TIDMPTRO

RNS Number : 7254A

Pelatro PLC

26 May 2023

26 May 2023

Pelatro Plc

("Pelatro" or the "Group")

Final Audited Results for the Year ended 31 December 2022

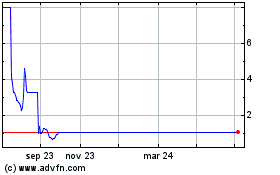

Pelatro Plc (AIM: PTRO), the precision marketing software

specialist, today announces today results for the year ended 31

December 2022.

Financial highlights

-- Decrease in revenue to $5.4m (2021: $7.3m)

-- Recurring revenue of $4.3m (2021: $4.8m)

-- Adjusted EBITDA(*) of $0.6m (2021: $2.8m)

-- Adjusted loss per share of (27.3)c (2021: (0.4)c)

-- Trade receivables of $3.5m (2021: $5.0m)

-- Exceptional costs incurred of $1.1m, relating primarily to

write off of one trade receivable and one contract asset, together

with staff retention share issue

-- Impairment charges of $9.3m incurred, primarily relating to

intangible assets as a result of reduction in revenue in 2022

Operational highlights

-- Three new customers added during the year, bringing total to

26, increased presence in Africa and the Middle East

-- Continuing to retain customers at end of initial contracts

-- Shortlisted by an increasing number of banks, demonstrating

the validity of our product for non-telcos

Outlook

-- Substantial order book with a number of new contracts won

since the year end, including a good level of repeat activity from

change requests, and a large number of significant contracts in

advanced stages of negotiation, including banks

-- New customer wins for the year expected to be in double figures

-- Excellent visibility over revenues for the current year, currently around $8m

-- ARR now c.$7m

-- New business pipeline (#) of c. $23m, including some $5m of non telco business

Harry Berry, non-executive Chairman of Pelatro commented:

"Despite a disappointing 2022, I look forward with cautious

optimism to 2023 as the efforts put in to date, particularly our

diversification into non-telco customers, begin to pay off. Our new

business pipeline is at its highest ever level and I am confident

that this will produce results in the coming months and years."

Presentation

A copy of the results presentation to be provided to investors

and analysts will be available on Pelatro's website in due course (

www.pelatro.com ).

For further information contact:

Pelatro Plc

Subash Menon, Managing Director c/o finnCap

Nic Hellyer, Chief Financial Officer

finnCap Limited (Nominated Adviser and

Joint Broker) +44 (0)20 7220 0500

Carl Holmes/Milesh Hindocha (Corporate

Finance)

Dowgate Capital Limited (Joint Broker) +44 (0)20 3903 7715

Stephen Norcross

* earnings before interest, tax, depreciation, amortisation,

exceptional items and share-based payments

** ARR is calculated by reference to the full annualised value

of a contract; the total ARR thus calculated may not all accrue in

the 12 months following due to (for example) implementation periods

and other timing differences between signing a contract and the "Go

Live" or similar date

# Pipeline value is defined as expected license revenue or 3 x

ARR, depending on the nature of the contract

This announcement is released by Pelatro Plc and, prior to

publication, the information contained herein was deemed to

constitute inside information under the Market Abuse Regulations

(EU) No. 596/2014. Such information is disclosed in accordance with

the Company's obligations under Article 17 of MAR. The person who

arranged for the release of this announcement on behalf of Pelatro

Plc was Nic Hellyer, CFO.

Notes to editors

The Pelatro Group was founded in March 2013 by Subash Menon and

Sudeesh Yezhuvath with the objective of offering specialised,

enterprise class software solutions for customer engagement

principally to telcos who face a series of challenges including

market maturity, saturation and customer churn.

Pelatro provides its "mViva" platform for use by customers in

B2C and B2B applications and is well positioned in the Customer

Engagement space. Our technology orchestrates the digital journey

of the customers of the telcos through contextual, relevant and

real time offers and loyalty programs across multiple channels

including websites, social media, apps and others.

For more information about Pelatro, visit www.pelatro.com

Chairman's statement

I joined the Group in December 2022 at the end of a mixed year

in which we had consolidated our position with existing customers

and continued to win new ones, in particular in the non-telco

space. However, a number of these wins will only produce revenue in

2023 or later and hence did not contribute to the 2022 results.

Unusually, we also renegotiated contracts with a small number of

customers, in particular a Middle East telco (part of a wider

international group) with which we had originally agreed a license

contract (worth around $1m in total). The value of this contract

was recognised in the interim results for the 6 months to 30 June

2022; however, based on mutually beneficial discussions, we agreed

to convert this to a managed services contract which, whilst

overall better for the Group in economic terms, resulted in a

deferral of the revenue to following years.

Also unusually for the Group, we recognised two write offs of

trade receivables or contract assets, the former a long-standing

debtor of around $0.2m where a change of ownership of the customer

meant that the new management refused to recognise the validity of

certain products and services provided by Pelatro on its usual

commercial terms. Despite protracted negotiations the Directors are

now of the view that this debt is unlikely to be recovered and

hence we have written it off. Contract assets of around $0.3m

arising from the sale of a license (and where there is no trade

receivable as the revenue was recognised on an IFRS 15 basis on

transfer of the license) have also been written off where it has

not been possible to agree the detailed technical terms of

implementation with the customer concerned.

More positively our mViva product was selected by Orea Money and

Banque Nationale d'investissement in Africa to provide its

Contextual Campaign Management in a SaaS model to analyse user

behaviour, generate predictions using AI/ML based models and

increase revenue, with a. contract value of around US$ 1.5 million

for an initial period of three years.

Also we were selected by a large global telco to provide our

mViva Campaign Management Solution to provide a Proof of Concept

(POC) prior to the telco choosing a service provider. We have done

well at this POC stage; however, the telco finally progressed with

two telcos and so the opportunity is smaller than initially

thought. Notwithstanding this, the contract is likely to produce an

attractive revenue stream from 2023 onwards and leaves us well

positioned to expand within the customer group in due course.

Outlook

Since the year end we have continued to add new customers and

additional product contracts, with wins across the range of

licenses, managed services and change requests. We therefore have

confidence in 2023 being a better year for the Group overall.

Harry Berry

Chairman

CEO's statement

Our results for 2022 reflect a year of both progress and some

setbacks as already announced. We added 5 new customers, including

an entry into the financial services sector with a significant win.

We therefore closed the year with 26 customers, of which 9 are on

contracts which mostly recurring revenue in nature. However, the

global macro-economic environment has not left our customer base

(both current and prospective) untouched. Consequently certain

customers cut back on their demand for our services, in one case

significantly, although it is pleasing to note that there has been

no indication that they would consider alternative suppliers.

Similarly, depending on their particular circumstances, certain

customers may lean more towards license contracts or recurring

revenue contracts, reflecting changing "capex v. opex" budget

requirements. Over the past few years w e have worked hard to

enhance the quality of our earnings such that the significant

majority of our revenue is now recurring in nature; however, we

will always seek to accommodate the wishes of customers, even to

the extent of renegotiating the terms of existing, signed

contracts. This was particularly relevant this year where one

customer in particular agreed to transition from a license contract

to a managed service contract, which is more beneficial for both

the customer and Pelatro, as we will benefit from an addition to

recurring revenue and the termination of the contract (in this case

after 3 years) and prospective renewal on revised terms thereafter,

rather than a perpetual license.

Existing customers

Existing customer relationships continue to be "sticky" - given

that our first customer was secured in 2016, a number of our

typically three to five year contracts have been coming up for

renewal in the last 12-18 months, and it is extremely pleasing to

note that not one of our existing customers has sought to replace

us. We pro-actively chose to terminate two relatively small

contracts as the economic return did not match the effort involved.

