TIDMSIS

RNS Number : 9063N

Science in Sport PLC

28 September 2023

28 September 2023

AIM: SIS

SCIENCE IN SPORT PLC

("Group" or "Company")

Interim results for the six months ended 30 June 2023

Focus on margin enhancement underpins strong EBITDA

improvement

Science in Sport plc (AIM: SIS), the premium performance

nutrition company serving elite athletes, sports enthusiasts, and

the active lifestyle community, announces interim results for the

six months to 30 June 2023.

Summary H1 results

Key highlights

-- Revenue grew by 7% to GBP34.4m in the period. Record trading

month in March, with April, May, and June all setting records for

the respective months, with Q2 delivering 11% growth versus Q2

2022.

-- Gross margin was 42% (2022: 42.8%), with further progress

expected in H2, given whey prices softening and our new in-house

bar line delivering a margin enhancement.

-- Trading contribution was GBP6.9m (20% of net revenue), a

sharp increase on the GBP3.6m (11.1% of net revenue) in 2022, given

marketing efficiencies, and the new Blackburn site contributing

with GBP1.4m savings versus H1 2022.

-- Overheads were reduced by GBP0.3m year-on-year, with the most

significant contributor being people costs.

-- These efficiencies throughout our operations resulted in an

adjusted H1 EBITDA (1) of GBP1.1m (H1 2022: loss of GBP2.8m).

-- Loss before tax for H1 of GBP3.3m (H1 2022: loss of GBP7.2m

before tax), with the improvement driven by the positive underlying

trading performance and cost efficiencies.

-- Cash generated in the period of GBP0.3m, compared to an

outflow of GBP3.5m in H1 2022. Headroom of GBP3.8m in

facilities.

Stephen Moon, Chief Executive Officer of Science in Sport plc,

said:

"We are seeing the results from our year-long contribution

margin enhancement activity reflected in a GBP3.9 million positive

movement in EBITDA. Our investment in the Blackburn site and

technology are critical enablers in this. Overall growth of 7% is

encouraging, but there is no doubt that consumer confidence is

fragile and trading is volatile.

Whilst we expect H2 to broadly reflect H1, the full-year outcome

is always heavily influenced by Q4. Provided there is no material

deterioration in consumer confidence, the improved and ongoing

margin improvements give upside potential with a strong finish to

the year.

We remain committed to our long-term strategy with our premium

brand equities in good health and efficiencies from our strategic

capital investment delivering on track."

INTERIM REPORT

Overview

Our strategy remains unchanged, with the medium-term goal of

GBP100m of profitable revenue, driven by our scientifically proven

premium brands and operational gearing enhancing the bottom line.

Our world-class supply chain delivers high gross margin products

with best-in-class quality and banned substance controls.

Our premium brands remain in good health. Science in Sport leads

the endurance nutrition category in brand awareness, consideration,

and all brand image measures. PhD ranks behind the established

mass-market brands of MyProtein and Grenade in awareness and

consideration but is strong compared to similar-sized peer

brands.

Our science and innovation teams remain very active. We will

deliver a relaunch of our Rego recovery range in Q1 2024. Our PhD

bar range will relaunch in Q4 2023 with an improved higher protein,

lower fat, and sugar format, enabling access to more channels and

markets.

Operational improvements

Management commenced an organisation-wide margin enhancement

programme in H1 2022, continuing throughout H2 2022 and 2023.

We restructured our Digital operations and USA business. Given

rising acquisition costs and aggressive price competition, we

reduced digital marketing costs and delivered GBP4.1m revenue (H1

2022: GBP7.5m), with a strongly improved trading contribution

expected for the full year. Costs in the channel will reduce by a

further GBP1.2m annualised from Q4 2023. The Digital channel will

focus on high-lifetime-value customers, who contribute 65% of

revenue. Our change to a distributor model in the USA reduced

revenue by 15% to GBP1.9m, although trading contribution was

positive at GBP0.4m (H1 2022: loss GBP0.1m.)

The Blackburn site is delivering efficiencies in line with our

plan. Particularly notable is the reduction in carriage costs by

GBP1.4m in H1 versus last year. We commissioned a new bar line in

Q1 2023, delivering a unit cost per bar of approximately 30% less

than the previous bought-in product range. The full benefit will

flow into the gross margin in H2 as the co-manufactured product

exits inventory. Further efficiencies are expected from the

site.

