TIDMRUA

RNS Number : 0655X

RUA Life Sciences PLC

18 December 2023

18 December 2023

RUA Life Sciences plc

("RUA", the "Company" or the "Group")

Interim Results

RUA Life Sciences, the holding company of a group of medical

device businesses focused on the exploitation of the world's

leading long-term implantable biostable polymer (Elast-Eon (TM) ) ,

today announces its unaudited interim results for the six months

ended 30 September 2023.

Highlights:

-- Gross profit GBP616,000 - margin 77% (H1 FY2023: GBP875,000 - 79%)

-- 12% reduction in loss to GBP1,010,000 (H1 FY2023: GBP1,143,00)

-- Short-term revenue timing differences led to a 28% decrease

in revenues to GBP794,000 (H1 FY2023: GBP1,104,000)

-- Cash on hand GBP493,000 (30 September 2022: GBP2,509,000, 31 March 2023: GBP1,484,000)

-- Post-period end normalisation of revenues plus R&D tax credit strengthens cash

-- Operational Investment in development projects decreased 11%

to GBP471,000 (H1 FY2023: GBP532,000)

-- Technical breakthroughs in heart valve leaflet material opens commercial opportunities

-- Increased commercial opportunities within Contract Manufacturing business segment

Bill Brown, Chairman of RUA Life Sciences, commented:

"The objectives for the Company are to maximise return on

investment from each of the four business units. A successful fund

raise announced after the period end has provided RUA with the

resources and balance sheet to allow the business units to pursue

the agreed strategies to meet group objectives. We remain excited

by the shorter-term commercialisation opportunities present in RUA

Structural Heart and RUA Contract Manufacture, and the agreed

regulatory pathway enables engagement with potential partners to

facilitate the commercialisation of RUA Vascular."

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the UK version of the EU Market Abuse Regulation (2014/596), which

is part of UK law by virtue of the European Union (Withdrawal) Act

2018, as amended and supplemented from time to time.

For further information contact:

RUA Life Sciences

Bill Brown, Chairman Tel: +44 (0)1294 317073

Caroline Stretton, Group Managing Director Tel: +44 (0)1294

317073

Cavendish Capital Markets Limited (Nominated Adviser and Broker) Tel: +44 (0)20 7220 0500

Giles Balleny / Dan Hodkinson (Corporate Finance)

Michael Johnson (Sales)

About RUA Life Sciences

The RUA Life Sciences group was created in April 2020 when RUA

Life Sciences Plc (formerly known as AorTech International Plc)

acquired RUA Medical Devices Limited to create a fully formed

medical device business. RUA Life Sciences is the holding company

of the Group's four trading businesses, each exploiting the Group's

patented polymer technology.

Our vision is to improve the lives of millions of patients by

enabling medical devices with Elast-EonTM, the world's leading

long-term implantable polyurethane.

Whether it is licensing Elast-Eon (TM) , manufacturing a device

or component, or developing next generation medical devices, a RUA

Life Sciences business is pursuing our vision.

Elast-Eon(TM)'s biostability is comparable to silicone while

exhibiting excellent mechanical, blood contacting and flex-fatigue

properties. These polymers can be processed using conventional

thermoplastic extrusion and moulding techniques. With over 8

million implants and 16 years of successful clinical use, RUA's

polymers are proven in long-term life enabling applications.

The Group's four business segments are:

Contract Manufacturing: End-to-end contract developer and manufacturer

of medical devices and implantable fabric specialist

.

Biomaterials : Licensor of Elast-Eon (TM) polymers to the

medical device industry.

Vascular: Development and commercialisation of the Group's

Elast-Eon (TM) sealed Vascular Graft products

.

Structural Heart Development of the Group's Elast-Eon (TM) composite

: heart valve material.

A copy of this announcement will be available shortly at

www.rualifesciences.com/investor-relations/regulatory-news-alerts

.

CHAIRMAN'S STATEMENT

I am pleased to set out below an overview of the unaudited

interim results of RUA Life Sciences Plc for the six months to 30

September 2023. The focus of the period was ensuring the Group was

best positioned to undertake a capital raise to fund the

commercialisation of the development divisions of the business.

Much of the funding options available to the Group relied upon

ensuring VCT and EIS qualification for potential investors. As a

result of changes in VCT/EIS rules, the Group underwent a

reorganisation to transfer the heart valve and vascular assets into

the respective subsidiary companies. This reorganisation allowed

advance assurance to be received and ultimately in the Company

announcing the placing and retail offer which conditionally raised

GBP4.4 million.

Unaudited interim results for the six months to 30 September

2023

The results below are the consolidated figures for the entire

group and are further analysed in the relevant segmental

update.