Most customers have sought to strengthen their relationship with us

by requesting upgrades and change requests and/or additional

software modules or services. All of these activities produce

valuable income for us and embed Pelatro at the very heart of the

customers' operations. The success of our mViva software in

enabling users to increase their revenue; this is further

demonstrated by the consistency of income from contracts where we

take a share of the resulting gain by the customer. Additionally we

regularly see mViva enabling significant reductions in subscriber

churn.

New sectors

We have also been expanding the range of industries we cover:

having started serving solely the telecommunications sector, we

have now secured contracts in the financial services sector and are

closely tracking opportunities in banking, all data rich sectors

where our powerful data analytics capabilities with advanced

features like AI/Machine Learning technologies and real time

engagement enable our customers to enhance, enrich and extend their

relationships with their consumers. By analysing customer behaviour

data, such as purchase history, spending patterns, and product

feedback, fintech companies for example can identify trends and

preferences that can help them tailor their services and offerings

to meet their customers' needs. This can lead to increased customer

loyalty, retention, and engagement. Data analytics is also crucial

for the efficient and effective management of operations - by

analysing operational data, such as transaction processing times,

customer support response times, and system performance metrics,

fintech firms can identify areas for improvement and optimize their

processes. This can help to reduce costs, improve operational

efficiency, and increase customer satisfaction.

Ukraine

We of course continue to closely monitor the situation in

Ukraine. Pelatro has a small development and support team in

Russia, representing around 10% of the Group's cash cost base. This

team can and does operate remotely with no requirement for travel,

and remains currently fully operational, with support services and

similar being reallocated to other jurisdictions where appropriate

for the relevant customer. The Group has no revenue from Russia or

any other related sanctioned jurisdiction.

Conclusion

We continue to focus on recurring revenue while building a

strong pipeline in the telecom space. Entering the banking sector

is also a key area of focus.

Subash Menon

Managing Director, CEO and Co-Founder

Financial review

Overview

The financial results for the year reflect a consolidation of

our existing customer base and the loss of some business from

long-standing customers as a result of underlying economic

pressures. Limited revenue was recognised from new customers; those

customers won in the year will generate revenue in 2023 onwards (as

noted above certain prospective customers were slower than expected

to commit to contracts and/or renegotiated their terms from license

to recurring revenue, with the result that income originally

expected in 2022 will now be recognised later). Currency headwinds

due to the strength of the dollar (USD) against the Indian Rupee

(INR) also contributed to the reduction in total revenue from

$7.27m in 2021 to $5.38m in 2022.

On the cost side, in addition to the operating cost base, the

Group also incurred a number of exceptional costs, including a

retention payment made to a small number of key staff, in shares in

lieu of cash but with the same effect on the profit and loss

account. Highly unusually for the Group, we also provided an amount

against a trade receivable which, due to a very specific set of

circumstances (largely deriving from the change of ownership of the

customer) is now considered unlikely to be received. Similarly we

wrote off a contract asset initially recognised on the sale of a

low value license where, following the sale, we could not agree on

the detailed technical terms of installation and operation and

hence, by mutual agreement, took the decision to withdraw.

Largely due to a reduction in activity levels in one particular

customer group, but also due to the overall reduction in revenue

for the Group, we also recognised a significant impairment charge

against our customer relationship assets (which arose on the

acquisition of the Danateq assets in 2018). Given the reduction in

revenue in the year and the short-term outlook, we also recognised

a wider impairment of tangible and intangible assets across the

Group, including a specific charge against the computer hardware

assets relating to one specific managed services contract.

Income Statement

Revenue

Out of our total revenue of $5.38m, approximately $4.27m (79%)

arose from recurring revenue (2021: $4.79m), comprising some $3.11m

from managed service and gain share contracts and the balance from

post-contract support. A further $1.11m came from change requests

(2021: $1.96m) and thus all of our revenue was "repeating" in

nature, compared to just over 90% in 2021. We had recognised some

$0.85m of license revenue in the first half of the year (as

reported in the interim results for the 6 months to 30 June 2022);

however, as noted above, during the year negotiations commenced to

convert this license contract to a managed services contract and,

whilst the revised agreement was not finally formally signed until

February 2023, in order to give a true and fair view of the results

for the year this revenue has not been recognised in 2022.

With a significant proportion of the Group's revenue denominated

in Indian Rupees ("INR") rather than US Dollars ("USD"), and a

small but significant amount in other currencies, the Group is

exposed to currency fluctuations on revenue as well as costs. 2022

was a year of exceptional volatility in global currency markets

and, whilst a depreciation of INR against USD is normal (in the

last few years averaging around 2-3%), in 2022 the INR weakened by

around 10%.

Cost of sales and overheads

Cost of sales decreased slightly to $2.09m (2021: $2.21m). These

costs comprise principally (i) the direct salary costs of providing

software support and maintenance, professional services and

consultancy; (ii) third-party software maintenance and licensing

costs; and (iii) sales commissions. The decrease reflected mainly a

reduction in sales commission accruing over the term of contracts

for which revenue was recognised in the year and other

software-related purchases, offset by an increase in support staff

salary costs.

Pre-exceptional overheads (excluding depreciation and

amortisation) increased to $2.69m (2021: $2.27m), reflecting some

increase in overall staff costs, additional efforts in sales and

marketing and the cost of travel compared to the restricted travel

in previous years.

Exceptional items and impairments

During the year the Group was unable to agree on the technical

terms of implementation of a license contract entered into in 2021

with a small customer. The Group has now formally withdrawn from

this contract and accordingly the Group has provided $0.3m against

the carrying value of the contract on the statement of financial

position (shown in contract assets). This amount is reflected in

exceptional items for the year.

Unusually for the Group, we also wrote off a receivables balance

with a long-standing debtor of around $0.2m where a change of

ownership of the customer meant that the new management refused to

recognise the validity of certain products and services provided by

Pelatro on its usual commercial terms. The group concerned

continues to be a customer with contracts entered into by new

management which recoverability is not impaired.

During the year it became clear that the activity level of one

particular customer (which the Group had acquired as a result of

the Danateq acquisition in 2018) was reducing considerably. As a

result the value of the "customer relationships" asset recognised

at the time of that acquisition was considered impaired and an

impairment charge of $3.83m taken against this (and the

corresponding goodwill was also written off). Given the effect of

the wider downturn and volatility in global markets and the demand

for Pelatro's products, we also recognised a further impairment

charge of $5.48m against the Group's other non-current assets,

resulting in a total impairment charge of $9.31m.

Profitability

Adjusted EBITDA (earnings before interest, tax, depreciation,

amortisation and exceptional items, as adjusted for the effect of

certain non-recurring or exceptional items) fell to $0.61m (2021:

$2.81m).

After taking into account net finance costs, depreciation and

amortisation (including c. $0.7m of acquisition-related

amortisation) and impairment, loss before tax was $(13.86)m (2021:

loss of $(0.67)m) before impairment and exceptional items.

Comprehensive Loss for the year was $(14.54)m (2021: $(0.94)m).

Taxation

The net taxation charge was $0.51m (2021: $0.18m) comprising

some $0.54m relating to current tax offset by a credit of $27,000

relating to a deferred tax asset recognised in one of the Group's

subsidiaries. The higher level of current tax arises due to

increased profitability in the Group's Indian subsidiary as well as

the continuing impact of withholding tax charges which are an

unavoidable feature of our global business.

Loss per share

Adjusted loss per share was (27.3)c (2021: loss of (0.4)c), and

reported loss per share was (31.5)c (2021: loss (2.1)c). No

dividend is proposed for the year (2021: nil).

Statement of Financial Position

Intangible assets

Capitalised development costs and patents

Approximately $2.78m (including $29,000 spent on patent

protection) was capitalised in the year in respect of software

development, offset by amortisation of $2.61m. As noted above an

impairment charge of $4.69m was recognised, resulting in a carrying

value of $1.94m at the balance sheet date.

