TIDMSHRS

RNS Number : 5490W

Shires Income PLC

13 December 2023

SHIRES INCOME PLC

HALF YEARLY FINANCIAL REPORT

FOR THE SIX MONTHSED 30 SEPTEMBER 2023

Legal Entity Identifier (LEI): 549300HVCIHNQNZAYA89

INVESTMENT OBJECTIVE

The Company's investment objective is to provide shareholders

with a high level of income, together with the potential for growth

of both income and capital from a diversified portfolio

substantially invested in UK equities but also in preference

shares, convertibles and fixed income securities.

BENCHMARK

The Company's benchmark is the FTSE All-Share Index (total

return).

DIVIDS

The Company pays dividends to Ordinary shareholders on a

quarterly basis.

Performance Highlights

Net asset value per Ordinary

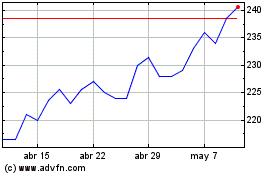

share total return(A) Share price total return(A)

Six months ended 30 September Six months ended 30 September

2023 2023

+0.9% (3.1)%

Year ended 31 March 2023 (2.2)% Year ended 31 March 2023 (5.5)%

Benchmark index total return Earnings per Ordinary share (revenue)

Six months ended 30 September Six months ended 30 September

2023 2023

+1.4% 7.66p

Six months ended 30 September

Year ended 31 March 2023 +2.9% 2022 7.50p

Dividend yield(A) Discount to net asset value(A)

As at 30 September 2023 As at 30 September 2023

6.1% (7.0)%

As at 31 March 2023 5.7% As at 31 March 2023 (3.1)%

(A) Considered to be an Alternative Performance Measure.

Financial Calendar and Financial Highlights

Financial Calendar

Expected payment dates of quarterly dividends 27 October 2023

31 January 2024

26 April 2024

26 July 2024

============================================== =================

Financial year end 31 March 2024

============================================== =================

Expected announcement of results for year May 2024

ended 31 March 2024

============================================== =================

Annual General Meeting July 2024

============================================== =================

Financial Highlights

30 September 31 March % change

2023 2023

============================================ ============ ======== ========

Total assets (GBP'000)(A) 96,310 98,864 -2.6

============================================ ============ ======== ========

Shareholders' funds (GBP'000) 77,353 79,913 -3.2

============================================ ============ ======== ========

Net asset value per share 252.20p 257.92p -2.2

============================================ ============ ======== ========

Share price (mid-market) 234.50p 250.00p -6.2

============================================ ============ ======== ========

Discount to net asset value (cum-income)(B) (7.0)% (3.1)%

============================================ ============ ======== ========

Dividend yield(B) 6.1% 5.7%

============================================ ============ ======== ========

Net gearing(B) 23.1% 22.2%

============================================ ============ ======== ========

Ongoing charges ratio(B) 1.26% 1.17%

============================================ ============ ======== ========

(A) Less current liabilities excluding

bank loans of GBP9,000,000.

(B) Considered to be an Alternative Performance Measure.

Performance (total return)

Six months Year ended Three years Five years

ended ended ended

30 September 30 September 30 September 30 September

2023 2023 2023 2023

======================= ============= ============= ============= ============

Net asset value(A) +0.9% +12.1% +29.4% +20.3%

======================= ============= ============= ============= ============

Share price(A) -3.1% +8.2% +29.2% +21.3%

======================= ============= ============= ============= ============

FTSE All-Share Index +1.4% +13.8% +39.8% +19.7%

----------------------- ------------- ------------- ------------- ------------

(A) Considered to be an Alternative Performance Measure.

All figures are for total return and assume reinvestment of net dividends

excluding transaction costs.

For further information, please contact:

Paul Finlayson

abrdn Investments Limited

0131 372 9376

Chairman's Statement

Introduction

I am pleased to present the Half Yearly Report for the period

ended 30 September 2023. I would like to welcome those new

shareholders who have rolled over their shareholdings from abrdn

Smaller Companies Income Trust PLC ("aSCIT"), following the

completion of the combination of our two companies on 1 December

2023. The transaction offers significant benefits for both sets of

shareholders, which I will describe in more detail later in this

statement and in the subsequent events note.

It has been an eventful period for the Company and I'm pleased

to be able to end it on this positive note.

Market Background

The main macro-economic trend in the six-month period was the

continued rise in interest rates as central banks attempted to

tackle inflation. The US Federal Reserve increased rates from 4.75%

in March to 5.5% at the end of September and the Bank of England

increased interest rates from 4.0% to 5.25%. In both cases rising

short rates together with the corresponding rises in longer-term

bond yields, have seen a rapid tightening of financial conditions

since the end of 2021. Markets have accepted the likelihood that

interest rates will remain higher for longer, and that the previous

period of ultra-low interest rates will not be returned to. It is,

however, increasingly likely that we are close to the peak in

interest rates. Inflation has started to decline as key input costs

such as energy and agricultural commodities fall, and although more

persistent inputs such as wage inflation remain high, recent data

suggests that economic growth is slowing, giving central banks some

room to consider interest rate cuts as we move into 2024.

Over the last twelve months the UK economy has defied the

pessimists with economic growth being far more resilient than

feared and more recent data has also indicated that the recovery

post Covid has been at least as strong as elsewhere in the world.

In the US, the economy has performed reasonably well, driven by

robust consumer and business balance sheets and, alongside

moderating inflation, this has increased the probability of a soft

landing. By contrast, the Chinese and European economies are facing

some headwinds. The Chinese property market is heavily indebted and

in considerable excess supply, with developer and homebuyer

confidence very low. However, policy is now easing, which should

prevent further downside outcomes and deflation becoming embedded

in the economy, and this could even surprise markets on the upside.

But in the Eurozone and the UK, the pass-through of earlier

monetary policy tightening reflected in both short and longer-term

interest rates, is still likely to mean that economic growth

remains subdued in 2024 given the effects on mortgage rates and

corporate borrowing costs.

Despite these forces, equity markets have been resilient, with

the MSCI World Index up 3% over the six-month period, although it

was up by as much as 10% at its high at the end of July. The UK

FTSE All-Share Index benchmark did not quite keep pace, rising by

1.4% over the period in total return terms. Performance by sector

was mixed. Technology was the best performing sector in the UK,

rising by 14.5%, but remains a small weight in the market. Energy

(+11.5%) and Financials (+4.3%) performed well. Conversely, those

sectors which are negatively correlated to rising bond yields, such

as Consumer Staples (-5.0%) and Real Estate (-4.8%) lagged the

market.

Investment Performance

Over the six-month period to 30 September 2023 the Company's Net

Asset Value ("NAV") increased by 0.9% on a total return basis. This

compares to the FTSE All-Share Index total return of 1.4% referred

to above, and the average return from the open-ended UK Equity

Income Sector of 0.5%. The main driver of performance was a

recovery in the Company's preference shares in the last few months

as bond yields started to peak. The total return from the

preference share portfolio during the period was 5.8%. Given the

tough economic and equity market background we believe that this

was a creditable performance from the Investment Manager.