Commercial review

The Science in Sport brand delivered GBP18.6m revenue in H1, 20%

ahead of H1 2022. The high-margin gel format delivered 38% growth,

accounting for 29% of total Group revenue. SiS gels are the market

leader in each UK channel.

The PhD brand delivered GBP15.8m H1 revenue, a 5% decline

compared to 2022, given a slow start to the year. PhD is the second

largest protein powder and bar manufacturer in UK grocery and is

Amazon UK's fastest-growing protein brand.

Retail

We saw growth of 21%, given the improved rate of sale, new

distribution, and price increases. The channel is performing

consistently during H2, and we are extending distribution

further.

At the period end, the Group had a 15.7% share in UK Grocery,

second behind Grenade. Science in Sport is the leader in endurance

nutrition, growing 23% in the last 52 weeks and 28% in the 12 weeks

to the end of June. PhD is the number two protein powder

manufacturer, with a 25.5% share. PhD is the market leader in both

lean whey and plant protein. PhD is the second largest Sports

Nutrition bar manufacturer, with a 6.4% share.

30% growth to GBP7.2m in H1 came from international retail.

Shimano Europe delivered a solid performance, and we made good

gains through our distributor serving Indonesia, Malaysia, and

Japan.

Amazon

Sales started slowly due to a global destocking programme by the

customer. Amazon UK and Europe grew 17% to GBP7.5m in H1. Overall

growth, including the discontinued Amazon USA business, which

transferred to The Feed, was 10%. Sales out from Amazon UK and

Europe to end customers were up 35% year compared to our top five

competitors growing at 22%. With a share of 11.3%, the Group is the

second largest sport nutrition manufacturer on Amazon UK.

China

China has been and continues to be challenging. Dampened demand,

given COVID-19 in January and February and a weaker economy later

in the period, resulted in revenue of GBP2.7m, down on the GBP3.1m

delivered in H1 2022. Visibility on orders from our current

distributor remains below expectations and our focus for Q4 will be

restoring the strong growth we saw in 2022, starting with our

sponsorship of Shanghai Marathon in November.

Retail share data Nielsen IQ Grocery Multiples L12wks w/e

01.07.23

Amazon data from Amazon EPOS and Edge

Capital Investment and Working Capital

Capital investment for H1 was GBP1.5m (H1 2022: GBP7.0m), the

reduction in spending due to the strategic investment in the

Blackburn facility now being complete. H2 2023 capital expenditure

will be lower than H1.

Headroom of GBP3.8m in facilities on 30 June 2023 in-line with

the position on 31 December 2022 of GBP4m. Cash generated in the

period of GBP0.3m, compared to an outflow of GBP3.5m in H1

2022.

Cash at bank of GBP1.2m (H1 2022: GBP1.3m; 2022: GBP0.9m). HSBC

have renewed and increased credit facilities by GBP1.5m, giving a

total of GBP12.6m of working capital facilities. The increase in

facilities due to the higher mix of revenue through wholesale

channels compared to our direct-to-consumer channel. This trend is

expected to continue in the future.

Pre IFRS 16 net debt(2) (note 6) of GBP13.2m (2022: GBP10.9m)

due to weighting of capital spend in H1 2023 and higher inventory

levels of GBP9.5m as at 30 June 2023 (2022: GBP6.6m). Net debt is

forecast to reduce throughout H2 2023 due to positive operating

cash flow and a decrease in inventory. Overall net debt at the

year-end is anticipated to be at similar levels to 31 December

2022.

Outlook

Key focus areas for management are delivering EBITDA

improvements and managing cash tightly. Further cost efficiencies

are expected in H2 2023 as part of the organisation-wide margin

improvement programme, which commenced during Q2 2022. This will

feed into operational gearing gains as we grow revenue.

We expect H2 to mirror H1 at a revenue level. Q4 always heavily

influences the full year, given Black November and all retail and

online platforms finishing December strongly, ahead of the

traditional January health awareness campaigns. Provided there is

no material deterioration in consumer confidence the improved and

ongoing margin improvements may bring upside potential with a

strong finish to the year.

Our strategy remains unchanged. We continue to target profitable

growth to take us to GBP100m in revenue and beyond.

