TIDMSTEM

RNS Number : 8330M

SThree plc

19 September 2023

19 September 2023

SThree plc

FY23 Q3 Trading Update

Resilient performance sustained, underpinned by Contract

SThree plc ("SThree" or the "Group"), the only global specialist

talent partner focused on roles in Science, Technology, Engineering

and Mathematics ('STEM'), today issues a trading update covering

the period 1 June 2023 to 31 August 2023.

Highlights

-- Resilient performance, with the movement in Group net fees

for Q3 in line with Q2, down 7% YoY (1) against a strong comparative

period(2) and ongoing global macro-economic weakness.

-- Excluding restructured businesses the movement in Group net

fees improved from -6% YoY in Q2 to -5% YoY in Q3 demonstrating

the value of a focused and disciplined market investment approach.

-- Contract net fees performance improved to flat YoY, now representing

84% of Group net fees (FY22 Q3: 77%).

-- Permanent net fees (representing 16% of Group) down 31% YoY,

reflecting both market conditions and our strategic investment

towards Contract in specific markets (average Permanent headcount

down 21%).

-- In our largest three markets, which represent 73% of net fees,

the Netherlands grew 5%, while Germany was down 6% and USA

was down 19%.

-- Engineering up 20%, with Technology down 6% and Life Sciences

down 24%.

-- Contractor order book(3) remained flat YoY, reflecting sequentially

improved new placement activity together with continued robust

extensions performance and providing good visibility for the

remainder of the year.

-- Strong balance sheet with net cash of GBP83 million at 31

August 2023 (31 August 2022: GBP57 million).

-- Technology Improvement Programme remains on track and on budget,

with first city, Houston, now live, and sequenced rollout

across the Group progressing in line with stated plans.

-- Trading in line with market expectations for full year(4)

.

Timo Lehne, Chief Executive, commented:

"We continue to deliver a resilient performance, underpinned by

the Group's strategic focus on Contract. While the wider

environment remains uncertain, we are encouraged by our

sequentially improving new placement performance and strong

Contract extensions, demonstrating our clients' sustained demand

for critical STEM skills.

Our Technology Improvement Programme, key to driving both scale

and higher margins over the mid-to-long term, and to delivering a

differentiated and higher value proposition within the market,

continues to progress on track and on budget. I am delighted that

the first phase of the rollout in Houston is now complete, which is

a significant milestone for the Group. We are incredibly excited

about the progress that has been made so far and continue to

believe that this will be a key strategic step forward for our

business.

Our long-term opportunity is clear, underpinned by structural

megatrends driving the acute need for scarce STEM talent. While w e

remain mindful of the macro-economic uncertainty across global

markets, with all lead indicators of the Group's performance

monitored closely, we look ahead to the opportunities facing us

with optimism. Our specialism in STEM skills and new ways of

working provides a unique offering to clients and candidates.

Supported by a resilient business model and strong financial

position, we are trading in line with market expectations for the

full year, and we remain well positioned to source and place the

best STEM talent the world needs."

Q3 Q3 Q3 2023 Q2 2023 Q1 2023

Net fees 2023 2022 YoY (1) YoY (1) YoY (1)

------------------------------- ---------- -------- -------- --------

Contract GBP86.2m GBP86.6m - -1% +8%

Permanent GBP16.8m GBP25.2m -31% -25% -12%

GROUP GBP103.0m GBP111.8m -7% -7% +4%

Regions

DACH (5) GBP36.6m GBP38.5m -6% -7% +8%

Netherlands (incl. Spain) (6) GBP21.5m GBP19.6m +9% +4% +6%

Rest of Europe (7) GBP17.8m GBP18.7m -5% -7% +4%

USA GBP22.6m GBP29.3m -19% -15% -6%

Middle East & Asia (8) GBP4.5m GBP5.7m -14% -5% +19%

GROUP GBP103.0m GBP111.8m -7% -7% +4%

Top five countries

Germany GBP32.2m GBP33.9m -6% -8% +7%

Netherlands GBP20.1m GBP18.9m +5% +1% +4%

UK GBP11.6m GBP12.2m -4% -6% +6%

USA GBP22.6m GBP29.3m -19% -15% -6%

Japan GBP2.1m GBP2.5m -4% -2% +7%

ROW (9) GBP14.3m GBP15.0m -5% -2% +12%

Group GBP103.0m GBP111.8m -7% -7% +4%

------------------------------- ---------- -------- -------- --------

Service mix Q3 2023 Q3 2022

----------

Contract 84% 77%

Permanent 16% 23%

----------

Skills mix Q3 2023 Q3 2022

----------

Technology 48% 47%

Life Sciences 17% 22%

Engineering 27% 21%

Other 7% 10%

---------- ----------

Business performance highlights

The Group continued to deliver a resilient performance in the

quarter with net fees down 7% YoY, with no further deterioration

from Q2 against an equally strong prior year comparative period. On

a like for like basis (excluding our restructured businesses in

Singapore, Hong Kong and Ireland) net fees were down 5% YoY, a

sequential improvement on the 6% YoY decline in Q2. Contract, our

strategic focus, was flat (or up 1% on a like for like basis

excluding our restructured businesses) and now represents 84% of

net fees. Our Permanent business was down 31% (or down 28% on a

like for like basis), reflecting global market conditions and the

strategic transition from Permanent to Contract in several markets,

with average Permanent headcount for the quarter down 21% YoY .