Property, plant and equipment

Expenditure on property, plant and equipment was minimal at

$49,000, principally relating to IT and peripheral equipment (2021:

$88,000). The Group recognised $0.12m in impairment charges against

the Group's IT and other equipment.

Depreciation in the year amounted to $0.28m (excluding amounts

relating to Right-of-Use assets now recognised under IFRS 16, and

gross of amounts capitalised as intangible assets) (2021: $0.30m).

The aggregate net book value of property, plant and equipment fell

accordingly from $0.98m to $0.55m.

Right of use assets

The Group recognises certain long-term leases under IFRS 16 as

"right of use" assets. The reduction in the overall value of the

right of use assets from $0.24m in 2021 to $0.13m in 2022, is net

of depreciation of $0.17m and capital additions of $0.26m. These

additions do not reflect new leases but instead the capitalised

value of expected extensions to current leases. The right-of-use

assets were also impaired by $0.18m as part of the Group impairment

charge.

Trade receivables and contract assets

At 31 December 2022 total trade receivables (i.e. including

long-term receivables) stood at $3.45m (2021: $4.96m). The

reduction is largely due to the fall in related revenue.

Short-term contract assets relating to revenue (i.e. those which

are expected to reverse in less than one year) decreased to $0.08m

(2021: $0.38m), These relate entirely to the "run off" of pre-2022

contracts which have been recognised under IFRS 15 differently to

their invoicing profile. Likewise long-term contract assets

deriving from revenue decreased to $0.11m (2021: $0.23m).

Short-term fulfilment assets included in contract assets total

$0.30m (2021: $0.18m) (representing costs relating to certain

contracts to be recognised in profit and loss in the next 12

months); and $0.41m (2021: $0.38m) in respect of long-term assets

(representing costs directly relating to certain contracts to be

recognised in profit and loss after one year). This reflects the

charge to P&L in respect of sales commissions contracted in

previous years but recognised in the line with the life of the

related contract (therefore typically over 3 to 5 years)

Trade and other payables, provisions and contract

liabilities

Trade and other payables

At the year end, short-term trade payables stood at $0.53m

(2021: $0.15m), the increase being due principally to amounts due

in respect of sales commissions incurred in 2022 and payable during

2023. Other short-term payables of $0.36m (2021: $0.45m), comprise

principally amounts due in respect of staff bonuses and the balance

for sundry creditors.

Provisions

Under the Indian Payment of Gratuity Act 1972, employees i n the

Group's Indian subsidiary with more than 5 years' service are

eligible for the payment of a "gratuity" upon certain end of

employment events - short-term provisions include amounts estimated

in respect of such gratuity payments, as well as carried over leave

payments and sundry expense provisions, in total $52,000 (2021:

$37,000). The tax provision fell from $35,000 to $21,000 mainly due

to an increase in the amount of advance tax payable from our Indian

subsidiary which reduced the year end tax creditor.

Long-term provisions of $0.20m (2021: $0.20m) relate solely to

amounts estimated in respect of leave encashment and gratuity

payments. Further details of such provisions are given in Note

26.

Contract liabilities

Contract liabilities represent customer payments received in

advance of satisfying performance obligations, which are expected

to be recognised as revenue in 2023 and beyond. Short-term contract

liabilities fell to $0.17m (2021: $0.47m) along with long-term

contract liabilities to $0.18m (2021: $0.28m).

Statement of Cash Flows

Cash flow and financing

Cash generated by operations before tax payments amounted to

$1.64m (2021: $1.27m), the increase largely resulting from the

reduction in trade receivables. The Group had closing gross cash of

just under $1.0m (2021: $3.3m). Borrowings amounted to $0.59m

(2021: $0.75m) excluding amounts relating to lease liabilities.

These borrowings are to be repaid on an Equal Monthly Instalment

("EMI") basis over the next 2-5 years. In March 2023 the Group

concluded a $1.2m funding into one of its subsidiaries, to be used

for working capital and/or acquisition purposes.

Summary

Whilst the year was disappointing in revenue terms, a

significant portion of the revenue "lost" will now be recognised in

future years. The Group has continued to invest in its software

assets and this, together with targeted marketing and increasingly

successful sales efforts, has ensured an increasing stream of new

business for 2023 and beyond.

Nic Hellyer

Chief Financial Officer

Group Statement of Comprehensive Income

For the year ended 31 December 2022

2022 2021

Note $'000 $'000

Revenue 5 5,382 7,266

Cost of sales and provision of services (2,092) (2,206)

_______ _______

Gross profit 3,290 5,060

Operating expenses 6 (2,690) (2,290)

Depreciation and amortisation (3,068) (2,541)

_______ _______

Adjusted operating profit/(loss) (2,468) 229

Exceptional items 7 (1,152) -

Amortisation of acquisition-related intangibles 18 (686) (686)

Impairment of non-current assets 18 (9,305) -

--------- --------

Share-based payments 11 (45) (32)

--------- --------

_______ _______

Operating loss (13,656) (489)

Finance income 12 7 44

Finance expense 13 (212) (221)

_______ _______

Loss before taxation (13,861) (666)

Income tax expense 14 (509) (181)

_______ _______

LOSS FOR THE YEAR ATTRIBUTABLE TO OWNERS

OF THE PARENT (14,370) (847)

Other comprehensive income/(expense):

Items that may be reclassified subsequently

to profit or loss:

Exchange differences on translation of

foreign operations (134) (147)

Items that will not be reclassified subsequently

to profit or loss:

Exchange differences on translation of

equity balances (40) 50

_______ _______

Other comprehensive income, net of tax (174) (97)

TOTAL COMPREHENSIVE LOSS FOR THE YEAR (14,544) (944)

Earnings per share

Attributable to the owners of the Pelatro

Group ( basic and diluted) 15 (31.5)c (2.1)c

Group Statement of Financial Position

For the year ended 31 December 2022

2022 2021

Note $'000 $'000

Assets

Non-current assets

Intangible assets 18 1,952 11,453

Tangible assets 19 549 982

Right-of-use assets 20 132 240

Deferred tax assets 28 14

Contract assets 21 521 606

Trade receivables 21 - 163

_______ _______

3,182 13,458

Current assets

Contract assets 21 380 555

Trade receivables 21 3,450 4,793

Other assets 22 301 315

Cash and cash equivalents 987 3,331

_______ _______

5,118 8,994

TOTAL ASSETS 8,300 22,452

Liabilities

Non-current liabilities

Borrowings 23 429 608

Lease liabilities 24 130 80

Contract liabilities 25 181 278

Long-term provisions 26 199 202

_______ _______

939 1,168

Current liabilities

Short term borrowings 23 130 136

Lease liabilities 24 190 188

Trade and other payables 25 897 603

Contract liabilities 25 174 469

Provisions 26 73 72

_______ _______

1,464 1,468

TOTAL LIABILITIES 2,403 2,636

NET ASSETS 5,897 19,816

Issued share capital and reserves attributable

to owners of the parent

Share capital 27 1,606 1,501

Share premium 27 18,502 18,046

Other reserves (779) (639)

Retained earnings (13,432) 908

_______ _______

TOTAL EQUITY 5,897 19,816

Group Statement of Cash Flows

For the year ended 31 December 2022

2022 2021

$'000 $'000

Cash flows from operating activities

Profit/(loss) for the year (14,370) (847)

Adjustments for:

Income tax expense recognised in profit

or loss 509 181

Finance income (7) (44)

Finance costs 212 221

Depreciation and impairment of tangible

non-current assets 744 467

Amortisation and impairment of intangible

non-current assets 12,314 2,814

Profit on disposal of fixed assets - (10)

Share-based payments and shares issued

in lieu of cash 605 32

_______ _______

Operating cash flows before movements

in working capital 7 2,814

(Increase)/decrease in trade and other

receivables 1,690 (1,271)

Decrease in contract assets 273 206

Increase in trade and other payables 60 (532)