Stephen Moon

Chief Executive Officer

Ends

Science in Sport plc T: 020 7400 3700

Stephen Moon, CEO

Dan Lampard, CFO

Liberum (Nominated adviser and broker) T: 020 3100 2000

Richard Lindley

About Science in Sport plc

www.sisplc.com

Headquartered in London, Science in Sport plc is a leading

sports nutrition business that develops, manufactures, and markets

innovative nutrition products for professional athletes, sports and

fitness enthusiasts and the active lifestyle community. The Company

has two highly regarded brands, PhD Nutrition, a premium

active-nutrition brand targeting the active lifestyle community,

and SiS, a leading endurance nutrition brand among elite athletes

and professional sports teams.

The two brands sell through the Company's phd.com and

scienceinsport.com digital platforms, third-party online sites,

including Amazon and Tmall, and extensive retail distribution in

the UK and internationally, including major supermarkets, high

street chains and specialist sports retailers. This omnichannel

footprint enables the Company to address the full breadth of the

sports nutrition market, sports nutrition market, worth $24.6bn in

2022 and forecast to grow CAGR 5.9% from 2022 to 2027.(3)

SiS, a leading endurance nutrition business founded in 1992, has

a core range comprising gels, powders and bars

focused on energy, hydration, and recovery. SiS is an official

endurance nutrition supplier to over 320 professional teams,

organisations, and national teams worldwide.

SiS is Performance Solutions partner to Ineos Grenadiers cycling

team, Tottenham Hotspur and CGC Nice football, as well as Official

Nutrition Partner to the Milwaukee Bucks, 2021 National Basketball

Association Champions.

PhD is one of the UK's leading active nutrition brands with a

reputation for high quality and product innovation. The brand has

grown rapidly since its launch in 2005. The range now comprises

powders, bars, and supplements, including the high protein, low

sugar range, PhD Smart. PhD brand ambassadors include leading

endurance and strength athlete Ross Edgley and influencer Gabby

Allen.

For further information, please visit phd.com and

scienceinsport.com

(1) EBITDA excludes interest, tax, depreciation, amortisation,

share-based payments, foreign exchange variances on intercompany

balances and non-cash & non-recurring items set out in note 3

to the financial statements.

(2) Net debt is defined as cash, less banking working capital

facilities and asset financing and excludes property leases

(3) Euromonitor Passport Database Global Assessment (October

2022)

Consolidated statement of comprehensive income

Six months ended 30 June 2023

Unaudited Unaudited Audited

six months six months twelve months

ended ended ended 31

30 June 30 June December

2023 2022 2022

Notes GBP'000 GBP'000 GBP'000

------------------------------------ --------------- ------------ ------------ ---------------

Revenue 34,436 32,279 63,773

Cost of goods (19,957) (18,473) (36,837)

------------------------------------ --------------- ------------ ------------ ---------------

Gross Profit 14,479 13,806 26,936

Total Costs (16,999) (20,667) (36,757)

------------------------------------ --------------- ------------ ------------ ---------------

Loss from operations (2,520) (6,861) (9,821)

Comprising:

Underlying EBITDA 3 1,132 (2,800) (2,689)

Depreciation and amortisation (2,743) (2,571) (4,808)

Foreign exchange variances

on intercompany balances (344) 60 (99)

Share-based payment charges (181) (660) (262)

Blackburn transition costs - (618) (1,075)

Restructuring costs (228) (272) (888)

Cost of Strategic review (156) - -

------------------------------------ --------------- ------------ ------------ ---------------

Loss from operations (2,520) (6,861) (9,821)

Finance income - - -

Finance costs (747) (339) (757)

Loss before taxation (3,267) (7,200) (10,578)

Taxation benefit/(charge) 4 - 92 (332)

------------------------------------ --------------- ------------ ------------ ---------------

Loss for the period (3,267) (7,108) (10,910)

------------------------------------ --------------- ------------ ------------ ---------------

Other comprehensive income

Cash flow hedges - (40) 2

Exchange difference on translation

of foreign operations - 82 (21)

Total comprehensive loss

for the period (3,267) (7,066) (10,929)

------------------------------------ --------------- ------------ ------------ ---------------

(Loss) per share to owners

of the parent

Basic and diluted 7 (1.9p) (5.2p) (7.6p)

------------------------------------ --------------- ------------ ------------ ---------------

All amounts relate to continuing operations

Consolidated statement of financial position

30 June 2023

Unaudited Unaudited Audited

six months six months twelve months

ended 30 ended ended 31

June 2023 30 June December

2022 2022

Notes GBP'000 GBP'000 GBP'000

------------------------------- ------ ------------ ------------ ----------------

