TIDMSBSI

RNS Number : 6181R

Schroder BSC Social Impact Trust

30 October 2023

Schroder BSC Social Impact Trust plc

Annual Report and Accounts

Schroder BSC Social Impact Trust plc (the "Company") hereby

submits its final results for the year ended 30 June 2023.

Highlights

The Company has generated resilient shareholder returns since

inception on 22 December 2020 in a highly volatile market and

continues to provide a source of portfolio diversification for

investors, along with the opportunity to make a meaningful positive

difference to communities across the UK.

-- NAV of 104.90 pence per share as of 30 June 2023.

-- NAV total return per share of 0.8% in the financial year

ended 30 June 2023, during a period of continued downwards pressure

in the wider market.

-- NAV total return per share of 8.6% since inception (3.4% annualised).

-- Dividend of 2.30p per share for the year, increasing 77% from

1.30p per share for the year to 30 June 2022; dividend yield on NAV

guidance increased to 2-3% (from 1-2%).

-- High impact housing portfolio remains resilient - 100% of rent collection due by June 2023.

-- GBP87m of capital committed to date to support 168 frontline

organisations, reaching 276,000 people, at least 94% of whom are

disadvantaged or vulnerable.

-- 100% of investments align with the UN Sustainable Development

Goals, across four key impact themes, with the majority of the

portfolio aimed at reducing poverty and inequality (SDGs 1 &

10).

The Portfolio Manager will be presenting at a webinar on 31

October 2023 at 14:00. This is open to all existing and potential

shareholders, who can sign up for the webinar at:

https://registration.duuzra.com/form/SBSI23

The Company's Report and Accounts for the year ended 30 June

2023 is also being published in hard copy format and an electronic

copy will shortly be available to download from the Company's

website:

https://www.schroders.com/en-gb/uk/individual/funds-and-strategies/investment-trusts/schroder-bsc-social-impact-trust-plc/

Please click on the following link to view the document:

http://www.rns-pdf.londonstockexchange.com/rns/6181R_1-2023-10-28.pdf

Enquiries:

Augustine Chipungu (Press) 020 7658 6000

Matthew Riley (Company Secretary) 020 7658 6000

Schroder BSC Social Impact Trust plc

Chair's Statement

I am pleased to present the third annual report of Schroder BSC

Social Impact Trust plc ("the Company"), covering the year ended 30

June 2023.

Following a period of high market volatility, the Bank of

England's monetary tightening policy appears to have been

successful in bringing inflation back in single-digit territory in

2023. The "worst-case" recessionary concerns of late 2022 appear to

have been (narrowly) averted, and we start seeing early signs of

interest rate stabilisation, alongside hopes of reducing

inflation.

However, the full impact of the higher inflation and interest

rates environment are only beginning to be felt and will have

long-term consequences for the cost of living in the UK, putting

pressure on the affordability of essential items like food, energy,

and housing.

It is estimated that UK households are facing the largest fall

in living standards since records began in the 1950s, and

low-income households are the most affected. In this challenging

environment, the social impact created by the Company's investments

is needed more than ever, with many investments providing solutions

to the cost-of-living crisis, such as increasing the supply of

affordable housing and helping households manage energy costs

through retrofit businesses and community renewables. In a time of

constrained government spending, the Company's investments

targeting innovation in public service commissioning through Social

Outcomes Contracts generate significant savings for the Government

[1] .

The Board believes the Company offers investors a valuable

source of portfolio diversification, through access to a unique mix

of private market investments, with the dual objectives of

providing long term capital growth and income and serving as a

source of permanent funding for organisations dedicated to positive

social impact.

Furthermore, the Board, AIFM and Portfolio Manager are committed

to advancing impact investing in the UK, through events and

publications aimed at increasing investors' understanding of best

practices and supporting them in making impact allocations in their

portfolios. We build relationships and maintain an active dialogue

with the investment community, actively seeking to understand how

the Company can best serve investors' requirements in committing

capital to high quality, high impact investments.

We understand that our investors want the Company to grow, both

through NAV asset growth and fresh capital raises, and it is a

stated high priority for the Board to take actions to make this

possible. We welcome conversations with investors interested in

helping us to achieve this goal of growing the Company.

Financial performance

The Company has delivered resilient NAV total returns since

inception on 22 December 2020, in a highly volatile market. Net

asset value ("NAV") total return for the year ended 30 June 2023

was 0.8% (2022: 1.6%), resulting in a NAV total return since

inception of 8.6% (3.4% annualised).

Overall, the Company's NAV per share fell from 105.4p to 104.9p

during the year ended 30 June 2023, after fees which included an

interim dividend payment of 1.30p per share paid on 6 December 2022

(2021: 0.57p).

The total share price return during the year ended 30 June 2023

was -11.0% (2022: -4.7%) as the Company's shares were not immune to

negative investor sentiment towards equities resulting in a wider

discount to NAV. The Company moved from trading at a premium to NAV

to a discount after the mini budget of September 2022, and traded

at an average discount of 7.3% in the twelve months to 30 June

2023, narrower than the average investment trust discount of 13.2%

over the same period.

A more detailed analysis of performance and additional

information on investments in the period under review are included

in the Portfolio Manager's Report. I would particularly like to

highlight that our Portfolio Manager has demonstrated the benefits

of extensive experience and an impact-led approach to investing in

social housing this year. Our portfolio has shown resilience within

a turbulent market, and should the Company raise more capital, we

are well positioned to deploy it responsibly in this important

sector.

Social impact performance

The Company published its second Impact Report on 29 June 2023,

showcasing the meaningful roles our investees have played in

communities across the UK during the year, the engagement of our

Portfolio Manager to support their success, and our impact

management methodology.

As of the date of the Impact Report the Company had committed

GBP87m, financing 168 organisations and reaching 276,000 people, of

whom at least 94% were from disadvantaged and vulnerable

backgrounds. The Company's investments helped fund over 27,000

affordable homes through the High Impact Housing asset class and

generated over GBP98m of near-term value as savings for government

and households. The full report is available on the Company's

website.

The Company's investments are also contributing to addressing

the specific social challenges created by rising energy costs. For

example, Agility Eco (in the Bridges Evergreen portfolio) is a

leading installer of energy efficiency improvements for low-income

households. Man Community Housing Fund received planning permission

for a development of 226 zero carbon, 100% affordable homes. Heart

of England Community Energy (backed by Triodos UK and the Community

Investment Fund) generates enough power for 4,500 homes as well as

providing wider community benefits.

More detail can be found in the Impact Report section on pages

29 to 30 of the 2023 Annual Report and Accounts. We continue to

welcome your feedback on the report, to help guide our

communications with shareholders about the frontline work of our

investees and our impact management methodology.

The Board was privileged in May 2023 to see first hand the

valuable work that our investees are undertaking in Hull and

together with representatives from the Portfolio Management team

visited Hull Women's Network, an organisation helping women and

their children escape domestic abuse, and Hull and East Yorkshire

Mind, providing support services to individuals and families

experiencing poor mental health. Both organisations also provide

safe and appropriate housing for people who need it most as part of

their wrap-around support services and have used social investment

from the Social and Sustainable Housing fund (in the Company's High

Impact Housing portfolio) to purchase and refurbish homes to a high

standard for their beneficiaries.