Increase/(decrease) in contract liabilities (392) 45

_______ _______

Cash generated from operating activities 1,638 1,262

Income tax paid (463) (258)

_______ _______

Net cash generated from operating activities 1,175 1,004

Cash flows from investing activities

Development of intangible assets (2,767) (2,540)

Purchase of intangible assets (29) (42)

Acquisition of property, plant and equipment (49) (88)

_______ _______

Net cash used in investing activities (2,845) (2,670)

Cash flows from financing activities

Proceeds from issue of ordinary shares,

net of issue costs - 4,290

Proceeds from borrowings - 70

Repayment of borrowings (122) (748)

Repayments of principal on lease liabilities (181) (173)

Interest received 7 44

Interest paid (197) (203)

Interest expense on lease liabilities (15) (25)

_______ _______

Net cash generated by/(used in) financing

activities (508) 3,255

Net increase/(decrease) in cash and cash

equivalents (2,178) 1,589

Foreign exchange differences (166) (63)

Cash and cash equivalents at beginning

of period 3,331 1,805

_______ _______

Cash and cash equivalents at end of period 987 3,331

Group Statement of Changes in Equity

For the year ended 31 December 2022

Share Share Exchange Merger Share-based Retained Total

capital premium reserve reserve payments profits

reserve

$'000 $'000 $'000 $'000 $'000 $'000 $'000

Balance at 1 January

2021 1,212 14,045 (240) (527) 184 1,734 16,408

(Loss) after taxation

for the period - - - - - (847) (847)

Share-based payments - - - - 62 - 62

Transfer on forfeit

of share options (21) 21 -

Other comprehensive

income:

Exchange differences - - (97) - - - (97)

Transactions with owners:

Shares issued by Pelatro

Plc for cash 289 4,334 - - - - 4,623

Issue costs - (333) - - - - (333)

_____ _____ _____ _____ _____ _____ _____

Balance at 31 December

2021 1,501 18,046 (337) (527) 225 908 19,816

(Loss) after taxation

for the period - - - - - (14,370) (14,370)

Share-based payments - - - - 64 - 64

Transfer on forfeit

of share options (30) 30 -

Other comprehensive

income:

Exchange differences - - (174) - - - (174)

Transactions with owners:

Shares issued by Pelatro

Plc in lieu of cash 105 464 - - - - 569

Issue costs - (8) - - - - (8)

_____ _____ _____ _____ _____ _____ _____

Balance at 31 December

2022 1,606 18,502 (511) (527) 259 (13,432) 5,897

Notes to the Group Financial Statements

As at 31 December 2022

5 Revenue and segmental analysis

The Directors consider that the Group has a single business

segment, being the sale of information management software and

related services principally to providers of telecommunication

services ("telcos") but also to other producers and users of

significant quantities of consumer data, at present being one

customer in the financial services space. The operations of the

Group are managed centrally with Group-wide functions covering

sales and marketing, development, professional services, customer

support and finance and administration.

An analysis of revenue by product or service and by geography is

given below.

Revenue by type

The Group has five principal revenue models, being:

(1) contracts for the use of the Group's software on a regular

(usually monthly) basis, which may also provide for Group employees

to provide related services the customer ("managed services")

and/or for the Group to take a share of the revenue gain achieved

through use of the software ("gain share");

(2) contracts based on the sale of perpetual licenses for use of

the Group's proprietary enterprise software;

(3) provision of specific customer-requested modifications to

Group software ("change requests");

(4) provision of maintenance and support for the software and

its users; and

(5) provision of consultancy services and/or training relating

to the use of the software

In addition, the Group may, if required by the customer, supply

appropriate hardware on which to host the software, either for the

account of the customer or (particularly in the case of managed

services) retained in the ownership of the Group.

An analysis of revenue by type is as follows:

At 31 December 2022 2021

$'000 $'000

Recurring software sales and services 3,112 3,456

Maintenance and support 1,160 1,334

_______ _______

Total recurring revenues 4,272 4,790

Change requests 1,110 1,958

_______ _______

Total repeating revenues 5,382 6,748

Software - new licenses - 498

Consulting - 20

_______ _______

5,382 7,266

Revenue by geography

The Group recognises revenue in seven geographical regions based

on the location of customers, as set out in the following

table:

At 31 December 2022 2021

$'000 $'000

Caribbean 175 130

Central Asia - 443

Eastern Europe 241 426

MENA 77 104

South Asia 3,012 2,656

South East Asia 1,817 3,407

Sub-Saharan Africa 60 100

_______ _______

5,382 7,266

Management makes no allocation of costs, assets or liabilities

between these segments since all trading activities are operated as

a single business unit.

Customer concentration

The Group has one customer representing over 10% of revenue

(being 34% of total revenue at $1.82m) (2021: two customers,

approximately 38% of total revenue at $2.73m).

Revenue recognition

License revenue

As explained in Note 3, the Group recognises revenue from the

sale of licenses and the implementation of the software so licensed

separately, as the two activities represent distinct performance

obligations. However, as implementation to date has always been

carried out by Group personnel and is usually viewed by the

customer as an integral part of the license purchase, the two

activities are reported as one.

Irrespective of the split between license and implementation

recognition, some contracts provide for fixed payments to be made

by customers (usually monthly) over a given term (e.g. three or

five years). Under IFRS 15, in order to reflect the time value of

money, such contracts are recognised (at the point of transfer of

the license) as the capitalised value of the income stream. In

addition, interest income accrues on the credit deemed to be

extended to the customer (on a reducing balance basis). For the

financial year 2022 this figure amounts to license revenue of $nil

and interest income (from pre 2022 contracts) of $7,000 (2021:

$0.50m and $38,000).

PCS

Ancillary to a license sale, the Group typically provides five

years of PCS but does not charge for the first year; similarly in

certain contracts the Group may provide PCS at other than a

standalone selling price ("SSP"). For revenue recognition purposes

PCS income is deemed to accrue over the full term of the service

provision (whether paid or otherwise) and, as far as is estimable,

at a deemed market rate (i.e. the SSP). Accordingly, the financial

statements reflect adjustments to income:

(i) to accelerate the recognition of revenue for initial years

for which no contractual payment is due (and consequent adjustments

to revenue to derecognise revenue in later years when contractual

payments exceed revenue to be recognised); and

(ii) to accelerate or defer the recognition of revenue in cases

where the contractual PCS charge is lower (or higher) than a market

rate (the difference being netted off or added to the revenue

recognised in respect of the license fee).

For the financial year 2022 revenue includes/(excludes) (i) a

net amount of $(64,000) representing income from PCS already

recognised ahead of its contractually due dates (2021: $(101,000)),

and (ii) an amount of nil (2021: $40,000) representing revenue

netted off license income allocated to PCS.

Remaining performance obligations

There are certain software support, professional service,

maintenance and licences contracts that have been entered into for

which both:

-- the original contract period was greater than 12 months; and

-- the Group's right to consideration does not correspond directly with performance.

The amount of revenue that will be recognised in future periods

on these contracts when those remaining performance obligations

will be satisfied is shown below.

Year to 31 December

2023 2024 2025-8

$'000 $'000 $'000

Revenue expected to be recognised

on software and service contracts 366 229 133

Comparative figures for the year ended 31 December 2021 were as

follows:

Year to 31 December

2022 2023 2024-7

$'000 $'000 $'000

Revenue expected to be recognised

on software and service contracts 449 314 320

Costs of obtaining and fulfilling contracts of $0.35m have been

capitalised in 2022 (net of amortisation against revenue recognised

in respect of those contracts) (2021: $0.12m).