Intangible assets 29,704 30,939 30,739

Right of use assets 10,160 10,642 10,536

Plant and equipment 10,431 8,395 10,338

Total non-current assets 50,295 49.976 51,613

--------------------------------- ------ ------------ ------------ ----------------

Inventories 9,538 8,726 6,638

Trade and other receivables 19,727 14,706 16,524

Cash and cash equivalents 1,228 1,310 930

Total current assets 30,493 24,742 24,092

--------------------------------- ------ ------------ ------------ ----------------

Total assets 80,788 74,718 75,705

--------------------------------- ------ ------------ ------------ ----------------

Trade and other payables (27,962) (20,619) (19,993)

Lease liabilities (415) (784) (415)

Asset financing (843) (845) (843)

Hire purchase agreement (80) (98) (80)

Derivative financial - (42) -

instruments

Provision for liabilities (976) - (901)

Total current liabilities (30,276) (22,388) (22,232)

--------------------------------- ------ ------------ ------------ ----------------

Lease liabilities (9,990) (10,393) (10,261)

Asset financing (3,275) (2,545) (2,839)

Hire purchase agreement (43) (129) (82)

Total non-current liabilities (13,308) (13,067) (13,182)

--------------------------------- ------ ------------ ------------ ----------------

Total Liabilities (43,584) (35,455) (35,414)

Total net assets 37,204 39,263 40,291

--------------------------------- ------ ------------ ------------ ----------------

Share capital 8 17,242 13,510 17,242

Share premium reserve 53,134 51,839 53,134

Employee benefit trust (204) (256) (429)

Other reserve (907) (907) (907)

Foreign exchange reserve (138) (35) (138)

Cash Flow hedge reserve - (42) -

Retained deficit (31,923) (24,846) (28,611)

Total Equity 37,204 39,263 40,291

--------------------------------- ------ ------------ ------------ ----------------

Consolidated statement of cash flows

Six months ended 30 June 2023

Unaudited Unaudited Audited

six months six months twelve

ended 30 ended months

June 2023 30 June ended 31

2022 December

2022

GBP'000 GBP'000 GBP'000

---------------------------------------- ------------ ------------ ----------

Cash flows from operating activities

Loss after tax (3,267) (7,108) (10,910)

Adjustments for:

Amortisation 1,565 1,693 2,919

Amortisation of right-of-use assets 350 437 963

Depreciation 816 442 926

Interest Expense 747 339 757

Taxation benefit - (92) 332

Share-based payment charges 181 660 262

Operating cash inflow / (outflow)

before changes in working capital 392 (3,629) (4,751)

---------------------------------------- ------------ ------------ ----------

Changes in inventories (2,900) (280) 1,809

Changes in trade and other receivables (3,204) (2,027) (3,737)

Changes in trade and other payables 6,577 2,734 2,207

Total cash inflow / (outflow)

from operations 865 (3,202) (4,472)

---------------------------------------- ------------ ------------ ----------

Cash flow from investing activities

Purchase of property, plant and

equipment (820) (3,577) (6,013)

Purchase of intangible assets (532) (1,013) (1,941)

Net cash outflow from investing

activities (1,352) (4,590) (7,954)

---------------------------------------- ------------ ------------ ----------

Cash flow from financing activities

Net proceeds from asset financing 900 1,890 2,184

Net proceeds from invoice financing 1,363 2,540 3,080

Repayments of asset financing (679) - -

Interest paid on invoice financing (284) - (172)

Gross proceeds from issue of share

capital - - 5,000

Interest paid on asset financing (134) (7) (143)

Principal paid on lease liabilities (170) (134) (629)

Interest paid on lease liabilities (212) (37) (442)

Share issue costs - - (372)

Net cash (outflow)/inflow from

financing activities 784 4,252 8,506

---------------------------------------- ------------ ------------ ----------

Net increase / (decrease) in

cash and cash equivalents 298 (3,540) (3,920)

Opening cash and cash equivalents 930 4,850 4,850

Closing cash and cash equivalents 1,228 1,310 930

---------------------------------------- ------------ ------------ ----------

Consolidated statement of changes in equity

Share Share Employee Other Foreign Cash Retained Total

Capital Premium Benefit Reserve Exchange Flow Deficit Equity

trust Reserve Hedge

Reserve Reserve

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---------------------------- ---------- --------- --------- --------- --------- --------- --------- --------