The Board is keen to help our investors meet their own

developing needs in relation to impact reporting, and we welcome

feedback.

Discount management

During the year to 30 June 2023 the Company's share rating

ranged between a discount to NAV of 15.3% and a premium to NAV of

1.5%. The 12-month average discount on 30 June 2023 was 7.3%

(average discount 2022: 0.5%).

The Company's share price moved to a discount to NAV in October

2022, during a period of turbulence for UK equities. Following

consultation with the Manager and the Company's corporate broker in

late 2022 the Board agreed that it was in shareholders' best

interests to commence buying back a limited number of shares with

the aim of narrowing the discount at which the shares were trading

to NAV. The Board also considers the shares an attractive

investment and the buybacks have been accretive to existing

shareholders.

While the Board is conscious that buybacks shrink the size of

the Company marginally in the short-term it remains our ambition to

grow the Company through share issuance in the longer term.

Addressing the discount to NAV is considered critical to achieving

this goal and the Board believes buy backs are one of the tools to

use in pursuit of this. During the year ended 30 June 2023 the

Company bought back 711,720 ordinary shares for a total

consideration of GBP674,000. All shares were bought back at a

discount to the prevailing NAV, and were placed into Treasury for

future re-issue. Should the Company's shares reach a sufficient

rating to its NAV, the Board will seek to use these shares to issue

to new and existing investors. Our Portfolio Manager has an

attractive pipeline of high impact investments, and it is the

Board's ambition to raise funds to take advantage of these

opportunities for our shareholders and to deploy further capital to

create more equal life chances and build resilient communities in

the UK.

Since 30 June 2023 and up to 26 October 2023, a further 449,924

shares have been bought back for a total consideration of

GBP411,130.84 and placed in Treasury.

At the forthcoming Annual General Meeting ("AGM") the Board will

seek to renew the authorities previously granted by shareholders to

issue or buy back shares. We encourage shareholders to vote in

favour of these resolutions which are described in more detail in

the on pages 91 to 94 of the 2023 Annual Report and Accounts.

Investor engagement

Another important plank in the strategy of closing the discount

and ultimately growing the Company, is active engagement with

current and prospective shareholders, which the Board and the

Managers take very seriously. Webinars and forums have been held

during the year under review to shed light on the investment

approach and portfolio holdings, and to help educate and inform

investors newer to social impact investing. In particular,

excellent feedback was received about the event convened in March

2023 that focused on the UK social housing market and the way that

a high impact focus has successfully been used to manage risk and

deliver resilient returns.

I am personally keen to meet with investors who may have a

desire or mandate to allocate to social impact, as the Company

aspires to be an attractive, diversified and reliable 'go-to'

partner for such portfolios. It has been useful to hear the issues

being faced by investors in this regard, and I am grateful for the

ideas shared in the meetings I have had during the year under

review and subsequently.

The Board recognises the size of the Company is a hurdle for

some investors, but we also hear from many that our strategy

answers a need across a range of investor types. Therefore, the

Board is thinking creatively and proactively about our outreach in

the year ahead. I hope our events, reports, and activities will be

valuable to you, and will help broaden and deepen our shareholder

base. I look forward to more dialogue with new investors to

increase our own investor impact and accelerate the much-needed

deployment of capital into high quality, high impact investments in

communities across the UK.

Dividend

The Board has considered the amount available to distribute to

investors and, as in previous years, has declared that the Company

will pay out substantially all of its income as a dividend,

resulting in a dividend of 2.30p per share (2022: 1.30p), payable

on 20 December 2023 to shareholders on the Company's share register

on 10 November 2023. This is above the target dividend of 1-2% of

net asset value communicated to investors at the initial public

offering ("IPO") and the Portfolio Manager is increasing its

guidance for future dividends to yield 2-3%. The dividend of 2.30p

is split between a 2.16p interest distribution and a 0.14p equity

dividend.

Continuation vote

In the Prospectus, published at the time of the IPO, the Company

undertook to provide shareholders with the opportunity to vote on

the Company's continuation should the Company's shares trade, on

average, at a discount in excess of 10% to NAV for the two-year

period ending 31 December 2023 and in any subsequent two-year

period. In the event that a vote was triggered shareholders would

be provided with the opportunity to vote on whether the Company

should continue in its present form.

The Board believes that since launch the Company has established

a clearly differentiated and unique position relative to other

investment companies. The Company provides shareholders with

exposure to hard to access high impact assets and managers whilst

its investments support partnerships between UK fund managers,

social organisations and the communities they serve. The Board also

believes that social impact investments should continue to provide

attractive long term investment opportunities and that the

prospects for private market social impact investments remains

positive. In addition, your Board notes that if the discount on 26

October 2023 of 13.13% were to continue until the end of this year,

then the Company's shares will have traded for the two years ending

31 December 2023 on average at a discount of 6.79%.

Quarterly valuations

In the Half Year Report, I advised that the Company intended to

increase the frequency of its valuation points from bi-annually to

quarterly to provide increased transparency for existing and

potential shareholders. Subsequently, the quarterly NAVs in respect

of 31 March and 30 June 2023 were published and the Company will

continue to publish the NAVs on a quarterly basis.

Online presentation

There will be a presentation by the Portfolio Manager at 2.00

p.m. on Tuesday, 31 October 2023 which will be available to watch

online. To sign up to watch the presentation please click on this

link: https://registration.duuzra.com/form/SBSI23

Details on how to watch the presentation are also available on

the Company's webpage: www.schroders.com/sbsi

By using a webinar, I hope more shareholders, and interested

parties will be able to listen to and ask questions of the

Portfolio Manager.

AGM

The AGM will be held on Friday, 15 December 2023 at 12.00 noon

at the offices of Schroders at 1 London Wall Place, London, EC2Y

5AU. A presentation from the Portfolio Manager will be given at the

AGM, and attendees will also be able to ask questions in person.

The presentation will be made available on the Company's website

following the meeting. Details of the formal business of the

meeting are set out in the Notice of Meeting on pages 92 to 94 of

the 2023 Annual Report and Accounts.

All shareholders are encouraged to vote by proxy in advance of

the AGM and to appoint the Chair of the meeting as their proxy.

This will ensure that shareholders' votes will be counted even if

they (or any appointed proxy) are not able to attend.

If shareholders have any questions for the Board, please write

to the Company's registered office address: Company Secretary,

Schroder BSC Social Impact Trust plc, 1 London Wall Place, London,

EC2Y 5AU, or email: amcompanysecretary@schroders.com .

For regular news about the Company, shareholders are also

encouraged to sign up to the Manager's investment trusts update by

visiting the Company's website:

https://www.schroders.com/en/uk/private-investor/fund-centre/funds-in-focus/investment-trusts/schroders-investment-trusts/never-miss-an-update/

Outlook

Following the volatile environment in global and UK markets, a

higher inflation, higher interest rate environment is expected to

have a long-term impact on the real economy, and the standards of

living of UK households. Most vulnerable and disadvantaged

households are the most affected, at a time when government

spending is also constrained.

In this context, the services provided by the organisations

funded by the Company's investments are needed more than ever.