Disappointingly, the share price total return for the period was

-3.1%, reflecting a widening of the discount at which the Ordinary

shares trade relative to the NAV, from 3.1% at the start of the

period to 7.0% at 30 September 2023. This is addressed in more

detail below, under Discount and Share Buy Backs. The average

discount over the 12 month period to 30 September 2023 was 3.1%,

demonstrating that the discount widening has been a recent

development.

On an individual equity basis, the greatest positive

contribution to performance came from the holding in Standard

Chartered , where the shares rallied by 13% over the period as

concerns around contagion from US banks at the start of the year

receded and the company continued to report good performance. HSBC

Holdings (+15%) benefitted from the same trends. There were also

strong performances from a number of more cyclical UK companies,

with Morgan Sindall (+26%), Direct Line Insurance (+26%), Melrose

Industries (+15%) and Vistry Group (+21%) all performing well.

Dechra Pharmaceuticals was a standout performer, with its shares

rising by more than 30% following a bid from a private equity firm.

A rally in energy stocks in September was also positive, with

TotalEnergies and Shell both performing well. The holding in aSCIT

(+4%) also outperformed the benchmark, with the discount narrowing

as a result of the proposal for the combination with the Company,

as referred to above.

Negative performers were more concentrated, with a number of

portfolio holdings disappointing meaningfully. OSB (OneSavingsBank)

fell by 30% after having to adjust assumptions made in its credit

book in response to higher interest rates. The Investment Manager

sees this as a one-off hit to the bank and considers the shares to

be good value. Since the period end the shares have regained some

lost ground after a reassuring update. Genus (-30%) was also weak

as it faces headwinds from cyclical weakness in the Chinese pork

market. Drax (-25%) has also been weak as the market has grown

concerned about the viability of its BECCS biomass power generation

project.

Portfolio Activity

Activity in the portfolio was, as ever, driven by the Investment

Manager's views on individual companies rather than a change in

strategy. However, if we were to characterise the aim of trading

during the period, it was to increase the resilience and strength

of income from the portfolio. The Investment Manager's view at the

end of the 2023 financial year was that upwards progress from

equity markets would be challenging in the short-term and that a

period of some economic weakness was a reasonable possibility in

the next 12-18 months. At the same time, rising interest rates and

bond yields meant that cash and bonds were a reasonable alternative

for investors looking for income. It is therefore important that

the portfolio continues to provide a high level of income, and that

this income generation will be resilient in any macro-economic

downturn.

In April, the Investment Manager made a number of trades to

enhance income from the portfolio. It sold out of the position in

Nordea. While it continues to like the company, it saw better value

elsewhere in the sector and initiated a position in Dutch bank ING

Group which it considers to be a low risk, well-funded and

attractively priced bank.

The Investment Manager also started a new position in Genus ,

which develops genetics for livestock. While the company is lower

yielding than would usually be considered for the portfolio, it

does pay a dividend and is very high quality, with a strong market

position. The Investment Manager considers that the shares are

valued attractively compared to their historic levels and that

there are potential catalysts from gene editing development within

the investment time horizon.

Similar to the trades in European banks, the Investment Manager

changed the UK bank exposure at the start of the period by

switching from NatWest to Lloyds Banking Group . This trade took

advantage of the timing of dividend payments to enhance income and

gives the Company exposure to a retail bank with a high level of

sustainable returns and likely increasing distribution capacity as

interest rates normalise and the group's pension fund deficit is

eliminated, reducing the drag on statutory profits.

In May, the Investment Manager bought back into Sirius Real

Estate . It exited this position late in 2022, with increasing

concerns around commercial real estate. However, the shares were

recently upgraded and the company has delivered strong cashflow and

an increase in its dividend, signalling management's confidence in

cashflows to come. The Investment Manager therefore saw an

opportunity to add back some weight in real estate to the

portfolio, with the view that the sector could rally sharply once

bond yields peak, provided demand remains resilient in the

sector.

The Investment Manager sold the Company's holding in British

American Tobacco , which had been a source of significant income in

the portfolio for a long period of time. However, recent sales data

had disappointed in its key US market and, after reducing the

position over time, the Investment Manager decided to exit. The

Company continues to hold a position in Imperial Brands , where the

Investment Manager sees continued operational improvement after

recent management change and a strategy focused on driving cash

generation, which protects the dividend.

In June, the Investment Manager exited the position in Dechra

Pharmaceuticals . This was a recent purchase, in November last

year. However, the company received a bid from a private equity

buyer in April and the share price moved higher, giving an

attractive 30%+ return in a short period of time. The proceeds from

the sale were invested in a new holding, IP Group , which is an

investor in early-stage companies focused on three areas: Life

Sciences, Clean Energy and Advanced Technology.

The Investment Manager started one new position in July, buying

Italian utility Enel . The holding provides exposure to long term

investment growth in renewable power generation.. To fund the

purchase and control the level of overseas exposure, the Investment

Manager sold the remaining position in Bawag , which had done well

since purchase but where the Investment Manager saw less attractive

risk/reward.

During August, the Investment Manager started a new position in

Convatec , which produces medical supplies in areas such as wound

care, infusion and stomas. To fund the purchase, the Investment

Manager sold out of the holding in Smith & Nephew , where it

saw less consistent delivery. Finally, the Investment Manager sold

out of a small remaining position in Vodafone , where it saw the

dividend as unlikely to grow and where the quality did not meet the

level it looks for in portfolio companies.

Earnings and Dividends

The revenue earnings per share for the period were 7.66p, which

compares to 7.50p for the equivalent period last year. Across the

portfolio, there has been a modest increase in dividend income as

companies continue to increase distributions from levels re-based

during the Covid pandemic. Companies in certain sectors have seen

tailwinds to earnings, with energy companies benefitting from

higher commodity prices and banks from higher interest rates. One

marked trend has been an increased preference for share buybacks

amongst UK companies. This is understandable given the need to

maintain flexibility with distributions and also the recognition

that UK equities are lowly valued compared to history and other

developed markets. The UK now has a higher buyback yield than the

US, the long-time leader in this regard, providing an additional

source of shareholder returns. Portfolio changes have also been

made with the aim of enhancing the income generation. At a time of

higher inflation and an uncertain economic outlook, the Investment

Manager considers a high level of income as being important for the

total return potential of the Company.

A first interim dividend of 3.2p per Ordinary share in respect

of the year ending 31 March 2024 was paid on 27 October 2023 (2023:

first interim dividend - 3.2p). The Board is declaring a second

interim dividend of 3.2p per Ordinary share, payable on 31 January

2024 to shareholders on the register at close of business on 5

January 2024. Subject to unforeseen circumstances, it is proposed

to pay a further interim dividend of 3.2p per Ordinary share prior

to the Board deciding on the rate of final dividend at the time of

reviewing the full year results.

The current annual rate of dividend Is 14.20p per Ordinary

share, and represented a dividend yield of 6.1% based on the share

price at the end of the period. The Board considers that one of the

key attractions of the Company is its high level of dividend and

recognises that, in the current economic environment, there is

likely to be a continuing demand for an attractive and reliable

level of income. Whilst the Company remains on track to cover its

annual dividend cost with net income, the Board is conscious of the

Company's accumulated revenue reserves which add security to the

sustainability of the dividend.

Discount and Share Buy Backs

As stated above, the discount at which the price of the

Company's Ordinary shares trade relative to the NAV widened during

the period, to 7.0% as at 30 September 2023. This is consistent

with a general widening of discounts across the whole investment

trust sector, but exacerbated by the transfer of the abrdn

investment trust saving plans to Interactive Investor.

