal business is Signature which is the leading provider of

aviation support facilities for private jets throughout the world. The company

has modest debt and is seeing good growth as the US in particular emerges from

recession.

Catalyst Media Group Plc

Cost GBP1,444,779 (3,125,000 shares)

Market value GBP3,000,000 representing 6.00% of Net Asset Value

Catalyst Media Group's principal asset is a 21% stake in SIS the leading

provider of data and racing programmes to the bookmaking industry. The company

has recently announced that it is seeking to be acquired.

Gleeson (M.J.) Group Plc

Cost GBP5,552,664 (2,105,227 shares)

Market value GBP2,752,584 representing 5.50% of Net Asset Value

Gleeson is a small builder with operations in the Midlands and North of England.

The company has no debt and was modestly profitable for the six months ended

December. Our estimated private market value of the business is over 50% higher

than the current share price.

Castle Support Services Plc

Cost GBP1,603,016 (3,914,037 shares)

Market value GBP2,661,454 representing 5.32% of Net Asset Value

Castle Support Services is the largest electro and electro mechanical repair

business in the U.K. Recent trading conditions have been favourable. The company

has no debt.

Orthoproducts Limited

Cost GBP1,206,964 (319 shares)

Market value GBP2,552,000 representing 5.10% of Net Asset Value

Orthoplastics is one of two companies in the world capable of manufacturing

advanced plastic materials to the orthopedics industry. In addition the company

is successful in rapidly growing plastic components for the same industry.

Inspired Gaming Group Plc

Cost GBP6,107,629 (5,040,834 shares)

Market value GBP2,520,417 representing 5.04% of Net Asset Value

Inspired Gaming Group is the largest server based gaming company in the UK and

possibly the world. The company is in talks to be acquired.

Tenon Group Plc

Cost GBP2,690,000 (6,000,000 shares)

Market value GBP2,520,000 representing 5.04% of Net Asset Value

Tenon Group Plc is a large Midlands based accountancy group providing services

to SME's. A recent acquisition is expected to significantly boost earnings per

share. The company is a leading beneficiary of the rise in insolvency work due

to the UK recession.

Bavaria Industriekapital AG

Cost GBP1,886,885 (209,286 shares)

Market value GBP2,371,008 representing 4.74% of Net Asset Value

Bavaria Industriekapital AG is a small German industrial conglomerate. The

company has no debt and sells on a modest price earnings ratio. The stock is

very liquid and the holding was reduced over the period.

INVESTMENT POLICY

The Company principally invests in small and mid-size quoted and unquoted

companies in the United Kingdom and United States. The Investment Manager

targets companies that have fundamentally strong business models but where there

may be specific factors which are constraining the maximisation or realisation

of shareholder value, which may be realised through the pursuit of an activist

shareholder agenda by the Investment Manager. Dividend income is a secondary

consideration when making investment decisions.

Achieving the Investment Policy

The investment approach of the Investment Manager is characterised by a rigorous

focus on research and financial analysis of potential investee companies so that

a thorough understanding of their business models is gained prior to investment.

Comprehensive due diligence, including one or more meetings with management as

well as site visits, are standard procedure before shares are acquired.

Typically the portfolio will comprise of 40 to 60 holdings (but without

restricting the Company from holding a more or less concentrated portfolio in

the future).

The Company may invest in derivatives, financial instruments, money market

instruments and currencies solely for the purpose of efficient portfolio

management (i.e. solely for the purpose of reducing, transferring or eliminating

investment risk in the Company's investments, including any technique or

instrument used to provide protection against exchange and credit risks).

The Investment Manager expects the Company's assets will normally be fully

invested. However, during periods in which changes in economic conditions or

other factors so warrant, the Company may reduce its exposure to securities and

increase its position in cash and money market instruments.

A detailed description of the investment process and risk controls employed by

the Manager is disclosed in Note 18 to the consolidated financial statements. A

comprehensive analysis of the Company's portfolio is disclosed on pages 6 to 9

including a description of the ten largest equity investments. At the year end

the Company's portfolio consisted of 47 holdings. The top 10 holdings

represented 58.42% of total net assets.

The Board is responsible for determining the gearing strategy for the Company.

Gearing is used selectively to leverage the Company's portfolio in order to

enhance returns where and to the extent this is considered

appropriate to do so. Borrowings are short term and particular care is taken to

ensure that any bank covenants

permit maximum flexibility of investment policy.

The Company may only make material changes to its investment policies with the

approval of Shareholders (in the form of an ordinary resolution).

INVESTMENT RESTRICTIONS

The Company has adopted the following policies:

(a) it will not invest in securities carrying unlimited liability;

(b) short selling for the purpose of efficient portfolio management will be

permitted provided that the aggregate value of the securities subject to a

contract for sale that has not been settled and which are not owned by the

Company shall not exceed 20 per cent. of the Net Asset Value; in addition, the

Company may engage in uncollateralised stock lending on normal commercial terms

with counterparties whose ordinary business includes uncollateralised stock

lending provided that the aggregate exposure of the Company to any single

counterparty shall not exceed 20 per cent. of the Net Asset Value;

(c) it will not take legal or management control of investments in its

portfolio;

(d) it will not buy or sell commodities or commodity contracts or real estate or

interests in real estate although it may purchase and sell securities which are

secured by real estate or commodities and securities of companies which invest

in or deal in real estate commodities;

(e) it will not invest or lend more than 20 per cent of its assets in securities

of any one company or single issuer;