6 Operating expenses

Profit for the year has been arrived at after charging:

2022 2021

$'000 $'000

Amortisation of intangible non-current assets 3,306 2,814

Impairment of intangible non-current assets 9,008 -

Depreciation of tangible non-current assets 448 413

Impairment of tangible non-current assets 122 -

(Profit)/loss on disposal of Right of Use

assets - (10)

Impairment of Right of Use assets 175 -

Staff costs (see note 9) 2,888 2,865

Auditor's remuneration (see note 8) 59 47

Short-term lease expenses 21 35

Realised foreign exchange (gains)/losses 64 17

7 Non-GAAP profit measures and exceptional items

Reconciliation of operating profit to adjusted earnings before

interest, taxation, depreciation and amortisation ("EBITDA")

Year to 31 December 2022 2021

$'000 $'000

Operating profit/(loss) (13,656) (489)

Adjusted for:

Amortisation, depreciation and impairment 13,059 3,227

_______ _______

EBITDA (597) 2,738

Revenue recognised as interest under IFRS

15 7 38

Expensed share-based payments 45 32

Exceptional items:

Write off of trade receivables and contract 493 -

assets

Expenses of aborted acquisition 90 -

Employee share issue 569 -

_______ _______

Adjusted EBITDA 607 2,808

Criteria for adjustments to operating profit or loss in the

calculation of adjusted EBITDA are that they (i) arise from an

irregular and significant event or (ii) are such that the

income/cost is recognised in a pattern that is unrelated to the

resulting operational performance.

Exceptional items are treated as exceptional by reason of their

nature and are excluded from the calculation of adjusted EBITDA

(and adjusted earnings per share in Note 15) to allow a better

understanding of comparable year-on-year trading and thereby an

assessment of the underlying trends in the Group's financial

performance. These measures also provide consistency with the

Group's internal management reporting.

Adjustment for share-based payment expense is made because, once

the cost has been calculated for a given grant of options, the

Directors cannot influence the share-based payment charge incurred

in subsequent years relating to that grant; also the value of the

share option to the employee differs considerably in value and

timing from the actual cash cost to the Group.

Elements of depreciation on right-to-use assets recognised under

IFRS 16 and share-based payment expense are deemed to be directly

attributable overheads for the purposes of capitalising relevant

expenditure on developing intangible assets (see Note 18). The

figures above are shown net of amounts so capitalised.

EBITDA (and adjusted EPS) are financial measures that are not

defined or recognised under IFRS and should not be considered as an

alternative to other indicators of the Group's operating

performance, cash flows or any other measure of performance derived

in accordance with IFRS. Accordingly, these non-IFRS measures

should be viewed as supplemental to, but not as a substitute for,

measures presented in this Annual Report and Accounts. Information

regarding these measures is sometimes used by investors to evaluate

the efficiency of an entity's operations; however, there are no

generally accepted principles governing the calculation of these

measures and the criteria upon which these measures are based can

vary from company to company. These measures, by themselves, do not

provide a sufficient basis to compare the Group's performance with

that of other companies and should not be considered in isolation

or as a substitute for operating profit or any other measure as an

indicator of operating performance, or as an alternative to cash

generated from operating activities as a measure of liquidity.

Adjusted operating profit is calculated as reported operating

profit as adjusted for share-based payments, exceptional items,

impairment and acquisition-related amortisation.

The calculation of adjusted earnings per share is shown in Note

15.

9 Staff costs

Year to 31 December 2022 2021

$'000 $'000

Wages and salaries 5,611 5,256

Social security contributions 44 80

_______ _______

5,655 5,336

Less: amounts capitalised as intangible assets (2,767) (2,471)

_______ _______

2,888 2,865

The average number of persons employed by the Group during the

period was:

Year to 31 December 2022 2021

Sales 3 3

Software development 109 98

Support 130 113

Marketing 2 3

Administration 20 18

_______ _______

264 235

10 Directors' remuneration and transactions

The Directors' emoluments in the year ended 31 December 2022

were:

Basic Bonus Benefits Share-based Pension

salary in kind payments Total Total

2022 2022 2022 2022 2022 2022 2021

$'000 $'000 $'000 $'000 $'000 $'000 $'000

Executive Directors

N. Hellyer 183 10 7 34 5 239 122

S. Menon 186 - 16 - - 202 279

S. Yezhuvath 164 - 12 - - 176 272

Non-Executive

Directors

R. Day (resigned

3 December 2022) 71 - - - 2 73 68

P. Verkade 37 - - - - 37 41

H . Berry (appointed

5 December 2022 5 - - - - 5 -

_______ ______ ______ ______ _______ _______ _______

646 10 35 34 7 732 782

11 Share-based payments

A charge of $45,000 (net of amounts capitalised of $34,000)

(2021: $32,000) has been recognised during the year for share-based

payments over the vesting period. This share-based payment expense

comprises the charge in the current period relating to the

expensing of the fair value of (a) 1,323,500 options granted under

the Plan (net of forfeited options) and (b) the 33,000 options (net

of forfeited options) issued at the time of the Company' IPO. The

options issued under the terms of the Plan were granted with an

exercise price of 73p, vesting in tranches as follows: 25% after

one year, 25% after two years and 50% after three years. There are

no conditions attaching to the vesting of the options other than

continued employment. Of this amount, $10,000 net (2021: $14,000)

relates to costs of share options issued to subsidiary

employees.

Movements in the number of share options outstanding and their

related weighted average exercise prices are as follows:

No. of options Weighted average

exercise price

2022 2021 2022 2021

Outstanding at the beginning of

the year 1,356,500 1,505,500 72.7p 72.7p

Granted during the year 250,000 - 2.5p -

Forfeited during the year (170,000) (149,000) 73.0p 73.0p

_______ _______

Outstanding at the end of the

year 1,436,500 1,356,500 60.8p 72.7p

Outstanding options are exercisable at prices between 2.5p and

73p and have a weighted average remaining contractual life of 7.4

years.

12 Finance income

2022 2021

$'000 $'000

Interest receivable on interest-bearing deposits - 6

Notional interest accruing on contracts with

a significant financing component 7 38

_______ _______

Total finance income 7 44

13 Finance expense

2022 2021

$'000 $'000

Interest and finance charges paid or payable

on borrowings 197 202

Interest on lease liabilities under IFRS

16 15 25

Less: amounts capitalised as intangible assets - (6)

_______ _______

Total finance expense 212 221

14 Taxation

Tax on profit on ordinary activities

Year to 31 December 2022 2021

$'000 $'000

Current tax

UK corporation tax charge/(credit) on profit - -

for the current year

Overseas income tax charge/(credit) 514 232

Adjustments in respect of prior periods 22 (42)

_______ _______

Total current income tax 536 190

Deferred tax

Reversal/(recognition) of deferred tax asset (27) (9)

_______ _______

Total deferred income tax (27) (9)

Total income tax expense recognised in the

year 509 181

Reconciliation of the total tax charge

The effective tax rate in the income statement for the year is

higher than the standard rate of corporation tax in the UK of 19%

(2021: higher). A reconciliation of income tax expense applicable

to the profit before taxation at the statutory tax rate to income

tax expense at the effective tax rate is as follows:

Year to 31 December 2022 2021

$'000 $'000

(Loss) before taxation (13,861) (666)

Tax charge/(credit) at the applicable rate

of 19% (2,634) (127)

Tax effect of amounts which are not deductible

(taxable) in calculating

taxable income:

Differences arising on capitalisation of

expenses (327) (275)

Fixed asset differences - impairment 1,768 -

Expenses not deductible for tax purposes

and other permanent items 467 244

Income not taxable and other permanent items 2 11

Tax exemptions, allowances and rebates (49) -

Foreign tax credits (53) -

Overseas taxation at different rates 69 12

Overseas withholding tax expenses 326 109

(De)recognition of deferred tax liability 12 (11)

(De)recognition of deferred tax asset (101) (2)

Loss carry back/tax repayable - (67)

Adjustments recognised in current year tax

in respect of prior years 29 13

Current tax (prior period) exchange difference - -

Deferred tax asset not recognised 999 274

_______ _______

Income tax expense recognised for the current

year 509 181

The Group had approximately $8.45m of tax losses carried forward

as at 31 December 2022 against which no deferred tax asset has been

recognised.