Revenue for the Group decreased from GBP1,104,000 last year to

GBP794,000, a reduction of 28%. This reduction was due to delays in

shipping product to a customer. The operational team at RUA Life

Sciences worked exceptionally well both internally and externally

with our customer during October and November, ultimately bringing

orders back in line with targets by the end of November. The

revenue reduction impacted gross profits adversely, and despite

strong cost control, operating losses increased 20% from

GBP1,136,000 to GBP1,360,000.

Post-tax losses, however, improved from GBP1,143,000 to

GBP1,010,000 as a result of the timing of the receipt of R&D

tax credits. Working capital continued to be tightly managed with

cash reducing at less than the rate of operating losses, with the

balance at the period end being GBP493,000, a fall of GBP991,000

from the start of the period. The cash position has subsequently

recovered strongly due to the strong trading in October and

November, which when coupled with the receipt of R&D Tax

Credits allowed the cash balance to increase to GBP900,000 at the

beginning of December. The net proceeds from the equity fundraise

will materially strengthen the cash position further.

Biomaterials

The Biomaterials business segment is the part of the business

that holds the Intellectual Property relating to Elast-Eon(TM) and

related polymers, and licences that IP to other medical device

companies.

The Biomaterials business witnessed further growth in royalty

and license fee income and increased an additional 6% compared to

the first half of last year, rising from GBP187,000 to GBP199,000.

The Biomaterials business is, however, very much second half

weighted as a result of the timings of when royalty fees are

recognised

Net margins in Biomaterials remain high, with the contribution

to the Group increasing from GBP154,000 (82%) last year to

GBP166,000 (84%) in the current period.

Contract Manufacturing

Based on headline performance, the Contract Manufacturing

business performed poorly with revenues down from GBP917,000 in the

first half of last year to GBP579,000, a decrease of 37%. The

shortfall was a result of much-reduced revenue being recognised

during August and September due to delays in the completion,

shipment and sterilisation testing of orders from the major

customer. The issues have been resolved by RUA with record

shipments during October and November, resulting in revenues from

the customer now being ahead of budget.

Business development activities are now achieving results in

line with the Group's growth strategy. A formal Request For

Proposal (RFP) has been received from a global business seeking

manufacturing services to derisk supply chain issues across a range

of implantable devices. RUA proposed a phased work plan involving

project scoping and reverse engineering, proof of concept

manufacture and process validation followed by a long term supply

contract. Phase one has now been agreed with the client and work

will commence on contract signature. A successful completion of

this project should result in annual revenue potential in excess of

GBP1 million. Meeting production volumes should be achievable

within current clean room facilities.

Vascular

The Group's vascular graft is now fully prepared to undergo the

regulatory testing regime agreed with the FDA, following a

successful pre-submission process which allows the graft to go

through the less onerous 510k market clearance route. Subject to

starting recruitment for the remaining clinical studies, regulatory

approval is anticipated in 30 to 36 months with a required budget

of approximately GBP6 million. However, as announced on 20 November

2023, given the current cost of capital and funding of the

business, the Board elected to pursue a strategy of seeking

external funding for the completion of these trials. A business

plan for the regulatory pathway and business model is being

prepared as the basis of attracting third-party investment for the

project.

The Board believes that the Vascular project has very attractive

risk-adjusted returns on the additional investment required to

achieve regulatory approval. The investment in RUA Vascular will be

exploited by seeking third party funding for the project whilst

retaining an interest which could involve an equity interest, a

Contract Manufacture development and manufacture agreement or a

form of licensing of technology developed.

The Group's vascular products have already developed OEM

customer interest with the first commercial sale recently achieved.

Furthermore, a global distribution partnership has also been put in

place with Corcym, the global medical device company, to allow a

much-simplified route to market.

Structural Heart

A year ago, we discussed the development of a prototype

composite combining the exceptional blood contacting and

biostability properties of Elast-Eon with RUA's expertise in

implantable textiles. The objectives for the Structural Heart

business were to manufacture prototype valves and undertake

durability testing to further evaluate this material.

An ideal heart valve leaflet material would have several

qualities. The biological properties of low calcium susceptibility,

low thrombogenicity and hemocompatibility are the key properties of

Elast-Eon and have been demonstrated in numerous trials and

devices. It is in demonstrating the mechanical properties of the

RUA composite that we have seen the technological breakthrough

during the period. A heart valve leaflet needs to be durable. The

RUA composite has undergone both flex fatigue and accelerated wear

testing as a valve. In both cases, our expectations were exceeded.

In hydrodynamic testing, the RUA composite leaflet valve was as

efficient as current mechanical valves and required around 50% less

energy than a biological valve. The novel material itself also has

interesting properties. At only 150 microns thick, it is much

thinner than animal tissue material, therefore potentially

delivering benefits to transcatheter valve delivery and

performance. Additionally, the composite has isotropic properties

in having similar strength in every direction and the strength is

higher than the initial fabric substrate.