(f) it will not invest more than 35 per cent of its assets in securities not

listed or quoted on any

recognised stock exchange;

(g) it will not invest in any company where the investment would result in the

company holding more than 10 per cent. of the issued share capital of that

company or any class of that share capital, unless that company constitutes a

trading company (for the purposes or the relevant United Kingdom legislation) in

which case the company may not make any investment that would result in its

holding 50 per cent. or more of the issued share capital of that company or of

any class of that share capital;

(h) it will not invest more than 5 per cent. of its assets in units of unit

trusts or shares or other forms of participation in managed open-ended

investment vehicles; or

(i) the Company may use options, foreign exchange transactions on the forward

market, futures and contracts for differences for the purpose of efficient

portfolio management provided that:

(1) in the case of options, this is done on a covered basis;

(2) in the case of futures and forward foreign exchange transactions, the face

value of all such contracts does not exceed 100 per cent. of the Net Asset Value

of the Company; or

(3) in the case of contracts for difference (including stock index future or

options) the face value of all such contracts does not exceed 100 per cent. of

Net Asset Value of the Company. None of these restrictions, however, require the

realisation of any assets of the Company where any restriction is breached as a

result of an event outside the control of the Investment Manager which occurs

after the investment is made, but no further relevant assets may be acquired by

the Company until the relevant restriction can again be complied with. In the

event of any breach of these investment restrictions, the Board will as soon as

practicable make an announcement on a Regulatory Information Service and

subsequently write to Shareholders if appropriate.

(j) the Company will ensure gearing does not exceed 20% of net assets.

DIRECTORS' RESPONSIBILITIES

The Directors are responsible for preparing the Annual Report and consolidated

Financial Statements for each financial year which give a true and fair view of

the state of affairs of the Group as at the end of the financial year and of the

net income or loss for that year in accordance with International Financial

Reporting Standards and are in accordance with applicable laws.

The Directors confirm, to the best of their knowledge, that

(a) these consolidated Financial Statements, prepared in accordance with

International Financial Reporting Standards, give a true and fair view of the

assets, liabilities, financial position and loss of the Company and the

undertakings included in the consolidation taken as a whole; and

(b) these consolidated Financial Statements include information detailed in the

Directors' Report, the Investment Adviser's Report and Notes to the consolidated

Financial Statements, which provide a fair review of the development and

performance of the business and the position of the Company and the undertakings

included in the consolidation as a whole, together with a description of the

principal risks and uncertainties that they face.

In accordance with The Companies (Guernsey) Law, 2008 each Director confirms

that so far as they are aware, there is no relevant audit information of which

the Company's Auditor is unaware. Each Director also confirms that they have

taken all steps they ought to have taken as a Director to make themselves aware

of any relevant audit information and to establish that the Company's Auditor is

aware of that information.

Directors are also required to:

· properly select and apply accounting standards;

· present information, including accounting policies, in a manner that

provides relevant, reliable, comparable and understandable information;

· provide additional disclosures when compliance with the specific

requirements of IFRS's is insufficient to enable users to understand the impact

of particular transactions, other events and conditions on the Company's

financial position and financial performance; and

· prepare the consolidated Financial Statements on a going concern basis

unless it is inappropriate to presume the Company will continue in business.

The Directors are responsible for keeping proper accounting records which

disclose with reasonable accuracy at any time the financial position of the

Group and to enable them to ensure that the consolidated Financial Statements

comply with The Companies (Guernsey) Law, 2008. They are also responsible for

safeguarding the assets of the Company and hence for taking reasonable steps for

the prevention and detection of fraud and other irregularities.

The Directors are also responsible for the maintenance and integrity of the

Company's website. Legislation in the United Kingdom and in Guernsey governing

the preparation and dissemination of consolidated financial statements differs

from legislation in other jurisdictions.