Deferred tax

Recognised deferred tax asset

2022 2021

$'000 $'000

At 1 January 2022 14 16

Recognised in profit and loss 14 (2)

_______ _______

At 31 December 2022 28 14

Comprising:

Tax losses 13 14

Timing differences 15 -

_______ _______

28 14

Deferred income tax assets have only been recognised to the

extent that it is considered probable that they can be recovered

against future taxable profits based on profit forecasts for the

foreseeable future. The deferred income tax assets at 31 December

2022 above are expected to be utilised in the next two years.

Recognised deferred tax liability

2022 2021

$'000 $'000

At 1 January 2022 13 24

Recognised in profit and loss (13) (11)

_______ _______

At 31 December 2022 - 13

Comprising:

Timing differences - 13

_______ _______

- 13

15 Earnings

Reported earnings per share

Basic earnings per share ("EPS") amounts are calculated by

dividing net profit or loss for the year attributable to owners of

the Company by the weighted average number of ordinary shares

outstanding during the year.

The Group has one category of security potentially dilutive to

ordinary shares in issue, being those share options granted to

employees where the exercise price (plus the remaining expected

charge to profit under IFRS 2) is less than the average price of

the Company's ordinary shares during the period in issue. No

dilution arose in the year as the exercise price was above the

average share price for the year.

The following reflects the earnings and share data used in the

basic earnings per share computations:

Year to 31 December 2022 2021

$'000 $'000

Profit/(loss) attributable to equity holders

of the parent:

Profit/(loss) attributable to ordinary equity

holders of the parent for basic earnings (14,370) (847)

Weighted average number of ordinary shares

in issue 45,644,075 41,153,537

Basic earnings/(loss) per share attributable

to shareholders (31.5)c (2.1)c

Adjusted earnings per share

Adjusted earnings per share is calculated as follows:

2022 2021

$'000 $'000

Profit/(loss) attributable to ordinary equity

holders of the parent for basic earnings (14,370) (847)

Adjusting items:

- exceptional items (see note 7} 1,152 -

- share-based payments 45 32

- amortisation of acquisition-related intangibles 686 686

- prior year adjustments to tax charge 22 (42)

_______ _______

Adjusted earnings attributable to owners

of the Parent (12,465) (171)

Weighted number of ordinary shares in issue 45,644,075 41,153,537

Adjusted earnings/(loss) per share attributable

to shareholders (27.3)c (0.4)c

The criteria for inclusion of adjusting items in the calculation

of adjusted EPS are the same as those relating to the calculation

of adjusted EBITDA as set out in Note 7. Additionally, finance

expense on liabilities relating to contingent consideration are

non-cash costs reflecting the time value of money in arriving at

the fair value of such liabilities and the effluxion of time over

the period for which they are outstanding; and amortisation of

acquisition-related intangibles relates to the amortisation of

intangible assets in respect of customer relationships and brands

which are recognised on a business combination and are non-cash in

nature.

18 Intangible assets

Intangible assets comprise capitalised development costs (in

relation to internally generated software and software acquired

through business combinations), software acquired from third

parties for use in the business, patents, customer relationships

and goodwill.

An analysis of goodwill and other intangible assets is as

follows:

2022 Development Third Patents Customer Goodwill Total

costs party relationships

software

$'000 $'000 $'000 $'000 $'000 $'000

Cost

At 1 January

2022 11,839 120 57 6,862 470 19,348

Additions 2,786 - 29 - - 2,815

Foreign exchange - (5) (1) - - (6)

_______ _______ _______ _______ _______ _______

At 31 December

2022 14,625 115 85 6,862 470 22,157

Amortisation

and impairment

At 1 January

2022 (5,478) (71) (2) (2,344) - (7,895)

Charge for the

year - amortisation (2,591) (23) (6) (686) - (3,306)

Charge for the

year - impairment (4,635) (18) (55) (3,832) (470) (9,010)

Foreign exchange 1 4 1 - - 6

_______ _______ _______ _______ _______ _______

At 31 December

2022 (12,703) (108) (62) (6,862) (470) (20,205)

Net carrying

amount

At 31 December

2022 1,922 7 23 - - 1,952

At 31 December

2021 6,361 49 55 4,518 470 11,453

2021 Development Third Patents Customer Goodwill Total

costs party relationships

software

$'000 $'000 $'000 $'000 $'000 $'000

Cost

At 1 January

2021 9,263 110 27 6,862 470 16,732

Additions 2,576 12 30 - - 2,618

Foreign exchange - (2) - - - (2)

_______ _______ _______ _______ _______ _______

At 31 December

2021 11,839 120 57 6,862 470 19,348

Amortisation

and impairment

At 1 January

2021 (3,373) (52) - (1,658) - (5,083)

Charge for the

year - amortisation (2,105) (21) (2) (686) - (2,814)

Charge for the - - - - - -

year - impairment

Foreign exchange - 2 - - - 2

_______ _______ _______ _______ _______ _______

At 31 December

2021 (5,478) (71) (2) (2,344) - (7,895)

Net carrying

amount

At 31 December

2021 6,361 49 55 4,518 470 11,453

Impairment of non-financial assets and goodwill

Goodwill arose on the acquisition of (i) the Danateq Assets and

(ii) PSPL. It is assessed as having an indefinite life but the

Group tests whether goodwill has suffered any impairment on an

annual basis.

Danateq

The Danateq Acquisition in 2018 (the "Acquisition") comprised

various contracts and customer relationships, certain enterprise

software and the related workforce (together the "Danateq Assets").

Given the opportunity to leverage this expertise across Pelatro's

existing business and the ability to exploit the Group's thus

enlarged customer base, the fair value of the Danateq Assets was

deemed to be greater than the assessed book value of the assets as

recognised in the financial statements of Pelatro, thus leading to

the recognition of an amount of goodwill (the "Danateq Goodwill").

Given that the software acquired has been subsumed into the Group's

mViva product suite, the contracts acquired have been transitioned

onto and/or are being fulfilled (for example in the case of the

Telenor framework agreement) by the mViva product, and the

workforce are employed by a branch of Pelatro in Singapore and work

across the product suite, the former Danateq cash-generating unit

("CGU") no longer has a separable identity. However, the customer

relationships asset which was recognised following the acquisition

is directly related to the Danateq Assets and accordingly, given

the impairment provision recognised in respect of that asset, it

was considered appropriate to write off the Danateq Goodwill in its

entirety.

Further details are given in "Customer Relationships" below.

PSPL

The PSPL CGU comprises the Group's software development and

administrative centre in Bangalore which was acquired in December

2017, and whose principal activity was at the time to develop the

Group's software and provide administrative support for the rest of

the Group. The fair value of the acquired assets was deemed to be

greater than the assessed book value of the assets as recognised in

the financial statements of Pelatro, thus leading to the

recognition of an amount of goodwill (the "PSPL Goodwill").

Subsequent to its acquisition, the activities of this subsidiary

have grown to include the provision of managed services,

post-contract support and other services to customers, using both

intangible assets (including developed software, patents and

third-party software) along with various tangible assets (in

particular on-premise hardware purchased to fulfil a significant

contract) and right-of use assets recognised under IFRS 16

(principally office leases).

The carrying value of these assets, including the associated

PSPL Goodwill, was assessed, individually where applicable, as part

of the impairment review carried out at 31 December 2022, and given

the impairment loss deemed appropriate for the related assets, the

PSPL Goodwill was written off in its entirety. Further details are

given in "Other intangible and tangible assets" below.

