TIDMSHI

RNS Number : 0141Z

SIG PLC

09 January 2024

9 January 2024

SIG plc: 2023 Full Year Trading Update

SIG plc ("SIG", or "the Group"), a leading supplier of

specialist insulation and building products across Europe, today

issues a trading update for the year ended 31 December 2023

("FY23").

Highlights

-- FY23 results reflect continued strong execution, against a challenging market backdrop

-- Full year like-for-like(1) ("LFL") sales down 2% on the prior

year, with revenues of GBP2.76bn

-- Underlying operating profit (2) expected to be in the upper

half of the guidance range of GBP50m to GBP55m provided

previously

-- Positive free cash flow (3) of cGBP4m expected for the year

-- Restructuring and productivity initiatives completed in H2

2023 will deliver approximately GBP10m of annualised cost savings,

the majority of which will benefit FY24

-- Increased strategic focus on specialist businesses and operational execution across the Group

Summary

The Group has managed effectively the impact of increasingly

challenging market conditions through the year, delivering robust

trading results relative to the market. As anticipated and reported

in our October 2023 trading update, demand softened in most of our

geographic markets in the second half. Despite this, we continued

to benefit from execution of our commercial strategy, retaining a

strong focus on customer service across our branch network and

ensuring we maintained strong momentum.

Subject to audit, the Board expects to report FY23 revenues of

GBP2.76bn , and underlying operating profit in the upper half of

the guidance range of GBP50m to GBP55m provided in October.

The Group expects to report a modest free cash inflow for the

year of cGBP4m, helped by solid working capital management, with

year-end gross cash balances of around GBP132m (2022: GBP130m). The

movement in cash balances in the year reflects the free cash flow,

partially offset by small currency movements and deferred

acquisition costs. The Group's revolving credit facility ("RCF") of

GBP90m remained undrawn as at 31 December 2023.

The Group expects to report net debt as at 31 December 2023 of

cGBP457m on a post IFRS 16 basis (2022: GBP444m), and cGBP154m on a

pre IFRS 16 basis (2022: GBP160m). The movement in post IFRS 16 net

debt is due mainly to an increase in lease liabilities of cGBP19m,

mostly a result of market driven inflation, combined with some

investments in new branches. This was partially offset by the cash

movement and a favourable currency movement on bond debt. Leverage

at 31 December 2023 is expected to be around 3.4x and 2.7x on post

and pre IFRS 16 bases respectively.

Trading performance

Reported Group revenues were 1% higher in the year, including

c1% from acquisitions and a c1% positive impact from exchange

rates. LFL revenues declined 2% compared to prior year. Pass

through of input cost inflation added an estimated 5% to revenues

in the full year, 9% in H1 and flat in H2.

LFL growth rates across most geographies dropped in H2, compared

to H1, due to the declining impact of input cost inflation noted

above. Year over year volume declines moderated in H2 as expected,

reflecting weaker comparators in H2 2022. Absolute volumes softened

through the year due to

continued weakening in market demand, reflecting conditions

across the building and construction sector.

LFL sales

growth FY 2023

2023 vs 2022 H1 H2 FY sales

GBPm

UK Interiors 5% (7)% (1)% 557

UK Exteriors 1% 2% 1% 369

UK Specialist

Markets (7)% (5)% (6)% 248

UK 1% (4)% (1)% 1,174

------------------ ------ ------ ------ --------

France Interiors 1% (3)% (1)% 219

France Exteriors 2% (8)% (3)% 458

Germany 0% (2)% (1)% 462

Poland (9)% 5% (2)% 238

Benelux 7% (8)% 0% 117

Ireland (18)% (10)% (15)% 94

------------------ ------ ------ ------ --------

EU (1)% (4)% (3)% 1,588

------------------ ------ ------ ------ --------

Group 0% (4)% (2)% 2,762

------------------ ------ ------ ------ --------

As announced at our Capital Markets Event on 23 November 2023,

and as shown above, we will now report the UK Specialist Markets

business as a separate reporting unit, in line with the new

management structure in place.

In the UK Interiors business, the strategic and operational

changes made since mid-2020 continue to enable the business to

return towards its previous market position, reflected in a robust

performance against the market in FY23. In UK Exteriors, the

performance was also strong relative to the market, driven by

renewed commercial focus and execution under the new structure. The

Specialist Markets business experienced continuing good demand for

its high specification and innovative building solutions, but

revenue was affected by weaker demand in the agricultural and

commercial warehousing and residential new build segments, and by

lower year over year input pricing on steel.