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

for the year ended 31 March 2010, expressed in GBP sterling

+----------------+--------+--------+-------------+--------------+

| | | | | |

+----------------+--------+--------+-------------+--------------+

| | | | 2010 | 2009 |

+----------------+--------+--------+-------------+--------------+

| | | Notes | GBP | GBP |

+----------------+--------+--------+-------------+--------------+

| Income | | | | |

| | | | | |

+----------------+--------+--------+-------------+--------------+

| Interest | | 3 | 451,310 | 532,972 |

+----------------+--------+--------+-------------+--------------+

| Dividends | | 4 | 1,766,236 | 1,957,538 |

| and | | | | |

| investment | | | | |

| income | | | | |

+----------------+--------+--------+-------------+--------------+

| | | | | |

+----------------+--------+--------+-------------+--------------+

| | | | 2,217,546 | 2,490,510 |

+----------------+--------+--------+-------------+--------------+

| | | | | |

+----------------+--------+--------+-------------+--------------+

| Realised | | 10 | (1,480,675) | (536,343) |

| (losses)/gains | | | | |

| on investments | | | | |

+----------------+--------+--------+-------------+--------------+

| Unrealised | | | | |

| gain/(loss) | | 10 | 13,432,513 | (21,891,039) |

| on | | | | |

| revaluation | | | | |

| of | | | | |

| investments | | | | |

+----------------+--------+--------+-------------+--------------+

| Loss/(gain) | | | (18,297) | 4,044 |

| on foreign | | | | |

| currency | | | | |

| translation | | | | |

+----------------+--------+--------+-------------+--------------+

| | | | | |

+----------------+--------+--------+-------------+--------------+

| Income | | | 14,151,087 | (19,932,828) |

| and | | | | |

| loss | | | | |

| from | | | | |

| investments | | | | |

+----------------+--------+--------+-------------+--------------+

| | | | | |

+----------------+--------+--------+-------------+--------------+

| Expenses | | | | |

+----------------+--------+--------+-------------+--------------+

| Management | | 5 | 523,255 | 550,833 |

| and | | | | |

| investment | | | | |

| adviser's | | | | |

| fee | | | | |

+----------------+--------+--------+-------------+--------------+

| Custodian | | 6 | 17,894 | 17,025 |

| fees | | | | |

+----------------+--------+--------+-------------+--------------+

| Administration | | 7 | 51,496 | 59,161 |

| fees | | | | |

+----------------+--------+--------+-------------+--------------+

| Registrar | | | 14,763 | 112,314 |

| and | | | | |

| transfer | | | | |

| agent | | | | |

| fees | | | | |

+----------------+--------+--------+-------------+--------------+

| Transaction | | | 132,580 | 107,757 |

| costs | | | | |

+----------------+--------+--------+-------------+--------------+

| Directors' | | 8 | 132,580 | 133,000 |

| fees and | | | | |

| expenses | | | | |

+----------------+--------+--------+-------------+--------------+

| Audit | | | 36,500 | 36,000 |

| fees | | | | |

+----------------+--------+--------+-------------+--------------+

| Insurance | | | 10,500 | 9,000 |

+----------------+--------+--------+-------------+--------------+

| Legal | | | 225,544 | 294,206 |

| and | | | | |

| professional | | | | |

| fees | | | | |

+----------------+--------+--------+-------------+--------------+

| Loan | | | - | 117,942 |

| facility | | | | |

| interest | | | | |

+----------------+--------+--------+-------------+--------------+

| Other | | | 492,593 | 190,646 |

| expenses | | | | |

+----------------+--------+--------+-------------+--------------+

| | | | | |

+----------------+--------+--------+-------------+--------------+

| Total | | | 1,637,705 | 1,627,884 |

| expenses | | | | |

+----------------+--------+--------+-------------+--------------+

| | | | | |

+----------------+--------+--------+-------------+--------------+

| Net | | | 12,513,382 | (21,560,712) |

| income/(loss) | | | | |

| for the year | | | | |

| before | | | | |

| taxation | | | | |

+----------------+--------+--------+-------------+--------------+

| | | | | |

+----------------+--------+--------+-------------+--------------+

| Withholding | | | 275,063 | 258,915 |

| tax on | | | | |

| dividends | | | | |

+----------------+--------+--------+-------------+--------------+

| | | | | |

+----------------+--------+--------+-------------+--------------+

| Net | | | 12,238,319 | (21,819,627) |

| income/(loss) | | | | |

| for the year | | | | |

+----------------+--------+--------+-------------+--------------+

| | | | | |

+----------------+--------+--------+-------------+--------------+

| Income/(loss) | | | | |

| per share - | | | | |

| basic and | | | | |

| diluted: | | | | |

+----------------+--------+--------+-------------+--------------+

| Ordinary | | 16 | GBP0.54 | GBP(0.90) |

+----------------+--------+--------+-------------+--------------+

| | | | | |

+----------------+--------+--------+-------------+--------------+

All items in the above statement are derived from continuing operations.