Consequently, to help address the imbalance of supply and demand

for the shares, and in accordance with the share buy-back authority

provided by shareholders at the Annual General Meeting, the Company

bought back 312,673 Ordinary shares during the period at a cost of

GBP720,000 and an average discount of 9.2%, thereby providing an

enhancement to the NAV for continuing shareholders. Since the

period end, the Company has bought back a further 432,895 shares at

a cost of GBP954,000. The Board will continue to make use of the

share buy-back authority if it considers it in the interests of

shareholders to do so. All shares bought back are held in treasury

for future resale at a premium to the NAV.

Gearing

The Company has a GBP20 million loan facility of which GBP19

million was drawn down at the period end. Net of cash, this

represented gearing of 23.1%, compared to 22.2% at the start of the

period. The weighted average borrowing cost at the period end was

5.3% (31 March 2023 - 4.7%). The Board continually monitors the

level of gearing and continues to take the view that the borrowings

are notionally invested in the less volatile fixed income part of

the portfolio which generates a high level of income, giving the

Investment Manager greater ability to invest in a range of equity

stocks with various yields. The Board believes that this

combination should enable the Company to achieve a high and

potentially growing level of dividend, and also deliver some

capital appreciation for shareholders.

Board Changes

At the AGM in July 2024, I shall be stepping down from the Board

having served for nine years. Having conducted a full succession

process involving the evaluation of external candidates, the Board

has reached the decision that Robin Archibald, who is the current

Chair of the Audit Committee and Senior Independent Director,

should replace me as Chairman upon my retirement. Jane Pearce will

become the new Chair of the Audit Committee, and Helen Sinclair

will become the new Senior Independent Director. We have separately

announced that Simon White, who was Head of Investment Trusts at

BlackRock from 2011 until June 2022 will be joining the B oard as

an independent non-executive Director on 1 January 2024. With these

changes, the Board remains confident that we have the appropriate

collective skills and experience to take the Company forward.

Combination of aSCIT and Shires

On 26 July 2023, the Company announced that it had agreed terms

with the Board of aSCIT for a proposed combination of the assets of

the Company with those of aSCIT. This was achieved by a scheme of

reconstruction and winding up of aSCIT, where assets were

transferred to the Company in exchange for the issue of new

Ordinary shares to aSCIT shareholders. A cash exit was also

available under the scheme. aSCIT and Shires shareholders approved

the scheme on 20 November 2023 and the scheme completed on 1

December. Shires issued 11,268,494 new Ordinary shares to aSCIT

shareholders, with the new Shares admitted to trading on 4 December

2023. The terms of the scheme were such that Shires shareholders

did not suffer any dilution in their interests from the costs of

the scheme.

The combination has increased the size of Shires by more than

35%, to net assets of GBP101 million at the point when aSCIT's

assets transferred. As a result, the Company will benefit from the

reducing tiered management fee structure at higher levels of assets

under management, reducing the Ongoing Charges Ratio ("OCR"), and

there should be improved secondary liquidity in the Company's

shares, as well as greater scale to promote the Company from. The

Company will continue with its existing investment objective and

policy and management arrangements, but will have a direct exposure

to UK smaller companies rather than obtaining its exposure through

investing in aSCIT. The Company's gearing ratio has fallen as a

result of the combination, from 23.1% at 30 September 2023 to 13.5%

at the time of writing, which includes GBP4.4 million of cash

awaiting investment.

aSCIT's shares were trading at a 12-month average discount of

15.7% before the announcement of its strategic review on 13

February 2023. aSCIT shareholders who have received new Shires

shares will benefit from a much lower OCR, a significant increase

in dividend yield outlook and an improved rating for their

shareholding.

We believe it has been a successful transaction for all

concerned.

Outlook

UK equities look good value, trading at a material discount to

other developed markets which is not justified by the fundamentals

of earnings and dividends. Economic growth has been similar to

other large economies and while inflation has been higher this is

now falling. The yield available on UK equities is ahead of other

markets and delivers an attractive rate of return. The preference

shares held in the portfolio also offer a high yield and the

potential decline in bond yields should provide a tailwind to their

valuation. However, the Investment Manager remains cautious on

equities globally, as it believes on a medium-term view that

markets are pricing in an overly benign outlook for macro-economic

outcomes and interest rates.

By sector, the expected peaking of interest rates creates

opportunities for income investors in the UK, although the

Investment Manager continues to look for higher quality and more

defensive areas of the market. Certain high yield sectors, such as

Utilities and Real Estate, are negatively correlated with bond

yields and can perform well. Utilities, in particular, offer

defensive exposure to falling bond yields and longer-term

structural growth due to higher investment requirements through a

period of energy transition. Sectors which are more economically

sensitive and consumer exposed, such as Consumer Discretionary,

look less attractive.

It is reassuring to see more government attention on potential

solutions to some issues around UK market valuations, including

liquidity and a lack of home-grown investors into equities. While

these will likely take time to bear fruit, it highlights that there

remain relatively cheap valuations ascribed to UK equities that

should provide rewards to patient investors. The combination of the

Company and abrdn Smaller Companies Income Trust will increase

direct exposure to small and mid-cap names in the portfolio.

Despite the issues currently facing smaller companies, the

Investment Manager sees this as an attractive area for new

opportunities, and continues to invest in companies that have

sufficient quality and income characteristics, independent of their

size.

Overall, while market conditions may remain challenging in the

shorter-term, the Board remains confident in the defensive nature

of the portfolio, its ability to deliver long term capital growth

and, most importantly, the resilience of income, supported by

substantial revenue reserves.

Robert Talbut

Chairman

13 December 2023

Interim Management Statement

Directors' Responsibility Statement

The Directors are responsible for preparing the Half Yearly

Financial Report in accordance with applicable law and regulations.

The Directors confirm that to the best of

their knowledge:

- the condensed set of financial statements within the Half

Yearly Financial Report has been prepared in accordance with IAS 34

'Interim Financial Reporting'; and

- the Interim Board Report (constituting the Interim Management

Report) includes a fair review of the information required by rules

4.2.7R of the Disclosure Guidance and Transparency Rules (being an

indication of important events that have occurred during the first

six months of the financial year and their impact on the condensed

set of financial statements and a description of the principal

risks and uncertainties for the remaining six months of the

financial year) and 4.2.8R (being related party transactions that

have taken place during the first six months of the financial year

and that have materially affected the financial position of the

Company during that period; and any changes in the related party

transactions described in the last Annual Report that could so

do).

Principal and Emerging Risks and Uncertainties

The Board regularly reviews the principal and emerging risks and

uncertainties faced by the Company together with the mitigating

actions it has established to manage the risks. These are set out

within the Strategic Report contained within the Annual Report for

the year ended 31 March 2023 and comprise the following risk

headings:

- Strategic objectives and investment policy

- Investment performance

- Failure to maintain, and grow the dividend over the longer term

- Share price and shareholder relations

- Gearing

- Accounting and financial reporting

- Regulatory and governance

- Operational

Exogenous risks such as health, social, financial, economic,

climate and geo-political

In addition to these risks, the Board is conscious of the

continuing impact of the conflicts in Ukraine and, more recently,

the Middle East, as well as continuing tensions between the US and

China. The Board is also conscious of the impact of inflation and

higher interest on financial markets. The Board considers that

these are risks that could have further implications for financial

markets.