Other intangible and tangible assets

Other intangible and tangible assets comprise the development

costs, patents and third-party software referenced above, together

with customer relationships recognised on the Danateq Acquisition,

together with the Group's tangible assets (principally computer

hardware and office-related assets, referenced in Note 19 and

similar Right-of-Use assets recognised under IFRS 16.

Management reviews the carrying value of intangible and tangible

assets for impairment annually, or on the occurrence of an

impairment indicator. Some revenue streams in the group of assets

related to the Danateq Acquisition of 2018 have shown a steep

decline as one customer in particular has retrenched its operations

and withdrawn from taking the Group's managed service operations in

the short-term. More widely, given the downturn in Group revenue in

2022, the management have considered the value attributable to the

entirety of the Group's non-current tangible and intangible asset

base. Of this asset base, other than the Danateq assets referenced

above, individual cash-generating units ("CGUs") can be identified

as the hardware assets pertaining to one particular large managed

services contract (and certain related right-of-use lease assets)

and a small number of motor vehicles (whether owned outright or as

a right-of-use asset). In the latter case, due to the fair value

less costs of disposal no impairment has been recognised. The

remaining assets (comprising principally the capitalised value of

software developed for resale, associated patents and related third

party software), "administrative" assets such as office equipment

and leasehold improvement, along with similar right-of-use assets

have been assessed together by considering the profitability and

cash flows remaining to the Group once the specific assets referred

to above have been taken into account.

The recoverable amounts of assets have been determined from

value in use calculations based on cash flow projections covering

five years plus a terminal value. Based on these assessments, an

impairment loss has been recognised during the year totalling

$3.88m against the Danateq goodwill and related customer

relationship assets. Similarly an impairment loss has been

recognised during the year totalling $4.63m against capitalised

software and a further $55,000 and $18,000 respectively against

related patents and third party software. A specific impairment

charge of $52,000 has been made against the computer hardware

assets (and related right of use assets) associated with the

Group's significant managed services contract in India (the "MS

Contract"); for the rest of the Group, a total impairment loss of

$0.67m has been recognised against other intangible and tangible

assets, allocated as to $0.43m (goodwill), $44,000 leasehold

improvements, $13,000 office equipment and $0.17m against other

right-of-use assets. These provisions have resulted in the total

write down of all goodwill on the Group balance sheet.

With the exclusion of CGUs deemed particularly sensitive to

impairment from a reasonably possible change in key assumptions,

which have been reviewed in further detail below, management

forecasts for 2023 and 2024 anticipate revenue growth of between 8%

and 13% when compared to 2022 levels. In accordance with IAS 36

forecasts for the subsequent periods (years 3-5) assume nil real

growth in revenues, nil real growth in certain costs and a

reduction in certain growth-related "investment" costs in line with

the forecast of nil real growth. Management has applied pre-tax

discount rates to the cash flow projections between 29% and

33%.

Certain CGUs which are referred below are considered sensitive

to changes of assumptions used for the calculation of the value in

use.

The recoverable amount of the MS Contract CGU, with a net book

value of $0.49m, has been determined using cash flow forecasts that

include annual revenue growth rates (in real terms) of nil% over

the 2 year forecast period, nil% real long-term growth rate, growth

in associated costs of 5% over the 2 year forecast period and nil

thereafter (in real terms) and a pre-tax discount rate of 29%. The

recoverable amount would equal the carrying amount of the CGU if

the discount rate applied was lower by 5% or revenue growth was

higher by 3%.

The recoverable amount of the Customer Relationships asset, with

a net book value of $3.88m, has been determined using cash flow

forecasts that include annual revenue growth rates of nil% over the

2 year forecast period, nil% real long-term growth rate, growth in

associated costs of 5% over the 2 year forecast period and nil

thereafter (in real terms) and a pre-tax discount rate of 33%. The

recoverable amount is nil at any reasonable discount rate, and

would equal the carrying amount of the CGU if revenue growth was

higher by 80%.

Sensitivity to changes in assumptions

The key assumptions for the value in use calculations are those

regarding growth rates, discount rates and expected changes to

selling prices and direct costs during the period. Changes in

selling prices and direct costs, if any, are based on expectations

of future changes in the market. Management estimates discount

rates using pre-tax rates that reflect current market assessments

of the time value of money.

19 Tangible assets

2022 Leasehold Computer Office Vehicles Total

improvements equipment equipment

$'000 $'000 $'000 $'000 $'000

Cost

At 1 January 2022 129 1,151 58 299 1,637

Additions - 45 4 - 49

Foreign exchange differences (12) (113) (6) (30) (161)

_______ _______ _______ _______ _______

At 31 December 2022 117 1,083 56 269 1,525

Depreciation

At 1 January 2022 (41) (454) (31) (129) (655)

Charge for the year (18) (215) (11) (35) (279)

Impairment (44) (63) (13) - (120)

Foreign exchange differences 5 55 4 14 78

_______ _______ _______ _______ _______

At 31 December 2022 (98) (677) (51) (150) (976)

Net carrying amount

At 31 December 2022 19 406 5 119 549

At 31 December 2021 88 697 27 170 982

2021 Leasehold Computer Office Vehicles Total

improvements equipment equipment

$'000 $'000 $'000 $'000 $'000

Cost

At 1 January 2021 131 1,084 59 305 1,579

Additions - 88 - - 88

Foreign exchange differences (2) (21) (1) (6) (30)

_______ _______ _______ _______ _______

At 31 December 2021 129 1,151 58 299 1,637

Depreciation

At 1 January 2021 (24) (222) (20) (95) (361)

Charge for the year (18) (238) (11) (36) (303)

Foreign exchange differences 1 6 - 2 9

_______ _______ _______ _______ _______

At 31 December 2021 (41) (454) (31) (129) (655)

Net carrying amount

At 31 December 2021 88 697 27 170 982

As explained in Note 18, the carrying value of the Group's

non-financial assets was reviewed at 31 December 2022 and as a

result an impairment charge was recognised against all categories

of tangible assets.

20 Right-of-use assets

Right-of-use assets comprise leases over office buildings and

vehicles as follows:

2022 Office Vehicles Total

buildings

$'000 $'000 $'000

Cost

At 1 January 2022 750 - 750

Additions in respect of new or extended

leases 232 24 256

Effects of foreign exchange movements (70) - (70)

_______ _______ _______

At 31 December 2022 912 24 936

Depreciation

At 1 January 2022 (510) - (510)

Charge for the period (167) (2) (169)

Impairment recognised (175) - (175)

Effects of foreign exchange movements 50 - 50

_______ _______ _______

At 31 December 2022 (802) (2) (804)

Net carrying amount

At 31 December 2022 110 22 132

At 31 December 2021 240 - 240

2021 Office Vehicles Total

buildings

$'000 $'000 $'000

Cost

At 1 January 2021 661 32 693

Additions in respect of new or extended

leases 112 - 112

Disposals in respect of leases terminated (10) (32) (42)

Effects of foreign exchange movements (13) - (13)

_______ _______ _______

At 31 December 2021 750 - 750

Depreciation

At 1 January 2021 (355) (30) (385)

Charge for the period (164) (2) (166)

Eliminated on leases terminated - 32 32

Effects of foreign exchange movements 9 - 9

_______ _______ _______

At 31 December 2021 (510) - (510)

Net carrying amount

At 31 December 2021 240 - 240

At the end of 2021 the Group had had plans to relocate certain

office functions then spread over a number of offices in the

Bangalore area to one larger office. However, the Group was not

able to find a suitable space and accordingly no such relocation

was made. The relevant existing leases (all of which are on short

term notice periods) were deemed to have been extended

accordingly.

21 Trade and other receivables and contract assets

The timing of revenue recognition, invoicing and cash collection

results in the recognition of the following assets on the

Consolidated Statement of Financial Position:

(i) invoiced accounts receivable;

(ii) accounts invoiceable but uninvoiced at the period end (i.e.