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

as at 31 March 2010, expressed in GBP sterling

+----------------+--------+--------+-------------+--------------+

| | | | 2010 | 2009 |

+----------------+--------+--------+-------------+--------------+

| | | Notes | GBP | GBP |

+----------------+--------+--------+-------------+--------------+

| | | | | |

+----------------+--------+--------+-------------+--------------+

| Non-current | | | | |

| assets | | | | |

+----------------+--------+--------+-------------+--------------+

| Listed | | 10 | | |

| investments | | | 39,996,704 | 29,388,138 |

| designated | | | | |

| at fair | | | | |

| value | | | | |

| through | | | | |

| profit or | | | | |

| loss (Cost | | | | |

| - | | | | |

| GBP65,081,145: | | | | |

| 2009 - | | | | |

| GBP64,662,030) | | | | |

+----------------+--------+--------+-------------+--------------+

| Unlisted | | 10 | | |

| investments | | | 11,165,794 | 9,144,411 |

| designated | | | | |

| at fair | | | | |

| value | | | | |

| through | | | | |

| profit or | | | | |

| loss (Cost | | | | |

| - | | | | |

| GBP8,306,047: | | | | |

| 2009 - | | | | |

| GBP9,527,727) | | | | |

+----------------+--------+--------+-------------+--------------+

| | | | 51,162,498 | 38,532,549 |

+----------------+--------+--------+-------------+--------------+

| Current | | | | |

| assets | | | | |

+----------------+--------+--------+-------------+--------------+

| Other | | | 102,333 | 368,865 |

| receivables | | | | |

+----------------+--------+--------+-------------+--------------+

| Dividends | | | 173,230 | 318,876 |

| and | | | | |

| interest | | | | |

| receivable | | | | |

+----------------+--------+--------+-------------+--------------+

| Amounts | | | 12,687 | 3,032 |

| due | | | | |

| from | | | | |

| brokers | | | | |

+----------------+--------+--------+-------------+--------------+

| Cash | | | 195,000 | 906,097 |

| and | | | | |

| cash | | | | |

| equivalents | | | | |

+----------------+--------+--------+-------------+--------------+

| | | | 483,250 | 1,596,870 |

+----------------+--------+--------+-------------+--------------+

| | | | | |

+----------------+--------+--------+-------------+--------------+

| Total | | | 51,645,748 | 40,129,419 |

| assets | | | | |

+----------------+--------+--------+-------------+--------------+

| | | | | |

+----------------+--------+--------+-------------+--------------+

| Current | | | | |

| liabilities | | | | |

+----------------+--------+--------+-------------+--------------+

| Overdraft | | | 1,116,352 | - |

+----------------+--------+--------+-------------+--------------+

| Amounts | | | 34,632 | 15,978 |

| due to | | | | |

| brokers | | | | |

+----------------+--------+--------+-------------+--------------+

| Other | | | 456,761 | 348,420 |

| payables | | | | |

| and | | | | |

| accrued | | | | |

| expenses | | | | |

+----------------+--------+--------+-------------+--------------+

| | | | 1,607,745 | 364,398 |

+----------------+--------+--------+-------------+--------------+

| | | | | |

+----------------+--------+--------+-------------+--------------+

| Net | | | 50,038,003 | 39,765,021 |

| assets | | | | |

+----------------+--------+--------+-------------+--------------+

| | | | | |

+----------------+--------+--------+-------------+--------------+

| Shareholders' | | | | |

| equity | | | | |

+----------------+--------+--------+-------------+--------------+

| Called | | 11 | 11,252,912 | 11,888,325 |

| up | | | | |

| share | | | | |

| capital | | | | |

+----------------+--------+--------+-------------+--------------+

| Share | | 11 | 42,696,509 | 42,696,509 |

| premium | | | | |

+----------------+--------+--------+-------------+--------------+

| Capital | | | 1,246,500 | 1,246,500 |

| redemption | | | | |

| reserve | | | | |

+----------------+--------+--------+-------------+--------------+

| Other | | 12 | (5,157,918) | (16,066,313) |

| reserves | | | | |

+----------------+--------+--------+-------------+--------------+

| Total | | | 50,038,003 | 39,765,021 |

| equity | | | | |

| shareholders' | | | | |

| funds | | | | |

+----------------+--------+--------+-------------+--------------+

| | | | | |

+----------------+--------+--------+-------------+--------------+

| Net | | 16 | GBP2.22 | GBP1.67 |

| Asset | | | | |

| Value | | | | |

| per | | | | |

| Share | | | | |

| - | | | | |

| basic | | | | |

| and | | | | |

| diluted | | | | |

+----------------+--------+--------+-------------+--------------+

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

for the year ended 31 March 2010, expressed in GBP sterling

+--------------------+-------+------------+------------+------------+--------------+-------------+

| |Notes | Share | Share | Capital | Other | Total |

| | | Capital | Premium |redemption | reserves | |

| | | | | reserve | | |

+--------------------+-------+------------+------------+------------+--------------+-------------+

| | | GBP | GBP | GBP | GBP | GBP |

+--------------------+-------+------------+------------+------------+--------------+-------------+

| | | | | | | |

+--------------------+-------+------------+------------+------------+--------------+-------------+

| Balance at 1 April | | 11,888,325 | 42,696,509 | 1,246,500 | (16,066,313) | 39,765,021 |

| 2009 | | | | | | |

+--------------------+-------+------------+------------+------------+--------------+-------------+

| | | | | | | |

+--------------------+-------+------------+------------+------------+--------------+-------------+

| Total | | | | | | |

| Comprehensive | | | | | | |

| Income | | | | | | |

+--------------------+-------+------------+------------+------------+--------------+-------------+

| For the Year | | | | | 12,238,319 | 12,238,319 |

+--------------------+-------+------------+------------+------------+--------------+-------------+

| | | | | | | |

+--------------------+-------+------------+------------+------------+--------------+-------------+

| Transactions with | | | | | | |

| owners, | | | | | | |

+--------------------+-------+------------+------------+------------+--------------+-------------+

| recorded directly | | | | | | |

| in equity | | | | | | |

+--------------------+-------+------------+------------+------------+--------------+-------------+

| Contributions, | | | | | | |

| redemptions and | | | | | | |

| distributions to | | | | | | |

| shareholders | | | | | | |

+--------------------+-------+------------+------------+------------+--------------+-------------+

| - Cancellation of | 11,12 | (635,413) | | | (1,329,924) | (1,965,337) |

| shares | | | | | | |

+--------------------+-------+------------+------------+------------+--------------+-------------+

| Total transactions | | (635,413) | - | - | (1,329,924) | (1,965,337) |

| with owners | | | | | | |

+--------------------+-------+------------+------------+------------+--------------+-------------+

| | | | | | | |

+--------------------+-------+------------+------------+------------+--------------+-------------+

| Balance at 31 | | 11,252,912 | 42,696,509 | 1,246,500 | (5,157,918) | 50,038,003 |

| March 10 | | | | | | |

+--------------------+-------+------------+------------+------------+--------------+-------------+