In all other respects, the Company's principal and emerging

risks and uncertainties have not changed materially since the date

of the Annual Report and are not expected to change materially for

the remaining six months of the Company's financial year.

Going Concern

The Company's assets consist mainly of equity shares in

companies listed on the London Stock Exchange. The Board has

performed stress testing and liquidity analysis on the portfolio

and considers that, in most foreseeable circumstances, the majority

of the Company's investments are realisable within a relatively

short timescale.

The Board has set limits for borrowing and regularly reviews

actual exposures, cash flow projections and compliance with banking

covenants, including the headroom available. The Company has a

GBP20 million loan facility which matures in May 2027. GBP9 million

of this amount is drawn down on a short-term basis through a

revolving credit facility and can be repaid without incurring any

financial penalties.

The Board has also taken into account the impact on the Company

of its combination with abrdn Smaller Companies Income Trust PLC

since the period end.

Having taken these factors into account, the Directors believe

that the Company has adequate resources to continue in operational

existence for the foreseeable future and has the ability to meet

its financial obligations as they fall due for the period to 31

December 2023, which is at least twelve months from the date of

approval of this Report. For these reasons, they continue to adopt

the going concern basis of accounting in preparing the financial

statements.

On behalf of the Board

Robert Talbut

Chairman

13 December 2023

Investment Portfolio - Equities

As at 30 September 2023

=========================================================

Market Total

value portfolio

Company GBP'000 %

===================================== ======= =========

abrdn Smaller Companies Income Trust 7,715 8.2

===================================== ======= =========

Shell 4,379 4.6

===================================== ======= =========

AstraZeneca 4,032 4.2

===================================== ======= =========

BP 3,268 3.5

===================================== ======= =========

Diversified Energy 2,727 2.9

===================================== ======= =========

Diageo 2,408 2.5

===================================== ======= =========

Anglo American 2,293 2.4

===================================== ======= =========

SSE 2,053 2.2

===================================== ======= =========

TotalEnergies 2,052 2.2

===================================== ======= =========

HSBC Holdings 2,016 2.1

------------------------------------- ------- ---------

Ten largest investments 32,943 34.8

------------------------------------- ------- ---------

Standard Chartered 1,857 1.9

===================================== ======= =========

Energean 1,641 1.7

===================================== ======= =========

Rio Tinto 1,614 1.7

===================================== ======= =========

National Grid 1,523 1.6

===================================== ======= =========

Unilever 1,318 1.4

===================================== ======= =========

Intermediate Capital Group 1,209 1.3

===================================== ======= =========

Novo-Nordisk 1,205 1.3

===================================== ======= =========

Melrose Industries 1,199 1.3

===================================== ======= =========

Lloyds Banking Group 1,193 1.3

===================================== ======= =========

Imperial Brands 1,191 1.3

------------------------------------- ------- ---------

Twenty largest investments 46,893 49.6

------------------------------------- ------- ---------

Inchcape 1,184 1.2

===================================== ======= =========

Chesnara 1,106 1.2

===================================== ======= =========

Morgan Sindall 1,059 1.1

===================================== ======= =========

M&G 1,033 1.1

===================================== ======= =========

Balfour Beaty 988 1.0

===================================== ======= =========

Engie 952 1.0

===================================== ======= =========

Sirius Real Estate 950 1.0

===================================== ======= =========

Close Brothers 934 1.0

===================================== ======= =========

IP Group 920 1.0

===================================== ======= =========

Prudential 914 1.0

------------------------------------- ------- ---------

Thirty largest investments 56,933 60.2

------------------------------------- ------- ---------

Mondi 903 1.0

===================================== ======= =========

Hiscox 879 0.9

===================================== ======= =========

Convatec 875 0.9

===================================== ======= =========

Softcat 869 0.9

===================================== ======= =========

GSK 860 0.9

===================================== ======= =========

Howden Joinery 835 0.9

===================================== ======= =========

XP Power 819 0.9

===================================== ======= =========

AXA 771 0.8

===================================== ======= =========

Oxford Instruments 716 0.8

===================================== ======= =========

Games Workshop Group 707 0.7

------------------------------------- ------- ---------

Forty largest investments 65,167 68.9

------------------------------------- ------- ---------

ING Group 674 0.7

===================================== ======= =========

OSB 667 0.7

===================================== ======= =========

Dr. Martens 659 0.7

===================================== ======= =========

Vistry Group 632 0.7

===================================== ======= =========

Enel 624 0.6

===================================== ======= =========

Telecom Plus 586 0.6

===================================== ======= =========

Telenor 569 0.6

===================================== ======= =========

Wood Group 564 0.6

===================================== ======= =========

Bodycote 546 0.6

===================================== ======= =========

Coca-Cola HBC 534 0.6

------------------------------------- ------- ---------

Fifty largest investments 71,222 75.3

------------------------------------- ------- ---------

Genus 532 0.6

===================================== ======= =========

Ashmore 442 0.5

===================================== ======= =========

Direct Line Insurance 435 0.4

===================================== ======= =========

Drax 412 0.4

===================================== ======= =========

Marshalls 349 0.4

===================================== ======= =========

Redrow 328 0.4

------------------------------------- ------- ---------

Total equity investments 73,720 78.0

------------------------------------- ------- ---------

Investment Portfolio - Other Investments

As at 30 September 2023

========================================= ======= =========

Market Total

value portfolio

Company GBP'000 %

========================================= ======= =========

Preference shares(A)

========================================= ======= =========

Ecclesiastical Insurance Office 8 5/8% 5,215 5.5

========================================= ======= =========

Royal & Sun Alliance 7 3/8% 4,611 4.9

========================================= ======= =========

General Accident 7.875% 3,796 4.0

========================================= ======= =========

Santander 10.375% 3,685 3.9

========================================= ======= =========

Standard Chartered 8.25% 2,991 3.1

========================================= ======= =========

R.E.A Holdings 9% 552 0.6

----------------------------------------- ------- ---------

Total preference shares 20,850 22.0

----------------------------------------- ------- ---------

Total equity investments 73,720 78.0

----------------------------------------- ------- ---------

Total investments 94,570 100.0

----------------------------------------- ------- ---------

(A) None of the preference shares listed

above has a fixed redemption date.