While some of these organisations themselves will be affected by

rising cost pressures, the organisations in the Company's portfolio

have an average 30-years' track record, having demonstrated their

resilience through multiple economic cycles.

An expected election in the UK in the next twelve months

introduces further uncertainty around the policy risk. A

significant portion of the Company's portfolio is invested in

organisations with government-backed revenue sources. The Portfolio

Manager mitigates policy risk by diversifying the portfolio across

policy areas, and targeting areas with broad cross-party support,

such as housing, health and social care, and energy resilience.

Despite the challenging market environment, the social

investment market in the UK grew by 18% to GBP9.4bn in 2022,

according to the most recent annual market sizing exercise

published by Big Society Capital [2] . The Board believes that the

Company remains well positioned to lead and benefit from further

market growth, as the Portfolio Manager continues to see an

expanding and maturing pipeline of investment opportunities.

One of these opportunities is in very advanced stages, and we

expect the Portfolio Manager to fully commit the capital available

(following partial exits and capital repayments from the existing

portfolio) by early 2024. This opportunity would increase the

portfolio exposure to the "just transition to net zero" impact

theme and is expected to provide attractive returns to

investors.

In September 2023, the Company was Highly Commended in the Best

Newcomer Sustainable Fund category of Investment Week's Sustainable

Investment Awards 2023. We are pleased that the Company's

contribution as a key player in the sustainable investing space is

being recognised by the investor community.

We are encouraged to see growing appetite for sustainable

investment products, and an increased focus both from regulators

and investors on ensuring quality and clear standards. In the UK,

the Company engaged with the Financial Conduct Authority's

Sustainable Disclosure Requirement ("SDR") consultation through

Schroders and Big Society Capital, and we were pleased to see

extensive engagement from the broader financial sector. The

proposed SDR framework signals the regulator's commitment to

supporting the integrity and growth of the impact and wider

sustainability investment markets in the UK. We believe transparent

labelling and disclosure of impact products are essential for the

impact investment market to grow healthily. We also welcome the

EU's Sustainable Finance Disclosure Requirements ("SFDR")

consultation, launched this year to review SFDR's implementation

and explore new classifications that offer greater clarity on

investment product impact credentials.

Through engagement with key stakeholders in the investment and

regulatory space, as well as showcasing best practice in making

successful impact investments, the Managers aspire to position the

Company as a trusted leader and attractive partner for investors

making allocations to this emerging asset class.

We have been gratified to hear the interest in, and support for,

the Company's approach and purpose, but realise successful growth

depends on converting more of this latent demand and widening the

shareholder base. We look forward to speaking with you during the

year.

Susannah Nicklin

Chair

27 October 2023

Portfolio Manager's Report

Market developments

The twelve months to 30 June 2023 were a particularly

challenging one for the UK economy with inflation at a 40 year

high, led by large increases in energy and food prices and

contending with recessionary concerns. The "mini-budget" of

September 2022 further exacerbated the instability in financial

markets, and negative investor sentiment, despite its subsequent

reversal.

The Bank of England's ("BoE") response to market conditions was

to raise interest rates eight times in a 12-month period, to 5% on

30 June 2023, with a further rise to 5.25% voted for in August

2023. The new interest rate environment has broad implications on

the investment community as well as the broader population, in

particular, the most vulnerable and disadvantaged people that the

Company's investments are aiming to support.

Inflation started to reduce during 2023, returning to single

digits; however, the full effects of the higher inflationary and

interest rate environment are only just beginning to be felt, and

are expected to have long term consequences in areas such as

housing affordability, and continued pressures on

cost-of-living.

A House of Commons research briefing published in September 2023

highlights some of the starkest data illustrating the impact on the

cost of living of the last 2 years of rising inflation:

-- Food prices: Over the two years from August 2021 to August

2023 food prices rose by 28.4% . It previously took over 13 years,

from April 2008 to August 2021, for average food prices to rise by

the same amount.

-- Energy prices: household energy tariffs and road fuel costs

increased sharply in 2022; in an effort to mitigate the impact of

rising gas and electricity prices, the Government introduced an

Energy Price Guarantee (EPG) in October 2022, capping typical

consumption at GBP2,500 a year. This limited increases in typical

bills to 27% in October 2022.

-- Housing affordability: base interest rates rose from 0.1% in

December 2021 to 5.25% in September 2023, which led to higher

borrowing rates for households (specifically higher mortgage

rates), and higher rental costs - significantly impacting housing

affordability.

Low-income households are most affected by rising prices, mostly

due to being more affected by high food and energy prices.

"Food bank charities are reporting an increase in demand: the

Trussell Trust reported that in the year to March 2023 they

provided nearly 3 million emergency food parcels, a record number,

more than during the pandemic and more than double the number in

the same period five years before."

- House of Commons Library Research -

Rising Cost of Living in UK - Sep 23.

The new environment creates both risk and opportunities for the

Company on both social impact and financial returns. Looking first

at the social impact risk, many of the charities and social

enterprises supported by the Company's investments, and the

vulnerable people who benefit from their services, will be

negatively affected by the current environment. Whilst increasing

the need for the positive impact of our investments it means that

in some cases impact will be outweighed in overall terms by the

rising cost of living. On financial returns, we have aimed to build

a portfolio with a degree of inflation correlation. However, in a

very volatile inflation environment some of those correlations will

be only partial and some operate with a time-lag. In particular, as

the portfolio relies to a significant extent on government backed

revenues, government restrictions on how fast inflation flows

through into social housing rents and contract payments will be

important.

Looking at the opportunities for our investment strategy, the

social impact created by our investments is needed more than ever.

Many of our investments are directly tackling the cost of living

crisis, such as increasing the supply of affordable housing and our

retrofit and community renewable investments tackling fuel poverty.

In a time of constrained government finances our investments are

targeting service innovation that create significant savings - for

example our recent review of Social Outcomes Contracts showed that

every GBP1 spent has generated GBP10 in public value.

On the financial side, we expect the Company will continue to

provide a valuable source of diversification in a challenging

investment environment. High and volatile inflation is strongly

negative for traditional public market equity and bond portfolios.

We have aimed for a unique mix of impact-focused private assets

with diverse and resilient revenue streams that has thus far

protected capital and should continue to do so in the event of

further sharp market downturns.

Across our portfolios we are seeing the wider move to invest in

impact continuing. Our latest market sizing report values the

social impact investment market at GBP9.4bn as of the end of 2022,

an 18% increase from 2021. This represents an almost 11-fold

increase in the social impact investment market in the last 11

years. As a result, we are seeing an expanding and maturing

pipeline of investment opportunities, primarily in private markets

that are difficult for many investors to access. We believe the

Company remains well positioned to offer investor access to a

mature portfolio of high quality impact investments within this

expanding opportunity set.

Performance update

The NAV total return per share for the twelve-month period to 30

June 2023 was 0.8%. Overall, the Company's total NAV reduced

slightly from GBP89.92m to GBP88.75m over the period due to share

buy-backs reducing the number of shares in issue from 85.32 million

to 84.60 million. The shares bought back were held in Treasury at

the end of the financial year.

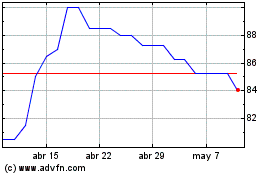

The Company's NAV per share declined from 105.39p to 104.90p

after an 1.30p dividend payment - with a full performance bridge in

the chart below.