+--------------------+-------+------------+------------+------------+--------------+--------------+

| |Notes | Share | Share | Capital | Other | Total |

| | | Capital | Premium |redemption | reserves | |

| | | | | reserve | | |

+--------------------+-------+------------+------------+------------+--------------+--------------+

| | | GBP | GBP | GBP | GBP | GBP |

+--------------------+-------+------------+------------+------------+--------------+--------------+

| | | | | | | |

+--------------------+-------+------------+------------+------------+--------------+--------------+

| Balance at 1 April | | 12,393,708 | 42,894,039 | 1,246,500 | 6,773,905 | 63,308,152 |

| 2008 | | | | | | |

+--------------------+-------+------------+------------+------------+--------------+--------------+

| | | | | | | |

+--------------------+-------+------------+------------+------------+--------------+--------------+

| Total | | | | | | |

| Comprehensive | | | | | | |

| Income | | | | | | |

+--------------------+-------+------------+------------+------------+--------------+--------------+

| For the Year | | | | | (21,819,627) | (21,819,627) |

+--------------------+-------+------------+------------+------------+--------------+--------------+

| | | | | | | |

+--------------------+-------+------------+------------+------------+--------------+--------------+

| Transactions with | | | | | | |

| owners, | | | | | | |

+--------------------+-------+------------+------------+------------+--------------+--------------+

| recorded directly | | | | | | |

| in equity | | | | | | |

+--------------------+-------+------------+------------+------------+--------------+--------------+

| Contributions, | | | | | | |

| redemptions and | | | | | | |

| distributions to | | | | | | |

| shareholders | | | | | | |

+--------------------+-------+------------+------------+------------+--------------+--------------+

| - Cancellation of | 11,12 | (505,383) | (197,530) | | (1,020,591) | (1,723,504) |

| shares | | | | | | |

+--------------------+-------+------------+------------+------------+--------------+--------------+

| Total transactions | | (505,383) | (197,530) | - | (1,020,591) | (1,723,504) |

| with owners | | | | | | |

+--------------------+-------+------------+------------+------------+--------------+--------------+

| | | | | | | |

+--------------------+-------+------------+------------+------------+--------------+--------------+

| Balance at 31 | | 11,888,325 | 42,696,509 | 1,246,500 | (16,066,313) | 39,765,021 |

| March 09 | | | | | | |

+--------------------+-------+------------+------------+------------+--------------+--------------+

CONSOLIDATED STATEMENT OF CASH FLOWS

for the year ended 31 March 2010, expressed in GBP sterling

+---------------------+--------+--------+-------------+-------------+

| | | | 2010 | 2009 |

+---------------------+--------+--------+-------------+-------------+

| | | Notes | GBP | GBP |

+---------------------+--------+--------+-------------+-------------+

| | | | | |

+---------------------+--------+--------+-------------+-------------+

| Net | | | | |

| cash | | 14 | 156,185 | 2,523,265 |

| inflow | | | | |

| from | | | | |

| operating | | | | |

| activities | | | | |

+---------------------+--------+--------+-------------+-------------+

| | | | | |

+---------------------+--------+--------+-------------+-------------+

| Financing | | | | |

| Activities | | | | |

+---------------------+--------+--------+-------------+-------------+

| Cancellation | | | (1,965,337) | (1,663,504) |

| of shares | | | | |

+---------------------+--------+--------+-------------+-------------+

| Proceeds | | | - | 6,400,000 |

| of | | | | |

| borrowings | | | | |

+---------------------+--------+--------+-------------+-------------+

| Repayment | | | - | (7,150,000) |

| of | | | | |

| borrowings | | | | |

+---------------------+--------+--------+-------------+-------------+

| Bank | | | 1,116,352 | - |

| overdraft | | | | |

+---------------------+--------+--------+-------------+-------------+

| Cash | | | (848,985) | (2,413,504) |

| outflow | | | | |

| from | | | | |

| financing | | | | |

| activities | | | | |

+---------------------+--------+--------+-------------+-------------+

| | | | | |

+---------------------+--------+--------+-------------+-------------+

| | | | | |

+---------------------+--------+--------+-------------+-------------+

| Net | | | | |

| increase/(decrease) | | | (692,800) | 109,761 |

| in cash and cash | | | | |

| equivalents | | | | |

+---------------------+--------+--------+-------------+-------------+

| | | | | |

+---------------------+--------+--------+-------------+-------------+

| Cash | | | 906,097 | 792,292 |

| and | | | | |

| cash | | | | |

| equivalents | | | | |

| at | | | | |

| beginning | | | | |

| of year | | | | |

+---------------------+--------+--------+-------------+-------------+

| Effect | | | | |

| of | | | (18,297) | 4,044 |

| exchange | | | | |

| rate | | | | |

| fluctuations | | | | |

| on cash and | | | | |

| cash | | | | |

| equivalents | | | | |

+---------------------+--------+--------+-------------+-------------+

| | | | | |

+---------------------+--------+--------+-------------+-------------+

| Cash | | | 195,000 | 906,097 |

| and | | | | |

| cash | | | | |

| equivalents | | | | |

| at end of | | | | |

| year | | | | |

+---------------------+--------+--------+-------------+-------------+

NOTES

1. General

Oryx International Growth Fund Limited (the "Company") was incorporated in

Guernsey on 2 December 1994 and commenced activities on 3 March 1995.

The above results comprise an abridged version of the Company's full accounts

for the year ended 31 March 2009 ("Annual Report). Copies of the Annual Report

will be sent to shareholders shortly, together with a circular, containing

details of a proposed waiver of the Rule 9 provisions of the City Code on

Takeovers and Mergers which also contains the Notice convening the Company's

Annual General Meeting to be held at 10.00 a.m. on 20 August 2010.

The Annual Report and Circular will be available to view and download at the

Company's website www.oryxinternationalgrowthfund.co.uk and copies may also be

obtained from the Company's registered office at BNP Paribas House, 1 St

Julian's Avenue, St Peter Port, Guernsey GY1 1WA.