Distribution of Assets and Liabilities

Valuation at Movement during the Valuation at

period

============================

31 March 2023 Purchases Sales Losses 30 September

2023

GBP'000 % GBP'000 GBP'000 GBP'000 GBP'000 %

============================= ======= ====== ========= ======== ======= ======= ======

Listed investments

============================= ======= ====== ========= ======== ======= ======= ======

Equities 75,760 94.8 11,489 (12,200) (1,329) 73,720 95.3

============================= ======= ====== ========= ======== ======= ======= ======

Preference shares 20,895 26.2 - - (45) 20,850 27.0

----------------------------- ------- ------ --------- -------- ------- ------- ------

Total investments 96,655 121.0 11,489 (12,200) (1,374) 94,570 122.3

============================= ======= ====== ========= ======== ======= ======= ======

Current assets 2,559 3.2 2,154 2.8

============================= ======= ====== ========= ======== ======= ======= ======

Current liabilities (9,350) (11.7) (9,414) (12.2)

============================= ======= ====== ========= ======== ======= ======= ======

Non-current liabilities (9,951) (12.5) (9,957) (12.9)

----------------------------- ------- ------ --------- -------- ------- ------- ------

Net assets 79,913 100.0 77,353 100.0

----------------------------- ------- ------ --------- -------- ------- ------- ------

Net asset value per Ordinary

share 257.92p 252.20p

----------------------------- ------- ------ --------- -------- ------- ------- ------

Condensed Statement of Comprehensive Income

30 September 30 September 31 March 2023

2023 2022

(unaudited) (unaudited) (audited)

====================== ==== ============================ ============================ ============================

Revenue Capital Total Revenue Capital Total Revenue Capital Total

Note GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

====================== ==== ======== ======== ======== ======== ======== ======== ======== ======== ========

Losses on investments

at fair value - (1,374) (1,374) - (12,177) (12,177) - (6,084) (6,084)

====================== ==== ======== ======== ======== ======== ======== ======== ======== ======== ========

Currency

(losses)/gains - (39) (39) - 5 5 - 39 39

====================== ==== ======== ======== ======== ======== ======== ======== ======== ======== ========

Investment income

====================== ==== ======== ======== ======== ======== ======== ======== ======== ======== ========

Dividend income 2,920 - 2,920 2,814 - 2,814 5,586 - 5,586

====================== ==== ======== ======== ======== ======== ======== ======== ======== ======== ========

Interest income 16 - 16 - - - 7 - 7

====================== ==== ======== ======== ======== ======== ======== ======== ======== ======== ========

Traded option premiums 79 - 79 31 - 31 73 - 73

====================== ==== ======== ======== ======== ======== ======== ======== ======== ======== ========

Money market interest 8 - 8 - - - 7 - 7

---------------------- ---- -------- -------- -------- -------- -------- -------- -------- -------- --------

3,023 (1,413) 1,610 2,845 (12,172) (9,327) 5,673 (6,045) (372)

---------------------- ---- -------- -------- -------- -------- -------- -------- -------- -------- --------

Expenses

====================== ==== ======== ======== ======== ======== ======== ======== ======== ======== ========

Management fee (100) (100) (200) (103) (103) (206) (207) (207) (414)

====================== ==== ======== ======== ======== ======== ======== ======== ======== ======== ========

Administrative

expenses (240) (24) (264) (220) - (220) (417) - (417)

====================== ==== ======== ======== ======== ======== ======== ======== ======== ======== ========

Finance costs (245) (245) (490) (152) (152) (304) (363) (363) (726)

---------------------- ---- -------- -------- -------- -------- -------- -------- -------- -------- --------

(585) (369) (954) (475) (255) (730) (987) (570) (1,557)

---------------------- ---- -------- -------- -------- -------- -------- -------- -------- -------- --------

Profit/(loss) before

taxation 2,438 (1,782) 656 2,370 (12,427) (10,057) 4,686 (6,615) (1,929)

====================== ==== ======== ======== ======== ======== ======== ======== ======== ======== ========

Taxation 2 (80) - (80) (54) - (54) (102) - (102)

---------------------- ---- -------- -------- -------- -------- -------- -------- -------- -------- --------

Profit/(loss)

attributable

to equity holders 2,358 (1,782) 576 2,316 (12,427) (10,111) 4,584 (6,615) (2,031)

---------------------- ---- -------- -------- -------- -------- -------- -------- -------- -------- --------

Earnings per Ordinary

share (pence) 4 7.66 (5.79) 1.87 7.50 (40.25) (32.75) 14.83 (21.40) (6.57)

---------------------- ---- -------- -------- -------- -------- -------- -------- -------- -------- --------

The Company does not have any income or expense that is not included

in the profit for the period, and therefore the profit for the period

is also the "Total comprehensive income for the period", as defined

in IAS 1 (revised).

The total column of this statement represents the Statement of Comprehensive

Income of the Company, prepared in accordance with UK adopted International

Accounting Standards. The revenue and capital columns are supplementary

to this and are prepared under guidance published by the Association

of Investment Companies.

All items in the above statement derive from continuing operations.

The accompanying notes are an integral part of the financial statements.

Condensed Balance Sheet

As at As at As at

30 September 30 September 31 March

2023 2022 2023

(unaudited) (unaudited) (audited)

Note GBP'000 GBP'000 GBP'000

=========================================== ==== ============ ============ =========

Non-current assets

=========================================== ==== ============ ============ =========

Equities 73,720 70,571 75,760

=========================================== ==== ============ ============ =========

Preference shares 20,850 20,819 20,895

------------------------------------------- ---- ------------ ------------ ---------

Securities at fair value 94,570 91,390 96,655

------------------------------------------- ---- ------------ ------------ ---------

Current assets

=========================================== ==== ============ ============ =========

Accrued income and prepayments 988 890 1,383

=========================================== ==== ============ ============ =========

Cash and cash equivalents 1,166 1,442 1,176

------------------------------------------- ---- ------------ ------------ ---------

2,154 2,332 2,559

------------------------------------------- ---- ------------ ------------ ---------

Creditors: amounts falling due within

one year

=========================================== ==== ============ ============ =========

Trade and other payables (414) (968) (350)

=========================================== ==== ============ ============ =========

Short-term borrowings (9,000) (9,000) (9,000)

------------------------------------------- ---- ------------ ------------ ---------

(9,414) (9,968) (9,350)

------------------------------------------- ---- ------------ ------------ ---------

Net current liabilities (7,260) (7,636) (6,791)

------------------------------------------- ---- ------------ ------------ ---------

Total assets less current liabilities 87,310 83,754 89,864

=========================================== ==== ============ ============ =========

Non-current liabilities

=========================================== ==== ============ ============ =========

Long-term borrowings (9,957) (9,945) (9,951)

------------------------------------------- ---- ------------ ------------ ---------

Net assets 77,353 73,809 79,913

------------------------------------------- ---- ------------ ------------ ---------

Share capital and reserves

=========================================== ==== ============ ============ =========

Called-up share capital 6 15,532 15,532 15,532

=========================================== ==== ============ ============ =========

Share premium account 21,411 21,412 21,411

=========================================== ==== ============ ============ =========

Capital reserve 7 33,428 30,118 35,930

=========================================== ==== ============ ============ =========

Revenue reserve 6,982 6,747 7,040

------------------------------------------- ---- ------------ ------------ ---------

Equity shareholders' funds 77,353 73,809 79,913

------------------------------------------- ---- ------------ ------------ ---------

Net asset value per Ordinary share (pence) 5 252.20 238.20 257.92

------------------------------------------- ---- ------------ ------------ ---------

The accompanying notes are an integral part of the financial statements.