Balance at 31 December

2021 13,510 51,839 (158) (907) (117) (2) (17,836) 46,329

---------------------------- ---------- --------- --------- --------- --------- --------- --------- --------

Comprehensive Income

Total comprehensive loss

for the period - - - - 82 (40) (7,108) (7,066)

Transactions with owners

Exercise of share options - - (98) - - - 98 -

Balance at 30 June 2022 13,510 51,839 (256) (907) (35) (42) (24,846) 39,263

---------------------------- ---------- --------- --------- --------- --------- --------- --------- --------

Comprehensive Income

Total comprehensive loss

for the period - - - - (103) 42 (3,801) (3,862)

Transactions with owners

Issue of shares 3,732 1,295 (399) - - - - 4,628

Issue of shares held by

EBT to employees - - 226 - - - (226) -

Share-based payments charge - - - - - - 262 262

Balance at 31 December

2022 17,242 53,134 (429) (907) (138) - (28,611) 40,291

---------------------------- ---------- --------- --------- --------- --------- --------- --------- --------

Comprehensive Income

Total comprehensive loss

for the period - - - - - - (3,267) (3,267)

Transactions with owners

Issue of shares to EBT - - - - - - - -

Share Based payments charge - - - - - - 181 181

Exercise of share options - - 225 - - - (225) -

Balance at 30 June 2023 17,242 53,134 (204) (907) (138) - (31,922) 37,204

---------------------------- ---------- --------- --------- --------- --------- --------- --------- --------

Notes to the interim financial information

For the six months ended 30 June 2023

1. Basis of preparation

This interim report has been prepared using the same accounting

policies as those applied in the annual financial statements for

the year ended 31 December 2022.

The Directors believe that operating profit / (loss) before

depreciation, amortisation, share based payments and foreign

exchange variances on intercompany balances and exceptional items

of Strategic review costs and restructuring items measure provides

additional useful information for shareholders on underlying trends

and performance. This measure is used for internal performance

analysis.

Strategic review costs relate to one-off costs from the review

that commenced in December 2022 and concluded in April 2023.

Restructuring costs includes one-off people-related expenses from

reduced headcount when implementing the new leaner organisation

structure.

Underlying operating profit / (loss) is not defined by IFRS and

therefore many not be directly comparable with other companies'

adjusted profit measures. It is not intended to be suitable

substitute for, or superior to IFRS measurements of profit. A

reconciliation of underlying operating profit to statutory

operating profit is set out on the face of the statement of

comprehensive income.

The condensed financial information herein has been prepared

using accounting policies consistent with International Financial

Reporting Standards in conformity with the requirements of the

Companies Act 2006 ("adopted IFRS") and as applied in accordance

with the provisions of the Companies Act 2006. While the financial

figures included in this interim report have been prepared in

accordance with IFRS applicable for interim periods, this interim

report does not contain sufficient information to constitute an

interim financial report as defined in IAS 34. The Company has

taken advantage of the exemption not to apply IAS 34 'Interim

Financial Reporting' since compliance is not required by AIM listed

companies.

This interim report does not constitute statutory accounts as

defined in section 434 of the Companies Act 2006 and has been

neither audited nor reviewed by the Company's auditors, pursuant to

guidance issued by the Auditing Practices Board.

The interim report should be read in conjunction with the annual

financial statements period ended 31 December 2022.

The statutory Accounts for the last period ended 31 December

2022 were approved by the Board on 30 June 2023 and are filed at

Companies House. The report of the auditors on those accounts was

unqualified, did not draw attention to any matters by way of

emphasis and did not contain a statement under section 498 of the

Companies Act 2006.

The unaudited interim report was authorised by the Company's

Board of Directors on 26 September 2023.

2. Segmental reporting

Operating segments are identified on the basis of internal

reporting and decision making. The Group's Chief Operating Decision

Maker ("CODM") is considered to be the Board, with support from the

senior management teams, as it is primarily responsible for the

allocation of resources to segments and the assessments of

performance by segment.

The Group's reportable segments have been split into the two

brands, SiS and PhD Nutrition. Operating segments are reported in a

manner consistent with the internal reporting provided to the CODM

as described above. The reportable segments are consistent with

2022 year-end financial statements with relevant costs across the

brands allocated on a more appropriate basis.