Previous attempts at polymeric heart valves have required a

combination of polymer material and a valve design to work within

the limitations of the original polymer. The RUA composite has been

created to eliminate valve design constraints and as such, can be

commercialised as a component rather than a finished product. The

target for the heart valve business is now to pursue material

supply and license agreements with other heart valve businesses,

thus bringing time to commercialisation closer and future

development budget requirements reduced dramatically.

Conclusion and Outlook

Recent priorities have been to secure a solid financial base for

the Company to allow the value in each of the businesses to be

demonstrated through achieving their growth potential and

commercialising the investment made to date. The strategy is for

the business to turn profitable in the shorter term as a result of

growing contract manufacturing and commercialising the R&D

undertaken within Vascular and Structural Heart. Your Board is

grateful for the support demonstrated by current and new

shareholders allowing the successful placing and retail offer.

Bill Brown, Chairman

15 December 2023

CONDENSED CONSOLIDATED INTERIM INCOME STATEMENT

Unaudited Unaudited Audited

Six months Six months Twelve months

to 30 Sep to 30 Sep to 31 Mar

2023 2022 2023

Note GBGBP000 GBGBP000 GBGBP000

----------- ----------- --------------

Revenue 2 794 1,104 2,179

Cost of sales (178) (229) (388)

----------- ----------- --------------

Gross profit 616 875 1,791

Other income 44 98 72

Administrative

expenses (2,020) (2,109) (4,169)

----------- ----------- --------------

Operating loss (1,360) (1,136) (2,306)

Net finance expense (36) (11) (16)

----------- ----------- --------------

Loss before

taxation (1,396) (1,147) (2,322)

Taxation 386 4 319

----------- ----------- --------------

Loss attributable

to equity holders

of the parent

company (1,010) (1,143) (2,003)

----------- ----------- --------------

Loss per share

Basic & Diluted

(GB Pence per

share) (4.55) (5.15) (9.03)

CONDENSED CONSOLIDATED INTERIM STATEMENT OF FINANCIAL

POSITION

Unaudited Unaudited Audited

30 Sep 30 Sep

2023 2022 31 Mar 2023

Note GBGBP000 GBGBP000 GBGBP000

Assets

Non-current assets

Goodwill 3 301 301 301

Other intangible assets 4 445 495 470

Property, plant and

equipment 5 2,621 2,543 2,739

---------- ---------- ------------

Total non-currents

assets 3,367 3,339 3,510

---------- ---------- ------------

Current assets

Inventories 6 139 68 81

Trade and other receivables 7 755 681 588

Cash and cash equivalents 8 493 2,509 1,484

---------- ---------- ------------

Total current assets 1,387 3,258 2,153

---------- ---------- ------------

Total assets 4,754 6,597 5,663

---------- ---------- ------------

Equity

Issued capital 1,112 1,109 1,109

Share premium 11,729 11,729 11,729

Capital redemption

reserve 11,840 11,840 11,840

Other reserve (1,389) (1,507) (1,450)

Profit and loss account (19,558) (17,685) (18,545)

---------- ---------- ------------

Total equity attributable

to equity holders of

the parent company 3,734 5,486 4,683

---------- ---------- ------------

Liabilities

Non-current liabilities

Borrowings 9 150 364 165

Lease liabilities 9 169 - 200

Deferred tax 80 71 85

Other Liabilities 101 140 116

---------- ---------- ------------

Total non-current

liabilities 500 575 566

---------- ---------- ------------

Current liabilities

Borrowings 9 29 86 29

Lease liabilities 9 97 4 81

Trade and other payables 10 354 397 255

Other liabilities 40 49 49

---------- ---------- ------------

Total current liabilities 520 536 414

---------- ---------- ------------

Total liabilities 1,020 1,111 980

---------- ---------- ------------

Total equity and liabilities 4,754 6,597 5,663

---------- ---------- ------------

CONDENSED CONSOLIDATED INTERIM CASH FLOW STATEMENT

Unaudited Unaudited Audited

Six months Six months Twelve

to to months to

30 Sep 30 Sep 31 March

2023 2022 2023

GBGBP000 GBGBP000 GBGBP000

Cash flows from operating

activities:

Group loss after tax (1,010) (1,143) (2,003)

Adjustments for:

Amortisation of intangible

assets 25 26 51

Depreciation of property,

plant and equipment 160 148 307

Share-based payments 61 46 102

Net finance costs 36 9 16

Tax credit in year (381) - (319)

Decrease / (increase) in trade

and other receivables 214 439 327

Decrease / (increase) in inventories (58) 56 43

Taxation (5) (4) 533

Decrease in trade and other

payables 75 (38) (203)

----------- ----------- -----------

Net cash flow from operating

activities (883) (461) (1,146)

----------- ----------- -----------

Cash flows from investing

activities:

Purchase of property plant

and equipment (42) (94) (449)

Interest paid (21) (9) (28)

----------- ----------- -----------

Net cash flow from investing

activities (63) (103) (477)

----------- ----------- -----------

Cash flows from financing

activities:

Proceeds from borrowing 33 150 229

Repayment of borrowings and

leasing liabilities (63) (40) (97)

----------- ----------- -----------

Net cash flow from financing

activities (30) 110 132

----------- ----------- -----------

Net decrease in cash and

cash equivalents (976) (454) (1,491)

Cash and cash equivalents

at beginning of year 1,484 2,963 2,963

Effect of foreign exchange

rate changes (15) - 12

----------- ----------- -----------

Cash and cash equivalents

at end of the period 493 2,509 1,484

----------- ----------- -----------

CONDENSED CONSOLIDATED INTERIM STATEMENT OF CHANGES IN EQUITY

Issued Capital Profit

Share Share Redemption Other and loss Total

capital premium Reserve reserve account equity

GBGBP000 GBGBP000 GBGBP000 GBGBP000 GBGBP000 GBGBP000

Balance at

31 March 2022 1,109 11,729 11,840 (1,552) (16,542) 6,584

Share based

payments - - - 46 - 46

Total comprehensive

income for the

period - - - - (1,143) (1,143)

--------- --------- ------------ --------- ---------- ---------

Balance at

30 September

2022 1,109 11,729 11,840 (1,506) (17,685) 5,487

--------- --------- ------------ --------- ---------- ---------

Share based

payments - - - 56 - 56

Total comprehensive

income for the

period - - - - (860) (860)

--------- --------- ------------ --------- ---------- ---------

Balance at

31 March 2023 1,109 11,729 11,840 (1,450) (18,545) 4,683

--------- --------- ------------ --------- ---------- ---------

Issue of share

capital 3 - - - (3) -

Share based

payments - - - 61 - 61

Total comprehensive

income for the

period - - - - (1,010) (1,010)

--------- --------- ------------ --------- ---------- ---------

Balance at

30 September

2023 1,112 11,729 11,840 (1,389) (19,558) 3,734

--------- --------- ------------ --------- ---------- ---------

NOTES TO THE CONDENSED CONSOLIDATED INTERIM FINANCIAL

STATEMENTS

1. BASIS OF PREPARATION

General information

RUA Life Sciences plc is the ultimate parent company of the

Group, whose principal activities are contract design and

manufacture of medical devices and exploiting the value of its IP

and know-how.

RUA Life Sciences plc is incorporated and domiciled in the UK

and its registered office is c/o Davidson Chalmers Stewart LLP, 163

Bath Street, Glasgow, G2 4SQ.

Basis of preparation

These condensed consolidated interim financial statements are

for the six months ended 30 September 2023 and have been prepared

with regard to the requirements of IAS 34 on "Interim Financial

Reporting". They do not include all of the information required for

full financial statements and should be read in conjunction with

the audited consolidated financial statements of the Group for the

year ended 31 March 2023.

The financial information for the six months ended 30 September

2023 and the comparative figures for the six months ended 30

September 2022 are unaudited. They have been prepared on the basis

of the accounting policies set out in the consolidated financial

statements of the Group for the year ended 31 March 2023 and, on

the recognition, and measurement principles of IFRS in issue as

effective at 30 September 2023. The accounting policies have been

applied consistently throughout the Group for the purposes of

preparation of these condensed consolidated interim financial

statements.

The figures for the year ended 31 March 2023 have been extracted

from the audited statutory accounts which were approved by the

Board of Directors on 25 July 2023, prepared under IFRS. The

Independent Auditor's Report on the Report and Financial Statements

for the year ended 31 March 2023 was unqualified but did draw

attention to Note 1 of those financial statements which explains

that the Group and Parent Company's ability to continue as a going

concern is dependent on the execution of its business plan together

with its ability to raise sufficient capital to meet capital and

liquidity requirements. The auditors report did not contain any

statements under sections 498(2) or 498(3) of the Companies Act

2006.

These condensed consolidated interim financial statements were

approved for issue by the Board of Directors on 15 December

2023.

Going concern

Pending approval by shareholders at the upcoming general meeting

on 18 December 2023, the business will raise approximately GBP4m

(after expenses) through a Placing, Subscription and Retail Offer

of new ordinary shares. The Directors are confident in the passing

of the necessary resolutions. The Directors believe the balance

sheet, strengthened by the finance proceeds, provides a pathway to

cashflow breakeven and profitability.

The Directors have considered the applicability of the going

concern basis in the preparation of the financial statements. This

included the review of financial results, internal budgets and cash

flow forecasts, including the anticipated proceeds of the financing

for the period of at least 12-months following the date of approval

of these interim financial statements (the "Going Concern

Period").

The Directors have modelled severe but plausible downside

scenarios, including the downside of a vote against the financing

at the general meeting, on the going concern period.