"unbilled revenue" or UBR) (collectively with (i) recognised as

"trade receivables"); and

(iii) amounts relating to revenue recognised at the date of the

statement of financial position but not invoiceable under the terms

of the contract, or fulfilment assets ("contract assets")

In addition (iv) contract assets are recognised in respect of

certain trade-related liabilities (notably sales commissions

payable) where the full amount of such commission is payable within

one year but the revenue to which it relates is recognised over

several years (i.e. "contract fulfilment assets").

Contract assets

Due after one year 2022 2021

$'000 $'000

At 1 January 606 751

Contract assets recognised in the period 238 195

Contract assets impaired (56) -

Transfer to current contract assets (267) (340)

_______ _______

At 31 December 521 606

Due within one year 2022 2021

$'000 $'000

At 1 January 555 609

Contract assets recognised in the period,

net of releases to receivables or cash,

or amortisation to profit or loss (202) (394)

Contract assets impaired (234) -

Transfer from non-current contract assets 267 340

_______ _______

At 31 December 386 555

The Group was unable to agree on appropriate terms of

implementation of a license contract with a small customer entered

into in 2021 (and accordingly part-recognised as revenue under IFRS

15 in that year). The Group chose to withdraw from this contract

after the year end; accordingly management has impaired the entire

carrying value of this contract as it is unlikely that revenue will

arise from it. No amounts have been invoiced to the customer (and

hence there is no write-off of trade receivables) and no penalties

or similar costs would arise from such a withdrawal.

Contract assets are comprised as follows:

Due after one year 2022 2021

$'000 $'000

Contract assets relating to revenue 113 227

Contract fulfilment assets 408 379

_______ _______

521 606

Due within one year 2022 2021

$'000 $'000

Contract assets relating to revenue 80 375

Contract fulfilment assets 300 180

_______ _______

380 555

The largest individual counterparty to a receivable included in

trade and other receivables at 31 December 2022 was $0.69m (of

which some $0.24m related to unbilled revenue) (2021: $1.14m). This

customer was also the largest individual counterparty based on

invoiced receivables ($0.45m, 2021: $0.52m). The small increase in

loss allowance is due to a significant increase in a number of

country risks (driven partly by geo-political events) offset by the

reduction in the overall quantum of trade receivables. The Group's

customers are spread across a broad range of geographies.

22 Other assets

At 31 December 2022 2021

$'000 $'000

Prepayments 131 146

Deposits 70 77

Other assets (including withholding tax, GST

and VAT refunds) 101 92

_______ _______

Total other assets 302 315

23 Loans and borrowings

Loans and borrowings comprise:

At 31 December 2022 2021

$'000 $'000

Non-current liabilities

Secured term loans 10 23

Unsecured borrowings 419 585

_______ _______

429 608

Current liabilities

Current portion of term loans 11 11

Unsecured borrowings 119 125

_______ _______

130 136

Total loans and borrowings 559 744

At the reporting date the Group had two term loans, in its

operating subsidiary in India and denominated in INR, with interest

rates between 10% and 15.5% (in INR), repayable between 5 and 6

years from their inception, between June 2023 and September

2024.

24 Lease liabilities

Lease liabilities comprise liabilities arising from the

committed and expected payments on leases over office buildings and

vehicles.

2022

Amounts due in more than one year Office Vehicles Total

buildings

$'000 $'000 $'000

At 1 January 2022 80 - 80

Liabilities taken on in the period 102 12 114

Liabilities (disposed of) in the - - -

period

Transfer from long-term to short-term (53) (2) (55)

Effects of foreign exchange movements (9) - (9)

_______ _______ _______

At 31 December 2022 120 10 130

Amounts due in less than one year Office Vehicles Total

buildings

$'000 $'000 $'000

At 1 January 2022 188 - 188

Liabilities taken on in the period 130 12 142

Liabilities (disposed of) in the - - -

period

Repayments of principal (180) (2) (182)

Transfer to short-term from long-term 53 2 55

Effects of foreign exchange movements (13) - (13)

_______ _______ _______

At 31 December 2022 178 12 190

2021

Amounts due in more than one year Office Vehicles Total

buildings

$'000 $'000 $'000

At 1 January 2021 172 - 172

Liabilities taken on in the period 24 - 24

Liabilities (disposed of) in the

period (10) - (10)

Transfer from long-term to short-term (103) - (103)

Effects of foreign exchange movements (3) - (3)

_______ _______ _______

At 31 December 2021 80 - 80

Amounts due in less than one year Office Vehicles Total

buildings

$'000 $'000 $'000

At 1 January 2021 174 - 174

Liabilities taken on in the period 89 - 89

Liabilities (disposed of) in the

period (1) - (1)

Repayments of principal (171) - (171)

Transfer to short-term from long-term 103 - 103

Effects of foreign exchange movements (6) - (6)

_______ _______ _______

At 31 December 2021 188 - 188

As noted above, at the end of 2021 the Group had had plans to

relocate certain office functions spread over a number of offices

in the Bangalore area to one larger office. However, the Group was

not able to find a suitable space and accordingly no such

relocation was made. The relevant existing leases (all of which are

on short term notice periods) were deemed to have been extended

accordingly and additional lease liabilities recognised

accordingly.

25 Trade and other payables and contract liabilities

At 31 December 2022 2021

$'000 $'000

Due within one year

Trade payables 534 152

Other payables 363 451

_______ _______

Total trade and other payables 897 603

Trade payables include amounts due in respect of sales

commissions due to sales agents which is payable in less than one

year. Other payables comprise principally amounts due in respect of

staff bonuses declared for December and paid in January.

Contract liabilities

Contract liabilities represent consideration received in respect

of unsatisfied performance obligations. Changes to the Group's

contract liabilities are attributable solely to the satisfaction of

performance obligations.

At 31 December 2022 2021

$'000 $'000

Due after one year

Contract liabilities at 1 January 278 207

Contract liabilities recognised in the period - 152

Transfers to short-term liabilities (97) (81)

_______ _______

Contract liabilities at 31 December 181 278

At 31 December 2022 2021

$'000 $'000

Due within one year

Contract liabilities at 1 January 469 495

Contract liabilities recognised/(released to

revenue) in the period (392) (107)

Transfers from long-term liabilities 97 81

_______ _______

Contract liabilities at 31 December 174 469

26 Provisions

At 31 December 2022 2021

$'000 $'000

Due after one year

Employee gratuities 144 141

Leave encashment 55 61

_______ _______

199 202

At 31 December 2022 2021

$'000 $'000

Due within one year

Employee gratuities 8 7

Leave encashment 44 30

Other provisions (including tax) 21 35

_______ _______

73 72

Other provisions comprise tax and other expenses.

Under the Indian Payment of Gratuity Act 1972, employees with

more than 5 years' service are eligible for the payment of a

"gratuity" upon certain end of employment events, including

retirement, resignation, death and termination or redundancy. The

calculation of the gratuity due is based on the last drawn salary

and number of years of service. The potential liability arising

from these requirements is calculated by third party actuaries

based on employee profiles, their completed number of years in the

organization, their age, salary and also on the probability of

termination of employment, and a provision made accordingly.

Under the terms of their employment, employees are eligible to

carry forward 30 "earned leaves" (EL) to the next calendar year.

Any EL balance over and above this is paid in cash by March the

following year, hence resulting in a long-term provision.

27 Share capital and reserves

Share capital and share premium

Ordinary shares of 2.5p each (issued and fully $'000 Number

paid)

At 1 January 2021 1,212 37,032,431

Issued for cash during the year 289 8,375,000

_______ _______

At 31 December 2021 1,501 45,407,431

Issued in lieu of cash during the year 105 3,455,000

_______ _______

At 31 December 2022 1,606 48,862,431

General

Audited accounts

The financial information set out above does not comprise the

Group or the Company's statutory accounts. The Annual Report and

Financial Statements for the year ended 31 December 2021 have been