Unaudited six months ended

30 June 2023

SiS PhD Total

GBP'000 GBP'000 GBP'000

Sales 18,618 15,818 34,436

-------------------------- --------- --------- ---------

Gross profit 8,942 5,537 14,479

Marketing costs (3,310) (1,413) (4,723)

Carriage (1,613) (1,013) (2,626)

Online selling costs (138) (118) (256)

-------------------------- --------- --------- ---------

Trading contribution 3,881 2,993 6,874

Other operating expenses (9,394)

-------------------------- --------- --------- ---------

Loss from Operations (2,520)

========================== ========= ========= =========

Unaudited six months ended

30 June 2022

SiS PhD Total

GBP'000 GBP'000 GBP'000

Sales 15,543 16,736 32,279

-------------------------- --------- --------- ---------

Gross profit 8,725 5,081 13,806

Marketing costs (3,966) (1,585) (5,551)

Carriage (2,807) (1,198) (4,005)

Online selling costs (322) (345) (667)

-------------------------- --------- --------- ---------

Trading contribution 2,505 1,078 3,583

Other operating expenses (10,444)

-------------------------- --------- --------- ---------

Loss from Operations (6,861)

========================== ========= ========= =========

Year ended

31 December 2022

SiS PhD Total

GBP'000 GBP'000 GBP'000

Sales 29,708 34,065 63,773

-------------------------- -------- -------- ---------

Gross profit 17,383 9,553 26,936

Marketing costs (6,602) (2,387) (8,989)

Carriage (4,839) (2,273) (7,112)

Online selling costs (703) (807) (1,510)

-------------------------- -------- -------- ---------

Trading contribution 5,021 4,304 9,325

Other operating expenses (19,146)

-------------------------- -------- -------- ---------

Loss from Operations (9,821)

========================== ======== ======== =========

3. Operating expenses

Unaudited six Unaudited Audited twelve

months ended six months months ended

30 June 2023 ended 30 31 December

June 2022 2022

GBP'000 GBP'000 GBP'000

------------------------------ ----------------- ------------ ---------------

Sales and marketing costs 7,605 10,223 17,611

----------------------------------- ------------ ------------ ---------------

Operating Costs 6,571 7,273 13,977

Depreciation and amortisation 2,298 2,571 4,808

Foreign exchange variances

on intercompany balances 344 (60) 99

Share-based payments 181 660 262

Administrative Costs 9,394 10,444 19,146

Total operating expenses 16,999 20,667 36,757

----------------------------------- ------------ ------------ ---------------

The operating expenses above includes costs that were incurred

in relation to transition to our consolidated supply chain facility

in Blackburn, strategic review and restructuring costs.

These costs are not deemed to be recurring costs, as such they

are not deemed to be part of the usual operating expenditure:

GBP'000

Total

------------------------ --------

Strategic review costs 156

Restructuring costs 228

384

Management uses alternative performance measures as part of

their internal financial performance monitoring, including

Underlying EBITDA. The measure provides additional information for

users on the underlying performance of the business, enabling

consistent year-on-year comparison.

4. Taxation

The corporation tax and deferred tax for the six months ended 30

June 2023 has been calculated with reference to the estimated

effective tax rate on the operating results for the full year and

taking into account movements in deferred tax assets and

liabilities.

5. Revenue from contracts with customers

The Group operates four primary sales channels, which form the

basis the basis on which management monitor revenue. UK Retail

includes domestic grocers and high street retailers, Digital are

sales through the phd.com and scienceinsport.com platforms,

International Retail relates to retailers and distributors outside

of the UK and Marketplace relates to online marketplaces such as

Amazon and Tmall.

Unaudited six Audited twelve

Unaudited six months ended months ended

months ended 30 June 2022 31 December

30 June 2023 2022

SiS PhD Total SiS PhD Total SiS PhD Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------- -------- -------- -------- ---------- -------- -------- -------- -------- --------

Digital 2,866 1,245 4,111 5,288 2,249 7,537 8,859 3,618 12,477

Marketplace 3,268 4,291 7,559 2,597 4,273 6,870 6,199 7,851 14,050

China 882 1,806 2,688 89 3,018 3,107 178 7,031 7,209

USA 1,745 - 1,745 - - - - - -

--------------- -------- -------- -------- ---------- -------- -------- -------- -------- --------

Global Online 8,761 7,342 16,103 7,974 9,540 17,514 15,236 18,500 33,736

--------------- -------- -------- -------- ---------- -------- -------- -------- -------- --------