In the 12 months to 30 June 2023 the Company recorded gross

revenue of GBP2.77m (2022 - GBP1.86m) and net revenue after fees,

costs and expenses of GBP1.97m (2022 - GBP1.12m), providing a net

revenue return per share of 2.32 pence (2022 - 1.37 pence). The

Company recorded losses on the fair value of investments of

GBP1.02m (2022 - gains of GBP0.63m) and capitalised expenses of

GBP0.33m (2022 - GBP0.29m), resulting in a total gross return of

GBP1.75m (2022 - GBP2.49m), and total net return of GBP0.62m (2022

- GBP1.44m), or 0.73 pence per share (2022 - 1.77 pence).

As shown in the table below, portfolio returns since inception

have been driven by the performance of investments in their mature

phase, contributing 10.67% to NAV total return. However, in the 12

months to 30 June 2023, the mature phase investments underperformed

plan contributing 0.17% due to a significant write down in the

Bridges Evergreen portfolio and the headwinds of rising rates.

Assets in their investment phase, which are earlier in their

lifecycles and J-curves, made a 1.58% contribution to NAV total

return during the year to 30 June 2023, which is in line with

expectations.

Liquidity Assets made a positive contribution of 0.16% to

performance during a challenging year for markets through

allocations to shorter duration and floating rate credit.

30 Jun NAV total

2023 30 Jun 2023 NAV total return return

% NAV % NAV contribution contribution

12m to 30 June

committed invested 2023 since launch

-------------------------- --------- ----------- ---------------- ------------

Mature 65.04% 63.89% 0.17% 10.67%

-------------------------- --------- ----------- ---------------- ------------

Investment phase 32.33% 23.62% 1.58% 1.74%

-------------------------- --------- ----------- ---------------- ------------

Liquidity Assets - 10.53% 0.16% -0.57%

-------------------------- --------- ----------- ---------------- ------------

Cash and cash equivalents - 1.97% -1.14% -3.23%

-------------------------- --------- ----------- ---------------- ------------

Total* 97.37% 100.00% 0.78% 8.61%

-------------------------- --------- ----------- ---------------- ------------

*Please note totals might not sum due to rounding

The key drivers of financial performance in the twelve-month

period to 30 June 2023 were:

-- A ramp-up of returns in the High Impact Housing portfolio, in

particular valuation gains in the CBRE Affordable Housing Fund,

contributing 0.58p to NAV per share, and the Man Community Housing

Fund contributing 0.48p to NAV per share, mostly driven by

developments reaching completion.

-- A mix of income and capital gains in the Social Outcomes

Contracts portfolio driven by strong performance of the underlying

projects, with Bridges Social Outcomes Fund II contributing 0.48p

to NAV per share.

-- A notable negative development in the Bridges Evergreen

portfolio was the write-down to zero of their investment in Skills

Training UK. Bridges Evergreen contributed a negative 1.66p to NAV

per share.

-- With the exception of the Bridges Evergreen investment, all

other holdings in the Company's High Impact Portfolio made a

positive contribution to returns and are performing to plan.

The Social Impact performance of the portfolio was reported in

the Company's second Impact report published in June 2023. The

report highlighted that since launch, the Company's investments

have reached 276,000 people, 94% of whom are from disadvantaged,

vulnerable or underserved backgrounds; generated GBP98m in social

outcomes and savings; and funded 27,000 affordable, decent homes.

The Impact Section of this report contains the key highlights from

the Social Impact report, as well as details of our evolving

approach to impact management and reporting.

Portfolio cash flows and balance sheet

Overall, in the period GBP7.61m was deployed into existing and

new investments in the High Impact Portfolio:

-- The majority of the amount invested (GBP6.27m) was deployed

towards delivering new affordable homes in the High Impact Housing

allocation: Man Community Housing Fund drew down GBP2.55m and the

Social and Sustainable Housing fund drew down GBP3.72m over the

year.

-- In Debt and Equity for Social Enterprises , GBP1.03m was

drawn for further investment into the secured co-investments made

with Charity Bank, and the Charity Bond portfolio, delivering high

social impact in Health and Social Care.

-- Within Social Outcomes Contracts , further investment was

made into existing projects helping children on the edge of care

and homelessness. The Social Outcomes Contracts investments made in

the year to 30 June 2023 totaled GBP419,000.

Some of the Company's higher impact investments involve the

staged deployment of capital over multiple years; we aim to

mitigate any cash drag on returns through our Liquidity Assets

allocation. This is invested in assets with similar financial risk

and return characteristics as the core asset allocation, though has

a lower direct social impact given the lack of availability of

social impact-focused assets in publicly listed markets. During the

period, we fully redeemed our positions in two investments to

fulfil drawdowns in our High Impact Portfolio. The Liquidity Assets

portfolio experienced some volatility over the year due to market

turbulence but had a small net positive contribution to the total

return for the year of 0.16%.

Portfolio Allocation

The Company's investment objective is defined as:

-- Delivering measurable positive social impact as well as long

term capital growth and income, through investing in a diversified

portfolio of private market impact funds, co-investments alongside

impact investors and direct investments in order to gain exposure

to private market social impact investments.

-- Aiming to provide NAV total return of CPI plus 2 per cent.

per annum (once the portfolio is fully invested and averaged over a

rolling three- to five-year period, net of fees).

-- With low correlation to traditional quoted markets whilst

offering to address significant social issues in the UK.

A diversified asset allocation delivering local UK social

impact

The Company delivers its investment objective through allocating

to best-in-class social impact managers in private markets - with

proven track records delivering high quality financial returns

alongside measurable social impact for more disadvantaged groups in

the UK. Investments that are committed but not yet drawn by private

market funds are held in listed Liquidity Assets investments to

mitigate cash drag during longer drawdown periods.

As of 30 June 2023, the portfolio was 97% committed and 88%

invested in the Company's High Impact Portfolio. The Company has

approximately GBP2.5m of uncommitted capital, following the

cancellation of an unused follow-on commitment to the Charity Bond

portfolio, a partial exit from the Real Lettings Property Fund in

the third quarter of 2023, scheduled capital repayments from the

portfolio, and share buybacks. Furthermore 10% of NAV was held in

our Liquidity Assets portfolio and will in the longer term be

invested in higher impact private investments. In response to the

higher interest rate environment, the Company is balancing use of

Liquidity Assets with greater use of cash and cash equivalents in

money market funds, earning interest in line with base rates.

Providing access to a seasoned high impact portfolio

The Company has built a seasoned high impact portfolio that

would be difficult for shareholders to access directly - through a

combination of a seed portfolio and secondary investments from the

Portfolio Manager's relationships and knowledge of the sector. This

provides a greater allocation to more mature assets that will help

drive future financial and impact performance. The Portfolio

Manager's broader portfolio relationships offer additional fee

benefits to Company shareholders - with 41% of the Company's

portfolio with no or discounted management fees - from

co-investments or fee discounts that the Portfolio Manager has

negotiated, often through their role as initial cornerstone

investor in funds.