Condensed Statement of Changes in Equity

Six months ended 30 September 2023 (unaudited)

==================================================================================

Share

Share premium Capital Revenue

capital account reserve reserve Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

=================================== ======= ======= ======== ======= ========

As at 31 March 2023 15,532 21,411 35,930 7,040 79,913

=================================== ======= ======= ======== ======= ========

Repurchase of ordinary shares into

treasury - - (720) - (720)

=================================== ======= ======= ======== ======= ========

(Loss)/profit for the period - - (1,782) 2,358 576

=================================== ======= ======= ======== ======= ========

Equity dividends - - - (2,416) (2,416)

----------------------------------- ------- ------- -------- ------- --------

As at 30 September 2023 15,532 21,411 33,428 6,982 77,353

----------------------------------- ------- ------- -------- ------- --------

Six months ended 30 September 2022 (unaudited)

Share

Share premium Capital Revenue

capital account reserve reserve Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

=================================== ======= ======= ======== ======= ========

As at 31 March 2022 15,460 21,109 42,545 6,705 85,819

=================================== ======= ======= ======== ======= ========

Issue of Ordinary shares 72 303 - - 375

=================================== ======= ======= ======== ======= ========

(Loss)/profit for the period - - (12,427) 2,316 (10,111)

=================================== ======= ======= ======== ======= ========

Equity dividends - - - (2,274) (2,274)

----------------------------------- ------- ------- -------- ------- --------

As at 30 September 2022 15,532 21,412 30,118 6,747 73,809

----------------------------------- ------- ------- -------- ------- --------

Year ended 31 March 2023 (audited)

Share

Share premium Capital Revenue

capital account reserve reserve Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

=================================== ======= ======= ======== ======= ========

As at 31 March 2022 15,460 21,109 42,545 6,705 85,819

=================================== ======= ======= ======== ======= ========

Issue of Ordinary shares 72 302 - - 374

=================================== ======= ======= ======== ======= ========

(Loss)/profit for the period - - (6,615) 4,584 (2,031)

=================================== ======= ======= ======== ======= ========

Equity dividends - - - (4,249) (4,249)

----------------------------------- ------- ------- -------- ------- --------

As at 31 March 2023 15,532 21,411 35,930 7,040 79,913

----------------------------------- ------- ------- -------- ------- --------

Condensed Cash Flow Statement

Six months Six months Year ended

ended ended

30 September 30 September 31 March

2023 2022 2023

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

=========================================== ============ ============ ==========

Net cash inflow from operating activities

=========================================== ============ ============ ==========

Dividend income received 3,301 3,134 5,478

=========================================== ============ ============ ==========

Options premium received 81 31 71

=========================================== ============ ============ ==========

Interest received from money market

funds 9 - 7

=========================================== ============ ============ ==========

Bank interest received 13 2 7

=========================================== ============ ============ ==========

Management fee paid (206) (212) (415)

=========================================== ============ ============ ==========

Other cash expenses (247) (200) (432)

------------------------------------------- ------------ ------------ ----------

Cash generated from operations 2,951 2,755 4,716

=========================================== ============ ============ ==========

Interest paid (503) (183) (684)

=========================================== ============ ============ ==========

Overseas tax paid (79) (88) (184)

------------------------------------------- ------------ ------------ ----------

Net cash inflow from operating activities 2,369 2,484 3,848

------------------------------------------- ------------ ------------ ----------

Cash flows from investing activities

=========================================== ============ ============ ==========

Purchases of investments (11,404) (5,731) (16,518)

=========================================== ============ ============ ==========

Sales of investments 12,200 5,100 16,199

------------------------------------------- ------------ ------------ ----------

Net cash inflow/(outflow) from investing

activities 796 (631) (319)

------------------------------------------- ------------ ------------ ----------

Cash flows from financing activities

=========================================== ============ ============ ==========

Equity dividends paid (2,416) (2,274) (4,249)

=========================================== ============ ============ ==========

Issue of Ordinary shares - 375 374

=========================================== ============ ============ ==========

Repurchase of ordinary shares into

treasury (720) - -

=========================================== ============ ============ ==========

Loan repayment - - (19,000)

=========================================== ============ ============ ==========

Loan drawdown - - 19,000

------------------------------------------- ------------ ------------ ----------

Net cash outflow from financing activities (3,136) (1,899) (3,875)

------------------------------------------- ------------ ------------ ----------

Net increase/(decrease) in cash and

cash equivalents 29 (46) (346)

------------------------------------------- ------------ ------------ ----------

Reconciliation of net cash flow to

movements in cash and cash equivalents

=========================================== ============ ============ ==========

Increase/(decrease) in cash and cash

equivalents as above 29 (46) (346)

=========================================== ============ ============ ==========

Net cash and cash equivalents at start

of period 1,176 1,483 1,483

=========================================== ============ ============ ==========

Effect of foreign exchange rate changes (39) 5 39

------------------------------------------- ------------ ------------ ----------

Cash and cash equivalents at end of

period 1,166 1,442 1,176

------------------------------------------- ------------ ------------ ----------

Notes to the Financial Statements

For the six months ended 30 September 2023

1. Accounting policies - Basis of accounting

The condensed interim financial statements have been prepared in

accordance with International Financial Reporting Standards (IFRS)

34 'Interim Financial Reporting', as adopted by the International

Accounting Standards Board (IASB), and interpretations issued by

the International Financial Reporting Interpretations Committee

of the IASB (IFRIC). They have also been prepared using the same

accounting policies applied for the year ended 31 March 2023 financial

statements, which were prepared in accordance with International

Financial Reporting Standards (IFRS) and received an unqualified

audit report.

The financial statements have been prepared on a going concern basis.

In accordance with the Financial Reporting Council's guidance on

'Going Concern and Liquidity Risk', the Directors have undertaken

a review of the Company's assets which primarily consist of a diverse

portfolio of listed equity shares and in most circumstances, are

realisable within a very short timescale.

2. Taxation

The taxation charge for the period represents withholding tax suffered

on overseas dividend income.

3. Dividends

The following table shows the revenue for each period less the dividends

declared in respect of the financial period to which they relate.

Six months Six months Year ended

ended ended

30 September 30 September 31 March

2023 2022 2023

GBP'000 GBP'000 GBP'000

========================== ================= ================= =============

Revenue 2,358 2,316 4,584

============================== ================= ================= =============

Dividends declared (1,962)(A) (1,982)(B) (4,397)(C)

------------------------------ ----------------- ----------------- -------------

396 334 187

------------------------------ ----------------- ----------------- -------------

(A) Dividends declared relate to first two interim dividends (3.20p

each) in respect of the financial year 2023/24.

(B) Dividends declared relate to first two interim dividends (3.20p

each) in respect of the financial year 2022/23.

(C) Three interim dividends (3.20p each), and the final dividend

(4.60p) declared in respect of the financial year 2022/23.

4. Earnings per Ordinary share

==================================== ============ ============ ==========

Six months Six months Year ended

ended ended

30 September 30 September 31 March

2023 2022 2023

GBP'000 GBP'000 GBP'000

==================================== ============ ============ ==========

Returns are based on the following

figures:

==================================== ============ ============ ==========

Revenue return 2,358 2,316 4,584

======================================== ============ ============ ==========

Capital return (1,782) (12,427) (6,615)

---------------------------------------- ------------ ------------ ----------

Total return 576 (10,111) (2,031)

---------------------------------------- ------------ ------------ ----------

Weighted average number of Ordinary

shares in issue 30,795,219 30,874,580 30,919,854

---------------------------------------- ------------ ------------ ----------

5. Net asset value per Ordinary share

The net asset value per Ordinary share and the net asset values

attributable to Ordinary shareholders at the period end were as

follows:

As at As at As at

30 September 30 September 31 March

2023 2022 2023

(unaudited) (unaudited) (audited)

==================================== ============ ============ ==========

Net assets per Condensed Balance

Sheet (GBP'000) 77,353 73,809 79,913

======================================== ============ ============ ==========

3.5% Cumulative Preference shares

of GBP1 each (GBP'000) (50) (50) (50)

---------------------------------------- ------------ ------------ ----------

Attributable net assets (GBP'000) 77,303 73,759 79,863

---------------------------------------- ------------ ------------ ----------

Number of Ordinary shares in issue 30,651,907 30,964,580 30,964,580

---------------------------------------- ------------ ------------ ----------

Net asset value per Ordinary share

(p) 252.20 238.20 257.92

---------------------------------------- ------------ ------------ ----------

The Company has a policy of calculating the net asset value per

Ordinary share based on net assets less an amount due to holders

of 3.5% Cumulative Preference shares of GBP1 each equating to GBP1

per share (GBP50,000), divided by the number of Ordinary shares

in issue.