Contract

-- Net fees flat YoY.

o Regionally, Netherlands (incl. Spain) was up 10% YoY

and Rest of Europe up 4%, while DACH was down 3%, USA

down 7% and Middle East & Asia was up 3%.

o Strong growth in Engineering, up 21% YoY, with Technology

down 1% and Life Sciences down 15%.

-- Contractor order book remained flat YoY, with continued strong

Contract extensions.

Permanent

-- Permanent net fees down 31% YoY, with challenging market conditions

across all regions, together with the planned transition from

Permanent to Contract , particularly in the USA and UK. Average

Permanent headcount was down 21% YoY for the quarter.

o In our major Permanent markets, DACH was down 13% YoY,

Netherlands down 9% and Japan down 6%.

o Modest growth in Engineering, up 13%, with Technology

down 22% and Life Sciences down 53%.

Headcount and productivity

-- For the quarter, average headcount was down 6% YoY, with average

headcount on a YTD basis up 2%.

-- Group period-end headcount was down 14% vs FY22 Q4, in part

impacted by the restructure of the Singapore, Hong Kong and

Ireland businesses. On a like-for-like basis, Group period-end

headcount was down 12% vs FY22 Q4.

-- Sequentially, period-end headcount was down 5% vs FY23 Q2.

-- While we are managing costs tightly, highly disciplined and

targeted investment in talent acquisition within Contract

remains a priority.

-- Productivity was down only 1% YoY in the quarter with the

impact of a strong prior year comparator offset by the 6%

reduction in average headcount. Productivity was 38% above

pre-pandemic levels achieved in FY19 Q3.

Regional highlights

DACH saw net fees decline 6% YoY.

-- Germany, our largest country in the region, saw Contract down

3% with overall net fees down 6%, driven by:

o Engineering up 22%, with increased demand for Construction

roles.

o Offset by Technology and Life Sciences, down 10% and

14% respectively.

Netherlands (incl. Spain) region saw net fees grow 9% YoY.

-- Strong growth in Contract up 10% YoY, partially offset by

Permanent down 9%.

-- The Netherlands, which represents 94% of the region, saw Contract

up 7% with overall net fee growth of 5% driven by:

o Engineering up 16% reflecting increased demand for roles

within Project Management, Process Engineering, Electrical

Engineering, and QHSE.

o Technology up 2% with higher demand for Project Managers,

Data Engineers and Data Science roles.

-- Spain saw strong growth of 107% in the quarter driven by Technology.

Rest of Europe saw net fees decline 5% YoY.

-- Contract, which represents 97% of net fees for the region,

grew 4%.

-- The UK, our largest country in the region, saw Contract up

1% with overall net fees down 4%, reflecting:

o Engineering up 17%, as demand increased for roles within

Project and Construction Management, and Mechanical Engineering.

o Offset by declines in both Technology, down 5% and Life

Sciences, down 26%.

USA saw net fees decline 19% YoY.

-- Strategic shift toward Contract in region, which now represents

91% of net fees, with Contract net fees down 7% YoY reflecting:

o Life Sciences, down 18% YoY in line with the market conditions

for that sector.

o This was partly offset by Engineering up 16%, with increased

demand for roles within Construction Management and Electrical

Engineering.

Middle East and Asia saw net fees decline 14% YoY. On a like for

like basis (excluding our restructured businesses in Singapore and

Hong Kong) net fees were up 5% YoY.

-- Japan, which represents 48% of the region, was down 4% YoY

driven by Technology.

-- Solid performance in UAE with net fees up 18% driven by Engineering.

Balance sheet

SThree retains a strong balance sheet, with net cash at 31

August 2023 of GBP83m (31 August 2022: net cash GBP57m, 31 May

2023: net cash GBP72m), partly reflecting the working capital

release from the Group's contractor model. Total accessible

liquidity of GBP138m comprises GBP83m net cash, an undrawn GBP50m

revolving credit facility ('RCF'), which runs until 2025 (with

options to extend it until 2027), and a GBP5m overdraft facility.

In addition, SThree has an undrawn GBP30m accordion facility as

well as a substantial working capital position, reflecting net cash

due to the Group for placements already undertaken.