Targeting inflation resilient returns

The Company aims to deliver an asset allocation that is

resilient through periods of rising prices through targeting

two-thirds of its asset allocation to assets that will benefit from

inflation. These assets are:

-- Property and renewables - with a mix of long dated inflation

linked leases, shorter property leases where value is more driven

by property prices, and smaller investments in community renewables

in our Debt and Equity for Social Enterprises asset class; we also

hold renewables investments in our Liquidity Assets portfolio

-- Mezzanine and equity investments - where the value is driven

by government contracts that have historically moved with

inflation

-- Floating rate instruments which will benefit from increases in the base rate

As of 30 June 2023, the Company had committed 62% of its capital

to inflation sensitive assets. The remaining capital committed to

high impact investments was allocated to fixed income securities

such as charity bonds and social outcomes contracts; the Company

aims to minimise the duration of these fixed income assets, to

allow reinvestment over time into a potentially higher interest

rate environment. Including the investments in Liquidity Assets and

cash and cash equivalents held in money market funds, the Company's

invested amount in assets that will benefit from inflation is 66%

of its capital. The Portfolio Manager is seeking to optimise its

liquidity management, by investing its cash reserves in money

market funds benefitting from increases in the base rate.

As previously indicated, the Company sees significant risk in

achieving target returns to match recent elevated inflation levels.

As a result, the Company is underperforming its CPI+2% aim. This is

due to:

-- Property and renewables: The presence of caps and collars in

property index linked leases, caps in housing benefit increases and

expected real falls in property prices.

-- Mezzanine and equity investments: Delays in the pass through

of inflation to government contracts in the current environment

-- Floating rate instruments: Expected path of floating rates to continue to lag inflation

-- A portion of the investment allocation (34% of invested

capital) in fixed income securities and social outcome contracts

where Company revenue will only benefit over time from inflation at

higher interest rates as capital is re-invested.

Targeting low correlation to mainstream markets

The Company's asset allocation aims to achieve low correlation

to mainstream markets by backing business models that are

underpinned by government expenditure and have been historically

resilient through economic cycles. As at 30 June 2023, 70% of the

committed portfolio (61% invested) is underpinned by government

backed revenue streams. The proportion of government-backed

revenues in the portfolio is slightly below our long-term target of

75% (on a committed basis) due to the partial exit from The Real

Lettings Property Fund ("RLPP1"), the cancellation of the charity

bond top-up commitment, capital repayments in the period and the

write-down in the BEH portfolio; however, the advanced pipeline

opportunities which are being considered for the re-deployment of

available capital have a high proportion of government-backed

revenues, which we expect to bring our capital allocation in line

with the target. These revenue streams are themselves diversified

across policy areas, such as housing, clean energy and fuel

poverty, education, redressing inequalities/levelling up. This

diversification reduces exposure to individual policy risk, such as

the risk that government or budgetary changes would significantly

reduce or withdraw payments. The Company targets areas with a track

record of delivering impact for more disadvantaged groups and

generating savings for the public purse which provides additional

revenue resilience. Reflecting the uncorrelated nature of the

portfolio

relative to mainstream markets, the Company's share price had a

negative correlation with the FTSE ALL Share Index in the twelve

months to 30 June 2023 (-0.62), and since inception (-0.53).

Recent Events

Following the realisation of capital from RLPF1 and the

cancellation of unused commitments, and net of capital used for

share buybacks to date, the Company has c. GBP2.5m of uncommitted

capital, held to invest in further High Impact Investment

opportunities or provide flexibility for further share buybacks. We

are actively reviewing an active pipeline of investments in the

High Impact Portfolio, which we think will provide further

diversification and exposure to the four key impact themes

identified in our latest Impact Report (reducing poverty and

inequalities; good health and wellbeing; education, training and

decent work; and just transition to net zero), while also enhancing

returns. In particular, we are in an advanced stage with a new

investment in an opportunity that will increase the Company's

exposure to the "just transition to net zero" theme (currently with

the lowest weight in our investment portfolio), while providing an

attractive returns profile. We expect to be in a position to

complete and announce the transaction by the first quarter of next

year, which would bring us back to being fully committed.

We are confident that the Company remains well positioned to

lead and benefit from further market growth, as we continue to see

an expanding and maturing pipeline of investment opportunities.

In September, the Company was Highly Commended in the Best

Newcomer Sustainable Fund category of Investment Week's Sustainable

Investment Awards 2023. Entries were judged by a panel of experts

from across the investment industry considering factors such as

strong performance record; strength of the team; meeting the fund's

sustainable objectives; excellence in sustainable investing within

the investment process; strong engagement record; effective client

communication; wider fund impact; and key developments on the

strategy in the past year. We are pleased that the Company's

contribution is being recognised as playing a key role in the

evolution of sustainable investing.

Outlook

Following a year of monetary tightening, inflation continued on

a downward trend over the summer, and in October UK food prices

dropped slightly for the first time in two years. The Bank of

England slowed its rate increases, and guides towards inflation

reaching mid-single digits by the end of the year, returning to the

long-term 2% target by 2025. HM Treasury has set 22 November 2023

for this year's Autumn Statement, to be accompanied by an Office

for Budget Responsibility forecast. This is expected to be the

chancellor's last fiscal update before a general election, and it

is expected that one of the areas of scrutiny will be the

government's performance against the economic pledges from earlier

this year, in particular the pledge to halve inflation by year end.

While the Prime Minister made comments about prioritising curbing

inflation and easing cost of living, there is an expectation that

we will see real-term cuts to benefits and public spending while

the UK is trying to contain high levels of national debt.

Despite the "bright spots", the outlook for the UK economy

remains uncertain, with some market commentators suggesting a

recession remains "unavoidable" [3] , as higher rates will have a

lagged effect on the economy.

It is estimated that UK households are facing the largest fall

in living standards since records began in the 1950s [4] , and this

fall in living standards disproportionately affects those who are

already most vulnerable in society [5] . UK households are seeing

their real incomes fall, while struggling to meet significantly

higher costs for essential items like food, energy and housing [6]

.

With continued pressures on government spending, the scaling of

proven solutions tackling social issues - such as the organisations

that the Company supports - remains as essential as ever.

This uncertain environment provides opportunities and risks for

the Company. While the solutions provided by the organisations that

the Company supports are needed more than ever, these organisations

need to manage higher cost bases themselves in order to remain

viable. We work with organisations with long track records (30

years on average [7] ), who have demonstrated their resilience over

multiple economic cycles. Two thirds of our capital is invested in

models with revenues rising with inflation; while our historical

returns to date are lagging the CPI+2% target, as explained in the

Performance Update section, we are maintaining our target for the

medium-to-long term, as we expect some of the benefits to flow

through with a lagged effect, and the inflation and interest rate

environment to stabilise. What we have seen in the last year was an

increase in the income generated by the portfolio, as a result of

increases in the interest rate on floating-rate loans, and higher

income generated by maturing investments. This increased income is

being passed on to our investors as a dividend exceeding our

previous guidance of 1-2% yield on net asset value. We expect the

income generated by our investments to continue to improve in the

future and have increased our future guidance on dividend yield to

2-3%.