6. Called up share capital

===========================================================================================

30 September 30 September 31 March 2023

2023 2022

============================ =================== =================== ===================

Number GBP'000 Number GBP'000 Number GBP'000

============================ ========== ======= ========== ======= ========== =======

Allotted, called up and

fully paid Ordinary shares

of 50 pence each:

============================ ========== ======= ========== ======= ========== =======

Balance brought forward 30,964,580 15,482 30,819,580 15,410 30,819,580 15,410

================================ ========== ======= ========== ======= ========== =======

Ordinary shares issued - - 145,000 72 145,000 72

================================ ========== ======= ========== ======= ========== =======

Ordinary shares bought back (312,673) (156) - - - -

-------------------------------- ---------- ------- ---------- ------- ---------- -------

Balance carried forward 30,651,907 15,326 30,964,580 15,482 30,964,580 15,482

-------------------------------- ---------- ------- ---------- ------- ---------- -------

Treasury shares:

============================ ========== ======= ========== ======= ========== =======

Ordinary shares bought back

to treasury 312,673 156 - - - -

-------------------------------- ---------- ------- ---------- ------- ---------- -------

Balance carried forward 312,673 156 - - - -

-------------------------------- ---------- ------- ---------- ------- ---------- -------

Allotted, called up and

fully paid 3.5% Cumulative

Preference shares of GBP1

each

============================ ========== ======= ========== ======= ========== =======

Balance brought forward

and carried forward 50,000 50 50,000 50 50,000 50

-------------------------------- ---------- ------- ---------- ------- ---------- -------

15,532 15,532 15,532

-------------------------------- ---------- ------- ---------- ------- ---------- -------

During the six months ended 30 September 2023, 312,673 Ordinary

shares were bought back to treasury at a total cost of GBP720,000.

No Ordinary shares were issued during the period (six months ended

30 September 2022 - 145,000 for proceeds of GBP374,000; year ended

31 March 2023 - 145,000 for proceeds of GBP374,000).

7. Capital reserve

The capital reserve reflected in the Condensed Balance Sheet at

30 September 2023 includes unrealised gains of GBP6,691,000 (30

September 2022 - unrealised gains of GBP2,800,000; 31 March 2023

- unrealised gains of GBP7,045,000) which relate to the revaluation

of investments held at the reporting date. The balance relates to

realised gains of GBP26,737,000 (30 September 2022 - GBP27,318,000;

31 March 2023 - GBP28,885,000).

8. Analysis of changes in financial liabilities

============================================================================

Six months Six months Year ended

ended ended

30 September 30 September 31 March 2023

2023 2022

GBP'000 GBP'000 GBP'000

============================== ============= ============= ==============

Opening balance at 1 April (18,951) (19,000) (19,000)

================================== ============= ============= ==============

Cashflow - 60 60

================================== ============= ============= ==============

Other movements(A) (6) (5) (11)

---------------------------------- ------------- ------------- --------------

Closing balance (18,957) (18,945) (18,951)

---------------------------------- ------------- ------------- --------------

(A) The other movements represent the amortisation of the loan

arrangement fees.

On 3 May 2022, the Company entered into a new five year GBP20 million

loan facility with The Royal Bank of Scotland International Limited,

London Branch. GBP10 million of the new loan facility has been drawn

down and fixed at an all-in interest rate of 3.903%. GBP9 million

of the facility has been drawn down on a short-term basis at an

all-in interest rate of 6.836%, maturing 4 October 2023. The new

loan facility matures on 30 April 2027.

9. Transactions with the Manager

The Company has an agreement with abrdn Fund Managers Limited ("aFML")

for the provision of management, secretarial, accounting and administration

services and for the carrying out of promotional activities in relation

to the Company.

The management fee is based on 0.45% per annum up to GBP100 million

and 0.40% per annum over GBP100 million, by reference to the net

assets of the Company and including any borrowings up to a maximum

of GBP30 million, and excluding commonly managed funds, calculated

monthly and paid quarterly. The fee is allocated 50% to revenue

and 50% to capital. The agreement is terminable on not less than

six months' notice. The total of the fees paid and payable during

the period to 30 September 2023 was GBP200,000 (30 September 2022

- GBP206,000; 31 March 2023 - GBP414,000) and the balance due to

aFML at the period end was GBP100,000. (30 September 2022 - GBP101,000;

31 March 2023 - GBP105,000). The Company held an interest in a commonly

managed investment trust, abrdn Smaller Companies Income Trust plc,

in the portfolio during the period to 30 September 2023 (30 September

2022 and 31 March 2023 - same). The value attributable to this holding

was excluded from the calculation of the management fee payable

by the Company.

The management agreement with aFML also provides for the provision

of promotional activities, which aFML has delegated to abrdn Investments

Limited. The total fees paid and payable in relation to promotional

activities were GBP20,000 (30 September 2022 - GBP20,000; 31 March

2023 - GBP40,000) and the balance due to aFML at the period end

was GBP20,000 (30 September 2022 - GBP20,000; 31 March 2023 - GBP10,000).

The Company's management agreement with aFML also provides for the

provision of company secretarial and administration services to

the Company; no separate fee was charged to the Company during the

period in respect of these services, which have been delegated to

abrdn Holdings Limited.

10. Segmental information

For management purposes, the Company is organised into one main

operating segment, which invests in equity securities and debt instruments.

All of the Company's activities are interrelated, and each activity

is dependent on the others. Accordingly, all significant operating

decisions are based upon analysis of the Company as one segment.

The financial results from this segment are equivalent to the financial

statements of the Company as a whole.

11. Fair value hierarchy

IFRS 13 'Fair Value Measurement' requires an entity to classify

fair value measurements using a fair value hierarchy that reflects

the significance of the inputs used in making the measurements.

The fair value hierarchy has the following levels:

Level 1: quoted prices (unadjusted) in active markets for identical

assets or liabilities;

Level 2: inputs other than quoted prices included within Level 1

that are observable for the assets or liability, either directly

(ie as prices) or indirectly (ie derived from prices); and

Level 3: inputs for the asset or liability that are not based on

observable market data (unobservable inputs).