Analyst conference call

SThree is hosting a conference call for analysts and investors

today at 8.30am to discuss the FY23 Q3 Trading Update . If you

would like to register for the conference call, please contact

SThree@almapr.co.uk.

The Group will issue its trading update for the year ending 30

November 2023 on 14 December 2023.

(1) All YoY growth rates in this announcement are expressed at

constant currency.

(2) FY22 Q3 Group Net Fees up 19% YoY.

(3) The contractor order book represents value of net fees until

contractual end dates, assuming all contractual hours are

worked.

(4) Current consensus PBT expectation is GBP71.0m for FY23.

Source: SThree compiled consensus.

(5) DACH - Germany, Austria and Switzerland.

(6) Netherlands (incl. Spain) - Netherlands and Spain, which is

managed from the Netherlands.

(7) Rest of Europe - UK, Belgium, France, Luxembourg and

Ireland.

(8) Middle East & Asia - Japan, UAE & Singapore.

(9) ROW - All other countries we operate in.

The information contained within this announcement is deemed by

the Group to constitute inside information under the Market Abuse

Regulation (Regulation (EU) No.596/2014) as it forms part of UK

Domestic Law by virtue of the European Union (Withdrawal) Act

2018.

Enquiries:

SThree plc

Timo Lehne, CEO via Alma

Andrew Beach, CFO

Alma PR +44 20 3405 0205

Rebecca Sanders-Hewett SThree@almapr.co.uk

Hilary Buchanan

Sam Modlin

Will Ellis Hancock

Notes to editors

SThree plc brings skilled people together to build the future.

We are the only global specialist talent partner focused on roles

in Science, Technology, Engineering and Mathematics ('STEM') ,

providing permanent and flexible contract talent to a diverse base

of over 8,200 clients across 14 countries. Our Group's c.2,700

staff cover the Technology, Life Sciences and Engineering sectors.

SThree is part of the Industrial Services sector. We are listed on

the Premium Segment of the London Stock Exchange's Main Market,

trading with ticker code STEM.

Important notice

Certain statements in this announcement are forward looking

statements. By their nature, forward looking statements involve a

number of risks, uncertainties or assumptions that could cause

actual results or events to differ materially from those expressed

or implied by those statements. Forward looking statements

regarding past trends or activities should not be taken as

representation that such trends or activities will continue in the

future. Certain data from the announcement is sourced from

unaudited internal management information and is before any

exceptional items. Accordingly, undue reliance should not be placed

on forward looking statements.

- Ends -

Appendix

Following the reporting structure change at the start of FY23

the table below provides the historical reporting structure.

Q3 Q3 Q3 2023 Q2 2023 Q1 2023

Net fees 2023 2022 YoY (1) YoY (1) YoY (1)

-------------------- ---------- --------- -------- --------

Contract GBP86.2m GBP86.6m - -1% +8%

Permanent GBP16.8m GBP25.2m -31% -25% -12%

GROUP GBP103.0m GBP111.8m -7% -7% +4%

Regions

DACH GBP36.6m GBP38.5m -6% -7% +8%

EMEA excl. DACH GBP41.6m GBP40.3m +3% - +8%

USA GBP22.6m GBP29.3m -19% -15% -6%

APAC GBP2.2m GBP3.7m -30% -22% -4%

GROUP GBP103.0m GBP111.8m -7% -7% +4%

Top five countries

Germany GBP32.2m GBP33.9m -6% -8% +7%

Netherlands GBP20.1m GBP18.9m +5% +1% +4%

UK GBP11.6m GBP12.2m -4% -6% +6%

USA GBP22.6m GBP29.3m -19% -15% -6%

Japan GBP2.1m GBP2.5m -4% -2% +7%

ROW GBP14.3m GBP15.0m -5% -2% +12%

GROUP GBP103.0m GBP111.8m -7% -7% +4%

-------------------- ---------- --------- -------- --------

Service mix Q3 2023 Q3 2022

----------

Contract 84% 77%

Permanent 16% 23%

----------

Skills mix Q3 2023 Q3 2022

----------

Technology 48% 47%

Life Sciences 17% 22%

Engineering 27% 21%

Other 7% 10%

---------- ----------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTNKFBQFBKDQCD

(END) Dow Jones Newswires

September 19, 2023 02:00 ET (06:00 GMT)

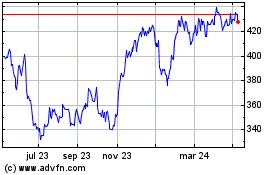

Sthree (LSE:STEM)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

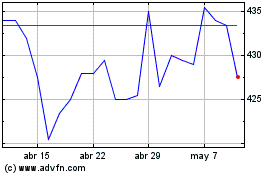

Sthree (LSE:STEM)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024