With a general election expected in the next 12 months, we

acknowledge our portfolio is subject to policy risk. At the time of

writing, 70% of our committed capital is underpinned by

government-backed revenues. During the year, we have seen a

negative impact from policy risk in our portfolio, following a

change in government policy regarding traineeships, leading to a

write-down in the Bridges Evergreen portfolio. While this

development was disappointing, we believe this to be an isolated

case in our portfolio, which is diversified across multiple policy

areas, mostly targeting the most vulnerable and disadvantaged

groups. Successful interventions in these areas typically generate

savings for the government that are multiples of the cost, and

therefore these areas benefit from cross-party support. We further

mitigate policy risk by working with organisations that have been

successfully operating for several decades, navigating different

policy environments, and making investments that benefit from some

element of asset backing.

We are encouraged to see growing appetite for sustainable

investment products, and an increased focus both from regulators

and investors on ensuring quality and clear standards.

In this uncertain environment the goals of the Company remain

the same: to deliver for shareholders high quality returns with a

low correlation to traditional quoted markets alongside significant

social impact for more disadvantaged groups across the UK.

Hermina Popa, Jeremy Rogers

Big Society Capital

27 October 2023

Strategic Report

Principal and emerging risks and uncertainties

The Board, through its delegation to the Audit and Risk

Committee, is responsible for the Company's system of risk

management and internal control and for reviewing its

effectiveness. The Board has adopted a detailed matrix of principal

risks affecting the Company's business as an investment trust and

has established associated policies and processes designed to

manage and, where possible, mitigate those risks, which are

monitored by the Audit and Risk Committee on an ongoing basis. This

system assists the Board in determining the nature and extent of

the risks it is willing to take in achieving the Company's

strategic objectives. Both the principal and emerging risks and the

monitoring system are also subject to robust assessment at least

annually. The last assessment took place in October 2023.

During the year, the Board discussed and monitored a number of

risks which could potentially impact the Company's ability to meet

its strategic objectives. The Board received updates from the

Manager, Portfolio Manager, Company Secretary and other service

providers on emerging risks that could affect the Company. The

Board was mindful of the following emerging risks during the year;

the ongoing conflict in Ukraine, rising inflation and interest

rates, the threat of a UK recession and volatile energy prices.

These risks were not seen as new principal or emerging risks but

those that exacerbate existing risks and have been incorporated in

the market risks section in the table below.

Although the Board believes that it has a robust framework of

internal control in place this can provide only reasonable, and not

absolute, assurance against material financial misstatement or loss

and is designed to manage, not eliminate, risk.

Actions taken by the Board and, where appropriate, its

committees, to manage and mitigate the Company's principal risks

and uncertainties are set out in the table below.

The "Change" column on the right highlights the Audit and Risk

Committee's assessment of any increases or decreases in risk during

the year after mitigation and management. The arrows show the risks

as increased or decreased, and sideway arrows show risks as

stable.

Risk Mitigation and management Change

Strategic risk

The Company's investment objectives The appropriateness of the Company's Up

may become out of line with the investment remit is regularly reviewed

requirements of investors, or the and the success of the Company in

Company's investment strategy might meeting its stated objectives is

not lead to the Company achieving monitored.

its investment objective resulting

in the Company being subscale and The share price relative to NAV

shares trading at a discount. per share is monitored and the Board

has implemented a buy-back programme.

The target return of the company

is inflation plus 2%. There is no

guarantee that this will be achieved

and in high inflation environments

the target becomes more challenging

despite a element of the portfolios

investment returns benefitting from

higher inflation, with a lag.

Continuity risk

31 December 2023, and in any two-year The Portfolio Manager has extensive Up

period following such date, the experience and a track record in

Ordinary Shares have traded, on accurately timing the exits of private

average, at a discount in excess equity investments. The Board will

of 10 per cent. to Net Asset Value regularly monitor the position to

per Share, the Directors will propose ensure that any alternative proposals

an ordinary resolution at the Company's to be made to shareholders are put

next annual general meeting that forward at an appropriate time.

the Company continues its business

as presently constituted (the "Continuation The Board also made enquiry of the

Resolution"). broker and discussed with Big Society

Capital and Schroders, who in aggregate

It could take several years until hold 43.99% of the Company's total

all of the Company's private equity voting rights as at 30 September

investments are disposed of and 2023. It believed that there is

any final distribution of proceeds no reason to anticipate that shareholders

made to shareholders. would not be supportive should a

continuation vote be held in 2024.

The Company moved from trading at

a premium to NAV to trading at an If the Continuation Resolution is

average discount of 7.3% in the not passed, the Directors will put

twelve months to 30 June 2023, which forward proposals for the reconstruction

is narrower than the average investment or reorganisation of the Company,

trust discount over the period. bearing in mind the liquidity of

the Company's Investments, as soon

as reasonably practicable following

the date on which the Continuation

Resolution is not passed. These

proposals may or may not involve

winding up the Company and, accordingly,

failure to pass the Continuation

Resolution will not necessarily

result in the winding up of the

Company.

Investment management risks

Risks relating to the social impact The Portfolio Manager has extensive No change

of investee companies and the achievement experience in selecting private

of the target financial return. social impact investments and has

a robust investment process to ensure

that the anticipated positive impact

of investee companies is realistic

and achievable. The Board also monitors

impact regularly and publishes an

annual impact report.

The Portfolio Manager makes investments

according to a tested and robust

process and based on the goal of

achieving the target return. A pipeline

of opportunities is vetted and reviewed

and significant care is taken in

selecting high quality managers

and investees. The Portfolio Manager

receives regular management information

and engages regularly with investees

to monitor and ensure performance

to plan.

Liquidity risk

Liquidity risks include those risks Concentration limits are imposed No change

resulting from holding private equity on single investments to minimise

investments as well as not being the size of positions.

able to participate in follow-on

fundraises through lack of available The Portfolio Manager can sell Liquidity

capital which could result in dilution Assets to meet investment commitments

of an investment. and capital calls. The Portfolio

Manager will monitor and manage

Risks relating to investment commitments cash flows and expected capital

and capital calls. calls.

The Portfolio Manager will seek

to manage cashflow such that the

Company will be able to participate

in follow on fundraisings where

appropriate.

Valuation risk

Private equity investments are generally Contracts with investee companies No change

less liquid and more difficult to and funds are drafted to include

value than publicly traded companies. obligations to provide information

A lack of open market data and reliance to the Portfolio Manager in a timely

on investee company projections manner, where possible.

may also make it more difficult

to estimate fair value on a timely The Portfolio Manager and AIFM have

basis. extensive track records of valuing

privately held investments.

A valuation policy has been agreed

by the AIFM and Portfolio Manager

and includes a robust process for

the valuation of assets, including

consideration of the valuations

provided by investee companies and

the methodologies they have used.

Any changes to this policy must

be approved by the Audit and Risk

Committee.

The Audit and Risk Committee reviews

all valuations of unlisted investments

and challenges the methodologies

used by the Portfolio Manager and

AIFM. The Audit and Risk Committee

may also appoint an independent

party to complete a valuation of

the Company's assets.

Cyber security risks

Each of the Company's service providers Experienced third party service No change

is at risk of cyber attack, data providers are employed by the Company

theft or disruption to their infrastructure under appropriate terms and conditions

which could have an effect on the and with agreed service level specifications

services they provide to the Company. in relation to cyber security and

These risks could lead to reputational related procedures.

damage or the risk or loss control

of sensitive information leading The Board receives regular reports

to a potential breach of data protection from its service providers and the

law. Management Engagement Committee

will review the performance of key

service providers at least annually.