These scenarios include sensitivity analysis, which delays

future growth. In such a case, the Group would take mitigating

actions, and the Directors concluded that the Group would be able

to reduce expenditure on its research and development programmes

and other areas in order to meet its liabilities as they fall due

for the Going Concern Period. The forecasts show that under both

the base case and severe but plausible scenarios, the Group's cash

resources will extend beyond the Going Concern Period, satisfying

the Directors that the Group and Company will have sufficient funds

to meet their liabilities as they fall due for at least the Going

Concern Period and therefore have prepared the financial statements

on a going concern basis.

Principal Risks and Uncertainties

The principal risks and uncertainties affecting the business

activities of the Group remain those detailed on pages 24-26 of the

Annual Report 2023, a copy of which is available on the Company's

website www.rualifesciences.com

Loss per share

Loss per share has been calculated on the basis of the result

for the period after tax, divided by the weighted average number of

ordinary shares in issue in the period of 22,184,798. (30 September

2023: 22,184,798 and 31 March 2023: 22,184,798).

2. SEGMENTAL REPORTING

The principal activity of the RUA Life Sciences Group comprises

exploiting the value of its IP & know-how, medical device

contract manufacturing and development of cardiovascular

devices.

The following analysis by segment is presented in accordance

with IFRS 8 on the basis of those segments whose operating results

are regularly reviewed by the Chief Operating Decision Maker

(considered to be the executive chairman of the board) to assess

performance and make strategic decisions about the allocation of

resources. Segmental results are calculated on an IFRS basis.

A brief description of the segments of the business is as

follows:

-- Biomaterials - Licensor of Elast-Eon(TM) polymers to the medical device industry.

-- Contract Manufacturing - End-to-end contract developer and

manufacturer of medical devices and implantable fabric

specialist.

-- Vascular - Development and commercialisation of the Group's

Elast-Eon sealed Vascular Graft products.

-- Structural Heart - Development of the Group's Elast-Eon composite heart valve material.

Operating results which cannot be allocated to an individual

segment are recorded as central and unallocated.

Analysis of revenue

by income stream Unaudited Unaudited Audited

Six months

to 30 Sep Six months to Twelve months

2023 30 Sep 2022 to 31 Mar

GBGBP000 GBGBP000 2023 GBGBP000

Manufacture of 595 - -

Medical Devices

Royalty Income 199 187 554

Total 794 1,104 2,179

----------- -------------- ---------------

Analysis of revenue

by geographical

location Unaudited Unaudited Audited

Twelve months

Six months Six months to 31 Mar

to 30 Sep 2023 to 30 Sep 2022 2023

GBGBP000 GBGBP000 GBGBP000

Israel 26 26 48

Italy 19 - 15

Switzerland - 7 168

UK - (1) (1)

USA 749 1,072 1,949

---------------- ---------------- --------------

Total 794 1,104 2,179

---------------- ---------------- --------------

The Group's revenue for six months to 30 September 2023 is

segmented as follows:

Analysis of revenue by income

stream

Unaudited Unaudited Unaudited Unaudited Unaudited Unaudited

Contract Structural Central

Biomaterials Manufacture Vascular Heart and unallocated Total

GBGBP000 GBGBP000 GBGBP000 GBGBP000 GBGBP000 GBGBP000

Manufacture of

Medical Devices - 579 16 - - 595

Royalty revenue 199 - - - - 199

-------------- ------------- ---------- ----------- ----------------- ----------

Total 199 579 16 - - 794

-------------- ------------- ---------- ----------- ----------------- ----------

Analysis of revenue by geographical

location

Unaudited Unaudited Unaudited Unaudited Unaudited Unaudited

Contract Structural Central

Biomaterials Manufacture Vascular Heart and unallocated Total

GBGBP000 GBGBP000 GBGBP000 GBGBP000 GBGBP000 GBGBP000

Israel 26 - - - - 26

Italy - 19 - - - 19

Switzerland - - - - - -

UK - - - - - -

USA 173 560 16 - - 749

------------------- ------------- ---------- ----------- ----------------- ----------

Total 199 579 16 - - 794

------------------- ------------- ---------- ----------- ----------------- ----------

The Group's revenue for six months to 30 September 2022 is

segmented as follows:

Analysis of revenue by income

stream

Unaudited Unaudited Unaudited Unaudited Unaudited Unaudited

Contract Structural Central

Biomaterials Manufacture Vascular Heart and unallocated Total

GBGBP000 GBGBP000 GBGBP000 GBGBP000 GBGBP000 GBGBP000

Manufacture of

Medical Devices - 917 - - - 917

Royalty revenue 187 - - - - 187

-------------- ------------- ---------- ----------- ----------------- ----------

Total 187 917 - - - 1,104

-------------- ------------- ---------- ----------- ----------------- ----------

Analysis of revenue by geographical

location

Unaudited Unaudited Unaudited Unaudited Unaudited Unaudited

Contract Structural Central

Biomaterials Manufacture Vascular Heart and unallocated Total

GBGBP000 GBGBP000 GBGBP000 GBGBP000 GBGBP000 GBGBP000

Europe 7 (1) - - - 6

USA 154 918 - - - 1,072

RoW 26 - - - - 26

------------------------ ------------- ---------- ----------- ----------------- ----------