2. Accounting Policies

Basis of Preparation

The financial statements of the Company, which give a true and fair view have

been prepared in accordance with International Financial Reporting Standards

("IFRS"), as adopted by the EU which comprise standards and interpretations

approved by the International Accounting Standards Board (the "IASB"), and

International Accounting Standards and Standing Interpretations Committee

interpretations approved by the International Accounting Standards Committee

("IASC") that remain in effect and comply with the Companies (Guernsey) Law,

2008. The financial statements have been prepared on the going concern basis.

The financial statements have been prepared on the historical cost basis except

for the inclusion at fair value of certain financial instruments. The principal

accounting policies are set out below.

Use of estimates and judgements

The preparation of consolidated financial statements in accordance with IFRS

adopted by the EU requires management to make judgements, estimates and

assumptions that affect the application of accounting policies and the reported

amounts of assets, liabilities, income and expenses. These estimates and

associated assumptions are based on historical experience and other factors that

are considered to be relevant. Actual results may vary from these estimates.

Judgement is exercised in terms of whether the price of recent transaction

remains the best indicator of fair value at the balance sheet date. The manager

reviews sector and market information and the circumstances of the investee

company to determine if the valuation adopted at the balance sheet date remains

the best indicator of fair value

The estimates and underlying assumptions are reviewed on an ongoing basis.

Revisions to accounting estimates are recognised in the period in which the

estimate is revised if the revision affects only that period, or in the period

of the revision and future periods, if the revision affects both current and

future periods.

Information about significant areas of estimation uncertainty and critical

judgements in applying accounting policies that have the most significant effect

on the amounts recognised in the financial statements are set out in Note 2(b)

New standards and interpretations not yet adopted

A number of new standards, amendments to standards and interpretations are not

yet effective for the year ended 31 March 2010, and have not been applied in

preparing these financial statements. None of these will have an effect on the

financial statements of the Group, with the exception of the following:

IFRS 9 Financial Instruments, published on 12 November 2009 as part of phase I

of the IASB's comprehensive project to replace IAS 39, deals with classification

and measurement of financial assets. The requirements of this standard represent

a significant change from the existing requirements in IAS 39 in respect of

financial assets. The standard contains two primary measurement categories for

financial assets: amortised cost and fair value. A financial asset would be

measured at amortised cost if it is held within a business model whose objective

is to hold assets in order to collect contractual cash flows, and the asset's

contractual terms give rise on specified dates to cash flows that are solely

payments of principal and interest on the principal outstanding. All

other financial assets would be measured at fair value. The standard eliminates

the existing IAS 39 categories of held to maturity, available for sale and loans

and receivables. For an investment in an equity instrument which is not held for

trading, the standard permits an irrevocable election, on initial recognition,

on an individual share-by-share basis, to present all fair value changes from

the investment in other comprehensive income. No amount recognised in other

comprehensive income would ever be reclassified to profit or loss at a later

date. However, dividends on such investments are recognised in profit or loss,

rather than other comprehensive income unless they clearly represent a partial

recovery of the cost of the investment. Investments in equity instruments in

respect of which an entity does not elect to present fair value changes in other

comprehensive income would be measured at fair value with changes in fair value

recognised in profit or loss.

The standard requires that derivatives embedded in contracts with a host that is

a financial asset within the scope of the standard are not separated; instead

the hybrid financial instrument is assessed in its entirety as to whether it

should be measured at amortised cost or fair value.

The standard is effective for annual periods beginning on or after 1 January

2013. Earlier application is permitted.

The Group is currently in the process of evaluating the potential effect of this

standard on the Group's financial statements.

Amendments to IAS 39 Financial Instruments: Recognition and Measurement -

Eligible Hedged Items clarifies the application of existing principles that

determine whether specific risks or portions of cash flows are eligible for

designation in a hedging relationship. The amendments became mandatory for the

Group's 2010 consolidated financial statements, with retrospective application

required. The amendments are not expected to have a significant impact on the

company's financial statements.

Adoptions of new standards

The following new standards and amendments are mandatory for the financial year

beginning 1 January 2009.

IAS 1 (revised), 'Presentation of Financial Statements.' The revised standard

prohibits the presentation of items of income and expenses (that is 'non-owner

changes in equity' in the statement of changes in equity, requiring 'non-owner

changes in equity' to be presented separately from owner changes in equity. All

'non-owner changes in equity' are required to be shown in a performance

statement.

Entities can choose whether to present one performance statement (the statement

of comprehensive income) or two statements (the income statement and statement

of comprehensive income). The Group has elected to present one statement: the

statement of comprehensive income.

IFRS 8, 'Operating Segments' replaces IAS 14 Segment Reporting. The new standard

requires a 'management approach', under which segment information is presented

on the same basis as that used for internal reporting purposes.

The Board has considered the requirements of IFRS 8 'Operating Segments', and is

of the view that the Company is engaged in a single segment of business, being

investment in listed and unlisted funds. The Board, as a whole, has been

determined as constituting the chief operating decision maker of the Company.

The key measure used by the Board to assess the Company's performance and to

allocate resources is the total return on the Company's net asset value ("NAV")

as a whole, as calculated under IFRS and therefore no reconciliation is required

between the measure of profit or loss used by the Board and that contained in

the consolidated financial statements.

Other accounting developments

The Fund has applied Improving Disclosures about Financial Instruments

(Amendments to IFRS 7), issued in March 2009, that require enhanced disclosures

about fair value measurements and liquidity risk in respect of financial

instruments.