The Audit and Risk Committee reviews

reports on the external audits of

the internal controls operated by

certain service providers.

Economic, policy, and market risk

Changes in general economic and The risk profile of the portfolio N/A

market conditions, such as interest is considered and appropriate strategies

rates, inflation rates, industry to mitigate any negative impact

conditions, tax laws, political of substantial changes in markets

events and trends can substantially and government policies are discussed

and adversely affect the value of with the Portfolio Manager.

investments.

The rise in government bond yields

Market risk includes the potential has had, and may continue to have,

impact of events which are outside a negative impact on property prices.

the Company's control, such as pandemics, A portion of the Company's portfolio

civil unrest and wars. is invested in UK property.

Policy risk includes the potential

negative impact of changes in UK

government policies that affect

the business models, revenue streams

or have other material implications

for investees.

Risk assessment and internal controls review by the Board

Risk assessment includes consideration of the scope and quality

of the systems of internal control operating within key service

providers, and ensures regular communication of the results of

monitoring by such providers to the Audit and Risk Committee,

including the incidence of significant control failings or

weaknesses that have been identified at any time and the extent to

which they have resulted in unforeseen outcomes or contingencies

that may have a material impact on the Company's performance or

condition.

No significant control failings or weaknesses were Identified

from the Audit and Risk Committee's ongoing risk assessment which

has been in place throughout the financial year and up to the date

of this report. The Board is satisfied that it has undertaken a

detailed review of the risks facing the Company.

A full analysis of the financial risks facing the Company is set

out in note 20 to the accounts on pages 86 to 89 of the 2023 Annual

Report and Accounts.

Viability statement

The Directors have assessed the viability of the Company over a

five year period, taking into account the Company's position at 30

June 2023 and the potential impact of the principal risks and

uncertainties it faces for the review period. The Directors have

assessed the Company's operational resilience and they are

satisfied that the Company's outsourced service providers will

continue to operate effectively, following the implementation of

their business continuity plans.

A period of five years has been chosen as the Board believes

that this reflects a suitable time horizon for strategic planning,

taking into account the investment policy, liquidity of

investments, payment of commitments, potential impact of economic

cycles, nature of operating costs, dividends and availability of

funding. This time period also reflects the average holding period

of an investment.

In its assessment of the viability of the Company, the directors

have considered each of the Company's principal risks and

uncertainties detailed on pages 47 to 49 of the 2023 Annual Report

and Accounts. The Directors have also considered the Company's

income and expenditure projections, liquid investments, cash

balances as well as commitments to provide further funding to the

Company's private equity investee companies; the Company currently

has no borrowings. A substantial proportion of the Company's

expenditure varies with the value of the investment portfolio. In

the event that there is insufficient cash to meet the Company's

liabilities, the liquid investments in the portfolio may be

realised.

The Company has additionally performed stress tests which

confirm that a 50% fall in the market prices of the portfolio would

not affect the Board's conclusions in respect of going concern.

The Board monitors the portfolio risk profile, limits imposed on

gearing, counterparty exposure, liquidity risk and financial

controls at its quarterly meetings. Although there continue to be

regulatory changes which could increase costs or impact revenue,

the Directors do not believe that this would be sufficient to

affect its viability.

The Board has assumed that the business model of a closed ended

investment company, as well as the Company's investment objective,

will continue to be attractive to investors. The Directors also

considered the beneficial tax treatment the Company is eligible for

as an investment trust. If changes to these taxation arrangements

were to be made it would affect the viability of the Company to act

as an effective investment vehicle.

The Board made enquiry of the broker and discussed with Big

Society Capital and Schroders, who in aggregate hold 43.99% of the

Company's total voting rights as at 30 September 2023. It believes

that there is no reason to anticipate that shareholders would not

be supportive should a continuation vote be held in 2024.

Therefore, Directors have concluded that there is a reasonable

expectation that the Company will be able to continue in operation

and meet its liabilities as they fall due over the five year period

of their assessment.

Going concern

The Directors have assessed the principal risks, the impact of

the emerging risks and uncertainties and the matters referred to in

the viability statement. Based on the work the Directors have

performed, they have not identified any material uncertainties

relating to events or conditions that, individually or

collectively, may cast significant doubt on the Company's ability

to continue as a going concern for the period assessed by the

Directors, being the period to 31 October 2024 which is at least

twelve months from the date the financial statements were

authorised for issue.

By order of the Board

Schroder Investment Management Limited

Company Secretary

27 October 2023

Statement of Directors' Responsibilities

The Directors are responsible for preparing the annual report

and accounts in accordance with applicable law and regulations.

Company law requires the Directors to prepare financial

statements for each financial period. Under that law the Directors

have prepared the financial statements in accordance with United

Kingdom Generally Accepted Accounting Practice (FRS: 102 The

Financial Reporting Standard applicable in the UK and Republic of

Ireland) and applicable law. Under company law the Directors must

not approve the financial statements unless they are satisfied that

they give a true and fair view of the state of affairs of the

Company and of the return or loss of the Company for that period.

In preparing these financial statements, the Directors are required

to:

- select suitable accounting policies and then apply them consistently;

- make judgements and accounting estimates that are reasonable and prudent;

- state whether applicable UK Accounting Standards, comprising

FRS 102, have been followed, subject to any material departures

disclosed and explained in the financial statements;

- prepare a directors' report, a strategic report and directors'

remuneration report which comply with the requirements of the

Companies Act 2006; and

- prepare the financial statements on a going concern basis

unless it is inappropriate to presume that the Company will

continue in business.

The Directors are responsible for keeping adequate accounting

records that are sufficient to show and explain the Company's

transactions and disclose with reasonable accuracy at any time the

financial position of the Company and enable them to ensure that

the financial statements and the Directors' Remuneration Report

comply with the Companies Act 2006. They are also responsible for

safeguarding the assets of the Company and hence for taking

reasonable steps for the prevention and detection of fraud and

other irregularities.

The Directors are responsible for ensuring the annual report and

the financial statements are made available on a website. Financial

statements are published on the Company's website in accordance

with legislation in the United Kingdom governing the preparation

and dissemination of financial statements, which may vary from

legislation in other jurisdictions. The maintenance and integrity

of the Company's website is the responsibility of the Manager. The

Directors' responsibility also extends to the ongoing integrity of

the financial statements contained therein.

Each of the Directors, whose names and functions are listed on

pages 51 and 52 of the 2023 Annual Report and Accounts, confirm

that to the best of their knowledge:

- the financial statements, which have been prepared in

accordance with United Kingdom Generally Accepted Accounting

Practice (United Kingdom Accounting Standards and applicable law),

give a true and fair view of the assets, liabilities, financial

position and net return of the Company;

- the annual report and accounts includes a fair review of the

development and performance of the business and the financial

position of the Company, together with a description of the

principal risks and uncertainties that it faces; and

- the annual report and accounts, taken as a whole, is fair,

balanced and understandable and provides the information necessary

for shareholders to assess the Company's position and performance,

business model and strategy.