Total 187 917 - - - 1,104

------------------------ ------------- ---------- ----------- ----------------- ----------

The Group's Segmental analysis for six months to 30 September

2023 is segmented as follows:

Unaudited Unaudited Unaudited Unaudited Unaudited Unaudited

Contract Structural Central

Biomaterials Manufacture Vascular Heart and unallocated Total

GBGBP000 GBGBP000 GBGBP000 GBGBP000 GBGBP000 GBGBP000

Consolidated group

revenues from external

customers 199 579 16 - - 794

Contributions to

group operating loss 166 305 (602) (215) (1,014) (1,360)

Depreciation - 27 99 9 25 160

Amortisation of intangible

assets - 22 - - 3 25

Segment assets 103 1,329 1,225 165 1,930 4,752

Segment liabilities - 220 407 19 374 1,020

Intangible assets

- goodwill - 301 - - - 301

Other intangible

assets - 237 139 - 69 445

Additions to non-current

assets 1 - 3 - 38 42

The Group's Segmental analysis for six months to 30 September

2022 is segmented as follows:

Unaudited Unaudited Unaudited Unaudited Unaudited Unaudited

Contract Structural Central

Biomaterials Manufacture Vascular Heart and unallocated Total

GBGBP000 GBGBP000 GBGBP000 GBGBP000 GBGBP000 GBGBP000

Consolidated group

revenues from external

customers 187 917 - - - 1,104

Contributions to

group operating loss 154 384 (619) (289) (766) (1,136)

Depreciation - 139 - 8 1 148

Amortisation of intangible

assets - 22 - - 4 26

Segment assets 90 4,012 - 152 2,343 6,597

Segment liabilities 2 897 34 4 174 1,111

Intangible assets

- goodwill - 301 - - - 301

Other intangible

assets - 419 - - 76 495

Additions to non-current

assets - 94 - - - 94

3. GOODWILL

The final valuation following the acquisition of RUA Medical

Devices Limited gave rise to adjustments being required to the

value of intangibles recognised in the Interim Report for the six

months ended 30 September 2020, and lead to the following goodwill

being recognised:

No impairment review has been carried out in the six-month

period.

GBGBP000

Gross carrying amount

Balance at 30 September

2022 301

Balance at 31 March 2023 301

Balance at 30 September

2023 301

4. OTHER INTANGIBLE ASSETS

Development Intellectual Customer Technology Total

costs property Related Based (CM)

(CM)

GBGBP000 GBGBP000 GBGBP000 GBGBP000 GBGBP000

Gross carrying

amount

At 31 March

2022 337 3,325 247 141 4,050

Additions - - - - -

------------ ------------- --------- ------------ ----------

At 30 September

2022 337 3,325 247 141 4,050

Additions - - - - -

------------ ------------- --------- ------------ ----------

At 31 March

2023 337 3,325 247 141 4,050

Additions - - - - -

------------ ------------- --------- ------------ ----------

At 30 September

2023 337 3,325 247 141 4,050

------------ ------------- --------- ------------ ----------

Amortisation

and impairment

At 31 March

2022 337 3,106 58 28 3,529

Charge - 4 15 7 26

------------ ------------- --------- ------------ ----------

At 30 September

2022 337 3,110 73 35 3,555

Charge - 4 14 7 25

------------ ------------- --------- ------------ ----------

At 31 March

2023 337 3,114 87 42 3,580

Charge - 3 15 7 25

------------ ------------- --------- ------------ ----------

At 30 September

2023 337 3,117 102 49 3,605

------------ ------------- --------- ------------ ----------

Net book value

At 30 September

2022 - 215 174 106 495

------------ ------------- --------- ------------ ----------

At 31 March 2023 - 211 160 99 470

------------ ------------- --------- ------------ ----------

At 30 September

2023 - 208 145 92 445

------------ ------------- --------- ------------ ----------

5. PROPERTY, PLANT AND EQUIPMENT

Land Assets Plant Office Motor Total

& Buildings Under Construction & Machinery Equipment Vehicles

GBGBP000 GBGBP000 GBGBP000 GBGBP000 GBGBP000 GBGBP000

Cost

At 31 March

2022 1,335 - 1,614 79 25 3,053

Additions - - 80 14 - 94

------------- -------------------- ------------- ----------- ---------- ---------

At 30 September

2022 1,335 - 1,694 93 25 3,147

Additions - 142 211 2 - 355

------------- -------------------- ------------- ----------- ---------- ---------

At 31 March

2023 1,335 142 1,905 95 25 3,502

Transfer of Assets - - - - - -

Additions - - 7 2 33 42

------------- -------------------- ------------- ----------- ---------- ---------