The amendments require that fair value measurement disclosures use a three-level

fair value hierarchy that reflects the significance of the inputs used in

measuring fair values of financial instruments. Specific disclosures are

required when fair value measurements are categorised as Level 3 (significant

unobservable inputs) in the fair value hierarchy. The amendments require that

any significant transfers between Level 1 and Level 2 of the fair value

hierarchy be disclosed separately, distinguishing between transfers into and out

of each level. Furthermore, changes in valuation techniques from one period to

another, including the reasons therefore, are required to be disclosed for each

class of financial instruments.

Revised disclosures in respect of fair values of financial instruments are

included in note 18. Further, the definition of liquidity risk has been amended

and it is now defined as the risk that an entity will encounter difficulty in

meeting obligations associated with financial liabilities that are settled by

delivering cash or another financial asset.

The amendments require disclosure of a maturity analysis for non-derivative and

derivative financial liabilities, but contractual maturities are required to be

disclosed for derivative financial liabilities only when contractual maturities

are essential for an understanding of the timing of cash flows. Revised

disclosures in respect of liquidity risk are included in note 18.

a) Income Recognition

Dividend income is recognised when the right to receive income is established.

Usually this is the ex-dividend date for equity securities. Deposit interest is

accrued on a day-to-day basis. Loan interest is accounted for using the

effective interest method. All income is shown gross of any applicable

withholding tax.

b) Investments

Classification

All investments of the Company, together with its subsidiaries ('the Group'),

are designated into the financial assets at fair value through profit or loss

category. The investments are purchased mainly for their capital growth and the

portfolio is managed, and performance evaluated, on a fair value basis in

accordance with the Group's documented investment strategy. Therefore the

Directors consider that this is the most appropriate classification.

This category comprises financial instruments designated at fair value though

profit or loss upon initial recognition - these include financial assets that

are not held for trading purposes and which may be sold. These are principally

investments in listed and unlisted equities.

Fair value measurement principles

Financial instruments are measured initially at fair value being the transaction

price. Subsequent to initial recognition on trade date, all instruments

classified as fair value through profit or loss are measured at fair value with

changes in their fair value recognised in the Statement of Comprehensive Income.

Transaction costs are separately disclosed in the Statement of Comprehensive

Income.

Listed investments have been valued at the bid market price ruling at the

Statement of Financial Position date. In the absence of the bid market price,

the closing price has been taken, or, in either case, if the market is closed on

the Statement of Financial Position date, the bid market or closing price on the

preceding business day.

Unlisted investments are valued in accordance with the International Private

Equity and Venture Capital Association (IPEVCA) guidelines. Their valuation

includes all factors that market participants would consider in setting a price.

The primary valuation techniques employed to value the unlisted investments are

earnings multiples, recent transactions and the net asset basis. Cost is

considered appropriate for early stage investments. The relevance of this

methodology can be eroded over time and in these cases the carrying values will

be adjusted to reflect fair value.

For certain of the Group's financial instruments, including cash and cash

equivalents, interest and dividends and interest receivable and amounts due to

and from broker, the carrying amounts approximate fair value due to their

immediate or short-term maturity.

Derecognition of financial assets occur when the rights to receive cash flows

from financial instruments expire or are transferred and substantially all of

the risks and rewards of ownership have been transferred.

Fair value measurement should be determined based on assumptions that market

participants would use in pricing an asset or liability. As a basis for

considering market participant assumptions, IFRS 7 establishes a fair value

hierarchy that gives the highest priority to unadjusted quoted prices in active

markets (Level 1) and lowest priority to unobservable inputs (Level 3). The

three levels of the value hierarchy are as follows.

Level 1: Inputs that reflect unadjusted quoted prices in active markets for

identical assets or liabilities that the Company has the ability to access at

the measurement date;

Level 2: Inputs reflect quoted prices of similar assets and liabilities in

active markets and quoted prices of identical assets and liabilities in markets

that are considered to be inactive, as well as inputs other than quoted prices

that are observable for the asset or liability either directly or indirectly;

and

Level 3: Inputs that are unobservable for the asset or liability and reflect the

Investment Manager's own assumptions in accordance with the accounting policies

disclosed within note 2 to the financial statements.

c) Other receivables

Other receivables do not carry any interest and are short term in nature and are

accordingly stated at their amortised cost as reduced by appropriate allowances

for impairment.

d) Cash and cash equivalents

Cash and cash equivalents consist of cash in hand and short term deposits in

banks with original maturities of less than three months.

e) Other Accruals and Payables

Other accruals and payables are not interest bearing and are stated at their

amortised cost.

f) Foreign Currency Translation

Items included in the Group's financial statements are measured using the

currency of the primary economic environment in which it operates (the

"functional currency"). This is the pound sterling which reflects the Group's

primary activity of investing in sterling securities. The Group's shares are

also issued in sterling.

Foreign currency assets and liabilities have been translated at the exchange

rates ruling at the Balance Sheet date. Transactions in foreign currency during

the period have been translated into pounds sterling at the spot exchange rate

in effect at the date of the transaction. Realised and unrealised gains and

losses on currency translation are recognised in the consolidated Statement of

Comprehensive Income.

g) Realised and Unrealised Gains and Losses

Realised gains and losses arising on the disposal of investments are calculated

by reference to the cost attributable to those investments and the sales

proceeds, and are included in the consolidated Statement of Comprehensive

Income. Unrealised gains and losses arising on investments held at the

consolidated Statement of Financial Position date are also included in the

consolidated Statement of Comprehensive Income.

h) Financial Liabilities

All bank loans and borrowings are initially recognised at cost, being the fair

value of the consideration received, less issue costs where applicable. After

initial recognition, all interest bearing loans and borrowings are subsequently

measured at amortised cost. Any difference between cost and redemption value

has been recognised in the consolidated Statement of Comprehensive Income over

the period of the borrowings on an effective interest basis.