On behalf of the Board

Susannah Nicklin

Chair

27 October 2023

Income Statement

For the year ended 30 June 2023

2023 2022

Revenue Capital Total Revenue Capital Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

(Losses)/gains on

investments held at

fair value through

profit or loss - (1,020) (1,020) - 632 632

Income from investments 2,695 - 2,695 1,817 - 1,817

Other interest receivable

and similar income 77 - 77 40 - 40

-------------------------- ------- ------- ------- ------- ------- -------

Gross return 2,772 (1,020) 1,752 1,857 632 2,489

Investment management

fees (334) (334) (668) (286) (286) (572)

Administrative expenses (464) - (464) (452) - (452)

Transaction costs - - - - (22) (22)

-------------------------- ------- ------- ------- ------- ------- -------

Net return/(loss)

before taxation 1,974 (1,354) 620 1,119 324 1,443

Taxation - - - - - -

-------------------------- ------- ------- ------- ------- ------- -------

Net return/(loss)

after taxation 1,974 (1,354) 620 1,119 324 1,443

-------------------------- ------- ------- ------- ------- ------- -------

Return/(loss) per

share 2.32p (1.59)p 0.73p 1.37p 0.40p 1.77p

The "Total" column of this statement is the profit and loss

account of the Company. The "Revenue" and "Capital" columns

represent supplementary information prepared under guidance issued

by The Association of Investment Companies. The Company has no

other items of other comprehensive income, and therefore the net

return after taxation is also the total comprehensive income for

the year.

All revenue and capital items in the above statement derive from

continuing operations. No operations were acquired or discontinued

in the year (2022: none).

Statement of Changes in Equity

For the year ended 30 June 2023

Year ended 30 June 2023

Called-up

share Share Special Capital Revenue

capital premium reserve reserves reserve Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 30 June 2022 853 10,571 72,993 4,373 1,126 89,916

Repurchase of the

Company's own shares

into treasury - - (674) - - (674)

Net (loss)/return

after taxation - - - (1,354) 1,974 620

Dividends paid in

the year - - - - (1,109) (1,109)

-------------------------- --------- ------- ------- -------- -------- -------

At 30 June 2023 853 10,571 72,319 3,019 1,991 88,753

-------------------------- --------- ------- ------- -------- -------- -------

Year ended 30 June

2022

Called-up

share Share Special Capital Revenue

capital premium reserve reserves reserve Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 30 June 2021 750 - 72,993 4,049 435 78,227

Issue of ordinary

shares 103 10,729 - - - 10,832

Share issue costs - (158) - - - (158)

Net return after taxation - - - 324 1,119 1,443

Dividends paid in

the year - - - - (428) (428)

-------------------------- --------- ------- ------- -------- -------- -------

At 30 June 2022 853 10,571 72,993 4,373 1,126 89,916

-------------------------- --------- ------- ------- -------- -------- -------

Statement of Financial Position

at 30 June 2023

30 June 30 June

2023 2022

GBP'000 GBP'000

Fixed assets

Investments held at fair value through profit or

loss 64,199 67,000

Investments held at amortised cost 22,583 21,832

------------------------------------------------- ------- -------

86,782 88,832

------------------------------------------------- ------- -------

Current assets

Debtors 401 206

Cash at bank and in hand 2,089 1,310

------------------------------------------------- ------- -------

2,490 1,516

------------------------------------------------- ------- -------

Current liabilities

Creditors: amounts falling due within one year (519) (432)

------------------------------------------------- ------- -------

Net current assets 1,971 1,084

------------------------------------------------- ------- -------

Total assets less current liabilities 88,753 89,916

------------------------------------------------- ------- -------

Net assets 88,753 89,916

------------------------------------------------- ------- -------

Capital and reserves

Called-up share capital 853 853

Share premium 10,571 10,571

Special reserve 72,319 72,993

Capital reserves 3,019 4,373

Revenue reserve 1,991 1,126

------------------------------------------------- ------- -------

Total equity shareholders' funds 88,753 89,916

------------------------------------------------- ------- -------

Net asset value per share 104.90p 105.39p

Cash Flow Statement

For the year ended 30 June 2023

2023 2022

GBP'000 GBP'000

Net cash inflow from operating activities 1,116 873

Investing activities

Purchases of investments (7,833) (31,411)

Sales of investments 9,279 4,516

----------------------------------------------------- -------- ---------

Net cash inflow/(outflow) from investing activities 1,446 (26,895)

----------------------------------------------------- -------- ---------

Net cash inflow/(outflow) before financing 2,562 (26,022)

----------------------------------------------------- -------- ---------

Financing activities

Dividend paid (1,109) (428)

Repurchase of the Company's own shares into treasury (674) -

Issue of Ordinary Shares - 10,832

Share issue costs - (158)

----------------------------------------------------- -------- ---------

Net cash (outflow)/inflow from financing activities (1,783) 10,246

----------------------------------------------------- -------- ---------

Net cash inflow/(outflow) in the year 779 (15,776)

----------------------------------------------------- -------- ---------

Cash at bank and in hand at the beginning of the

year 1,310 17,086

Net cash inflow/(outflow) in the year 779 (15,776)

----------------------------------------------------- -------- ---------

Cash at bank and in hand at the end of the year 2,089 1,310

----------------------------------------------------- -------- ---------

Included in net cash inflow from operating activities are

dividends received amounting to GBP860,000 (year ended 30 June

2022: GBP723,000), income from debt securities amounting to

GBP1,236,000 (year ended 30 June 2022: GBP1,039,000) and other

interest receivable and similar income amounting to GBP70,000 (year

ended 30 June 2022: GBP40,000).

Notes to the Accounts

1. Accounting Policies

(a) Basis of accounting

Schroder BSC Social Impact Trust plc ("the Company") is

registered in England and Wales as a public company limited by

shares. The Company's registered office is 1 London Wall Place,

London EC2Y 5AU.

The accounts are prepared in accordance with the Companies Act

2006, United Kingdom Generally Accepted Accounting Practice ("UK

GAAP"), in particular in accordance with Financial Reporting

Standard (FRS) 102 "The Financial Reporting Standard applicable in

the UK and Republic of Ireland", and with the Statement of

Recommended Practice "Financial Statements of Investment Trust

Companies and Venture Capital Trusts" (the "SORP") issued by the

Association of Investment Companies in July 2022. All of the

Company's operations are of a continuing nature.

The accounts have been prepared on a going concern basis under

the historical cost convention, as modified by the revaluation of

investments held at fair value. The Directors believe that the

Company has adequate resources to continue operating until 31

October 2024, which is at least 12 months from the date of approval

of these accounts. In forming this opinion, the Directors have

taken into consideration: the controls and monitoring processes in

place; the Company's level of debt, undrawn commitments and other

payables; the low level of operating expenses, comprising largely

variable costs which would reduce pro rata in the event of a market

downturn; the Company's cash flow forecasts and the liquidity of

the Company's investments. In forming this opinion, the Directors

have also considered any potential impact of climate change, and

the risk/impact of elevated and sustained inflation and interest

rates on the viability of the Company. The Company has additionally

performed stress tests which confirm that a 50% fall in the market

prices of the portfolio would not affect the Board's conclusions in

respect of going concern. Further details of Directors'

considerations regarding this are given in the Chair's Statement,