At 30 September

2023 1,335 142 1,912 97 58 3,544

------------- -------------------- ------------- ----------- ---------- ---------

Depreciation

At 31 March

2022 120 - 287 33 16 456

Charge 30 - 106 8 4 148

------------- -------------------- ------------- ----------- ---------- ---------

At 30 September

2022 150 - 393 41 20 604

Charge 30 - 116 9 4 159

------------- -------------------- ------------- ----------- ---------- ---------

At 31 March

2023 180 - 509 50 24 763

Charge 20 - 127 7 6 160

------------- -------------------- ------------- ----------- ---------- ---------

At 30 September

2023 200 - 636 57 30 923

------------- -------------------- ------------- ----------- ---------- ---------

Net book value

At 30 September

2022 1,185 - 1,301 52 5 2,543

------------- -------------------- ------------- ----------- ---------- ---------

At 31 March 2023 1,155 142 1,396 45 1 2,739

------------- -------------------- ------------- ----------- ---------- ---------

At 30 September

2023 1,135 142 1,275 40 28 2,621

------------- -------------------- ------------- ----------- ---------- ---------

Included in the net carrying amount of property plant and

equipment are right-of-use assets as follows:

Plant Motor Total

& Machinery Vehicles

(Leased)

GBGBP000 GBGBP000 GBGBP000

Cost

At 31 March

2022 162 25 187

Additions 150 - 150

------------- ---------- ---------

At 30 September

2022 312 25 337

Additions 79 - 79

------------- ---------- ---------

At 31 March

2023 391 25 416

Additions - 33 33

------------- ---------- ---------

At 31 September

2023 391 58 449

------------- ---------- ---------

Depreciation

At 31 March

2022 23 16 39

Charge 13 4 17

------------- ---------- ---------

At 30 September

2022 36 20 56

Charge 12 4 16

------------- ---------- ---------

At 31 March

2023 48 24 72

Charge 21 5 26

------------- ---------- ---------

At 31 September

2023 69 29 98

------------- ---------- ---------

Net book value

At 30 September

2022 276 5 281

------------- ---------- ---------

At 31 March

2023 343 1 344

------------- ---------- ---------

At 30 September

2023 322 29 351

------------- ---------- ---------

6. INVENTORIES

Inventories consist of the following:

Unaudited Unaudited Audited

Six months Six months

to 30 Sep to 30 Sep Twelve months

2023 2022 to 31 Mar 2023

GBGBP000 GBGBP000 GBGBP000

Raw Materials 58 45 48

Work in Progress 65 23 33

Finished Goods 16 - -

----------- ----------- ----------------

139 68 81

----------- ----------- ----------------

The cost of inventories recognised as an expense and included in

cost of goods sold amounted GBP26K (2022: GBP37K).

7. TRADE AND OTHER RECEIVABLES

Unaudited Unaudited Audited

Six months Six months

to 30 Sep to 30 Sep Twelve months

2023 2022 to 31 Mar 2023

GBGBP000 GBGBP000 GBGBP000

Current:

Trade receivables -

gross 98 146 175

Allowance for credit

losses - (5) -

----------- ----------- ----------------

Trade receivables net 98 141 175

Other receivables 50 82 34

Tax credit due 381 28 -

Prepayments and accrued

income 226 430 379

----------- ----------- ----------------

755 681 588

----------- ----------- ----------------

8. CASH AT BANK

Unaudited Unaudited Audited

Six months Six months

to 30 Sep to 30 Sep Twelve months

2023 2022 to 31 Mar 2023

GBGBP000 GBGBP000 GBGBP000

Cash at bank and in

hand 493 2,509 1,484

----------- ----------- ----------------

493 2,509 1,484

----------- ----------- ----------------

9. BORROWINGS & LEASE LIABILITIES

Unaudited Unaudited Audited

Six months Twelve months

Six months to 30 Sep to 31 Mar

to 30 Sep 2023 2022 2023

GBGBP000 GBGBP000 GBGBP000

Current:

Bank loans 29 86 29

Lease Liabilities 97 4 81

---------------- ----------- --------------

126 90 110

---------------- ----------- --------------

Non-current:

Bank loans 150 364 165

Lease Liabilities 169 - 200

---------------- ----------- --------------

319 364 365

---------------- ----------- --------------

Bank loans Lease liabilities Total

GBGBP000 GBPGBP000 GBGBP000

Repayable in less than

6 months 14 45 59

Repayable in 7 to 12

months 15 46 61

Repayable in 1 to 5

years 98 175 273

Repayable after 5 years 52 - 52

----------- ------------------ ---------

179 266 445

----------- ------------------ ---------

GBP148,449 of bank loans is secured on the property at 2

Drummond Crescent, Irvine, Ayrshire and subject to a bond and

floating charge over the Group's assets. Secured bank loans carry a

variable rate of interest, which were between 6% and 7.8%.