Financial liabilities are derecognised from the consolidated Statement of

Financial Position only when the obligations are extinguished either through

discharge, cancellation or expiration.

i) Equity

Share Capital represents the nominal value of equity shares.

Share Premium represents the excess over nominal value of the fair value of

consideration received for equity shares, net of expenses of the share issue.

Share premium is debited for the excess of redemption price over par value of

shares.

Other Reserves and the Capital Redemption Reserve include all current and prior

results as disclosed in the consolidated Statement of Comprehensive Income.

Other Reserves also includes the excess over nominal value of the fair value of

consideration deducted on share buy-backs.

j) Expenses

Expenses are recognised in the consolidated Statement of Comprehensive Income

upon utilisation of the service or at the date they are incurred.

k) Consolidation

These consolidated financial statements comprise the financial statements of the

Company and its wholly owned subsidiary undertakings, Baltimore plc and American

Opportunity Trust PLC, both UK registered. Subsidiaries are those entities

controlled by the Company. Control exists when the Company has the power to

govern the financial and operating policies of an entity so as to obtain

benefits from its activities.

The financial statements of subsidiaries are included in the consolidated

financial statements from the date that control commences until the date that

control ceases. The financial statements have been prepared using uniform

accounting policies for like transactions and other events in similar

circumstances. All intra-group balances and transactions are eliminated in full

in preparing the consolidated financial statements.

3. Share Capital and Share Premium

a) Authorised Share Capital

+--------------------+------+----------+------+-+------------+----------+------------+

| | | | | | Number | | GBP |

| | | | | | of | | |

| | | | | | Shares | | |

+--------------------+------+----------+------+-+------------+----------+------------+

| Authorised: | | | | | | | |

+--------------------+------+----------+------+-+------------+----------+------------+

| Ordinary shares of | | | | | 90,000,000 | | 45,000,000 |

| 50p each | | | | | | | |

+--------------------+------+----------+------+-+------------+----------+------------+

b) Ordinary Shares Issued - 1 April 2009 to 31 March 2010

+----------------+----------+-------------+----------+------------+----------+------------+

| Ordinary | | Number | | Share | | Share |

| Shares of 50p | | of | | Capital | | Premium |

| each | | Shares | | GBP | | GBP |

+----------------+----------+-------------+----------+------------+----------+------------+

| At 1 April | | 23,776,649 | | 11,888,325 | | 42,696,509 |

| 2009 | | | | | | |

+----------------+----------+-------------+----------+------------+----------+------------+

| Cancellation | | (1,270,824) | | (635,413) | | - |

| of shares | | | | | | |

+----------------+----------+-------------+----------+------------+----------+------------+

| At 31 March | | 22,505,825 | | 11,252,912 | | 42,696,509 |

| 2010 | | | | | | |

+----------------+----------+-------------+----------+------------+----------+------------+

Ordinary Shares Issued - 1 April 2008 to 31 March 2009

+----------------+----------+-------------+----------+------------+----------+------------+

| Ordinary | | Number | | Share | | Share |

| Shares of 50p | | of | | Capital | | Premium |

| each | | Shares | | GBP | | GBP |

+----------------+----------+-------------+----------+------------+----------+------------+

| At 1 April | | 24,787,416 | | 12,393,708 | | 42,894,039 |

| 2008 | | | | | | |

+----------------+----------+-------------+----------+------------+----------+------------+

| Cancellation | | (1,010,767) | | (505,383) | | (197,530) |

| of shares | | | | | | |

+----------------+----------+-------------+----------+------------+----------+------------+

| At 31 March | | 23,776,649 | | 11,888,325 | | 42,696,509 |

| 2009 | | | | | | |

+----------------+----------+-------------+----------+------------+----------+------------+

4. Earnings per Share and Net Asset Value per Share

The calculation of basic earnings per share for the Ordinary Share is based on a

gain of GBP12,238,319 (2009 - loss GBP21,819,627) and the weighted average

number of shares in issue during the year of 22,855,527 shares (2009 -

24,318,802 shares). In accordance with IAS 33 - Earnings per Share, the diluted

earnings per share is also disclosed. At 31 March 2010 there was no difference

in the diluted earnings per share calculation for the Ordinary Shares.

Enquiries:

Sara Bourne

BNP Paribas Fund Services (Guernsey) Limited Tel: 01481 750858

Alastair Moreton

Hannah Pearce

Arbuthnot Securities Limited Tel: 020 7012 2000

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR SEUFMEFSSEDM

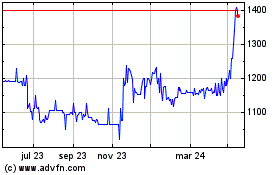

Oryx International Growth (LSE:OIG)

Gráfica de Acción Histórica

De Jun 2024 a Jul 2024

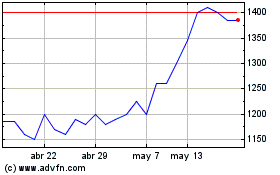

Oryx International Growth (LSE:OIG)

Gráfica de Acción Histórica

De Jul 2023 a Jul 2024