TIDMSBSI

Schroder BSC Social Impact Trust

30 October 2023

Schroder BSC Social Impact (SBSI)

30/10/2023

Results analysis from Kepler Trust Intelligence

Schroder BSC Social Impact (SBSI) has released its financial

results for the year ending 30/06/2023. Over the year, the trust

saw its NAV increase by 0.8% on a total return basis, which

compares to an average NAV total return of -5.8% for the AIC

Flexible sector.

The portfolio consists of investments in projects that are

designed to provide a meaningful impact on those otherwise

underserved. These are private, illiquid assets whose valuations

are affected by factors such as development milestones or revenue

changes and valued regularly. During the year, the board decided to

value the whole portfolio quarterly in future to provide more

clarity to investors, rather than semi-annually as before.

In the period, the key drivers of the NAV performance were

valuation gains in the high impact housing portfolio, and capital

and income gains in social outcomes contracts, though this was

somewhat offset from a write down in one holding. The period also

saw an increase in net revenue mostly because of higher interest

generation from floating rate loans and mature investments. This

improved revenue has led to a final dividend of 2.3p per share

versus 1.3p in 2022.

Chair Susannah Nicklin commented on the managers delivering both

NAV returns and a social impact, saying: "the social impact created

by the company's investments is needed more than ever". She also

highlighted that the "portfolio has shown resilience within a

turbulent market".

Kepler View

SBSI has shown good resilience with a stable NAV performance

which we believe demonstrates the benefits of social investment as

an asset class. The managers categorise the portfolio into

committed capital, called the high impact portfolio which are

divided into different maturities, and undrawn commitments. The

investment phase holdings contributed the most to returns in the

period, adding 1.58% to NAV, with the more mature holdings

contributing 0.17% and liquidity assets, which is capital invested

in best-in-class, liquid ESG funds in order to fund capital

commitments in future, contributing 0.16%.

The key drivers behind the performance in the period came from

the high impact housing portfolio. Two projects completed

development which meant they began producing income which has led

to valuation uplifts. A number of holdings in the social outcomes

contracts delivered a combination of both capital gains and income

for the trust. With the exception of a write-off in Skills Training

UK, the trust's holdings in the high impact portfolio contributed

positive returns in the period. This shows the performance has come

from across the portfolio, rather than any one holding driving

performance which we believe is evidence of diversification.

An increase in revenue has supported an increase in the dividend

for this year. The managers believe this improvement is sustainable

and have therefore upgraded the long-term guidance. We have

previously described the dividend as a positive, supplementary

feature of the investment case, though this change in policy could,

in our opinion, increase the attraction for potential

investors.

Despite the resilience shown, the trust has fallen to a wide

discount. The board has begun trying to narrow this with share

buybacks which we believe could be a turnaround catalyst. For

investors, this could prove a compelling entry point with the

discount around its widest level since inception.

CLICK HERE TO READ THE FULL REPORT

Visit Kepler Trust Intelligence for more high quality

independent investment trust research.

Important information

This report has been issued by Kepler Partners LLP. The analyst

who has prepared this report is aware that Kepler Partners LLP has

a relationship with the company covered in this report and/or a

conflict of interest which may impair the objectivity of the

research.

Past performance is not a reliable indicator of future results.

The value of investments can fall as well as rise and you may get

back less than you invested when you decide to sell your

investments. It is strongly recommended that if you are a private

investor independent financial advice should be taken before making

any investment or financial decision.

Kepler Partners is not authorised to make recommendations to

retail clients. This report has been issued by Kepler Partners LLP,

is based on factual information only, is solely for information

purposes only and any views contained in it must not be construed

as investment or tax advice or a recommendation to buy, sell or

take any action in relation to any investment.

The information provided on this website is not intended for

distribution to, or use by, any person or entity in any

jurisdiction or country where such distribution or use would be

contrary to law or regulation or which would subject Kepler

Partners LLP to any registration requirement within such

jurisdiction or country. In particular, this website is exclusively

for non-US Persons. Persons who access this information are

required to inform themselves and to comply with any such

restrictions.

The information contained in this website is not intended to

constitute, and should not be construed as, investment advice. No

representation or warranty, express or implied, is given by any

person as to the accuracy or completeness of the information and no

responsibility or liability is accepted for the accuracy or

sufficiency of any of the information, for any errors, omissions or

misstatements, negligent or otherwise. Any views and opinions,

whilst given in good faith, are subject to change without

notice.

This is not an official confirmation of terms and is not a

recommendation, offer or solicitation to buy or sell or take any

action in relation to any investment mentioned herein. Any prices

or quotations contained herein are indicative only.

Kepler Partners LLP (including its partners, employees and

representatives) or a connected person may have positions in or

options on the securities detailed in this report, and may buy,

sell or offer to purchase or sell such securities from time to

time, but will at all times be subject to restrictions imposed by

the firm's internal rules. A copy of the firm's Conflict of

Interest policy is available on request.

PLEASE SEE ALSO OUR TERMS AND CONDITIONS

Kepler Partners LLP is authorised and regulated by the Financial

Conduct Authority (FRN 480590), registered in England and Wales at

70 Conduit Street, London W1S 2GF with registered number

OC334771.

This information is provided by Reach, the non-regulatory press

release distribution service of RNS, part of the London Stock

Exchange. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NRABUBDGDUXDGXG

(END) Dow Jones Newswires

October 30, 2023 11:53 ET (15:53 GMT)

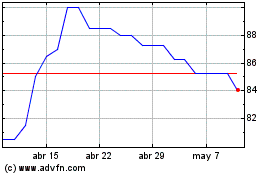

Schroder Bsc Social Impact (LSE:SBSI)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Schroder Bsc Social Impact (LSE:SBSI)

Gráfica de Acción Histórica

De May 2023 a May 2024