GBP30,309 of bank loans is an unsecured government support loan.

Unsecured bank loans carry an effective rate of interest at 9%.

The lease liabilities are secured by the related underlying

assets. Lease borrowings carry fixed rates of interest, ranging

between 4.0% and 9.6%.

Reconciliation of change in lease liabilities:

GBGBP000

As at 1 April 2022 121

Payment of lease liability - principal (25)

Payment of lease liability - interest (5)

Interest expense 5

Additions 150

Disposals -

As at Sep 2022 246

Payment of lease liability - principal (44)

Payment of lease liability - interest (11)

Interest expense 11

Additions 79

Disposals -

As at 31 March 2023 281

Payment of lease liability - principal (48)

Payment of lease liability - interest (12)

Interest expense 12

Additions 33

Disposals -

---------

As at 30 September 2023 266

---------

10. TRADE AND OTHER PAYABLES

Unaudited Unaudited Audited

Six months Twelve months

Six months to 30 Sep to 31 Mar

to 30 Sep 2023 2022 2023

GBGBP000 GBGBP000 GBGBP000

Current liabilities:

Trade payables 184 142 43

Other payables 24 91 8

Accruals and deferred

income 146 164 204

---------------- ----------- --------------

354 397 255

---------------- ----------- --------------

Deferred grant income is included within other liabilities in

the Consolidated statement of financial position. GBP39,000 (2022:

GBP49,000) is included in current liabilities and GBP101,000 (2022:

GBP140,000) included in Non-current Liabilities.

11. SUBSEQUENT EVENTS

The Company announced on 30 November 2023 a placing to raise a

minimum of GBP4.0m and a retail offer to raise up to GBP0.75m.

Certain Directors noted their intention to invest a further

GBP80,000 through the subscription for an additional 727,272 shares

subject to being out of a close period.

The Company subsequently announced on 1st December that it had

conditionally raised gross proceeds of approximately GBP4.0m

(before expenses) under the placing. In total, 36,363,636 Placing

Shares have been conditionally placed at the price of 11 pence per

share.

On the 8 December following the closing of the Retail Offer on 7

December 2023, the Company announced that the Retail Offer had

raised an additional GBP0.31 million through the issue of 2,784,566

Ordinary Shares at the Issue Price of 11 pence.

12. ISSUED SHARE CAPITAL

The Company's issued share capital as at 30 September 2023

comprises 22,184,798 Ordinary Shares of which none are held in

treasury.

13. INTERIM ANNOUNCEMENT

The interim results announcement was released on 18 December

2023. A copy of this Interim Report is also available on the

Company's website www.rualifesciences.com.

BOARD OF DIRECTORS AND ADVISORS

DIRECTORS

W Brown - Executive Chairman

C Stretton - Group Managing Director

L Smith - Group CFO

I Anthony - Clinical and Regulatory Affairs (Resigned 01/09/2023)

J McKenna - Director of Marketing

I Ardill - Non-Executive Director

G Berg - No n-Executive Director

J Ely - Non-Executive Director

COMPANY SECRETARY

K M Full FCC A (Resigned 03/09/23)

L Smith (Appointed 03/09/23)

HEAD OFFICE REGISTERED OFFICE

2 Drummond Crescent c/o Davidson Chalmers Stewart

Irvine LLP

Ayrshire 163 Bath Street

KA11 5AN Glasgow

G2 4SQ

web: www.rualifesciences.com

email: info@rualifesciences.com

NOMINATED ADVISER AND BROKER REGISTRARS

Cavendish Capital Markets Equiniti Limited

Limited

One Bartholomew Close Aspect House

London Spencer Road

EC1A 7BL West Sussex

BN99 6DA

LAWYERS

Davidson Chalmers Stewart

163 Bath Street

Glasgow

G2 4SQ

Burness Paull LLP

50 Lothian Road

Festival Square

Edinburgh

EH3 9WJ

INDEPENT AUDITOR

Grant Thornton UK LLP

Statutory Auditor

Chartered Accountants

110 Queen Street

Glasgow

G1 3BX

Registered in Scotland, Company No.SC170071

Financial statements will be available to Shareholders from

the Company Website, along with copies of the announcement.

Dealings permitted on Alternative Investment Market (AIM)

of the London Stock Exchange .

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR NKOBQABDDQBD

(END) Dow Jones Newswires

December 18, 2023 02:00 ET (07:00 GMT)

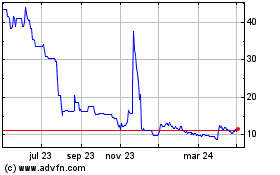

Rua Life Sciences (LSE:RUA)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

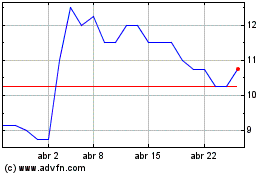

Rua Life Sciences (LSE:RUA)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024