International

Retail 4,919 2,278 7,197 3,564 1,969 5,533 6,491 3,904 10,395

UK Retail 4,938 6,198 11,136 4,006 5,226 9,232 7,981 11,661 19,642

--------------- -------- -------- -------- ---------- -------- -------- -------- -------- --------

Retail 9,857 8,476 18,333 7,570 7,195 14,765 14,472 15,565 30,037

--------------- -------- -------- -------- ---------- -------- -------- -------- -------- --------

Total sales 18,618 15,818 34,436 15,544 16,735 32,279 29,708 34,065 63,773

--------------- -------- -------- -------- ---------- -------- -------- -------- -------- --------

Turnover by geographic destination of sales may be analysed as

follows:

Unaudited Unaudited Audited

six months six months twelve months

ended 30 ended 30 ended 31

June 2023 June 2022 December

2022

GBP'000 GBP'000 GBP'000

------------------- ------------ ------------ ---------------

United Kingdom 19,982 18,250 36,574

Rest of Europe 7,502 6,627 11,391

USA 1,913 2,254 4,670

Rest of the World 5,039 5,148 11,138

Total sales 34,436 32,279 63,773

-------------------- ------------ ------------ ---------------

6. Net debt reconciliation

Unaudited Unaudited Audited

six months six months twelve months

ended 30 ended ended 31

June 2023 30 June December

2022 2022

GBP'000 GBP'000 GBP'000

-------------------------------- ------------ ------------ ----------------

Invoice financing 5,960 4,055 4,523

Trade facility 3,330 - 2,733

Virtual credit card 988 898 877

Total working capital

facilities 10,279 4,953 8,133

----------------------------------- ------------ ------------ ----------------

Asset financing 4,118 3,390 3,682

----------------------------------- ------------ ------------ ----------------

Debt 14,397 8,343 11,815

Less cash and cash equivalents 1,228 1,310 930

----------------------------------- ------------ ------------ ----------------

Net Debt 13,169 7,033 10,885

----------------------------------- ------------ ------------ ----------------

Net debt is defined as cash, less banking working capital

facilities and asset financing and excludes property leases.

Working capital facilities are included within trade and other

payables.

As at 30 June 2023 there is headroom of GBP3.8m in working

capital facilities (31 December 2022 GBP4.0m; 30 June 2022

GBP4.7m).

7. Loss per share

Basic and diluted loss per share is calculated by dividing the

loss attributable to owners of the parent by the weighted average

number of ordinary shares in issue during the period.

Unaudited Unaudited Audited

six months six months twelve months

ended 30 June ended 30 ended 31

2023 June 2022 December

2022

GBP'000 GBP'000 GBP'000

----------------------------------- --------------- ------------ ---------------

(Loss) for the financial period (3,267) (7,066) (10,929)

Number of shares Number Number Number

'000 '000 '000

Weighted average number of shares 172,420 136,429 143,313

EPS Summary

Basic and diluted loss per share (1.9p) (5.2p) (7.6p)

----------------------------------- --------------- ------------ ---------------

8. Share Capital

The number of ordinary shares in issue as at 30 June 2023 is

172,419,741 shares (31 December 2022 - 172,419,741).

The number of shares held by the EBT and referred to as Treasury

shares was 2,045,230 (30 June 2022: 4,293,194, December 2022:

4,293,194).

9. Cautionary statement

This document contains certain forward-looking statements with

respect to the financial condition, results, and operations of

business. These statements involve risk and uncertainty as they

relate to events and depend on circumstances that will incur in the

future. Nothing in this interim report should be construed as a

profit forecast.

10. Copies of the interim report

The interim report for the six months ended 30 June 2023 can be

downloaded from the Company's website www.sisplc.com . Further

copies can be obtained by writing to the Company Secretary, Science

in Sport plc, 16-18 Hatton Garden, Farringdon, London, EC1N

8AT.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR BRGDCLSDDGXR

(END) Dow Jones Newswires

September 28, 2023 02:00 ET (06:00 GMT)

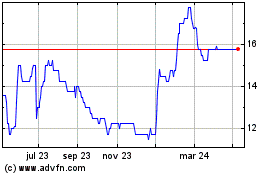

Science In Sport (LSE:SIS)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Science In Sport (LSE:SIS)

Gráfica de Acción Histórica

De May 2023 a May 2024