In France, market conditions affected demand, in the Exteriors

business in H2 in particular, but both businesses continue to

execute very effectively on their strategic plans. The German

business continued its robust recovery of the last two years,

performing well in what is currently a very challenging market.

Poland's growth rebounded in the second half, with increased

volumes as well as the impact of some softer H2 comparators.

Benelux has had new management in place since October to address

and improve performance, and Ireland's results reflect an

especially tough market environment in 2023, as previously

reported.

Operating efficiency is a key plank of our medium and long term

margin ambitions. To that end, during the latter part of 2023 we

executed a number of restructuring and productivity initiatives

that will benefit the business in 2024 and beyond. These include a

streamlining of central costs, and a review of operating company

cost structures, most notably in the UK and Ireland. As well as

generating permanent cost reductions of around GBP10m on an

annualised basis, these initiatives will facilitate improved

operational agility and execution.

Gavin Slark, CEO, commented:

"Despite challenging market conditions across the European

building and construction sector, the Group has delivered a robust

trading performance, through a strong focus on our customers and

the great efforts of all our people.

"In my first year as CEO, I have been impressed by the

opportunities that exist within SIG's portfolio for strengthening

our operating performance and accelerating our specialist

businesses, and for delivering more profitable growth over the

medium term. Whilst we expect continued softness in market

conditions in 2024, we are confident in our ability to manage

through this current phase of the cycle and to continue to

strengthen our operations, ready to take advantage of the

significant long-term opportunities for the Group as markets

recover."

FY23 Results date, and Outlook

We will publish our full FY23 results on 5 March 2024, and will

hold a presentation and conference call for analysts and investors

at 10.00am (GMT) on that date. We will provide a more detailed

outlook on 2024 at that time.

The numbers in this update remain subject to final close

procedures and to audit.

1. Like-for-like is defined as sales per working day in constant

currency, excluding completed acquisitions and disposals

2. Underlying represents the results before Other items. Other

items relate to the amortisation of acquired intangibles,

impairment charges, profits and losses on agreed sale or closure of

non-core businesses and associated impairment charges, net

operating profits and losses attributable to businesses identified

as non-core, net restructuring costs, and other non-underlying

profits or losses.

3. Free cash flow is defined as all cash flows excluding M&A

transactions, dividend payments, and financing transactions.

Contacts

SIG plc +44 (0) 114 285 6300 /

ir@sigplc.com

Gavin Slark Chief Executive Officer

Ian Ashton Chief Financial Officer

Sarah Ogilvie Head of Investor Relations

FTI Consulting +44 (0) 20 3727 1340

Richard Mountain

Peel Hunt LLP - Joint broker to

SIG +44 (0) 20 7418 8900

Mike Bell / Charles Batten

Investec Bank plc - Joint broker

to SIG +44 (0) 20 7597 5970

Bruce Garrow / David Anderson

LEI: 213800VDC1BKJEZ8PV53

Cautionary Statement

This document contains certain forward-looking statements

concerning the Group's business, financial condition, results of

operations and certain Group's plans, objectives, assumptions,

projections, expectations or beliefs with respect to these items.

Forward-looking statements are sometimes, but not always,

identified by their use of a date in the future or such words as

'anticipates', 'aims', 'due', 'could', 'may', 'will', 'would',

'should', 'expects', 'believes', 'intends', 'plans', 'potential',

'targets', 'goal', 'forecasts' or 'estimates' or similar

expressions or negatives thereof.

Forward-looking statements involve known and unknown risks,

uncertainties and other factors, which may cause the Group's actual

financial condition, performance and results to differ materially

from the plans, goals, objectives and expectations set out in the

forward-looking statements included in this document.

All written or verbal forward-looking statements, made in this

document or made subsequently, which are attributable to the Group

or any persons acting on its behalf are expressly qualified in

their entirety by the factors referred to above. Accordingly,

readers are cautioned not to place undue reliance on

forward-looking statements. No assurance can be given that the

forward-looking statements in this document will be realised;

actual events or results may differ materially as a result of risks

and uncertainties facing the Group. Subject to compliance with

applicable law and regulation, the Group does not intend to update

the forward-looking statements in this document to reflect events

or circumstances after the date of this document and does not

undertake any obligation to do so.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTBIGDBCSGDGSI

(END) Dow Jones Newswires

January 09, 2024 02:00 ET (07:00 GMT)

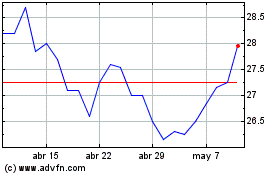

Sig (LSE:SHI)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Sig (LSE:SHI)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024