The financial assets and liabilities measured at fair value in the

Condensed Balance Sheet are grouped into the fair value hierarchy

as follows:

Level Level Level Total

1 2 3

At 30 September 2023 Note GBP'000 GBP'000 GBP'000 GBP'000

===================================== ===== ====== ======= ======= ======= =========

Financial assets at fair value

through profit or loss

===================================== ===== ====== ======= ======= ======= =========

Quoted investments a) 94,570 - - 94,570

===================================== ================= ======= ======= ======= =========

Net fair value 94,570 - - 94,570

------------------------------------- ----------------- ------- ------- ------- ---------

Level Level Level Total

1 2 3

At 30 September 2022 Note GBP'000 GBP'000 GBP'000 GBP'000

===================================== ===== ====== ======= ======= ======= =========

Financial assets at fair value

through profit or loss

===================================== ===== ====== ======= ======= ======= =========

Quoted investments a) 91,390 - - 91,390

===================================== ================= ======= ======= ======= =========

Net fair value 91,390 - - 91,390

------------------------------------- ----------------- ------- ------- ------- ---------

Level Level Level Total

1 2 3

At 31 March 2023 Note GBP'000 GBP'000 GBP'000 GBP'000

===================================== ===== ====== ======= ======= ======= =========

Financial assets at fair value

through profit or loss

===================================== ===== ====== ======= ======= ======= =========

Quoted investments a) 96,655 - - 96,655

===================================== ================= ======= ======= ======= =========

Net fair value 96,655 - - 96,655

------------------------------------- ----------------- ------- ------- ------- ---------

a) Quoted investments. The fair value of the Company's quoted investments

has been determined by reference to their quoted bid prices at

the reporting date. Quoted investments included in Fair Value

Level 1 are actively traded on recognised stock exchanges.

12. Subsequent events

On 26 July 2023 the Company announced that it had agreed terms

with the board of abrdn Smaller Companies Income Trust plc ("aSCIT")

in respect of a proposed combination of the assets of the Company

with those of aSCIT. Shareholders were sent documentation in October

explaining that this combination was to be effected by way of

a scheme of reconstruction and winding up of aSCIT under section

110 of the Insolvency Act 1986 (the "Scheme") and the associated

transfer of the assets of aSCIT to the Company in exchange for

the issue of new Ordinary shares in the Company to those aSCIT

shareholders who rolled their shareholdings into the Company in

accordance with the Scheme.

Shareholders approved the Scheme proposals at the Company's General

Meeting held on 20 November 2023 and aSCIT's shareholders approved

the Scheme proposals at their General Meeting held on the same

day. The Scheme completed on 1 December. On that date the Company

issued 11,268,494 new Ordinary shares to aSCIT shareholders in

accordance with the Scheme. The new shares were admitted to trading

on 4 December 2023.

As part of the Scheme, since the end of the period the Company

has received an exceptional terminal dividend of GBP445,000 from

its holding in aSCIT.

The management fee arrangements of the Company are unchanged,

other than through the introduction of an administration fee of

GBP120,000 per annum plus VAT, payable to the Manager.

Further details are contained in the Chairman's Statement.

13. The financial information contained in this Half Yearly Financial

Report does not constitute statutory accounts as defined in Sections

434 - 436 of the Companies Act 2006. The financial information for

the six months ended 30 September 2023 and 30 September 2022 has

not been reviewed or audited by the Company's independent auditor.

The information for the year ended 31 March 2023 has been extracted

from the latest published audited financial statements which have

been filed with the Registrar of Companies. The report of the independent

auditor on those accounts contained no qualification or statement

under Section 498 (2), (3) or (4) of the Companies Act 2006.

14. This Half Yearly Financial Report was approved by the Board on 13

December 2023.

Alternative Performance Measures

Alternative performance measures are numerical measures of the Company's

current, historical or future performance, financial position or cash

flows, other than financial measures defined or specified in the applicable

financial framework. The Company's applicable financial framework includes

IAS and the AIC SORP. The Directors assess the Company's performance

against a range of criteria which are viewed as particularly relevant

for closed-end investment companies.

Discount to net asset value per Ordinary share

The difference between the share price and the net asset value per

Ordinary share expressed as a percentage of the net asset value per

Ordinary share.

30 September 31 March 2023

2023

=================================================== ========== ============ =============

NAV per Ordinary share (p) a 252.20 250.00

=================================================== ========== ============ =============

Share price (p) b 234.50 257.92

=================================================== ========== ============ =============

Discount (a-b)/a (7.0)% (3.1)%

--------------------------------------------------- ---------- ------------ -------------

Dividend yield

The annual dividend divided by the share price, expressed as a percentage.

30 September 31 March 2023

2023(A)

=================================================== ========== ============ =============

Annual dividend per Ordinary share (p) a 14.20 14.20

=================================================== ========== ============ =============

Share price (p) b 234.50 250.00

=================================================== ========== ============ =============

Dividend yield a/b 6.1% 5.7%

--------------------------------------------------- ---------- ------------ -------------

(A) Based on annual dividend declared

for previous year.

Net gearing

Net gearing measures total borrowings less cash and cash equivalents

divided by shareholders' funds, expressed as a percentage. Under AIC

reporting guidance, cash and cash equivalents includes net amounts

due to and from brokers at the period end as well as cash and short

term deposits.

30 September 31 March 2023

2023

=================================================== ========== ============ =============

Borrowings (GBP'000) a 18,957 18,951

============================================== =============== ============ =============

Cash (GBP'000) b 1,166 1,176

============================================== =============== ============ =============

Amounts due to brokers (GBP'000) c 85 -

============================================== =============== ============ =============

Amounts due from brokers (GBP'000) d - -

============================================== =============== ============ =============

Shareholders' funds (GBP'000) e 77,353 79,913

---------------------------------------------- --------------- ------------ -------------

Net gearing (a-b+c-d)/e 23.1% 22.2%

---------------------------------------------- --------------- ------------ -------------

Ongoing charges

The ongoing charges ratio has been calculated in accordance with guidance

issued by the AIC as the total of investment management fees and administrative

expenses and expressed as a percentage of the average daily net asset

values published throughout the year. The ratio for 30 September 2023

is based on forecast ongoing charges for the year ending 31 March 2024.

30 September 31 March 2023

2023

=================================================== ========== ============ =============

Investment management fees (GBP'000) 400 414

=================================================== ========== ============ =============

Administrative expenses (GBP'000) 476 417

=================================================== ========== ============ =============

Less: non-recurring charges(A) (GBP'000) (24) -

=================================================== ========== ============ =============

Ongoing charges (GBP'000) 852 831

=================================================== ========== ============ =============

Average net assets (GBP'000) 78,175 80,617

--------------------------------------------------- ---------- ------------ -------------

Ongoing charges ratio (excluding look-through

costs) 1.09% 1.03%

--------------------------------------------------- ---------- ------------ -------------

Look-through costs(B) 0.17% 0.14%

--------------------------------------------------- ---------- ------------ -------------

Ongoing charges ratio (including look-through

costs) 1.26% 1.17%

--------------------------------------------------- ---------- ------------ -------------

(A) Comprises promotional activity fees not expected to recur.

(B) Calculated in accordance with AIC guidance issued in October 2020

to include the Company's share of costs of holdings in investment companies

on a look-through basis.

The ongoing charges ratio provided in the Company's Key Information

Document is calculated in line with the PRIIPs regulations which, amongst

other things, includes the cost of borrowings and transaction costs.

Total return

NAV and share price total returns show how the NAV and share price

has performed over a period of time in percentage terms, taking into